The market keeps sliding—just who is selling?

TechFlow Selected TechFlow Selected

The market keeps sliding—just who is selling?

In addition to the overall supply and demand relationship, the futures market is also one of the key influencing factors.

Author: Willy Wo

Translation: 1912212.eth, Foresight News

Bitcoin spot ETF inflows indicate continuous buying—retail investors are buying, institutions are buying—but market price action seems to move in the opposite direction, steadily declining. So who is selling? Since 2024, market participants have increasingly focused on bitcoin spot ETF inflow and outflow data, as if these figures hold the key to understanding true market dynamics.

What matters is total demand and total supply.

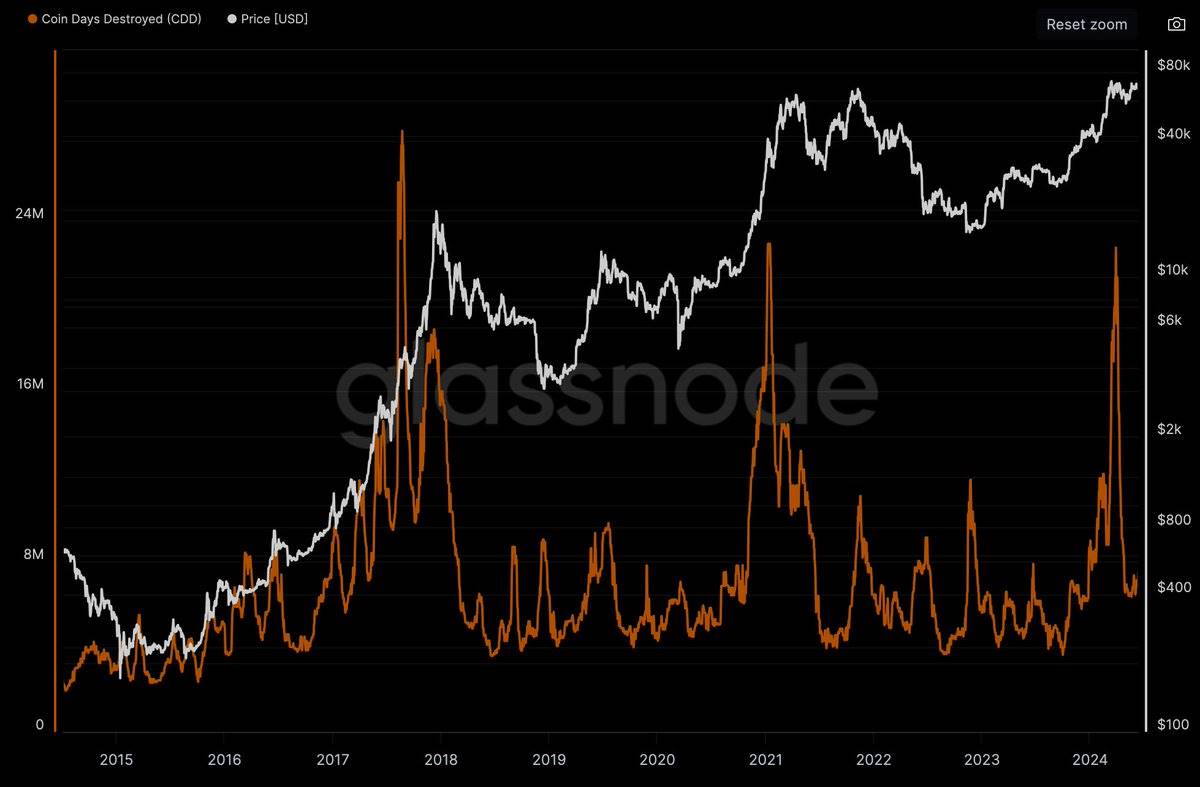

Let me first tell you who's selling. OGs are selling—and they hold 10 times more BTC than the combined holdings of all ETFs. They sell during every bull market. This pattern has existed as long as Bitcoin’s genesis block.

To better visualize this phenomenon, consider the chart below: coin age multiplied by the amount sold. This chart reveals OG selling behavior and its impact on market movements.

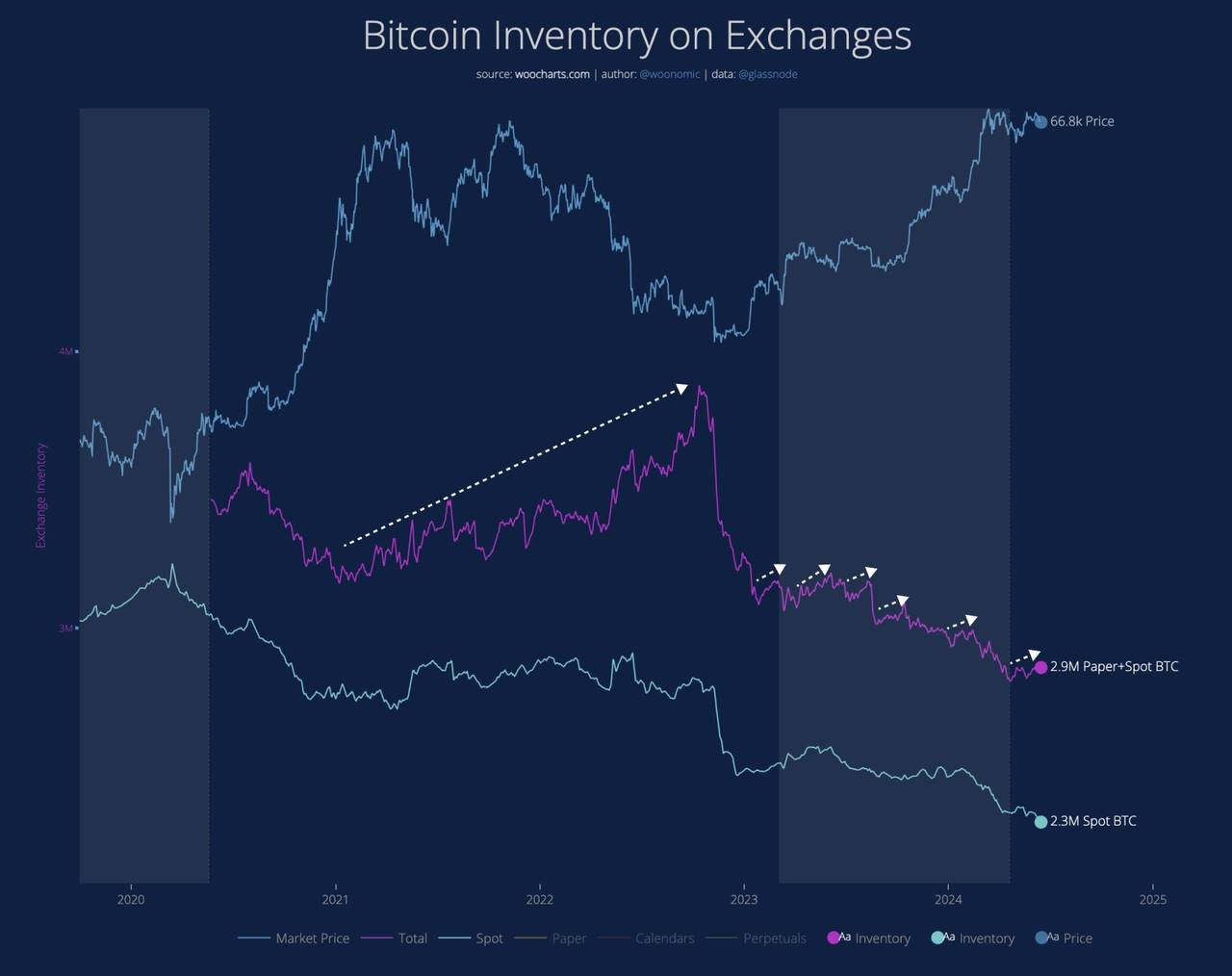

We are now in Bitcoin’s “modern era.” Since 2017, “paper BTC” (referring to synthetic or non-physical BTC) has flooded the market.

Futures markets are also a key factor influencing price action.

In the past, if you wanted to buy Bitcoin, you had to purchase actual BTC. But in recent years, you can buy so-called paper BTC—meaning someone without real coins can still sell you that piece of paper.

Together, you create synthetic Bitcoin.

This latent demand for BTC is being absorbed by paper BTC, fulfilled by counterparties who don’t own BTC but only use dollars as betting capital.

In the past, Bitcoin prices could grow exponentially because the only sellers were early holders disposing small amounts and miners selling newly minted coins.

Now, you should pay attention to the magic of "paper BTC."

The 2022 bear market was caused by an oversupply of paper BTC—even though actual spot holders weren't selling.

In the current bull market, I’ve marked periods when paper BTC increased—yet prices didn’t rise accordingly.

We are currently in such a phase.

Therefore, focusing solely on ETF purchases is insufficient for fully grasping market trends. One must also monitor on-chain data, derivatives data, and technical price patterns.

All these indicators add layers of complexity to supply and demand dynamics.

Analyzing them together is more akin to an art than a quantifiable science.

In this volatile market, everyone is merely making logical guesses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News