From $JENNER to $MOTHER, Why Are Meme Coins Still Standing Tall?

TechFlow Selected TechFlow Selected

From $JENNER to $MOTHER, Why Are Meme Coins Still Standing Tall?

The most important factor for memecoin success is a strong community.

Author: Min Jung

Compiled by: TechFlow

Summary

-

On Solana, the rise of memecoins has been greatly accelerated by the popularity of platforms like pump.fun, Bonkbot, and Photon. These tools enable people without programming skills to trade and create tokens easily. In May alone, 455,000 new memecoins were created on Solana, driving significant daily trading activity, with platforms like pump.fun generating millions in fee revenue.

-

Memecoins thrive due to their potential for extremely high returns, serving as an accessible entry point into the crypto market for ordinary people, and their ability to build strong communities—something critical for any business.

-

However, the memecoin market remains heavily manipulated by influential insiders, a problem exacerbated by the lack of regulation on decentralized exchanges.

Figure 1: Celebrity Memecoins

Source: Twitter

Love them or hate them, memecoins are one of the hottest areas in both crypto and traditional finance. With Roaring Kitty’s return, GameStop surged once again, drawing nearly a million viewers during his livestream—easily surpassing FOMC meeting viewership. In crypto, celebrity-driven memecoins such as $JENNER and $RNT have sparked countless new projects, some reaching billion-dollar valuations within days. With this in mind, this article aims to outline the current state of memecoins and explore why they may actually be here to stay.

Current State

Thanks to tools like pump.fun, Bonkbot, and Photon, trading memecoins has become easier and more accessible. Platforms like pump.fun allow anyone, even without programming knowledge, to create tokens without having to provide their own funds for liquidity pools (LPs). Trading bots such as Bonkbot and Trojanbot make it easy for users to trade memecoins directly from their mobile phones.

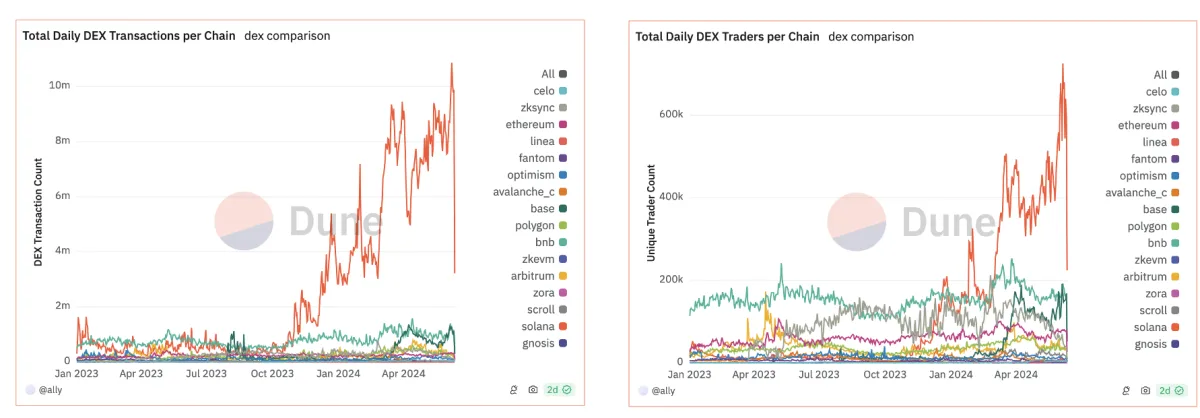

Due to low gas fees and fast transaction confirmations, 455,000 memecoins were created on Solana in May alone, attracting 600,000 daily DEX traders and generating 10 million DEX trades per day. As more memecoins are launched, pump.fun generated $3.3 million in fees over seven days—surpassing Uniswap’s weekly revenue. Even blockchain foundations are now paying attention to memecoins, recognizing them as vital parts of their ecosystems. For example, the Avalanche Foundation announced its Memecoin Fund in March, while Base founder Jesse Pollak promoted $BRETT, acknowledging that memecoins are becoming key drivers of Layer-1 and Layer-2 ecosystems.

With thousands of new memecoins created every day, market trends continue to evolve. The current trend is centered around celebrity memecoins, sparked by figures like Caitlyn Jenner and Iggy Azalea. Previously, the “~ on Sol” trend was popular (e.g., $BTC on Sol, $ETH on Sol), but just last week, over 1,000 memecoins themed around Andrew Tate emerged. Of course, most of these tokens eventually go to zero, leading to a new phenomenon known as “CTO (Community Takeover),” where developers abandon the project and remaining community members take over development.

Figure 2: Statistics on Solana Memecoins

Source: Dune

Why Memecoins Might Be Here to Stay

Return Potential

-

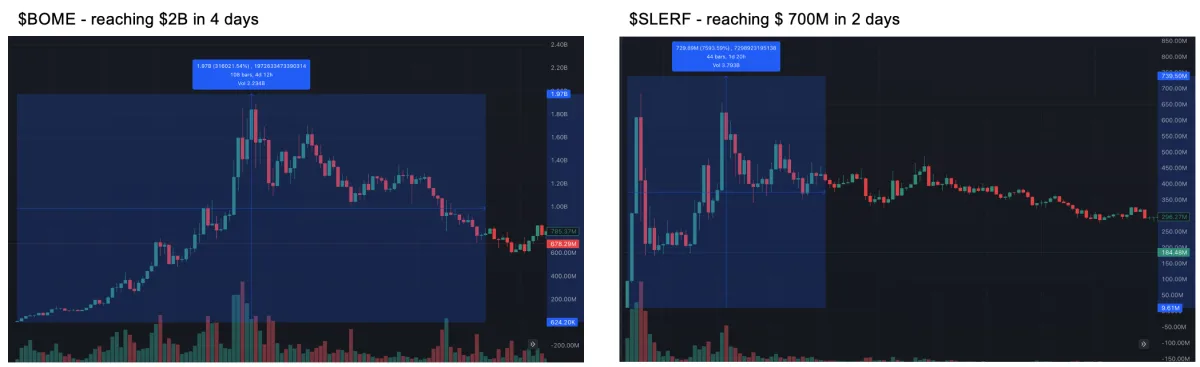

In today's world, what product starting from scratch can reach a $250 million or even $1 billion valuation within a week? Probably only memecoins. Regardless of whether memecoins have real utility, from a pure investment perspective, they offer a compelling addition to portfolios. At Consensus 2024, Joe McCann, CEO of Asymmetric Capital, recommended allocating 2–3% of a portfolio to memecoins, which could provide significant upside potential—at least in the current market environment. Hundred-bagger returns are common in the memecoin space. Whether viewed positively or negatively, memecoins are undoubtedly assets that investors and portfolio managers should consider including in their strategies.

Figure 3: Return Profile of Memecoins

Source: DEX Screener

Entry Point for the Average Person

-

Even people unfamiliar with cryptocurrency have likely heard of Dogecoin and Shiba Inu. For many, Dogecoin might be their first crypto purchase rather than something more complex like ZKSync or understanding what a ZK rollup is. While this may seem frivolous, memecoins actually serve as an entry point for newcomers into the crypto space, helping drive mass adoption. For instance, Elon Musk talking about Dogecoin on Twitter and discussing it on SNL brought massive attention to the entire asset class. Moreover, memecoins actively promote themselves through sports partnerships (such as $FLOKI) and fundraising for advertising campaigns on platforms (like $WIF), further accelerating adoption. Part of the reason lies in memecoins being “cute and fun.” Would a ZK rollup project get the same attention if Elon Musk mentioned it on SNL?

The Power of Community

-

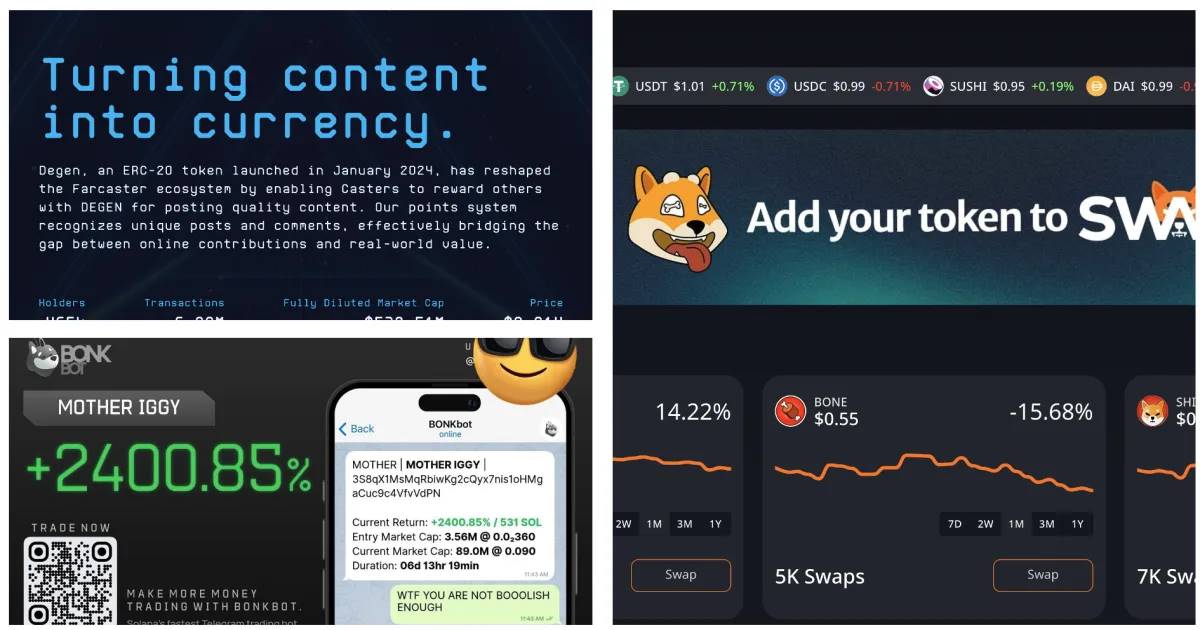

The most crucial factor behind a successful memecoin is a strong community. When you look at successful Web2 startups, most began as communities—like Reddit. For example, Instagram and Facebook initially had no revenue model but later introduced ads because they built a loyal user base. A company’s success often depends more on its community than its technology, because once a strong community exists, any business can be built on top of it. This is exactly what is happening with memecoins today. Bonk, originally seen as a “fake Doge,” now powers Bonkbot and has generated $65 million in fees. Similarly, Shiba Inu is building Shibarium, a Layer-2 solution. Even if a memecoin starts off seeming “useless,” it can evolve and expand in unexpected ways once a solid community forms. Thus, criticizing a memecoin with a strong community for lacking utility is akin to faulting early Facebook or Instagram for not having a revenue model.

Figure 4: From Meme-coins to Utility Coins

Sources: Degen, Shibarium, Bonkbot

However…

Of course, the memecoin market still faces many issues. It is a highly manipulated space where prices can be moved by large holders and insiders with minimal resources. Most importantly, since trading occurs primarily on decentralized exchanges, there is almost no regulatory oversight. This leads to frequent rug pulls on DEXs—where project creators suddenly withdraw liquidity or funds, causing token prices to crash and investors to suffer heavy losses. Among thousands of tokens, only a few survive beyond the next few months. Therefore, higher ethical standards and regulatory measures must be established to prevent such abuses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News