Dovey Wan's new article: Tokens are a financialized belief system

TechFlow Selected TechFlow Selected

Dovey Wan's new article: Tokens are a financialized belief system

Price is always the dominant narrative.

Author: Dovey Wan

Compiled by: TechFlow

Tokens represent a financialized belief system, where token volatility is the most powerful market entry strategy. Many first-time crypto founders adopt a bottom-up, milestone-driven mindset—similar to traditional tech startup founders—believing that as long as meaningful value is created, price will eventually follow. However, the growth trajectory of a successful crypto project typically follows a different sequence:

-

Price drives sentiment.

-

Sentiment drives narrative.

-

Narrative drives perception.

-

Perception drives community.

-

Community drives adoption and product-market fit (PMF).

Barbell Distribution and the Sunk Cost Fallacy

Cryptocurrency embodies the intersection of financial populism and technological libertarianism. The optimal token distribution strategy is a "barbell distribution"—simultaneously targeting both extremes of the user spectrum: core users and fringe users, from IQ 150 to IQ 50. This approach forms the upper funnel of belief formation. Many founders attempt to restrict initial token supply to avoid "sell pressure," but often fail to drive top-of-funnel growth. It's critical to first successfully attract one end of the barbell, then expand outward.

In its early days, Bitcoin served either core users (cypherpunks, miners, and billionaires seeking to avoid wealth redistribution) or fringe users (ordinary people in collapsing local currency regimes, or those wishing to circumvent sanctions or capital controls). Early DeFi mirrored this pattern, best suited for crypto-native core users (self-custody enthusiasts, large traders wanting transparent execution, long-tail asset issuers) or fringe users (those poorly served by centralized exchanges or financial infrastructure, driven by the "price going up" narrative). Most middle-ground users remained indifferent or unmotivated due to high psychological and product-switching costs.

For core users, the opportunity cost of not adopting crypto is too high. For fringe users, the opportunity cost is low, making them more likely to try.

Most "miners" within token economies are highly mercenary, influenced by their level of sunk cost. The higher the sunk cost, the closer they are to being core users. Pre-ASIC Bitcoin miners rarely held coins, as there was no significant sunk cost to recover. Post-ASIC miners hold coins to cover their sunk and operational costs. PoS stakers hold coins based on the opportunity cost of capital. The less productive a PoS coin is, the harder it is to build a strong core user base. Lockups (including TVL lockups) and airdrop farming are the worst forms of token distribution. The sunk costs involved are often proofs of meaningless work, making it difficult to assess "cost" and even harder to attract either core or fringe users.

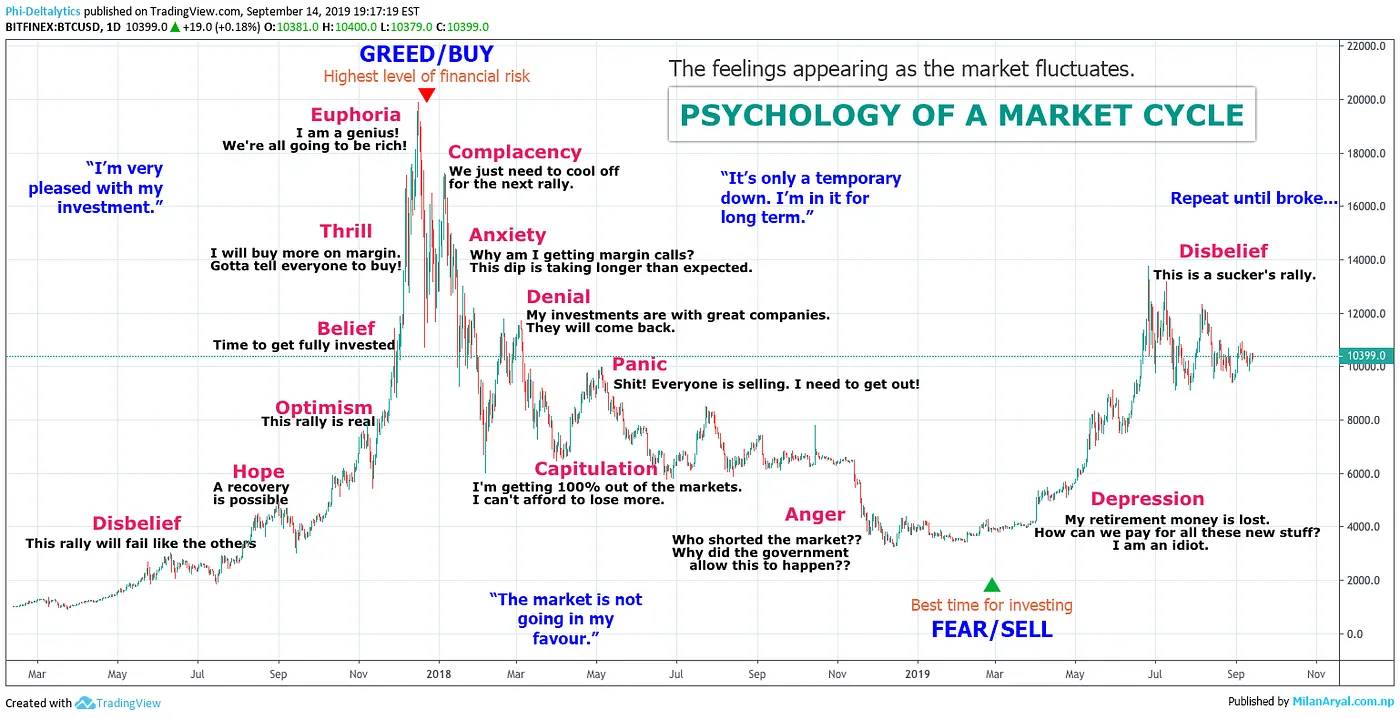

Achieving Active Circulation Through Volatility

Multiple rounds of turnover during market cycles are the ideal greenhouse for cultivating belief systems and serve as a true test of a founder’s adaptability and commitment. In crypto, these cycles move five times faster than in traditional finance. This dynamic acts like a natural selection process—early token holders who become passionate advocates amplify information and spread it like a meme virus. This shifts the environment from player-versus-player (PvP) to player-versus-environment (PvE).

The key to this shift lies in strong leadership, positive feedback loops of delivered promises, and healthy engagement with key members of the upper funnel. This effectively transforms the funnel within the crypto space. Certain domains like memes and NFTs demand even greater intensity and mental agility—moving five times faster than the already accelerated crypto cycle, resulting in an overall speed multiplier of 25x.

For meme coin founders, this is a game of extremely low hit rates, akin to spinning a roulette wheel wildly. Meme coins play a role in the history of financial populism: they are not products of financial nihilism, but rather expressions of financial absurdism and populist movements. Camus articulated this a century ago. Cultural fluidity, identity crisis, and the dual death of traditionalism and modern liberalism all contribute to a profound void—in the sense of today’s autistic monkeys. From consumerism to internet tribalism, trends, narratives, and products continuously emerge to fill this void.

Thus, narrative and identity alignment within each coin has become a new way to express meaning and connect with like-minded individuals—much like how introverted, socially awkward cat lovers finally found an outlet to share photos of their beloved pets when the internet first emerged. Unlike corporate or VC-backed coins that may cling to grand visions and brand legitimacy, meme coins offer refuge for those who don’t care about “long-term meaning.” Only the most absurd, fleeting, yet intense dopamine hits can retain this group of warriors who have no other battles to fight—but must release their hyperactive energy somewhere. This represents a powerful PMF in crypto, perfectly suited for a culture centered around decay.

This environment is characterized by extreme survivorship bias and power laws; users and traders are inherently fickle. This is why most tokens have only a 1–3 month lifespan in terms of liquidity and volatility, with very few remaining relevant beyond one cycle. Without liquidity, a token dies. Information is entropy, attention is currency. Liquidity is a token’s HRV.

Make Diamond Hands Rich

Generously reward early loyalists and establish a momentum-driven system that reinforces commitment within this belief funnel. Imagine a pyramid—the width of its base determines its height; diamond hands form the foundational base that determines FDV. Price always dominates narrative.

Failing to make diamond hands rich naturally breaks the conversion path of this belief funnel, turning it back into PvP instead of PvE. Rewards go beyond mere economic gain—they also serve as identity validation and self-esteem enhancement. As a token community rooted in a belief system, you can provide social and psychological value by fostering a shared sense of identity among holders. The decline of traditionalism and modern liberalism has left today’s keyboard monkeys with a massive existential void. Trends, narratives, and tokens arise to fill this gap, offering a sense of purpose and connection—just as the early internet gave introverted cat lovers a channel to share photos of their cherished pets.

Diamond hands exist not just for wealth effects, but for cultural and ideological alignment. Wealthy diamond hands will further elevate the token’s overall cultural influence, strengthening the belief system and making it increasingly self-fulfilling.

Ultimately, tokens represent a financialized belief system, where market dynamics, human nature, and psychological biases are not merely obstacles to overcome, but fundamental components of growth and adoption. Understanding and leveraging this belief system is crucial for navigating and succeeding in the crypto ecosystem. I’m always looking for founders who possess both solid technical skills and deep insight into human nature. Crypto entrepreneurship is a process that requires full mastery of capital markets, cultural evolution, and technological advancement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News