Gravity: Unveiling the Ultimate Holy Grail of Chain Abstraction

TechFlow Selected TechFlow Selected

Gravity: Unveiling the Ultimate Holy Grail of Chain Abstraction

This article explores the future potential of Galxe's upcoming Gravity chain through the metaphor of "chain as city," while analyzing the emerging concept of "chain abstraction" and its existing challenges.

Author: Rapolas

Translation: LlamaC

「Editor’s Note: From the metaphorical perspective of “chain as city,” this article explores the future potential of Galxe’s upcoming Gravity chain, analyzing the rising concept of “chain abstraction” and its existing challenges. Galxe occupies a unique position within its ecosystem, aggregating upstream and downstream resources for distribution—a growth trajectory noticeably convergent with that of early centralized exchanges (Cex). Yet, in the looming competitive landscape between parallel EVM chains and non-EVM parallel chains, what heights will Gravity elevate users to? This naturally sparks curiosity and sustained scrutiny! Will you copy this assignment?」

How Much Chain Abstraction Do We Really Need?

There is overinvestment in crypto infrastructure. The feedback cycles for infrastructure are too long, allowing product-market fit (PMF) gaps to remain hidden for extended periods—far longer than in consumer-facing crypto applications.

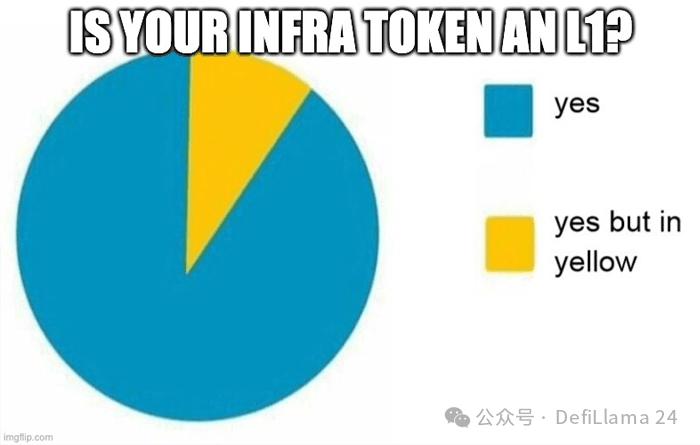

The absence of established infrastructure at the protocol layer enables venture capital to capture excessive value across numerous infrastructure and middleware projects. Layer 1s (L1s) generate massive value by leveraging an infinite total addressable market (TAM). Subsequently, infrastructure projects aim to align their valuations as closely as possible with those of L1s, given their own network consensus, block production, and so forth.

This is one reason why crypto infrastructure is so saturated with meme culture. Everyone knows the proven playbook and the outcome it delivers:

-

Claim you’re scaling blockchain;

-

Raise excessive funds from venture capital;

-

Announce "partnerships" with other infrastructure projects before your chain launches;

-

Launch a testnet (which may crash), then heavily promote some outrageous metrics;

-

Drop tokens into the market with valuations ranging from $1 billion to $10 billion.

The Rise of Chain Abstraction

Recently, we’ve observed attempts to further blur Step 1. Instead of claiming to scale blockchain, players now pivot toward chain abstraction. This sounds like the holy grail of infrastructure—the cherry on top, the endgame.

Every infrastructure founder has a natural desire to build a chain. Some just aren’t brave enough to admit it.

The problem is: who are we abstracting for if there are no users? Chain abstraction is venture capital’s solution to the chain fragmentation problem—an issue originally created by relentless VC investment. Without a product, chain abstraction isn’t a real solution to a real problem. It doesn’t deliver transformative changes or solve new problems for consumers the way Ford or the iPhone did—both of which represented qualitative leaps from prior consumer experiences.

Consider how each infrastructure project emerges as a response to the previous solution:

-

L1s couldn’t scale, so we built Rollups;

-

Rollups fragmented liquidity, so we built cross-chain bridges;

-

Too many bridges, so we aggregated them;

-

Too many aggregators, so we built intents;

-

Intents are hard to interpret, so we built intent interpreters;

-

… Do you really think it stops here?

User Experience and the Challenges of Chain Abstraction

Chain abstraction may introduce certain centralization trade-offs, since the decentralization of a stack is only as strong as its weakest link. Abstraction requires coordination around state proofs, solver execution, block finality, and cross-chain transaction guarantees—consensus must be reached. Capital markets will always offer another “faster / cheaper / trendier buzzword” chain abstraction solution that claims superiority over current implementations. Founders and VCs will keep rewriting the rules, but the game remains unchanged, aiming for the same rewards.

Building infrastructure is often a reaction to poor user experience, as high fees and slow settlements are part of UX issues. But when adoption falls short of expectations, poor crypto UX becomes an easy scapegoat. Criticizing UX requires almost zero effort, so everyone does it. Whenever the crypto cycle turns cold, people blame poor products, forgetting these same products were once so exciting they drove us to market peaks.

In the past, we talked about crypto super apps—products that started with applications, not infrastructure. Whether Uniswap, Metamask, Magic Eden, StepN, Blur/Blast, dYdX, or Hypeliquid, it’s clear the web3 vision is being inverted. Rather than collaborating on composable stacks, parties are building proprietary tech stacks based on their own incentives. And that’s okay.

But it also means chains will be abstracted not by those who call themselves chain abstraction providers, but by those who build the most popular applications in crypto.

The Leading Application in the Space: Galxe

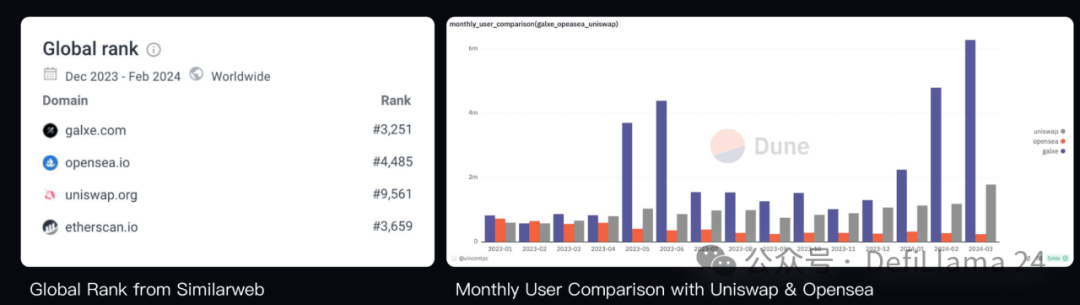

Galxe (formerly Project Galaxy) is by far the most widely adopted web3 application. Its web traffic surpasses Uniswap, Opensea, and Etherscan combined. Over 20 million unique addresses have interacted with Galxe. More than 1 million unique visitors use the Galxe website daily.

Before dismissing this engagement as bot-driven airdrop farming, consider that bots dominate nearly every on-chain use case. Most token trades are executed by bots. Crypto games are played by bots, since they’re still primarily driven by financial incentives. NFT market making is done by bots. AI agents (smarter bots) are beginning to participate in on-chain economies. Even our beloved social-fi platforms rely heavily on bots, making social-fi less social. Crypto is fundamentally about incentives and resource coordination—and so far, bots have proven to be excellent target users for harvesting on-chain incentives. In the future, agent DAOs and UBI may be closer than we imagine.

But whether users are bots or not doesn’t matter (notably, Galxe’s 1 million daily active users are real website visitors, not bots); what matters is the volume of economic activity and the value a protocol or application can capture.

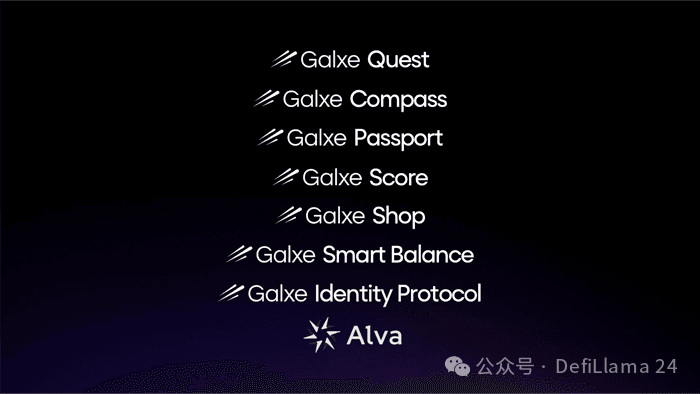

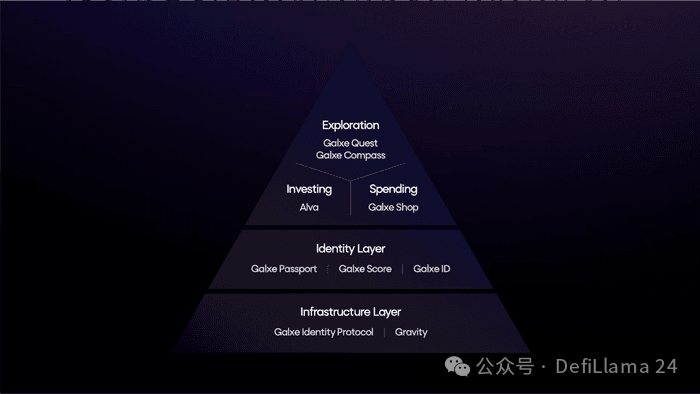

Galxe found its niche in airdrop distribution. Since then, it has evolved significantly by building identity layers such as Galxe Passport (identity) and Galxe Score (reputation).

The most successful companies are those that create new bundles or unbundlings. Galxe has aggregated the supply side—projects seeking to build communities and distribute tokens—with the demand side—users looking to earn tokens. This was once the core business of centralized exchanges, but by enabling projects to build communities before token generation events (TGEs), it has become an even larger market.

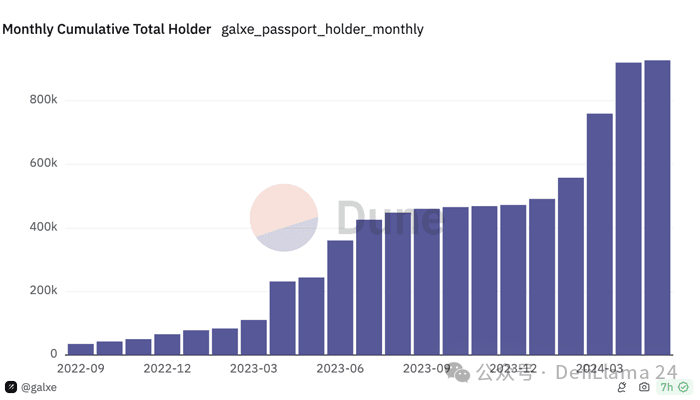

We’ve seen countless early attempts to build identity or data monetization platforms, yet they always failed because they didn’t start with products people actually wanted to use (most users don’t care who owns their data). Galxe built a unique use case with strong enough financial incentives to encourage users to reveal their identities. Such data will become valuable in ways we haven’t yet foreseen—especially if policymakers seriously pursue the consumerization of crypto.

Almost a million people have already created Galxe Passports using their real-world identities.

Aggregating users allows not only for valuable identity layers but also enables consumer-grade products that would otherwise fail as standalone ideas. These include the Galxe mobile app, fund transfers and spending, AI-assisted trading tools, research hubs, and more. Galxe has already become the first touchpoint in crypto for many new users.

Now the question is: How many valuable products can Galxe build so that these users never need to leave its ecosystem?

Galxe spans 34 different chains—more than any cross-chain bridge or centralized exchange could integrate. Through Galxe’s Smart Balance feature, users can deposit funds into a single vault and use that balance to pay gas fees for transactions across multiple chains via Galxe smart contracts, without needing to bridge. Soon, Smart Balance will evolve into Smart Savings, allowing users to earn yield on deposited assets.

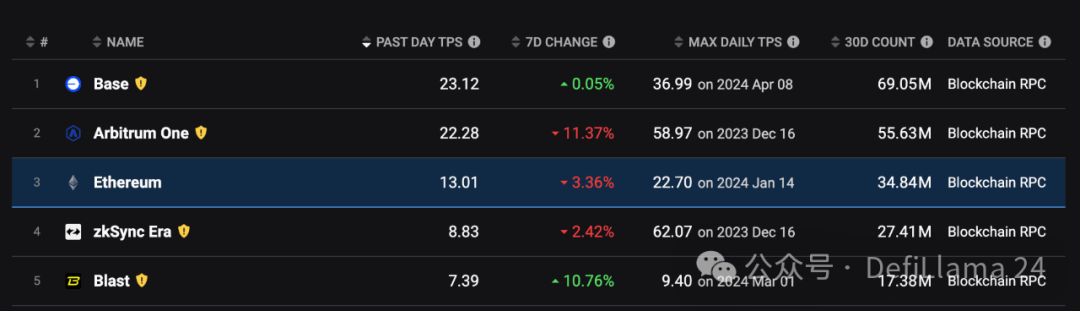

Few realize that while others weren’t looking, Galxe has been quietly abstracting chains and accounts. Following the recent announcement of Galxe’s Gravity chain launch, it will become the largest blockchain by transaction activity, processing approximately $100 million in transactions per month.

Aggregating user identities, their transactions, and controlling blockspace form the strategic combination for abstracting chains. To us, only a handful of crypto companies—Galxe, Coinbase, and perhaps TON—appear fully capable of delivering consumer-friendly chain abstraction. Though they approach it from different angles, the desired outcome—onboarding users to blockchain combined with identity—looks the same to us.

Coinbase and Galxe’s ultimate game has already been revealed.

We don’t know who needs to hear this, but rebranding in crypto is always bullish. There’s no better ticker symbol than $G.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News