Understanding Modularization: Plug-and-Play Solutions to Blockchain Performance Bottlenecks

TechFlow Selected TechFlow Selected

Understanding Modularization: Plug-and-Play Solutions to Blockchain Performance Bottlenecks

Modular technology represents a more "soulful" approach to plug-and-play products.

Author: @twilight_momo

Advisor: @CryptoScott_ETH

TL;DR

-

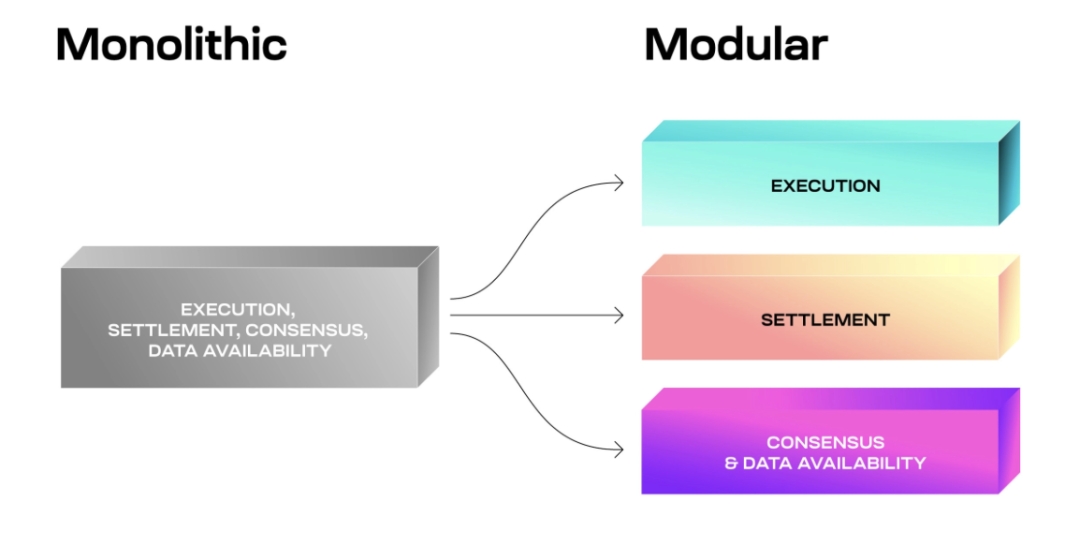

Monolithic blockchains are known for their comprehensiveness, independently handling all network layers—from data storage to transaction validation. In contrast, modular blockchains separate different blockchain functions into independent modules, enhancing performance and user experience in specific areas, thereby partially resolving the "impossible trinity" problem.

-

Ethereum, as the first blockchain platform supporting smart contracts, provided fertile ground for modular design. As blockchain technology evolves, the Bitcoin ecosystem is also exploring modularity by adding new modules to enable advanced features such as improved privacy, more efficient transaction processing, or enhanced smart contract capabilities.

-

Modular technology represents a more "soulful" approach to pluggable product design. In the future, we will see increasingly flexible and customizable blockchain solutions, where various services and functionalities can be easily plugged in and out like LEGO bricks. This flexibility allows developers to rapidly build and deploy blockchain solutions tailored to specific application scenarios.

1. What Is a Modular Blockchain?

source: Celestia.org

To understand modular blockchains, we must first grasp the concept of a monolithic blockchain. Monolithic chains such as Bitcoin and Ethereum are comprehensive systems that independently manage every layer of the network—from data storage and transaction validation to smart contract execution. These chains act as generalists, involved in every aspect of the process.

Taking Ethereum as an example, a mature monolithic blockchain can generally be divided into four architectural layers:

-

Execution Layer

-

Settlement Layer

-

Data Availability Layer (DA Layer)

-

Consensus Layer

The diagram below uses the analogy of a sports match to explain the role of each blockchain layer in recording transactions:

Through this analogy, we gain a clearer understanding of how the various blockchain components work together. A monolithic blockchain performs all functions on a single chain, whereas a modular blockchain is a new architectural model that decomposes the blockchain system into multiple specialized components or layers—each responsible for specific tasks such as consensus, data availability, execution, and settlement.

Modular blockchains function like a team of specialists, deeply focused on innovation and optimization within their respective domains. This specialization enables superior performance and user experience in targeted functions—for instance, achieving faster transaction speeds at lower costs.

In terms of node architecture, monolithic chains rely on full nodes that must download and process complete copies of the blockchain data—a requirement that demands significant storage and computational resources, limiting network scalability. In contrast, modular blockchains use lightweight nodes that only need to handle block header information, significantly improving transaction speed and network efficiency.

A key advantage of modular blockchains lies in their flexibility and collaborative nature. They can outsource non-core functions to other specialized components, creating synergistic effects that substantially enhance overall performance. This design philosophy resembles LEGO blocks, enabling developers to freely assemble different modules based on project requirements to create diverse solutions.

While monolithic chains excel in global control, security, and stability, they face challenges in scalability, upgrade complexity, and adapting to new demands. Modular blockchains stand out due to their high flexibility and customizability, simplifying the creation and optimization of new blockchains.

However, modular blockchains also face unique challenges. Their complex architecture increases the workload for developers in design, development, and maintenance. As an emerging technology, modular blockchains have not yet undergone comprehensive security testing or withstood market volatility—their long-term stability and security remain to be further validated.

2. Why Do We Need Modular Blockchains?

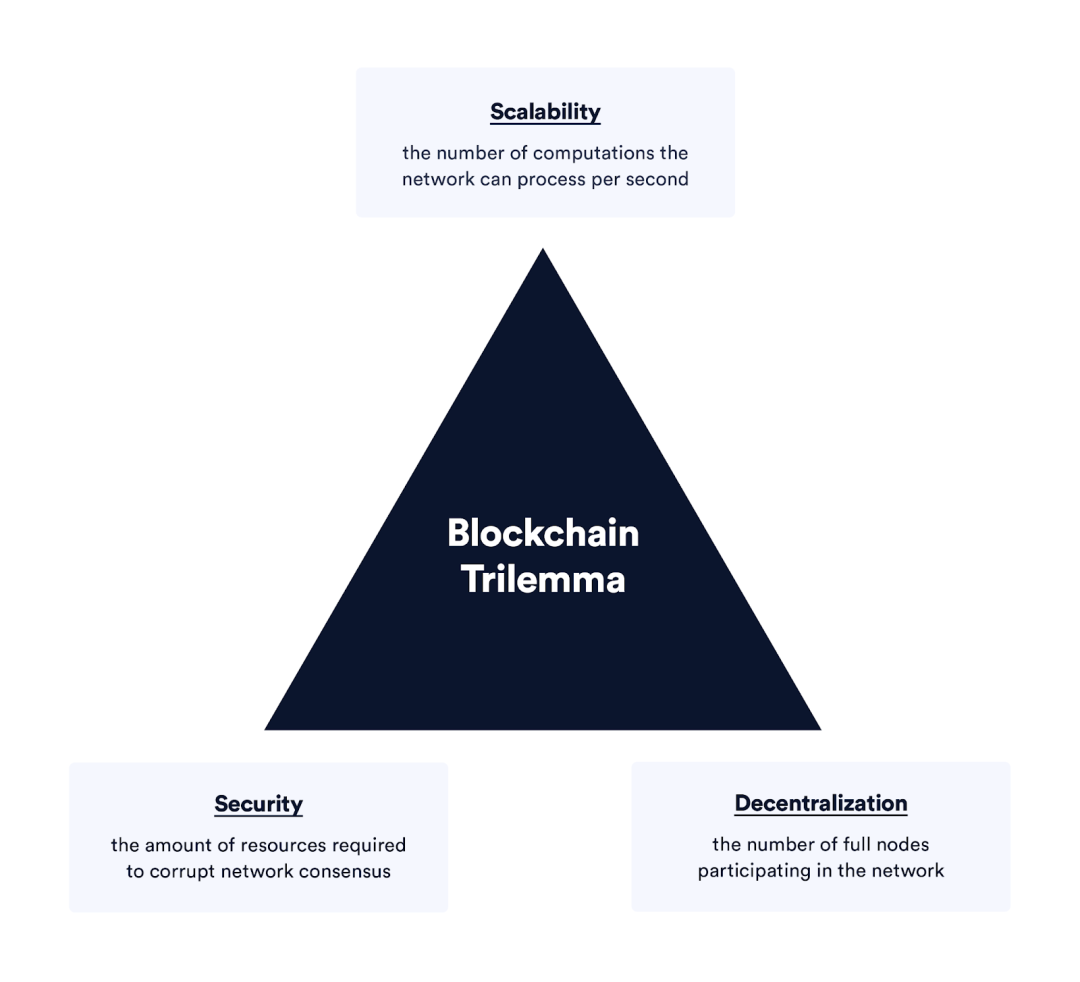

Why has modular blockchain technology gained widespread attention and been predicted as the "future trend"? The answer lies closely with the well-known "impossible trinity" theory in blockchain.

Source: chainlink

The blockchain "impossible trinity" refers to the difficulty of simultaneously optimizing three core attributes—security, decentralization, and scalability—in a single blockchain network.

-

Scalability refers to the network's ability to handle large volumes of transactions efficiently and cost-effectively as users and transaction volume grow. It is typically measured by TPS (transactions per second) and latency (time required for transaction confirmation).

-

Security concerns the cost and difficulty of protecting the blockchain from attacks. For example, Bitcoin's PoW mechanism requires attackers to control over 51% of the network's hash power, while Ethereum's PoS mechanism requires collusion among more than one-third of the nodes.

-

Decentralization describes how the network operates without reliance on a single central node, instead being distributed across many nodes. The greater the number and geographical spread of nodes, the higher the degree of decentralization.

The core idea of the "impossible trinity" is that it's extremely difficult for a blockchain system to achieve optimal performance across all three characteristics simultaneously. For example, among public chains, Bitcoin and Ethereum stand out in decentralization and security due to their extensive node distribution and large number of participants.

However, they sacrifice some scalability, resulting in slower transaction speeds and higher fees: Bitcoin produces a block approximately every 10 minutes, and Ethereum's TPS is around 13. During periods of high transaction volume, Ethereum gas fees can soar to hundreds of dollars.

It is precisely under these circumstances that modular blockchain technology emerged. By assigning different functions to specialized modules, it addresses the challenges traditional public chains face regarding scalability and transaction costs. Examples include Bitcoin's Lightning Network and Ethereum's Rollup technologies, both embodying modular principles.

The advantage of modular blockchains lies in their layered architecture, allowing each layer to be optimized for specific needs. The data layer can focus on storage and verification, while the execution layer handles smart contract logic. This separation not only improves performance and efficiency but also promotes interoperability between different blockchains, laying the foundation for an open and interconnected ecosystem.

In summary, modular blockchain technology offers a new pathway to overcome the limitations of traditional public chains. While maintaining decentralization and security, it achieves higher scalability and lower transaction costs, holding profound implications for the widespread adoption and long-term evolution of blockchain technology.

3. The Modular Blockchain Landscape – Project Analysis

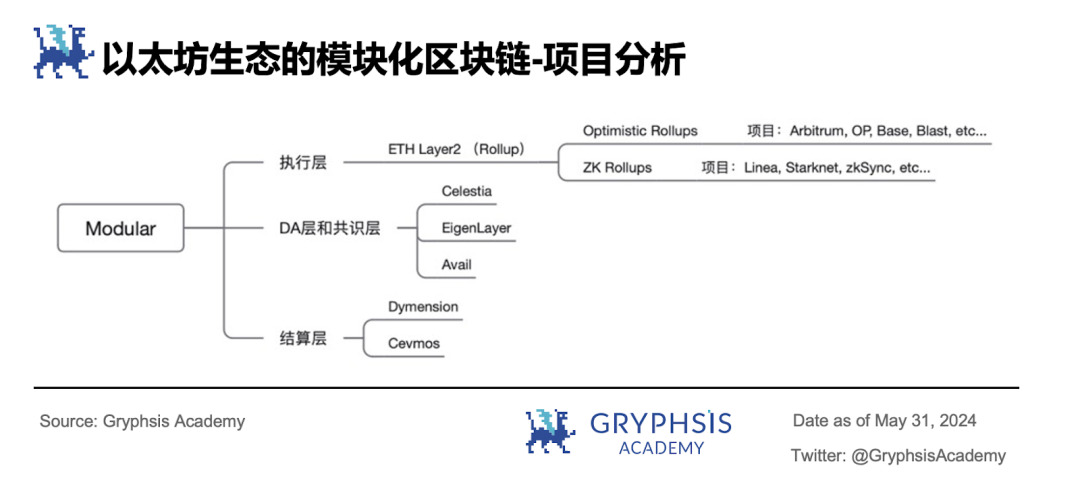

Modular blockchains can be categorized into different types based on architectural characteristics. Among these, the data availability layer and consensus layer are often tightly coupled and designed as a unified whole. This is because when nodes receive transaction data, the order of transactions is usually determined simultaneously—forming the cornerstone of blockchain security and immutability.

Based on this design principle, we can examine modular blockchain projects through three aspects: execution layer, data availability and consensus layer, and settlement layer.

3.1 Execution Layer

Layer 2 technology, as an extension of the execution layer in blockchain architecture, embodies the concept of modular blockchains. By building off-chain networks, systems, or technologies atop the base blockchain, it aims to enhance the main chain's scalability.

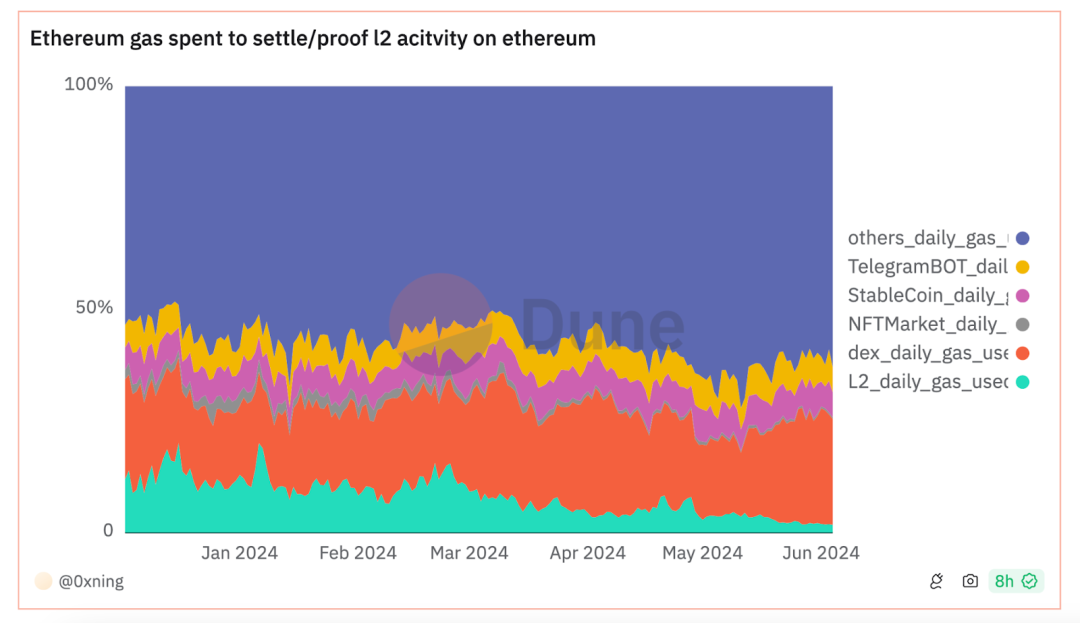

Layer 2 solutions enable faster and more cost-effective transaction processing while preserving the security and decentralization of the underlying blockchain. According to a Dune dashboard created by @0xning, gas consumed by verification and settlement on Ethereum Layer 2 averages less than 10%, significantly reducing user transaction costs.

source: https://dune.com/0xning/ethereum-gas-war

Rollup technology is currently the most mainstream Layer 2 solution. Its core idea is "off-chain execution, on-chain verification"—performing computation off-chain and then uploading calldata back to the mainnet.

Off-Chain Execution

In the Rollup model, transactions are executed off-chain, while the base blockchain only verifies proofs of transactions within smart contracts and stores raw transaction data. This design significantly reduces the main chain's computational load and storage demands, enabling more efficient transaction processing.

To further reduce costs, Rollups employ transaction batching. This can be compared to cargo containerization in logistics—shipping individual items incurs high freight charges. By bundling multiple transactions together, Rollups only require a single "shipment," drastically lowering the cost per transaction.

On-Chain Verification

On-chain verification is crucial for Layer 2 network security. Layer 2 networks must provide cryptographic proofs to resolve potential disputes on the base blockchain. Currently, two primary proof mechanisms exist: fraud proofs and validity proofs, which support Optimistic Rollups and ZK Rollups, respectively.

Fraud Proofs in Optimistic Rollups

Optimistic Rollups operate under an optimistic assumption—that all transactions are valid unless proven otherwise. This model relies on fraud proofs during a challenge period, allowing any network participant to submit evidence challenging the state of a smart contract, ensuring fairness and transparency.

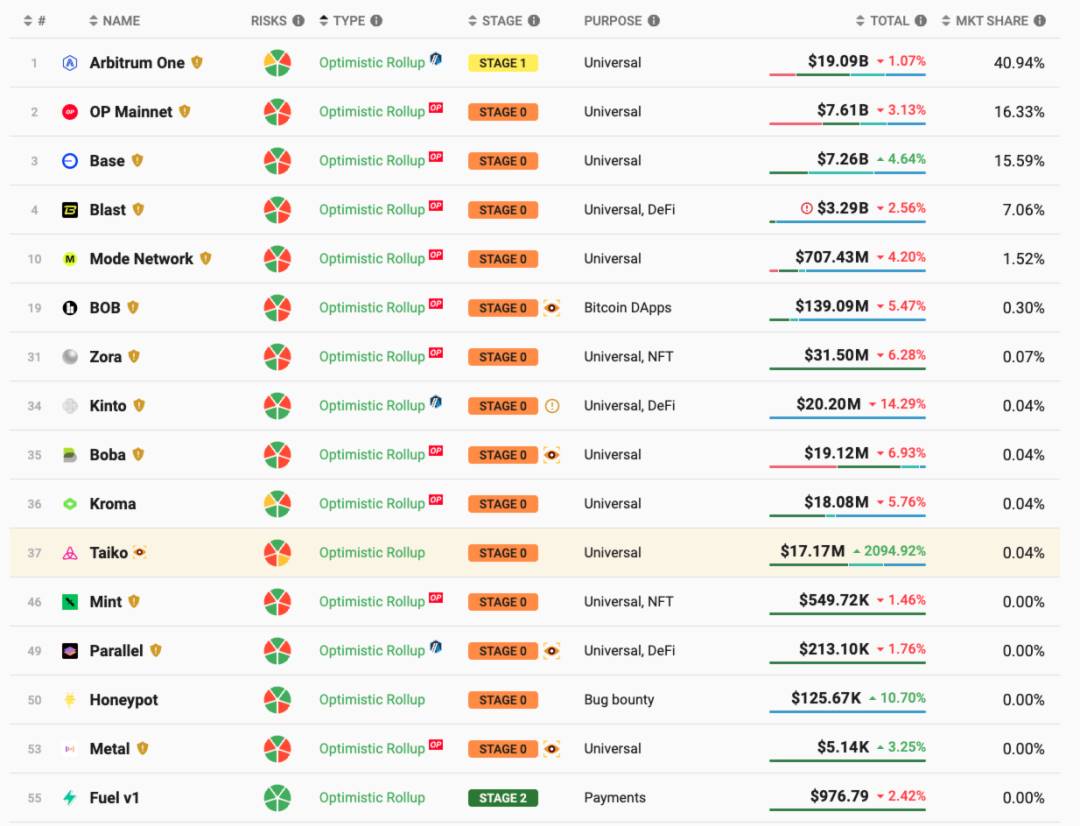

According to L2BEAT, there are currently 16 Layer 2 solutions using the Optimistic Rollup mechanism, including Arbitrum, OP, Base, and Blast.

Source: l2beat.com

Validity Proofs in ZK Rollups

Unlike Optimistic Rollups, ZK Rollups adopt a more cautious approach, requiring validity proofs for all transactions before acceptance. This mechanism acts like a verification process, ensuring every transaction and computation within the Layer 2 network is accurate.

In short, validity proofs are the foundation of ZK-Rollups. Each batch of transactions must be accompanied by a corresponding proof, enabling the base blockchain’s smart contract to verify and approve state changes. For validators, ZK Rollups offer a zero-error settlement mechanism since every transaction undergoes strict validity verification.

According to L2BEAT, there are currently 11 Layer 2 solutions using the ZK Rollup mechanism, including Linea, Starknet, and zkSync.

Source: l2beat.com

3.2 Data Availability Layer & Consensus Layer

3.2.1 Celestia

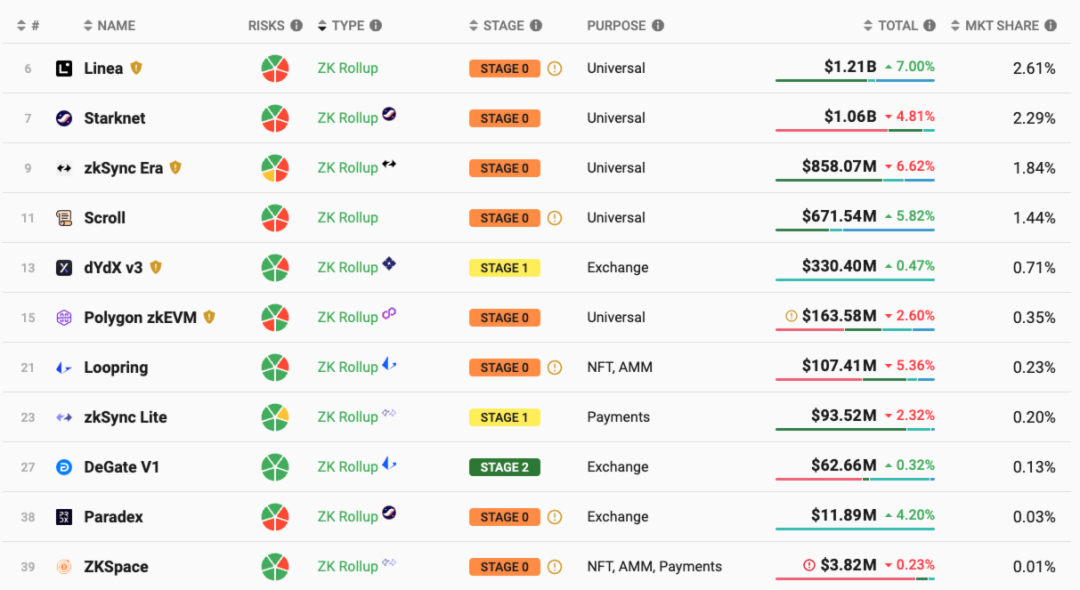

As a pioneer in the modular blockchain space, Celestia is fundamentally a data availability layer that provides a solid foundation for dApp and Rollup development. By deploying on Celestia’s data availability and consensus layers, application developers can focus on optimizing execution logic while delegating data availability and consensus complexity to Celestia.

Celestia’s architecture enables diverse modular scaling solutions. Its ecosystem primarily consists of three types:

-

Sovereign Rollups: Celestia provides the data availability and consensus layers, while the settlement and execution layers are independently implemented by sovereign chains.

-

Settlement Rollups (e.g., Cevmos): Building upon Celestia’s DA and consensus layers, Cevmos provides settlement services, while application-specific chains handle execution.

-

Celestium: Data availability is managed by Celestia, while consensus and settlement leverage Ethereum’s robust network. Application chains continue to focus on execution.

Celestia employs several innovative technologies that significantly reduce data storage costs and optimize storage efficiency.

Erasure Coding

One of Celestia’s innovations is the use of erasure coding. In a paper co-authored by Mustafa Al-Bassam (one of Celestia’s founders) and Vitalik Buterin titled “Data Availability Sampling and Fraud Proofs,” a new architectural idea was proposed: full nodes produce blocks, while light nodes verify them. Erasure coding introduces redundancy during data transmission, enabling full recovery of original data even if up to 50% of the data is lost.

This mechanism means that to ensure 100% data availability, block producers only need to publish 50% of the block data. If a malicious producer attempts to alter 1% of the data, they would actually need to tamper with 50% of it—greatly increasing the cost of malicious behavior.

Data Availability Sampling (DAS)

Celestia uses Data Availability Sampling (DAS) to address blockchain scalability. The DAS workflow includes the following key steps:

-

Random Sampling: Light nodes perform multiple rounds of random sampling, requesting only small portions of block data each time.

-

Gradually Increasing Confidence: As light nodes complete more sampling rounds, their confidence in data availability grows.

-

Reaching Confidence Threshold: Once a light node reaches a preset confidence level (e.g., 99%), it considers the block data available.

This mechanism allows light nodes to verify data availability without downloading entire blocks, ensuring data integrity and availability. By focusing solely on data availability rather than state execution, Celestia enhances block production rates, allocates more block space, accommodates more sampled data, and significantly boosts TPS (transactions per second).

3.2.2 EigenLayer

EigenDA is a secure, high-throughput, decentralized data availability service and the first active validation service (AVS) launched on EigenLayer. AVSs can be understood as node operators—selected from thousands of Ethereum node operators—who take on additional tasks (serving rollups or other networks needing consensus validation) alongside their primary duties (validating Ethereum consensus), earning extra rewards.

As the amount of re-staked ETH increases and more AVSs join the EigenLayer ecosystem, rollups can benefit from lower transaction costs and higher security composability within the ecosystem.

EigenLayer is a re-staking protocol built on Ethereum that leverages Ethereum’s consensus-layer stakers as validators—effectively borrowing part of Ethereum’s security. This avoids trust risks associated with centralized providers or native tokens, lowering the development barrier for other projects. At the same time, it strengthens Ethereum’s trust network, increasing its value and influence.

Architecturally, EigenDA uses ZK technology to verify state data submitted by Layer 2, while the EigenDA network secured by restaked ETH ensures finality. Finally, Layer 2 state data is submitted and stored on the Ethereum mainnet. Thus, EigenDA acts as a subcontractor for Ethereum’s DA service—handling verification and finality—not a competitor like Celestia.

3.2.3 Avail

Avail is a modular blockchain project announced by the Polygon team in June 2023 and spun off as an independent entity in March this year. Avail is currently operating on testnet and recently raised $43 million in Series A funding led by Dragonfly and Cyber Fund.

Avail’s core architecture consists of three parts: Avail DA, Avail Nexus, and Avail Fusion. Avail DA is a modular data availability layer that, like Celestia, provides DA services to various blockchains. Avail Nexus is a standardized cross-chain messaging protocol similar to Cosmos’ IBC, enabling interoperability between chains. Avail Fusion introduces multi-asset staking PoS consensus, aiming to provide secure consensus for the entire Avail network.

Technically, Avail DA uses Kate polynomial commitments, eliminating the need for fraud proofs and assumptions about honest majority nodes, and does not depend on full nodes for data availability. This differs fundamentally from Celestia, which relies on fraud proofs.

With the emergence of modular data availability projects like Celestia and Avail, competition in the modular DA space is intensifying. Ethereum’s role as a DA layer will likely be fragmented, potentially leading to a "one dominant, multiple strong" competitive landscape.

3.3 Settlement Layer

3.3.1 Dymension

Dymension is a modular blockchain platform built on Cosmos that provides a streamlined framework for RollApp development via built-in scalable rollup technology. Within Dymension’s architecture, developers can focus on business logic implementation, leveraging the Rollup Development Kit (RDK) and a dedicated settlement layer to quickly deploy application-specific rollups.

Dymension’s architecture comprises two core components: RollApp and Dymension Hub.

A RollApp is a fusion of a rollup and an app—an application-specific, high-performance modular blockchain on Dymension. RollApps can take various forms, including specialized Layer 2 solutions for DeFi platforms, Web3 games, NFT marketplaces, and other dApps.

Within a RollApp, the sequencer plays a critical role, responsible for validating, ordering, and processing local transactions. After block packaging, this data is passed to peer full nodes and published on-chain to the data availability network chosen by the RollApp, such as Celestia. Upon receiving confirmation from Celestia, the sequencer sends its state root to the Dymension Hub to achieve consensus and settlement.

The Dymension Hub serves as the central hub of the entire ecosystem, fulfilling the roles of consensus and settlement layers. It receives state roots from RollApps, providing final transaction confirmation and settlement services for RollApps.

Through this design, rollups can delegate consensus and settlement tasks to the Dymension Hub, while entrusting data storage and verification to DA networks like Celestia. This way, rollups can share the economic security of both networks while focusing on improving application execution efficiency and user experience.

3.3.2 Cevmos

Cevmos combines Celestia, EVMos, and CosmOS, aiming to provide a settlement layer for EVM-compatible rollups.

Since Cevmos itself is a rollup, all rollups built on it are collectively referred to as settlement rollups. Each rollup connects via a minimal two-way trust bridge to redeploy existing rollup contracts and applications from Ethereum, reducing migration effort. Rollups on Cevmos publish data to Cevmos, which batches the data and then publishes it to Celestia. Like Ethereum, Cevmos executes rollup proofs at the settlement layer.

4. Modular Blockchains in the Bitcoin Ecosystem

Fueled by the wealth effect of Ordinals protocol inscriptions and the approval of Bitcoin ETFs, multiple positive catalysts have injected new vitality into the Bitcoin ecosystem. Market attention has rapidly shifted toward Bitcoin, with institutional capital flowing into the space, reflecting confidence and optimism about Bitcoin’s future development.

Under this backdrop, Bitcoin Layer 2 technology is flourishing, with numerous technical approaches emerging, forming a diversified and vibrant technological ecosystem. Various innovative solutions are advancing together to expand and optimize the Bitcoin network.

Although the industry has yet to reach a consensus on the precise definition of Bitcoin Layer 2, this article draws inspiration from Ethereum’s modular blockchain concepts to explore the possibilities and methods of constructing Bitcoin Layer 2 from a modular perspective.

4.1 Why Does Bitcoin Need Modularity?

Ethereum is renowned for its Turing-complete smart contract functionality, capable of storing and verifying historical states, thus supporting complex decentralized applications (DApps). In contrast, Bitcoin is a stateless, non-smart-contract network. Its system limitations stem from two main aspects:

1. Limitations of the UTXO Account Model

In the blockchain world, two primary record-keeping models exist: account/balance and UTXO. Bitcoin uses the UTXO model, contrasting sharply with Ethereum’s account/balance model.

In the Bitcoin system, although users see balances in their wallets, Satoshi Nakamoto’s original design does not include a balance concept. The so-called "Bitcoin balance" is actually a concept derived by wallet applications based on UTXOs. UTXO stands for Unspent Transaction Output and is central to Bitcoin transaction generation and validation.

Each Bitcoin transaction consists of inputs and outputs. Every transaction consumes one or more inputs and generates new outputs. These newly generated outputs become new UTXOs, awaiting consumption by future transactions.

As an extremely minimal architecture for asset transfer and settlement, the UTXO model struggles to scale and support complex features like smart contracts.

2. Non-Turing-Complete Scripting Language

Bitcoin’s scripting language does not support all types of computations, lacking loops and conditional control statements, making it non-Turing-complete. While this limitation helps reduce hacker attacks and improves network security, it also restricts Bitcoin’s ability to execute complex smart contracts.

Due to these inherent design limitations, Bitcoin requires external modular extensions to support more advanced functionalities. In this regard, Bitcoin’s need for modularity is arguably even greater than Ethereum’s. Its ecosystem’s execution layer, data availability layer, consensus layer, and cross-chain interoperability layer all require modular encapsulation and expansion.

4.2 Analysis of Modular Projects in the Bitcoin Ecosystem

4.2.1 Execution Layer – Bitcoin Layer 2

Merlin

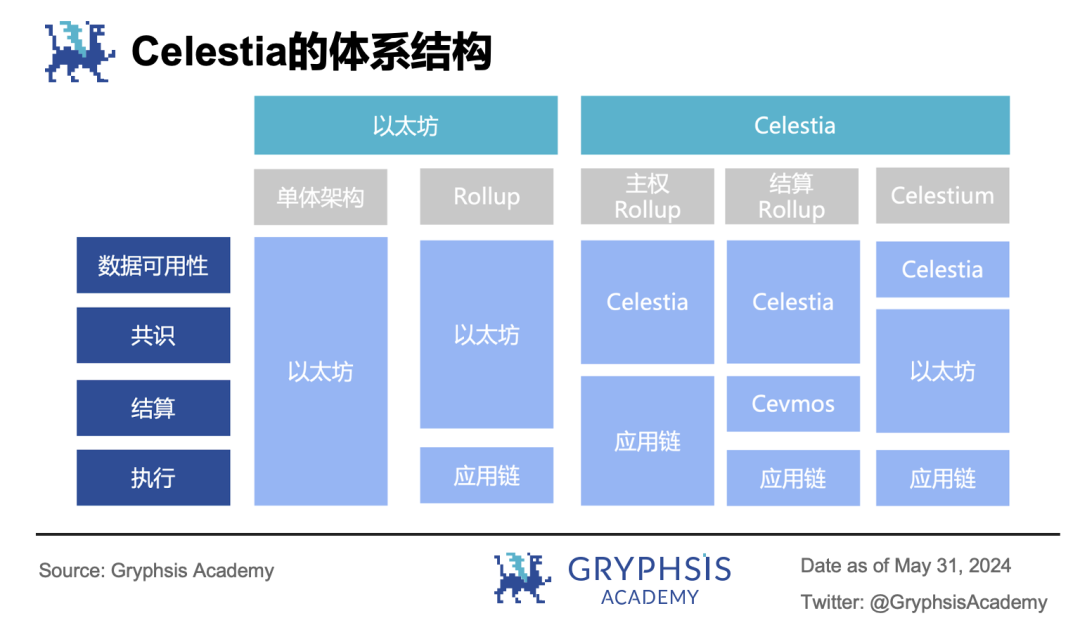

Among Bitcoin Layer 2 projects, Merlin Chain currently boasts the highest TVL, reaching several billion dollars, making it the most attention-grabbing project in the Bitcoin ecosystem. As a Bitcoin Layer 2 network, Merlin supports multiple native Bitcoin assets and is EVM-compatible, demonstrating balanced integration with both the Bitcoin and Ethereum ecosystems.

Source: https://defillama.com/chain/Merlin

Merlin’s functionality revolves around three core components: ZK-Rollup network, decentralized oracle network, and on-chain fraud prevention.

ZK-Rollup Network

The core of ZK-Rollups lies in zero-knowledge proofs. As a cryptographic method, zero-knowledge proofs allow one party (the prover) to convince another (the verifier) that a statement is true without revealing any information beyond the truth of that statement.

Merlin processes transactions off-chain, avoiding Bitcoin’s high fees and network congestion. Additionally, ZK-Rollups compress multiple transaction proofs into batches, requiring the Bitcoin mainnet to verify only a single aggregated proof, greatly reducing mainnet workload and improving transaction efficiency.

Decentralized Oracle Network

Merlin’s decentralized oracle network acts as a DAC (Data Availability Committee), checking and ensuring that sequencers faithfully publish complete DA data off-chain. The decentralization of the oracle network stems from its PoS structure—anyone who stakes sufficient assets can run an oracle node. This staking mechanism is highly flexible, supporting BTC, MERL, and proxy staking similar to Lido.

On-Chain Fraud Prevention

Merlin incorporates ideas from BitVM, adopting an "optimistic ZK-Rollup" mechanism—essentially assuming all ZK proofs are trustworthy unless challenged. Since verification occurs on the Bitcoin mainnet, technical constraints prevent full validation of ZK proofs on-chain. Instead, only specific computational steps can be verified under exceptional circumstances. Therefore, users can only point out errors in specific steps of the off-chain ZK proof verification process and challenge them via fraud proofs.

4.2.2 Data Availability Layer & Consensus Layer

B² Network

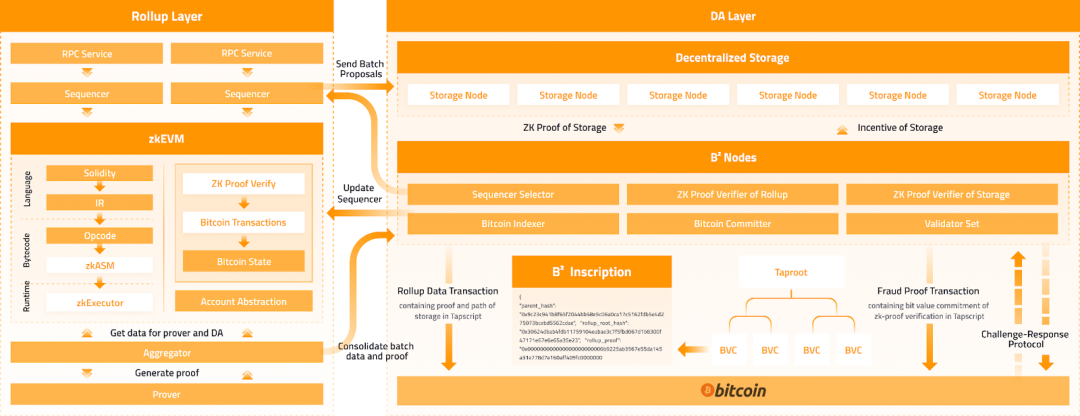

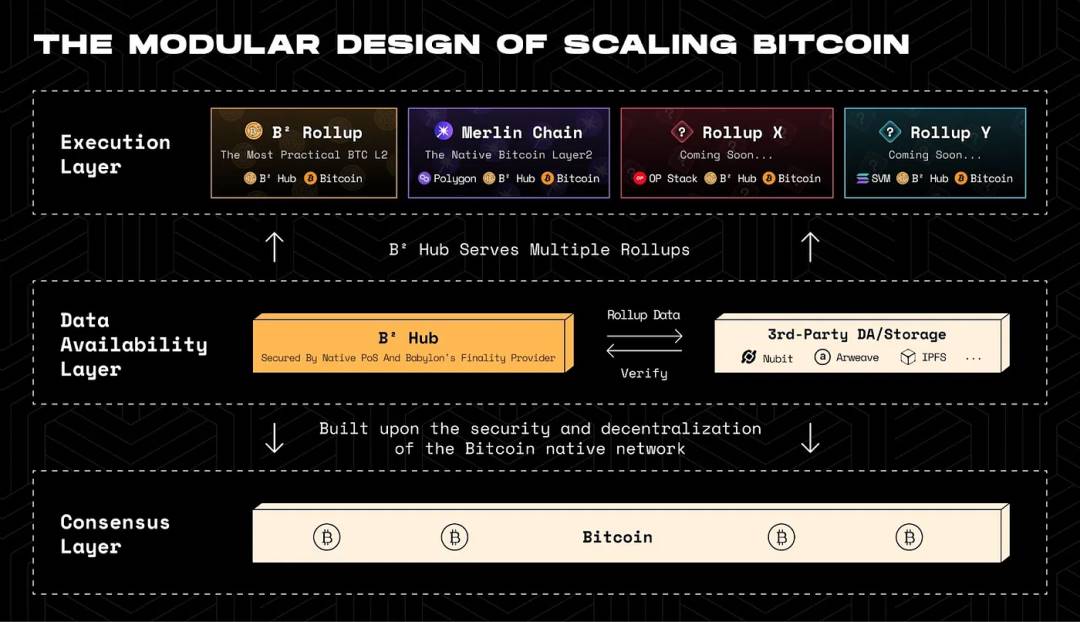

B² Network adopts a modular design: the Rollup layer (ZK-Rollup) handles execution, the data availability layer (B² Hub) manages data storage, B² Nodes conduct off-chain validation, and final settlement occurs on the Bitcoin mainnet.

The ZK-Rollup layer of B² Network uses a zkEVM solution to execute user transactions within the Layer 2 network and generate relevant proofs. The Rollup layer submits and processes user transactions, while the DA layer stores aggregated data copies and verifies associated zero-knowledge proofs.

Source: https://docs.bsquared.network

B² Hub is an off-chain DA network with data sampling capabilities, considered a pioneer in modular Bitcoin scaling solutions. Inspired by Celestia’s design, B² Hub incorporates data sampling and erasure coding to ensure rapid distribution of new data to numerous external nodes and minimize data withholding risks. Additionally, Committer nodes in B² Hub upload storage indexes and data hashes of DA data to the Bitcoin chain for public access.

Source: https://blog.bsquared.network

According to B² Network’s future roadmap, the EVM-compatible B² Hub could become the off-chain validation and DA layer for multiple Bitcoin Layer 2 solutions, forming a functional extension layer beneath Bitcoin. Given Bitcoin’s inability to support many use cases natively, building functional extension layers off-chain will likely become increasingly common in the Layer 2 ecosystem.

As the first third-party DA layer for modular Bitcoin, B² Hub helps other Bitcoin Layer 2 solutions leverage the Bitcoin mainnet as the ultimate settlement layer and inherit Bitcoin’s security, promoting network expansion and enhancing application diversity.

5. Conclusion

The slogan “Modular is the future” is gradually transitioning from vision to reality. With its flexibility and scalability, modular blockchain technology provides a solid foundation for building next-generation decentralized applications. This technology allows developers to select and combine different modules based on specific needs, creating more efficient, secure, and maintainable blockchain solutions.

The rise of modular blockchains represents a more "soulful" approach to pluggable product design. Under this paradigm, blockchains are no longer seen as closed systems but as open, extensible platforms where various services and functions can be effortlessly plugged in and out like LEGO bricks. This flexibility enables developers to rapidly build and deploy blockchain solutions tailored to specific application scenarios.

Originating in the Ethereum ecosystem and now gaining traction in Bitcoin, modular technology is already making waves across various sectors of the crypto industry.

For example, Chromia, a modular public chain using "relational database" technology, has partnered with multiple games like My Neighbor Alice and Chain of Alliance in the gaming sector. In the RWA space, Chromia developed the Ledger Digital Asset Protocol, adopted by several projects.

In AI, CARV focuses on building modular data layers for AI and Web3 games, leveraging trusted execution environments (TEE) and zero-knowledge proofs to ensure privacy and security during data processing.

As modular blockchain technology continues to mature and expand into new application domains, we have good reason to believe it will unlock further innovation across industries. From Bitcoin’s inception to today’s widespread adoption of modular blockchains, we have witnessed how blockchain evolved from a simple digital currency application into a robust ecosystem supporting complex, diverse use cases. In the future, modular blockchains will continue to drive technological progress, laying the groundwork for a more open, flexible, and secure digital world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News