Coinbase: On-chain projects from Fortune 100 companies in the U.S. surge nearly 40%

TechFlow Selected TechFlow Selected

Coinbase: On-chain projects from Fortune 100 companies in the U.S. surge nearly 40%

Well-known enterprises and products in the financial sector are embracing blockchain technology and cryptocurrencies.

Author: Coinbase

Translation: TechFlow

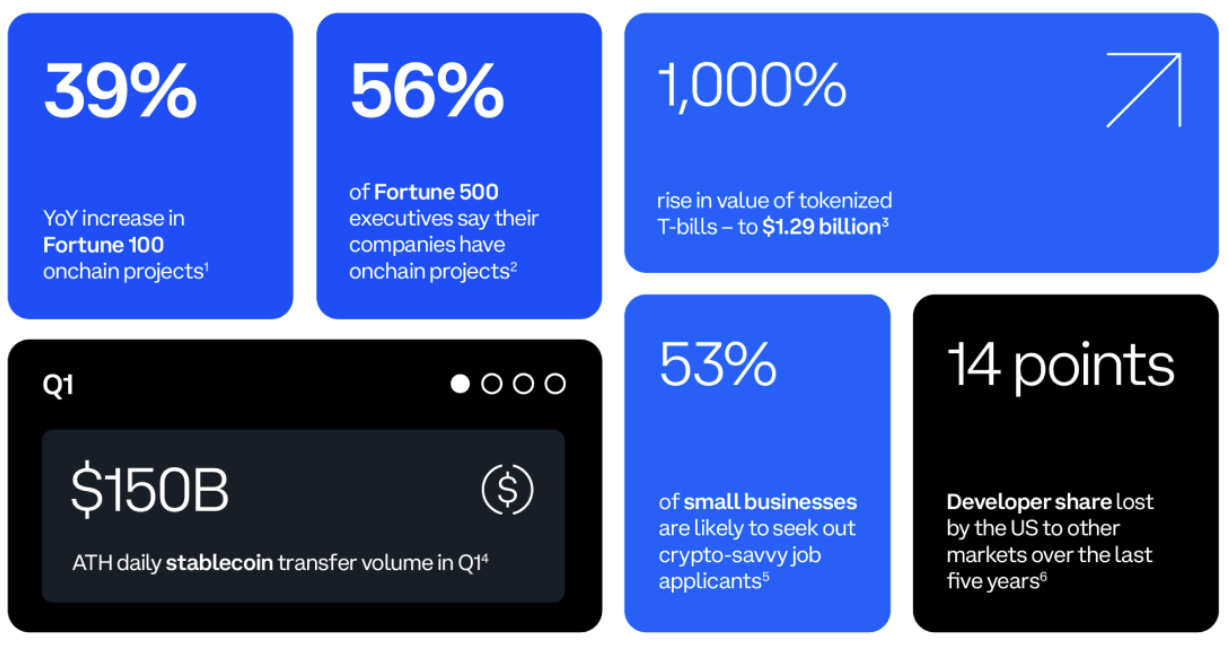

On-chain activity among America's top publicly traded companies is more active than ever before. Announced on-chain projects by Fortune 100 companies rose 39% year-over-year, hitting a record high in the first quarter of 2024. A survey of Fortune 500 executives found that 56% said their company is working on an on-chain project. From the largest traditional brands to small businesses, from stablecoins to tokenized Treasury bills, trusted names and products in finance are embracing blockchain technology and cryptocurrency, driving innovation and creating pathways to broad adoption. The surge in activity underscores the urgency of establishing clear crypto regulations that help keep crypto developers and other talent in the United States.

According to research conducted by The Block for Coinbase, the number of cryptocurrency, blockchain, or Web3 projects announced by Fortune 100 companies increased 39% year-over-year and reached a record high in Q1 2024. A survey of Fortune 500 executives revealed that 56% of companies are engaged in on-chain initiatives, including consumer-facing payment applications. This growing activity highlights the urgent need for clear crypto rules to help retain crypto developers and other talent in the U.S., fulfill the promise of better access to crypto, and maintain American leadership in the global crypto landscape.

Many trusted brands and products in finance are now embracing blockchain technology and cryptocurrency, driving innovation and paving the way for widespread adoption:

-

The launch of spot Bitcoin ETFs has met massive pent-up demand. As of today, spot Bitcoin ETFs have amassed over $63 billion in assets under management. On May 23, 2024, the U.S. Securities and Exchange Commission (SEC) approved exchange applications to list and trade spot Ethereum ETFs (pending S-1 approval), further expanding access to spot cryptocurrencies and accelerating adoption.

-

Beyond ETFs, on-chain government securities are fueling new interest in real-world asset tokenization. Recent high interest rates have increased demand for secure, high-yield on-chain U.S. Treasuries. Since early 2023, the value of tokenized U.S. Treasury products has grown over 1,000%, reaching $1.29 billion. BlackRock’s tokenized U.S. Treasury fund BUIDL has reached $382 million, recently surpassing Franklin Templeton’s $368 million fund to become the largest. Crypto hedge funds and market makers are using BUIDL as collateral for trading tokens. The tokenized assets market is projected to reach $16 trillion by 2030—equivalent to today’s EU GDP.

-

Beyond Coinbase, global payments giants PayPal and Stripe are making stablecoins easier to use. Merchants on Stripe can now accept USDC payments via Ethereum, Solana, and Polygon through Circle, automatically converting them into fiat currency. PayPal supports cross-border transfers for stablecoin users across approximately 160 countries—with zero transaction fees, compared to average remittance costs globally of 4.45% to 6.39%. In 2023, stablecoins settled $10 trillion annually—more than ten times the volume of global remittances.

-

This progress isn’t just top-down—it’s also bottom-up: America’s most trusted institutions, small businesses, are entering crypto too. About seven in ten (68%) small businesses believe crypto could help solve at least one financial pain point, with the biggest being transaction fees and processing times.

At Coinbase, we appreciate the strides traditional finance is making in modernizing systems and offer several calls to action based on the data:

-

The U.S. must cultivate much-needed talent instead of continuing to lose it overseas. Over the past five years, the share of U.S.-based developers has dropped by 14 percentage points; today only 26% of crypto developers are based in the U.S. Among Fortune 500 executives, concerns about the availability of credible talent have now become the primary barrier to adoption, surpassing regulatory concerns. Among small businesses, half say they may look for candidates familiar with crypto in their next hire for finance, legal, or IT/tech roles. Clear crypto rules are key to retaining developers—and essential for the U.S. to continue leading the world in frontier technological innovation.

-

Equally important is ensuring the technology fulfills its promise to serve companies using crypto, and even more critically, to serve underserved and unbanked individuals who need financial services. For the underbanked and unbanked, nearly half (48%) of Fortune 500 executives believe crypto has the potential to expand access to the financial system and build wealth. For companies using crypto, one Fortune 500 executive noted that banks could encourage innovation by finding more ways to collaborate with them.

-

The U.S. needs to lead in this space. Fortune 500 executives show strong interest: 79% want to work with U.S. partners (up from 73% last year), and 72% agree that having a dollar-backed digital currency (versus yen-backed) helps maintain America’s global economic competitiveness.

Cryptocurrency is the future of money.

This research report is Coinbase’s fourth since June 2023 and includes a year-over-year analysis on corporate adoption. It is the latest comprehensive research publication from Coinbase aimed at informing the public about the role crypto, blockchain, and related web technologies can play in modernizing the global financial system for the benefit of businesses and consumers.

Methodology

Unless otherwise noted, data and insights cited in this report come from the following sources:

-

Fortune 100 Projects: Analysis by The Block Pro Research of Fortune 100 companies’ Web3 project activity from Q1 2020 through early June 2024. “Activity” is broadly defined to include any internal corporate projects, investments, partnerships, product/service launches, and similar initiatives related to digital assets/blockchain. The Block conducts public information searches using keywords such as “cryptocurrency,” “blockchain,” “tokenization,” “NFTs,” “metaverse,” and “digital assets” across news sites, corporate filings, press releases, and announcements. Search results are manually reviewed, aggregated, and deduplicated. For each project in the database, The Block assesses the project stage, industry, and Web3 use case (e.g., tokenization, process automation, payments/settlement, etc.).

-

Fortune 100, stablecoin, and tokenization case studies: Research by The Block.

-

Web3 Adoption Survey: A survey of 104 Fortune 500 executives (director level and above) familiar with cryptocurrency and blockchain, conducted by third-party research firm GLG for Coinbase between April 17 and 25, 2024.

-

Small Business Survey: A survey of 250 financial decision-makers at U.S. small businesses (fewer than 500 employees) familiar with cryptocurrency, conducted by research firm NRG for Coinbase between April 24 and 29, 2024.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News