FMG In-depth Research Report: 5 Bottom-up Opportunities in the DePIN Sector

TechFlow Selected TechFlow Selected

FMG In-depth Research Report: 5 Bottom-up Opportunities in the DePIN Sector

Public chains that support the DePIN ecosystem in this cycle will reap the greatest benefits.

Authors: EO@codeboymadif, Lisa@lisal1l1, Ryan@Ryan0xfmg, Kelv@KelvinYuan13, Simon

Part 01 What and Why DePIN

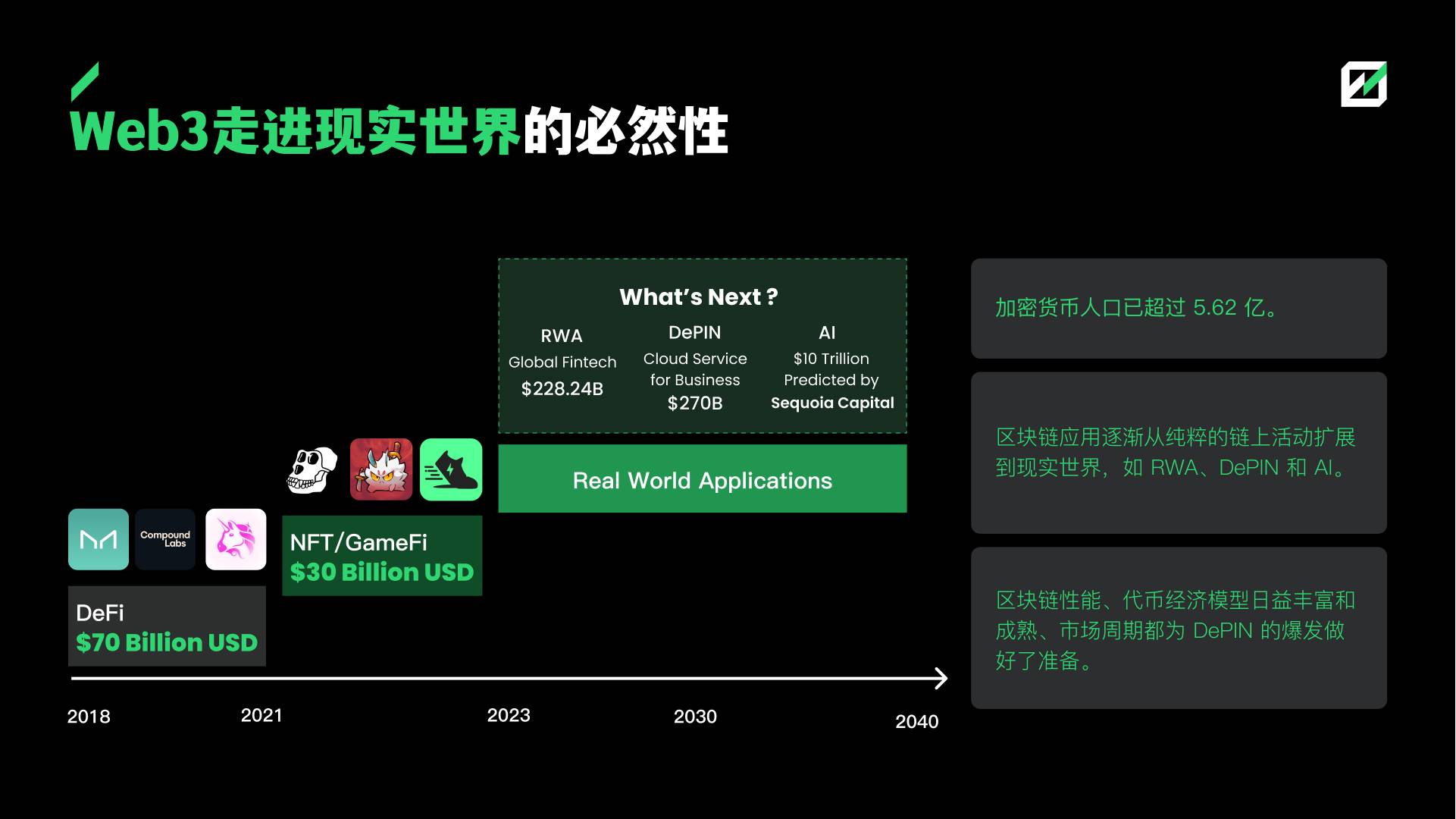

Using crypto economics to deploy real-world physical infrastructure has a long history, with some notable projects dating back to 2013. These early initiatives explored valuable use cases in communication, storage, and computing. Today, this model has expanded into new domains such as AI, energy, and data collection, leading to a period of ecosystem growth and prosperity.

DePIN represents a new paradigm for decentralized applications: node-based economies, miner models, and transforming the physical world.

-

Compared to centralized infrastructure (CePIN), DePIN achieves significantly higher unit economics. By replacing CePIN's hardware deployment, operations, and management with smart contracts, standardized devices, and token incentives, DePIN can reduce costs by 75%-90%.

-

Token economics are crucial for network expansion and achieving network effects. When token prices rise, economic incentives drive rapid node growth.

-

If Web2 enabled human interaction with the internet through various input devices, Web3 enables physical hardware to interact with blockchains through DePIN.

We've seen the DeFi Summer, NFT mania, and Metaverse hype. Could the next wave be DePIN? Between 2020 and 2021, DeFi’s market cap grew nearly 100x—from $1.75B to a peak of $172.2B. If in this bull cycle DeFi grows another 10x and DePIN reaches 50% of DeFi’s market cap, then DePIN’s total market cap could reach $500 billion—representing at least a 20x increase from current levels.Messari estimates DePIN’s market cap could reach $3.5 trillion by 2028, indicating a potential 120x growth opportunity.

We identify five key opportunities across the DePIN stack:

-

DePIN Blockchain Infrastructure. Serves as the settlement layer for DePIN applications, supporting transactions and token economy operations.

-

DePIN Middleware. Acts as a bridge between底层 infrastructure and upper-layer applications, providing standardized interfaces and tools. This layer is a critical hub in the DePIN ecosystem.

-

DePIN Applications. Built on top of DePIN infrastructure and middleware, these applications deliver real services and value to users—the frontend and use-case layer of the ecosystem.

-

Emerging Opportunity: Edge AI. A major extension of DePIN, leveraging DePIN networks to deploy edge computing and AI applications that process data locally and deliver intelligent services.

-

Emerging Opportunity: RWA. Combining DePIN with Real World Assets (RWA) to create novel financial products and services.

Part 02 Opportunities in DePIN Infrastructure

L1/L2 Blockchains Likely to Benefit from DePIN Growth

-

DePIN is a flagship use case for Solana’s OPOS (“Only Possible on Solana”) narrative. Riding this momentum, Solana rebounded from a post-FTX low of $3.6B to a market cap of $89.8B—a25x increase. DePIN will remain a core narrative for Solana going forward. The migration of Helium’s mainnet to Solana serves as a strong signal. Following this logic, Polygon and Arbitrum are also positioned to benefit from DePIN adoption.

-

Vertical-specific chains offering modular DePIN infrastructure—such as IoTeX and Peaq—will benefit from ecosystem and flagship application growth.

-

General-purpose blockchains tightly integrated with AI—like Near, which centers its narrative around AI, and Aptos, partnering with Microsoft to merge AI and Web3 products—will naturally extend into upstream DePIN sectors.

General-Purpose Middleware: The Crown Jewel of DePIN

Seamlessly connecting physical infrastructure to blockchains requires robust middleware. Currently, trusted hardware relies on official authorization, while anti-cheating mechanisms depend on governance and miner management tools.

Challenges facing general-purpose middleware:

-

High technical complexity: Technology alone struggles to prevent cheating and ensure trustworthy data on-chain.

-

Limited overall DePIN market size constrains the middleware market opportunity.

Once breakthroughs occur, general-purpose middleware will dramatically lower the barrier to building DePIN applications and accelerate ecosystem growth—with middleware providers being primary beneficiaries.

DePIN Miner Services Layer: Borderless Guilds, People’s Networks

The miner services layer sits at the base of the DePIN ecosystem and is essential for DePIN applications. It consists of two main categories: hardware manufacturing and node operations:

-

Hardware manufacturers supply the physical equipment—servers, storage, networking gear—needed to build networks. Through innovation and product improvements, they meet specific demands and open new markets, directly benefiting from DePIN’s growth. Leading manufacturers often participate beyond hardware support, including funding. These factors make them powerful drivers of DePIN development.

-

Node operation platforms assist miners with deployment and maintenance, charging service fees. This model performs well in the later stages of a bull market. During the DePIN flywheel effect, rising token prices shorten payback periods, allowing regular users to profit quickly by paying service fees.

Potential Opportunities:

1. Hardware manufacturers capable of global distribution and rapid production of trusted devices.

2. Permissionless DePIN node deployment platforms could play roles similar to gaming guilds.

3. We anticipate stronger tool-layer projects emerging to capture value. Device data aggregation platforms serve as excellent user entry points. Currently, DePIN data lacks transparency—key metrics like number of nodes, miner returns, end-user counts, and revenue are hard to access—making decision-making difficult. This gap presents a clear opportunity in the DePIN tooling space.

Part 03 Evaluating DePIN Application Value: Finding the Constants

A DePIN protocol functions as a two-sided market: supply provides services, demand generates revenue. Therefore, value assessment must consider both sides.

Demand-Side Evaluation

Rather than focusing solely on concepts, industries, or supply, we believe evaluating the demand market is more important—especially projects targeting consumer (C-end) markets.

Two key insights on demand:

-

Consumer-facing applications offer higher-margin scenarios and greater growth potential.

-

Applications serving AI data demand are still in very early stages.

Bold Prediction for Demand: Web3 Phones and a New Sharing Economy

1. Crypto phones will be pivotal in breaking into consumer markets

Customized phones with built-in DePIN apps and airdrop incentives can achieve rapid growth. Consumer markets often require subsidies. For example, Helium Mobile charges users $20/month. After paying T-Mobile partnership fees, profitability begins when 70–80% of data usage comes from Helium’s own network (as of December 2023, Miami reached 55%). Once past breakeven, the project becomes self-sustaining and strengthens the DePIN flywheel.

2. Building a Web3 version of the sharing economy

Leveraging Web3 mobile apps and effective token incentives, large-scale sharing economies or social networks could emerge.

Supply-Side Evaluation

Over the past two decades, hardware prices have plummeted, enabling individuals to act as infrastructure providers.

Our criteria for evaluating supply markets:

-

Is the product easily standardized? The more standardized, the easier it is to finance—e.g., compute priced by duration, varying configurations at different price points.

-

Is device cost low enough? Lower costs mean larger potential supply and greater decentralization.

Endgame for Supply: Focus on Projects That Scale Quickly and Standardize Easily

-

Most node devices across six sectors cost between $300–$1,000—consumer-grade pricing. High-end GPUs (A100, H100) are expensive; AI-focused hardware is also high-cost due to specialization. Some energy devices exceed $1,000.

-

Standardization remains generally low. Wireless bandwidth is standardized, but subfields like 5G and WiFi are not.

Part 04 Potential of DePIN Applications

According to Messari, by 2023 there were over 650 DePIN projects spanning six sub-sectors: computing, AI, wireless, sensors, energy, and services.

01 Computing Is the Most Mature DePIN Sector

Computing (compute + storage) has the largest TAM. In 2023, enterprise cloud services generated $270 billion in revenue (Synergy Research).

-

Demand: Driven by SMEs and individuals, with GPU demand particularly strong due to AI growth.

-

Supply: Akash offers a diverse hardware network (CPU, GPU, storage); Render and io.net aggregate large amounts of GPU power—io.net sourcing from its own and external platforms.

Two Trends in Computing:

1. The GPU compute market is currently the most promising niche. We see significant secondary market opportunities here, with future consolidation and vertical integration expected.

Growth drivers for decentralized GPU platforms:

1. Global GPU shortage amid soaring demand

2. Synergy with the AI narrative

3. Geopolitical tensions making compute a global currency

Decentralized GPU platforms will grow by using tokens to attract top-tier projects and integrating resources horizontally. Current risks include inefficient demand-supply matching, requiring either demand growth or business model innovation to justify valuations. Future growth lies on the supply side in bypassing B2B channels and expanding to C2C edge computing, and on the demand side in tighter downstream integration or building proprietary use cases.

2. Storage will evolve toward compute-storage convergence, forming a unique Layer1.

Large storage DePINs adding computation become unique Layer1s—blockchains offering decentralized storage and compute. Compared to existing blockchains, these drastically reduce on-chain storage and computation costs, enabling complex applications requiring massive storage and logic—content platforms, social networks, games, etc.

02 DePIN AI: Decentralized Platforms for Open AI Models, Data, and Agents

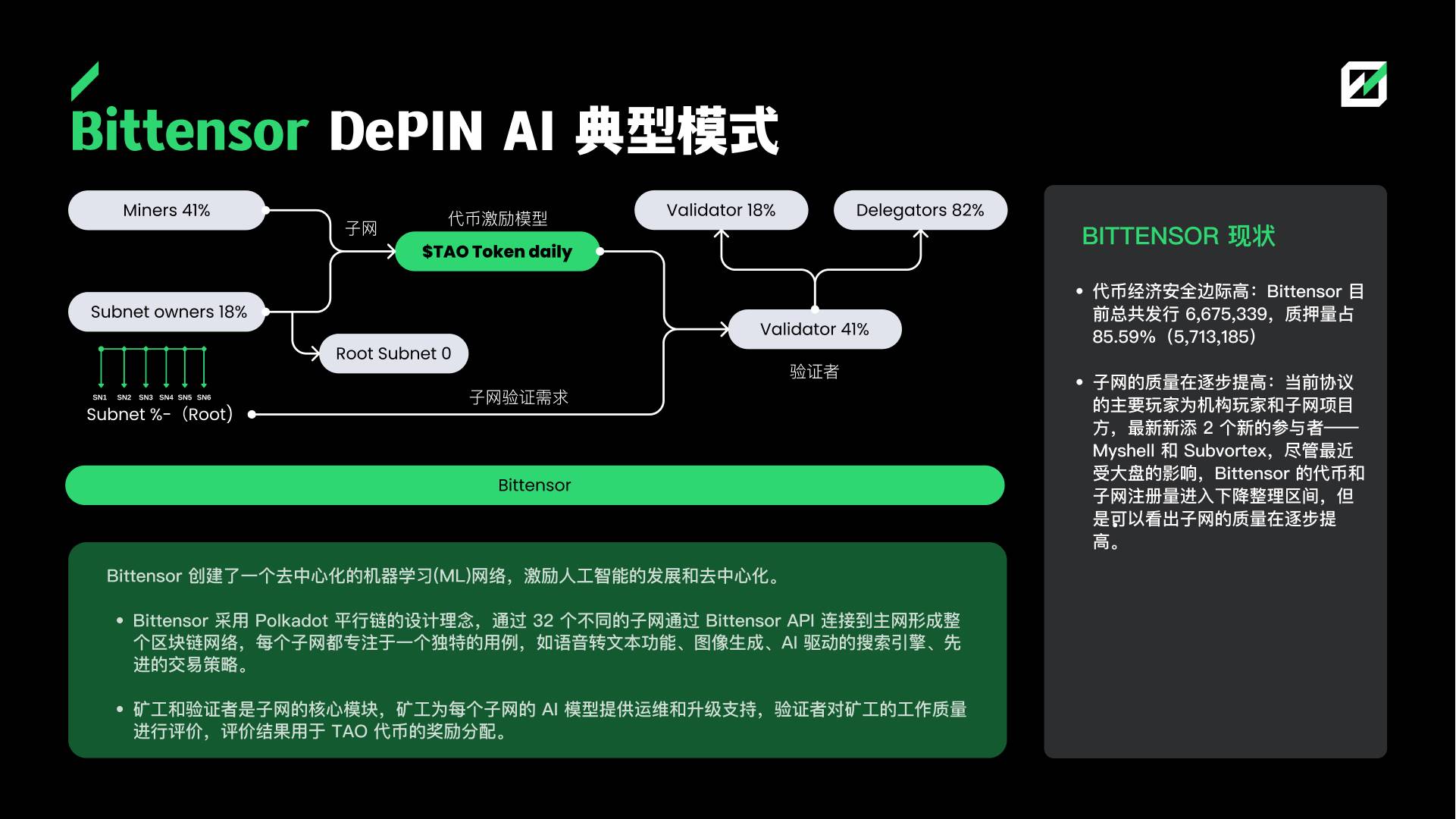

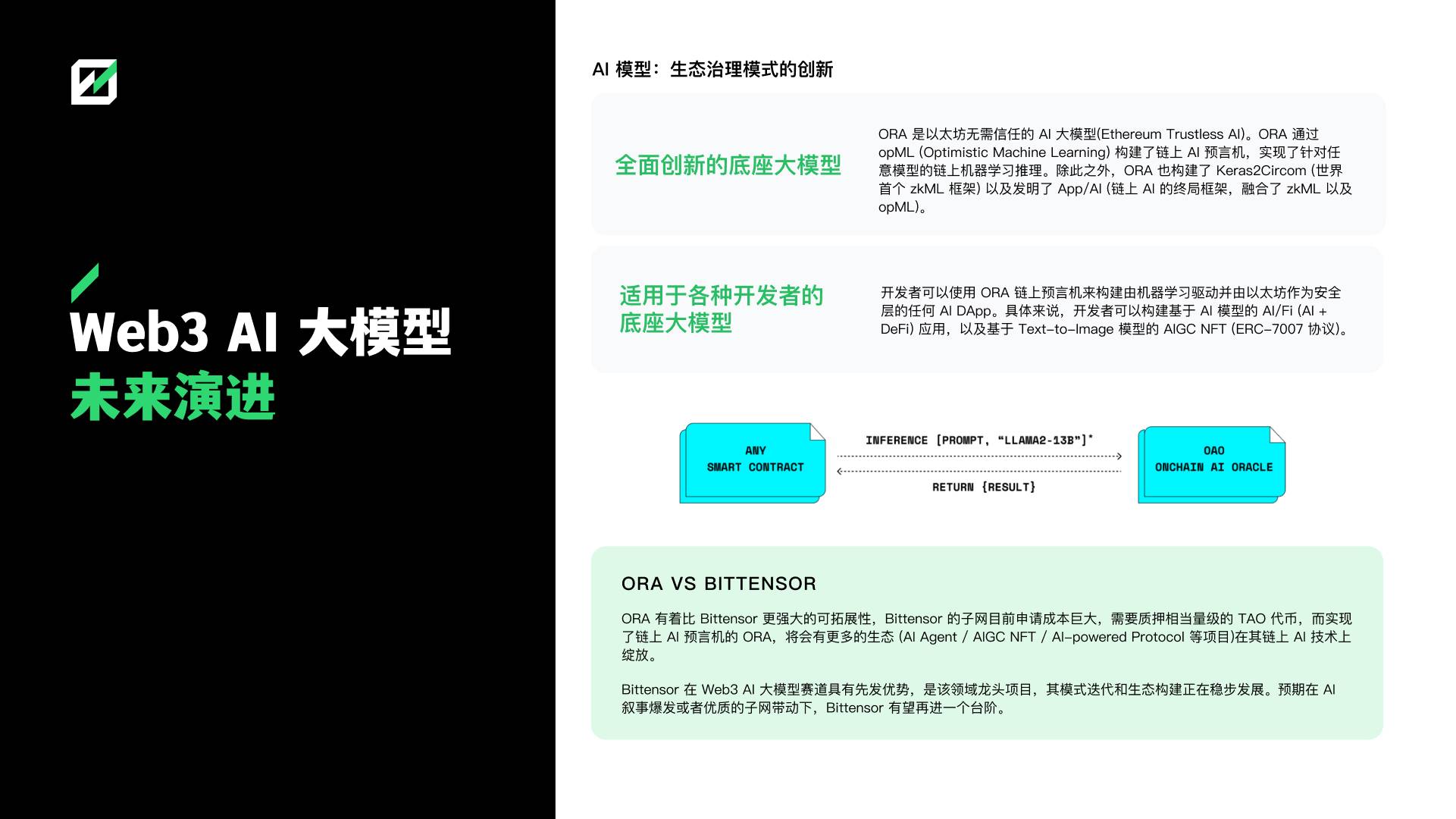

Bittensor exemplifies the DePIN AI model, creating a decentralized machine learning (ML) network that incentivizes AI development and decentralization. Bittensor holds first-mover advantage in the Web3 AI large-model space and is steadily evolving its model and ecosystem. With an AI narrative surge or strong subnet traction, Bittensor could take another leap forward.

ORA offers greater scalability than Bittensor. While joining Bittensor requires staking large amounts of TAO tokens, ORA—implementing on-chain AI oracles—enables a broader ecosystem of projects (AI agents, AIGC NFTs, AI-powered protocols) to flourish on its AI infrastructure.

03 Sensors: A High-Growth, AI-Driven Emerging Sector

Currently, few sensor-focused projects exist—especially those centered on data—indicating abundant early-stage investment opportunities.

Sensor sector value analysis:

-

Is the market large enough? Downstream demand determines ceiling.

-

Is the data valuable? Uniqueness and applicability determine value.

Growth logic for sensors:

1. AI-driven emerging sector

2. Inherently requires decentralization at the architectural level

3. Integrated mining hardware supply chain provides richer funding sources and longer profitability cycles.

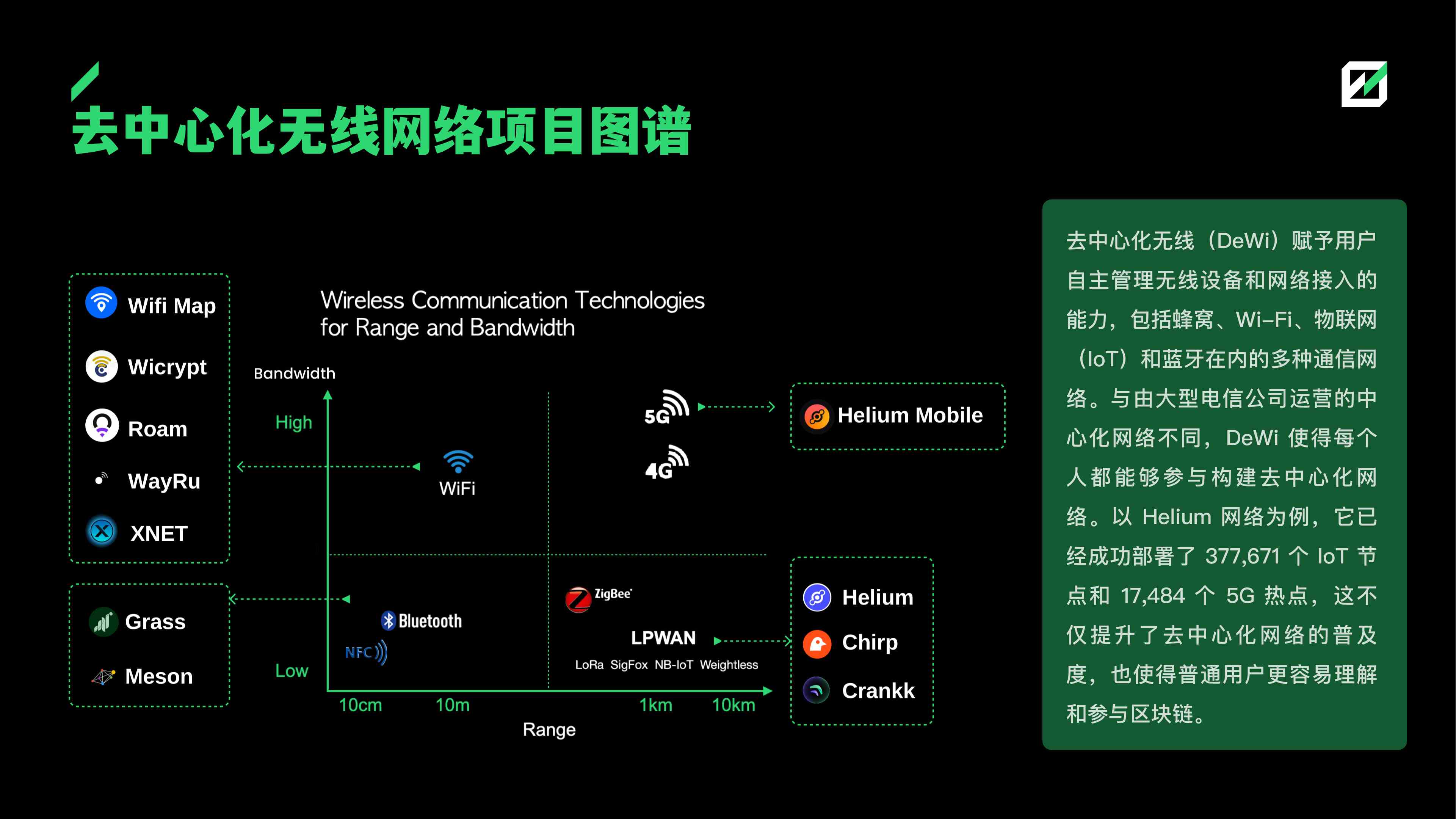

04 Wireless Networks: Highly Competitive, Operationally Challenging

DePIN uses decentralized base stations, routers, and other hardware to provide data transmission for IoT and end-users. Key challenges: fragmented demand and difficulty meeting needs via decentralized networks. Success requires collaboration with traditional telecom operators—either as supplements or data providers. Thus, competitive advantage lies in partnerships with legacy carriers. (Helium Mobile leveraged T-Mobile during cold-start.)

05 Energy Networks: Require Centralized Grids for MVP

DePIN energy networks use distributed generation to reduce transmission losses and improve efficiency, ultimately aiming for Virtual Power Plants (VPPs). As energy harvesting and storage advance, individuals can become suppliers—but transmission remains costly. Smart grids, using consumption data, simplify grid construction. Thus, smart grids will lead DePIN energy adoption. Like wireless, power-generation projects need centralized grid cooperation to function.

Our view on DePIN energy:

-

VPP (Virtual Power Plant) is the endgame: Using DePIN incentives to connect small-scale producers with demand, creating a virtuous cycle culminating in full VPP realization.

-

Current DePIN energy projects are gradually implementing parts of the VPP stack—data, meters, or generation.

06 DePIN + Consumer Products: A Marketing Revolution

Since DePIN gained popularity last October, numerous consumer products have emerged—watches, rings, e-cigarettes, power banks, game consoles—using DePIN incentives to boost sales and usage frequency.

Characteristics of DePIN + consumer products:

-

High market ceiling: Consumer electronics represent a multi-trillion to hundred-trillion dollar market in Web2, covering countless goods.

-

Reach C-end users: Most Web3 users are traders with limited real-world engagement. DePIN consumer products embed Web3 into daily life, increasing relevance and stickiness.

-

High return expectations drive traditional brand Web3 transformation: This new Web3 marketing model adds earning potential to utility, accelerating market capture and boosting profitability.

Risks and limitations of consumer-grade DePIN hardware:

Reliant on simple token incentives, attracting mostly “farmers” buying hardware for rewards rather than genuine users. Similar to current DePIN hardware-software verification issues, better anti-cheating solutions are needed.

Part 05 Two Emerging Opportunities from DePIN

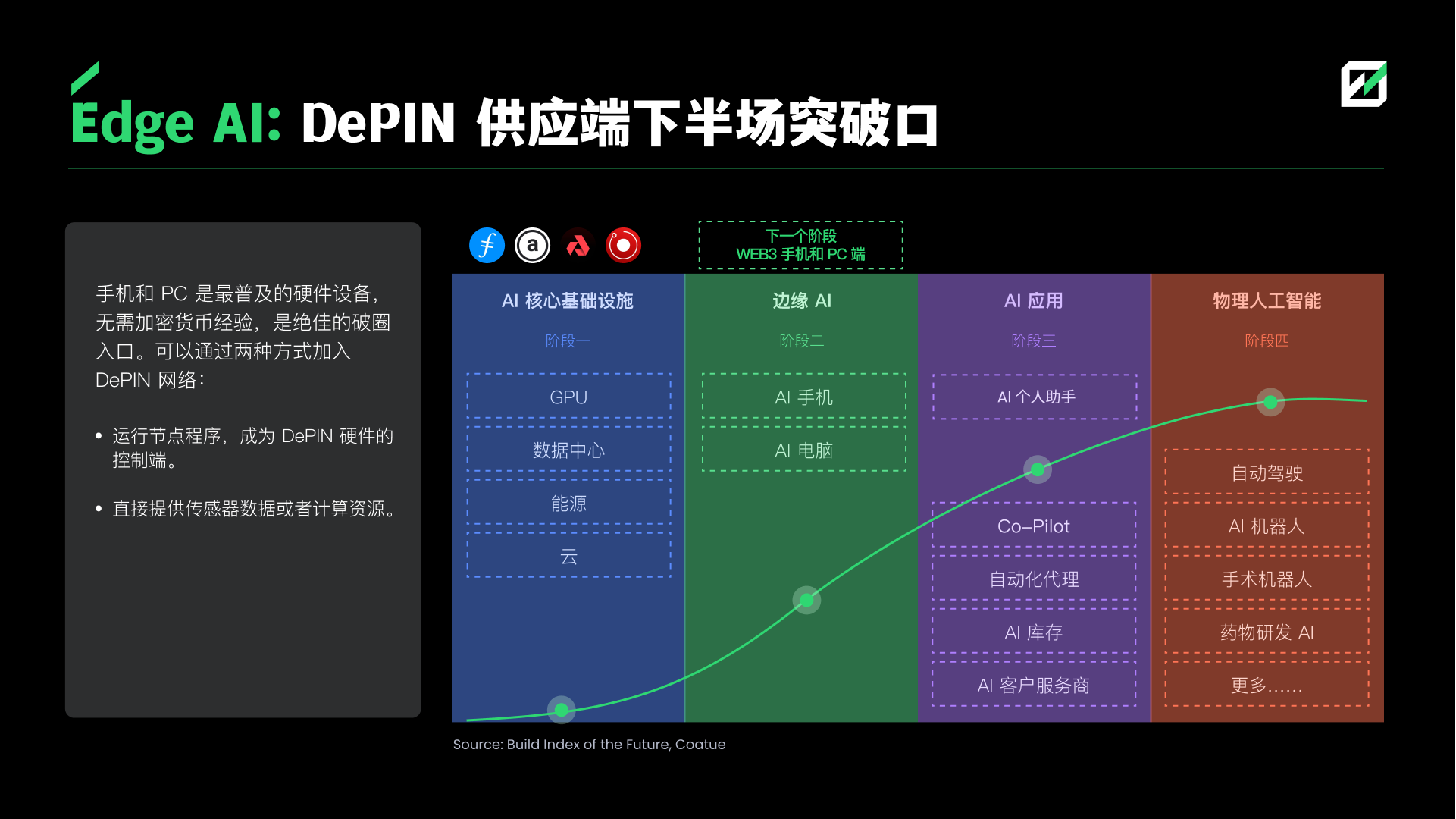

01 Edge AI: The Next Breakthrough in DePIN Supply—Phones and PCs

Phones and PCs are the most ubiquitous devices, requiring no crypto experience—ideal gateways to mainstream adoption. They can join DePIN networks in two ways:

-

Run node software as a control interface for DePIN hardware.

-

Directly contribute sensor data or compute resources.

The Rise of Crypto Phones: 4 Use Cases, Leveraging Potential Earnings to Drive Adoption

-

Mobile crypto apps: Built-in dApp stores make crypto phones ideal entry points for decentralized applications. As the most-used personal device, phones offer a platform for mass crypto adoption.

-

Edge computing: A clear trend. Moving data processing closer to sources improves efficiency and reduces costs. Token incentives combined with crypto phones can accelerate edge computing adoption.

-

Token airdrops: Provide financial returns to buyers. For projects, airdropping to crypto phone owners ensures broad token distribution, aiding meme propagation or consumer app cold starts.

-

DePIN mining: Phones’ sensors and compute modules are natural supply-side resources. Phones can participate in DePIN economies and earn rewards.

Keys to Crypto Phone Competition

-

Low hardware barriers: Mature supply chains enable short production cycles, controlled costs, and low prices—current crypto phones range from $100 to $1,000.

-

Distribution is the challenge: Projects with online sales and offline outreach networks will gain market share faster.

-

App ecosystem is key to defensibility: Once established, it can become a major Web3 traffic gateway.

-

Other hurdles: Hardware iteration tests funding strength and operational capability.

Endgame for Crypto Phones: DePIN + Sharing Economy

In the Web2 era, the internet aggregated personal cars and homes into vast service markets, monetizing individual assets.

In Web3, token economies organize idle, decentralized personal hardware into productive capacity, monetizing devices. Software on Web3 phones will build Web3 service infrastructure, revolutionizing the Web2 sharing economy across dining, transportation, lodging, etc. Web3 mobile apps will feature crypto-native marketing, token airdrops, high-frequency social interactions, and consumer products.

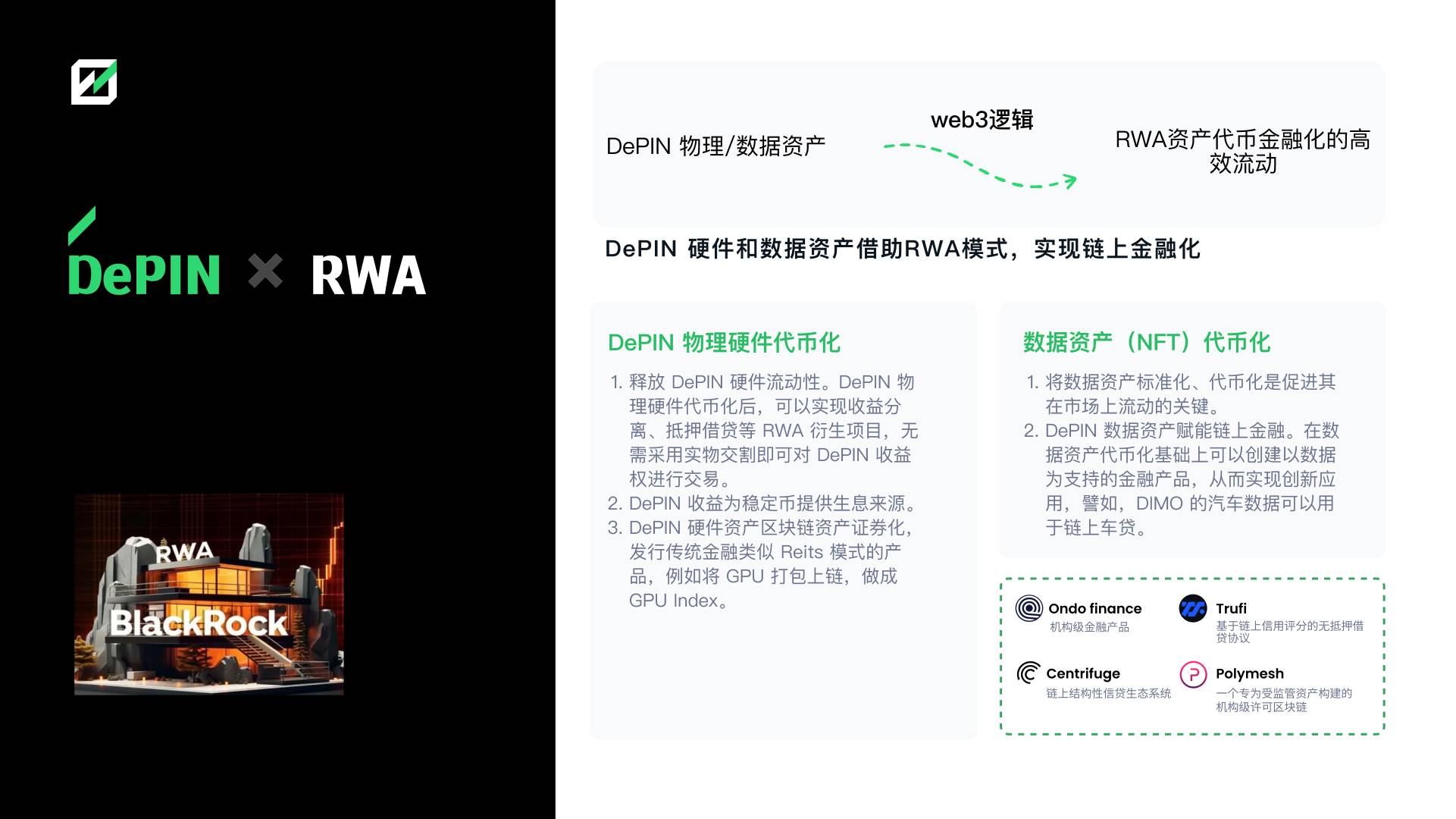

02 DePIN Hardware and Data Assets: Financialization via RWA

Tokenizing DePIN physical hardware:

-

Unlocks liquidity for DePIN hardware. Tokenization enables yield separation, collateralized lending, and other RWA derivatives—allowing trading of DePIN revenue rights without physical delivery.

-

DePIN yields serve as income sources for stablecoins.

-

Blockchain-based securitization of DePIN hardware assets—issuing Reit-like financial products, e.g., packaging GPUs into a GPU Index tokenized on-chain.

Data asset (NFT) tokenization:

-

Standardizing and tokenizing data assets is key to enabling market liquidity.

-

Empowering on-chain finance with DePIN data. Tokenized data can back innovative financial products—e.g., DIMO’s vehicle data powering on-chain auto loans.

Summary and Outlook

-

Blockchain’s expansion into the real world is inevitable. DePIN embodies a new decentralized application paradigm: node economies, miner models, and real-world transformation. Based on Messari’s 2023 forecast of a $3.5T DePIN market cap by 2028—and today’s ~$30B category size on CoinGecko—we estimate a 20x to 120x growth potential.

-

L1/L2 blockchains are the most certain and stable beneficiaries of ecosystem growth. This cycle, public chains supporting DePIN will reap the greatest rewards.

-

Currently, middleware is mainly a component of specialized DePIN L1s. Despite high technical barriers, we expect breakthroughs in general-purpose middleware—this would greatly accelerate DePIN application growth, with middleware as direct beneficiaries.

-

Similar to gaming guilds, DePIN miner services could evolve into borderless hardware miner guilds. Current opportunities lie in global hardware supply chains, node deployment platforms, and data aggregation tools—areas where gaps remain.

-

Within computing, GPU is the fastest-growing and most mature segment. Future GPU platforms will consolidate horizontally and integrate vertically. Additionally, “compute-storage convergence” will be a new narrative—revitalizing traditional storage projects like Filecoin and Arweave.

-

State of DePIN AI: Bittensor leads the AI large-model race with first-mover advantage, attracting major players. Others like Fetch.ai are actively building. Competition is fierce, landscape unclear—reminiscent of the dot-com boom, likely leading to a “thousand-model war” where all have chances.

-

Sensors are an AI-activated high-potential sector. Revenue from dedicated hardware gives sensor projects more room for innovation and resilience.

-

Wireless and energy networks follow similar logic. Wireless will likely succeed by partnering with major carriers—breakthroughs may come from emerging markets. Energy’s endgame is VPP; current projects explore various VPP components—still early stage.

-

Edge AI on phones and PCs is the next DePIN trend. Universal Web3 endpoint devices will fuel a new Web3 sharing economy, spawning frequent-use, consumer-facing Web3 apps.

-

DePIN is a novel RWA issuance method. Combined with on-chain DeFi, it unlocks liquidity for DePIN hardware and data.

Special thanks to DePhy, Exabits, Ora, EthStorage, Hotspotty, IoTeX, and DePIN Hub for their guidance and suggestions on this report.

Reference:

https://messari.io/report/state-of-depin-2023

https://public.bnbstatic.com/static/files/research/depin-an-emerging-narrative.pdf

https://mirror.xyz/sevenxventures.eth/Hx4AScWLZf4HrCl1IoumFTq1L20e3SzF-9XEkgWmrG4

https://www.galaxy.com/insights/research/understanding-intersection-crypto-ai/

https://gpus.llm-utils.org/nvidia-h100-gpus-supply-and-demand/

https://messari.io/report/the-depin-sector-map

FutureMoney Group (FMG) is a blockchain, cryptocurrency, and Web3 investment firm headquartered in Singapore. Co-founded in 2018 by serial entrepreneur EO Hao and venture capital professional Steven Li, FMG has invested in nearly 100 startups since inception and currently manages over $300 million in assets, establishing itself as one of Asia’s largest DePIN-focused crypto funds.

Website: https://www.fmgroup.xyz

Twitter: https://twitter.com/fmgroupxyz

Contact: media@fmgroup.xyz

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News