US Election: Will the MEME theme continue in 2024?

TechFlow Selected TechFlow Selected

US Election: Will the MEME theme continue in 2024?

During the election period, who can become the U.S. president and their public statements on crypto significantly influence the price movements of related tokens.

Author: Cycle Capital

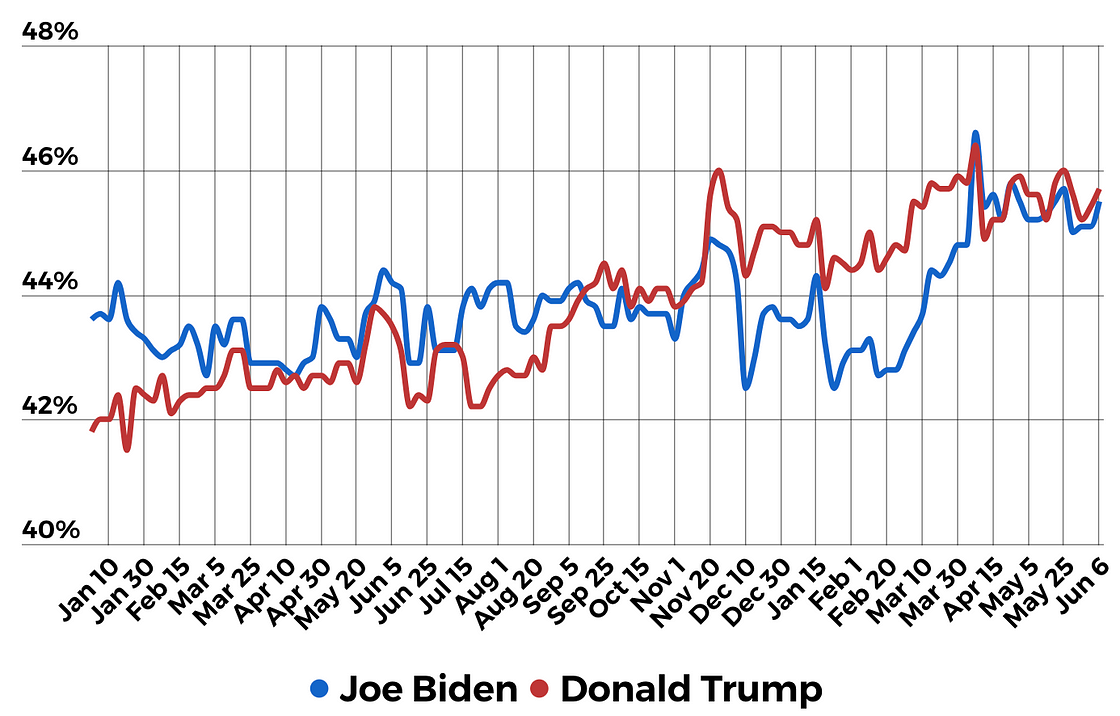

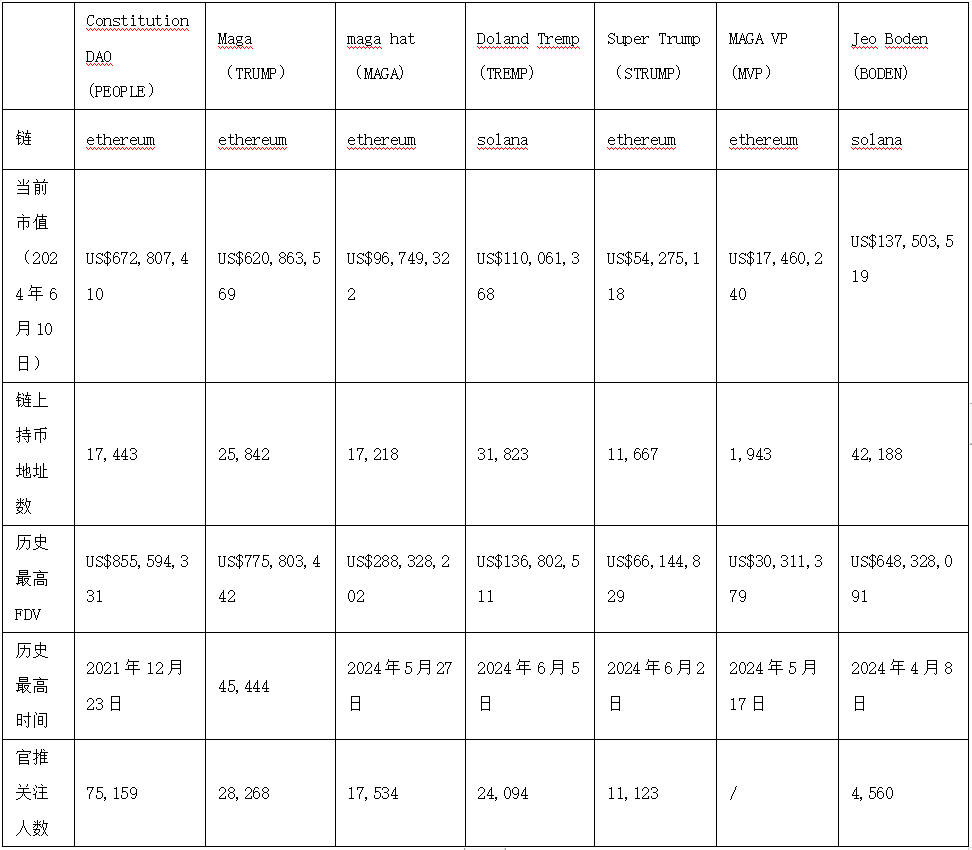

Since the start of the U.S. presidential election, a series of election-themed meme tokens have emerged. After Trump's campaign team publicly supported cryptocurrency donations, TRUMP became the most prominent, reaching a peak market cap of $775 million. In contrast, due to Biden’s more conservative stance on crypto, related tokens attracted less market attention. Following Trump's conviction in the hush-money case, prices of Trump-related tokens declined while those linked to Biden rose. Throughout the election period, who will become the next U.S. president and their public statements on crypto policy continue to influence the price movements of these associated tokens.

Candidates’ Stances on Cryptocurrency

Trump

In this campaign, Trump has reversed his previously skeptical attitude toward crypto, issuing a series of pro-crypto statements such as "ensuring the future of the crypto industry and Bitcoin happens in America" and promising to protect self-custody rights for the nation's 50 million crypto holders. He also pledged to pardon Silk Road founder Ross Ulbricht if elected.

This shift in position is not without precedent. By late 2022, Trump launched limited-edition NFT trading cards on Truth Social, followed by the "Win Trump Prizes" NFT collection on Polygon in 2023, offering perks like dinner with Trump, autographed memorabilia, and one-on-one meetings.

In May 2024, Trump’s campaign officially began accepting cryptocurrency donations, cementing its pro-crypto stance.

Biden

Biden’s latest position on crypto was demonstrated through his veto of the resolution to overturn SEC Staff Accounting Bulletin (SAB) 121. SAB 121 requires companies that custody crypto assets to record client-held cryptocurrencies as liabilities on their balance sheets—a rule widely seen as overly restrictive and inhibiting institutional custody services. In his veto letter, Biden stated that overturning SAB 121 would weaken the SEC’s authority over accounting standards and emphasized that his administration “will not support measures that harm consumers and consumer welfare.”

Thus, compared to Trump, Biden maintains a more cautious approach toward cryptocurrency. His next opportunity to clarify his stance may come with the FIT 21 bill, which aims to establish a regulatory framework for digital assets by assigning jurisdiction between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) based on whether a blockchain asset is “functional,” “non-functional,” or “decentralized.” The bill has passed the House but still requires Senate approval and presidential signature to become law.

SEC's Regulatory Approach Toward Crypto

During Trump’s term from 2016 to 2020, he held a skeptical view of crypto, and Jay Clayton served as SEC Chair. Clayton took a cautious approach, primarily cracking down on fraudulent ICOs and unregulated exchanges. Notable cases included actions against Block.one, Ripple Labs, and Telegram (regarding Ton). Most other cases targeted individuals or firms for illegally issuing tokens.

In April 2021, Biden appointed Gary Gensler as SEC Chair. Gensler had described himself as a “minimalist middle-grounder on Bitcoin,” leading some in the crypto industry to initially expect a more favorable regulatory environment under his leadership. However, both Gensler and Clayton have maintained a cautious stance toward non-Bitcoin cryptocurrencies, asserting that “all tokens are securities.” This position appeared slightly softened on June 5, 2024, though no clear pro-crypto shift has materialized. Under Gensler, the SEC has brought significantly more crypto-related enforcement actions than during Clayton’s tenure, particularly targeting major exchanges such as Poloniex, Coinbase, Bittrex, Binance, and Kraken. Based on the volume and targets of SEC enforcement, the Biden administration’s overall approach to crypto regulation has been notably more conservative.

Note: From June 6, 2023, to December 31, 2023, the SEC initiated 14 crypto-related cases. From January 1, 2024, to June 10, 2024, there were 6 such cases.

Election Timeline

Key Election Dates

July 15–18: Republican National Convention, where the Republican nominee and platform will be finalized. Trump has already secured the Republican nomination.

August 19–22: Democratic National Convention, confirming Joe Biden as the Democratic nominee.

June 27 and September 10: Presidential debates between Biden and Trump, potentially influencing final election outcomes.

November 5: U.S. presidential election day.

Key Event: Impact of the Hush-Money Case

Trump was found guilty on all 34 counts in the criminal hush-money case. Sentencing is scheduled for July 11 and could include prison time and substantial fines. Trump plans to appeal the verdict. Legally, however, the conviction does not disqualify him from running for president.

An Ipsos/ABC News poll from April indicated that 16% of Trump supporters would reconsider their vote if he were convicted. According to racetotheWH’s latest polling data, currently 8.8% of voters remain undecided, with Trump holding a slight lead. If Trump is sentenced, the share of undecided voters could rise to 17%, putting Biden ahead in support.

Surprisingly, the hush-money case has boosted Trump’s fundraising. In April, his campaign raised about $76 million, surpassing Biden’s $51 million. By May, Trump’s campaign disclosed raising over $400 million, largely driven by small-dollar donations averaging around $70. Exact figures will be reported by the end of June per federal requirements. It’s worth noting that while Trump’s campaign had strong financial backing early in the 2020 race, Biden’s campaign outperformed financially in the later stages. Strong fundraising provides advantages but does not guarantee victory.

The Role of Cryptocurrency in the Election (Is It Likely to Be Repeatedly Hyped?)

On March 14, Paradigm released a survey showing that 19% of registered U.S. voters own cryptocurrency, concluding that “one-fifth of the population is not a niche group.” Crypto holders appear open to switching political allegiance.

Battleground states are central to the election. Key swing states this year include Arizona, Georgia, Michigan, Pennsylvania, and Wisconsin, with potential additional battlegrounds in Nevada, North Carolina, and Minnesota.

A May survey by DGC across Michigan, Nevada, Ohio, Montana, Pennsylvania, and Arizona found that 26% of respondents said they care about candidates’ positions on crypto, and 21% consider it an important issue during the election. Meanwhile, 55% expressed concern that policymakers might stifle innovation through excessive regulation, underscoring demand for a crypto-friendly next president.

However, according to a CBS News poll released on April 29, voters in the “Rust Belt” swing states—Pennsylvania, Ohio, and Michigan—are most concerned about economic issues, especially growth and inflation. Since Biden took office in Q1 2021, real GDP (adjusted for inflation) has grown over 8%. Yet economic growth in these three swing states has lagged far behind the national average—Wisconsin, for example, saw only 3.1% total GDP growth over nearly four years.

Given that economic performance remains key to winning swing-state votes, candidates may revisit crypto topics to attract younger voters, though broader economic concerns are likely to dominate.

U.S. Election-Themed Meme Tokens

Election-themed meme tokens are highly volatile and carry significant risks, including sudden shifts in candidate positions or campaign messaging, and low likelihood of listing on major exchanges. This article is for informational purposes only and does not constitute investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News