Will DOG Lead the Revival of Rune Mania, and When Will the Sector Explode?

TechFlow Selected TechFlow Selected

Will DOG Lead the Revival of Rune Mania, and When Will the Sector Explode?

In the past month, DOG has risen from its bottom price to a new high, driving a surge in Rune-based assets and attracting renewed attention.

Author: Alfred @GametoRich, Cycle Capital

I. What Are Runes?

At the beginning of 2023, the BRC-20 standard built upon the Ordinals protocol sparked a wave of asset creation and speculation around BTC, driving significant attention and capital inflow into Bitcoin Layer 2 and DeFi infrastructure, positively impacting the long-term development of the BTC ecosystem. However, the BRC-20 craze also caused Bitcoin network congestion and redundant data storage. In response, Casey Rodarmor, creator of the Ordinals protocol, proposed the Runes protocol in a blog post from September 2023—a new fungible token protocol based on BTC’s UTXO model, known as the “Runes Protocol.”

The Runes protocol officially launched on April 20, 2024, coinciding with Bitcoin’s halving event. Its initial release generated intense excitement during the first Rune minting phase, pushing BTC network gas fees above 1000 sats—an unprecedented peak. However, market attention soon shifted to other sectors. Recently, DOG surged from its consolidation range to a new high, triggering a renewed rally and interest in Rune-based assets.

1. How Runes Work

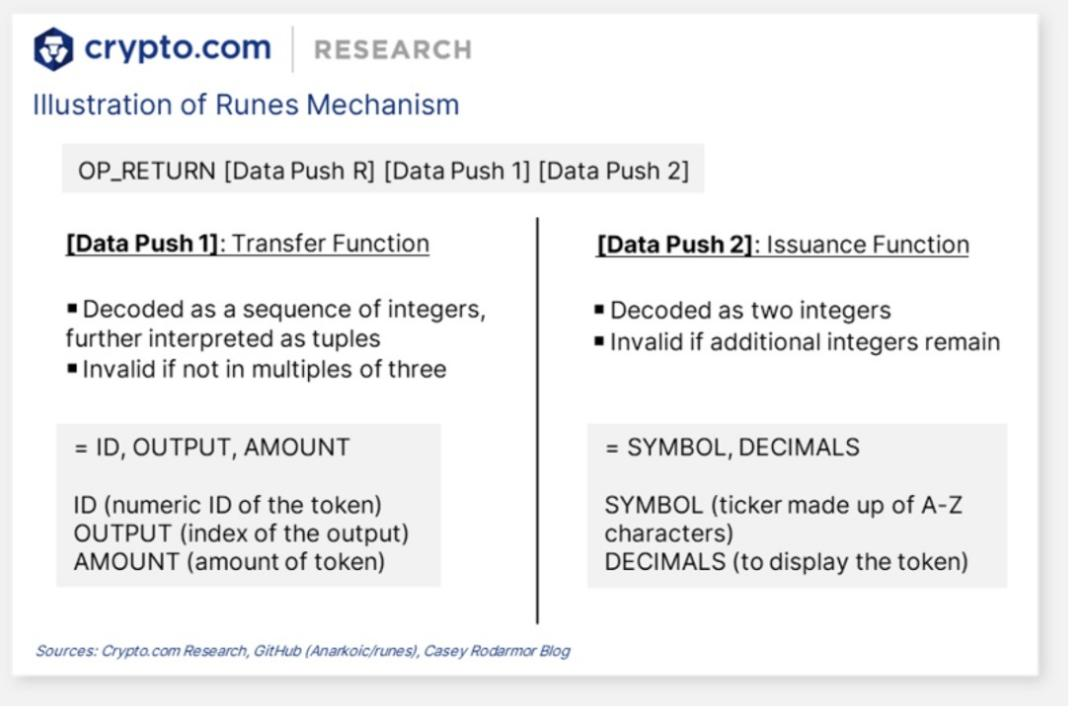

The Runes protocol issues and tracks tokens using Bitcoin's native UTXO model, making it more native and decentralized. Rune balances are directly held by UTXOs, with each UTXO capable of holding any number of runes. This mechanism avoids creating "junk" UTXOs, improving efficiency and reducing on-chain footprint.

Specifically, Runes data is stored within the OP_RETURN field—an opcode in Bitcoin transactions that allows up to 80 bytes of data per transaction output. Protocol messages use OP_RETURN tagged with a data push of the uppercase letter R. Issuance or transfer transactions then specify allocations to UTXOs via subsequent data pushes. Invalid protocol messages result in runes being burned.

The diagram below visually explains how the Runes protocol handles issuance and transfers:

Source: Crypto.com Research, GitHub, Casey Rodarmor Blog

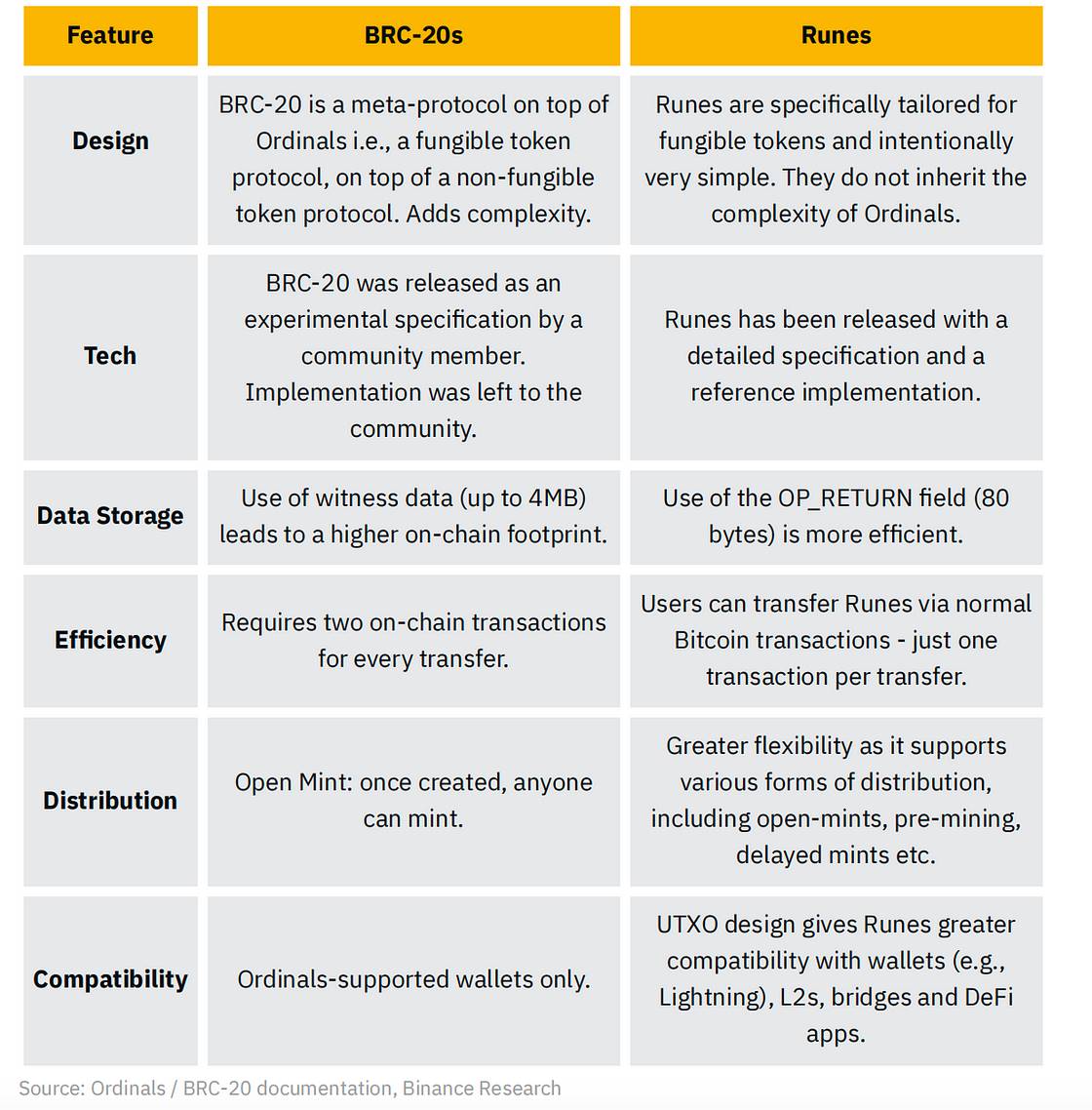

2. Runes vs. BRC-20

Compared to BRC-20, the Runes protocol has several key advantages:

(1) Runes is specifically designed for fungible tokens, built natively on Bitcoin’s architecture without relying on off-chain data and requiring only a single mint—making it simpler and more efficient. In contrast, BRC-20 is based on the Ordinals protocol, which was originally tailored for non-fungible assets, depends on off-chain indexing, and requires two-step minting, making it inherently more complex.

(2) Runes stores data in the 80-byte OP_RETURN field, while BRC-20 uses witness data that can consume up to 4MB. As a result, Runes-based tokens are more compatible and space-efficient, significantly reducing blockchain bloat.

(3) The Runes protocol leverages the UTXO model, seamlessly integrating with Bitcoin’s native architecture and inheriting its security. It offers stronger scalability potential and full compatibility with future BTC ecosystem developments such as the Lightning Network and Bitcoin L2 solutions.

Source: Binance Research, Ordinals/BRC-20 documentation

3. Significance of Runes

(1) Runes further enables breakout BTC-native asset issuance. Since the emergence of inscriptions via BRC-20, this new asset class has drawn increased attention and capital into the BTC ecosystem. The meme booms seen in 2023 on SOL and Base chains demonstrated that memes play a crucial role in attracting capital to their respective blockchains. Runes provides Bitcoin with a dedicated, fungible, and speculation-friendly token standard.

(2) This issuance method is simpler, more efficient, and more compatible than previous approaches. Built natively on Bitcoin’s UTXO model, Runes does not rely on third parties or off-chain data, consumes less block space, reduces network congestion, and will seamlessly integrate with future upgrades and ecosystem solutions (e.g., L2s, bridges).

(3) The popularity of these assets helps address Bitcoin’s security budget issue. Rune transactions generate additional fee revenue for the network—especially important post-halving when miners’ block rewards decrease—providing a new income stream that supports network security and sustainability.

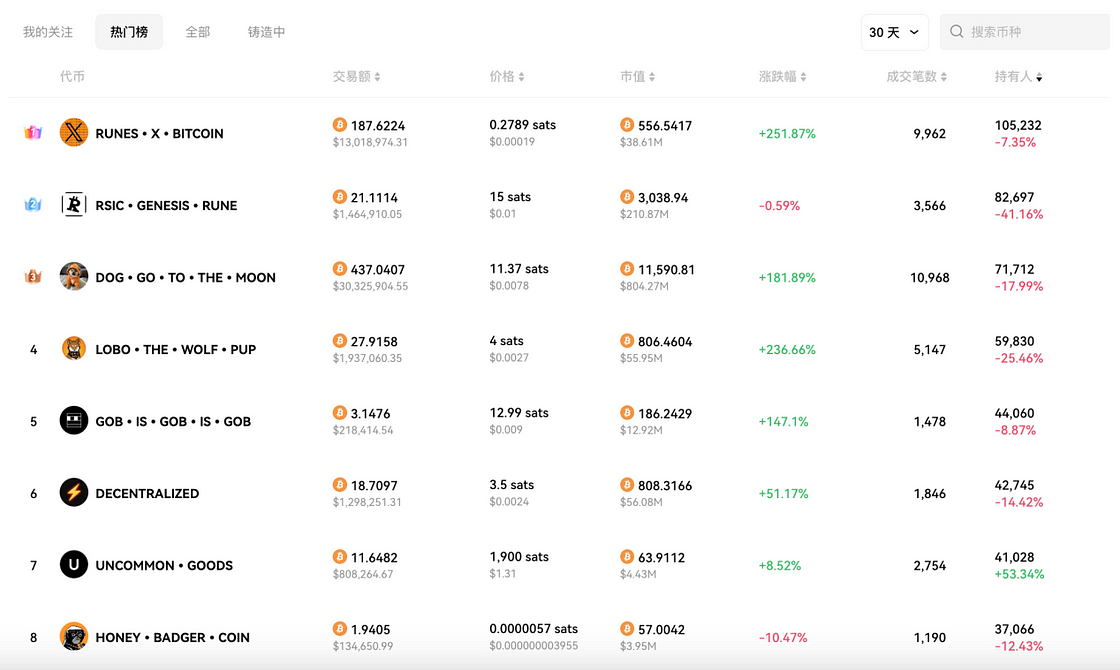

II. Sector Data Overview

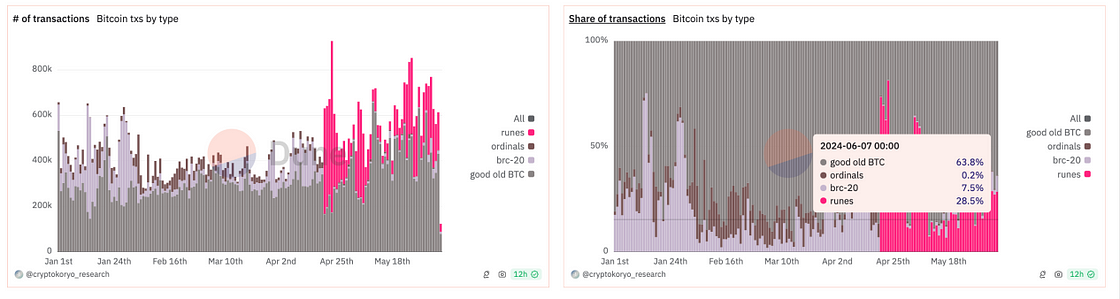

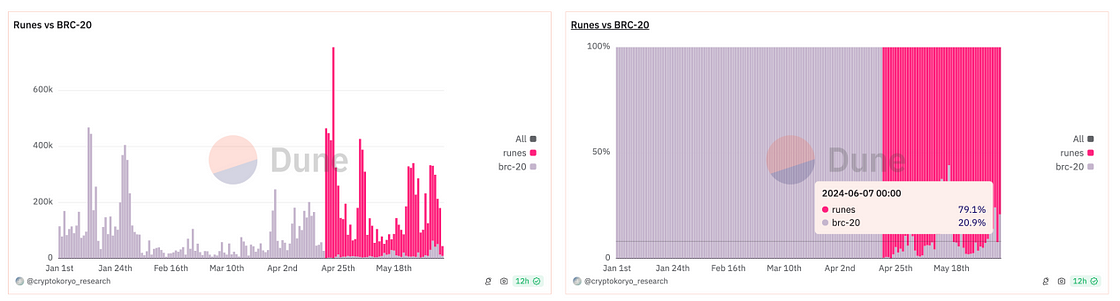

From a BTC network data perspective, Runes currently account for approximately 20% of total transaction volume and share. At launch, Rune-related transactions experienced extreme FOMO, peaking at 81.3% of network activity before quickly cooling down. Currently, Runes fluctuate between 10–40% of network usage, reflecting observable shifts in market interest.

Comparing Runes and BRC-20, Runes have become the most active L1 asset outside of native BTC transactions, with a current ratio of about 4:1. The highest share occurred at the halving launch (~99%), dropping as low as 55%. Today, Rune transaction activity exceeds that of BRC-20 tokens.

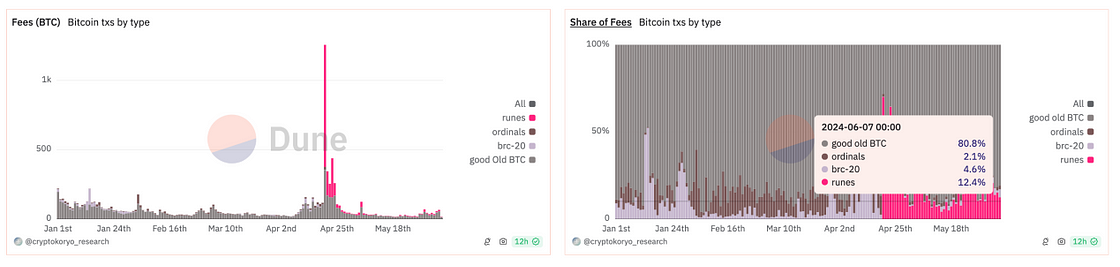

In terms of fee contribution, native Bitcoin transactions account for 70–80%, Runes contribute 10–20%, and Ordinals plus BRC-20 together make up around 10%. On the halving day, Runes briefly accounted for up to 70% of fees. Currently, Rune speculation broadens miner revenue streams and dominates among new asset classes.

Source: Dune@cryptokoryo

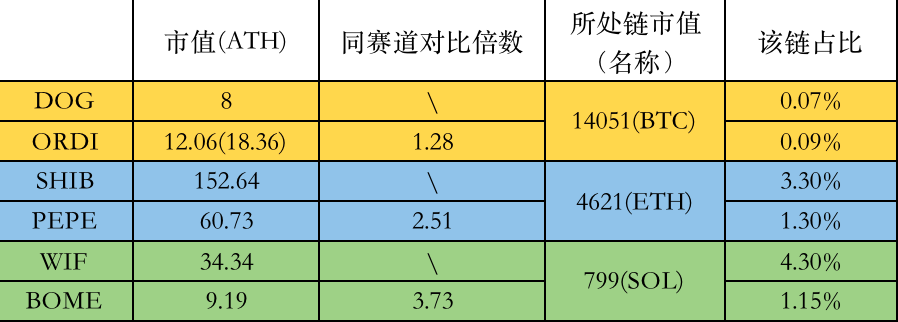

If we treat both Runes and BRC-20 as meme assets, Bitcoin’s meme market cap remains the lowest across major chains—less than 0.1% of BTC’s total value. In comparison, top meme coins on ETH and SOL represent over 3% of their respective chain valuations. Given BTC’s dominant position in consensus, market cap, and institutional attention, there is strong potential for meme assets to grow further in relative size. Vertically, while Runes already surpass BRC-20 in transaction volume and fee contribution, the leading Rune (DOG) still lags behind ORDI—the top BRC-20—in absolute valuation. If DOG were listed on a top-tier CEX, it could potentially overtake ORDI.

Source: Cycle Research

III. Evaluation Framework & DOG Analysis

This article proposes a three-stage, nine-dimension framework for evaluating popular Rune projects: early-stage focuses on distribution design, decentralization level, founder background, and narrative strength; mid-stage emphasizes continuity of spread and price momentum; late-stage evaluates trading volume, market cap, token distribution, and price stability.

Based on this framework, we identify DOG as the current leader in the Rune sector:

1. Distribution Design: Tiered rollout with full on-chain fee coverage—highly generous approach

Prior to the Runes protocol launch, the project executed a phased rollout: first launching Runestone NFTs to build hype, then airdropping the first Rune token to holders after the halving. Both the Runestone and the initial Rune (DOG) airdrops were completely free for recipients, with all on-chain fees covered by community-raised funds and paid by the team—an exceptionally large-scale and inclusive move.

2. Decentralization Level: High-quality and massive early adopter base enabling rapid cold start and widespread core user propagation

The Runestone airdrop targeted over 110,000 users who actively participated in the BTC inscription ecosystem. Eligibility required owning at least three inscriptions (excluding those starting with "text/plain" or "application/json") in block 826,000—including cursed inscriptions searchable via Ordinals. The first Rune, DOG, was airdropped to over 70,000 committed Runestone holders.

3. Founder & Narrative Strength

Founder Leonidas is an OG member of the BTC community and co-founder of Ord.io, one of the leading Ordinals browsers. He maintains close ties and frequent interactions with Ordinals creator Casey Rodarmor. The name "Runestone" links directly to the Runes protocol launch date and its encoding instructions, lending legitimacy and topical relevance. Leo commissioned a sculptor artist to design the Runestones, adding artistic value. The first airdropped Rune, named DOG, leverages one of crypto’s most viral memes, issued as a new token on Bitcoin—the most trusted and widely recognized blockchain.

4. Propagation Continuity: Strong and sustained attention capture

As a respected figure in the BTC community, Leo possesses strong outreach capabilities, especially within Western communities. His promotional efforts are frequent and impactful, posting up to ~100 tweets daily—many filled with detailed data and emotionally charged content—consistently capturing market attention.

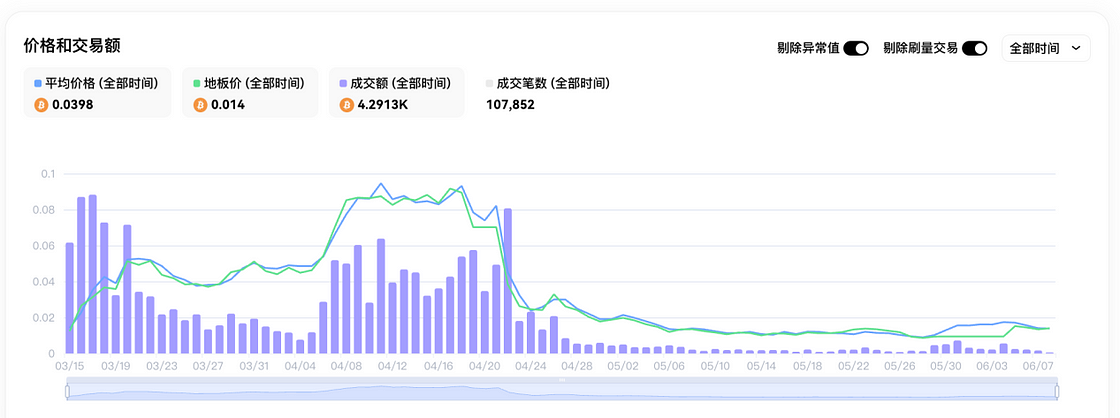

5. Price Continuity: Sequential hype cycle between Runestone and Rune

Runestone NFTs served as pre-launch hype vehicles, with prices steadily rising from March to April, reaching highs of 0.1166 BTC per piece. After the DOG airdrop, Runestone prices declined while DOG took over the speculation cycle. After a month of price discovery and consolidation, DOG rose from ~0.0025 to a peak of 0.0097, now settling around 0.0078. Two additional Runestone airdrops are expected later this year (triggered when DOG becomes the top meme coin), which may reignite demand for Runestones depending on DOG’s performance.

Runestone price, Source: Okx.com

DOG price, Source: Magic Eden

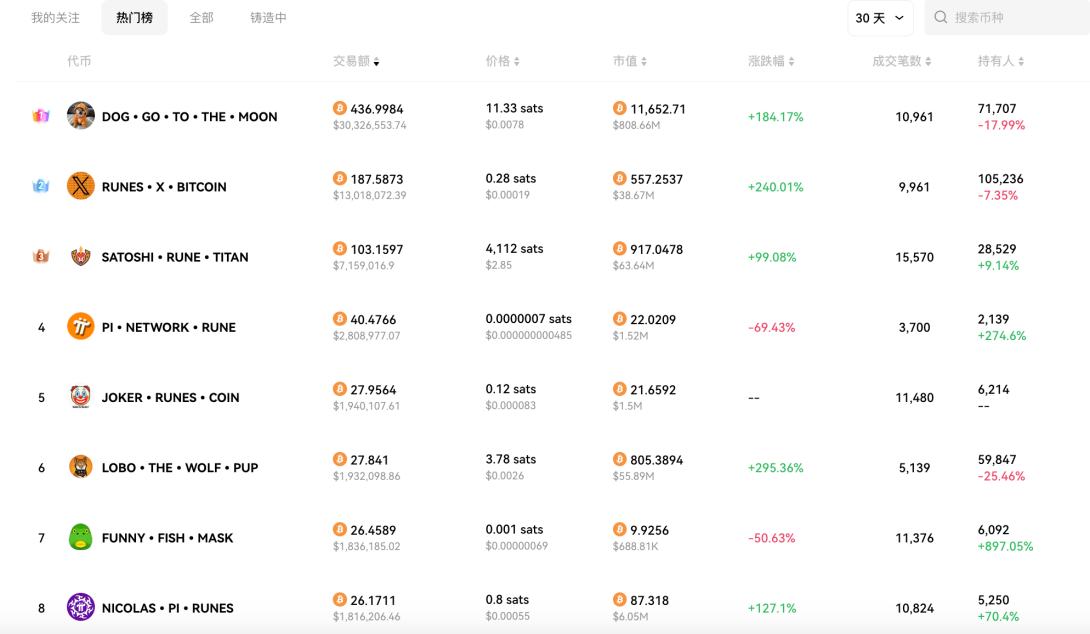

6. Trading Volume: Dominates other Runes with a cliff-like lead—best liquidity

Overall liquidity in the Rune sector is poor, but DOG has consistently ranked #1 in trading volume since launch. Most activity is concentrated on Gate.io (>80%), followed by Bitget, OKX Wallet, and Magic Eden. Current daily volume exceeds $70 million, compared to ~$2 million for the second-ranked Rune (Runes x). DOG leads all Rune assets by a wide margin and reaches the liquidity levels of mainstream tokens.

Source: Okx.com

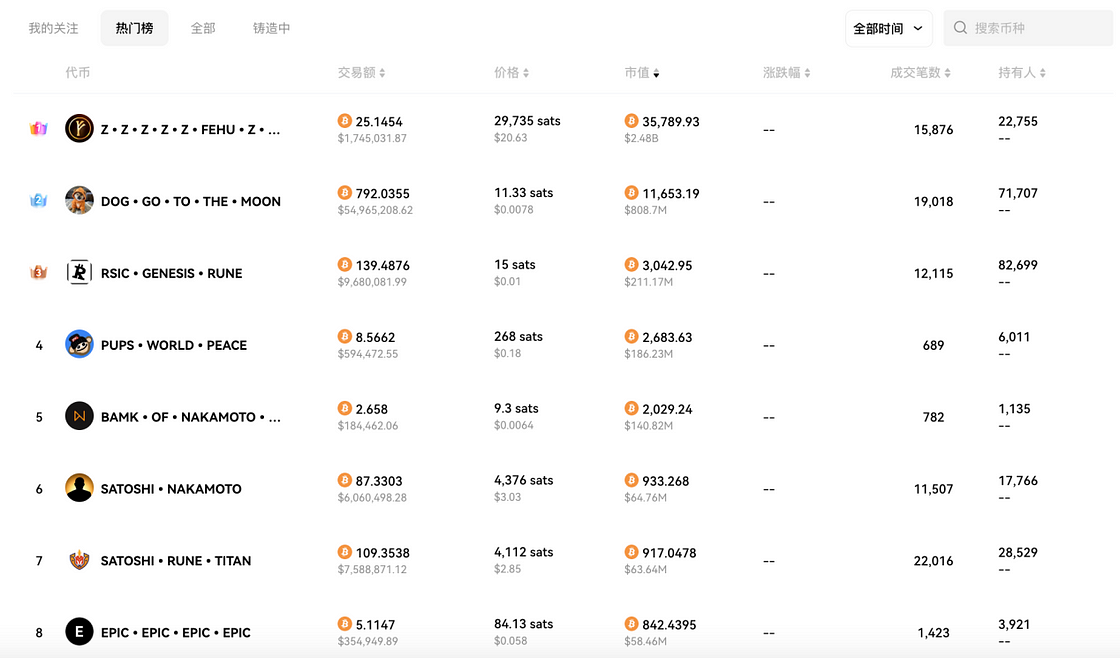

7. Market Cap: Highest overall market capitalization

Excluding ZZZ—a Rune with extremely low volume and artificially high unit price—DOG has maintained the #1 market cap position throughout most of its lifecycle post-launch.

Source: Okx.com

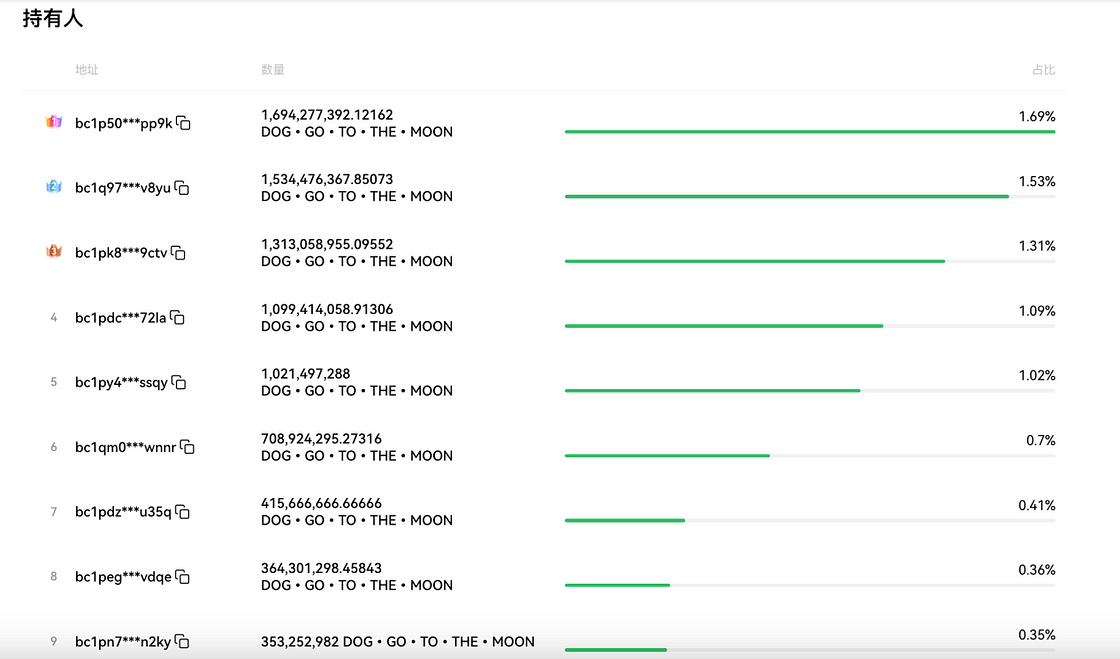

8. Token Distribution: Large holder base but insufficient concentration

On-chain, DOG has consistently maintained over 70,000 holders—ranking third among Runes. However, due to heavy CEX-based liquidity, the actual number of unique holders likely remains the highest. Despite strong consensus, the largest wallet holds only ~1.69% of supply and has been gradually reducing holdings. Only five addresses hold more than 1%, and the fifth-largest is rapidly accumulating. Overall, the lack of concentration may explain why DOG, despite its clear leadership, has yet to be listed on a top-tier exchange.

Source: Okx.com

9. Price Stability: Steady upward trajectory

After consolidating near its bottom (~0.002), DOG’s price rose steadily and strongly. It formed stable bases at 0.004 and 0.007 before breaking higher. Even during broader market pullbacks, buying pressure remains robust.

Source: CoinGecko

Using the evaluation framework proposed in this article, we can dynamically analyze leading Rune projects and screen newly launched ones. Due to space constraints, this analysis will not be expanded here.

IV. Conclusion

1. Runes is a purpose-built protocol for fungible tokens. Technically, it is simpler, more efficient, and more compatible than BRC-20. It has already surpassed BRC-20 in transaction share and fee contribution, establishing itself as a significant new asset class that cannot be ignored.

2. Currently, Runes primarily serve as meme coins to boost Bitcoin’s visibility and capital attraction. While they show promise for sustained growth, comprehensive market explosion has not yet occurred—indicating room for further price discovery.

3. This article introduces a three-phase, nine-dimension evaluation framework for Rune projects. Among current offerings, DOG clearly leads the pack. However, its token distribution remains relatively dispersed, suggesting that a listing on a top-tier exchange may require additional time and consolidation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News