Speed Reading Usual Protocol: How to Build the RWA-Collateralized Stablecoin USD0?

TechFlow Selected TechFlow Selected

Speed Reading Usual Protocol: How to Build the RWA-Collateralized Stablecoin USD0?

Usual is reimagining the stablecoin USD0 by opting for RWA-backed rather than fiat-backed or algorithmic stablecoins.

Author: 1912212.eth, Foresight News

For years, the holy grail of the cryptocurrency industry has been achieving monetary status. Ever since Bitcoin’s inception, the dream of realizing true monetary properties has been relentlessly pursued. Ironically, it is not BTC—the original cryptocurrency—that has achieved widespread adoption in payments, but stablecoins. Stablecoins have also become the first major use case for real-world assets (RWA). Whether fiat-backed or algorithmic—often seen as the crown jewel—they are all racing toward this ultimate goal. USDT leads by market cap, USDC stands out through compliance, while emerging algorithmic contender USDe leverages celebrity endorsements and aggressive brand integrations to carve out its own territory.

Stablecoins are also profit-printing machines. Tether, issuer of USDT, reported over $4.52 billion in profit during the first quarter of this year alone—setting a new record. For context, Tether's total net profit for all of 2023 was $6.2 billion, highlighting just how dramatically profitability has accelerated.

Lucrative sectors never lack new entrants. Stablecoin startup Usual Labs raised $7 million in April, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, StarkWare, and others. By late May, Usual Labs launched its stablecoin USD0.

What Is Usual Labs?

Usual Labs is a stablecoin startup building the DeFi protocol Usual Protocol, with its flagship product being the stablecoin USD0. According to Usual, traditional finance fails because banks capture deposit profits while passing risks onto customers. Even fiat-backed stablecoins aren't flawless—they inherit the same centralized structural issues as traditional banking.

How Does Usual Protocol Work?

When users deposit assets, they receive a synthetic asset called a Liquid Deposit Token (LDT), which represents their initial deposit value within the Usual Protocol. LDTs can be freely traded in a permissionless manner and are fully backed 1:1 by the underlying deposited assets. LDT holders retain permanent withdrawal rights, allowing them to redeem the underlying assets at any time under normal conditions.

This design allows users to leverage LDTs to unlock yield opportunities—for example, by providing liquidity or issuing Liquidity Bond Tokens (LBTs). LBTs involve locking up LDTs for a fixed period and provide liquidity, transferability, and composability, enabling seamless integration and trading across DeFi. Users participating in these activities will also earn Usual’s governance token.

What Are the Features of the USD0 Stablecoin?

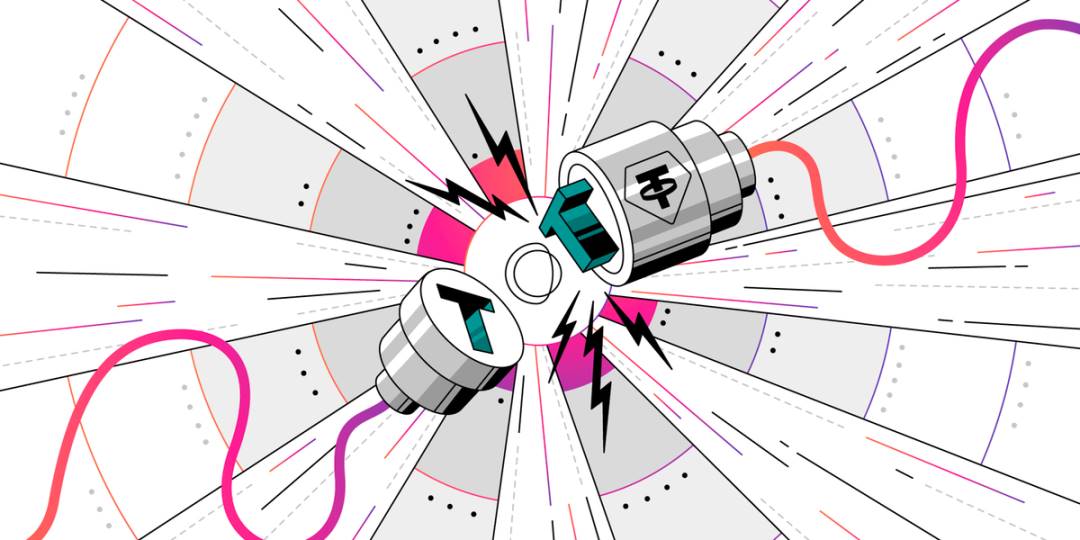

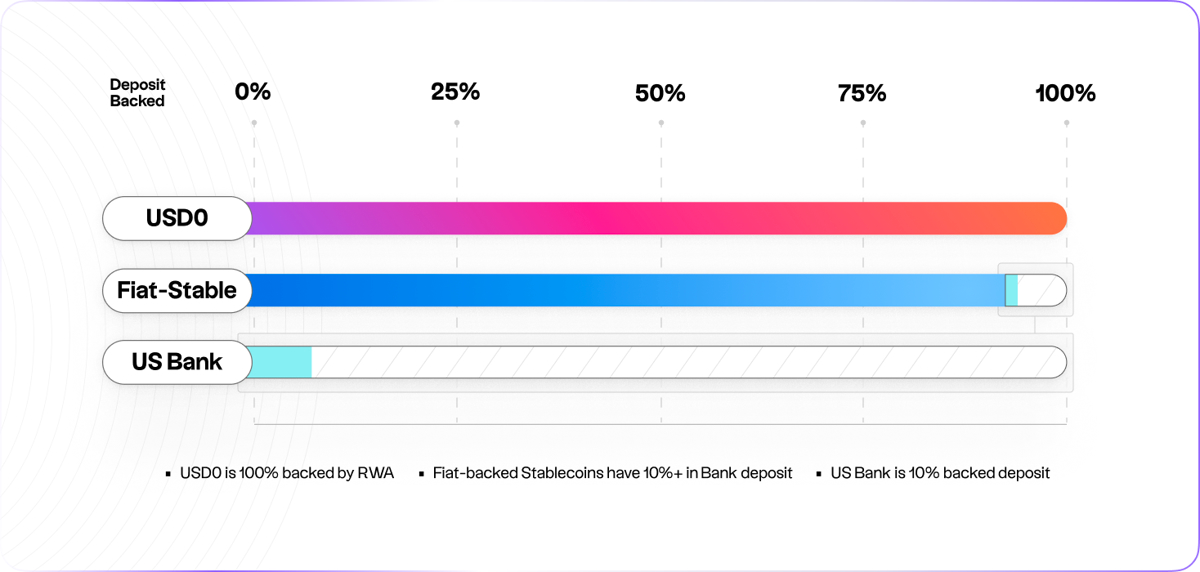

USD0 is the most important product on the Usual Protocol and the first LDT issued on the platform. Its name reflects its role as the equivalent of central bank money (M0) on Usual—hence "USD0." Unlike USDT or USDC, USD0 is 1:1 backed by ultra-short-term real-world assets (RWA).

Due to fractional reserve banking, even fiat-backed stablecoins carry inherent risks. The collapse of Silicon Valley Bank last year highlighted how insufficient collateralization in traditional banks could trigger systemic risk across DeFi.

USD0 addresses these concerns through multiple measures. First, it selects government bonds as its primary backing due to their high liquidity and safety. Second, to ensure stability, only assets with extremely short maturities are used as collateral, offering holders a high level of security. This strategy prevents forced fire sales at discounted prices during large-scale redemptions and shields against volatility events that could erode collateral value.

Usual has already integrated Hashnote and is awaiting confirmation from Ondo, Backed, M^0, Blackrock, Adapt3r, and Spiko. Once fully integrated, these partnerships are expected to significantly boost liquidity.

Usual Token Distribution: 90% to the Community

While the official tokenomics have not yet been released, Usual has clarified that its token will serve governance and utility functions. The token features a deflationary design: early adopters receive more tokens, and the issuance rate decreases as total value locked (TVL) grows.

Additionally, Usual token holders have control over the treasury and participate in governance decisions. Staking the token also enables users to earn rewards while supporting protocol security.

Unlike many protocols that allocate up to 50% of tokens to VCs and advisors, Usual allocates 90% of its supply to the community, with internal team allocations capped at no more than 10% of circulating supply. In an era where calls for fairness and decentralization grow louder, this model strongly embodies the spirit of community-driven governance.

Summary

In the competitive landscape between fiat-backed and algorithmic stablecoins, Usual has chosen RWA-backed design to reimagine the stablecoin USD0. With massive potential in the stablecoin market, it will be worth watching how USD0 performs in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News