SocialFi Functional Layering: Transaction-First or Social-First?

TechFlow Selected TechFlow Selected

SocialFi Functional Layering: Transaction-First or Social-First?

SocialFi app developers need to own multiple layers of the SocialFi stack to build defensibility for their protocols.

Author: MASON NYSTROM

Translation: TechFlow

As the use of crypto-based social platforms and financial games increases, so does the evolution of how they are built. We can expect to see more vertically integrated projects in the future, aiming to deliver seamless and holistic experiences for users—sparking new consumer behaviors around attention assets or social assets. While not all web3 social experiences are financial in nature, the blockchain infrastructure underpinning these crypto-native consumer apps enables the integration of token incentives and digital-native assets directly into social interactions.

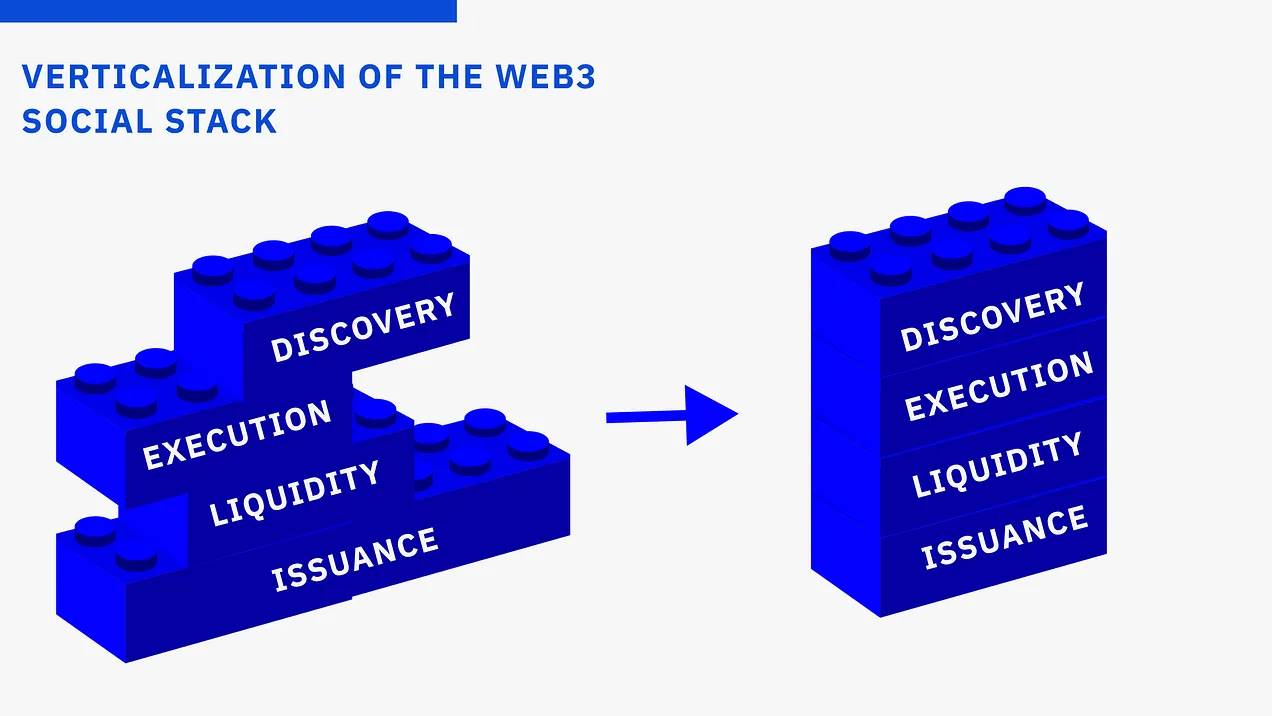

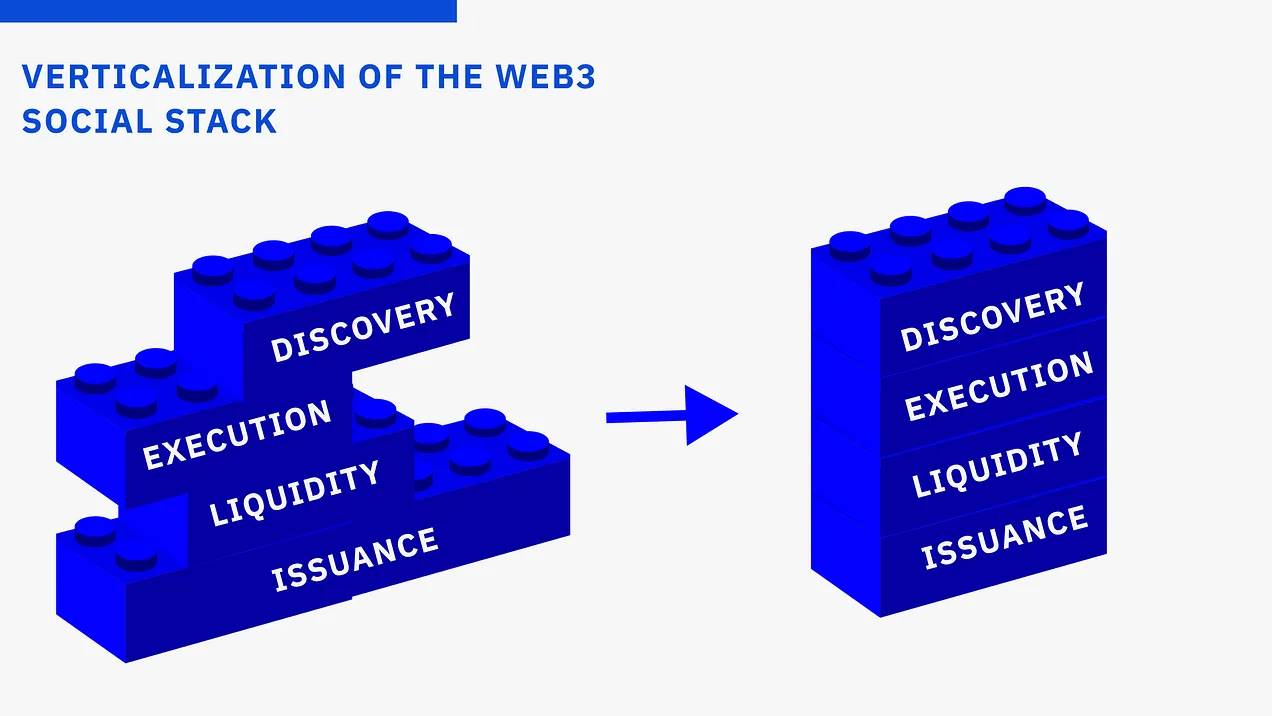

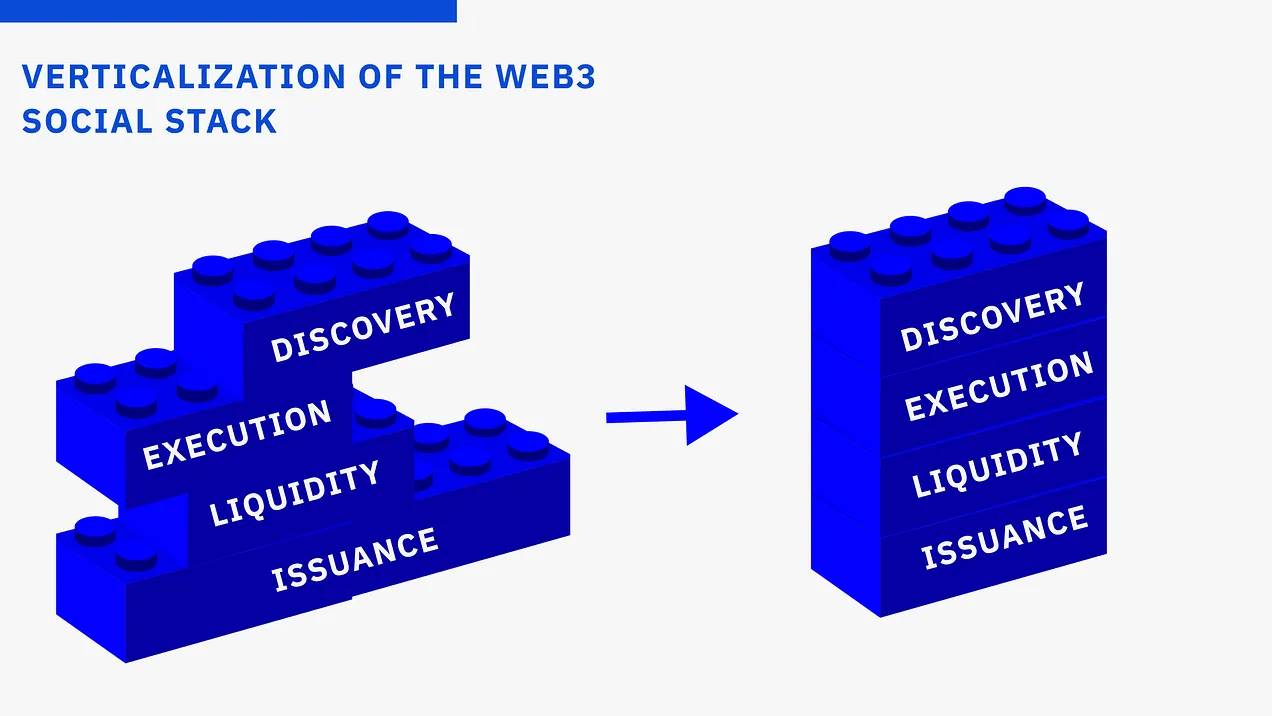

The existing SocialFi stack consists of four core layers:

-

Discovery Layer – Where users find things they want to buy

-

Execution Layer – Where assets are bought and sold

-

Liquidity Layer – Where assets are stored and pooled

-

Asset Issuance Layer – Where assets are created

Currently, this stack remains fragmented, with user discovery and social experiences disconnected from execution (e.g., trading), liquidity, and asset issuance. However, as the SocialFi space expands, applications will continue to pursue vertical integration of attention and markets to gain greater control over both social experience and the liquidity of attention assets.

SocialFi app developers need to own multiple layers of the SocialFi stack to build protocol defensibility. Transaction (i.e., execution) and issuance layers are becoming commoditized—token issuance is increasingly easy, and execution can be added wherever attention exists. Owning the discovery or liquidity layer will become increasingly critical, as these layers exhibit strong network effects and are inherently defensible.

In SocialFi, most applications choose between two primary approaches to verticalization:

-

Transaction-first approach: Build a marketplace or trading platform where users can trade attention assets (e.g., Memes) first, then evolve into a social/discovery platform.

-

Social/discovery-first approach: Build a social platform first, gradually adding financial components, making consumers or attention merchants key stakeholders in the platform.

Transaction-First

Any social network or discovery platform today faces significant challenges in the fiercely competitive attention economy: bootstrapping new social graphs, driving novel consumer behaviors, and sustaining user engagement. Given these hurdles, the transaction-first approach is often easier to launch, as user interest in speculation helps overcome them. However, this path faces more competition, as trading platforms are easier to start than social networks—and once social networks reach sufficient user density, they enjoy lasting advantages.

From a transaction-first perspective, deep vertical integration of the SocialFi stack has proven effective, as these apps natively embed attention trading. For example, FriendTech has emerged as one of the most vertically integrated SocialFi applications, controlling much of the stack. The app serves as both a hub for discovery and exclusive trading, while leveraging native financial primitives like "bonding curves" to issue assets with unique functionality within the FriendTech ecosystem.

Several newer SocialFi protocols have also achieved vertical integration. For instance, Meme issuance and discovery platforms like Pump and Ape Store allow users to easily deploy Memes on bonding curves. This enables direct token purchases from the curve without waiting for liquidity to be seeded on decentralized exchanges or liquidity pools. While some trading and discovery of Pump-initialized Memes occur on external platforms like Dexscreener and Twitter, Pump still provides a unique social discovery and trading experience for newly launched tokens.

Social-First

Historically, the social-first approach to SocialFi has succeeded through social platforms like Twitter, Farcaster, and Telegram, along with market terminals such as Dexscreener and CoinGecko. Many of these applications have experimented with moving down the stack by offering token trading features, but none have fully focused on delivering customized, proprietary trading experiences.

Telegram stands out as an exception, having successfully integrated social and financial experiences. Still, its user experience remains limited. While some advanced crypto users appreciate its convenience, there remains strong demand for a Robinhood-like experience—one that offers a seamless trading interface, frictionless onboarding, and retail-friendly features such as commission-free trading. Moreover, emerging primitives like Farcaster Frames and Lens Protocol open actions are further enabling new forms of financial transactions within these social-first networks.

Final Thoughts: Stay Opinionated

Builders who take a distinct stance on how their app monetizes and integrates finance can create compelling social-financial games and networks. The transaction-first approach is easier to launch, as it doesn’t require inventing new consumer behaviors—people already want to trade attention. Yet historically, the social-first approach holds greater long-term potential because it controls user attention itself, not just the transaction. The main goal for social-first builders is rapid iteration—testing new consumer behaviors and social-financial dynamics until user preferences emerge, potentially forming the foundation of a major social network. I believe the most successful applications will be those with strong convictions and vertically integrated designs—those that create liquid markets for new asset types or otherwise catalyze novel consumer behaviors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News