Will full decentralization + permissionless be the breakthrough solution for Perp?

TechFlow Selected TechFlow Selected

Will full decentralization + permissionless be the breakthrough solution for Perp?

The derivatives DEX赛道 is currently very crowded, yet no projects have emerged at the level of Uniswap or Curve during DeFi Summer.

Author: cmdefi

The derivatives sector has always been a missing piece of DeFi Summer. Although on-chain derivatives trading volume saw a surge after the FTX collapse, in reality, aside from brief periods of prominence by GMX and dYdX, the sector has never truly exploded.

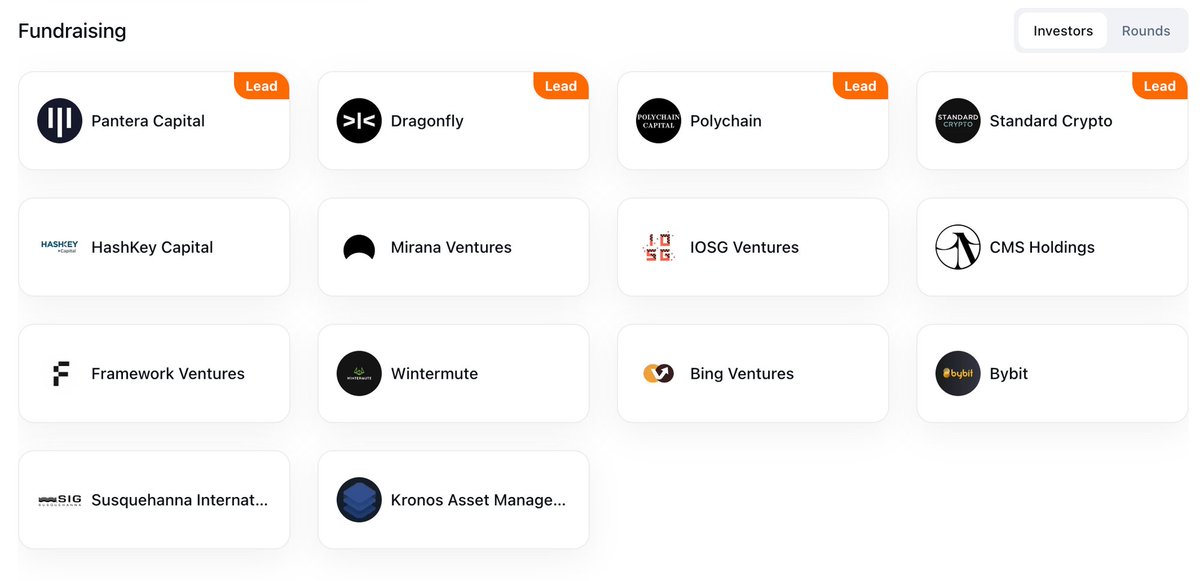

This analysis focuses on SynFutures @SynFuturesDefi, which has raised $38 million without launching a token yet, and has evolved from V1 to V3 since 2021. The discussion will mainly compare it with mainstream products like dYdX and GMX, and explore potential breakthrough points for the derivatives sector.

Currently, the more mature derivatives DEXs in the market are dYdX and GMX:

(1) GMX uses a liquidity pool model, where LPs and traders act as counterparty to each other, enabling LPs to capture fees and funding interest. Gains Network and Jupiter Perps have adopted similar mechanisms.

(2) dYdX uses an order book model, offering a trading experience closest to CEXs.

Although these DEXs seem to offer very similar product experiences, they have started carving out their own market positioning. For example, over 50% of trading volume on Gains Network comes from forex markets, while GMX's volume is dominated by ETH and BTC. dYdX has become the preferred choice for institutional traders, offering an order book experience most similar to CEXs.

SynFutures positions itself as a platform capable of enabling trading for any long-tail crypto asset—permissionless and decentralized. Its core mechanism is built around the Oyster AMM model, featuring two key innovations:

1. Permissionless Listing

Users can freely create new trading pairs or markets without platform approval—a feature unavailable on traditional derivatives DEXs such as GMX and dYdX. In particular, the liquidity pool model used by GMX makes permissionless listing risky, as allowing arbitrary tokens could expose the entire system to significant risk. In contrast, SynFutures assigns a dedicated liquidity pool to each trading pair instead of using a unified vault. Adding a market for a speculative or low-quality token ("shit coin") does not impact major markets like BTC or ETH. In theory, it supports using any ERC20 token as collateral without increasing systemic risk. At the protocol level, this grants high openness and freedom, achieving Uniswap-level capability to create derivative markets for any token. While SynFutures enables this mechanism, challenges remain—such as how to incentivize users to provide liquidity for derivative markets of obscure tokens. Liquidity will only form when LP returns are sufficient to offset impermanent loss and downside price risks.

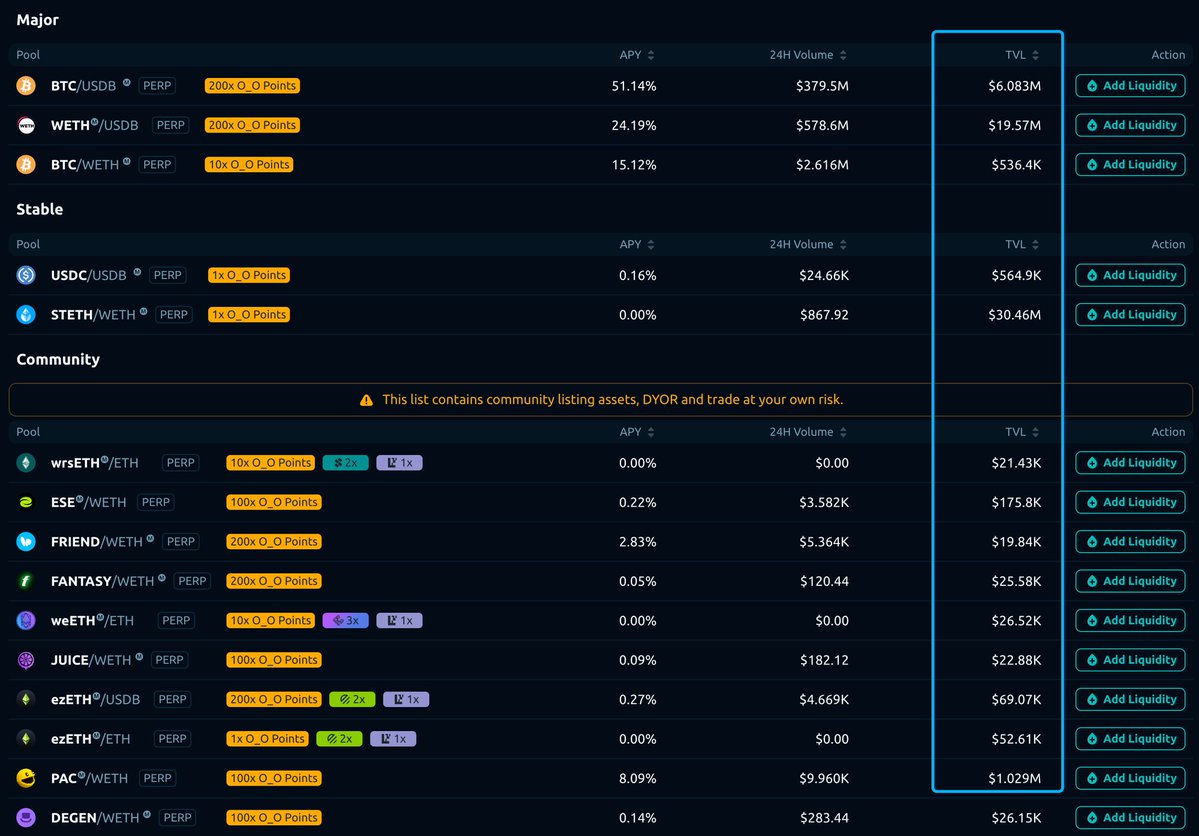

We observe that liquidity for major assets is relatively abundant, but TVL for community-driven altcoins remains limited. Currently, related projects rely on points-based incentives to encourage liquidity provision.

2. Combining Concentrated Liquidity with Order Book

In the Oyster AMM, liquidity can be concentrated within predefined price ranges. This means LPs only need to focus on their chosen price intervals—a mechanism similar to Uniswap v3. By concentrating capital in price ranges where trades are more likely to occur, capital efficiency is significantly improved.

For example, if an LP provides liquidity for ETH-USDB-PERP in the [3000, 4000] range, this interval is divided into multiple discrete price points, each allocated equal liquidity. Each price point functions like a limit order on an order book.

In effect, compared to traditional off-chain order books, SynFutures achieves on-chain limit orders by allowing users to provide liquidity at specific price points, thereby simulating a fully on-chain order book mechanism.

Additionally, due to the concentrated liquidity design, LPs only need to deposit one single token when providing liquidity, and the system automatically handles its exchange with other assets within the AMM.

Next, let’s dive deeper into operational mechanics:

How does the Oyster AMM manage concentrated liquidity when market prices change?

(1) Understanding the Concept – Pearl Structure

In the Oyster AMM model, the Pearl structure is a critical data structure used to store and manage all relevant liquidity and orders at the same price point. It is the key mechanism enabling the integration of concentrated liquidity with traditional order book advantages.

Aggregation of Concentrated Liquidity and Limit Orders: The Pearl structure contains all concentrated liquidity and open limit orders at the same price point. Whenever a trader wants to execute a trade at a specific price, the system looks up the corresponding Pearl and executes against it.

Indexed Storage of Liquidity: Each Pearl is indexed by price within the smart contract, enabling fast lookup and efficient trade execution, improving system responsiveness and performance.

(2) Automatic Price Point Adjustment

In Oyster AMM, price point adjustments are primarily driven by market forces. Whenever a trade occurs, the price automatically adjusts based on supply and demand between buyers and sellers.

When a trade request arrives, the system first checks whether there are unfilled limit orders in the order book (i.e., the Pearl) at the current price point (P0).

If so, those orders are filled first.

If the current price point cannot fully satisfy the trade size, the system moves to the next price point (P1).

This process ensures maximum utilization of available liquidity at each price level, with price movements occurring naturally according to market supply and demand.

(3) Adjusting Concentrated Liquidity Ranges

Adjustments to concentrated liquidity ranges depend on market price movements and LPs’ strategic decisions—similar to Uniswap V3. LPs must actively manage their liquidity ranges to keep them aligned with current market prices.

When the market price moves beyond the boundaries of a concentrated liquidity range, that liquidity may be automatically reconfigured or removed.

If the AMM price moves outside the price range set by an LP, the liquidity may be automatically converted into the target asset, or the LP may need to manually adjust their price range.

Such processes are often accompanied by fee structures or incentive rewards designed to encourage LPs to maintain or adjust their liquidity within active price ranges.

Summary and Insights

Overall, the derivatives DEX space is currently crowded but lacks breakout projects on the scale of Uniswap or Curve during DeFi Summer. The core reasons include:

1. The unique context of DeFi Summer, marked by the rise of self-custody movements, where users began prioritizing control over their funds.

2. Uniswap enabled permissionless token creation and listing, eliminating reliance on CEXs for asset trading.

3. Derivatives trading places greater emphasis on privacy, requiring advancements in privacy protocols—whereas spot trading is less sensitive in this regard.

4. Derivatives demand higher transaction performance and typically require user experiences comparable to CEXs.

These factors collectively explain why users currently lack strong motivation to migrate or change their habits. Beyond offering additional incentives, on-chain derivatives DEXs are building moats around their respective niches, resulting in a competitive landscape that is likely to persist for the foreseeable future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News