MIIX Capital Weekly Report: Regulatory Tailwinds Emerge, Market Confidence Recovers

TechFlow Selected TechFlow Selected

MIIX Capital Weekly Report: Regulatory Tailwinds Emerge, Market Confidence Recovers

As the U.S. legislative stance on crypto becomes clearer, the overall trend appears favorable, and market confidence is recovering.

Author: MIIX Capital

The SEC has approved the 19b-4 forms for eight ETH spot ETFs. Although trading cannot begin until S-1 registration statements are cleared, the entire market has raised its expectations for ETH's price trajectory and is already warming up in anticipation.

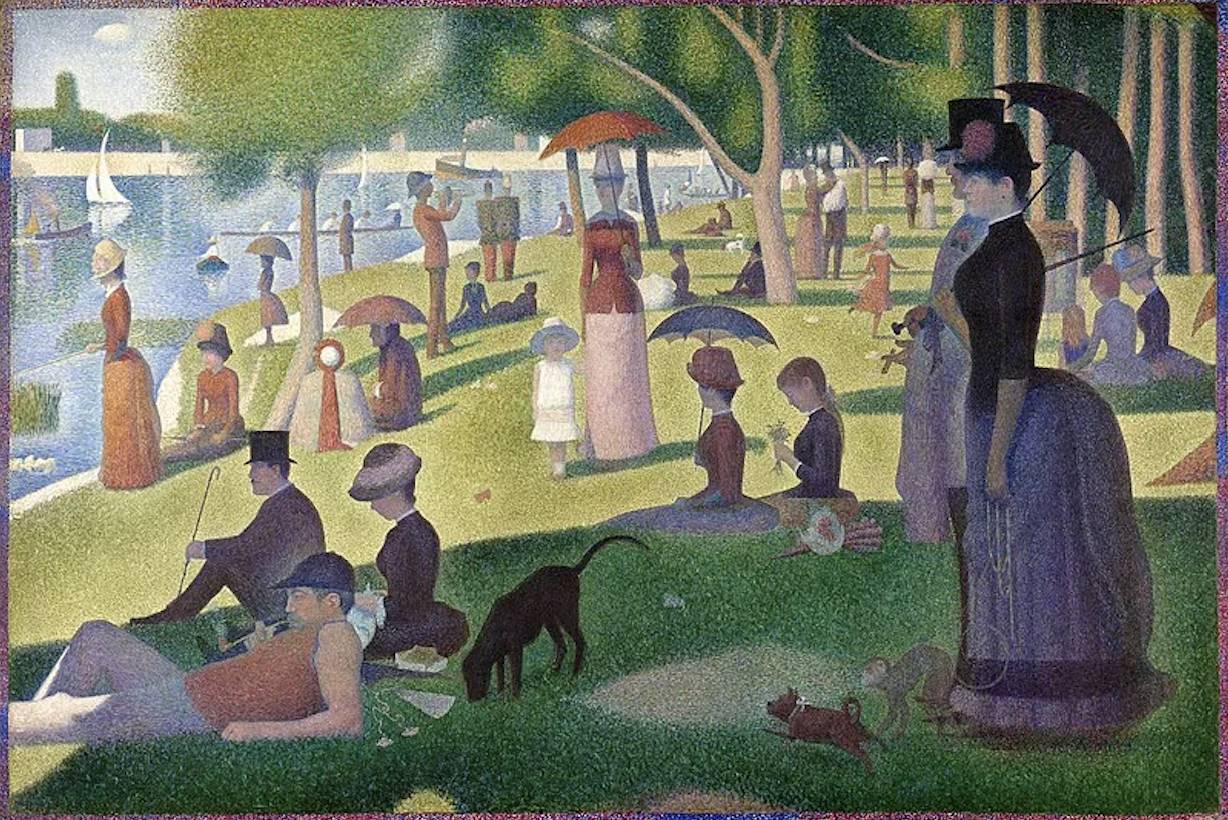

1. Investment & Funding Overview

Last week, the crypto market saw 33 funding events, a 26.9% increase week-on-week, with total capital raised exceeding $270 million—an impressive 58.8% rise. As market conditions improve, expansion is clearly accelerating:

-

DeFi sector announced 8 deals, including $9 million raised by Kelp, an Ethereum liquid restaking platform, led by SCB Limited and Laser Digital;

-

GameFi sector reported 1 deal, RPG blockchain game Aria completed seed funding, co-led by Folius Ventures, Spartan Group, and Merit Circle;

-

NFT sector reported 1 funding event, Singapore-based collectibles design company Mighty Jaxx secured another $11 million in an extension of its Series A+ round;

-

DePIN sector reported 1 deal, Blockless, a compute-focused DePIN project, raised $8 million across two early-stage rounds;

-

Infrastructure and tools sector reported 8 deals, including $12 million pre-A round for ZK hardware startup Cysic, led by HashKey Capital and OKX Ventures;

-

Other Web3/crypto applications reported 8 deals, including Farcaster, a Web3 social media platform, raising $150 million, led by Paradigm with participation from a16z crypto and others.

Week-on-week data shows that both the number and scale of crypto investments have sharply rebounded, indicating that institutions are increasing leverage and investment frequency as market sentiment improves. There were six funding rounds exceeding $10 million each—including Fracmaster, Cysic, Dora Factory, Plume Network, Fantom, and StripChain—with investor interest focused on DeFi, RWA, and SocialFi sectors. Among VCs, Paradigm stood out as particularly active this week, followed by OKX Ventures and Animoca Brands.

About Farcaster: Farcaster is a decentralized social network built on Optimism, functioning as an open protocol supporting multiple clients. Users can freely move their social identity across apps, while developers can build new applications with novel features on the network. About Cysic: Cysic is a ZK hardware acceleration project developing advanced ASIC chips to reduce ZK proof generation time. It already has several ecosystem partners, including Scroll, Nil Foundation, and Hyper Oracle. About Kelp DAO: Kelp DAO is a triple-yield restaking protocol based on EigenLayer. The team plans to use the newly raised funds to expand its liquid restaking services onto blockchains such as Bitcoin, Solana, and BNB Chain, aiming to launch on one to two new chains by Q3 this year.

2. Industry Data

U.S. BTC Spot ETFs Record 10 Consecutive Days of Net Inflows

According to SoSoValue data: As of market close on Friday, May 24 (Eastern Time), BTC spot ETFs have recorded net inflows for 10 consecutive days. By May 27 statistics, global BTC spot ETFs had a total net asset value of $61.203 billion, representing 4.53% of BTC’s total market cap.

Over the past two weeks, BTC spot ETF assets have grown positively, and their share of BTC’s total market cap continues to rise. The growth rate of ETFs clearly exceeds BTC issuance, meaning buying pressure outweighs supply, suggesting a slow but steady upward trend in BTC prices over the near term.

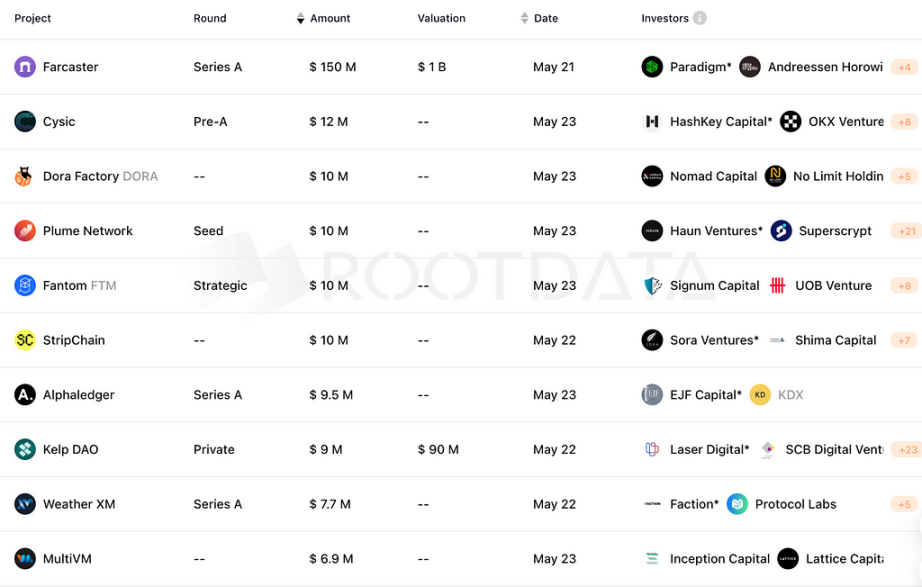

Hong Kong ETH ETF Trading Volume Rises Significantly

As of market close on May 24, the total trading volume of Hong Kong’s six virtual asset ETFs reached approximately HK$45.33 million. Among them, the three ETH ETFs saw significantly higher trading volumes than usual. This surge follows positive market momentum triggered by the U.S. approval of ETH spot ETF 19b-4 filings, highlighting the strong influence of U.S. policy and economic trends on crypto markets, while also showing that Hong Kong’s ETF market still requires stronger drivers to sustain activity.

Hong Kong ETF Trading Data on May 24: CSOP BTC ETF (3042.HK) traded HK$15.168 million; CSOP ETH ETF (3046.HK) traded HK$8.5851 million; Harvest BTC ETF (3439.HK) traded HK$6.8468 million; Harvest ETH ETF (3179.HK) traded HK$9.2268 million; Bosera HashKey BTC ETF (3008.HK) traded HK$1.7207 million; Bosera HashKey ETH ETF (3009.HK) traded HK$3.7849 million.

Reduced Selling Pressure, Whales Accumulate 20,000 BTC

IntoTheBlock data from May 23: Over the past week, whale addresses holding between 1,000 and 10,000 BTC collectively accumulated 20,000 BTC. This indicates that long-term holders are re-entering bullish accumulation mode. Compared to the significant sell-off after BTC hit its $73,000 high in March, recent selling pressure has notably eased, creating more room for bullish sentiment.

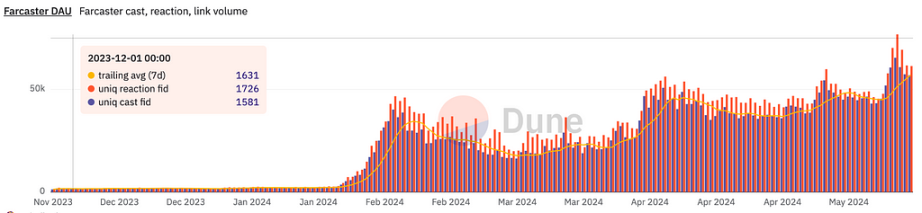

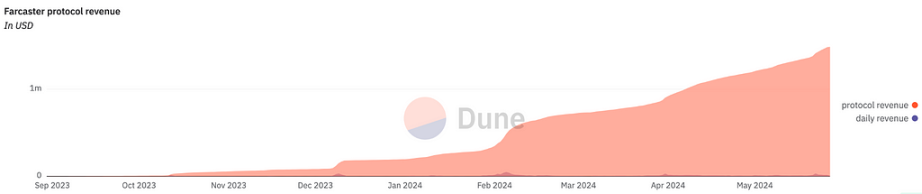

Farcaster User Metrics Hit New Highs

Dune data: Since May 21, Farcaster’s metrics have continuously set new historical highs:

-

On May 22, Farcaster recorded 69,901 unique reactions and 60,387 unique casts;

-

On May 25, Farcaster’s total revenue surpassed $1.45 million, reaching $1.4579 million, with total users exceeding 400,000;

Positioning itself as infrastructure for social applications—closer to a “Layer” than a single Dapp—Farcaster has greater potential to spawn diverse and widespread use cases. This architectural distinction sets its growth trajectory apart from other SocialFi products, warranting focused attention.

On May 22, Farcaster closed a $150 million funding round led by Paradigm, with participation from a16z crypto, Haun, USV, Variant, and Standard Crypto. The team stated it will focus this year on growing daily active users and adding developer primitives to the protocol, such as channel and direct messaging functionality.

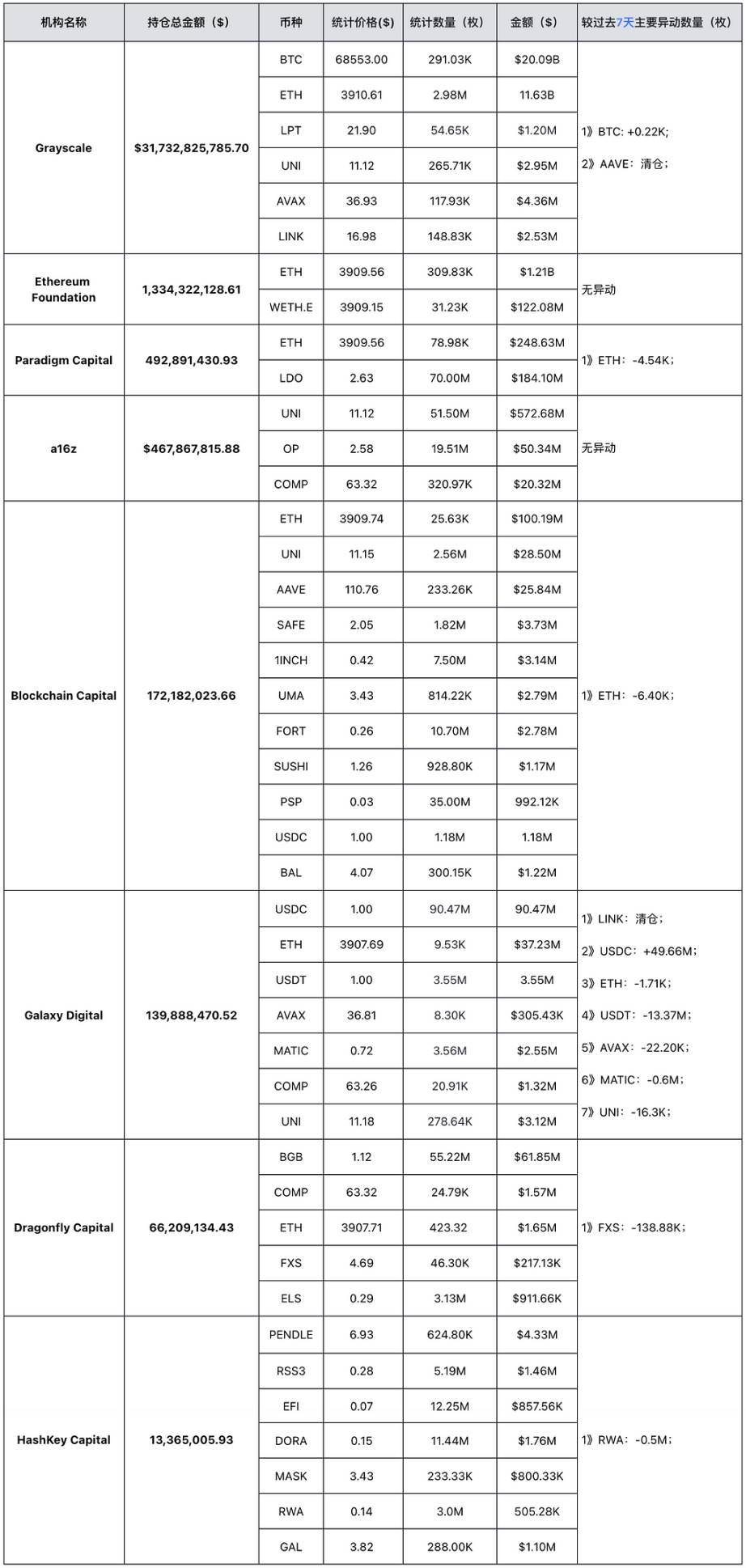

3. VC Holdings

Note: Data source: https://platform.arkhamintelligence.com/, as of May 27, 2024, 15:00 (UTC+8).

4. This Week’s Watchlist

May 27

-

Solana mainnet v1.18 release scheduled for May 27 to address network congestion;

-

Bitlayer launches its two-week Mining Gala initial mining event from May 27 to June 10;

-

Sei has voted to approve the "upgrade to V2" proposal, with mainnet upgrade scheduled for May 27;

-

YGG unlocks approximately 16.69 million tokens (~$16.94 million) at 22:00 on May 27, representing 4.49% of circulating supply;

May 28

-

U.S. May Conference Board Consumer Confidence Index;

-

London Stock Exchange accepts listing applications for BTC and ETH ETNs, with first listings expected on May 28;

-

Blast upgrades to support blobs at 05:00 on May 28;

-

Illuvium Open Beta testnet expected to go live on May 28;

-

SingularityNET (AGIX) unlocks ~8.71 million tokens (~$8.4 million) at 08:00 on May 28, 0.68% of circulating supply;

-

Blockchain Week Rome takes place from May 28–31, 2024;

May 29

-

Federal Reserve Governor Lisa Cook and 2024 FOMC voter Mary Daly speak on artificial intelligence;

-

SEC decision on options trading for BTC spot ETFs;

-

UK consultation on implementing OECD crypto reporting framework ends May 29;

-

Bitcoin Seoul held in Seoul, South Korea from May 29–31;

-

CoinDesk-hosted Consensus 2024 in Austin, Texas from May 29–31;

-

Binance launches new NFT collection featuring football superstar Cristiano Ronaldo on May 29;

-

Blockchain Economy Istanbul;

-

GenAI Summit San Francisco 2024;

May 30

-

U.S. weekly initial jobless claims;

-

Fed releases Beige Book on economic conditions;

-

FOMC permanent voter and New York Fed President Williams participates in a roundtable;

-

2024 FOMC voter and Atlanta Fed President Bostic speaks on economic outlook;

-

U.S. Department of Justice hosts AI industry competition research workshop at Stanford University on May 30;

-

Virtual asset trading platform VAEX begins restricting Hong Kong users from trading;

-

OKX HK will delist stablecoins and related trading pairs on May 30, 2024, and launch HKD-denominated trading pairs on "spot trading";

-

Cryptopunks hosts auction for digital avatar series "Super Punk World";

May 31

-

U.S. April Core PCE Price Index YoY;

-

EOS plans to deploy its new tokenomics model to mainnet before end of May;

-

BNB Chain announces Q2 2024 Hackathon winners and begins one-month incubation;

-

Uniswap Foundation launches on-chain vote on May 31 to upgrade fee mechanism and reward UNI holders;

-

Hong Kong platforms without virtual asset license applications must cease operations by end of May;

-

Optimism token OP unlocks 31.34 million tokens (~$79.61 million) at 08:00 on May 31, 2.88% of circulating supply;

-

Echelon Prime token PRIME unlocks 1.66 million tokens (~$31.66 million) at 08:00 on May 31, 4.23% of circulating supply;

-

Tornado Cash (TORN) unlocks 92,000 tokens (~$240,000) at 11:30 on May 31, 2.41% of circulating supply;

June 1

-

Dogechain Wallet shuts down on June 1; users must withdraw DOGE promptly;

-

dYdX token DYDX unlocks ~33.33 million tokens (~$67 million) at 08:00 on June 1, 11.91% of circulating supply;

-

ZetaChain (ZETA) unlocks ~5.29 million tokens (~$8.2 million) at 08:00 on June 1, 1.99% of circulating supply;

-

1inch (1INCH) unlocks ~98.74 million tokens (~$42 million) at 08:00 on June 1, 8.52% of circulating supply;

-

Manta Network (MANTA) unlocks ~1.87 million tokens (~$3.2 million) at 07:59 on June 1, 0.74% of circulating supply;

-

Sui token SUI unlocks ~65.08 million tokens (~$68.07 million) at 08:00 on June 1, 2.78% of circulating supply;

June 2

-

Ethena (ENA) unlocks ~53.6 million tokens (~$46 million) at 07:00 on June 2, 3.62% of circulating supply;

5. Conclusion

Last week, the FIT21 bill passed the U.S. House of Representatives, signaling a friendlier regulatory stance toward crypto from U.S. authorities. This policy tailwind provides clearer regulatory direction and political support for the cryptocurrency industry. Meanwhile, U.S. BTC spot ETFs recording 10 consecutive days of net inflows continue to drive a slow but steady upward movement in BTC prices. Additionally, the number and scale of crypto investments have sharply rebounded, reflecting institutional investors increasing leverage and investment frequency during market recovery, with heightened interest in DeFi, RWA, and SocialFi sectors.

This week, 18 token projects face token unlocks, with cumulative unlock values for PRIME, OP, Sui, DYDX, 1INCH, and ENA exceeding $300 million. As circulating token supply becomes increasingly inflationary, it remains critical to monitor whether sufficient demand will emerge to absorb the increased supply. On a positive note, Trump’s campaign accepting crypto donations signals growing favorable sentiment, suggesting election-related crypto narratives may intensify. Meanwhile, Uniswap’s upcoming fee incentive mechanism vote could bring sustained positive momentum for UNI and the broader industry.

Overall, the evolving regulatory posture at the U.S. legislative level reflects a favorable trend, and market confidence is recovering. While final implementation timelines remain uncertain, significant progress has already been made on the path through regulatory challenges, laying a solid foundation for future innovation and growth in the industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News