What is the best asset management model on BTC?

TechFlow Selected TechFlow Selected

What is the best asset management model on BTC?

Taking Runes as an example, analyze the optimal mechanism for asset proxy minting models on Bitcoin.

Author: Shijun

Trading is the soul of web3, attention is web3’s most critical resource, price is where momentum begins, and value is where time ends.

It has been one month since the BTC halving, and also one month since the much-anticipated Runes protocol launched. During this period, over a dozen代打 platforms and marketplaces have emerged. On the day of the halving, the cost to代打 a single Runes asset could exceed $100 in transaction fees alone.

This article takes Runes assets as an example to analyze which model represents the optimal mechanism for asset代打 (etching) on Bitcoin.

1. GAS Comparison Among Runes代打 Platforms

The chart below summarizes the landscape as analyzed by Shijun.

From a design perspective, the key conclusions are:

-

Gas cost: Split + Chained < Chained < Split < Single mint

-

Degree of centralization: Chained (no intermediary address) < Split (no intermediary address) < Chained (with intermediary address) < Split (with intermediary address)

-

Asset consolidation: Chained > Split + Chained > Split

-

Batch on-chain speed: Split = Split + Chained > Chained

At first glance, some may be confused—what exactly are “chained” and “split” models?

To understand this, we must return to the Runes protocol itself. For further reading, see: "With BTC Halving Approaching: Understanding the Underlying Design and Limitations of the Runes Protocol".

1.1 Overview of Runes Etching Mechanism

Runes uses etching technology—a simple and intuitive method of recording information on-chain by writing data into the op-return field of a Bitcoin UTXO (unspent transaction output). The OP_RETURN function was introduced in Bitcoin Core client version 0.9 (back in 2014), allowing for verifiable, non-spendable outputs that permanently store data on the blockchain, similar to UTXOs but non-consumable.

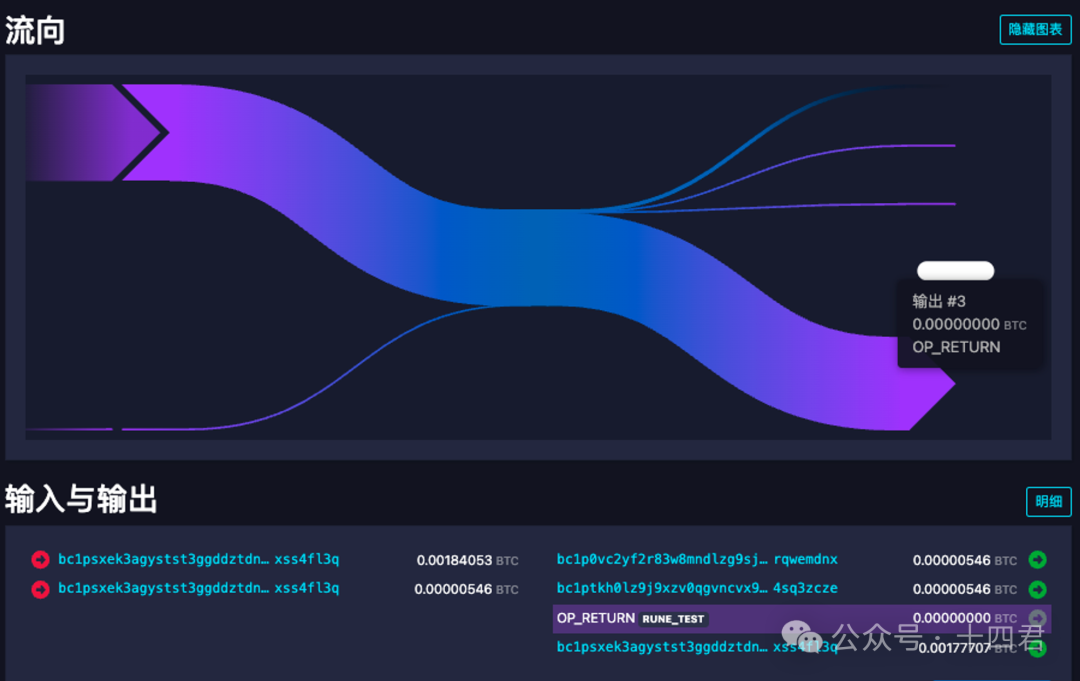

In a BTC blockchain explorer, you can clearly see that a transaction includes an op-return message, as shown in the image below:

Here, Output #3 is floating—it occupies a UTXO output slot but is represented as a closed circular rectangle, indicating it cannot be spent or transferred again. It functions like a note attached to the transaction, permanently stored on Bitcoin's ledger and retrievable via the transaction hash.

You might notice "RUNE_TEST" after OP_RETURN—that’s the decoded content. By clicking the details button, you’ll find a hex string like 52554e455f54455354, which decodes to "RUNE_TEST". Similarly, other encoded segments decode into JSON-like strings, conveying meanings such as asset deployment, minting, and issuance.

Thus, the core mechanism of代打 can be summarized as: one Runes transaction can only mint one asset.

In BTC, transaction cost is determined by the size of on-chain data. Therefore, the optimal代打 platform design minimizes the number of UTXOs generated per transaction.

Next, let’s dive into the split and chained models.

1.2 Split Model

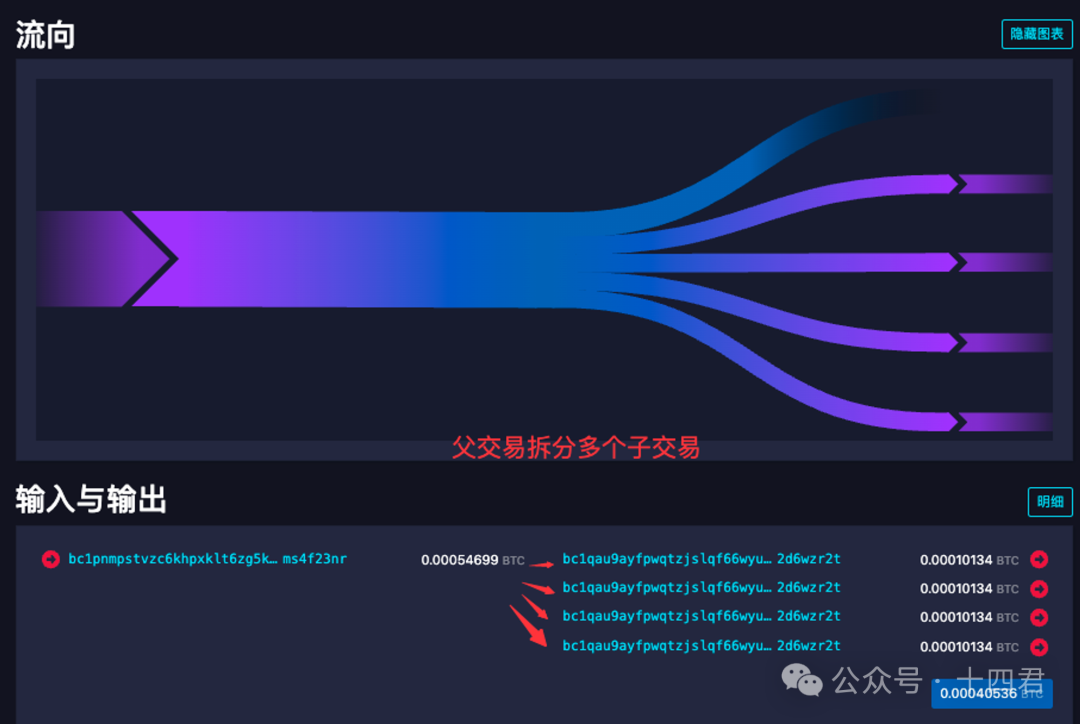

The split model involves first conducting a transaction to split funds into multiple sub-transactions, each then used for asset minting.

For example, tools.mempool’s代打 solution works as follows:

The first transaction estimates the fee required for each sub-mint, then splits into multiple UTXOs with 546 satoshis (common dust threshold) plus estimated fees, sending them to a new address.

The second transaction transfers back from the new address to the user’s wallet, completing the代打 and consolidating the Runes assets.

Key drawbacks of this model include:

- Requires an initial splitting transaction.

- Users receive fragmented UTXOs.

- When listing for sale, users must either list individually or merge UTXOs first—increasing costs for large-volume traders.

- tools.mempool does not perform a代打 during the split phase, leading to higher overall gas consumption among split models.

1.3 Chained Model

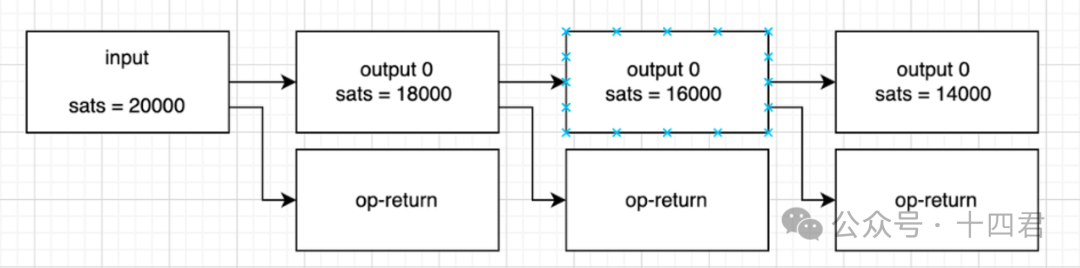

The chained model resembles the structure below: a user starts with 20,000 sats, and each subsequent transaction spends the previous one still pending in the mempool—resulting in multiple interlinked transactions.

Notice that the address ending in s2t4 collects 6,144 sats as platform fee. Compared to the actual base fee of 3,892 sats, this represents significant revenue for the platform.

This platform is Runestone, which claimed to build its Runes代打 and marketplace in just five days. While now largely inactive, it earned nearly 3 BTC (over $1.5M) in fees during its early days—an enormous sum for an individual developer.

However, these fees were essentially arbitrary. Multiple platforms have since open-sourced their代打 code—for instance, OKX released open-source Runes tools solving encoding/decoding and代打 entirely: https://github.com/okx/js-wallet-sdk, enabling developers to build their own tools directly.

Returning to the chained model: because fees are collected upfront, subsequent transactions follow a looped pattern as shown below, resulting in relatively low data volume.

2. Optimal Runes代打 Model: Split + Chained

Luminex currently offers the best model—supporting bulk minting, providing UTXO splitting tools, and adopting a hybrid split + chained approach.

As illustrated below:

- During the split phase, the platform immediately mints one asset for the user—zero waste.

- If minting ≤25 times, it splits sufficient gas for chained minting and proceeds.

- If minting >25 times, it splits multiple gas pools for chained minting across chains.

While base fees aren’t lower than pure chained models, Luminex enables critical large-scale minting and completes on-chain within just two blocks at maximum efficiency.

2.1 Why Does On-Chain Efficiency Matter?

Because BTC nodes enforce a DoS protection mechanism:

For any single UTXO’s vout and its spending chain, the mempool allows at most 25 pending transactions.

This explains why most bulk minting solutions use intermediate addresses—to bypass this limit. In chained models, assets accumulate before being sent to the user.

Thus, pure chained models are limited to 25 concurrent mempool transactions. But in split models, once the initial split is confirmed, unlimited transactions can enter the mempool (since parent transactions are no longer pending, each UTXO’s vout independently counts toward the 25-limit).

Therefore, Luminex isn’t optimal just due to low gas—it balances minimal fees with high-volume minting capability.

Still, there exists a better model than Luminex.

Luminex performs a代打 during the split phase and sends the asset to the user. However, this asset doesn't need to go to the user—it could instead be sent to the next chained transaction’s UTXO. Thanks to Runes’ default fungibility rules, this would eliminate one extra UTXO, further reducing costs beyond Luminex’s current design.

2.2 BTC Fee Optimization Rate Comparison

How do we quantify these cost differences? Simply put, users typically set a price per unit (like gasPrice), but BTC fees depend entirely on data size measured in vsize.

Taking Taproot addresses as an example (which have lower fees):

- Each additional input increases vsize by 58.

- Each additional output increases vsize by 43.

- Each OP_RETURN write requires ~30 vsize.

We can now calculate optimization rates:

Chained batch mint 10: cost = i*10 + o*10 + p*10 = 1310

Split batch mint 10: cost = i*10 + o*10 + o*9 + p*10 = 1697

Gas optimization rate: (1697–1310)/1697 = 22.8%

Chained batch mint 20: cost = i*20 + o*20 + p*20 = 2620

Split batch mint 20: cost = i*20 + o*20 + o*19 + p*20 = 3437

Gas optimization rate: (3437–2620)/3437 = 23.8%

Though 20% may seem modest, during peak periods when a single mint cost $100, batching 10 mints saves $200. These small savings influence psychological pricing thresholds in trading.

Given high代打 fees, those hoping to capture early gains in web3 should learn basic Node.js to run open-source code directly (such as OKX’s signing library mentioned above), bypassing platform fees entirely. In future articles on marketplaces, we’ll show how to build cross-platform trading systems, monitor the mempool directly, and even front-run trades for profit.

3. Conclusion

One month after the launch of the Runes asset protocol, it has unfortunately failed to surpass the $1 billion valuation mark. There were even rumors of Ordinals and Runes founder Casey joking about livestreaming seppuku.

Ultimately, the ecosystem lacks robust foundational infrastructure—particularly in代打 and marketplaces—making participation too costly for retail users and operationally insufficient for institutions.

Current platforms either charge excessive fees or offer incomplete functionality. For example, Runestone had low chained-model costs but inaccurate gas estimation, often causing failures in final transactions and increasing on-chain uncertainty, eventually driving it out of the market.

Moreover, existing代打 models overlook users’ real needs—liquidity and trading.

Most minted assets require quick resale, but in a volatile early market with severe BTC network congestion, demand for bulk minting remains limited unless driven by project teams themselves. Those with capital to mint 1,000 assets likely have the technical ability to do so independently. Thus, the core user base for these platforms remains retail investors.

While chained models offer lower costs, they’re ill-suited for early-stage markets. During rapid price fluctuations and without built-in splitting tools, having 20+ assets bundled in one transaction raises the barrier for buyers, making acquisition harder.

This article concludes our analysis of代打 mechanisms on Bitcoin. A follow-up piece will explore marketplace models applicable to new assets like BRC20, Ordinals, Atomicals, and Runes. Stay tuned.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News