Unreliable low-circulation / high-FDV tokens? How retail investors choose altcoins?

TechFlow Selected TechFlow Selected

Unreliable low-circulation / high-FDV tokens? How retail investors choose altcoins?

Market environment and narrative are the key factors determining asset performance.

Author: Crypto Koryo

Translation: Luffy, Foresight News

Over the past few weeks, many people have written about the topic of low-circulation / high-FDV tokens. Here, I'd like to add some insights using two data charts.

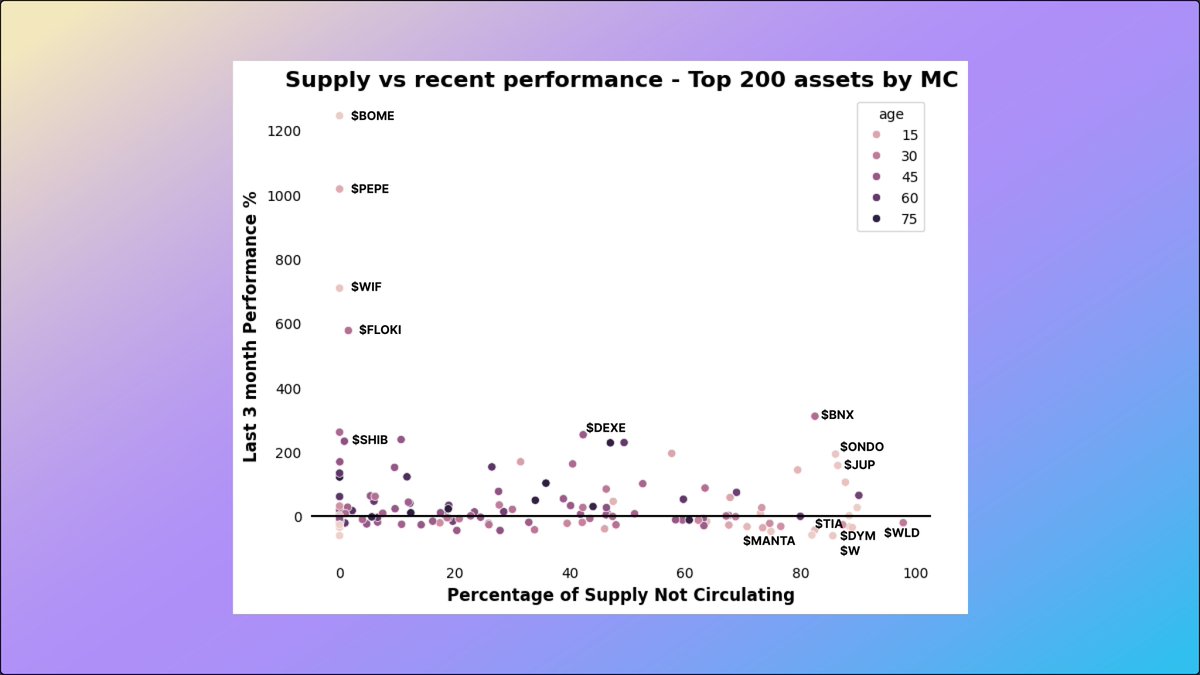

Non-Circulating Supply (NCS) and Recent Performance

The chart below shows the percentage of non-circulating supply versus market performance over the past three months. The color of the circles indicates how many months ago the project launched. (Lighter/darker circles represent more recently/earlier launched projects, respectively).

What can we observe?

1/ Memecoins performed best. Their entire supply has been in circulation from day one. Interestingly, both older memecoins (SHIB, FLOKI) and newer ones (BOME, WIF, PEPE) have performed exceptionally well.

2/ The worst-performing projects are mostly newer VC-backed projects with very high "non-circulating supply (NCS)" portions:

3/ Interestingly, there are some outliers:

Both projects launched in January 2024. This suggests that newly launched projects with high non-circulating supply can still perform well.

Why did these tokens stand out? The answer lies in narrative (explained later).

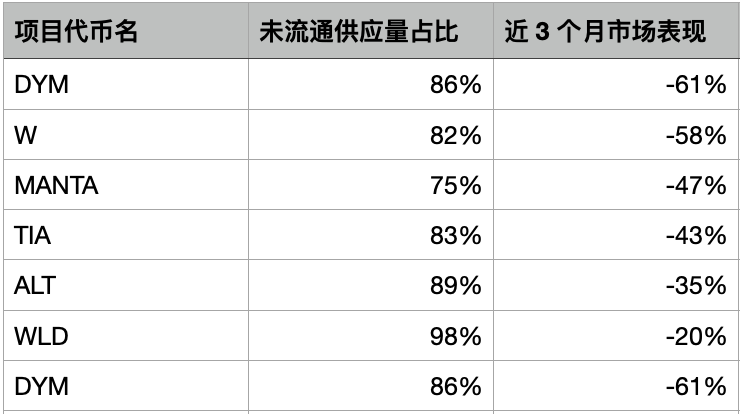

Now, removing the memecoin outliers, let's take a closer look at the distribution.

4/ Upon closer inspection, while projects with higher NCS tend to underperform, there isn't a very clear pattern among those with extremely low or extremely high NCS.

For example, quality projects with lower NCS such as FXS (NCS 20%), MASK (NCS 4%), and RPL (NCS 0%) delivered market performances of -44%, -10%, and -22% respectively over the past three months.

5/ On the positive side, we observe that regardless of project age, those with lower NCS generally perform better.

My conclusion is that, in general, market conditions and narrative are the primary drivers of asset performance. However, high-NCS projects tend to underperform and may serve as better hedges or short opportunities during bearish markets.

Low Circulation / High FDV vs. High Circulation / Low FDV

If "low circulation / high FDV" is bad, what about "high circulation / low FDV"?

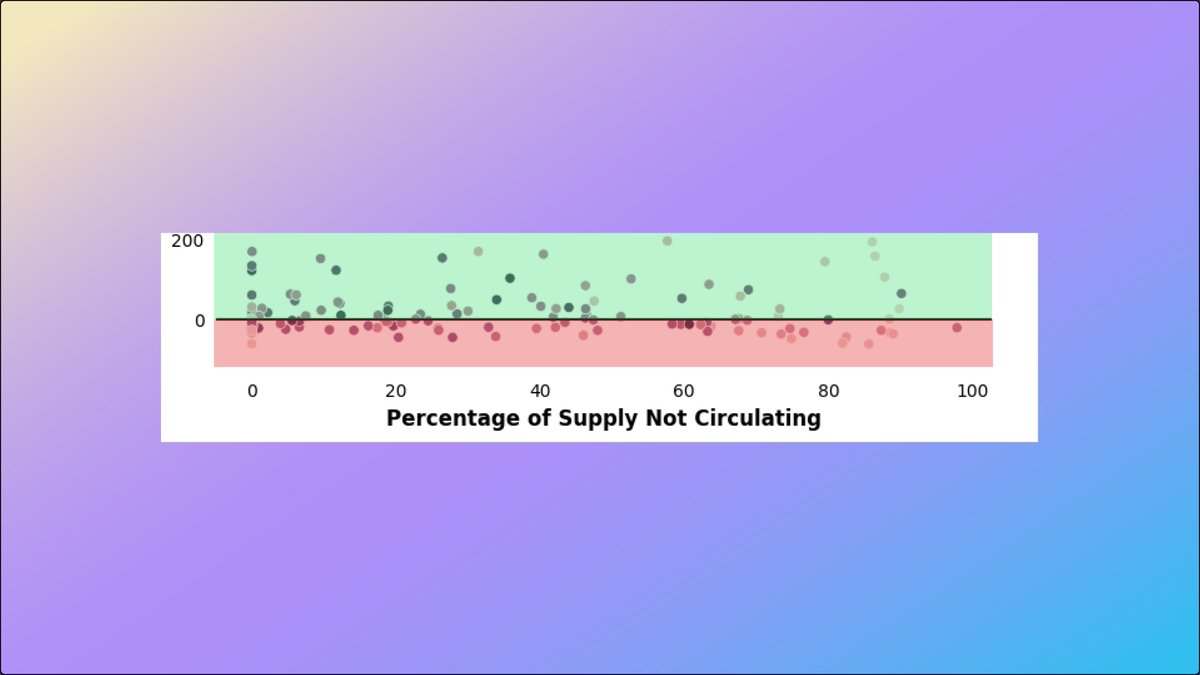

I examined the top 500 projects ranked by market cap from 2023–2024 (data: CMC), classifying projects with NCS above 80% as low-circulation.

Let’s look at the actual data:

As shown, low-circulation / high-FDV projects performed quite poorly, with only two notable exceptions: ONDO and JTO (guess why).

On the other hand, ignoring a few memecoin outliers, high-circulation / low-FDV projects generally performed better.

So what now?

Ultimately, back to the question we all care about: which altcoins should you buy?

Low-circulation / high-FDV projects tend to underperform. Sure, there are 2–3 exceptions, but are you willing to put in the effort to find them? You could, but it would require significant effort without guaranteed success.

Meanwhile, even though data shows memecoins excel in this regard, you might not be comfortable trading memecoins.

So what should you do?

1/ Become a Narrative Trader

I've said this many times. If a project has sufficient demand, any selling pressure will be absorbed. And such high demand only comes from catalysts and narratives. Since I've discussed this extensively elsewhere, I won't elaborate further here.

2/ Find the Sweet Spot

There are two extremes: memecoins with 0% NCS, and new VC tokens with high FDV and over 80% NCS.

Assume the sweet spot lies in projects with NCS between 10% and 50%. The following are recent top performers falling into this category:

Projects such as FET, FTM, PENDLE, RNDR, AGIX, and AKT all belong to this group.

Combine this with some basic narrative trading, and you’ve got a winning combination.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News