Franklin Templeton: To Stake or Not to Stake Crypto?

TechFlow Selected TechFlow Selected

Franklin Templeton: To Stake or Not to Stake Crypto?

Although staking can generate certain returns and hedge against inflation, cryptocurrency trading still involves some inherent risks.

Author: Franklin Templeton (a U.S.-listed fund management company)

Translation: Felix, PANews

Native assets on Proof-of-Stake (PoS) networks differ from traditional assets in one key aspect. Native assets on PoS networks allow long-term passive investors to earn network-native returns through staking. Moreover, choosing not to stake means forgoing these native yields.

What is Staking?

PoS networks rely on node operators to validate transactions and secure the network. In addition to newly minted staking rewards, operators can also receive a portion of transaction fees. The network requires node operators to commit a minimum amount of capital denominated in the native asset to ensure honest behavior (initial capital can be slashed to deter dishonest actions). Therefore, while directly operating a node may be capital-intensive and daunting for many, passive investors can delegate their tokens to node operators to earn staking rewards.

Comparing Actual Returns: Staking vs. Not Staking

Passive investors who do not stake will experience portfolio dilution in networks with positive net inflation, whereas net deflation will bring additional value to these investors. However, if passive investors choose to stake, they earn staking rewards that can offset network inflation.

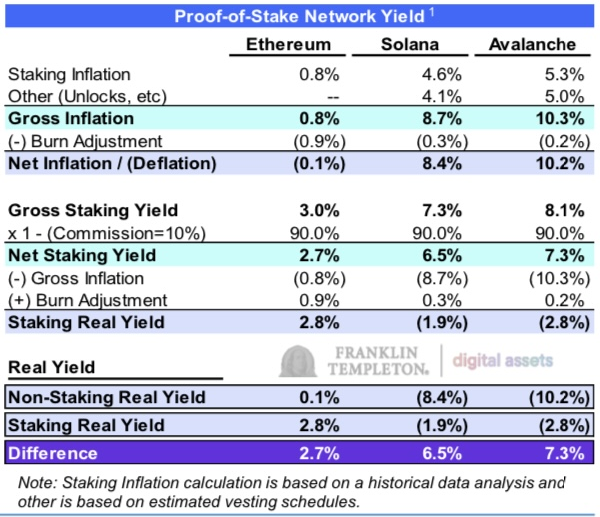

The chart below shows potential returns from staking versus not staking, adjusted for inflation. Regardless of whether they stake or not, investors benefit from burn adjustments, which mitigate some inherent protocol inflation. However, it should be noted that staking introduces new risks, including slashing and illiquidity.

For each respective asset, staking adds substantial incremental returns for passive investors—returns provided by each corresponding network.

The chart below shows that on the Ethereum network, the difference between staked and non-staked returns is 2.7% (2.8% - 0.1%); on Solana, the difference is 6.5% (8.4% - 1.9%); on Avalanche, the difference is 7.3% (10.2% - 2.8%).

What Are the Risks of Cryptocurrency?

All investments involve risk, including the loss of principal.

Investments in blockchain and cryptocurrency face various risks, including failure to develop or utilize digital asset applications, theft, loss, or destruction of cryptographic keys, the possibility that digital asset technology may never be fully implemented, cybersecurity risks, conflicting intellectual property claims, and inconsistent and evolving regulations.

Speculative trading in Bitcoin and other forms of cryptocurrency (many of which exhibit extreme price volatility) carries significant risk, and investors may lose their entire principal. Blockchain technology is new and relatively untested, and may never achieve widespread adoption. If cryptocurrencies are deemed securities, this could violate federal securities laws, and secondary markets for cryptocurrencies may be limited or nonexistent.

Digital assets are subject to risks such as immature and rapidly evolving technology, security vulnerabilities (e.g., theft, loss, or compromised keys), conflicting intellectual property claims, exchange counterparty risk, regulatory uncertainty, high volatility in value/price, uncertain user and global market acceptance, and manipulation or fraud. Although investment managers and service providers strive to adopt technologies, processes, and practices designed to mitigate these risks and protect the security of their computer systems, networks, and other technological assets, as market participants increasingly rely on complex information and communication systems to conduct business, these systems remain exposed to numerous threats that could adversely affect portfolios and their investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News