Exploring the Rune Layer2 Fragmentation Solution: Is There Value in Nekoswap's Implementation?

TechFlow Selected TechFlow Selected

Exploring the Rune Layer2 Fragmentation Solution: Is There Value in Nekoswap's Implementation?

As market sentiment warms up and Bitcoin's price recovers, can the Rune ecosystem usher in a new round of growth dividends?

Authors: Oliver, Andy, Howe

1 Introduction

Following ABCDE Capital, OKX Ventures also officially announced its strategic investment in Bitlayer on May 20. Amid the growing narrative around Bitcoin Layer 2 this year, Bitlayer—the first Bitcoin Layer 2 network based on the BitVM paradigm—has attracted significant investor interest by inheriting Bitcoin L1's security while greatly enhancing scalability and programmability. Committed to fostering its on-chain ecosystem, Bitlayer launched the "Ready Player One" campaign, pledging $50 million in incentives to attract projects. This has led to a surge of high-quality projects across various sectors, including Nekoswap, the first native Runes exchange on Bitlayer.

Although Runes underperformed in the market after launch, with its creator Casey even humorously acknowledging it, this does not mean the Runes ecosystem lacks potential. In fact, at its peak, Runes dominated transaction volume and fees within the Bitcoin ecosystem, accounting for up to 80% of network activity—clearly demonstrating both the technology’s promise and user demand. The recent decline in Runes activity is largely due to broader market downturns: falling Bitcoin prices and sluggish altcoin growth have cooled enthusiasm for new technologies. As market sentiment recovers and Bitcoin prices rebound, can the Runes ecosystem enter a new phase of growth? And as the first native Runes and token cross-chain exchange on Bitlayer, can Nekoswap successfully capture future liquidity from both Runes and Bitlayer? This article shares our perspectives on these two key questions.

2 Overview of the Runes Protocol

The Emergence of the Runes Protocol

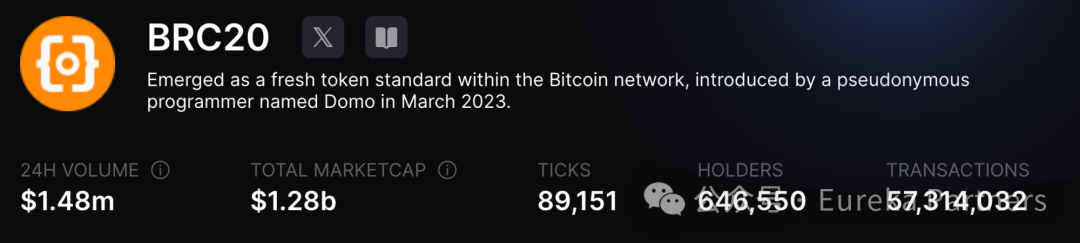

BRC-20, inspired by the Ordinals protocol, was introduced as a social experiment. As of this writing (May 21), it has evolved into a new asset market on Bitcoin with nearly 90,000 issued tokens valued at $1.28 billion.

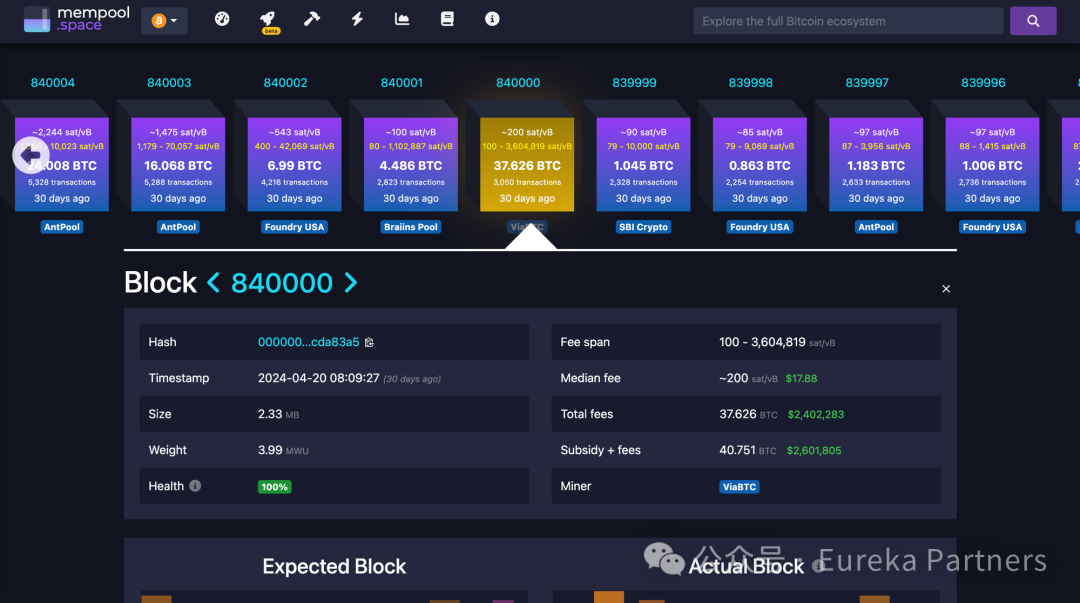

However, due to poor initial design choices, BRC-20 placed considerable strain on the Bitcoin mainnet and generated substantial on-chain bloat—unacceptable to Cassy, who prioritizes simplicity and efficiency. Thus, on September 26, 2023, Cassy proposed the Runes protocol. Due to Cassy’s focus on building infrastructure for the Ordinals protocol, Runes wasn't formally launched until April 20, 2024, coinciding with the Bitcoin halving event.

Features of the Runes Protocol

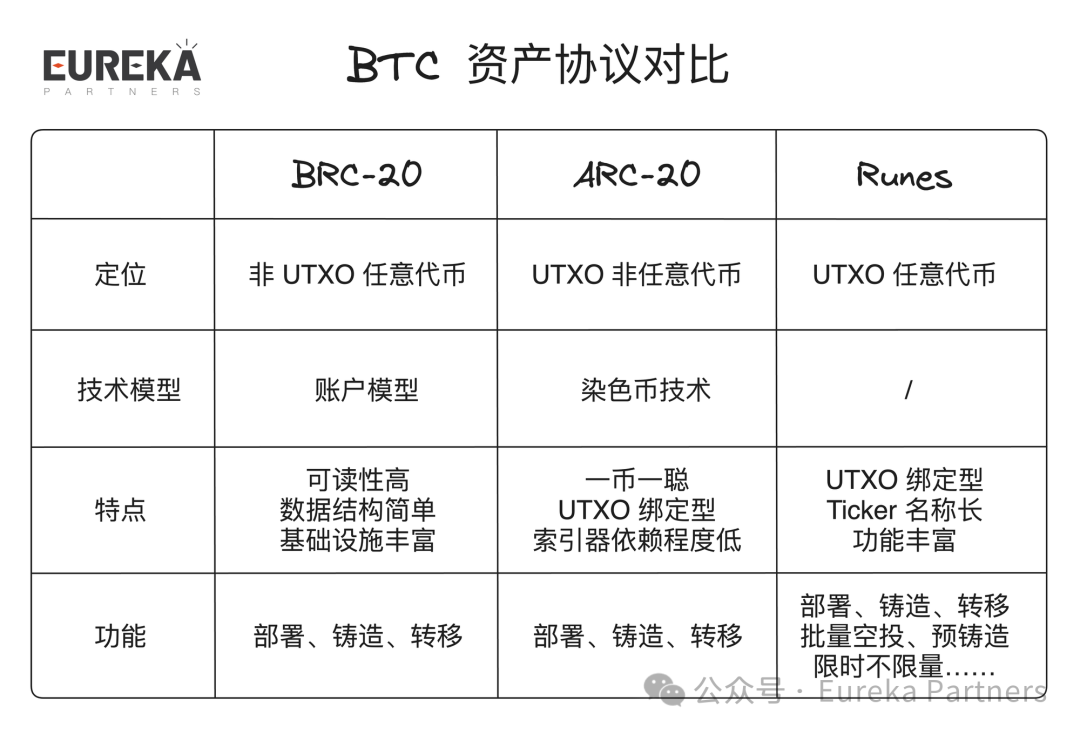

The Runes protocol can be simply understood as an upgraded version of BRC-20. It resolves BRC-20’s over-reliance on centralized indexing and excessive generation of useless on-chain data, while offering more flexibility and customization for asset issuance—such as pre-minting, bulk airdrops, flexible listing options, time-limited unlimited minting, etc.

These improvements have allowed the Runes protocol to stand alongside BRC-20 and ARC-20, forming a "three-legged stool" structure within the BTC asset ecosystem.

The differences between Runes and other BTC asset protocols are illustrated below👇🏻

Current State of the Runes Protocol

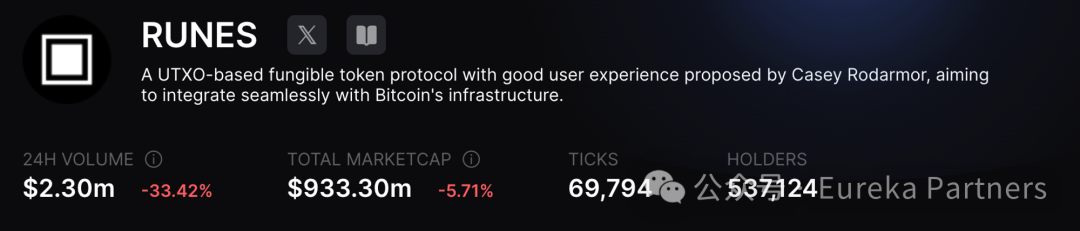

At launch, market sentiment was extremely FOMO-driven, with major projects racing to secure deployment rights for Runes #1–9. This frenzy pushed gas fees in the halving block to an astonishing 3,604,819 sat/vB. As of this writing (May 21), Runes has a market cap approaching $1 billion, with nearly 70,000 issued assets—only slightly behind the BRC-20 market.

Achieving such progress in such a short time, combined with the absence of a clear “blue-chip” leader akin to Ordi in BRC-20 or Atom in ARC-20, indirectly suggests that the Runes protocol still holds many untapped opportunities, and market participants remain optimistic about its long-term potential.

Meanwhile, despite the overall sluggishness in the Bitcoin ecosystem recently, positive developments continue to emerge in the Runes space.

First, Kraken and Binance have both recently published research reports on Runes. Kraken even hinted that Runes may be listed on their platform.

Second, there is currently a lack of stablecoins like USDT and USDC in the Bitcoin ecosystem. Runes presents an opportunity to fill this gap—by issuing USDC or USDT as Runes on Bitcoin. Circle or Tether could pre-mine trillions of Runes tokens and issue/redeem them as needed. While demand for stablecoins on Bitcoin remains low today, it is expected to grow as Bitcoin-based AMMs, lending platforms, and other dApps improve user experience.

3 Why Fragmentation Matters for Runes?

Runes fragmentation broadly refers to a set of measures aimed at increasing Rune liquidity, addressing the core issue of demand outstripping supply. Readers with over two years in the space will find this familiar—it echoes the narrative once seen during the NFT boom. Here, we deliberately refer to it as a “narrative” rather than a “need,” because the primary use case differs fundamentally.

Those who lived through the NFT wave know that entry barriers were extremely high, prompting proposals for fractionalization solutions. Yet, despite seemingly sound logic, many NFT fractionalization efforts saw little real adoption. Why did these rational-sounding ideas fail to achieve product-market fit (PMF)?

Let’s step back and consider the broader concept of fragmentation—it essentially means lowering barriers to access. For example, Ethereum’s PoS mechanism can also be viewed through the lens of fragmentation: liquid staking derivatives (LSDs) lower participation thresholds and increase stake distribution. According to Dune data, staking now accounts for 27% of total ETH supply. We can break down this adoption into push and pull factors:

-

Push factors: Users seeking stable, long-term “risk-free” returns; political demand for decentralization on Ethereum

-

Pull factors: Participation in DeFi via LSDs; contributing to network security

Clearly, both push and pull factors highlight strong underlying demand—indicating whether fragmentation aligns with the product’s foundational logic.

Now consider a typical NFT project: Project A claims the NFT was created by a famous artist, granting holders community privileges. When considering fragmentation:

-

Push factor: Enjoying community perks, status symbol

-

Pull factor: Better price discovery for traders; high entry barrier for newcomers

Here, fragmentation acts as an added-value feature—not a core need, nor one requiring mass adoption.

From this analysis, we see that the nature of the underlying asset determines the value of fragmentation. Returning to Runes—does it need fragmentation?

It must be noted that native Runes fragmentation is difficult to implement directly on BTC, unless using another token standard and relying on indexers for state tracking. Therefore, fragmentation is more likely to emerge on Layer 2.

Runes protocol breakdown:

-

Push factor: Need for better price discovery; high entry barrier for new users

-

Pull factor: High L1 transaction fees; slow processing speed

Theoretically, we can borrow Ethereum’s PoS narrative and frame Runes fragmentation as part of a “decentralization drive” to strengthen demand.

The fundamental difference from NFTs lies in the asset’s purpose: NFTs provide “identity,” while Runes are about “yield.” Therefore, the natural evolution path for Runes may indeed involve fragmentation—the only question is which approach to take.

4 Nekoswap

A Decentralized Cross-Chain Exchange for Runes and Tokens

To address the challenges outlined above, Nekoswap launched the first native decentralized cross-chain exchange for Runes and tokens on Bitlayer. Below are the details:

Business Model

The business model falls into two categories: BTC derivative assets and ERC-20 services.

1. BTC Derivative Asset Services

Nekoswap offers native Runes (Neko sats), a Runes fragmentation solution (Rneko), and a BTC derivative asset marketplace (Sats Marketplace).

-

Neko sats: The first utility-based Rune asset on Nekoswap, mapped via $Rneko (ERC-20) to enhance Rune liquidity. If technical implementation proves costly, alternative monetization methods may be used. $Rneko will eventually unlock $Neko (Nekoswap’s native token). Neko sats will undergo a fair launch, with only 2% of $Rneko held by the team; all other tokens will be airdropped (to loyal users, specific NFT holders) or added to liquidity pools.

-

Sats Marketplace: Allows users to mint BTC derivative assets (e.g., Runes, BRC-20, ARC-20) on Layer 2 and trade them using ETH, BTC, BRC-20, and other tokens.

Analogous to Unicross: After minting BTC derivatives, users receive stTokens (representing the derivative), while the original L1 assets are managed via multi-sig wallets involving Unicross, the L2 operator, and other key builders.

2. ERC-20 Services

Nekoswap meets standard DEX requirements, offering Swap, LPing/Farming, and IFO functionalities.

-

Swap: Supports ERC-20 token trading. Traders pay a 0.3% fee: 0.02% to LPs, 0.15% to the treasury, 0.08% for $Neko buyback & burn, and 0.05% to Neko Rune holders.

-

LPing/Farming: LP tokens can be staked to earn mining rewards in the native token.

-

IFO: Users can participate in public sales of early-stage projects. Specific eligibility criteria are not yet detailed, but Nekoswap’s门槛 is expected to remain accessible.

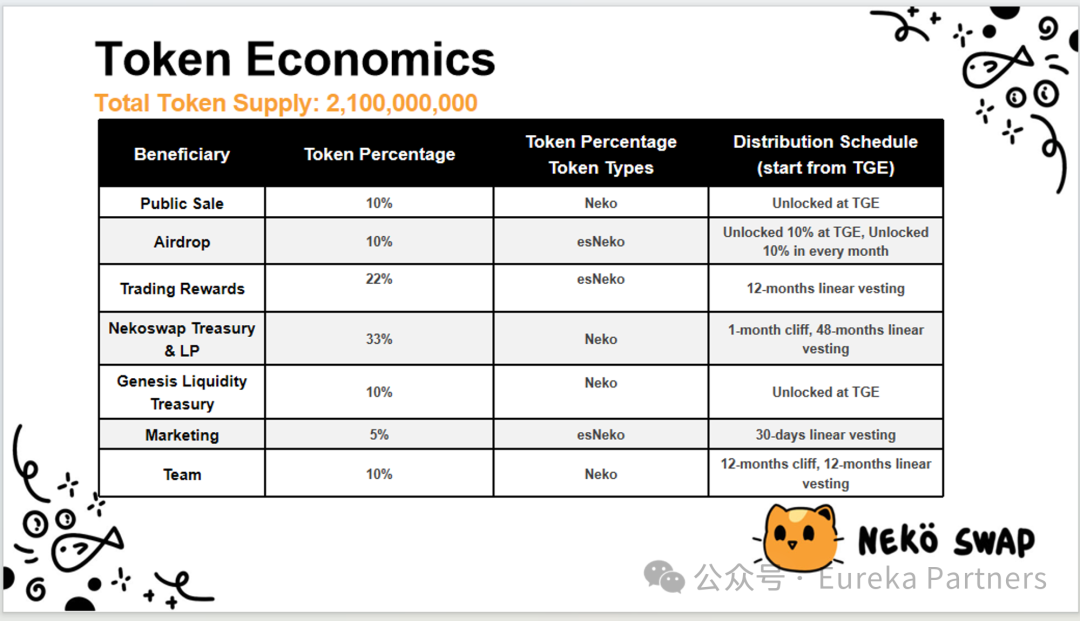

Token Model

Nekoswap features three assets: $Neko, $Rneko, and Neko sats.

1. $Neko

Total supply: 2,100,000,000 tokens, distributed as follows:

-

Public sale – 10%, 100% circulating at TGE: 210,000,000

-

Airdrop – 10%, 10% circulating at TGE: 21,000,000

-

Trading rewards – 22%, not included in TGE circulation

-

Treasury & LP pool – 33%, not included in TGE circulation

-

Genesis liquidity treasury – 10%, 100% circulating at TGE: 210,000,000

-

Marketing – 5%, not included in TGE circulation

-

Team – 10%, 0% circulating at TGE

Total TGE circulation: 441,000,000 (21% of total supply)

2. $Rneko

-

37% airdropped to users completing specific tasks (details pending)

-

37% allocated for LP formation

-

24% airdropped to specific NFT holders: Bitlayer Helmet holders, Merlin Penguins holders, and bitSmiley pre-season users each receive 500 $Rneko.

-

2% reserved for marketing

Notably, 4,200 $Rneko = 1 Neko Rune. Details on how Nekoswap implements Runes fragmentation on L2 are not yet available—refer to the Unicross model described earlier for reference.

Neko Rune is Neko sats.

Additionally, $Rneko will eventually be swapped for $Neko. Based on total issuance, if all $Neko airdrops were distributed via $Rneko, the conversion rate would be 10 Neko : 1 Rneko.

3. Neko sats

Specific details on Neko sats are limited, but based on $Rneko calculations, 5,000 Runes will be issued. Holders will receive 0.05% of platform trading fee revenue.

Perceptive readers may notice that Neko sats’ narrative parallels Ethereum’s PoS model, offering:

-

Push factor: Fair launch (mirroring decentralization ideals); higher revenue share (akin to PoS yield)

-

Pull factor: Access to more DeFi legos via fungible tokens / fragmentation (similar to LSDs)

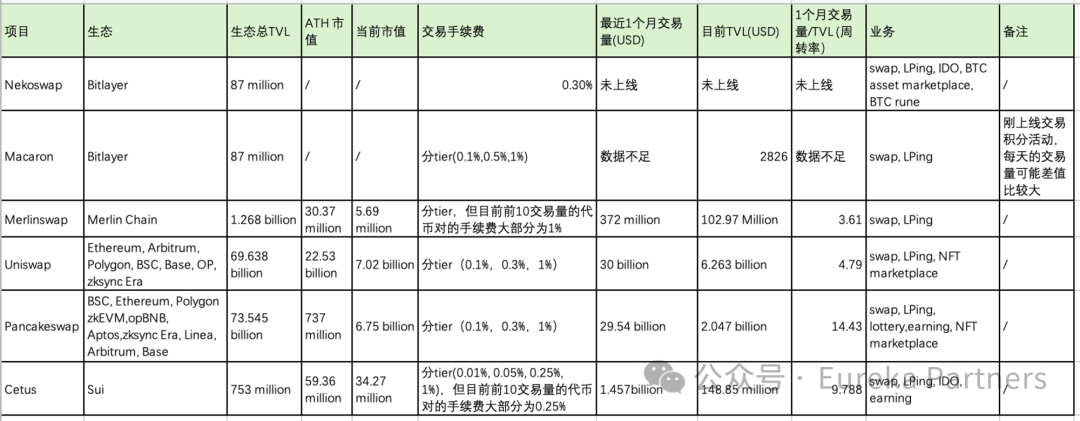

Competitor Analysis

Data as of May 21

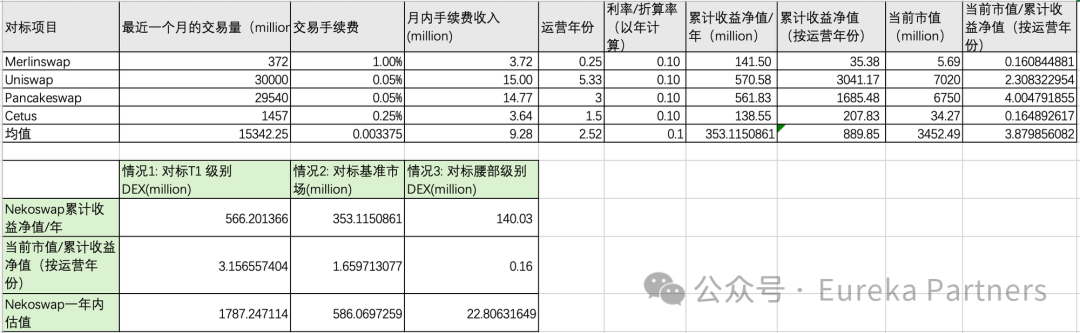

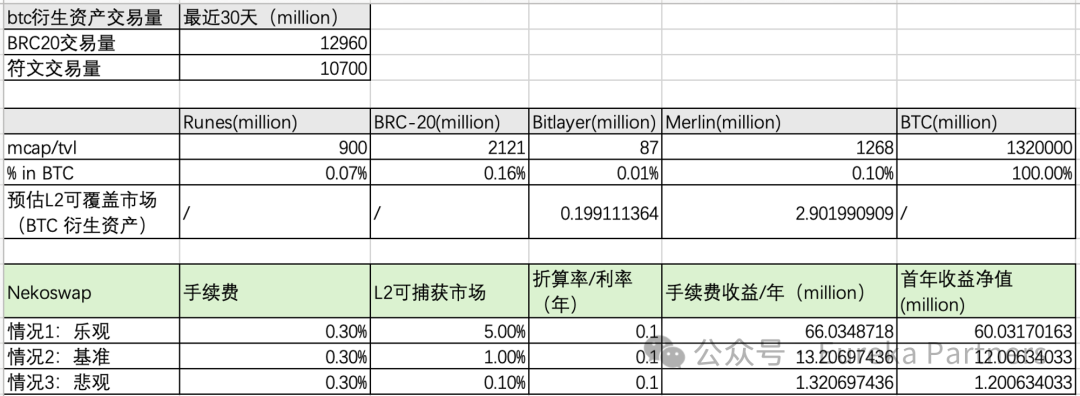

Valuation Forecast

Based on competitor data, we can estimate valuation using three methods:

Data as of May 21

1. **ATH Method:** Use macro factor derived from current crypto market cap relative to competitor ATH market cap to estimate Nekoswap’s expected valuation and TGE price when benchmarked against peers.

2. **ERC-20 Cash Flow Prediction:** Estimate valuation based on projected trading fee revenue.

3. **BTC Derivative Asset Cash Flow Prediction:** Evaluate potential trading volume to estimate valuation.

Given Nekoswap’s positioning as a Layer 2 BTC derivative asset exchange, assessing the potential of BTC L2 ecosystems is crucial to its valuation.

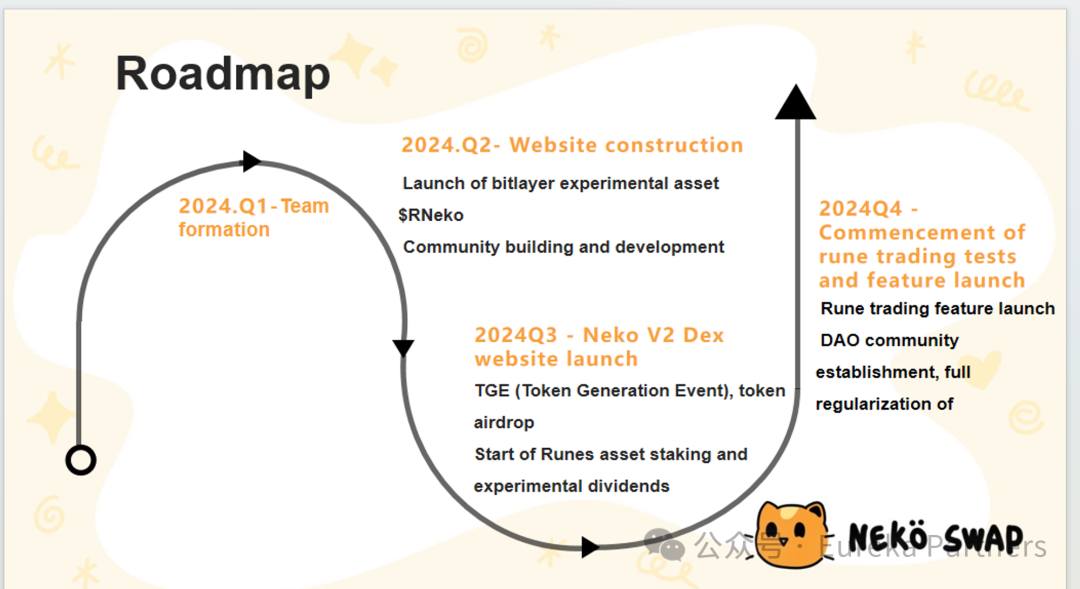

Roadmap

-

Q1 2024 – Team Formation

-

Q2 2024 – Website Development

-

Launch Bitlayer asset—$RNeko

-

Community building and development

-

Q3 2024 – Launch Neko V2 DEX on Mainnet

-

TGE and airdrop

-

Begin Rune staking and experimental dividend distribution

-

Q4 2024 – Begin Rune trading tests and feature rollouts

-

Official launch of Rune trading functionality

-

Establish DAO community and full operational standardization

Recent Updates

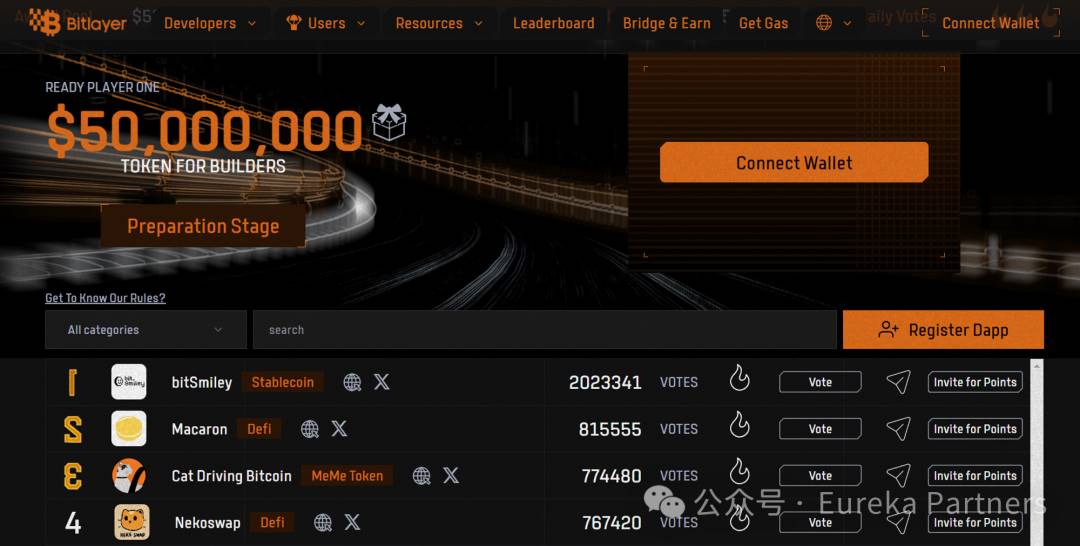

During Bitlayer’s Ready Player One campaign, as of May 10, Nekoswap ranked 4th on the Bitlayer Dapp Leaderboard.

On Twitter, Nekoswap also announced partnerships with @pumpad_io, @Pika_Web3, @SatoshiBEVM, and several other projects.

Evaluation

-

Business: Core operations resemble standard DEX offerings, but the introduction of a Runes fragmentation solution and a Layer 2 BTC derivative asset marketplace gives it a first-mover advantage in capturing market attention. Given the anticipated halving later this year, rising Bitcoin prices, and support from the Bitlayer ecosystem, this narrative remains promising.

-

Competition & Valuation: The key differentiator from conventional DEXs is the BTC derivatives trading market. However, turnover rates (volume/TVL) among BTC-native DEXs have slowed, constrained by broader market conditions. Post-launch expectations may not match actual performance—consider Macaron’s current trading volume as a cautionary example. Based on the three valuation methods above, a reasonable first-year valuation range is $10–30 million.

-

Recent Performance: Ranking 4th in Bitlayer’s Ready Player One campaign signals user interest. However, given Macaron’s prior performance, we remain cautious about post-launch results. On the day of writing, Bitlayer launched a second campaign focused on business metrics like TVL and trading volume. The first phase runs from May 23 to June 23; the second from June to August. According to Nekoswap’s roadmap, they can only join the second phase—giving us time to observe initial BTC L2 engagement levels and better assess Nekoswap’s future performance.

6 Conclusion and Outlook

Despite recent market downturns causing reduced Runes activity, we believe its long-term potential remains compelling. We’ve already seen signs of traditional exchanges paying attention to—and potentially investing in—the Runes ecosystem. Moreover, using Runes as a vehicle for stablecoins opens vast possibilities. Therefore, once market sentiment rebounds, we believe Runes is well-positioned to ride the next wave of Bitcoin ecosystem growth. Furthermore, by analyzing the demand for Runes fragmentation, we see that such solutions are necessary to meet the asset’s fundamental needs.

As the first native cross-chain exchange for Runes and tokens on Bitlayer, Nekoswap directly addresses these challenges. Its innovative Runes fragmentation model lowers entry barriers and enhances liquidity. Meanwhile, the Sats Marketplace enables users to mint and trade BTC derivative assets, enriching the diversity of Bitcoin-native assets. Additionally, Nekoswap’s standard ERC-20 DEX functions—Swap, LPing/Farming, and IFO—not only deliver seamless trading experiences but also establish a solid revenue foundation for the project.

As an early investor in Nekoswap, Eureka Partners believes that as Bitcoin ecosystem liquidity improves, Nekoswap will become a key player in both the Runes and Bitlayer ecosystems. We look forward to Nekoswap’s continued development and its positive impact on the Runes ecosystem and the broader Bitcoin world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News