Will the politicization of cryptocurrency influence the 2024 U.S. election?

TechFlow Selected TechFlow Selected

Will the politicization of cryptocurrency influence the 2024 U.S. election?

The era when cryptocurrencies held a marginal position in politics is long gone.

Author: M6 Labs

Translation: TechFlow

Trump's shift on cryptocurrency and Biden's regulatory stance could influence voter sentiment.

As the U.S. presidential election draws closer, traditional issues like foreign policy and culture wars are dominating discussions. Yet, a new topic appears to be emerging—one that may play a significant role in the nation’s electoral outcome: Bitcoin (and the broader cryptocurrency market). Let’s examine the rise of crypto in political discourse.

Crypto and Politics

Just four years ago, the idea of presidential candidates discussing Bitcoin during their campaigns seemed far-fetched. However, during last year’s primaries, things began to shift dramatically.

Prominent candidates such as Ron DeSantis, Vivek Ramaswamy, and Robert F. Kennedy Jr. attended Bitcoin conferences, appeared on major Bitcoin podcasts, and incorporated pro-Bitcoin agendas into their campaign platforms.

The real turning point came when former President Donald Trump clearly shifted from his previous stance—once calling Bitcoin a threat to the dollar—to now embracing it more openly. In response to what he describes as the Biden administration’s “crackdown” on the crypto industry, Trump has declared support for keeping the industry within the United States. Additionally, the Trump campaign has opened the door to cryptocurrency donations.

Current Environment

The Biden administration’s strict approach to crypto regulation has sparked strong backlash from the industry and its supporters. Senator Elizabeth Warren’s aggressive campaign against crypto, in particular, has prompted several large cryptocurrency firms to leave the U.S. in search of friendlier regulatory environments. This regulatory hostility risks alienating a significant portion of American voters, especially as cryptocurrencies like Bitcoin gain mainstream acceptance.

Hayden Adams, founder and CEO of Uniswap, urged President Biden to reconsider his administration’s stance on crypto, warning that current policies could drive voters away. In a May 12 article, Adams criticized the Biden administration for allowing Senator Warren and the SEC to wage “total war” on crypto, suggesting that Republicans are capitalizing on this by adopting more crypto-friendly positions.

Since taking office, President Biden signed an executive order on digital assets and appointed Gary Gensler as chair of the SEC. Under Gensler’s leadership, the SEC has intensified enforcement actions against crypto companies, drawing criticism for inconsistent application. As high-profile cases unfolded against Kraken, Coinbase, Ripple, and Binance, the government’s stance provoked pushback from the crypto community, increasing pressure on Biden to adjust policy ahead of the upcoming election.

Voter Sentiment

Recent polls show that in key swing states, a substantial number of voters now view Bitcoin and crypto policy as important issues. The efforts of pro-crypto political action committees (PACs) have amplified this shift, injecting millions not only into presidential races but also Senate and House campaigns. This level of investment and political engagement signals growing influence of the crypto community in American politics.

Over 20% of Americans own Bitcoin or another cryptocurrency—a demographic whose potential impact on the electoral landscape cannot be underestimated. Trump’s pivot toward supporting crypto can be seen as a strategic move to capture this growing voter base, particularly in an election cycle marked by tight polling margins.

Given that recent presidential elections have been decided by narrow margins, the crypto-voting bloc could very well determine the outcome of the 2024 election.

Voter Insights

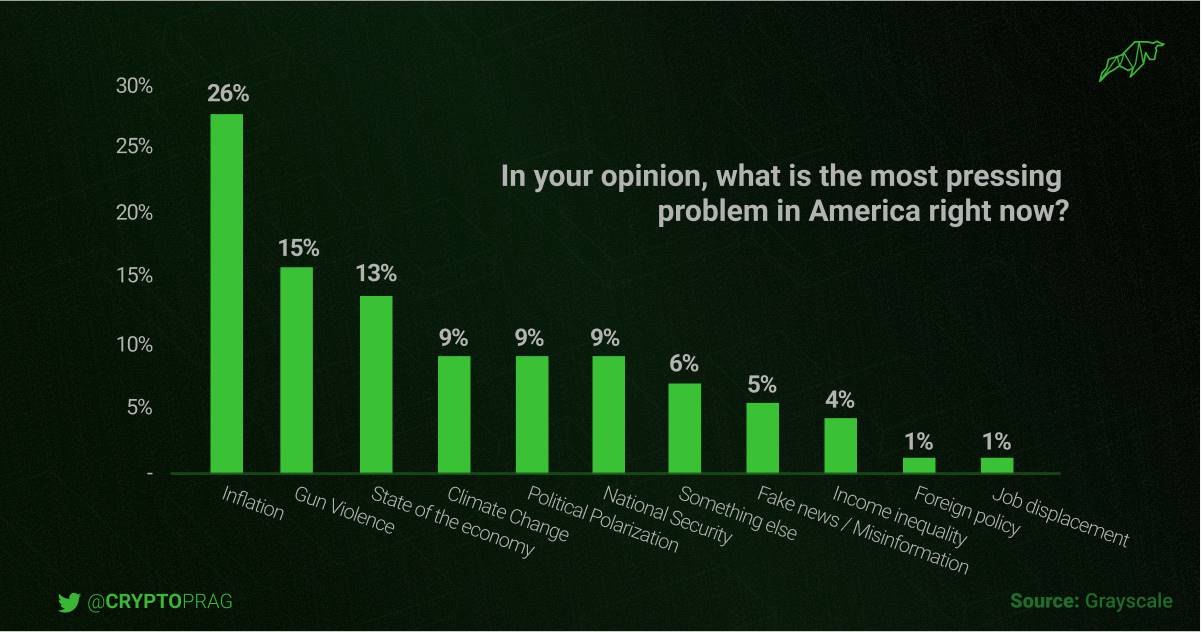

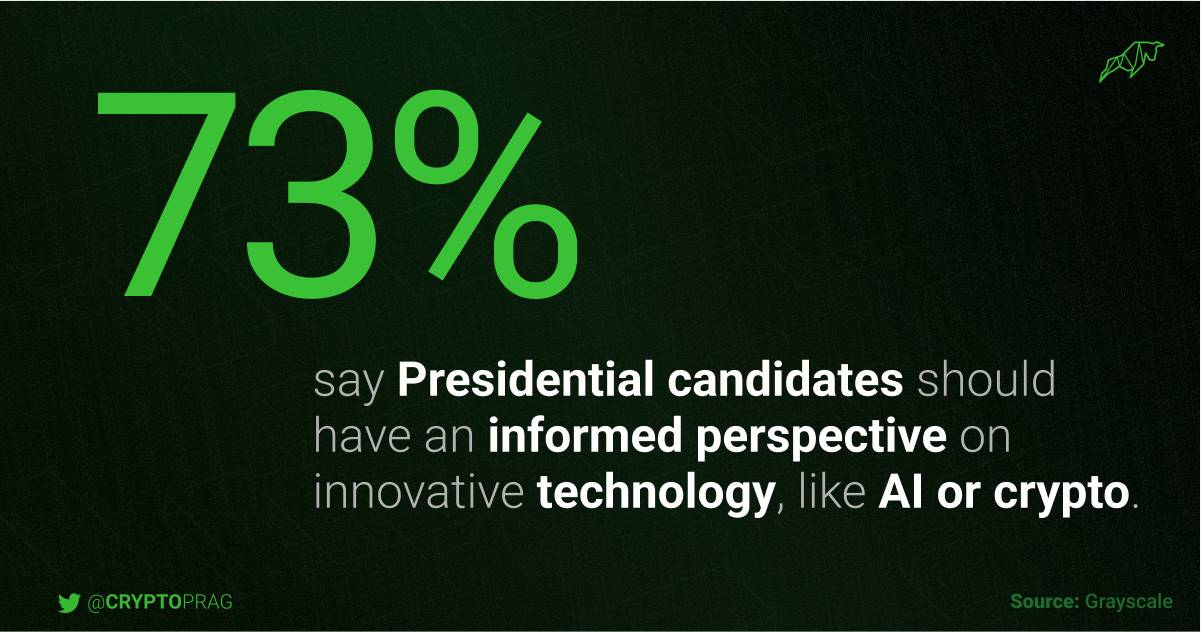

Harris Poll, commissioned by Grayscale, conducted a national survey titled “2024 Elections: The Role of Crypto.” Here are some key findings.

Voters’ Top Concerns and Cryptocurrency

Inflation is the top concern among U.S. voters, who prioritize economic stability and the ability to pay bills over other values such as family, patriotism, and community involvement. This concern aligns closely with Bitcoin’s appeal, which is often viewed as a hedge against currency devaluation due to its fixed supply cap. Nearly half of voters are waiting for clearer policy before investing in crypto, highlighting the demand for regulatory clarity.

Young Voters and Crypto Adoption

Compared to traditional stocks, younger voters—especially Gen Z and Millennials—show a clear preference for cryptocurrencies, with ownership rates of 31% and 35% respectively, versus 17% and 24% for stocks. A majority within these demographics believe that “crypto and blockchain technology represent the future of finance,” with 54% of Gen Z and 58% of Millennials expressing this view. Moreover, 68% of voters aged 18–34 say they would be more likely to invest in crypto if there were clearer regulations, underscoring the importance of regulatory clarity for broader adoption.

Bitcoin and Political Campaigns

The integration of Bitcoin into political campaigns highlights several key trends.

-

It underscores the growing importance of digital literacy and technological understanding among presidential candidates. As digital assets become increasingly intertwined with the economy, candidates who can credibly articulate both the potential benefits and challenges may gain a competitive edge.

-

Political discourse around Bitcoin and crypto may encourage greater regulatory clarity. As candidates outline their positions, they will need to respond to the industry’s calls for clear, consistent, and fair rules that foster innovation while protecting consumers.

Partisan Divide

While crypto enjoys bipartisan support, Republicans clearly favor it more. According to Politico, a critical vote on “the first major crypto policy bill to be considered by Congress as a whole” in Democratic-controlled chambers of Congress has essentially stalled. Meanwhile, the most vocal supporters of crypto currently in office are Republicans, such as Senators Emmer and Cynthia Lummis.

Critics argue that political support for crypto often stems from financial interests rather than principled advocacy. Nevertheless, crypto is undeniably becoming a more significant political issue. For many, it is not just an investment opportunity, but a movement, a philosophy, and a way of life.

For many crypto advocates, the stakes are existential: another four years under Biden means continued enforcement-heavy regulation, further legislative gridlock blocking practical crypto laws, and more anti-crypto rhetoric at the highest levels of government. During Biden’s tenure, growing hostility from U.S. lawmakers and regulators toward crypto has significantly impacted the global industry.

Recently, EigenLayer, hailed as a major innovation in blockchain, faced heavy criticism for an extremely restrictive airdrop. Under current regulations, this was effectively EigenLayer’s only viable option unless it wanted to risk an SEC lawsuit.

In this context, it’s understandable why figures like Ryan Selkis, Mike Dudas, and Mark Cuban believe the crypto industry must align with Republicans to secure favorable policies. Critics might argue that former President Donald Trump’s recent embrace of crypto is opportunistic, aimed at painting Biden as out of touch. Still, given how many in the U.S. crypto industry feel under attack by the government, having a prominent figure like Trump step forward in support may be a welcome development.

Potential Risks of Politicizing Crypto

Trump’s embrace of crypto carries potential risks. The digital asset market has experienced extreme booms and busts in recent years, with major players like Sam Bankman-Fried imprisoned for illegal activities. This shift also poses risks for Washington’s crypto lobbying groups. Trump could make digital asset regulation more politically polarized. The industry has spent years—and millions in campaign contributions—building bipartisan support, which may be crucial for securing favorable legislation.

Conclusion

Fifteen years after Satoshi introduced Bitcoin, it has evolved from a novel digital asset into a significant political issue. As the U.S. approaches one of its most watched presidential elections, Bitcoin’s role reflects not only its growing economic significance but also its potential to influence national policy.

Whether Bitcoin will be a decisive factor in the 2024 election remains to be seen. But one thing is certain: the days of crypto being politically marginal are over. As we move forward, the dialogue between policymakers, industry leaders, and voters will likely shape the trajectory of this digital revolution in ways we are only beginning to understand.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News