High FDV tokens spark discussions among multiple parties—should ETH be a better choice amid ETF expectations?

TechFlow Selected TechFlow Selected

High FDV tokens spark discussions among multiple parties—should ETH be a better choice amid ETF expectations?

The interesting part of the crypto market lies precisely in this mutual博弈 and voting with one's feet.

By TechFlow

Yesterday’s biggest market talking point was undoubtedly the debate around high-FDV, low-circulating supply tokens.

And today’s pleasant surprise? The surge in ETH price driven by growing expectations of an Ethereum ETF.

The former's token decline is an inevitable outcome of flawed tokenomic design, while the latter's price rise is an inevitable result of event-driven catalysts.

Faced with these two inevitabilities, should crypto retail investors still believe grand narratives and suffer from low circulation and unlock dilution—or would it be wiser to simply hold BTC and ETH and wait for real catalysts?

VCs, KOLs, and exchanges might not agree.

Interestingly, when asked “why are high-FDV, low-circulating tokens underperforming?” each group offers a different answer—conveniently absolving themselves of responsibility.

We’ve compiled key perspectives on high-FDV, low-circulating tokens. Seeing them side-by-side makes for a more revealing picture.

KOL Representative @cobie: Tokenomics and valuation are deeply flawed—retail should avoid buying the bag

Following Binance Research’s report, on May 19, prominent crypto KOL Cobie published an article analyzing the causes and risks behind new tokens launching with sky-high FDVs. His main points:

-

Retail understanding of "high FDV, low circulation" tokens remains immature. Many wrongly assume long unlock periods benefit token holders. Meanwhile, sophisticated players—project teams, exchanges, market makers—exploit their structural advantages.

-

Most value is captured during private sales. Due to intense competition in private rounds, early prices are inflated. Compared to the ICO era, this dynamic is far less favorable for retail investors.

-

Private round inflation drastically reduces secondary market returns. Compared to early projects like ETH or SOL, the gap between private-sale ROI and secondary-market ROI has widened dramatically—from ETH’s 1.5x advantage to STRK’s negative secondary returns despite seed-round investors still seeing 138x returns. Seed valuations keep rising, but public investor returns keep falling.

-

Cobie advises investors to avoid high-FDV tokens altogether. If participation is desired, conduct thorough due diligence on valuation and vesting schedules to distinguish realistic supply-demand dynamics from wildly disconnected “ghost markets.” He emphasizes: If investors stop buying into these high-FDV traps, project teams, founders, exchanges, and other market participants will be forced to change their current strategies.

Cobie provides a detailed critique of high-FDV, low-circulation tokens, analyzing pros and cons from a retail investor’s perspective, while expressing frustration toward VCs manipulating valuations in private rounds and project teams enabling such practices.

VC Representative Haseeb (@hosseeb): Geopolitical tensions in the Middle East are the real culprit

After Cobie’s post sparked heated discussion, Dragonfly Capital managing partner Haseeb published his own response on high-FDV, low-circulation tokens.

Haseeb argues the market structure isn’t broken—the recent price drops reflect a natural repricing cycle. He challenges three popular explanations:

-

VCs/KOLs dumping on retail? Not valid.

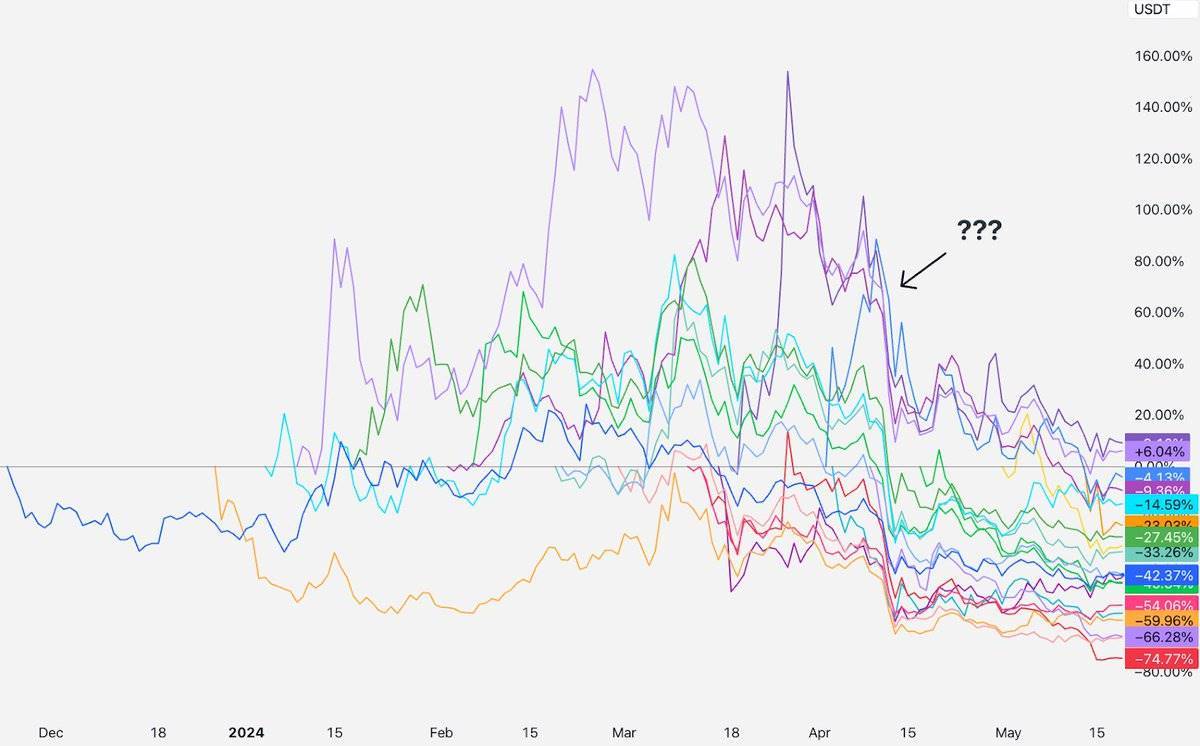

Using charts, Haseeb shows nearly all new tokens began declining simultaneously in mid-April. Yet most are still within their first year post-TGE, meaning VC allocations (with one-year locks) haven’t even unlocked. While some bad actors may exist, they can’t explain synchronized declines across dozens of projects.

-

Retail fleeing to Memes? Not valid.

Meme mania peaked in March; April saw Meme tokens already declining. There was no significant capital rotation into Meme sectors, and Binance’s Meme trading volume remains a small fraction of total volume. While social media amplifies “financial nihilism,” most investors still back tokens supported by technological narratives.

Regarding claims that “VCs hoard too many tokens, forcing retail out,” Haseeb cites 2017–2020 token distribution snapshots, showing successful projects like SOL and AVAX also had large VC allocations—proving VC-heavy models can succeed.

-

Initial circulation too low for price discovery? Not valid.

While low circulating supply is indeed a concern, historical data shows average initial circulation at TGE has been around 13% across past cycles—so scarcity alone doesn’t explain the downturn.

After dismissing these three theories, Haseeb identifies the true culprit: Middle East tensions.

He argues escalating geopolitical conflict in mid-April triggered broad risk-off sentiment, causing investors to dump newly listed, high-FDV, low-liquidity tokens as “untrusted assets” first.

In summary, Haseeb sees the crash not as structural failure, but as market repricing. He uses data to counter prevailing narratives and pins the blame squarely on Middle East instability.

Binance Research: Neutral data analysis highlighting complexity and shared responsibilities

On May 17, Binance Research issued the earliest market analysis on high-FDV, low-circulating tokens, identifying three key drivers:

-

Flood of capital into private markets: Massive inflows have driven up pre-listing valuations.

-

Aggressive market valuations: New projects are being priced too optimistically, fueling the trend of high-FDV, low-supply tokens.

-

Bullish market sentiment: Enthusiasm for new tokens pushes valuations higher, creating a feedback loop.

Binance Research also outlines responsibilities for market participants:

Project teams should design tokenomics with long-term sustainability in mind, avoiding excessive unlocks that create unhealthy sell pressure, protecting loyal holders, and ensuring healthy growth. VCs must increase transparency—especially around token allocation and unlock schedules—to help investors assess risk. They should consider long-term impacts over short-term profit-taking, which harms both market and project development.

Investors should focus on fundamentals—tokenomics, valuation, product—before investing. Pay special attention to unlock schedules and real demand.

Unlike Cobie’s blunt advice to avoid these tokens or Haseeb’s deflection toward geopolitics, Binance Research avoids strong moral judgments. As a major exchange with vested interests, its report likely refrains from directly criticizing high-FDV, low-circulating models.

The good news? Market debate is driving change: On May 20, Binance announced an updated listing policy, prioritizing smaller and mid-sized projects with strong fundamentals and sustainable development, and tightening requirements on token economics to promote industry sustainability.

Conclusion

Everyone has their explanation—but retail always ends up holding the bag.

Different players offer different analyses of the high-FDV, low-circulation phenomenon. While all provide relatively objective views, the underlying truth remains: “Where you stand depends on where you sit.”

Retail sits at the bottom of the extraction chain. No matter the cause, once they buy, they’re left holding depreciating tokens.

Expecting those atop the food chain to voluntarily cede profits is naive. Protecting oneself means focusing on achievable returns.

With Ethereum ETF hopes rising, ETH has quietly climbed. Cutting through noise and greed, simply being a BTC and ETH “hamster”—accumulating and holding—might deliver better long-term returns than chasing hyped, high-FDV narratives.

When mutual refusal to buy becomes consensus: If you offer everything except “lower FDV and higher circulation,” retail will offer everything except buying your token.

Mutual博弈, voting with feet—that’s what makes crypto markets fascinating.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News