"KOL Funding Rounds": A New Path to Getting Rich Quick or the Next Target for the SEC?

TechFlow Selected TechFlow Selected

"KOL Funding Rounds": A New Path to Getting Rich Quick or the Next Target for the SEC?

The existence of "KOL rounds" in fundraising is partly due to some unique characteristics of the cryptocurrency market.

By Ryan Weeks, Muyao Shen, Hannah Miller, Bloomberg

Translated by Yangz, Techub News

In March, the cryptocurrency market surged, with Bitcoin hitting record highs and billions of dollars flowing into new ETF products. But one particular group of investors had even more reason to celebrate.

That month, Monad Labs closed a funding round valuing the startup at $3 billion, backed by venture firms including Paradigm. By crypto standards, it was a massive raise—and came with a notable twist. According to people familiar with the matter, certain individuals known in the industry as “key opinion leaders” (KOLs) were allowed to invest at a valuation cap just one-fifth of what Paradigm paid.

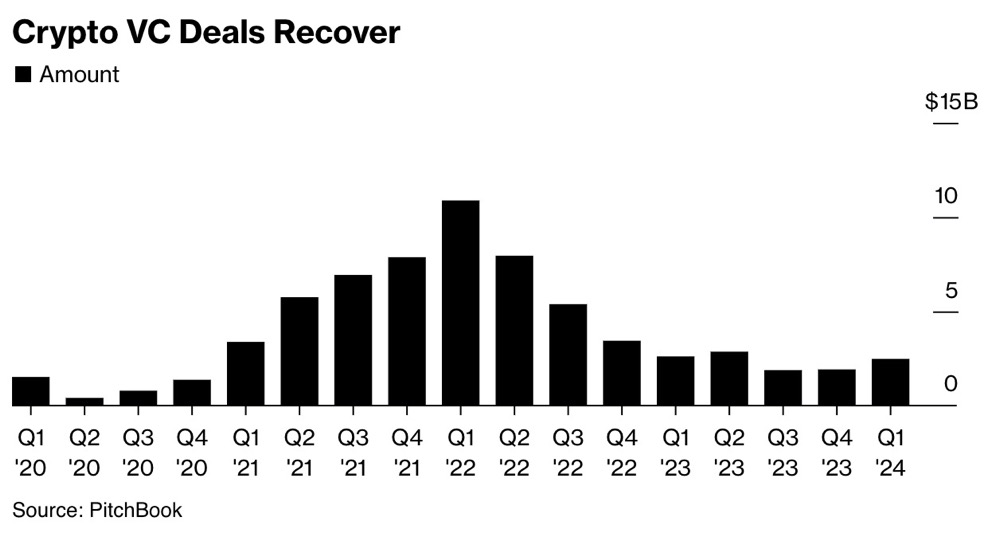

These so-called “KOL rounds” resemble celebrity promotions that U.S. regulators have cracked down on in recent years, but they’re now proliferating as markets rebound. This time around, the beneficiaries of discounted access are more likely to be crypto bloggers than athletes or reality TV stars.

Interviews with several influencers, entrepreneurs, and legal experts reveal that KOLs often receive favorable terms—such as investment discounts and shorter token vesting periods—in exchange for promoting cryptocurrency projects. These deals have become a source of controversy, particularly around inadequate disclosure and potential risks to retail investors.

Several people familiar with such arrangements said at least some startups haven’t required KOLs to disclose their relationships during fundraising—an apparent violation of U.S. regulations.

However, there’s currently no indication that Monad Labs’ fundraise violated any U.S. securities laws. One investor said the company did not impose explicit requirements on KOLs. CEO Keone Hon declined to comment on what vesting terms or disclosure rules applied to such investors. Paradigm also declined to comment.

KOLs and Cryptocurrency

“Including influential figures like KOLs in financings, with the expectation that they’ll promote a project’s tokens in return for investment rights, could attract scrutiny from the U.S. Securities and Exchange Commission,” said Michael Selig, a partner specializing in securities law at international law firm Willkie Farr & Gallagher, in an email.

The existence of “KOL rounds” stems partly from unique aspects of the crypto market. Some crypto startups raise venture capital by offering equity, while others raise funds by selling their own issued tokens or affiliated tokens. A project’s valuation depends on the number and price of tokens sold—similar to stock offerings. There are also hybrid funding rounds combining both tokens and equity, such as the one conducted by Monad Labs.

Purchasing tokens generally doesn’t afford investors the same protections as equity investments, but it offers a major advantage: investors can sell tokens within months, whereas shareholders often wait years until a liquidity event like an IPO.

Another factor is the role influencers play in the crypto space. For years, everyone from reality TV stars to athletes and self-proclaimed experts has promoted crypto projects online, effectively creating a cottage industry. During the 2017 initial coin offering (ICO) boom, having a large following on platforms like CT was akin to holding a golden ticket—gaining early access to hot tokens and getting paid for shilling them.

Yet, becoming a KOL investor doesn’t necessarily require a massive fan base.

“Almost anyone with influence or a community can become a KOL,” said Simon Chadwick, co-founder of Eclipse Fi, a modular multi-chain token issuance platform built on Cosmos. “For example, someone with 5,000 followers on Twitter who writes research threads.”

Chadwick said his company has built a network of over 400 KOL investors to help launch projects. He added that due to the huge profit potential, some KOLs have even tried using fake social media accounts to invest multiple times in the same funding round.

According to Chadwick, in such deals, KOLs typically receive discounts of 20% to 50%, along with shorter token vesting periods—allowing them to sell earlier than other investors. “Some KOLs have invested in hundreds of rounds and made a lot of money,” he said.

The SEC has long targeted influencer marketing in crypto. In October 2022, Kim Kardashian agreed to pay $1.3 million to settle charges that she failed to disclose she was being paid to promote a crypto asset, violating U.S. rules—though she neither admitted nor denied wrongdoing. Similarly, four years ago, the SEC fined former professional boxer Floyd Mayweather.

Emily Meyers, general counsel and chief compliance officer at crypto venture fund Electric Capital, said given the SEC’s case against Kardashian and another last year involving eight celebrities including Lindsay Lohan, she advises project teams against running KOL rounds.

Pump and Dump

Regardless of regulatory implications, KOL rounds are becoming increasingly controversial in the crypto world.

CL, a crypto KOL and member of early-stage investment group eGirl Capital, said she and her peers have recently been bombarded with pitches from crypto projects wanting them to invest as KOLs. But due to reputational risks, they’ve declined. With nearly 200,000 followers on X, CL described the surge in KOL deals as “an extension of low-market-cap token pump-and-dump schemes—but on a larger scale.”

Eclipse Fi’s Chadwick said that in larger deals backed by major VCs, KOLs are usually willing to accept longer vesting periods. On the flip side, they often demand higher discounts in these cases.

Orla Browne, research head at Dealroom, said because details of such deals are often “hard to obtain,” data compilers don’t separately track KOL transactions.

Such arrangements take various forms: some are formalized in written contracts outlining promotional duties for KOLs, while others are arranged via Telegram. Some are part of VC-backed funding rounds, while others involve early-stage projects not yet mature enough to attract institutional investors.

While most KOL deals consist entirely of tokens, some combine equity with subscription rights for yet-to-be-launched tokens.

Bloomberg reviewed a written contract for a KOL financing deal requiring participating KOLs to promote the project through long-form podcasts and TikTok videos. The agreement stipulated that KOLs must disclose their relationship with the project when promoting it.

But not all projects follow this practice.

“It’s not a requirement,” said 0xJeff, founder of Steak Capital, a crypto consultancy listing “KOL management” among its services. “It basically depends on whether the KOL wants the community to know they’ve invested in the project, and whether they’re formally affiliated.”

Growing Unease

Jed Breed, founder of Breed VC, said in an interview that major crypto projects typically don’t impose explicit obligations on KOL investors. Instead, issuers aim to build what he calls a “whisper network” within the crypto influencer community. “I’ve never seen a venture deal where you say, ‘If you want this allocation, you need to do X, Y, Z,’” Breed said.

For high-demand crypto startups, there’s little need to offer especially favorable terms to KOLs.

Take Humanity Protocol, which aims to build a blockchain-based palm-vein identity verification system. This month, it raised a $30 million seed round at a $1 billion valuation from VCs including Animoca Brands. Meanwhile, KOLs invested about $1.5 million in March—but under terms “the same as some venture capital firms,” with individual caps of $25,000, according to Humanity founder Terence Kwok.

Joshua Cheong, product engineer at Parity Technologies, initially told reporters that Monad Labs did not require him to promote the project as a condition of his KOL investment. However, after publication, Cheong said upon reviewing contractual documents, he hadn’t actually participated in the round. Still, he said he remains “supportive of the technology.”

0xJeff said that regionally, U.S.-based KOLs tend to be more cautious about potential SEC scrutiny and often disclose their affiliations when promoting projects or tokens. But regardless of location, unease across the community is quietly spreading—largely because ZachXBT, a Twitter user with nearly 600,000 followers on X, has begun publicly criticizing KOL deals.

“If I said KOLs aren’t worried, I’d be lying, right? All KOLs are nervous,” 0xJeff said. “Especially now, with so many KOL rounds happening—and many not going smoothly.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News