Coinbase Monthly Outlook: ETH Still Has Upside Potential in the Coming Months

TechFlow Selected TechFlow Selected

Coinbase Monthly Outlook: ETH Still Has Upside Potential in the Coming Months

The existence of U.S. spot ETH ETFs is only a matter of time, not if it will happen.

Author: David Han

Translated by: TechFlow

ETH's multiple roles have sparked questions about its position in investment portfolios. This article aims to clarify some of these narratives and highlight potential catalysts for the asset in the coming months.

Summary

-

Despite ETH’s weak year-to-date performance, we believe its long-term market positioning remains strong.

-

We believe ETH has the potential to deliver upside surprises in the later stages of the cycle. We also believe ETH maintains the strongest sustained demand momentum in the crypto market and retains a unique scaling roadmap advantage.

-

Historical trading patterns show that ETH benefits from dual narratives of “store of value” and “tech token.”

Main Text

The U.S. approval of spot BTC ETFs strengthened BTC’s store-of-value narrative and its status as a macro asset. In contrast, fundamental questions remain about ETH’s positioning within the crypto ecosystem. Competing Layer 1 networks like Solana have weakened ETH’s dominance as the preferred platform for decentralized application (dApp) deployment. ETH’s Layer 2 (L2) scaling and reduced ETH burning appear to be impacting the asset’s value accrual mechanisms at a high level.

Nevertheless, we maintain that ETH’s long-term positioning remains robust, with key advantages not found in other smart contract platforms. These include the maturity of the Solidity developer ecosystem, the widespread adoption of its EVM platform, ETH’s utility as collateral in DeFi, and the decentralization and security of its mainnet. Furthermore, we believe advances in tokenization could have a more positive short-term impact on ETH compared to other Layer 1 networks.

We find that ETH’s ability to capture both “store of value” and “tech token” narratives is reflected in its historical trading behavior. High correlation with BTC shows alignment with BTC’s store-of-value pattern. At the same time, during prolonged periods of BTC price appreciation, ETH decouples and behaves more like tech-oriented cryptocurrencies, similar to other altcoins—albeit to a lesser extent. We believe ETH will continue to play both roles and may outperform in the second half of 2024, despite its lackluster start to the year.

Addressing Controversies Around ETH

ETH has been categorized in various ways—from being dubbed “ultrasound money” due to its supply reduction mechanism, to “internet bond” because of its non-inflationary staking yield. With the growth of Layer 2s and re-staking capabilities, newer descriptions such as “settlement layer asset” or even “universal objective work token” have emerged. However, we believe these labels fail to fully capture Ethereum’s dynamism. In reality, Ethereum’s expanding and increasingly complex use cases make it harder to evaluate comprehensively through any single valuation metric. More importantly, these different labels may conflict with each other, creating negative effects by distracting market participants from the token’s positive drivers.

Spot ETH ETF

Spot ETFs were extremely important for BTC, providing regulatory clarity and a new channel for capital inflows. These ETFs structurally transformed the industry and disrupted the prior capital rotation model—where capital flowed from BTC to ETH and then to higher-beta altcoins. A barrier exists between capital allocated to ETFs and capital directed to centralized exchanges (CEXs), with only the latter having access to the broader crypto asset universe. The potential approval of a spot ETH ETF would remove this barrier, allowing ETH to tap into the same capital pool currently accessible only to BTC. In our view, this is arguably ETH’s biggest unresolved near-term catalyst, especially given the current challenging regulatory environment.

Although the SEC has maintained radio silence toward issuers, leaving timely approval uncertain, we believe a spot ETH ETF in the U.S. is a matter of when, not if. In fact, the primary justification used for approving spot BTC ETFs applies equally to spot ETH ETFs: the correlation between CME futures and spot prices is sufficiently high to “reasonably expect surveillance by CME to detect manipulative conduct in the spot market.” The correlation study period cited in the BTC approval notice began in March 2021—one month after the launch of CME ETH futures. We believe this timeframe was deliberately chosen to allow similar logic to be applied to the ETH market. Indeed, prior analyses submitted by Coinbase and Grayscale indicate that the spot-futures correlation in the ETH market is comparable to that of BTC.

Assuming this correlation argument holds, the remaining grounds for denial likely stem from fundamental differences between ETH and BTC. Previously, we discussed some differences in scale and depth between ETH and BTC futures markets, which may factor into SEC decisions. Among other distinctions, we believe the most relevant issue for approval is ETH’s proof-of-stake (PoS) mechanism.

Given the lack of clear regulatory guidance on staking, we believe it is unlikely that a staking-enabled spot ETH ETF will be approved in the near term. Differences such as potentially opaque fee structures from third-party staking providers, variations across validator clients, complexity of slashing conditions, and liquidity risks (and exit queue congestion) associated with unstaking are materially different from BTC. (Notably, some ETH ETFs in Europe do include staking, but European exchange-traded products typically differ from those offered in the U.S.) Nevertheless, we believe this should not affect the status of non-staking ETH ETFs.

We believe the decision could come as a surprise. Polymarket assigns only a 16% probability of approval by May 31, 2024, while Grayscale Ethereum Trust (ETHE) trades at a 24% discount to net asset value (NAV). We believe the actual probability is closer to 30–40%. As crypto becomes an election issue, we also question whether the SEC is willing to expend the necessary political capital to justify rejecting crypto. Even if denied by the first deadline of May 23, 2024, we believe there is a high likelihood of overturning the decision through litigation. Notably, not all spot ETH ETF applications must be approved simultaneously. In fact, Commissioner Uyeda’s approval statement for spot BTC ETF criticized the implicit motive of “approving applications expeditiously to prevent a first-mover advantage.”

Challenges from Alternative L1s

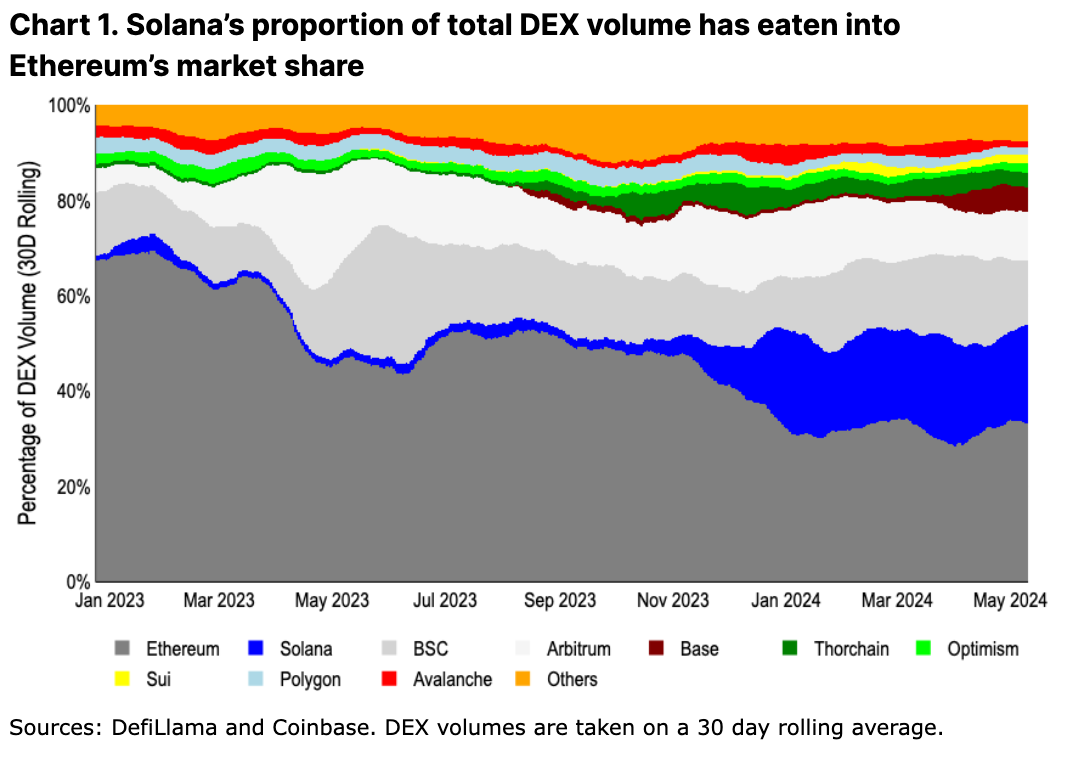

On adoption, highly scalable integrated chains, particularly Solana, appear to be eroding ETH’s market share. High throughput and low transaction fees have shifted the center of transactional activity away from the ETH mainnet. Notably, over the past year, Solana’s ecosystem has grown from accounting for just 2% of decentralized exchange (DEX) trading volume to 21% today.

We believe alternative L1s now offer more meaningful differentiation than during the previous bull run. Moving away from the Ethereum Virtual Machine (EVM) and redesigning dApps from the ground up has led to unique user experiences (UX) across ecosystems. Moreover, integrated/monolithic scaling enhances composability across applications, avoiding UX friction and liquidity fragmentation issues associated with bridging.

While these value propositions are significant, we believe it is premature to treat incentive-driven activity metrics as confirmation of success. For example, transaction user counts on some ETH L2s have declined by over 80% from peak airdrop levels. Meanwhile, from Jupiter’s airdrop announcement on November 16, 2023, to the first claim date on January 31, 2024, Solana’s share of total DEX volume rose from 6% to 17%. (Jupiter is Solana’s leading DEX aggregator.) Jupiter still has three rounds of airdrops pending, so we expect Solana DEX activity to continue for some time. During this period, assumptions about long-term activity retention remain speculative.

That said, transaction activity on leading ETH L2s—Arbitrum, Optimism, and Base—now accounts for 17% of total DEX volume (plus ETH’s 33%). This provides a more appropriate comparison for ETH demand drivers versus alternative L1 solutions, as ETH serves as the native gas token on these three L2s. Additional demand drivers for ETH on these networks remain underdeveloped, leaving room for future catalysts. In our view, this represents a more equitable comparison between integrated and modular scaling approaches in terms of DEX activity.

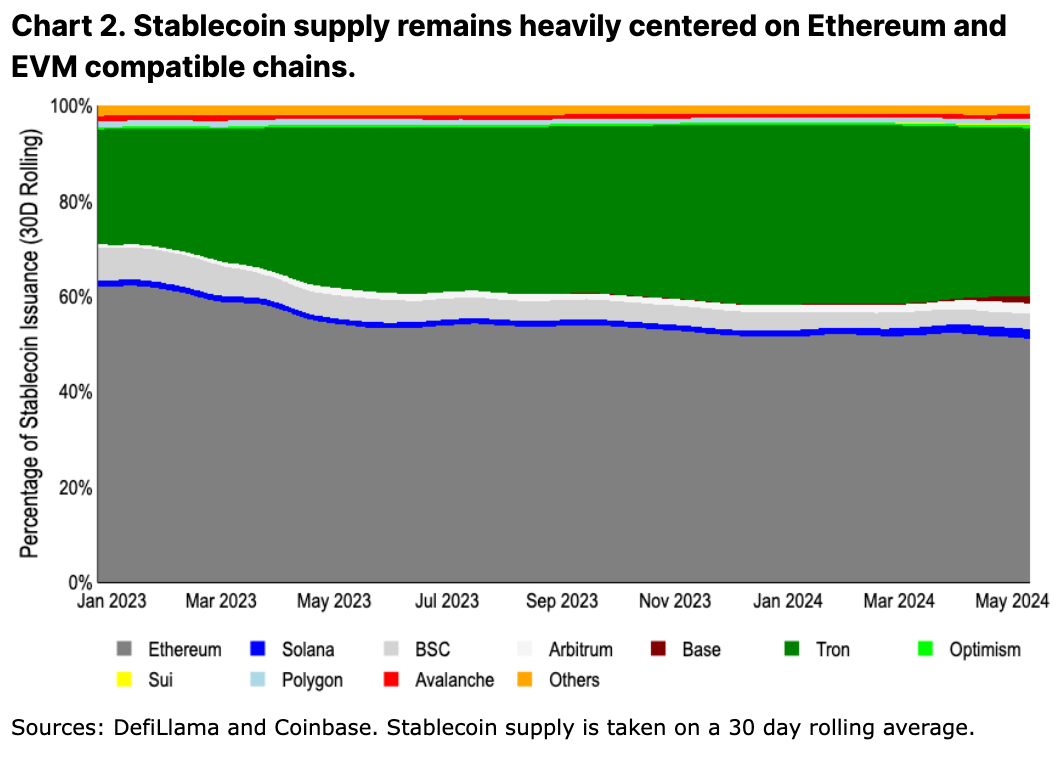

Another more “sticky” measure of adoption is stablecoin supply. Due to friction in bridging and issuance/redemption processes, changes in stablecoin distribution tend to be slow. (See Chart 2. Color scheme and layout match Chart 1, with Thorchain replaced by Tron.) Measured by stablecoin issuance, activity remains dominated by ETH. In our view, this is because many newer chains have yet to establish trust assumptions and reliability sufficient to support large amounts of capital, especially funds locked in smart contracts. Large capital holders are generally indifferent to ETH’s higher transaction costs (relative to scale) and prefer minimizing risk by reducing liquidity downtime and bridge-related trust assumptions.

Nonetheless, among high-throughput chains, ETH L2s are growing their stablecoin supply faster than Solana. Arbitrum surpassed Solana in stablecoin supply early in 2024 ($3.6B vs. $3.2B), and Base grew its stablecoin supply from $160M at the start of the year to $2.4B. While the final verdict on the scaling debate remains unclear, early signs in stablecoin growth may actually favor ETH L2s over alternative L1s.

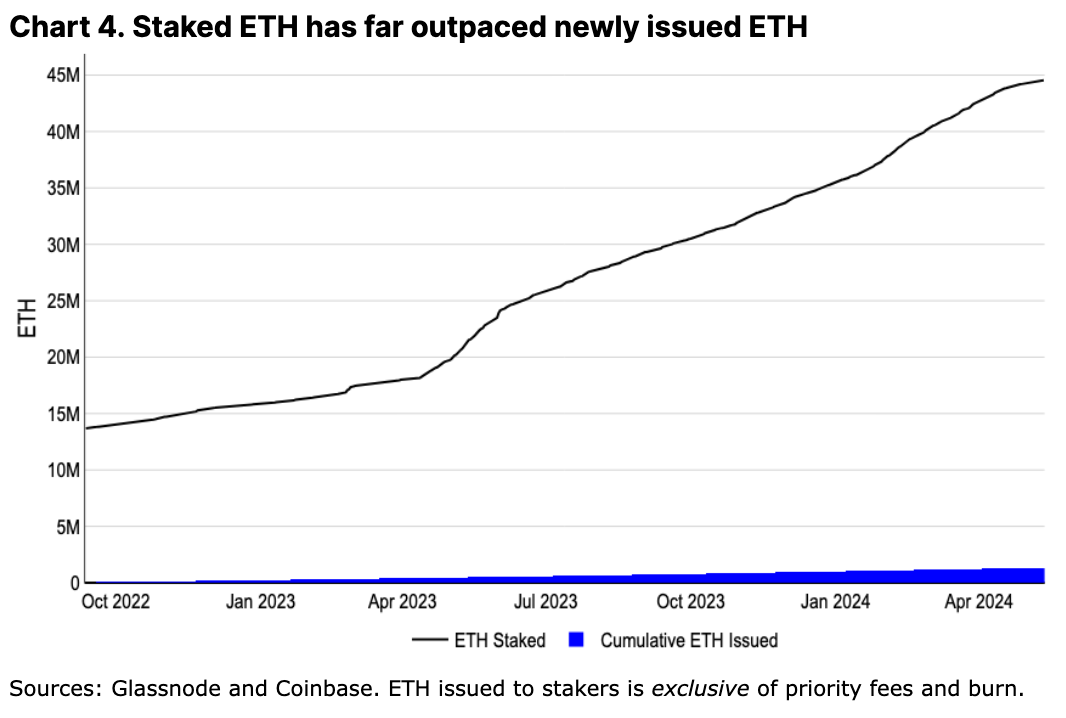

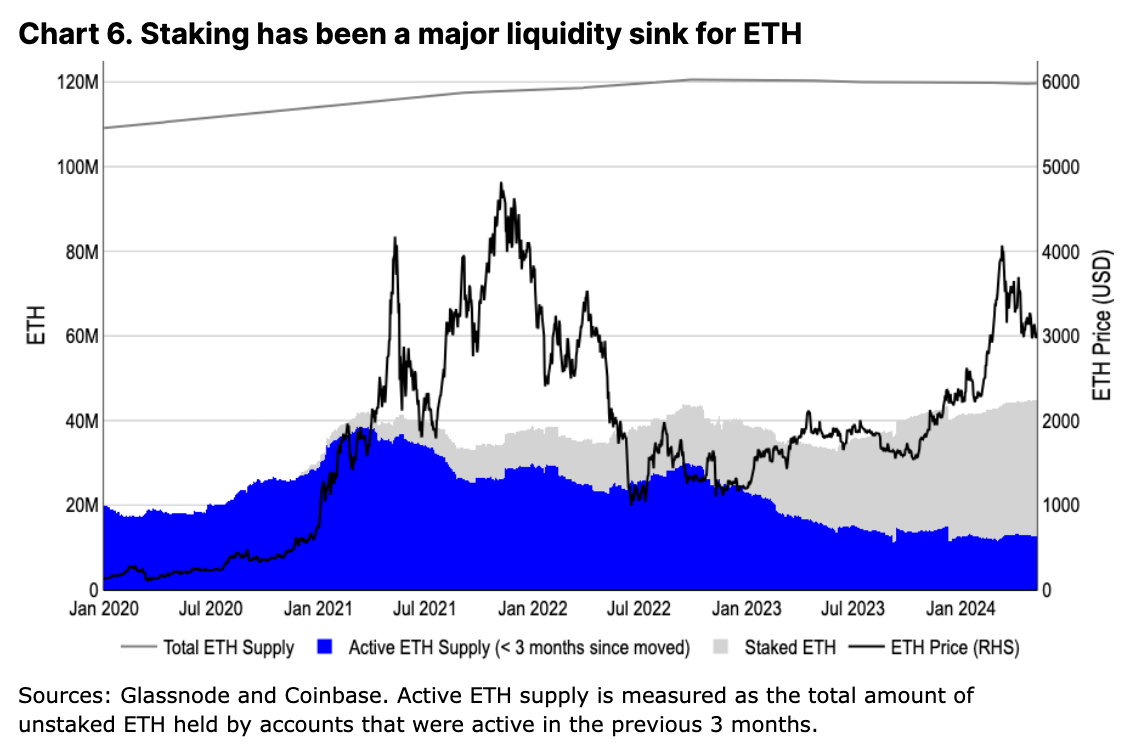

The growth of L2s raises concerns about potential real threats to ETH—they reduce demand for L1 block space (and thus transaction fee burning) and may support non-ETH gas tokens within their ecosystems (further reducing ETH burns). Indeed, since transitioning to proof-of-stake (PoS) in 2022, ETH’s annualized inflation rate has reached its highest level. While inflation is often seen as a structural feature of BTC supply, we believe this does not apply to ETH. All newly issued ETH goes to stakers, and since The Merge, stakers’ collective balances have far exceeded cumulative ETH issuance (see Figure 4). This contrasts sharply with BTC’s proof-of-work (PoW) miner economy, where competitive hash rate environments require miners to sell most of their newly minted BTC to fund operations. While miner BTC holdings are closely tracked across cycles due to inevitable selling pressure, ETH staking has minimal operational costs, allowing stakers to continuously grow their holdings. In practice, staking has become a liquidity sink for ETH—ETH held in staking exceeds ETH issuance (even excluding burns) by over 20 times.

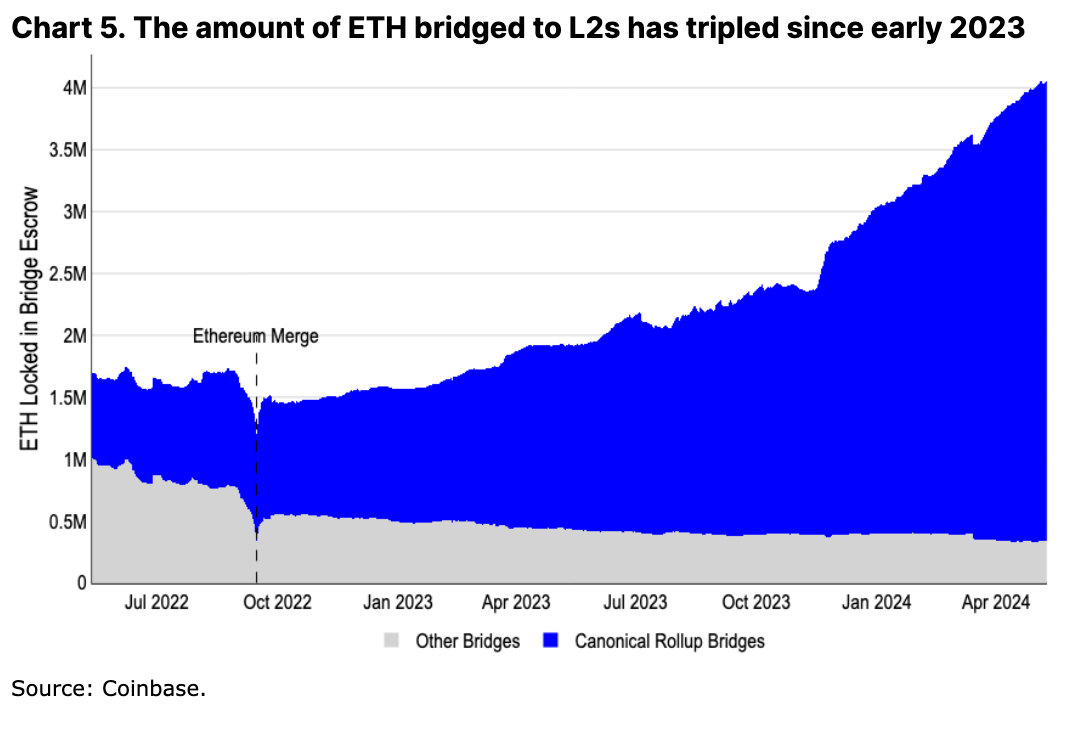

L2s themselves are also a major demand driver for ETH. Over 3.5 million ETH has already been transferred into L2 ecosystems, forming another liquidity sink for ETH. Additionally, even if ETH transferred to L2s isn’t directly burned, residual balances of native tokens held by new wallets for transaction fees constitute a soft lockup of an increasing portion of the ETH supply.

Moreover, we believe that even amid L2 expansion, some core activities will always remain on the ETH mainnet. Re-staking activities like EigenLayer, or governance actions from major protocols such as Aave, Maker, and Uniswap, remain firmly rooted on L1. Users with the highest security requirements—often those with the largest capital—may keep funds on L1 until fully decentralized sequencers and permissionless fraud proofs are deployed and battle-tested—a process that could take years. Even as L2s innovate in different directions, ETH will always be part of their treasuries (to pay L1 “rent”) and serve as the local unit of account. We firmly believe L2 growth benefits not only the ETH ecosystem but also the ETH asset itself.

Advantages of ETH

Beyond the usual metric-based narratives, we believe ETH possesses other hard-to-quantify yet equally important strengths. These may not fuel short-term tradable stories but represent a set of enduring advantages that sustain its current dominance.

Primary Collateral and Accounting Unit

One of ETH’s most important uses in DeFi is as collateral. ETH can be leveraged with minimal counterparty risk across ETH and its L2 ecosystems. It serves as collateral in money markets like Maker and Aave and forms the base trading pair for many on-chain DEXs. The expansion of DeFi on ETH and its L2s has created additional liquidity sinks for ETH.

While BTC remains the dominant store of value more broadly, using wrapped BTC (WBTC) on ETH introduces cross-chain bridge dependencies and trust assumptions. We believe WBTC will not replace ETH’s DeFi-native use of ETH—WBTC supply has remained flat for over a year, more than 40% below its previous peak. Instead, ETH can benefit from the diversity of its L2 ecosystem.

Sustained Innovation and Decentralization

An often-overlooked strength of the ETH community is its ability to innovate continuously while remaining decentralized. Critics point to ETH’s extended release timelines and development delays, but few acknowledge the complexity involved in balancing diverse stakeholder goals to achieve technical progress. Coordinating design, testing, and deployment changes across five or more execution clients and four or more consensus clients—without disrupting mainnet operations—is no small feat.

Since BTC’s last major Taproot upgrade in November 2021, ETH has enabled dynamic fee burning (August 2021), transitioned to PoS (September 2022), launched staking withdrawals (March 2023), and introduced blob storage to enable L2 scaling (March 2024)—alongside numerous other Ethereum Improvement Proposals (EIPs). While many other L1s appear to move faster, their single-client architecture makes them more vulnerable and centralized. The path toward decentralization inevitably introduces some rigidity, and it remains unclear whether other ecosystems can replicate such effective development processes if and when they begin their own decentralization journeys.

Rapid Innovation via L2s

This is not to say ETH’s innovation pace lags behind others. On the contrary, we believe ETH’s innovation around execution environments and development tools actually outpaces its competitors. ETH benefits from rapid, concentrated development across L2s—all of which pay settlement fees back to L1. The ability to create platforms with different execution environments (e.g., WebAssembly, Move, or Solana VM) or features (like privacy or enhanced staking rewards) means that slower L1 development timelines don’t prevent ETH from gaining recognition in more technically sophisticated use cases.

Meanwhile, the ETH community’s efforts to define varying trust assumptions and terminology around sidechains, Validiums, Rollups, etc., have contributed to greater overall transparency in the field. Comparable efforts in the BTC L2 ecosystem (such as L2Beat) have yet to emerge, where L2 trust assumptions vary widely and are often poorly communicated or understood by the broader community.

Popularity of EVM

Innovation around new execution environments doesn’t mean Solidity and EVM will become obsolete anytime soon. On the contrary, EVM has achieved broad adoption across other chains. For instance, many BTC L2s have adopted research breakthroughs pioneered by ETH L2s. Static analysis tools now exist to catch common vulnerabilities in Solidity (e.g., reentrancy bugs). Additionally, the language’s popularity has fostered a mature auditing sector, abundant open-source code examples, and detailed best-practice guides—all critical for building a large talent pool.

While EVM usage doesn’t directly drive ETH demand, changes to EVM originate from ETH’s development process. Other chains adopt these changes to maintain EVM compatibility. We believe core EVM innovations will likely remain rooted in ETH—or quickly captured by L2s—keeping developer focus centered within the ETH ecosystem and fostering new protocol development.

Tokenization and Lindy Effect

Growing interest in tokenization projects and clearer global regulation may also benefit ETH first (among public blockchains). In our view, financial products tend to prioritize mitigating technical risk over optimization and feature richness, and ETH holds an edge as the longest-running smart contract platform. We believe higher transaction fees (in dollars rather than cents) and longer confirmation times (seconds rather than milliseconds) are secondary concerns for many large-scale tokenization initiatives.

Additionally, for more traditional companies looking to expand on-chain, recruiting enough developers becomes a key factor. Here, Solidity is the obvious choice, as it constitutes the largest subset of smart contract developers—reinforcing our earlier point about EVM adoption. Blackrock’s BUIDL fund on ETH and JPMorgan’s proposed ERC-20-compatible Onyx Digital Assets Fungible Asset Contract (ODA-FACT) token standard are early signs of the importance of this talent pool.

Structural Supply Dynamics

Changes in active ETH supply differ significantly from BTC. Despite price increases since Q4 2023, ETH’s three-month circulating supply has not meaningfully increased. In contrast, we observed nearly a 75% increase in active BTC supply over the same period. Unlike the 2021/22 cycle when ETH still ran on proof-of-work (PoW), long-term ETH holders are not flooding the market; instead, growing ETH supply is being staked. This reaffirms our view that staking is a key liquidity sink for ETH, minimizing structural selling pressure on the asset.

Evolution of Trading Regime

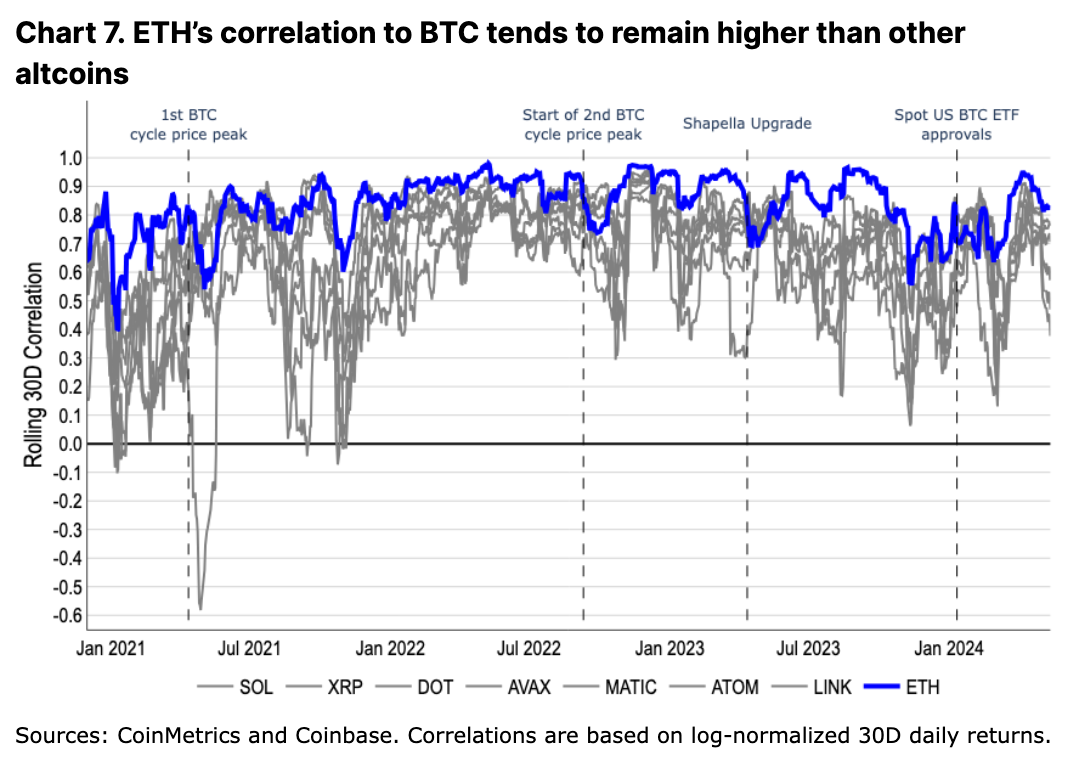

Historically, ETH’s trading behavior has been more aligned with BTC than with any other altcoin. At the same time, during bull market peaks or specific ecosystem events, it tends to decouple from BTC—a pattern observed in other altcoins as well, though to a lesser degree. We believe this trading behavior reflects the market’s relative valuation of ETH as both a store-of-value token and a technologically useful asset.

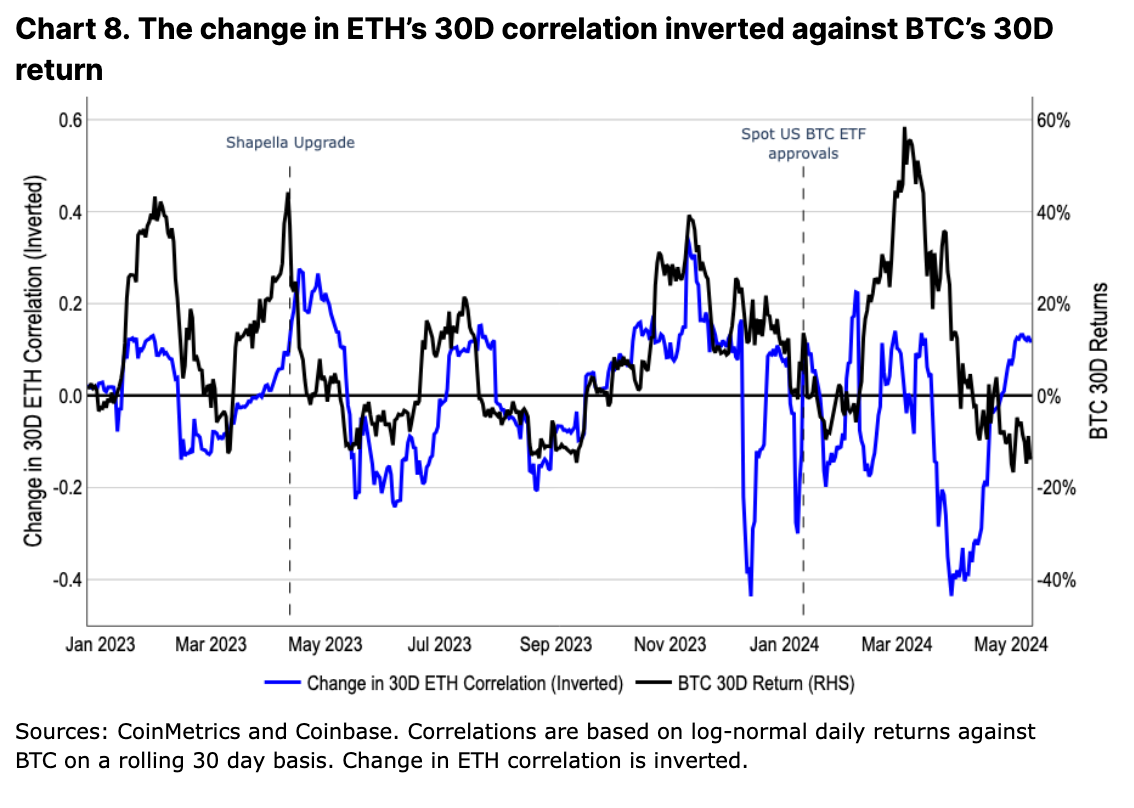

In 2023, ETH’s correlation with BTC was inversely related to changes in BTC’s price. That is, as BTC’s value increased, ETH’s correlation with BTC decreased, and vice versa. In fact, changes in BTC’s price appear to lead changes in correlation. We believe this reflects BTC-price-driven market sentiment spilling into altcoins, driving their speculative performance during bull markets (i.e., altcoins trade differently relative to BTC in bull versus bear markets).

However, this trend weakened after the approval of spot BTC ETFs in the U.S. We believe this highlights the structural impact of ETF-driven capital inflows—where a completely new investor base can only access BTC. New entrants such as registered investment advisors (RIAs), wealth managers, and broker-dealers may view BTC in portfolios differently than many crypto-native or retail traders. While BTC is the least volatile asset within pure crypto portfolios, in more traditional fixed-income and equity portfolios, it is often treated as a small diversifier. We believe this shift in BTC’s utility affects its relative trading dynamics with ETH—and if a spot ETH ETF is approved in the U.S., ETH may experience a similar shift (and recalibration of trading patterns).

Conclusion

We believe ETH still has upside potential in the coming months. ETH faces no major supply-side pressures such as token unlocks or miner sell-offs. Instead, staking and L2 growth have proven to be meaningful and growing liquidity sinks for ETH. We believe ETH’s position as the center of DeFi is unlikely to be displaced, thanks to the widespread adoption of EVM and continuous innovation on its L2s.

Furthermore, the potential significance of a U.S. spot ETH ETF cannot be overlooked. We believe the market may be underestimating both the timing and likelihood of approval, leaving room for upside. During this period, we believe ETH’s structural demand drivers and ongoing technological innovation within its ecosystem will allow it to continue embracing multiple narratives simultaneously.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News