On the Eve of Bitcoin Layer 2 Explosion: What Can We Learn from Ethereum L2?

TechFlow Selected TechFlow Selected

On the Eve of Bitcoin Layer 2 Explosion: What Can We Learn from Ethereum L2?

From Hype to Disproof: Where Is the Road for Bitcoin Layer 2?

Author: Web3CN

With the emergence of the Ordinal protocol in 2023, Bitcoin—the once so-called "digital gold"—welcomed a new type of asset: "inscriptions." If Bitcoin is like gold, then inscriptions are akin to crafted products made from that gold, each possessing unique value.

This native asset issuance method on the first blockchain quickly gained market popularity. It not only gave rise to more asset issuance protocols such as BRC20, Atomicals, and Runes, but also produced notable inscriptions like ORDI and SATS, along with numerous native Bitcoin NFTs.

For a time, the Bitcoin ecosystem experienced a renaissance, attracting massive capital, users, and developers. However, after some development, while the number of assets on Bitcoin has indeed grown, people gradually realized the limitations of Bitcoin as a Layer1. On one hand, Bitcoin itself does not support smart contracts, making it difficult to expand richer application scenarios using inscription-based technologies.

On the other hand, Bitcoin's performance and miner fees have become major obstacles to further ecological growth. During periods of active inscription activity, Bitcoin transaction fees spike rapidly, even affecting normal Bitcoin transfers. If more applications were introduced, this would further congest the network and lead to persistently high transaction costs.

Naturally, the enthusiasm sparked by inscriptions soon spilled over into the Bitcoin scaling space, giving birth to another hot sector—Bitcoin Layer2.

From Hype to Disillusionment: Where Is Bitcoin Layer2 Headed?

Some older Bitcoin scaling solutions regained attention, while new Bitcoin Layer2 projects emerged in increasing numbers. Among them, Bitmap Tech—a team known for its deep work in inscriptions and the nested BRC420 protocol on Bitcoin—rode the wave of inscription hype to launch a Bitcoin Layer2 early on: Merlin Chain.

Merlin Chain launched in February 2024 and quickly initiated a staking campaign called Merlin's Seal. The staking pool accepted Bitcoin, various inscriptions, and BRC420 Blue Boxes, triggering a surge in the value of Blue Boxes. Riding on the momentum of Bitcoin inscriptions, Merlin Chain attracted significant TVL (Total Value Locked) immediately after launching staking. Within less than 30 days, TVL surpassed $3 billion, peaking at $3.5 billion, making it a standout star project in the Bitcoin ecosystem at the time (data source: https://geniidata.com/ordinals/index/merlin).

On April 19, the long-anticipated MERL token finally launched, briefly reaching a high of 2 USDT before rapidly declining. Over the following weeks, it continued to fall, now down over 80% from its peak and approaching cost basis—an outcome that shocked many.

Shortly after the MERL listing, on April 25, Merlin enabled BTC unstaking, leading to a cliff-like drop in TVL. It has since fallen to around $1.3 billion—a decline of over 60%. Meanwhile, the previously staked Blue Boxes plummeted in value from about 1 BTC at their peak to under 0.05 BTC.

As a flagship Bitcoin Layer2 project, Merlin suffered dual crashes in both token price and TVL post-launch, causing heavy losses for many participants. This has led to growing skepticism about Bitcoin Layer2: Is it a genuinely promising narrative, or merely a flash-in-the-pan hype cycle?

In reality, the entire blockchain industry advances through cycles of doubt and validation. When it comes to blockchain scaling, Bitcoin is not the only ecosystem exploring solutions. Ethereum, the veteran runner-up, was designed early and also faces pressing scalability challenges. Yet, despite starting later than Bitcoin in pursuing scaling, Ethereum’s Layer2 landscape has flourished with diverse and vibrant development—offering valuable lessons. Let us examine Ethereum’s Layer2 journey to gain insights into Bitcoin Layer2’s potential path forward.

Looking Back at Ethereum's Scaling Journey

1. Learning and Exploration

Ethereum’s initial scaling approaches borrowed from Bitcoin’s experience, experimenting with state channels, Lightning Network, and sidechains.

State channels function like a dedicated channel opened off Layer1 between two parties, A and B, where they can conduct unlimited transactions without being constrained by Layer1’s performance or fees. The reason for continuously updating the state is to upload the latest off-chain state to the Ethereum mainnet as final settlement proof, preventing malicious behavior. This significantly improves efficiency and reduces costs. For example, Connext Network explores this model.

However, its limitation lies in requiring both parties to be continuously online and involved; otherwise, there is risk of asset loss. Moreover, it only works between direct participants.

The Lightning Network evolved from state channels. If a state channel represents a line between two entities, the Lightning Network connects many such lines into a network. Thus, even if A and B aren’t directly connected, they can still transact via interconnected channels.

The Lightning Network is essentially a networked version of state channels. Ethereum adopted a similar concept to create the Raiden Network. However, Raiden operates off-chain and doesn’t support smart contracts, limiting its use primarily to payments. Additionally, as a non-blockchain network, its nodes are vulnerable to centralization risks, meaning it still has significant shortcomings.

Later, sidechain technology addressed some of these gaps. Sidechains are actual blockchains capable of running smart contracts, offering higher security and greater scalability compared to Lightning-style networks.

However, sidechains introduced new issues. Due to their independence, sidechains only report transaction results back to the main chain, creating data availability risks. For instance, if sidechain validators alter records or refuse to execute transactions, incorrect outcomes could be submitted to the main chain, compromising system integrity. Hence, sidechains faced limited acceptance due to these concerns.

At this stage, Ethereum’s scaling efforts largely followed Bitcoin’s思路 (approach), but after multiple attempts, Ethereum didn’t stop there—it began forging ahead independently.

2. A Glimmer of Hope

In 2017, Joseph Poon (co-creator of the Lightning Network) and Vitalik Buterin proposed a new off-chain scaling framework for Ethereum Layer2: Plasma. Plasma drew inspiration from state channels and improved upon sidechains by adopting a tree-like architecture composed of many child chains structured as a Merkle tree. Unlike sidechains, Plasma hashes all transactions occurring on its child chains into a Merkle root, which is then submitted to the main chain. This allows the main chain to supervise Plasma transactions. The Merkle root contains summary information of all transactions on the Plasma chain, enabling the main chain to verify their completeness and validity, thereby ensuring legitimacy and security.

Although Plasma appeared to resolve certain limitations of state channels and sidechains, it still suffered from data availability issues and lacked support for smart contracts, eventually hitting a development bottleneck.

Just when hope seemed within reach, another solution quietly emerged a year after Plasma—one that ignited the Layer2 explosion: Rollup technology.

Rollups also utilize Merkle trees and child chains, but unlike Plasma, they compress and submit full transaction data—not just hashes—to the main chain. Nodes on the main chain can thus directly access and validate detailed transaction data, not just summaries. This provides strong data availability and transparency, enhancing trust and security.

With the introduction of Optimistic Rollup, projects based on this technology—such as Optimism and Arbitrum—launched successively. OP Rollup solved critical issues like data availability and supported smart contracts, earning broad recognition for its security and functionality. As a result, Optimism and Arbitrum attracted vast developer interest and user participation, quickly building rich ecosystems. At last, Ethereum’s Layer2 found its stride and exploded in growth.

3. Flourishing Diversity

The success of Layer2s like Optimism and Arbitrum inspired more teams to explore alternative Layer2 solutions. Technically strong teams developed their own Layer2 frameworks, while others wanted to operate independent Layer2s but lacked the technical capacity. This need was first recognized by the Optimism team, which released OP Stack—a tool allowing anyone to easily launch their own Layer2. Other self-developed Layer2 teams followed suit, releasing their own Layer2 deployment tools: Arbitrum Orbit, zkSync’s ZK Stack, Polygon’s Polygon CDK, and more.

Consequently, demand for Layer2s surged, turning it into a full-scale feast. Today, L2beat alone lists over 50 Layer2 projects, signaling that Layer2 development has entered a thriving phase.

On the other hand, current mainstream Rollup designs often face the issue of sequencer centralization. In Layer2, sequencers are responsible for ordering transactions according to certain rules, bundling them into blocks, and submitting them to the main chain for confirmation. Sequencers typically prioritize transactions based on fees or timestamps to ensure block validity.

However, because sequencers control transaction order, they may manipulate it to extract more MEV (Maximal Extractable Value). To address this, several teams are now exploring decentralized sequencer solutions to make Rollups more secure and mature.

Reviewing Ethereum’s Layer2 evolution, we see that its path wasn’t smooth—but consistently moved toward greater decentralization, better data availability, and enhanced security. Only when sufficiently secure and decentralized solutions emerged did they gain widespread adoption and accelerate growth.

Theoretically, Bitcoin Layer2 could follow a similar trajectory, finding its own path and eventually achieving a similarly diverse and flourishing ecosystem once security and decentralization meet market expectations.

So what are the current Bitcoin Layer2 solutions, and what new developments deserve attention? Let’s return to the Bitcoin ecosystem, guided by the lessons from Ethereum’s Layer2 journey.

Bitcoin Ecosystem: Challenges and Breakthroughs

1. Current Scaling Challenges Facing Bitcoin

Currently, we don’t see many professional organizations or institutions heavily investing in the Bitcoin ecosystem—largely because existing solutions haven't yet met institutional standards for security and decentralization.

When discussing BTC Layer2 development, it's worth noting that the Lightning Network whitepaper draft was published as early as February 2015—making it the earliest Layer2 “payment protocol” built on BTC and inspiring future Layer2 concepts. However, as widely known, Lightning Network does not support smart contracts, limiting its utility to payment scaling only.

Then in 2016, a company strongly believing in BTC Layer2 secured $55 million in funding led by Tencent. This company became industry-famous: Blockstream, and their product was Liquid Network—a two-way pegged asset bridge with Bitcoin’s main chain, one of the better-known BTC sidechains. However, Liquid’s cross-chain mechanism is relatively centralized, relying on 11 certified multisig nodes to custody BTC, resembling a permissioned consortium chain rather than a truly public blockchain.

Around the same time, another sidechain called RSK emerged, publishing its whitepaper earlier in October 2015. Yet it never became a celebrated solution and is now largely forgotten.

Also in 2016, developer Giacomo Zucco, inspired by Peter Todd, proposed the initial idea of the RGB protocol. But it wasn’t until 2019 that Maxim Orlovsky and Giacomo Zucco founded the LNP/BP Standards Association to advance RGB toward practical implementation. Then, last April, RGB v0.10 was released, bringing full smart contract capabilities to Bitcoin and Lightning Network. Only then did RGB achieve key “deployable” functionality, leading to recent buzz around “RGB++.” Still, both RGB and RGB++ remain distant from real-world adoption.

We mustn’t overlook another key player: Stacks—hailed as a true Layer2 enabling smart contracts and decentralized app development on Bitcoin. Since launching in 2018, Stacks has remained a top contender in the BTC Layer2 race, capturing industry attention with the upcoming “Nakamoto Upgrade,” though recent delays have cooled excitement.

A more recent BTC Layer2 proposal is BitVM, introduced last year. Its design closely mirrors Ethereum’s Optimistic Rollup, earning significant attention. However, BitVM runs smart contracts off-chain, with no shared state between contracts, and relies on traditional hash locks for BTC bridging—falling short of truly decentralized cross-chain functionality.

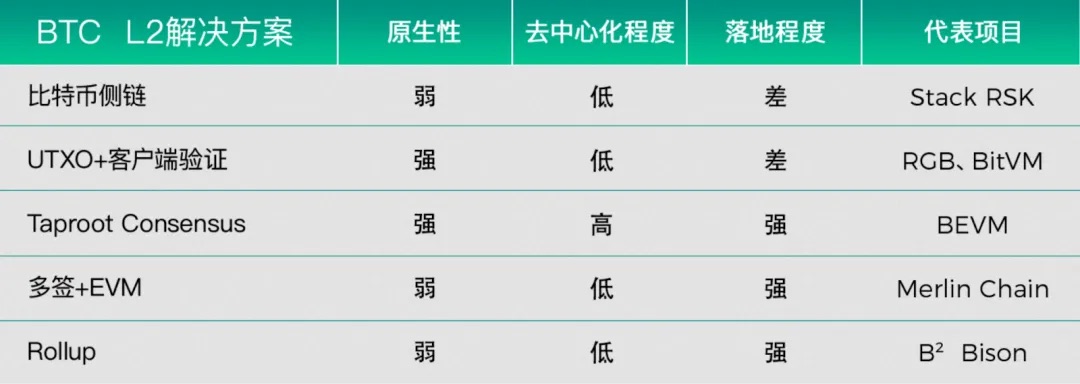

From this review, we see that BTC Layer2 development actually predates Ethereum’s, with continuous experimentation building upon past efforts. By 2024, BTC L2 is no longer a flicker of fire. The chart below illustrates the current state of major BTC Layer2 solutions and representative projects, clearly showing the existing challenges (credit to community contributor):

Public data shows that over 10 BTC Layer2 projects have raised funding this year, with more expected—marking it as a star sector. Yet, to date, very few BTC L2s have delivered truly compelling, widely accepted solutions. Some are stuck in technical bottlenecks, others like Merlin started strong but collapsed, drawing community criticism, while some remain too centralized for large capital to commit, staying only on the sidelines.

As analyzed earlier, Ethereum Layer2 succeeded by balancing “decentralization” and “nativism,” encouraging capital inflow and enabling ecosystem diversity. BTC Layer2 currently faces the same challenge and urgently needs a breakthrough.

2. Potential Breakthrough Directions for the Bitcoin Ecosystem

The recent Bitcoin Hong Kong Conference has just concluded. I had the privilege of attending and listening to prominent BTC L2 teams share their visions—not only to participate but also to seek answers, hoping to identify BTC Layer2 directions that are more decentralized, data-available, and secure. Two emerging BTC Layer2 projects stood out.

First, I had an in-depth conversation at the event with a member of the BEVM team. Although I’d seen news of their funding from Bitmain and learned about Taproot Consensus through my research on RGB, I wasn’t fully aware of their team background or specifics.

In fact, they launched ChainX back in 2017—a decentralized bridge bringing BTC into Polkadot, which attracted over 100,000 BTC into protocol interactions. However, it used an 11-signer multisig setup to custody user BTC, posing centralization risks. Then came Bitcoin’s landmark Taproot upgrade, introducing more efficient, flexible, and private transaction methods. This inspired the ChainX team to rethink BTC Layer2 construction, ultimately leading to BEVM—the first network built on Taproot Consensus.

According to official documentation, BEVM leverages Taproot Consensus to achieve a trustless BTC network solution. Taproot Consensus consists of three core components: First, Schnorr Signatures allow Bitcoin multisig addresses to scale up to 1,000 signers (a major security improvement over ChainX’s 11-signer model), enabling distributed custody. Second, MAST enables code-driven multisig management instead of human signatures. Third, a Bitcoin Light Node Network drives multisig operations via consensus among lightweight nodes, achieving fully decentralized BTC bridging and management.

Logically, Taproot Consensus differs from traditional sidechains and even popular models like RGB, seemingly opening a new technical pathway. While I’m not a technical expert to judge code-level merits, I at least see a novel solution. Additionally, BEVM’s core developers mentioned BEVM-Stack at the event—a concept reminiscent of OP Stack—that sparked considerable discussion. After all, enabling one-click Layer2 deployment on BTC could reshape the entire BTC Layer2 landscape.

Another frequently mentioned project in Hong Kong was Mezo, which recently closed a $21 million Series A round in April. The investors are impressive: Pantera Capital led the round, with Multicoin, Hack VC, Draper Associates, and others participating—truly representing Western-backed BTC Layer2 innovation.

Mezo builds on tBTC, a multi-year-old bridge connecting Ethereum and Bitcoin DeFi. tBTC allows any BTC or ETH holder to mint tBTC via a signer network. Unlike prior solutions, there’s no centralized custodian; signers are randomly selected, and different groups are assigned per tBTC minted. Signers must stake collateral to prevent theft, and over-collateralization ensures network stability.

Thus, tBTC acts as an ETH-denominated token pegged 1:1 to BTC value, bridging Bitcoin and Ethereum. BTC holders deposit BTC into a smart contract and receive tBTC in return. Mezo uses tBTC to deliver BTC Layer2 functionality. While innovative, it feels somewhat like a “technical Frankenstein”—and notably, the team behind this funding round is Thesis, the original developers of tBTC.

Moreover, based on available information, Mezo’s security model still relies on multisig mechanisms, which arguably lacks sufficient decentralization and remains debatable.

Of course, trust remains the fundamental barrier to BTC Layer2 progress. Ancient wisdom says “using your spear against your shield,” but rather than criticizing weaknesses, we should focus on how to grow the space and set examples. After all, if BTC Layer2 could achieve even a fraction of Ethereum Rollup’s success, why wouldn’t its ecosystem flourish? Why couldn’t we see trillion-dollar-scale BTC Layer2s?

Outlook

Despite recent macroeconomic shifts impacting the crypto ecosystem and pulling Bitcoin’s market cap back to around $1.2 trillion, this won’t halt industry progress or erode confidence in Bitcoin’s ecosystem. While projects like Merlin may have given the BTC Layer2赛道 (sector) a “bad start,” this won’t deter ongoing efforts to build BTC Layer2.

Remember, Ethereum’s Layer2 journey was equally fraught, requiring one or two bull markets to solidify the trend. But once the right technical direction is confirmed, growth becomes exponential. Currently, BTC Layer2 appears to be in this challenging uphill phase.

In terms of utility, we need more projects like BEVM—emphasizing “trustlessness,” “nativism,” and “security.” We also need enduring contributors like Stacks and innovative players like Mezo to enrich the ecosystem. Only when diverse projects coexist and thrive can BTC Layer2迎来 (welcome) a true spring.

“Pessimists are always right; optimists always move forward.” As long as we continue down the right path, we’re likely to witness a genuine explosion in the Bitcoin ecosystem—one that transcends fleeting hype. After all, the Pandora’s box of this trillion-dollar赛道 has already opened. Beyond anticipation, what we need most is patience and perseverance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News