Deep Insights into Web3 Gaming Industry Trends: Will 2024 Bring the "iPhone Moment" for Web3 Gaming?

TechFlow Selected TechFlow Selected

Deep Insights into Web3 Gaming Industry Trends: Will 2024 Bring the "iPhone Moment" for Web3 Gaming?

Web3 gaming is a crucial component of the Web3 industry and serves as an important catalyst for mainstream adoption of Web3.

Author: Jianshu

Gaming has long been seen as a key sector for unlocking the next major traffic gateway in the Web3 industry.

Currently, the crypto market is gradually recovering but remains volatile and uncertain. At this stage, focusing on the gaming sector reveals new developmental characteristics that have emerged after 2–3 years of evolution. For instance, projects are increasingly prioritizing gameplay and playability; building upon early "hit" cases, Web3 game genres continue to innovate and diversify; and projects are gradually evolving into platforms or ecosystems, enhancing their resilience against risks...

In light of this, J Lab spent nearly two months reviewing and organizing over 20 research reports and collecting multidimensional industry data. Based on mapping the full ecosystem landscape, we analyze the new features and talent trends in Web3 gaming in 2024, aiming to provide valuable insights for those tracking the space. Feedback and corrections are welcome!

1. Industry Overview: A Three-Year Review of the Web3 Gaming Industry (2021–2023)

The period from 2021 to 2023 marked the first boom cycle for the Web3 gaming industry, driven by rapid user growth, continuous innovation in business models, and massive capital inflows.

1. Market Size: "Hit" Effects Drive Transaction Volume Growth; Users Account for Over Half of the Sector

In 2021, Axie Infinity became one of Ethereum’s most profitable games, going viral and attracting a large influx of users. Active blockchain game users surged from 80,000 in early April 2021 to 1.33 million by October—growing at an average monthly rate exceeding 270%.

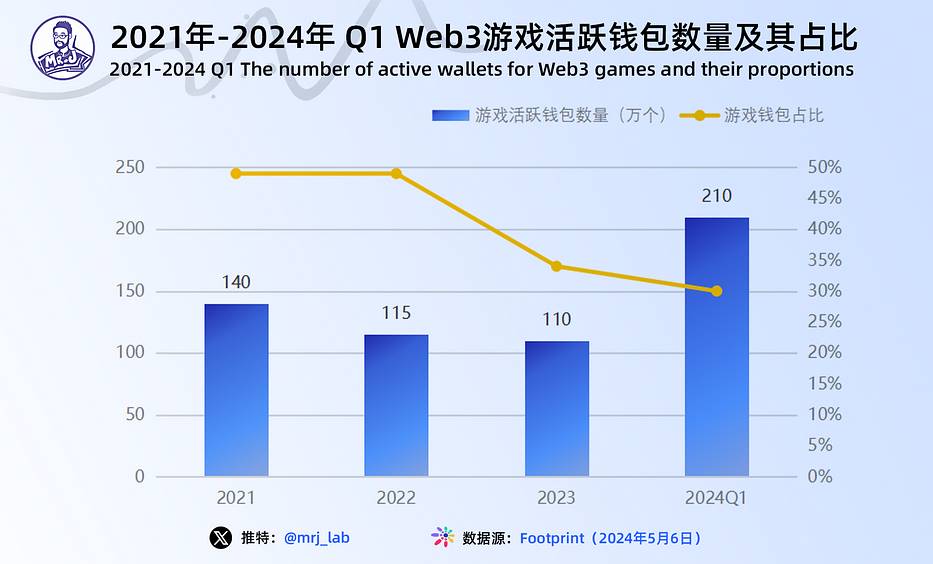

According to DappRadar's report, while transaction volumes in the blockchain gaming sector remained relatively stable between 2021 and 2023, they experienced explosive growth in Q1 2024. In 2021, daily unique active wallets (UAWs) in Web3 gaming exceeded 1.4 million, accounting for 49% of all crypto industry wallet activity—surpassing even DeFi. In 2022, Web3 gaming attracted 1.15 million active wallets, maintaining the same share. As overall crypto wallet usage increased, the proportion dipped slightly in 2023 despite stable UAW numbers. However, in Q1 2024, daily active wallets hit record highs with over 2 million on average per day. Although related wallet activity now accounts for 30% of the total industry—a slight decline—the absolute number continues to rise steadily, aligning with broader growth in crypto wallet adoption.

In 2023, there were over 3 billion global gamers, with a market size approaching $219.68 billion. Web3 gaming revenue reached $5.2 billion (source: Newzoo’s Global Games Market Report 2023 | January 2024 Update). While participation remains negligible compared to traditional Web2 gaming, sustained growth and the anticipated 2024 bull market suggest immense potential for expansion.

2. Development Journey: From "Fi-Centric" to "Gameplay-Centric"

Web3 gaming has shifted focus—from early emphasis on "Fi" and material rewards—to increasing attention on "gameplay" and "playability."

First, let's clarify these concepts. Gameplay refers to the interaction between players and the game system—the core mechanics, engagement level, enjoyment, and long-term appeal. Playability focuses more on ease of use and user-friendliness, including interface design, controls, tutorials, and guidance.

Put simply, today's Web3 games place greater emphasis than before on long-term player retention and user experience. Why has this shift occurred? The evolution of Web3 gaming offers some clues.

By development phase, Web3 games can be categorized into four types:

-

Early-stage Web3 games focused on finance ("Fi"), collectively known as GameFi;

-

X-to-Earn (X2E) games where users earn rewards through everyday in-game activities;

-

High-quality graphics and playability-focused AAA titles;

-

Metaverse games building virtual worlds.

GameFi integrates DeFi asset allocation principles with gaming elements. Early versions overly emphasized financialization, drawing investors but lacking depth in game design and playability, failing to attract genuine gamers. For example, Axie Infinity—one of the earliest GameFi hits—saw players focused solely on profits rather than gameplay, leading to extremely low user retention. According to Footprint Analytics, Axie Infinity is now stagnant, with only about 9,000 daily active users—down from millions at its peak—with a retention rate of just around 10%.

Thus, to build a successful GameFi ecosystem, it's essential to go beyond basic DeFi principles and develop complex in-game economies, prioritizing user experience in game design. This gave rise to X2E games. In X2E, "X" represents any human activity such as gaming or walking, which generates earnings. Unlike purely profit-driven predecessors, X2E emphasizes community culture and values, often using meaningful real-life or creative actions as core mechanics. STEPN exemplifies this model, gamifying physical fitness: users engage in sports, complete goals, submit proof via the app, and earn incentives for staying healthy.

Building on X2E, AAA games further prioritize playability and broad user appeal, significantly improving overall quality. With rich storylines and superior mechanics, Illuvium demonstrates inherent advantages in product quality and player experience.

As a result, project teams have gradually shifted their user retention strategies from emphasizing income generation toward enhancing playability and intrinsic quality.

3. Funding Landscape: Massive Capital Inflows Fuel Industry Boom

Between 2021 and 2023, the Web3 gaming industry saw significant investment inflows. 2021 was particularly notable—the so-called “Year Zero” of Web3 gaming fundraising—when traditional VCs, crypto funds, and angel investors actively participated. In 2022, global Web3 gaming funding peaked, reaching close to $10 billion.

Additionally, some Web3 gaming platforms began raising funds by issuing platform tokens or conducting initial coin offerings (ICOs), supporting platform development and operations—a model that also attracted investor interest.

Notable large-scale funding events emerged within the Web3 gaming space, driving industry advancement. Considering funding scale, outcomes, and media attention, J-Lab compiled several recent high-profile Web3 gaming funding cases to illustrate how capital inflows are reshaping the sector. See table below for details.

4. Challenges & Risks: Sustainability Threatened by Over-Financialization and Poor UX

Despite growing attention to gameplay and playability, the quantity and quality of high-end Web3 games remained limited during 2021–2023. Excessive financialization makes the industry vulnerable to market volatility and speculation, while poor usability and unintuitive interfaces limit mainstream adoption. True "breakout" success remains elusive.

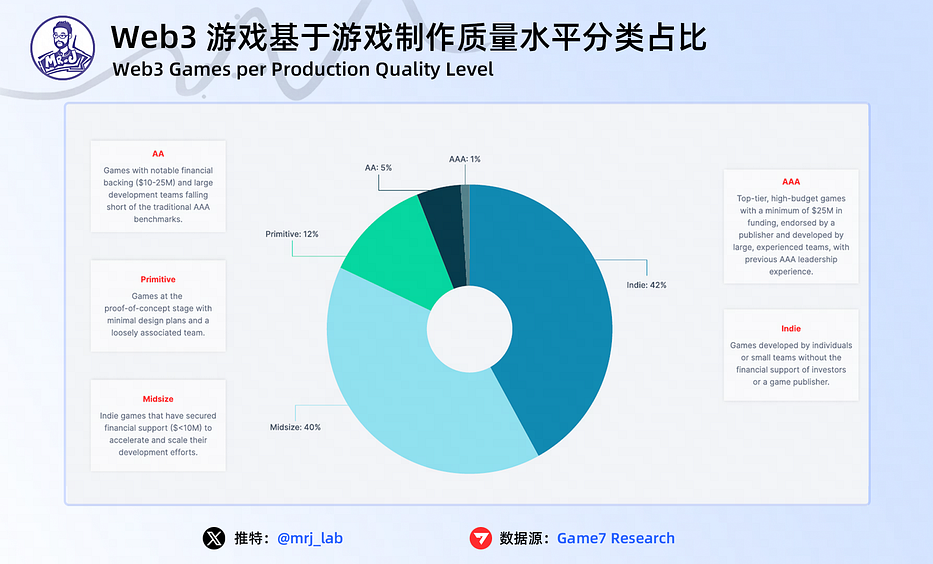

According to Game7 Research, over half of current Web3 games are developed by independent creators or small teams, with only 6% classified as AAA or AA-tier productions. Many projects focus excessively on technology and economics while neglecting refined game design, innovation, and content diversity. This could lead to player churn and market saturation, hindering long-term growth. Moreover, fierce competition may trigger overinvestment and funding bubbles. If too many similar projects flood a limited market, some will inevitably fail, resulting in lost capital.

Furthermore, blockchain scalability, transaction speed, and gas fees still hinder smooth gameplay and user experience. To compete with Web2 games, Web3 must urgently address UX issues—such as fast, seamless digital wallets and transaction tools—to enable fluid management and trading of in-game assets. For most Web2 users, entering Web3 gaming still involves a learning curve. Lack of user-friendly interfaces not only limits participation but also poses a major barrier to breaking out of niche circles.

2. Industry Ecosystem: The Web3 Gaming Landscape

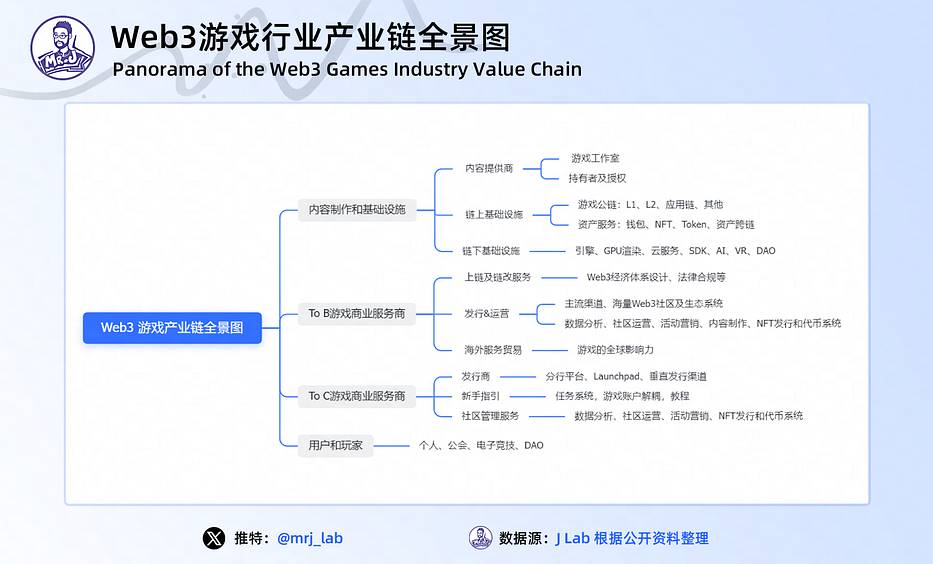

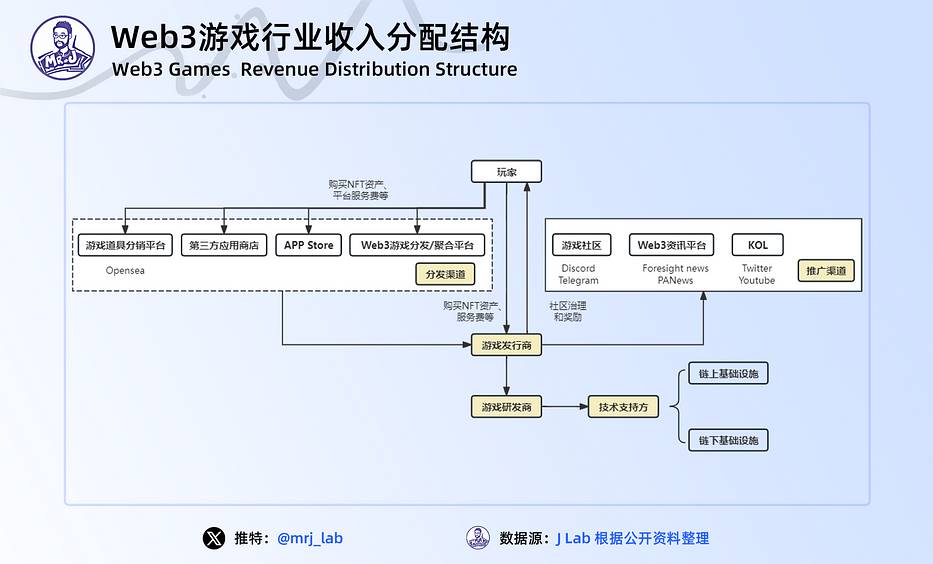

From a value chain perspective, the upstream of the Web3 gaming industry includes content creation and R&D infrastructure; midstream covers all B2B service providers; downstream encompasses all B2C services; and the endpoint consists of end users and paying players.

1. Upstream – Infrastructure: Public Gaming Chains Divided Among Three Major Forces, BNB Chain Shines

Public gaming chains, as critical infrastructure, are rapidly expanding and becoming increasingly diverse. Currently, three main types support Web3 games: general-purpose blockchains (General-Use Networks), Appchains (Application-Specific Network Frameworks), and game-dedicated chains.

-

General-purpose blockchains support large-scale gaming applications and access. These include L1 general chains like Ethereum, EVM sidechains, and non-EVM Layer 1s, as well as L2/L3 solutions;

-

Appchains are networks specifically designed and optimized for individual games, apps, or ecosystems—such as Wax, Flow, Immutable X, Oasys, and Hive. These offer performance benefits and game-specific optimizations, making them ideal for game deployment;

-

Game-dedicated chains are built exclusively for specific games, such as Ronin, created for Axie Infinity.

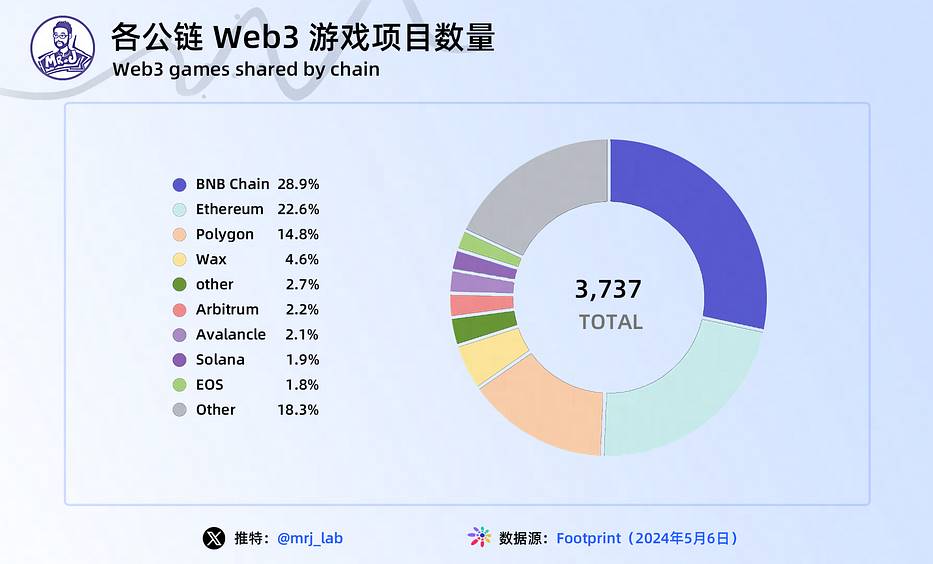

Looking deeper into the data, each type performs differently in terms of scale, user engagement, and transaction volume. The number of on-chain projects reflects a chain's attractiveness and vitality. Currently, the top three chains hosting Web3 games are BNB Chain (28.9%), Ethereum (22.6%), and Polygon (14.8%), together accounting for 66.3%—nearly two-thirds of the entire Web3 gaming ecosystem.

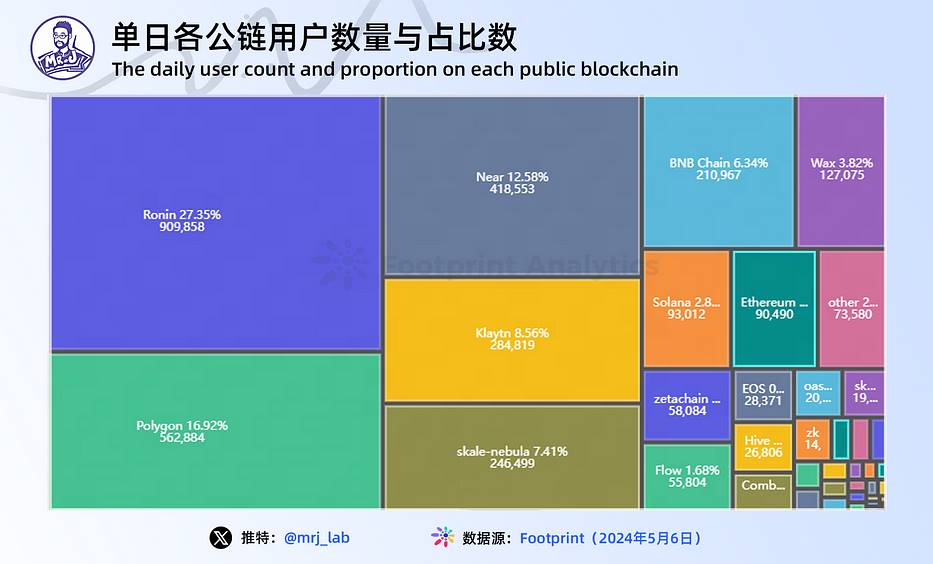

Active user count is a key indicator of engagement. Higher figures typically indicate strong user bases and vibrant communities. On a daily basis, Ronin (27.35%), Polygon (16.92%), Near (12.58%), and Klaytn (8.56%) dominate user shares. In Q1 of this year, Ronin and Polygon consistently ranked first and second in daily active users for Web3 games.

Transaction volume indicates liquidity and trading activity. High volumes signal substantial value transfers and economic activity. Overall industry transaction volume peaked in Q3 2023, then declined, falling below 2022 averages. Despite a sharp drop in transaction value compared to 2022, transaction counts did not fall nearly as much.

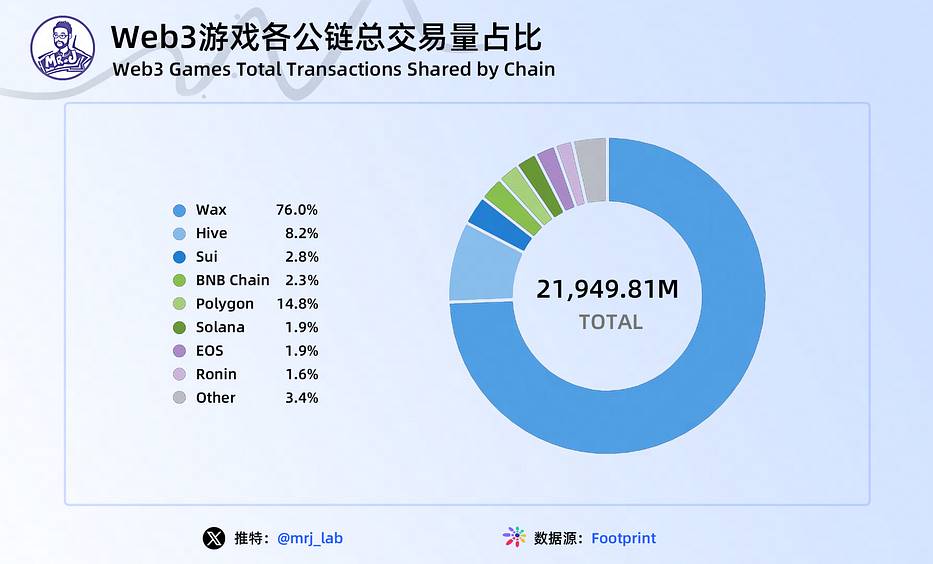

In terms of transaction volume share, the top four chains are Wax (76%), Hive (8.2%), Sui (2.8%), and BNB Chain (2.3%). As a chain purpose-built for NFTs and gaming, Wax leads by a huge margin over others.

Overall, public gaming chains appear to be divided among three dominant forces. BNB Chain and Avalanche (using EVM sidechain models), Polygon (leveraging sidechains and Layer 2), and Appchains like Wax and Hive have all shown strong performance.

BNB Chain and Polygon have attracted numerous developers due to their high performance, low gas fees, and EVM compatibility. BNB Chain, backed by Binance’s robust ecosystem and incubation programs, ranks highly across total game count, active users, and transaction volume.

Therefore, future-leading public gaming chains will likely possess three key attributes: high TPS with EVM compatibility, ability to meet specific gaming needs, and strong ecosystem-building capabilities.

2. Midstream – Game Distribution: Platforms Compete for Dominance in Web3 Game Publishing

As Web3 gaming grows rapidly, various challenges arise. To track market trends and mitigate risks, users rely on analytics tools, community forums, and project evaluation platforms to identify promising opportunities. Meanwhile, developers seek better user acquisition, trust-building marketing, and improved cross-chain functionality.

To address these needs, more platforms are targeting Web3 game aggregation and distribution—aiming to bypass centralized Web2 channels like Apple and Google Play—and create mutually beneficial bridges between developers and users.

An increasing number of platforms aim to become the "Steam of Web3," competing for dominance in Web3 game distribution. Compared to traditional Web2 platforms, Web3 distributors empower users through decentralization, fostering more player-centric, community-driven ecosystems with stronger user involvement.

For example, Portal—a cross-chain gaming platform launched in late February—uses technologies like network integration and LayerZero to solve cross-chain and payment issues, connecting games and players across different blockchains so users can seamlessly play across chains.

Another example, DeGame, positions itself as a search gateway for Web3 games, indexing over 4,000 game projects, 1,000+ chains, and tokens—covering nearly all major Web3 gaming initiatives. Users can discover and join projects via search or direct navigation.

Moreover, Steam’s January 2023 announcement banning Web3 games opened the door for alternative platforms to vie for distribution control. As shown in the table below, leading Web3 game distribution platforms now commonly integrate NFT markets, proprietary games, developer APIs/SDKs, DID systems, gamified marketing campaigns, guild integrations, and dashboards. Additionally, both game development and information aggregation platforms have attracted substantial funding, often involving large single-project investments.

3. Downstream – Game Communities: Active Communities Enhance Interaction, Feedback, and Economic Incentives

Unlike Web2 games, communities play a pivotal role in Web3 gaming ecosystems. In Web2, although large communities may strongly oppose certain updates or policy changes, studios rarely respond meaningfully. In contrast, Web3 introduces governance mechanisms—like community voting—that allow users to directly influence project development. Examples include:

-

A developer proposes changing the in-game combat reward formula and puts it to a vote—the implementation depends on a threshold of player votes (a real case from Cards Ahoy! community voting);

-

Community members in Discord or Telegram provide feedback and vote on proposed changes.

These communities often take the form of DAOs (Decentralized Autonomous Organizations). Take Yield Guild Games (YGG) as an example: founded to create a blockchain-based play-to-earn community, YGG enables more people to earn income through gaming while advancing decentralization and digital asset adoption. Unlike other platforms, YGG uses blockchain to track all in-game transactions, ensuring full transparency. It supports NFT assets and connects a global community of blockchain gamers and investors, enabling players to earn across multiple blockchain games.

Today, YGG has launched multiple earning programs across games like Axie Infinity, The Sandbox, and League of Kingdoms, operating and managing them via DAO governance. Members contribute capital, gameplay time, or community efforts to participate in decision-making and benefit from shared revenue opportunities.

For Web3 gaming, community represents an interactive and collaborative ecosystem between players and developers. This economic model incentivizes participation and contribution, boosting sustainability and appeal.

3. Industry Trends: Key Developments in 2024

Since late last year, the Web3 gaming sector has shown renewed signs of vitality: frequent funding rounds, entry of major Web2 gaming giants, and multiple games announcing public beta launches in 2024. These developments have sparked intense market interest, creating a sense of resurgence. Compared to the previous cycle, the Web3 gaming industry in 2024 exhibits the following traits:

1. Trend One: Improved Gameplay and Playability; "Grinding for Profit" No Longer the Sole Goal

The initial hype around Play-to-Earn (P2E) has faded. Low playability and poor gameplay are widely recognized as key limitations of that era.

Today, Web3 gaming is advancing toward high-resolution visuals, richer content, exceptional player experiences, and even AAA-grade production—aiming to attract Web2 gamers through enhanced playability. Titles like BigTime, Illuvium, BLOCKLORDS, and Shrapnel all promote themselves as AAA-level Web3 games.

Two main drivers fuel this evolution: the unsustainability of over-financialization and competitive pressure to break into the Web2 mainstream.

-

Unsustainability of over-FI focus: Early Web3 games were so finance-centric that "GameFi" was an apt label. But excessive financial orientation failed to sustain user growth. When bull market gains disappeared and returns underperformed expectations, the FI focus accelerated player exodus. Consequently, the GameFi sector faced unprecedented winter in 2022, with market cap shrinking by 50% compared to 2021.

-

Competitive pressure to reach Web2 audiences: Broadly speaking, Web3 gamers today consist of overlapping groups—Web3 natives and Web2 players. To expand this overlap, projects must appeal to both. The former group primarily seeks profit, with playability secondary. The latter has been shaped by polished Web2 gaming experiences, accustomed to "Earn (time/money) to Play," valuing sensory satisfaction. Relying solely on financial incentives won’t convert large numbers of Web2 users. Only by returning to gaming fundamentals—enhancing fun and novelty—can true crossover from Web3 to Web2 occur.

2. Trend Two: Diversification of Game Genres; RPG, Action, Strategy, and Casual Games Most Popular Among Developers

Compared to the previous cycle, Web3 game genres are becoming increasingly diverse. As the industry matures, genres now span:

-

RPG (Role-Playing) Games: Highly favored among developers, offering deep character progression and immersive storytelling in expansive virtual worlds.

-

Action Games: Emphasize player reflexes and mechanical skill, featuring fast-paced combat and intense sequences requiring precise execution.

-

Strategy Games: Focus on planning, resource management, base-building, empire development, and competitive interactions.

-

Casual Games: Designed for relaxation and entertainment, featuring simple rules and lighthearted experiences suitable for short sessions and broad audiences.

Beyond these, innovation continues with card games, racing, puzzle games, and more. What distinguishes Web3 games from traditional Web2 counterparts is their foundation on blockchain and cryptographic assets—granting players true ownership and tradability of in-game items, enabling novel gameplay and economic incentive structures.

Genre diversity and innovation in Web3 gaming continue to evolve. With technological advances and shifting user demands, entirely new game types and mechanics may emerge.

3. Trend Three: Accelerated Shift Toward Platformization and Ecosystem Building

Web3 gaming is evolving toward platformization and ecosystem development to extend lifecycle and strengthen cross-sector integration. Historically, every Web3 game has a finite lifespan influenced by internal factors and broader market cycles. Compared to standalone titles, platforms and ecosystems offer stronger risk resistance, longer lifespans, greater room for experimentation, and larger growth potential.

Platforms also serve as optimal hubs for consolidating resources and bridging internal and external loops. Information aggregation platforms help players discover games, enabling healthy alignment between ecosystems and users. For example, platforms like IGN allow players to access game descriptions and reviews, forming informed opinions. Multi-functional Web3 game aggregators offer one-stop services including game development, smart contract coding, NFT minting, and marketplace setup. LootRush, for instance, provides a rapid-launch platform for Web3 games and supports NFT rentals—reducing entry costs for players while generating yield for NFT owners. Similarly, Gala Games allows developers to build blockchain games while letting players own, transfer, and trade loot NFTs via peer-to-peer markets.

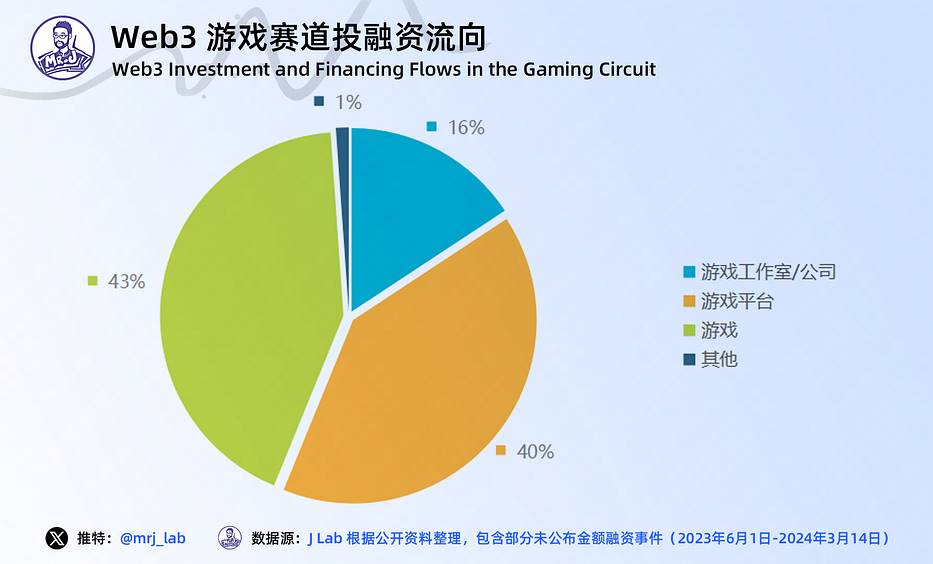

This trend is also evident in funding patterns: from late 2023 to publication, 56% of investments flowed to gaming platforms or studios, reflecting cautiousness toward single-game bets. In earlier stages, over half (53%) of funding went directly to individual game projects.

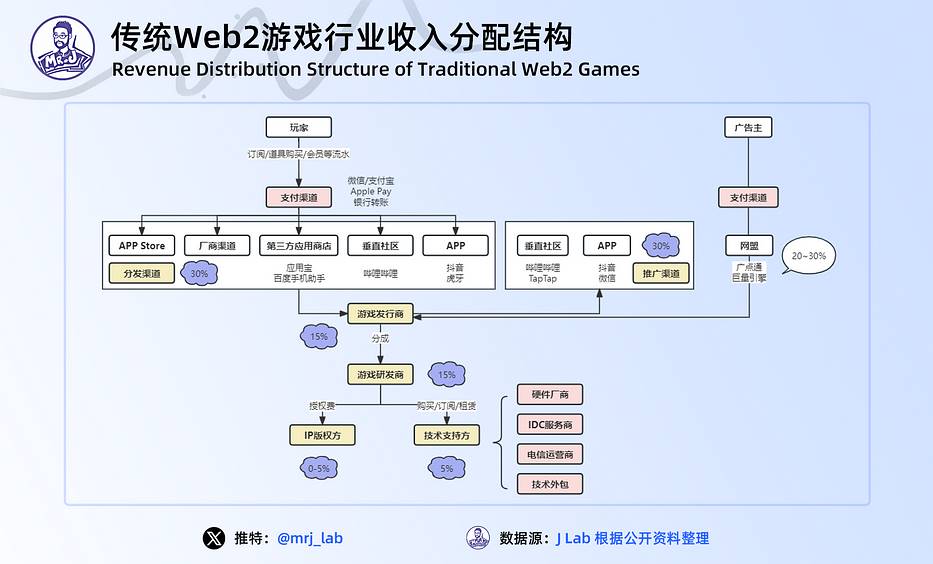

4. Trend Four: Community Ecosystems May Disrupt Traditional Game Industry Revenue Models

Traditional Web2 gaming features a centralized revenue model, with power concentrated among a few top companies. In contrast, Web3 gaming unites players, beneficiaries, and investors, introducing tokenomics and complex economic systems that reshape monetization and interaction. Its economy centers on decentralization and community engagement.

Take mainland China as an example: in early Web2 gaming, development, publishing, and distribution operated as separate entities. But as the industry matured, leading firms expanded vertically to improve efficiency and reduce costs, adopting integrated R&D-and-publishing models. This consolidation led to monopolies over resources and distribution channels, leaving players with fewer choices and limited influence.

In contrast, Web3 gaming adopts a more decentralized revenue model. Players, publishers, and developers co-create and share income. This decentralized structure fosters fairer, more transparent profit-sharing and elevates community participation and decision-making.

Beyond sustainable in-game economies, community strength is becoming a key competitive advantage in Web3 gaming. Below are some of the leading Web3 gaming communities that have grown substantially in recent years.

Over time, communities can grow into powerful entities capable of achieving tangible results through collective action. They encourage collaboration and sharing—players co-create content, participate in governance, exchange strategies and tips. Members support each other, share knowledge, and drive mutual progress. Player feedback is vital for iterative improvement. Developers leverage insights to understand preferences, adjust balance, refine features, and enhance UX—delivering better products.

4. Talent Supply: Productivity and Production Relations in the Web3 Gaming Era

Economist Carlota Perez systematically articulated the concept of “techno-economic paradigms” that drive societal development. She argues that human history has undergone five technological revolutions, each bringing new technologies, key production factors, infrastructures, and industries. The process by which technology drives economic transformation constitutes a “techno-economic paradigm,” with each major historical wave representing a new paradigm replacing the old.

1. Productive Empowerment: Innovation Engine Driven by Web3 Gaming Technology

The gaming industry has always stood at the forefront of technological innovation. Modern games are both a synthesis of art and a convergence of advanced technologies. After decades of evolution, the industry has established a clear path: upstream tech development, midstream content creation and publishing, and downstream distribution.

The Web3 revolution in gaming brings new technologies, key production inputs, next-gen infrastructure, and emerging industries.

Traditional gaming ecosystems typically include upstream IP development and engines, midstream developers and publishers, and downstream distributors and end users. Web3 gaming extends this chain with additional layers—onboarding to chain, tokenomics, trading systems—and serves not only end users but also B2B studios.

As an emerging industrial technology, Web3 gaming innovation is reshaping the industry landscape and generating rich downstream ecosystems in R&D, market transactions, and operations.

This innovative scientific ecosystem is giving rise to a new productive force system—one that creates vast employment opportunities in regional gaming markets and spawns entirely new production relations in Web3 gaming.

2. Paradigm Evolution: Changing Production Relations and Institutional Structures in Web3 Gaming

The emergence of new productive forces not only transforms productivity and socio-economics but also triggers profound shifts in production relations and social institutions.

Unlike other sectors in the Web3 ecosystem, Web3 gaming embodies both the new productive forces of Web3—transforming traditional inputs and labor processes—and inherits core elements of the gaming industry. It represents self-evolution—from “old paradigm” to “new paradigm”—while preserving foundational industry DNA.

Characterized by decentralization, openness, and utility, Web3 gaming is redefining human communities, enterprises, labor, and organizations. Leveraging blockchain and smart contracts, Web3 enables decentralized governance—anyone can launch a DAO around their project and invite participation. With smart contracts, individuals voluntarily collaborate based on shared values. Every completed task is immutably recorded on-chain; revenues are distributed via tokens, with voting power tied to holdings, enabling community governance.

Through on-chain records, token-based revenue sharing, and collective voting, a distributed cooperation and governance system emerges—DAOs achieve a degree of self-sufficiency. This decentralized model eliminates the need for headquarters or formal management hierarchies. Members work remotely with global peers, choosing whether to remain anonymous—an egalitarian organizational form. Web3’s decentralized and distributed nature enables gig economy opportunities.

Web3 gaming is considered one of the most promising areas for mass-adoption breakthroughs on the road to widespread Web3 use, offering players true ownership and economic incentives, opening new possibilities for the industry. Yet, developing high-quality games isn't instantaneous—it requires sustained investment, iterative testing, and optimization, demanding higher technical and financial capabilities from developers.

Since 2023, major Web2 gaming companies have accelerated their Web3 expansions, with dev, marketing, and ops teams increasingly integrating with Web3 product and engineering units. Furthermore, many existing Web2 studios already feature NFT-like mechanics internally, allowing smoother transitions into Web3.

3. Talent Demand: What Kind of Talent Does Web3 Gaming Need?

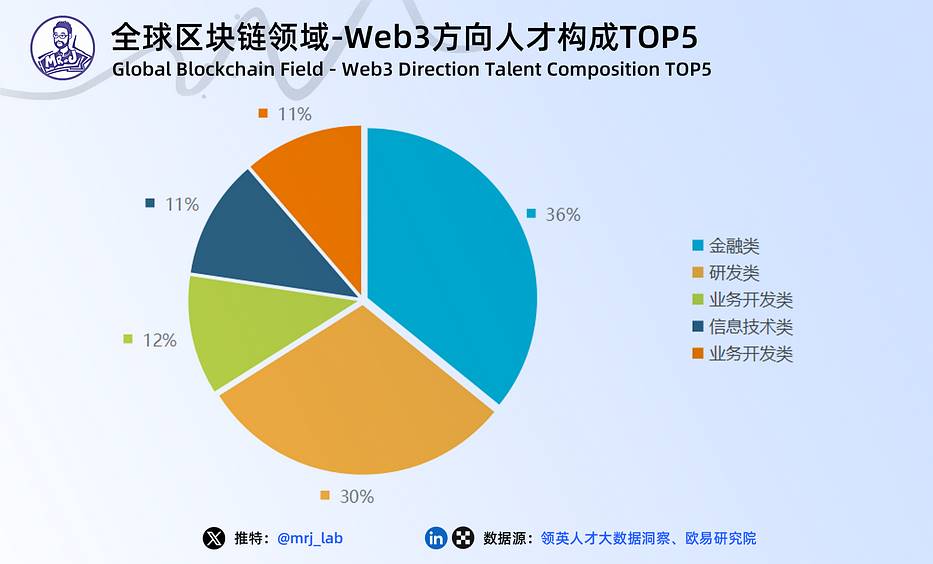

In 2023, OKX partnered with LinkedIn to release the “2022 Global Blockchain Talent Report – Web3.0 Edition.” Macroscopically, by June 2022, blockchain talent had grown 76% year-on-year, with India, Singapore, and the U.S. seeing the fastest growth at 122%, 92%, and 62%, respectively.

Talent demand is growing exponentially, far outpacing supply, resulting in a severe talent gap. Notably, Canada saw a staggering 560% increase. Growth rates in India, Singapore, the U.S., and China were 145%, 180%, 82%, and 78%, respectively. On the supply side, mobility is largely internal: from 2021 to June 2022, talent circulated mainly among blockchain firms like Coinbase, Crypto.com, Gemini, and Ripple. External entrants primarily came from fintech, including Goldman Sachs, JPMorgan, HSBC, etc. In terms of demand structure, early-stage industries require many foundational roles—development, product, finance, R&D, business development, IT, sales—which remain the most sought-after.

Web3 gaming is a crucial component of the Web3 industry and a key catalyst for mainstream Web3 adoption. Its underlying logic and commercial framework will transform traditional gaming. However, the talent ecosystem for Web3 gaming isn’t merely a sum of gaming and Web3 skills—it’s an organic integration of both domains.

As the Web3 gaming industry enters deeper waters, simple grinding and financial gimmicks no longer satisfy users. Exceptional art design, compelling gameplay, and sustainable economies are now critical to success. Future Web3 gaming studios will be composed of individuals who understand gaming deeply and are embedded in the Web3 ecosystem.

-

R&D and Development Talent: Requires technically proficient engineers—including blockchain developers, smart contract coders, and front-end/back-end engineers—with solid programming skills and knowledge of blockchain and cryptography.

-

Game Designers: Must craft innovative, engaging game designs. Deep understanding of game mechanics and the ability to integrate Web3 technologies and economic systems into gameplay are essential for delivering enjoyable, sustainable experiences.

-

Artists and Visual Designers: High-quality visuals are crucial for attracting users and enhancing UX. Artists must possess strong creative and design skills to produce stunning interfaces, characters, and environments.

-

Economists and Game Economy Designers: The in-game economy is a cornerstone of success. Experts must design sustainable, attractive economic models ensuring smooth circulation and effective incentives.

-

Product Managers: Play a vital role in guiding development. Must understand market and user needs and translate them into concrete product plans and feature designs.

-

Blockchain Experts: Given the tight coupling with blockchain tech, specialists familiar with various platforms and protocols are invaluable for designing and implementing game systems.

Additionally, the full pipeline—from creation to onboarding to distribution—generates abundant job opportunities, enabling traditional Web2 gaming professionals to transition into Web3. However, these individuals must embrace and understand Web3 philosophy, quickly learn its technologies and contexts, and effectively combine that with gaming expertise to thrive in Web3 gaming.

Of course, Web3 gaming remains in its infancy globally—no region yet hosts a mature industrial cluster. Yet, acute talent shortages are already apparent. Now is precisely the moment to seize the opportunity.

Conclusion

As initial hype fades, VCs and project teams are adopting more rational approaches—not chasing short-term explosions, but focusing instead on sustainability, sound economic models, and long-term user retention.

This shift presents new opportunities for Web3 gaming. While no one knows when the “winter” will end, everyone agrees that the next bull market will be spectacular.

Will 2024 bring the “iPhone moment” for Web3 gaming? We remain hopeful

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News