MIIX Capital: The cycle has bottomed out, but inflation concerns remain

TechFlow Selected TechFlow Selected

MIIX Capital: The cycle has bottomed out, but inflation concerns remain

Last week, although the crypto market experienced localized volatility, the increase in investment and financing activities demonstrated the industry's internal vitality and long-term growth potential.

Author: MIIX Capital

Federal Reserve Chair Powell hinted that interest rate hikes are unlikely in the near term, triggering broad gains across global risk asset markets. Additionally, weaker-than-expected U.S. non-farm payroll data may shift the Fed’s path from a gradual pace to a sprint toward rate cuts, potentially boosting equities, cryptocurrencies, and bonds, while weakening the dollar, gold, and crude oil.

1. Investment & Financing Overview

Last week, the crypto market recorded 32 investment and financing deals, up 10.34% week-on-week, with a total funding volume of $150 million, down 27.18%:

DeFi sector announced 9 deals, including Securitize, an RWA company, which raised $47 million in a strategic round led by BlackRock; Ironlight secured $12 million, primarily funded by individual investors with Wall Street backgrounds;

CeFi sector reported 1 deal, with retail derivatives trading platform LazyBear completing a strategic funding round of 4 million USDT, backed by Gogeko Labs, DWF Labs, and other strategic partners;

GameFi sector saw 6 deals, including Swedish game studio Patriots Division raising $5 million for its Web3 game Shadow War;

Infrastructure and tools sector reported 5 deals, including modular liquidity protocol Mitosis, which raised $7 million in a round co-led by Amber Group and Foresight Ventures;

AI-related sector had 1 deal, with Web3 developer platform Airstack securing $4 million in seed funding led by Red Beard Ventures;

Other Web3/crypto applications reported 7 deals, including Web3 content publishing platform Paragraph, which raised $5 million with participation from USV and Coinbase Ventures;

Week-on-week, the number of investment deals in the cryptocurrency market rose slightly, but the total funding volume declined significantly. Market interest remains focused on RWA, GameFi, and Web3 sectors. Among VCs, BlackRock and Electric Capital were notably active this week, focusing primarily on asset management and SocialFi areas.

According to Rootdata, April's total crypto market funding reached $1.025 billion, down 6.3% from March's $1.094 billion, with a 10.5% decline in the number of deals. By funding volume per sector, CeFi, DeFi, and tools & information services ranked top three.

About SecuritizeSecuritize is a digital asset securities firm aiming to provide investors access to alternative investments and help companies raise capital, manage shareholders, and offer potential liquidity. It pioneered a fully digital, integrated RWA platform compliant with existing U.S. regulations for issuing, managing, and trading digital asset securities, serving over 1.2 million investors and 3,000 enterprises.

About IronlightFounded by Rob McGrath and Matt Celebuski, Ironlight aims to tokenize traditionally illiquid private securities such as real estate, natural resources, fine art, public infrastructure, and private equity, targeting establishment as an SEC-regulated tokenized RWA marketplace.

About KioskSocialFi project Kiosk is a Farcaster client enabling creators to build zero-to-one communities within the app. Creators can share rich-media ideas via their social graph, mint them as NFTs, gather like-minded collectors and collaborators in channels, create custom channel economies (e.g., tipping and distribution), and chat with their community—all within the Kiosk application.

2. Industry Data

After 7 Days of Outflows, U.S. Bitcoin Spot ETFs See First Net Inflow

SoSoValue data: On May 3 Eastern Time, U.S. Bitcoin spot ETFs recorded a net inflow of $378 million—the first net inflow after seven consecutive days of outflows. Fidelity’s FBTC led with a single-day inflow of $103 million, bringing its cumulative net inflow to $8.03 billion.

Since launch, U.S. Bitcoin spot ETF flows have closely correlated with market movements. With positive ETF inflows resuming, recent price trends have shown slight recovery. Over the coming week, ETF inflows are likely to strengthen further, though GBTC’s inflows remain modest and may not expand significantly.

Currently, the total net asset value of Bitcoin spot ETFs stands at $51.021 billion, representing 4.12% of Bitcoin’s total market cap (ETF NAV ratio). Cumulative net inflows since inception amount to $11.561 billion.

Hong Kong ETF AUM Exceeds HK$2 Billion, But Below Expectations

Data from Hong Kong Exchange: As of market close on May 3, the combined AUM of three Hong Kong-based spot virtual asset ETFs—offered by China Asset Management, Harvest Fund, and Bosera HashKey—reached HK$2.13069 billion (approximately $255 million), nearly double the ~HK$1.192 billion AUM of virtual asset futures ETFs. Specifically:

-

Bitcoin spot ETFs recorded $27.51 million in total trading volume, holding 4,220 BTC with a total net asset value of $250 million;

-

Ethereum spot ETFs recorded $4.92 million in trading volume, holding 16,280 ETH with a total net asset value of $48.52 million;

These figures fall short of initial market expectations following approval, yet appear relatively reasonable when compared to data from Canadian ETFs and UK ETNs. A more rational assessment of Hong Kong’s market scale and influence is warranted, with continued monitoring of policy developments.

Hong Kong Spot ETF Data:Bosera HashKey Bitcoin ETF AUM: HK$447.22 million; Ether ETF: HK$90.82 million;Harvest Bitcoin ETF: HK$449.39 million; Ether ETF: HK$89.87 million;China Asset Management Bitcoin ETF: HK$904.49 million; Ether ETF: HK$148.9 million (combined over HK$1 billion);

Hong Kong Futures ETF Data:Samsung Bitcoin Futures ETF: ~HK$135.12 million;CSOP Bitcoin ETF: ~HK$848.9 million;CSOP Ethereum ETF: ~HK$208.06 million;

ETH Stablecoin Transaction Volume Breaks Monthly Record

According to The Block: Stablecoin transaction volume on Ethereum has grown steadily over the past three months, hitting a new monthly high in April. FDUSD achieved its best-ever monthly performance.

Much of this growth stems from DAI’s use in MEV-related flash loans, where large amounts of DAI are minted and repaid within single transactions, significantly inflating DAI’s volume. Even excluding flash loans, stablecoin volumes remain strong—indicating steady growth in activity across the Ethereum ecosystem.

About DAI Transaction Data:The Block reports DAI’s transaction volume reached $636 billion in April, forming the bulk of Ethereum’s on-chain stablecoin volume, with total stablecoin volume nearing $1.2 trillion. Compared to March, DAI’s volume increased more than threefold.DAI’s supply also grew by approximately $1 billion since March 7, reaching a current total of $5.44 billion. While other stablecoins also saw volume increases, DAI’s share of total stablecoin supply rose slightly during this period.

Tesla Adds DOGE Payments, DOGE Surges Over 20%

Tesla website update: Certain products now support Dogecoin payments, indicated by a DOGE symbol next to the order button. Buyers simply transfer DOGE to Tesla’s wallet to complete payment. Following this news, CoinGecko data showed DOGE surged over 20%, briefly exceeding $0.168, currently trading at $0.162.

Although Tesla’s plan to accept Dogecoin has been anticipated for some time, this implementation marks another step toward deeper integration between crypto and traditional markets. Tesla’s global reach helps expose more people to crypto assets.

According to Wayback Machine archives, the last snapshot of Tesla’s “Payment, Checkout and Pricing” page was on February 28 this year. The Dogecoin FAQ page has existed since January 2022.

Currently, Tesla does not accept Dogecoin for vehicle purchases. Supported items are limited to apparel, toys, and small merchandise such as children’s electric quad bikes, hats, stainless steel whistles, and commemorative belt buckles. These products are not available through Tesla’s official Chinese sales channels.

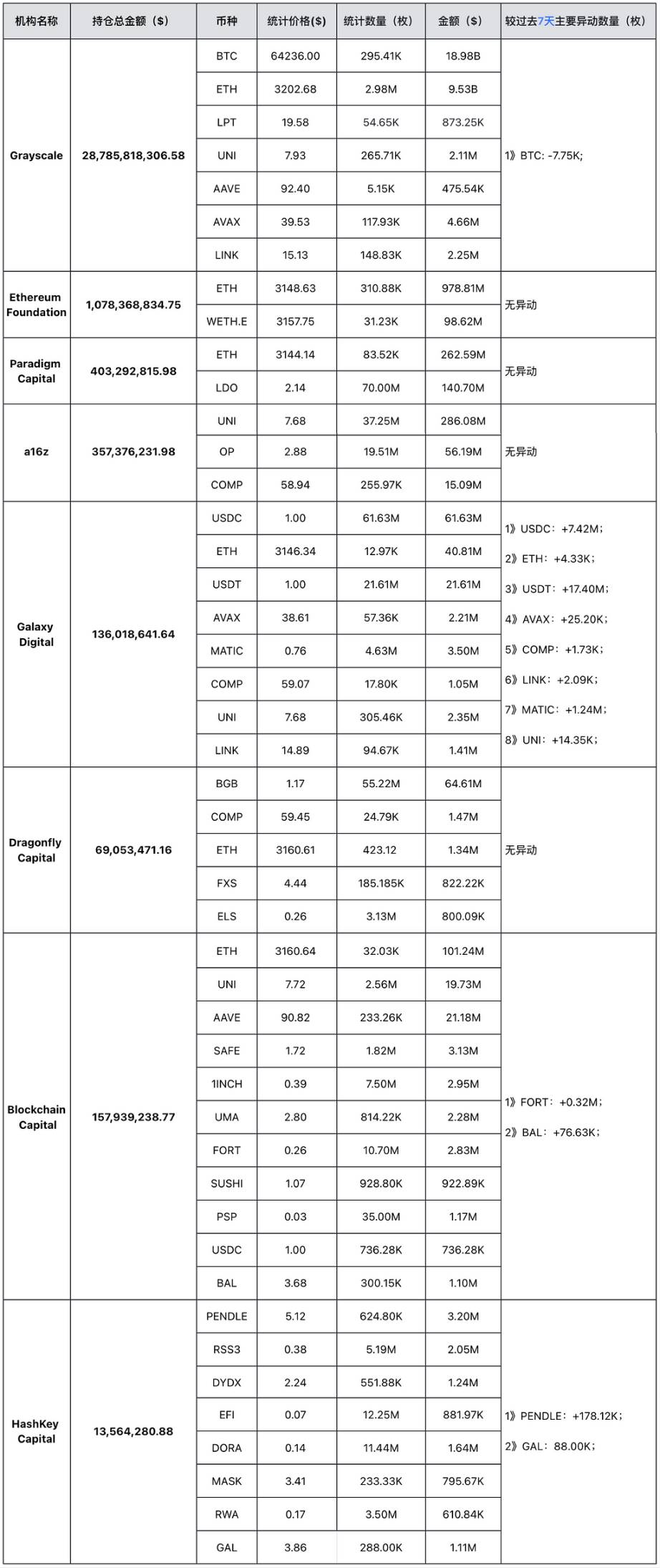

3. VC Holdings

Note: Data sourced from https://platform.arkhamintelligence.com/, as of May 6, 2024, 18:00 (UTC+8).

4. This Week Ahead

May 7

-

FOMC voting member and Richmond Fed President Barkin speaks on economic outlook;

-

FOMC permanent member and New York Fed President Williams delivers remarks;

-

Mode, an OP Stack-based L2 network, launches its governance token MODE with a total supply of 10 billion;

-

Hackathon hosted by TRON, HTX DAO, BitTorrent Chain, and JustLend DAO continues submissions until May 7;

-

Bitcoin Devcon, organized by UTXO Management, takes place at Hong Kong Science Park on May 7–8;

May 8

-

U.S. weekly EIA crude oil inventory data;

-

Fed Vice Chair Jefferson speaks on the economy;

-

FT Crypto & Digital Assets Summit;

May 9

-

U.S. weekly jobless claims;

-

Bank of England announces interest rate decision;

-

Bitcoin Asia summit held in Hong Kong on May 9–10;

May 10

-

U.S. one-year inflation expectations;

-

University of Michigan consumer sentiment index;

-

Fed Governor Bowman speaks on financial stability risks;

-

EigenLayer plans token claim launch on May 10, distributing 5% of token supply based on snapshot taken March 15, 2024;

-

Biconomy ARB airdrop to BICO stakers ends redemption today;

-

Kraken to delist Monero (XMR) from Irish and Belgian markets, ceasing deposits starting May 10;

May 11

-

Fed Governor Barr delivers speech;

-

China’s April YoY CPI released;

-

Moonbeam (GLMR) unlocks approximately 3.04 million tokens (~$920,000), representing 0.35% of circulating supply;

May 12

-

Aethir Cloud Drop, airdrop campaign by decentralized GPU cloud infrastructure Aethir, concludes on May 12;

-

Jupiter LFG Launchpad Phase II project UpRock plans Proof-of-Reputation and TGE event on May 12;

5. Conclusion

Last week, despite localized volatility, increased investment activity reflects strong internal momentum and long-term growth potential in the crypto industry. Growing investor focus on RWA, GameFi, and Web3 suggests these sectors could become new engines of market expansion. Meanwhile, ETF performance for BTC and ETH, along with Tesla accepting DOGE payments, underscores increasing recognition and adoption of crypto assets in broader financial and consumer markets.

This week, upcoming releases of U.S. EIA crude inventories and one-year inflation expectations, the Bank of England’s rate decision, and China’s CPI data may significantly influence market direction. With the Fed slowing its balance sheet reduction, despite lingering inflation concerns, improved market liquidity should gradually emerge. Absent major negative shocks, the market is likely entering a phase of valuation recovery.

While uncertainties remain, the long-term outlook appears favorable. As macroeconomic conditions improve and mainstream acceptance grows, the crypto market’s potential will continue to unfold, paving the way for a new market cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News