Rate cut expectations finally materialize, marking the start of a valuation rebound rally

TechFlow Selected TechFlow Selected

Rate cut expectations finally materialize, marking the start of a valuation rebound rally

This week, focus will be on speeches by multiple Federal Reserve officials and progress regarding the Gaza ceasefire agreement. Barring any surprises, the upward trend may continue moderately.

By LD Capital

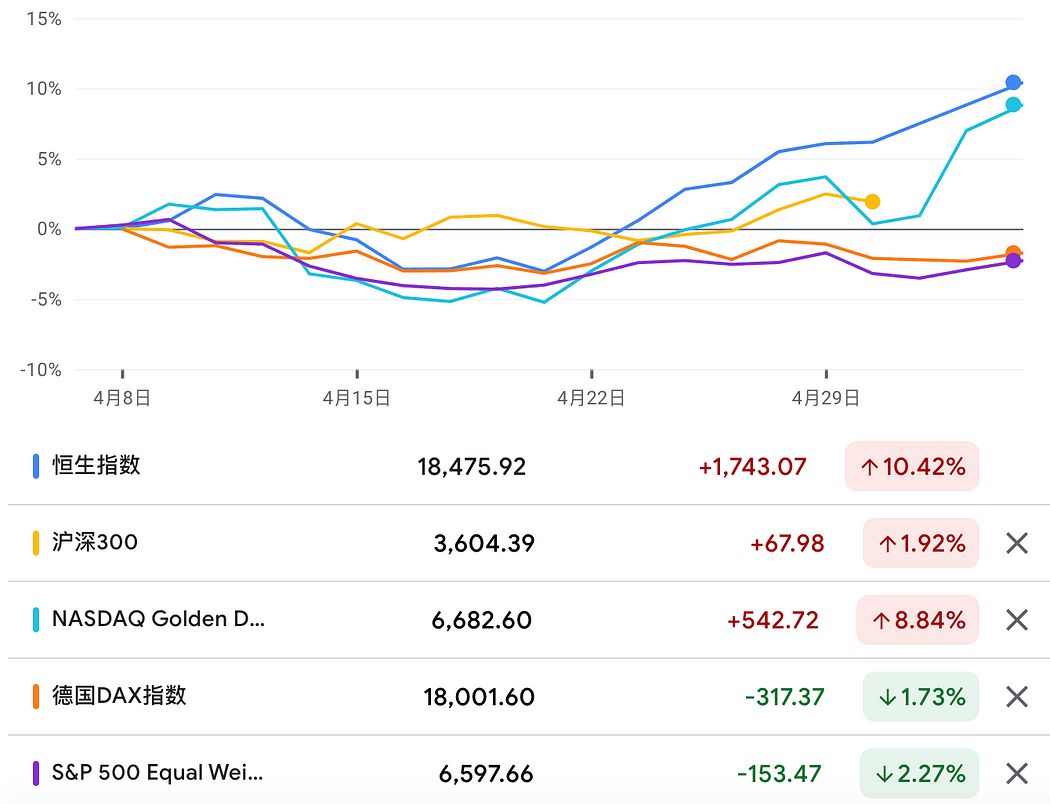

Last week, global risk assets broadly rose: S&P 500 +0.5%, Nasdaq 100 +1%, Hang Seng Index and CSI 300 increased by 4.7% and 0.6% respectively, while Japan's Nikkei 225 and South Korea’s KOSPI both gained 0.8%. Most major government bond yields declined, with the 10-year U.S. Treasury yield dropping sharply by 17 basis points to 4.50%. The market saw a temporary resolution in rate uncertainty due to key data and policy developments, strengthening expectations of slowing inflation and providing room for the Fed to cut rates. As a result, markets entered a phase of valuation recovery and oversold rebound.

Factors calming the market included weaker-than-expected U.S. nonfarm payrolls, ISM manufacturing PMI, and services index, dovish signals from the FOMC and Powell, Apple and Amazon’s $100 billion buyback plans combined with strong earnings, and Hamas-Israel peace talks facilitated by major powers. Only two concerns remained: higher-than-expected ECI labor cost data and larger-than-anticipated U.S. Treasury issuance.

First, on Monday, Wall Street was surprised when the U.S. Treasury not only failed to lower but significantly raised its quarterly borrowing estimate by 20% to $243 billion, while also increasing its projected cash balance at the end of Q3 from $750 billion to $850 billion. These figures suggest an increase in future Treasury supply, further draining market liquidity and raising risks of higher Treasury yields. Regarding this new debt plan, the Treasury clarified that it did not factor in potential adjustments to the Fed’s balance sheet reduction, still assuming the Fed will continue shrinking its balance sheet at $60 billion per month over the next two quarters. Second, the Employment Cost Index (ECI) showed a 1.2% quarter-on-quarter rise in compensation costs in Q1—well above the expected 0.9%. The annual increase reached 4.2%, exceeding the forecast of 4.0%, similar to last quarter’s level, indicating limited progress in wage growth moderation. The Fed needs this figure to fall within 3%-3.5% to align with its 2% inflation target, leading markets to anticipate a more hawkish tone from Powell on Wednesday—possibly explaining the market sell-off earlier in the week. (The good news is long-term Treasuries won’t face significant adjustments, and a small-scale, high-cost bond buyback program was announced.)

However, surprisingly, both the FOMC statement and Powell’s press conference were dovish. First, the Fed gave no indication about future inflation trends despite stubborn inflation data. More importantly, the Fed signaled a faster slowdown in balance sheet reduction. It decided to begin tapering QT as early as June, cutting monthly reductions from $60 billion to $25 billion—exceeding market expectations. Previously, most officials had expressed support for halving QT to $30 billion; reducing it further to $25 billion, though marginal in impact, was easily interpreted as a dovish signal. Secondly, during the press conference, Powell dismissed the possibility of future rate hikes, emphasized that monetary policy was already sufficiently restrictive, and noted signs of loosening in the labor market, stating patience was the prevailing sentiment among officials. He also mentioned the lag effect in housing inflation, suggesting it would eventually decline if current low levels persist, though timing remains uncertain. Thus, the entire press conference leaned dovish, without verbal hedging often used to offset dovish statements.

On the data front, April’s nonfarm payrolls grew by 175k, below the expected 240k, with unemployment slightly rising to 3.9%. Average hourly earnings rose only 0.20% month-over-month, below the expected 0.3%. For the first time, all three core components weakened simultaneously. Combined with JOLTS job openings falling to their lowest in three years, this indicates easing labor market tightness. Together with the dovish Fed stance and declining April ISM PMIs, market sentiment reversed decisively. We saw strong gains across equities, crypto, and bonds, while the dollar, gold, and oil weakened.

Notably, the largest job losses occurred in temporary help services, down 16,000. Temporary employment is often seen as a leading indicator of labor demand, typically reduced first when demand weakens. Though overall employment has remained resilient, temporary jobs have been quietly declining for months. From Q1 GDP data to consumer-facing companies like McDonald’s and Starbucks reporting soft consumer behavior, to now the weak NFP and PMIs, growing evidence suggests the economy may not be as strong as assumed. Therefore, we should now start paying attention to potential downside economic risks. An unexpected downturn could reshape investment logic for the entire year. (For now, the debate continues between soft landing and reflation narratives.)

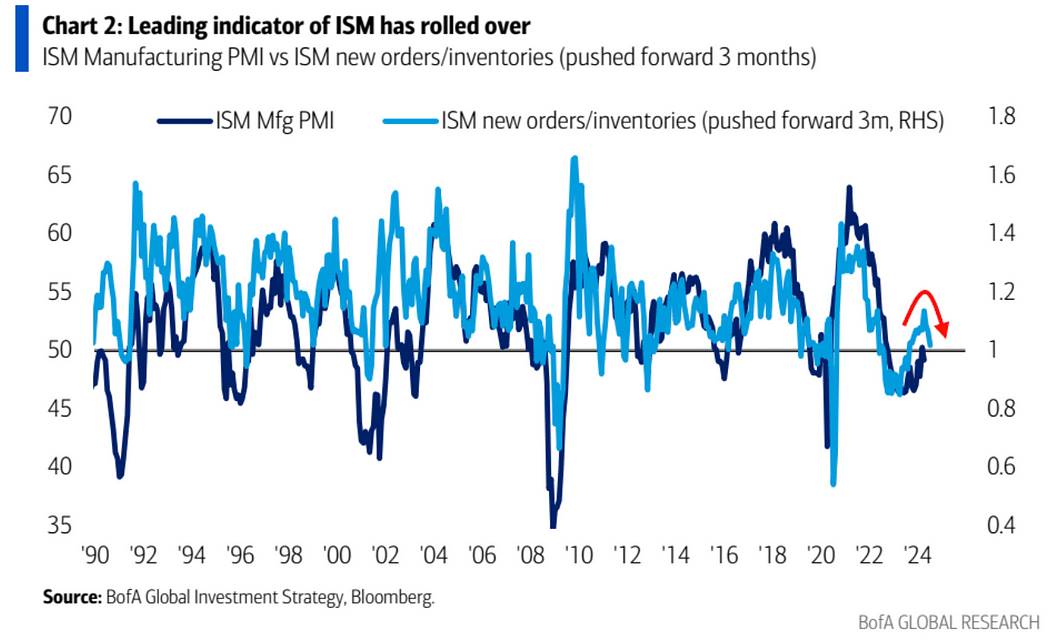

For example, the leading indicator ISM New Orders Index has declined for three consecutive months

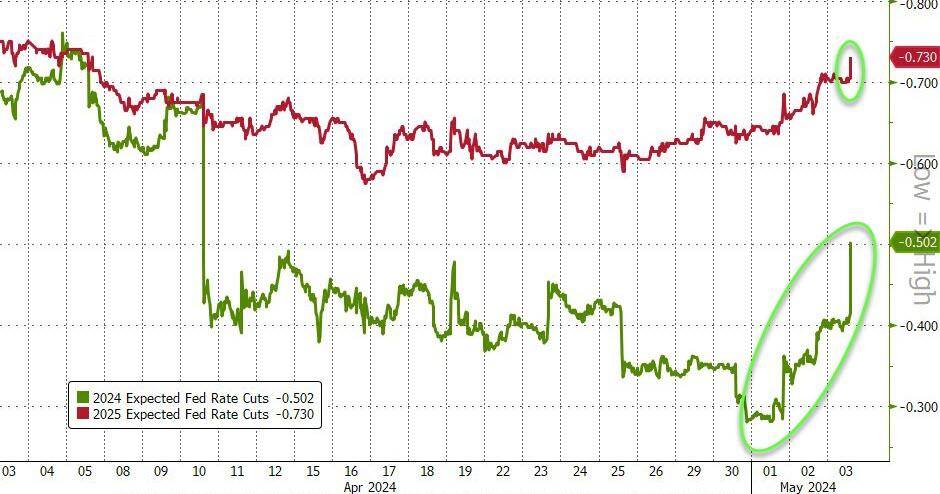

For markets, bad news has once again become good news. Rate markets now fully price in two rate cuts in 2024 and three additional cuts in 2025:

The first rate cut is now priced in for September:

Additionally, crude oil dropped ~7% due to eased geopolitical tensions, slowing U.S. economy, and higher-than-expected EIA crude inventories. Gold fell 1.4% to $2,301/oz.

Progress made in Gaza ceasefire and hostage release negotiations: Talks resumed Saturday in Cairo. However, major disagreements remain—Hamas demands any agreement must end the Gaza war, while Israel insists on releasing hostages, permanently disarming, and dissolving Hamas.

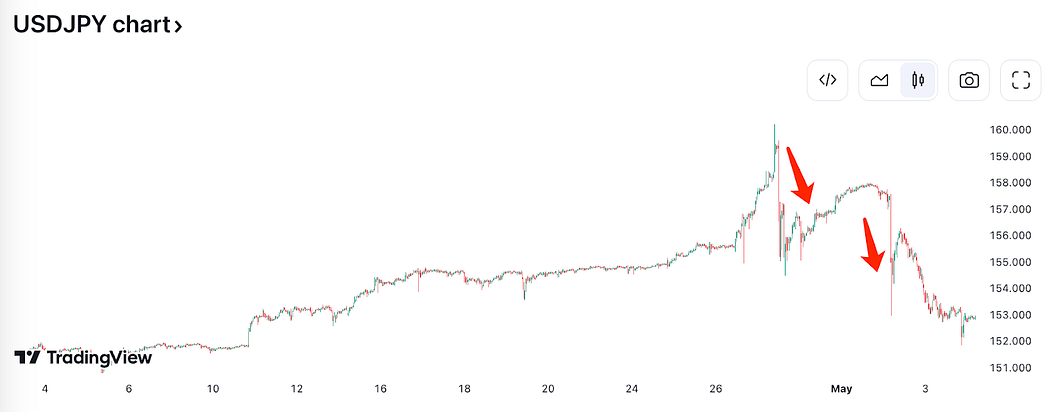

The yen experienced sharp volatility, with speculation of BOJ intervention: On April 29, the yen briefly broke through 160 before rebounding to around 156. On April 30, the BOJ reported its current account might drop by 7.56 trillion yen—far above expectations—suggesting possible intervention of about 5.5 trillion yen.

Yet again, government intervention proved ineffective—$35 billion spent only pulled the exchange rate back from 160 to 156. Further appreciation came later due to other factors mentioned above.

[Apple: $110 Billion Buyback, 4% Dividend Yield]

Apple reported better-than-expected Q2 results (market expectations were pessimistic due to weak iPhone revenue) and announced the largest share buyback in U.S. history—$110 billion—while increasing its dividend by 4% to $0.25 per share. Apple shares jumped 6%. This breaks Apple’s previous record for largest buyback and marks the 12th consecutive quarter of dividend increases. Analysts interpret this as signaling Apple’s shift toward being a capital-return value stock rather than a high-growth company needing cash for R&D or expansion. (That said, many A-shares offer dividend yields above 4%, some even trading below book value.)

Before the earnings release, Apple’s stock had fallen over 8%, underperforming the S&P 500 which rose 6%:

Apple plans to launch a new iPad on May 7, possibly aiming to boost future iPad sales. The company hasn't introduced a new model since 2022, likely contributing to sluggish iPad revenue. Next month’s WWDC will draw investor attention to Apple’s AI strategy—whether this new direction can unlock fresh growth drivers remains to be seen.

[Tesla Failed to Extend Previous Week’s Strong Rebound, Down 3.7% Last Week]

Previously, focus was on China granting Tesla approval for its Full Self-Driving (FSD) system, although specific details remain unclear. After returning from Beijing, Musk abruptly disbanded Tesla’s entire Supercharger team and canceled the next-generation一体化 GIGACASTING plan, casting uncertainty over the company’s outlook.

Currently, FSD costs 64,000 RMB (~$8,840) in China—relatively expensive. According to a 36Kr article, Tesla’s FSD is primarily trained on overseas data and may struggle to adapt locally. Initial novelty may boost Tesla’s revenue, but long-term sustainability depends on actual performance on Chinese roads. The article notes Chinese roads are far more complex than U.S. ones, requiring greater training volume. However, Tesla’s Shanghai data center cannot connect to U.S. supercomputers, and NVIDIA GPUs are restricted, limiting full-scale deployment. Meanwhile, domestic automakers train extensively on local data, so despite Tesla’s technological lead, it may not achieve overwhelming dominance.

Tesla operates across multiple sectors—automotive, energy, batteries, autonomy, robotics—each requiring continuous investment. Last quarter’s earnings showed negative free cash flow, with $1 billion spent on AI capex alone, and total cash reserves down $2.2 billion to $26.9 billion. While not yet critical, the trend is concerning. Its core auto business shows weak growth and sharply declining profits, with no near-term improvement in sight. With rising expenditures and falling revenues, the company must reassess priorities across its divisions.

S&P 500 +568%, Berkshire Hathaway +554%

[Coinbase Q1 Earnings Beat Expectations, ETF Drives Institutional Trading Volume to Record Highs]

Boosted by Bitcoin price recovery and spot ETF launches, the largest U.S. cryptocurrency exchange nearly doubled its year-on-year revenue and swung from loss to profit in Q1, significantly beating expectations.

On Thursday, May 2, after market close, Coinbase released its Q1 2024 financial report. Revenue reached $1.64 billion, surpassing the $1.34 billion estimate and up 113% YoY. With $737 million in unrealized gains from crypto holdings, net income hit $1.18 billion—profitable for the second consecutive quarter, compared to a $78.9 million loss in the same period last year.

Following the announcement, Coinbase shares rose slightly but ended the week down 2.8%. Year-to-date, the stock has gained over 45%.

Crypto Market Overview

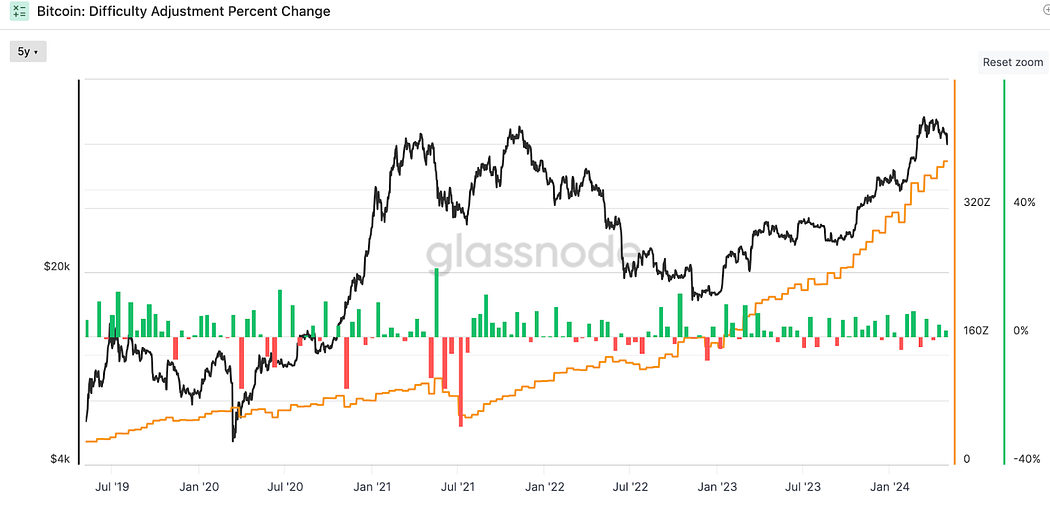

Bitcoin hash rate remains elevated:

Mining difficulty increased twice following halving:

Ordinals activity surged briefly:

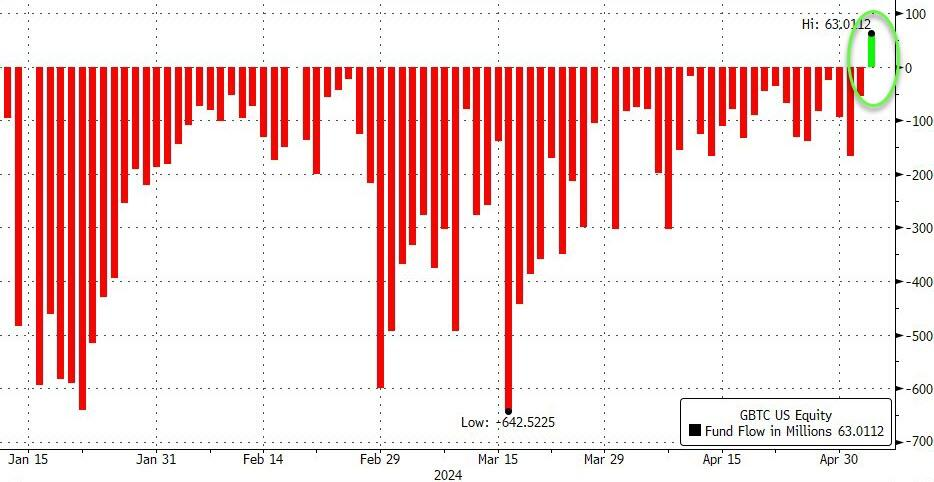

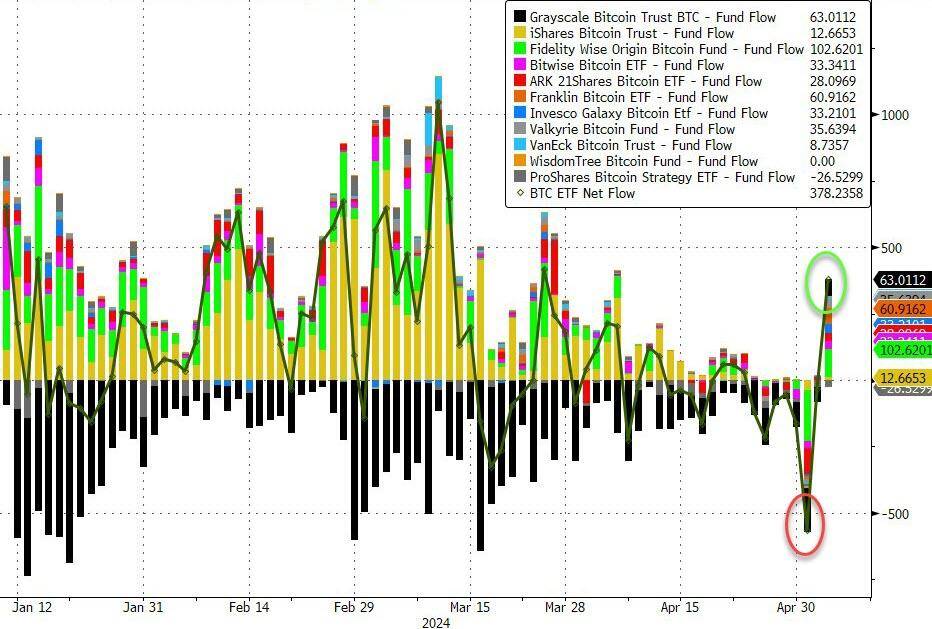

GBTC has been the main source of outflows among spot Bitcoin ETFs, but a surprising shift occurred: On Friday, GBTC recorded its first daily net inflow since the launch of spot Bitcoin ETFs—+$63 million (+1,020 BTC).

Although weekly net outflows continued, Friday saw inflows jump to $380 million—the highest since March 26. Just Wednesday, investors sold U.S. spot Bitcoin ETFs at the fastest pace ever, with 11 ETFs collectively posting $563.7 million in net outflows:

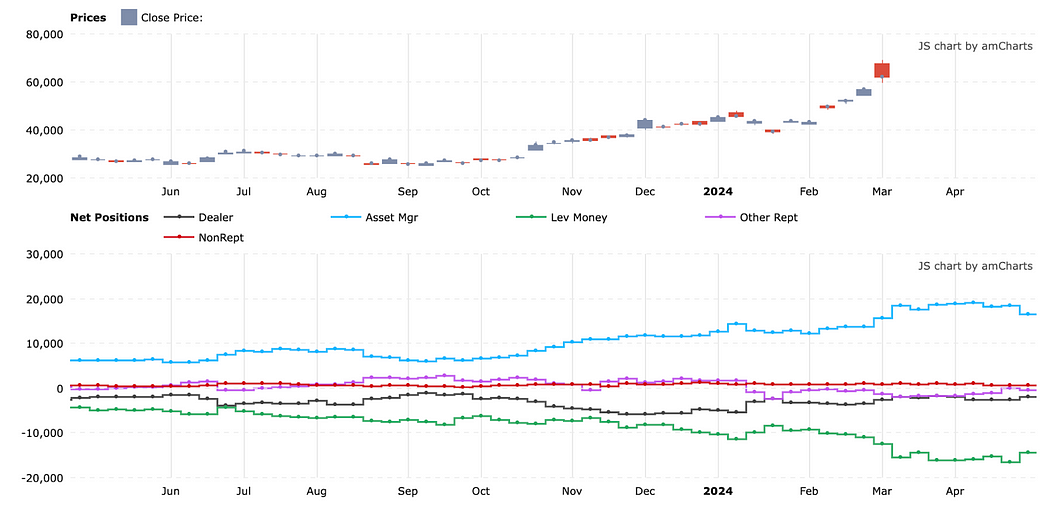

CME futures market hedge funds began reducing record net short positions last week, bringing net shorts back to levels seen seven weeks ago:

Perpetual contract funding rates remained near cycle lows and dipped into the deepest negative territory last week:

March 13 marked the market’s pivot from pricing in more rate cuts to fewer cuts than the Fed’s “dot plot.” On that very day, Bitcoin hit a record high of $73,157.

Notable Crypto News:

-

Fidelity Digital Assets VP Manuel Nordeste said at an event in London they’re working with pension funds interested in allocating to Bitcoin.

-

Bitwise CEO Hunter Horsley said: “Many traditional and reputable institutions are now engaging with Bitcoin in unprecedented ways.”

-

BlackRock stated it is meeting with various investors—including pensions, endowments, sovereign wealth funds, and insurers—about Bitcoin ETFs.

-

A Bitcoin ETF whale emerged in Hong Kong—Ovata Capital Management. The fund holds positions across four different U.S.-listed ETFs, with a total allocation of $60 million. They aim to “generate absolute returns uncorrelated to broader equity markets.”

-

European institutions disclosed BTC holdings in 13F filings: Swiss bank Lombard Odier ($209B AUM) holds $1.5 million worth of IBIT; BNP Paribas bought 1,030 shares of IBIT in Q1.

[Overseas Buzz Around ‘ABC’]

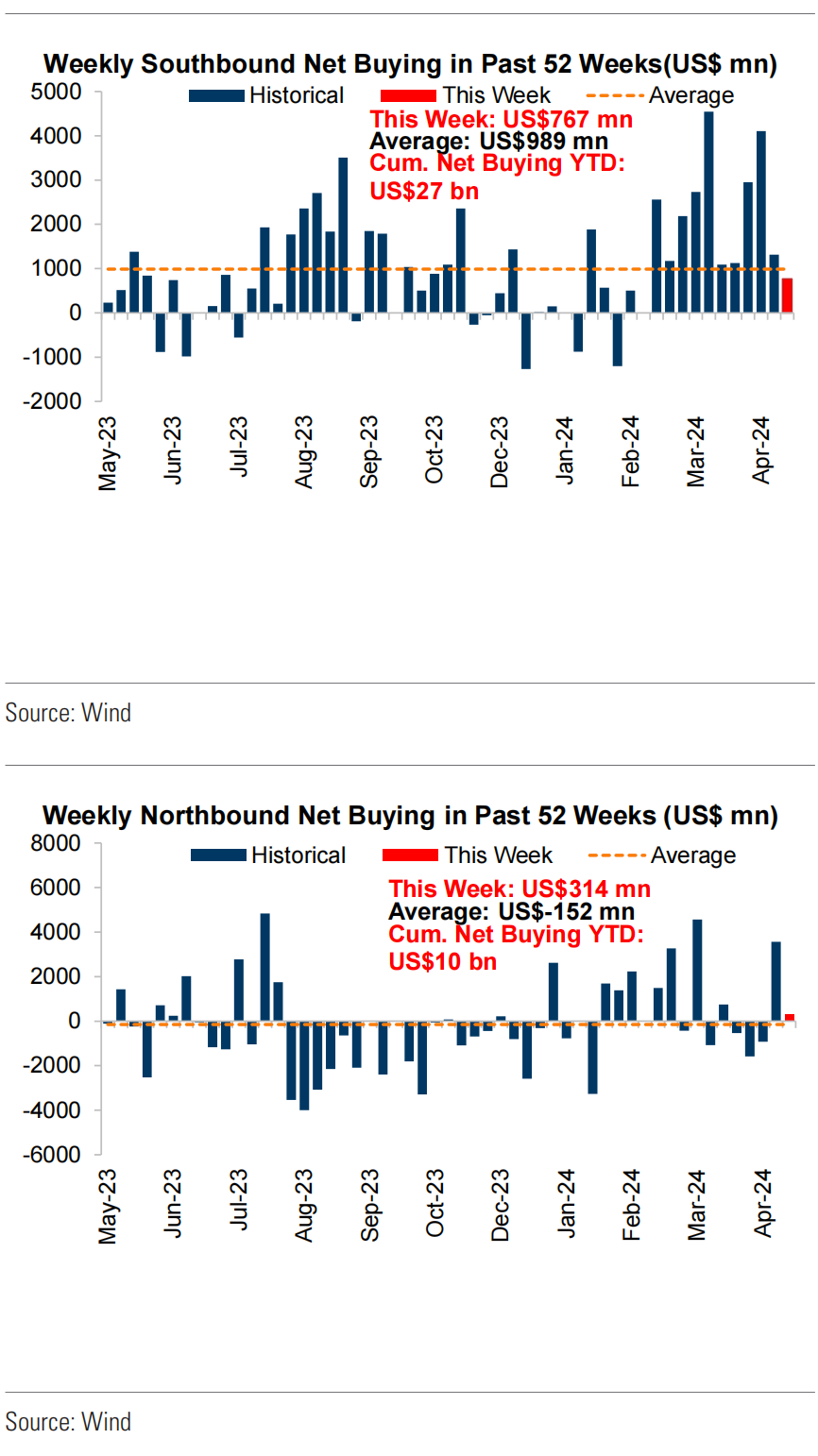

Recently, as earnings season concludes and China’s Politburo meeting sets the tone, expectations for easing and reform have strengthened. With less room for U.S. equity speculation, global investors show growing appetite for undervalued Chinese assets, significantly lifting risk appetite toward China. Just months ago—from last autumn through winter—discussions centered on the failure of the ABC strategy:

EPFR flows into China turned positive, marking the largest weekly net inflow in eight weeks:

One week behind northbound flows, missing the past five-week rally:

This week features relatively light macro data, with focus on speeches by several Fed officials and progress on the Gaza ceasefire. Absent surprises, the rally may extend moderately.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News