Why Can't This Bull Market Replicate the 2021 Altseason?

TechFlow Selected TechFlow Selected

Why Can't This Bull Market Replicate the 2021 Altseason?

Everyone is still "intoxicated" by the highs of 2021; but the altcoin season of this bull market seems far out of reach.

Author: Distilled

Compiled by: TechFlow

Introduction

Over the past two years, I've been fully immersed in the altcoin market. Yet, one persistent question has lingered: when will the long-awaited "altseason," reminiscent of 2021, finally arrive?

In this piece, I'll explain why it hasn't happened yet and offer actionable advice to refine your altcoin strategy.

First, let's define "altseason." Definition: a period when altcoins outperform Bitcoin ($BTC) and prices surge broadly across the board.

It's a time of explosive growth in the altcoin market, driven by euphoric sentiment. Imagine a rising tide lifting all boats—that’s what a strong altseason can do, boosting nearly every corner of the ecosystem. What drives it? A massive influx of liquidity into the market.

Tracking Liquidity Flows

Historically, this liquidity comes from two main sources:

-

New retail inflows entering via centralized exchanges (CEXs)

-

Liquidity shifting from Bitcoin on CEXs into altcoins

This liquidity then cascades down the market cap ladder, extending further along the risk curve. OGs are well familiar with this dynamic, often referring to it as the "path to altseason."

The Lalapalooza Effect

The path to altseason was clear in 2021—but now it’s obscured. I believe the reason is multifaceted, a convergence of several interlocking factors.

Individually, each variable may not shift the needle much. But when combined and aligned in the same direction, their collective impact becomes powerful. This phenomenon, famously described by investor Charlie Munger, is known as the "Lollapalooza effect."

So what are these converging forces? I see several—and will break them down below.

1. Too Many Projects

The market is awash with liquidity, but overwhelmed by extreme project saturation—imagine more boats than waves in the ocean.

Only specific sectors—like artificial intelligence (AI) or the SOL ecosystem—have truly felt the "altseason" wave.

What once was a rising tide lifting all boats has become a selective rotation game—more like PvP in "The Hunger Games."

2. Token Dilution: The Hidden Handbrake

Token dilution—especially from token unlocks—has been a major drag on a 2021-style altseason.

This often-overlooked factor absorbs significant organic inflows. No matter how strong the fundamentals, if supply exceeds demand, price appreciation becomes difficult.

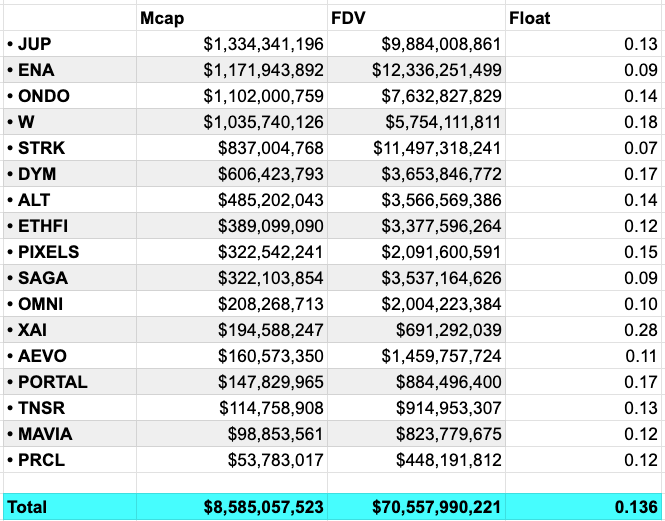

An investor recently sampled major project releases so far in 2024. These projects averaged around 14% in circulation, with over $70 billion in tokens still awaiting unlock.

What happens when market saturation meets oversupply? Altseason conditions become significantly harder to achieve.

3. Adoption: A Double-Edged Sword

Increased TradFi adoption is a mixed blessing. On one hand, it boosts crypto’s credibility and brings more talent into the space.

More talent might seem beneficial, but it also increases market efficiency. If more smart people enter crypto, finding an edge becomes harder.

4. Bitcoin ETFs: A New Dynamic

The approval of Bitcoin ETFs changed the altcoin game entirely. Before ETFs, the primary way to gain Bitcoin exposure was through centralized exchanges.

That was good news for altcoins—investors could easily rotate from BTC into alts.

This time, the buyers are different.

Those buying Bitcoin via ETFs face a more complex pathway into altcoins.

5. Perfect Storm: The Covid-19 Effect

Why was 2021 so remarkable for altcoins? Much of it ties back to unique circumstances.

With lockdowns in place, both capital flows and online engagement were exceptionally high.

This created perfect conditions for crypto to capture retail attention. Given the rarity of such an environment, viewing 2021 as an outlier is reasonable.

Everyone is still chasing the highs of 2021—but this cycle’s altseason feels increasingly distant.

Conclusion

Key Takeaways

-

The altcoin market has shifted from a broad-based rally to a rotation game.

-

With more sophisticated participants, gaining an edge requires deeper effort.

-

Project saturation and massive token overhang are draining liquidity.

-

The traditional path to altseason has been disrupted, primarily due to Bitcoin ETFs.

Practical Advice

There’s a lot covered here—so let’s make it actionable:

-

Focus on Fully Diluted Valuation (FDV) and saturation rates.

-

Monitor ETF developments and industries with heavy institutional involvement, such as RWA. In the coming years, these may present distinct—and potentially more favorable—opportunities.

-

When the market is flooded with alts, don’t just look at dollar value. Compare altcoin valuations against Bitcoin ($BTC). Holding higher-risk, lower-return assets makes no sense. Evaluating altcoins relative to Bitcoin offers a clearer signal of strength.

-

Work hard for your edge. It’s not just about accumulating assets—it’s also about deepening your knowledge, skills, and network.

Opportunities in crypto remain abundant—but they demand greater effort and fresh perspectives. With fast-moving markets, success will favor those who adapt quickly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News