The "Land Finance" and "Salinization Dilemma" of Public Chain Ecosystems

TechFlow Selected TechFlow Selected

The "Land Finance" and "Salinization Dilemma" of Public Chain Ecosystems

Currently, there are only three major asset classes in the true sense: BTC, ETH, and Stablecoins.

Authors: BeWater Giga-Brain & 0xLoki

1️⃣ The Eternal Driving Force: Asset Issuance

Recently, I came across an interesting concept—【the salinization of public chain land】. Vast tracts of land (L2s) are being developed, yet few seedlings (DApps) are planted. If we liken a public blockchain to land, its ecosystem resembles the industries built upon it, which can be abstracted into a "fiscal entity." From this perspective, similar to governments, ETH (or other blockchains) system revenue (or distributable value) can be divided into three parts:

(1) Direct income / taxes (Gas fee);

(2) Fiscal deficit (block rewards);

(3) Non-tax revenue, primarily land finance (asset issuance);

According to TokenTerminal data, ETH’s annualized fees (equivalent to tax revenue) are approximately $6.9 billion, while non-tax revenues include:

(1) In May 2020 (before DeFi Summer), the total market cap of ERC20 tokens was nearly 100% of ETH's market cap, around $100 billion; currently at $449 billion, or 103% of ETH’s market cap;

(2) Total market cap of DeFi tokens is $115.3 billion, about 26% of ETH’s market cap;

(3) Combined FDV of Top 10 L2s is $97.3 billion (with circulating market cap over $30 billion), roughly 22% of ETH’s market cap;

The market caps of ERC20 tokens, DeFi tokens, and Top 10 L2s are respectively 65x, 16x, and 14x ETH’s annualized fees. Thus far, the driving force behind the ETH ecosystem—and indeed the entire crypto industry—is not mass adoption of applications, but asset creation/issuance.

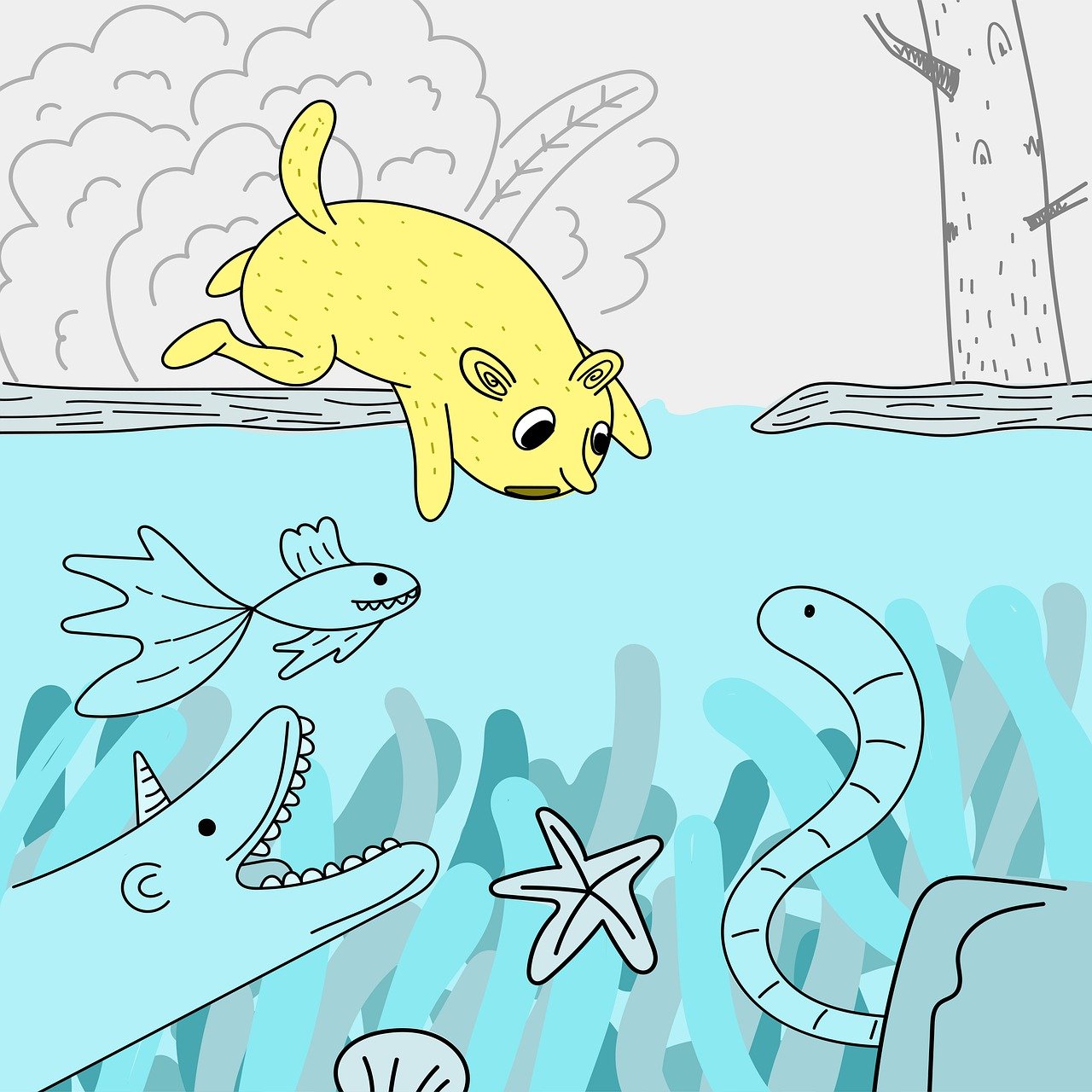

This trajectory holds true for ETH: from large-scale ICOs, to DeFi Summer, NFT Summer, then L2s, and now Restaking. Non-ETH ecosystems follow the same pattern—RWA, Memes, SocialFi, and inscriptions—all revolve around asset issuance, differing only in 【what kind of assets are issued?】 and 【how they are issued?】

2️⃣ ETH Ecosystem Development Through the Lens of Land Finance

Land finance originated from local government fiscal gaps caused by tax reform. Undeniably, land finance played a positive role in economic growth for a long time, enabling initial capital accumulation and urbanization. In the simplest model, land-related revenue becomes government income, which is then used for investment, transfer payments (including salaries for public healthcare and education), further stimulating consumption and employment. The rising 【nominal market value】 of housing fixes the newly created value, granting everyone wealth (statically) or income (dynamically).

Public chain ecosystem development follows a similar logic. Early ICOs resembled unplanned urban sprawl, whereas DeFi Summer, GameFi, and NFT booms were more like planned urban development. Competitive L1s and L2s resemble new satellite cities built to relieve congestion when the main city reaches capacity.

The benefit of this process is continuous creation of new assets. When building new districts, not only housing but also commercial spaces, transportation, medical facilities, and schools must be developed—sparking massive investment waves. In blockchain terms, this translates to constant issuance of new protocols and assets, fueling ecosystem prosperity during bull markets.

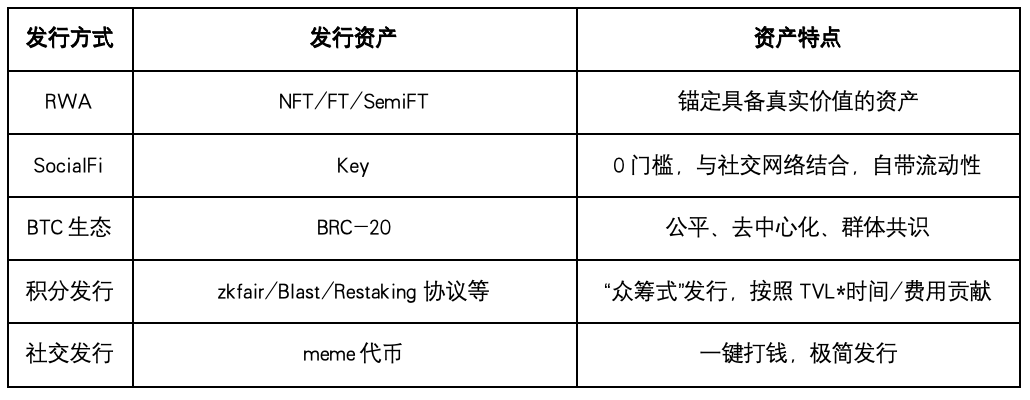

A prime example is the Curve ecosystem. If we view Curve as a residential community, we see that not only homes but also property management rights, parking spots, ground-floor shops, and even convenience stores at the entrance have all been securitized (tokenized). This approach is controversial: supporters argue 【it reflects ecological prosperity and efficient division of labor】, while critics claim 【taxes in Goose Town have already been collected 90 years in advance】.

Source: @mrblocktw

3️⃣ Abuse of Land Finance Leads to Salinization

2022 marked a turning point for competitive L1s and L2s, against the backdrop of ETH’s monthly total gas usage increasing 62.3x between January 2017 and November 2021. Essentially, competitive L1s and L2s absorbed spillover demand from ETH. Applying the land finance analogy: when the central city can no longer accommodate overflow investment and residential demand, satellite towns and new districts emerge. The land sale proceeds captured by these new zones fund infrastructure projects, restarting the economic cycle.

Source: Glassnode

However, this cycle cannot continue indefinitely. First, after the 2022 bear market, demand spillover disappeared. Second, reinventing the wheel repeatedly is unsustainable—just as schools in the city center open branches in suburbs, DeFi and infra protocols on ETH can migrate to other L1s and L2s. As a result, many L2s now exhibit signs of salinization. The root cause is that most of ETH’s demand serves 【asset issuance】, leaving L2s without issuance capabilities inherently flawed.

A clear example: only ETH, BTC, and Solana have seen truly successful meme coins (in terms of market cap, longevity, and community热度). On L2s, the relatively well-known AIdoge has a current market cap of just $120 million.

Additionally, this asset-centric ecosystem development has spawned several notable models.

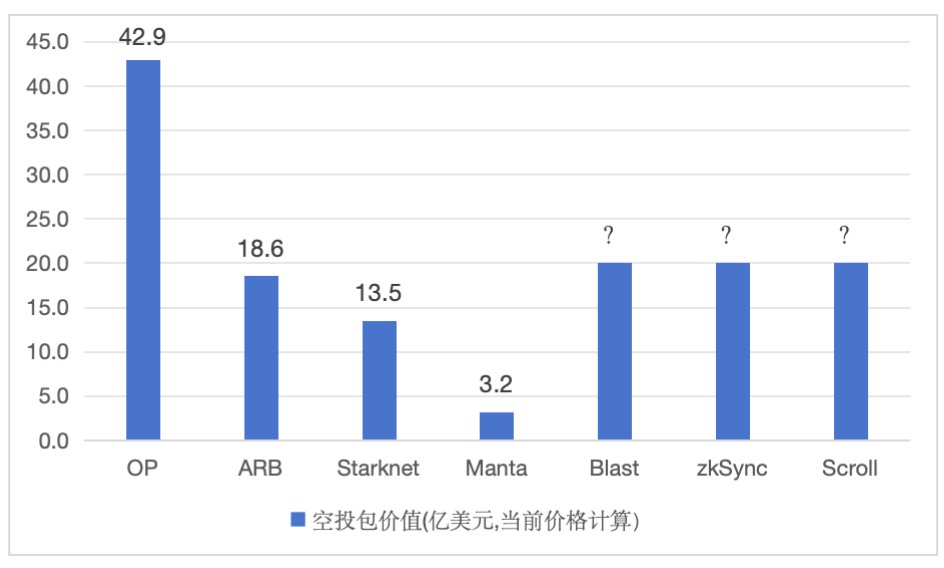

The first is the rise of Airdrop Hunters. Analogous to land finance, consumer-facing airdrops resemble 【monetized urban renewal】—first allocating land to secure funding for infrastructure, then rewarding early residents (users). Their activities attract more participants, whose economic activity increases land value. Hence, we observe increasingly generous chain incentives and disruptive players like zkFair, Blast, and Manta. However, this leads to escalating competition, shorter-lived incentive effects, and a growing number of emotionless yield farmers.

The second is developer incentives. Business-facing airdrops resemble industrial policy. Governments offer favorable conditions—nearly free land, low-interest loans, administrative support—to enterprises setting up in new industrial parks, requiring them to generate sufficient tax revenue after a certain period. In crypto, blockchains provide investments, incubation, marketing partnerships, and token incentives, expecting protocols to contribute TVL, user count, and transaction volume. There are many such cases; some chains even establish dedicated entities (e.g., Near’s Proximity Labs) to promote ecosystem growth.

Whether targeting consumers or developers, subsidized output often fails to cover costs over extended periods, leading to issues: 1) Programming for subsidies—for example, homogenous projects on Blast; 2) Sharp user decline post-incentive, turning chains into “ghost chains.” Yet these incentives aren’t meaningless—technological innovation and new market formation always involve some degree of bubble.

4️⃣ Seeking Fertile Ground

【Land salinization】 implies the need to seek higher efficiency. One of Charlie Munger’s investment principles is 【fish where the fish are】. In crypto, “fish” means asset creation (or issuance) capability—only large ecosystems or those with new asset creation potential will offer significant opportunities.

The Bitcoin ecosystem represents today’s largest and only full-stack opportunity. The emergence and evolution of inscriptions mark a Bitcoin-native 【Renaissance】. Art doesn’t directly boost productivity, nor do inscriptions—but they transform issuance mechanisms, returning Bitcoin to the center of crypto attention and rallying community consensus and participation. Today’s Bitcoin ecosystem resembles Western Europe centuries ago, where Bitcoin L2s like Merlin, Bitlayer, BSquare, RGB++, and capital-intensive DeFi projects like BitSmiley are poised to ignite an industrial revolution that transforms productive forces.

ETH’s growth rate may slow in this cycle, but it remains firmly on the right path. While endlessly recreating DEXs, animal avatars, or P2E mini-games is pointless, structural opportunities still exist—akin to “new infrastructure” in the traditional world. The first clear opportunity lies in Restaking. We’ve discussed Restaking extensively, but Layer-Native Restaking Derivatives (LRD) are just the beginning; downstream and derivative service areas remain underserved.

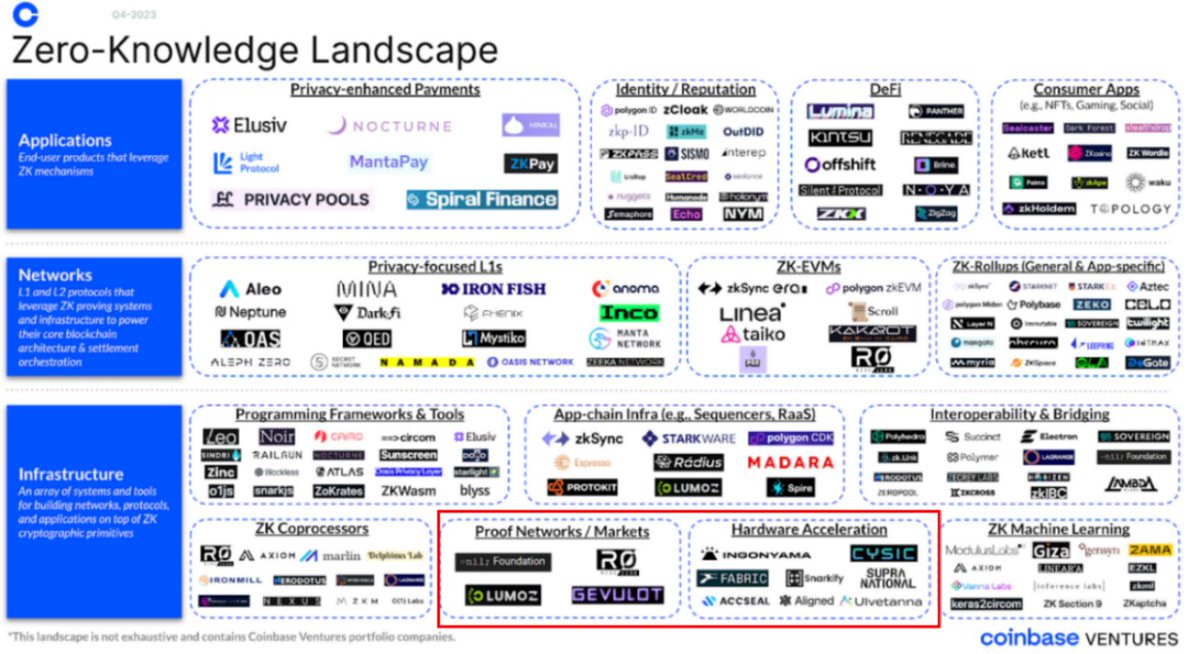

A second promising sub-sector is ZK hardware acceleration. The next 1–2 years could witness mass-scale breakout of ZK technology. However, in practice, most projects must limit ZK proof generation to seconds or minutes. Pure CPU computation is nearly impossible under current conditions, making high-performance hardware acceleration the preferred solution.

Hardware acceleration is to ZK what oracles are to DeFi—an essential and urgent infrastructure need. The probability of billion-dollar (even hundred-billion-dollar) projects emerging here is extremely high. Many such projects are already making steady progress.

Source: @coinbase

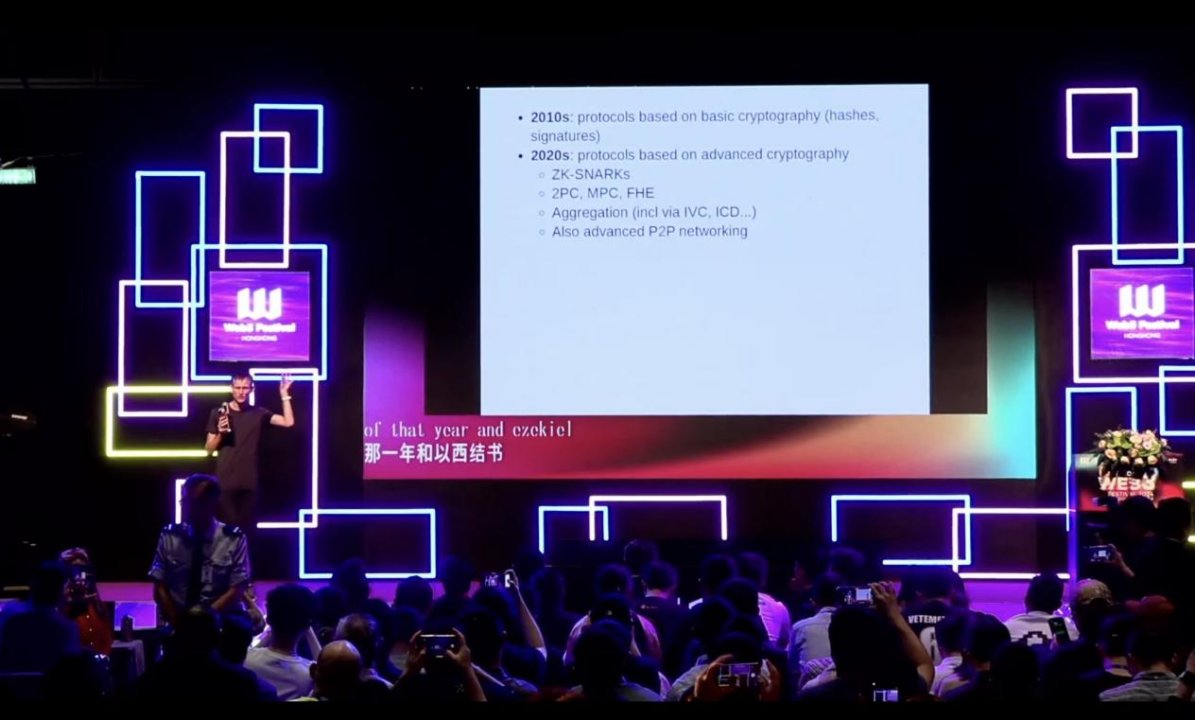

At this year’s Hong Kong Web3 Festival, Vitalik also pointed out inefficiencies in ZK-SNARK proof generation, emphasizing the need for hardware-accelerated proof generation.

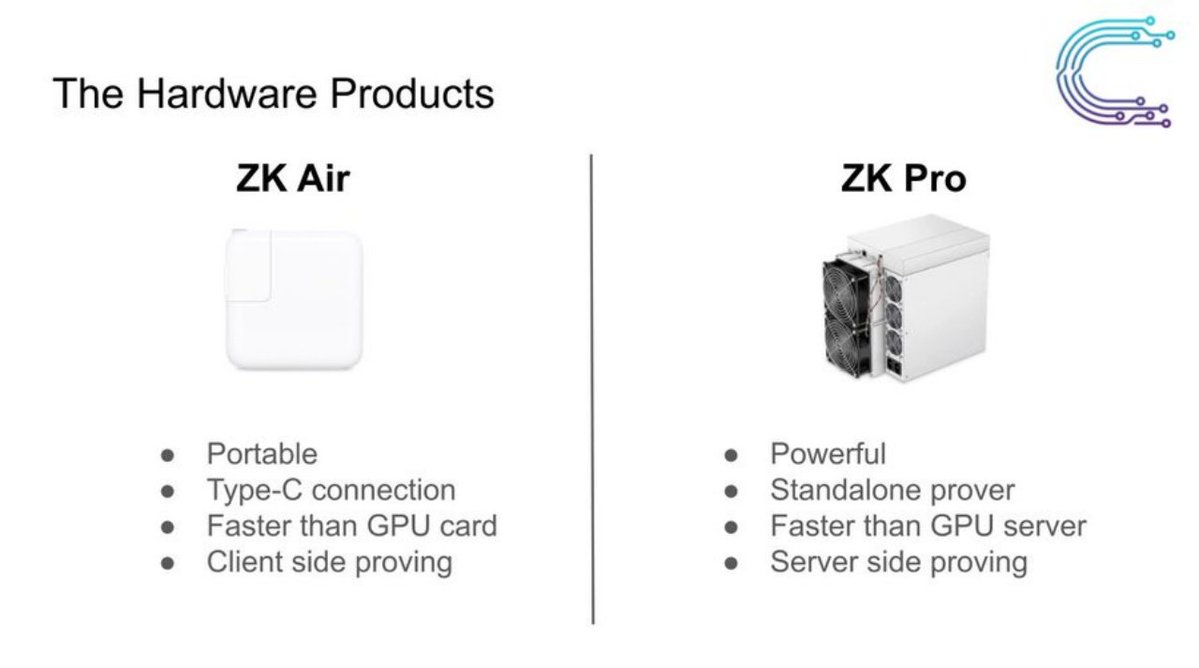

A representative project is Cysic, which acts as a Proof Generation and Verification Layer, providing real-time proof solutions for large-scale ZK applications through both hardware and computing power networks—the two core needs of ZK hardware acceleration.

Source: @cysic_xyz

Moreover, we observe differentiated ecosystem structures emerging elsewhere—for instance, Solana’s DePIN and Meme ecosystems, Near’s AI-driven memes and DA narrative, StarkNet’s active gaming ecosystem. Public chains with strong asset creation capabilities that haven’t yet completed their “urbanization” deserve higher expectations.

The final theme worth watching is improved asset efficiency and the construction of liquidity layers (or asset reuse). When MakerDAO introduced significant RWA exposure and Blast emerged in 2023, the seeds of liquidity layers were sown.

Currently, there are only three major asset classes in any meaningful sense: BTC, ETH, and stablecoins. Broadly speaking, Restaking has laid the foundation for ETH’s liquidity layer, and Ethena has outlined a blueprint for a stablecoin liquidity layer. But the largest asset—BTC—remains at an earlier stage. Recently, this trend has intensified, with Lorenzo, StakeStone, Solv, and others making notable progress. Most notably, Babylon, soon to launch, could fundamentally alter BTC’s “low-yield” status quo by introducing on-chain demand-side returns for the first time. Based on this, Lorenzo and other potential competitors could unlock broader asset utility. Compared to ETH and stablecoins, BTC Restaking and liquidity layer development present greater non-consensus opportunities.

Source: @babylon_chain

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News