VC Community Debate: a16z CTO Criticizes MEME Coins as Resembling Casinos, While Community Enjoys the Ride

TechFlow Selected TechFlow Selected

VC Community Debate: a16z CTO Criticizes MEME Coins as Resembling Casinos, While Community Enjoys the Ride

Fair, fair, and goddamn fair again.

By TechFlow

Whether it's a local dog or a golden dog, if it makes money, it's a good dog.

This might have become the true psychological reflection of retail investors in the crypto space.

As meme coins frequently emerge among the top 50 cryptocurrencies by market cap, and Solana repeatedly spawns overnight success stories, people have shifted from missing out to being "convinced by price surges." Recognition of meme coins is gradually taking shape.

Does everyone love memecoins? Not quite.

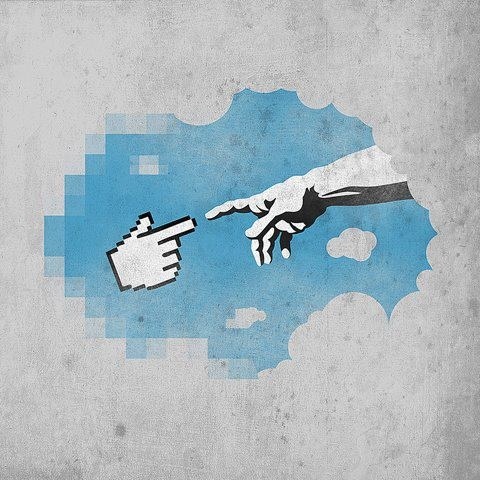

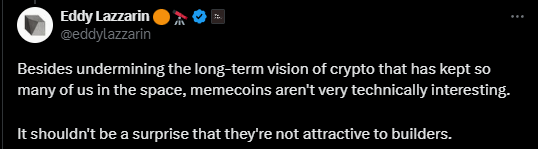

Take Eddy Lazzarin, CTO of A16Z, for example.

In a recent Twitter thread discussing the value of meme coins, Eddy clearly stated:

"Memecoins undermine the long-term vision that keeps many involved in crypto. They're technically uninteresting and unappealing to builders."

When someone pointed out that meme coins attract users and boost activity across different blockchains, Eddy doubled down on his disdain for this effect:

"Attract which users exactly? Providing casino services for a few isn't exciting... Memecoins are changing how the public, regulators, and entrepreneurs perceive cryptocurrency. At best, it looks like a high-risk casino; at worst, a series of deceptive promises masking casinos. This deeply impacts crypto adoption, regulations, and builder behavior. I see this damage every day."

Clearly, A16Z’s CTO sees meme coins primarily as casinos with little real value, harming the industry's image.

From a technical standpoint, meme coins indeed involve little more than changing an image, slogan, and copy-pasting code to launch a token—hardly groundbreaking innovation. From a CTO’s perspective, you can easily understand Eddy’s technical purism and condescension—

What we need are substantial technological innovations, optimizations, or transformations in production relationships—contributions that benefit the industry or the world. Meme coins create nothing but air. How could anyone with technical ambition not be annoyed?

However, the joys and sorrows of VCs and retail investors don’t align. I can understand the CTO, but can the CTO understand the retail investor?

VCs Delay Gratification, Retail Enjoys the Moment

Eddy’s comments naturally triggered pushback from the community.

One particularly insightful comment was:

Instead of criticizing meme coins, why not criticize the destructive pseudo-innovations—like arbitrarily named ERCxxx standards, or those launching massive dust attacks on Bitcoin (sending tiny amounts of BTC to numerous addresses)?

Smells familiar? ERC404 and inscriptions, perhaps?

The implication here is that so-called technological innovations in the industry often serve only to fuel hype—just another form of concept creation. In comparison, meme coins are actually more honest.

And from a purely retail investor perspective, one user’s rebuttal captured the collective sentiment perfectly:

"Meme coins are our chance to beat big institutions. I love memes—even though most will cost me money, catching just one could drastically improve my life. But investing in projects backed by big institutions means waiting days for a tiny return."

Meme coins do three things.

Fairness, fairness, and damn-it-all fairness.

Though “fairness” in crypto comes with quotation marks, compared to the previous cycle where VCs get early access, build up technical narratives, and then sell to the secondary market, retail investors clearly prefer the meme coin model.

This further highlights the irreconcilable conflict between VCs and retail investors:

VCs delay gratification; retail enjoys the moment.

VCs’ delayed gratification is built on extremely high information density and informational advantage. Getting in early and understanding deeply gives them the confidence to wait—it’s the foundation of their investment business model.

Retail investors once practiced delayed gratification too—participating in ICOs and holding tokens, hoping to get scraps after the big players ate. But now, they often get nothing—not even crumbs. Naturally, they lack both the position and motivation to wait patiently.

Thus, meme coins have become retail’s playground—small bets, multiple attempts, hitting one jackpot, and flying skyward.

In an environment starved of opportunities, gambling is inevitable. With no hope outside, within the circle one must seize the moment and place bets. That’s why meme coins resonate so strongly with the average investor.

For elite VCs and CTOs, there may be no need to gamble—their career paths and institutional strategies favor long-term plays. Achieving success through backing technically sound products brings greater professional fulfillment.

Position Determines Perspective

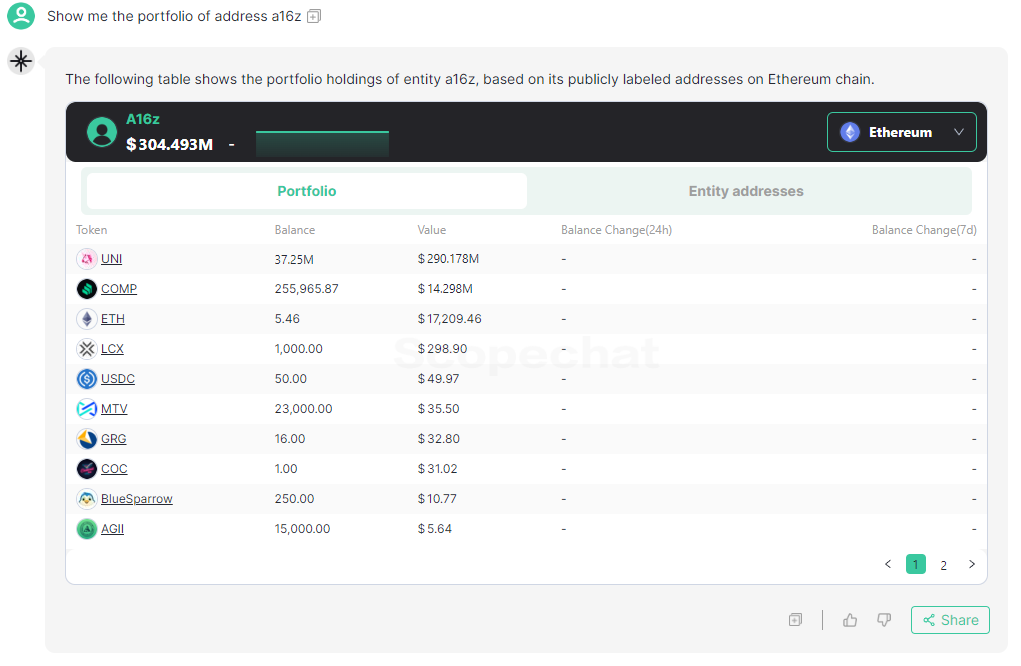

More practically, A16Z’s CTO publicly expressing dislike for meme coins likely suggests they hold no positions in them.

According to on-chain address data tracked by Scopechat and Rootdata, A16Z’s publicly known addresses show Uni as their largest position, followed by COMP and ETH.

In contrast, Jesse Walden, co-founder of Variant Fund, also weighed in on the discussion thread—his tone toward memes notably more tolerant:

"It's debatable which causes more harm:

a) Projects promising breakthrough technologies to mask token liquidity scams

b) Memecoins that promise nothing beyond volatility and entertainment"

While there's no public data confirming whether Variant holds significant meme coin positions, its other co-founder Li Jin previously announced a meme-themed hackathon hosted at Variant Fund’s headquarters. (Read more: When VCs Host Meme Hackathons, Is the Endgame of Crypto Investing Just Memes?)

Clearly, not all VCs reject memes. Many VC firms have actively participated in this meme-driven bull market.

Position determines perspective. When interests aren't at stake, it's easy to objectively criticize meme coins. But once you’re actually invested, no one wants meme coins to collapse.

Amid daily noise filled with criticism or praise, FUD or shilling, all the喧闹 debates hardly matter.

What matters is how you make your position profitable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News