Is Jupiter an amplifier for investing in Solana?

TechFlow Selected TechFlow Selected

Is Jupiter an amplifier for investing in Solana?

Backed by the massive traffic and user base captured by Jupiter, Jupiter is establishing a Launchpad to further capture the value of new projects in the Solana ecosystem.

Author: @charlotte0211z, Metrics Ventures

1 Jupiter: A Leveraged Bet on the Solana Ecosystem

1.1 Will Solana Become the "Ethereum Killer"?

Solana is regaining momentum after the FTX collapse, leading the crypto market surge in Q4 2023 and continuing into 2024 with strong ecosystem airdrops and explosive MEME token performances that have lifted overall market sentiment. Solana has emerged as the top contender to become the "Ethereum killer." We review Solana's growth from data, market sentiment, and ecosystem vitality perspectives, explaining why allocating capital to the Solana ecosystem should be significantly elevated this cycle.

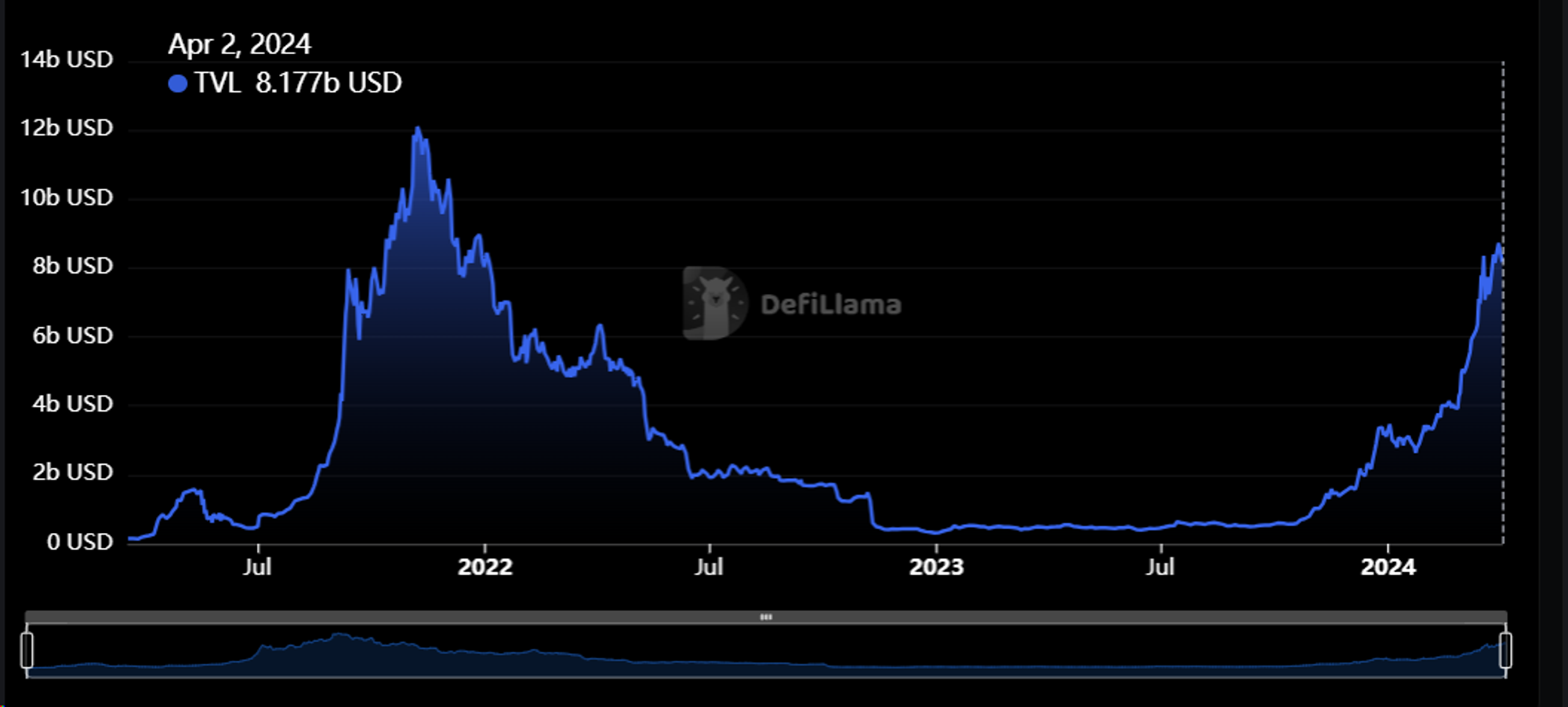

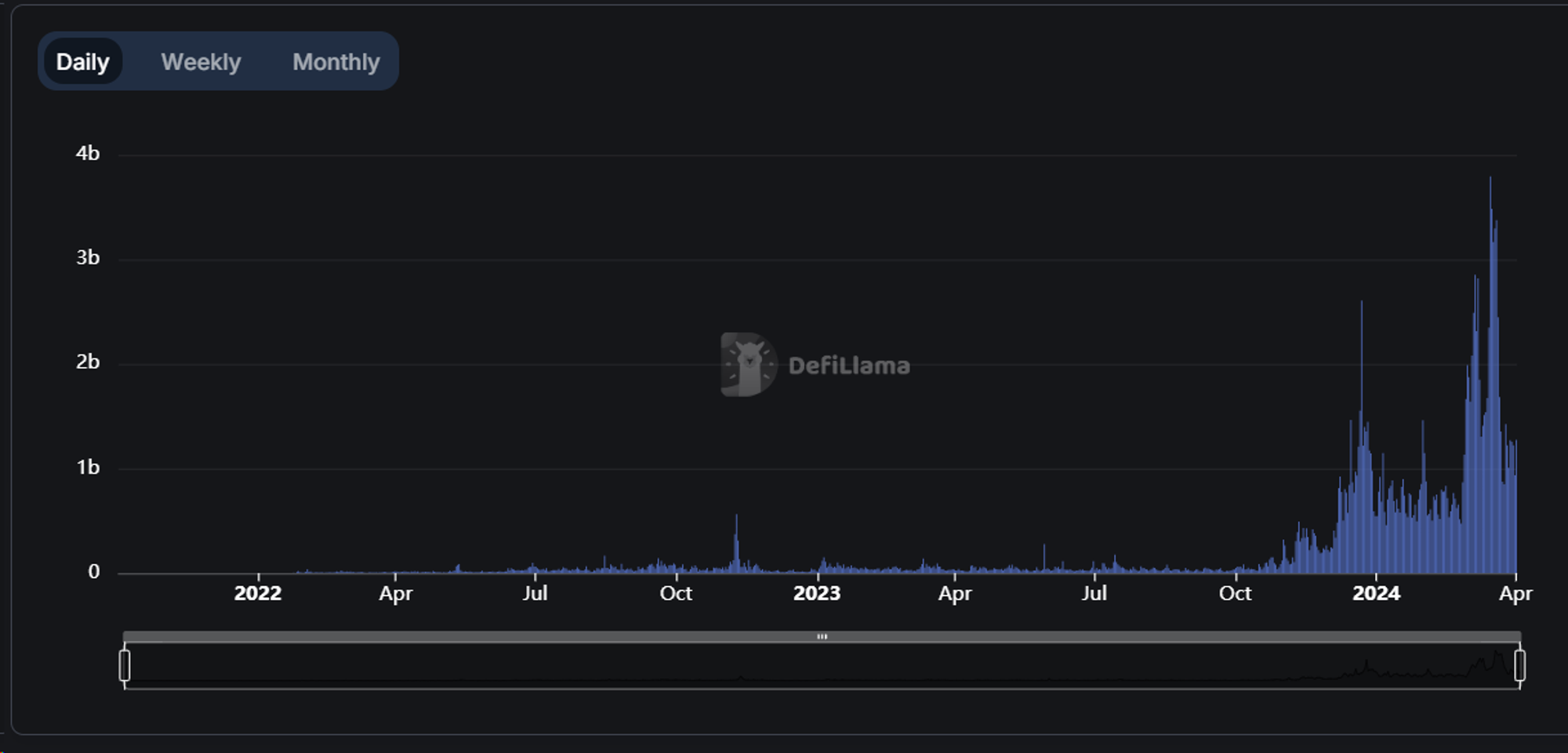

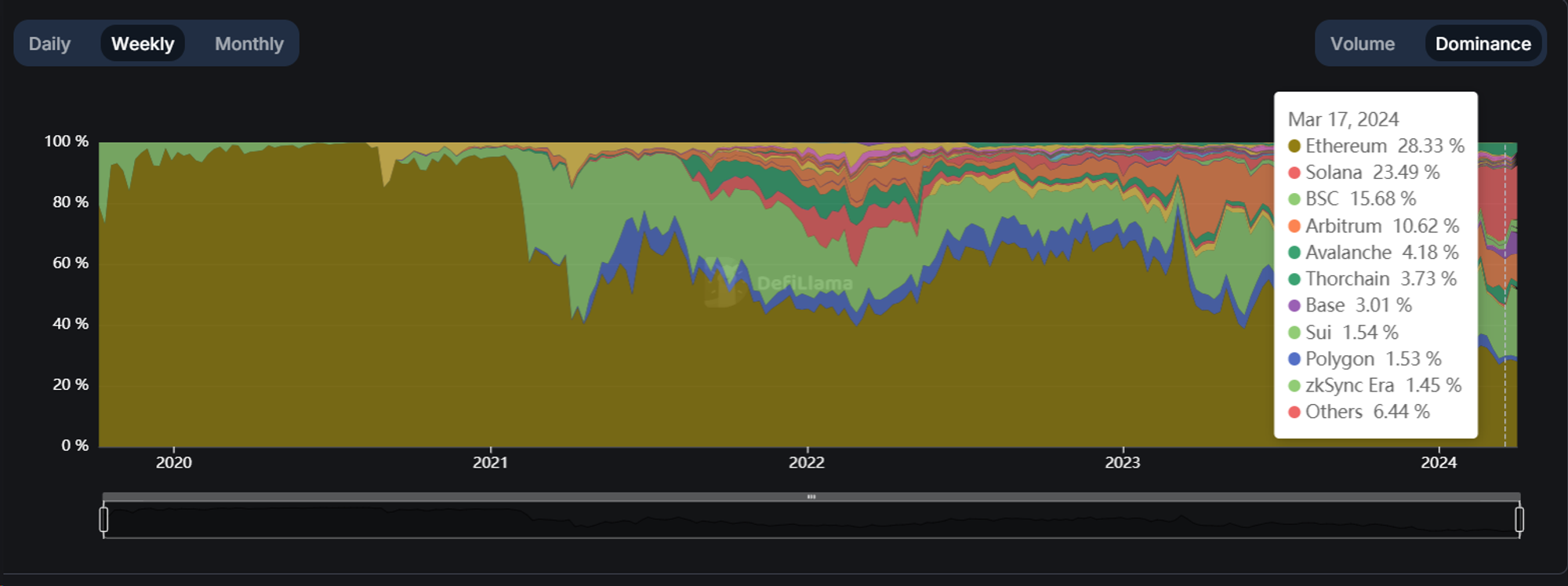

Solana’s key metrics are surging rapidly. TVL began accelerating in Q4 2023, growing from approximately $500M on October 1, 2023, to nearly $8B recently—an increase of over 1500% in just two quarters—approaching its all-time high of $12B in November 2021. DEX trading volume, fueled by MEME tokens, has spiked dramatically; it surpassed $3.8B on March 16, setting a new record. Solana’s share of DEX volume has grown rapidly, at times even surpassing Ethereum. In terms of token performance, SOL’s price has been rising steadily since October 2023 and is approaching its peak near $250, with total market cap already exceeding its previous bull market high.

(Solana TVL Over Time, Source: DeFiLlama)

(Solana DEX Volume Over Time, Source: DeFiLlama)

(DEX Volume Dominance Across Chains Over Time, Source: DeFiLlama)

(Solana Market Cap Over Time, Source: Coingecko)

From other angles such as ecosystem development and market sentiment, several factors explain why Solana's ecosystem is growing rapidly and still has substantial upside potential:

-

Solana has moved past the negative impact of the FTX incident: With SBF’s trial concluded, the FTX collapse is largely behind us. From the perspective of the Solana ecosystem, it has gradually recovered from the lows caused by FTX. Whether looking at ecosystem development, investor sentiment, or market psychology, the negative impact of FTX on Solana has dissipated. According to The Block citing insiders, the 41 million SOL locked up by FTX have attracted multiple bidders, indicating strong demand for acquiring SOL tokens. Both institutional sentiment and capital flows now provide positive signals for Solana’s future growth.

-

Solana has become the primary hub for DePIN projects, with many ecosystem launches upcoming: Thanks to its low fees and high performance, Solana has become the main chain supporting the DePIN narrative. Besides leading DePIN projects like Helium, Shadow, and Hivemapper, numerous AI×DePIN projects have also chosen Solana—including io.net, Render, Grass, and Nosana. Additionally, several major Solana-based projects have yet to launch their tokens, such as io.net and Magic Eden. Following the examples of JUP and JTO, these upcoming token launches and airdrops will continue injecting vitality into the Solana ecosystem.

-

Solana has achieved product-market fit and may become the primary interaction layer for retail investors and new users this cycle: Solana’s high performance and extremely low transaction costs make it ideal for retail traders and lower the barrier to entry for new users. Ethereum L1 transaction fees can reach tens or even hundreds of dollars during peak times—and this cost rises as ETH’s price increases. Meanwhile, L2 solutions suffer from fragmented liquidity and higher complexity for new users. Furthermore, the concept of fair launches resonates strongly with retail investors this cycle. Many believe Ethereum has become dominated by VCs, whereas Solana’s strong support for MEME coins has driven bottom-up market enthusiasm. Simple operations, low-cost entry points, and wealth creation effects will serve as key drivers attracting new retail participants.

In summary, across data performance, ecosystem vibrancy, and market sentiment, the Solana ecosystem has demonstrated robust strength over the past period, showing both sustained growth capability and a logical path for expansion during a bull market. Regardless of whether Solana becomes the “Ethereum killer,” from an investment allocation standpoint, the Solana ecosystem deserves equal weight to Ethereum. In terms of growth potential, it may even offer greater upside.

1.2 Jupiter Will Move in Tandem with Solana

As a liquidity infrastructure provider on Solana, Jupiter will move in lockstep with Solana’s trajectory.

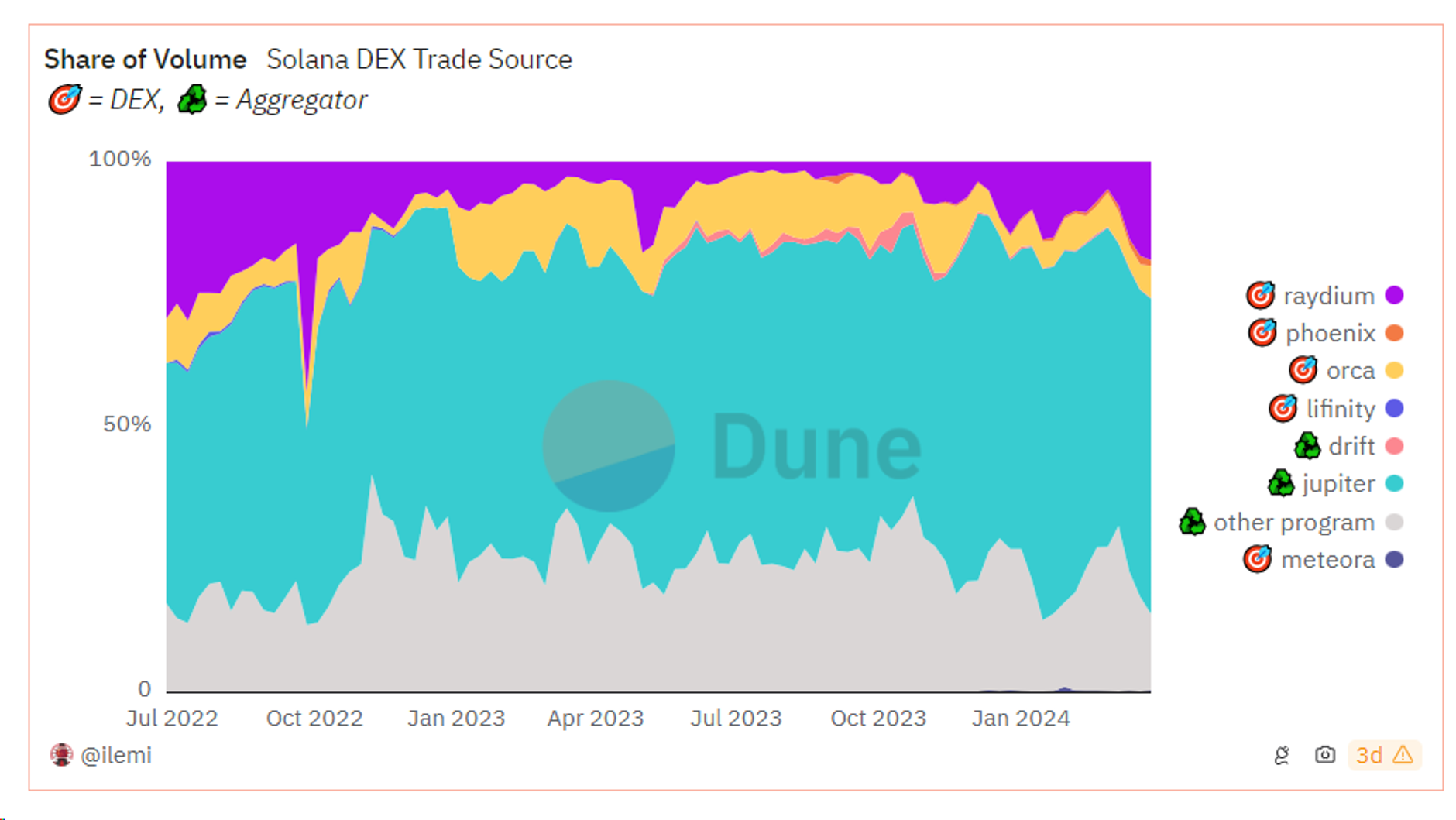

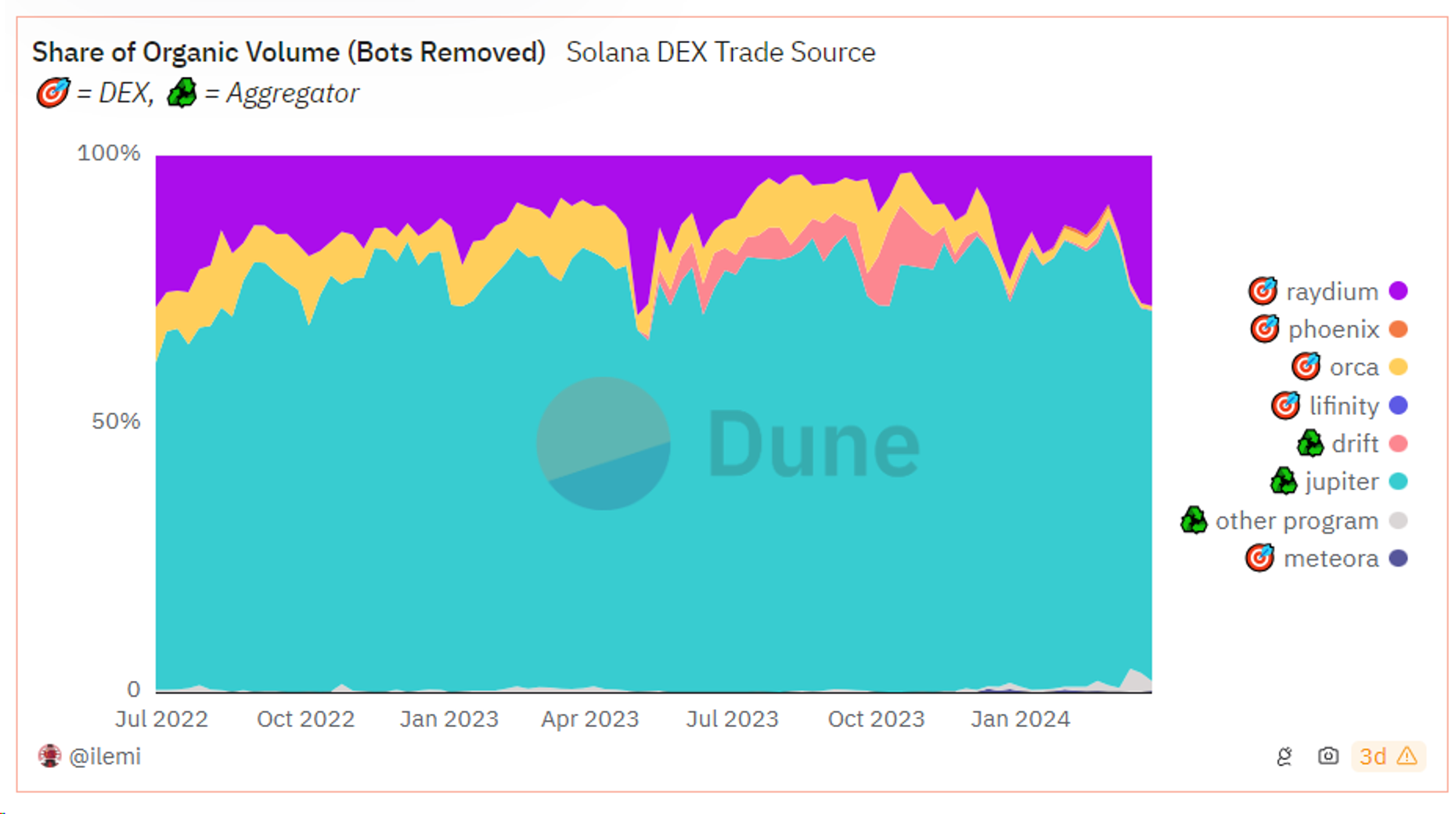

First, on the Solana network, Jupiter routes approximately 50%-60% of total trading volume and over 80% of organic trading volume (excluding trading bots). This means that aside from bot-driven trades, the vast majority of Solana ecosystem traders interact through Jupiter’s frontend. With its foundational role in trading infrastructure and massive user acquisition, Jupiter has become one of the most important protocols in the Solana ecosystem. Moreover, as a DEX aggregator, Jupiter’s significance to Solana far exceeds that of 1inch to Ethereum. Solana is inherently better suited for liquidity aggregators because splitting a single trade across multiple hops incurs minimal gas cost—unlike on Ethereum, where high gas fees create significant friction. As a result, Jupiter’s trading volume rivals or occasionally surpasses Uniswap’s, making it effectively the “Uniswap of Solana.”

Second, Jupiter has launched Jupiter Start and Launchpad. Given Jupiter’s dominant capture of users and traffic within the Solana ecosystem, it is highly likely that future Solana projects will integrate closely with Jupiter—either via the Launchpad or through direct airdrops to JUP holders. Thus, Jupiter stands to benefit greatly from the emergence and growth of new projects in the Solana ecosystem.

In terms of token performance, Jupiter and Solana have seen broadly synchronized price movements. Over the past month, JUP has outperformed SOL, reinforcing its status as a leveraged proxy for SOL exposure.

2 Fundamental Analysis: Top DEX Aggregator on Solana

Launched in November 2021, Jupiter’s product suite consists of two core components: trading infrastructure and the LFG Launchpad. The trading infrastructure includes liquidity aggregation, limit orders, DCA (dollar-cost averaging), and Perps trading. This section provides a brief overview of Jupiter’s products.

2.1 Liquidity Aggregation

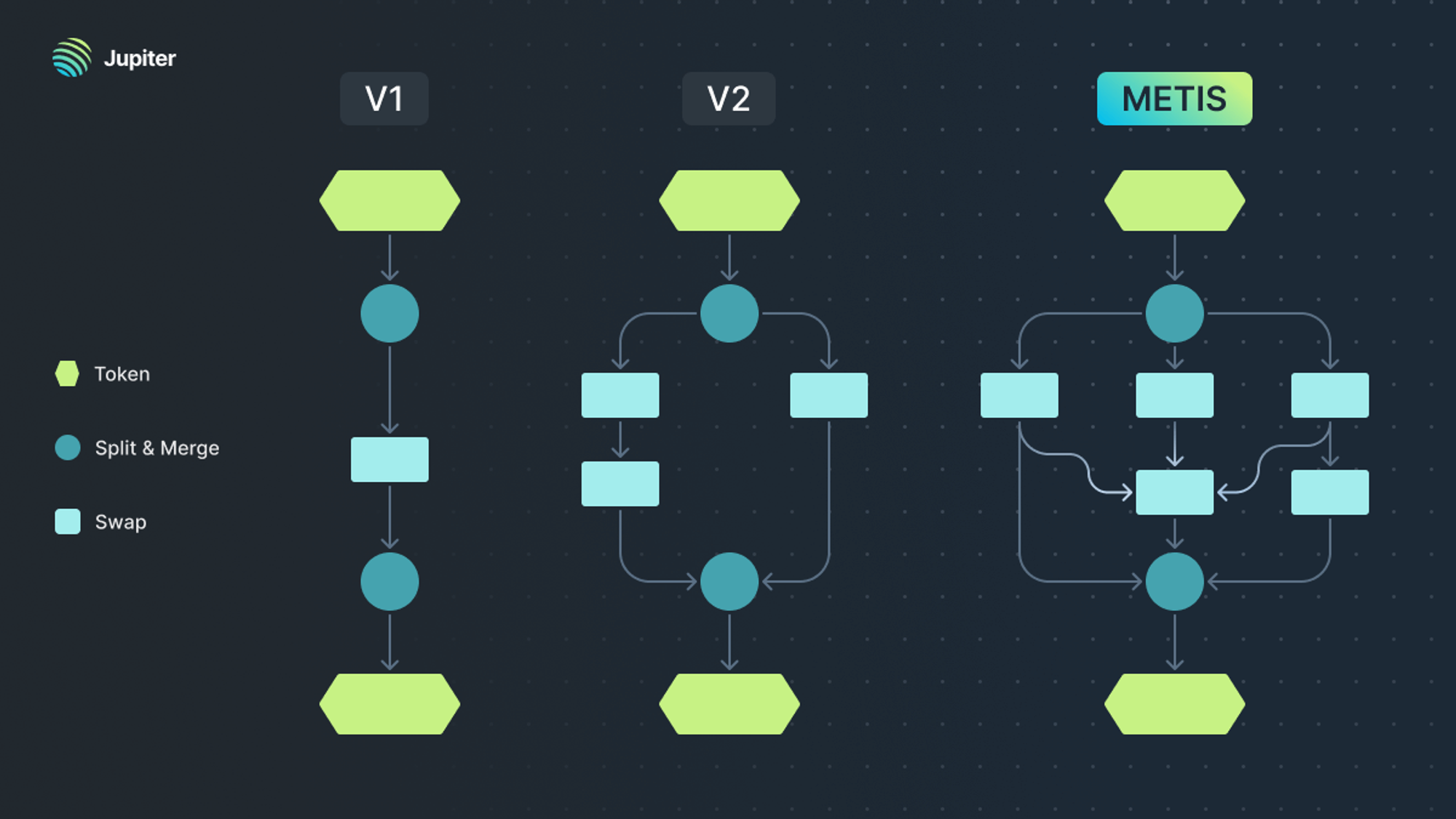

Token prices change rapidly, and the best execution price isn’t always found on a single DEX—it often requires routing across multiple DEXs. As a liquidity aggregator, Jupiter finds optimal swap paths across all major DEXs and AMMs on Solana, minimizing slippage and fees to deliver a more efficient and user-friendly trading experience. Aggregators primarily use two methods: multi-hop routing and order splitting. Multi-hop routing uses an intermediate token (e.g., A→C→B) to achieve better conversion rates between A and B, while order splitting divides a large trade into smaller ones executed across different DEXs.

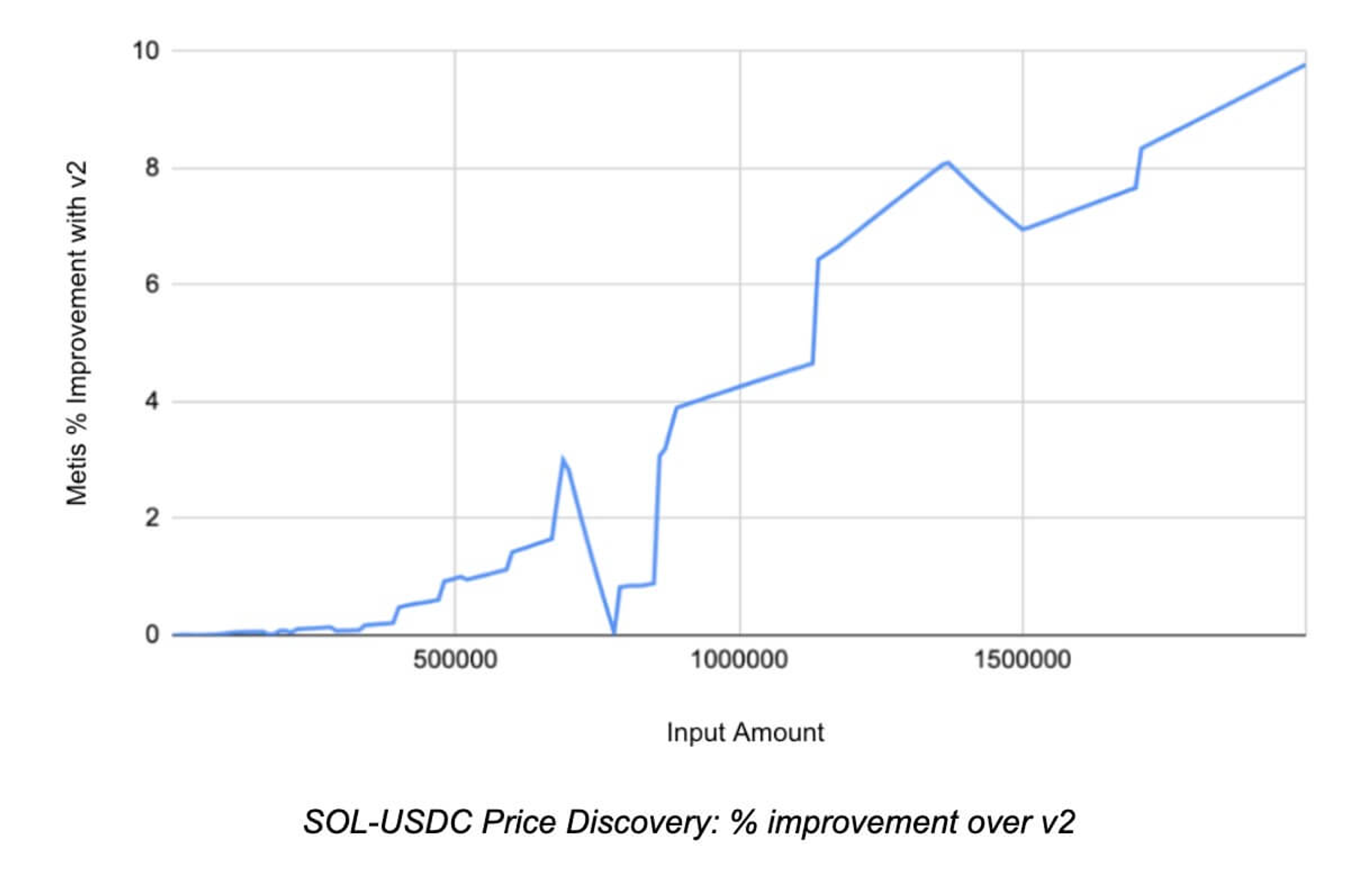

Jupiter currently employs an algorithm called Metis, designed to deliver optimal pricing under Solana’s fast block times. Compared to V1 and V2, Metis supports more complex and flexible routing paths, enabling superior price discovery. It also expands the number of supported DEXs and demonstrates stronger quote performance for large trades. According to official Jupiter data, Metis delivers average improvements of 5.22% over the V2 engine, with gains increasing alongside trade size.

Currently, Jupiter does not charge users for aggregation services. Instead, it functions as a front-end interface that captures attention and traffic within the Solana ecosystem—making it well-suited for launching the Launchpad business. However, during the last Solana MEME wave, Jupiter’s position as the primary trading front-end was challenged by trading bots. These bots offer more intuitive interfaces and built-in features like sniper tools and token information lookup, making them naturally optimized for MEME trading. Additionally, Jupiter’s pace of listing new token pairs fails to meet the rapid demands of MEME launches, requiring certain liquidity thresholds before display.

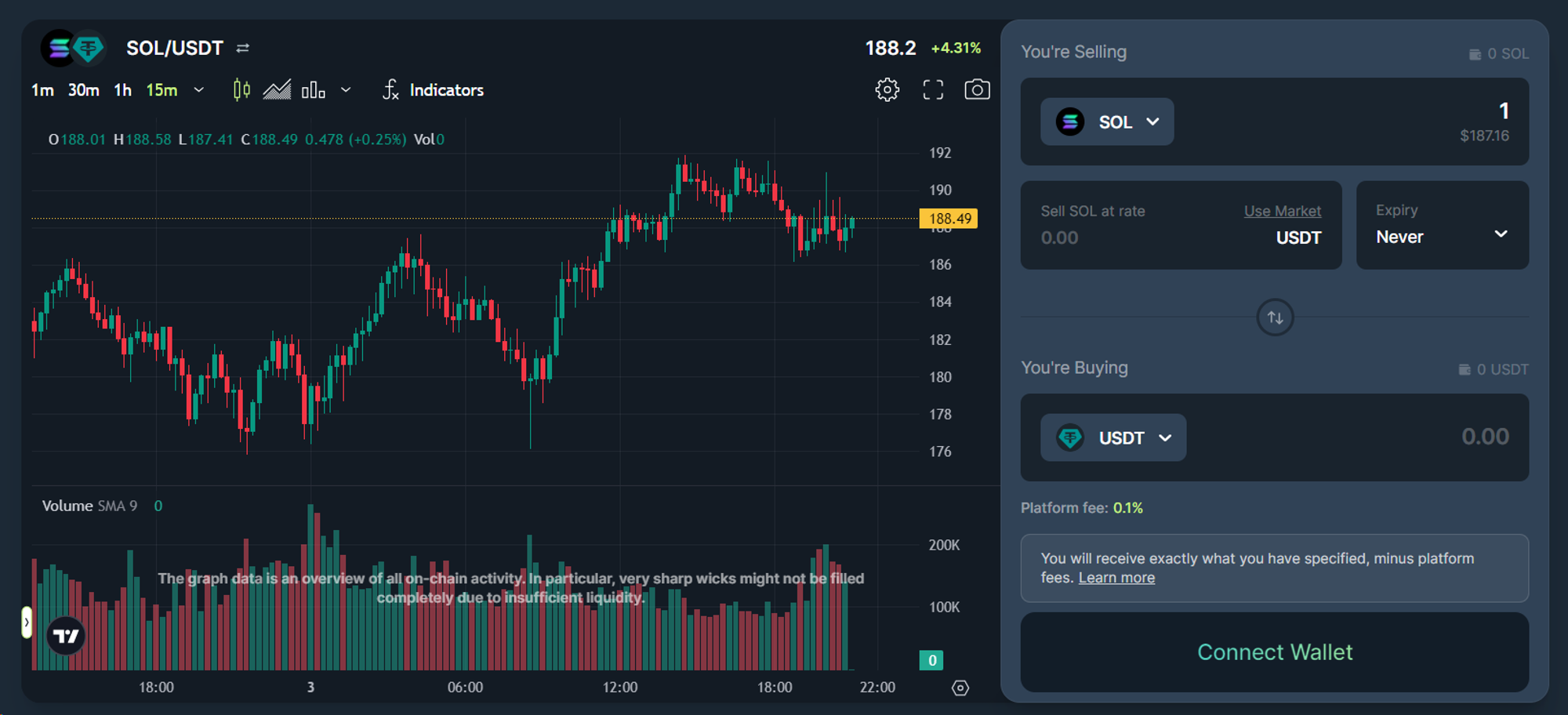

2.2 Limit Orders

Jupiter offers limit order functionality, giving users a CEX-like trading experience and helping avoid issues like slippage and MEV caused by rapid on-chain price fluctuations. Like other on-chain limit order platforms, Jupiter’s system is not an order book model. Instead, Keepers monitor prices via the Jupiter Price API and execute trades when target prices are reached. Leveraging Jupiter’s liquidity aggregation, limit orders can source liquidity from multiple pools across Solana.

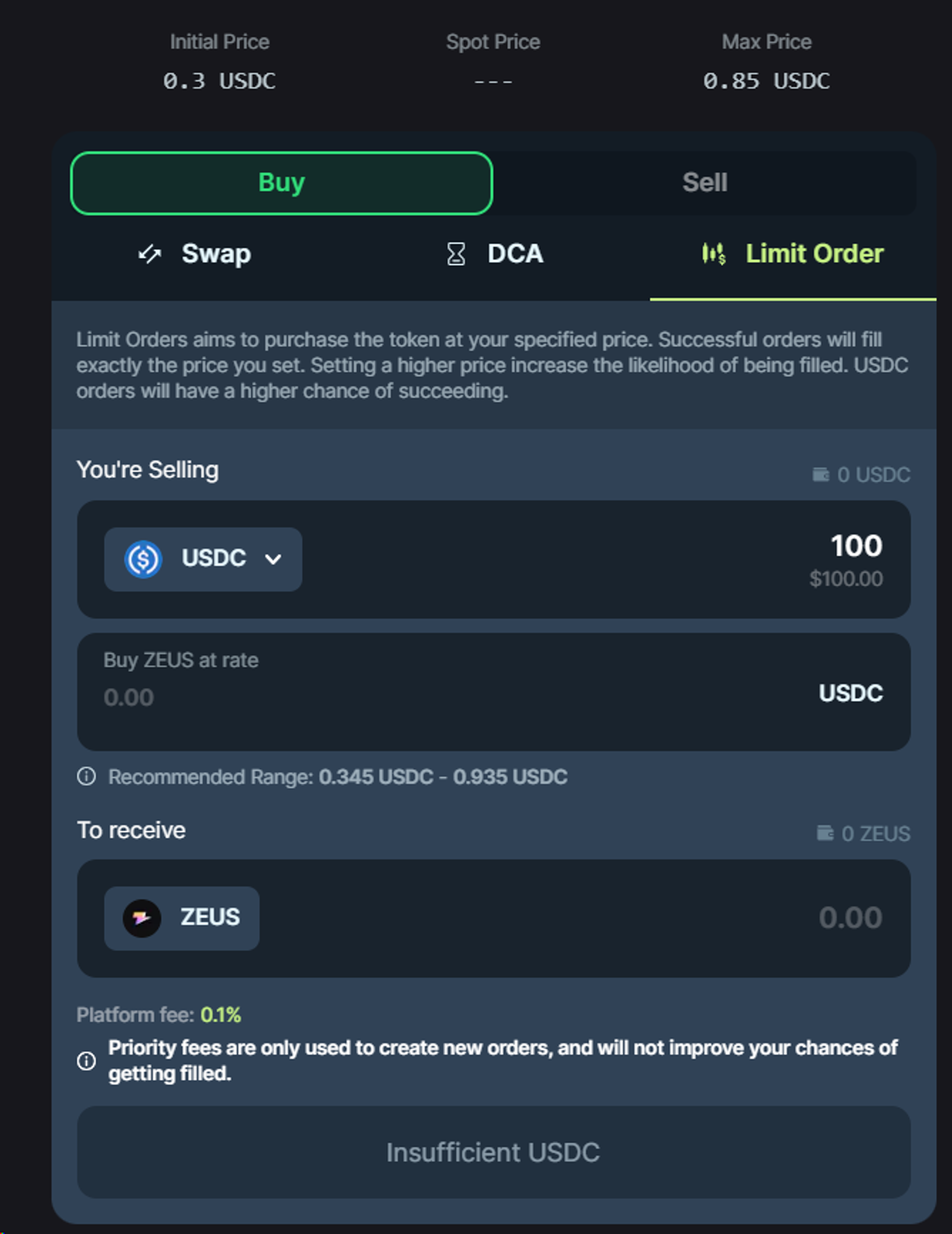

Currently, Jupiter supports trading between any token pair, offering a more convenient experience than many CEXs. It also partners with Birdeye and TradingView—Birdeye supplies on-chain price data, while TradingView integrates charts directly into the frontend for enhanced data visualization. Jupiter charges a 0.1% platform fee.

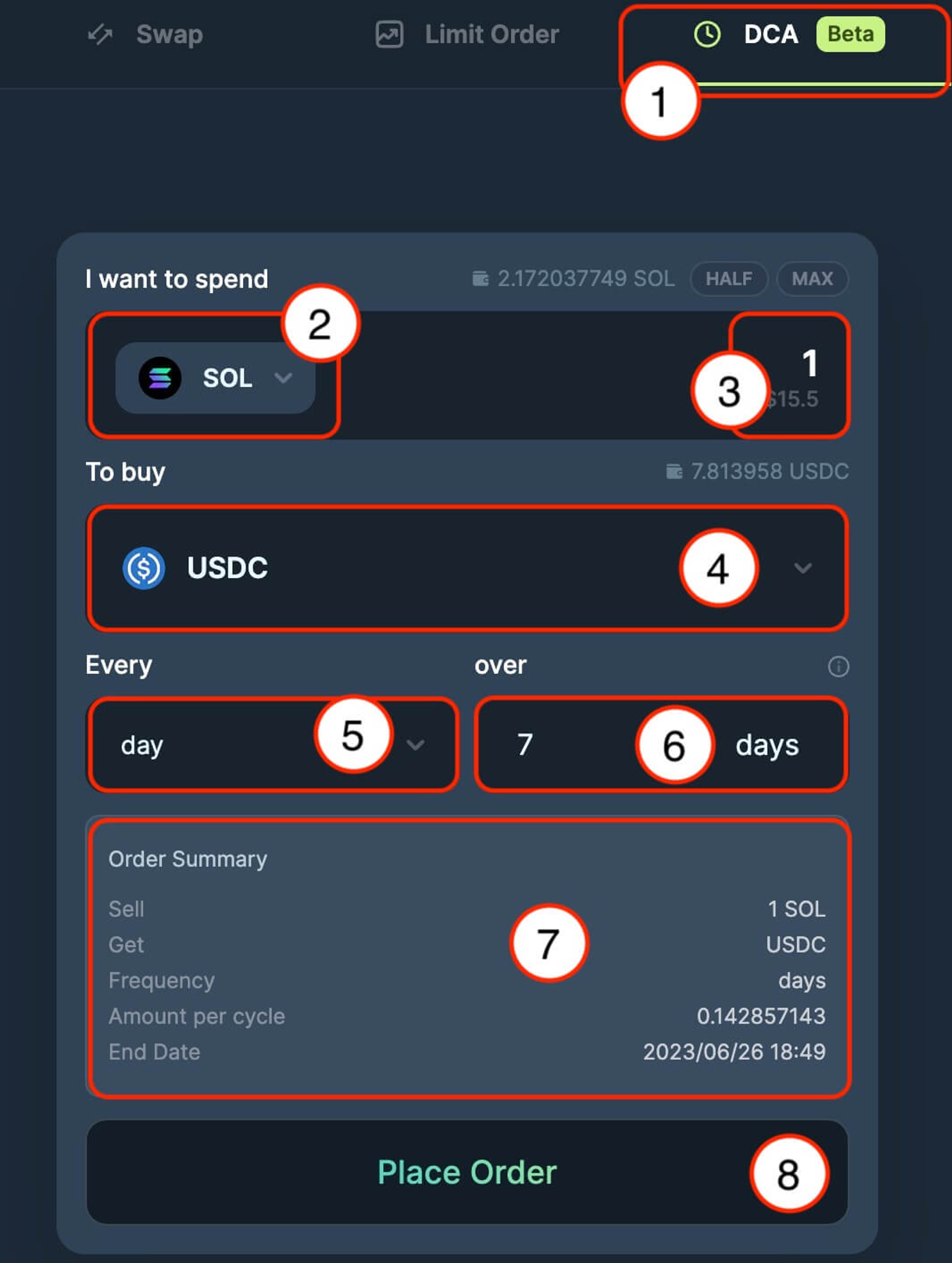

2.3 DCA

Jupiter DCA (Dollar Cost Averaging) enables users to automatically buy or sell any Solana-based token at regular intervals over a set period. Jupiter charges a 0.1% platform fee, collected on each executed trade. DCA is a fundamental strategy for both accumulating and exiting positions. By spreading purchases over time, users mitigate the impact of price volatility and achieve a more stable average cost basis. DCA is equally valuable during bull markets when taking profits, and for large trades or illiquid tokens, it allows gradual accumulation to minimize market impact.

2.4 Perps Trading

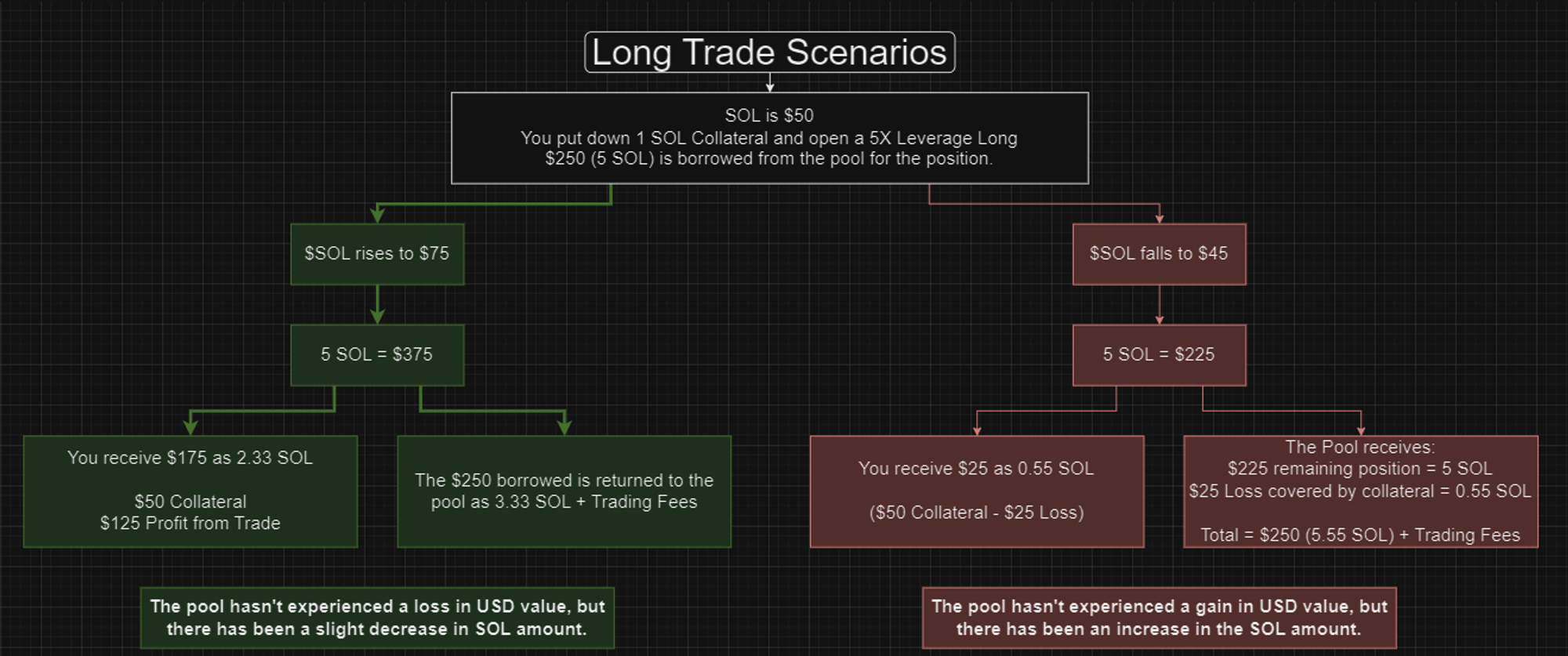

Perps trading operates using liquidity provided by LPs and price feeds from Pyth Oracle, and is currently in beta testing. Its mechanism resembles GMX’s GLP pool model: LPs supply liquidity to the JLP pool, and traders collateralize various Solana assets to open perpetual positions with leverage ranging from 1.1x to 100x. They borrow corresponding liquidity from the JLP pool (e.g., borrowing SOL for long positions, stablecoins for shorts). Upon closing, traders realize gains or settle losses and return residual tokens to the JLP pool. For example, if a trader profits from a long SOL position, the JLP pool’s SOL balance decreases—the profit comes directly from the pool.

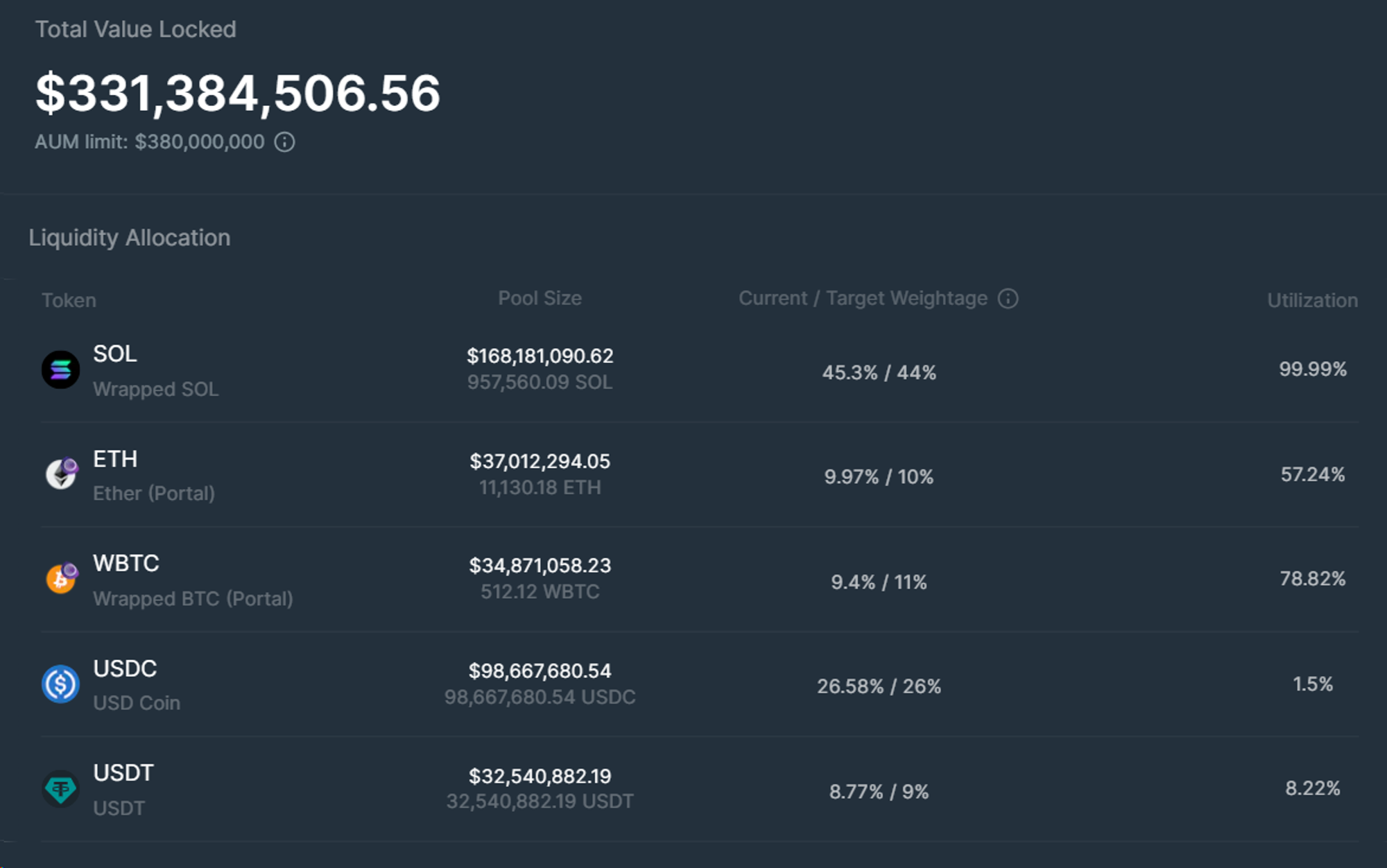

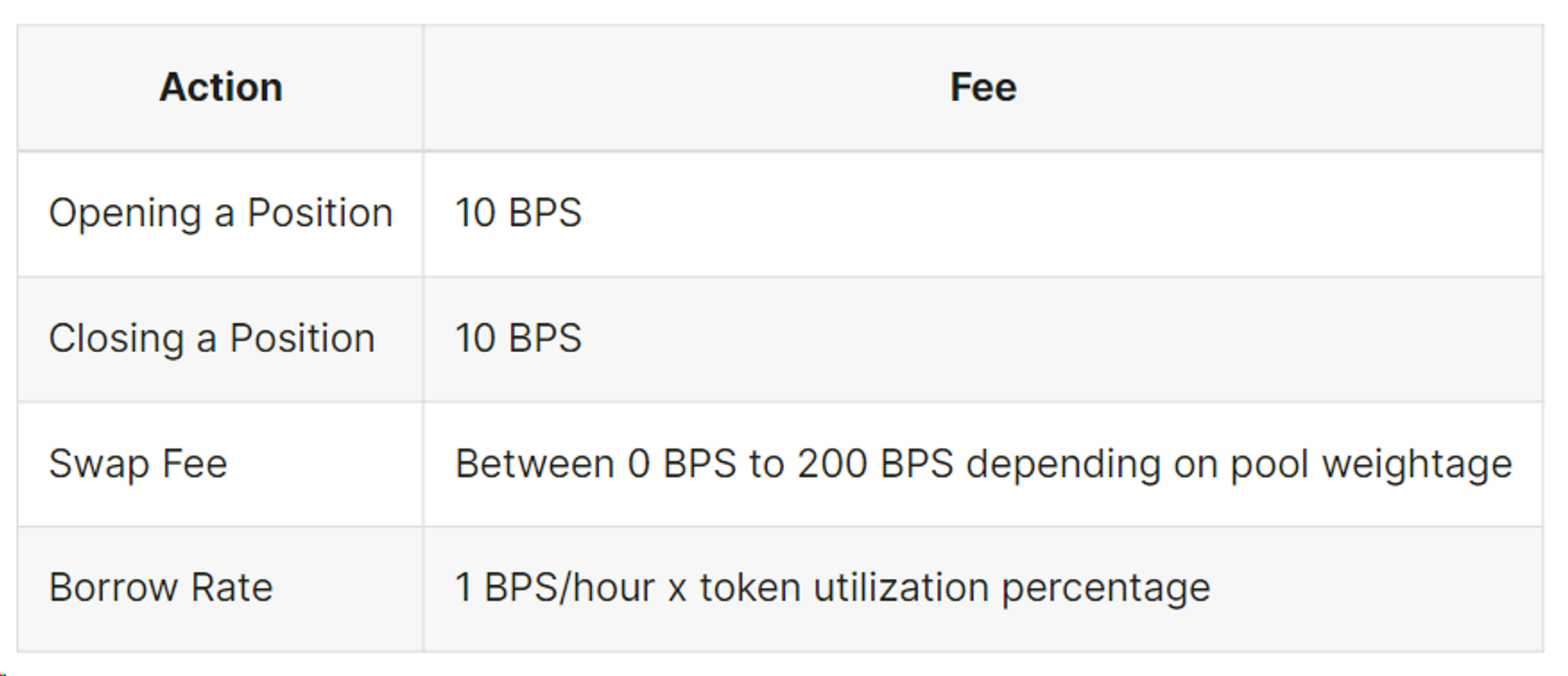

Currently, the JLP pool supports five assets: SOL, ETH, WBTC, USDC, and USDT. The JLP pool receives 70% of exchange revenues, including opening/closing fees and interest on borrowed assets (fee details shown below). The current TVL of the JLP pool is $331,384,506.56, with asset allocations shown in the chart below.

2.5 LFG Launchpad

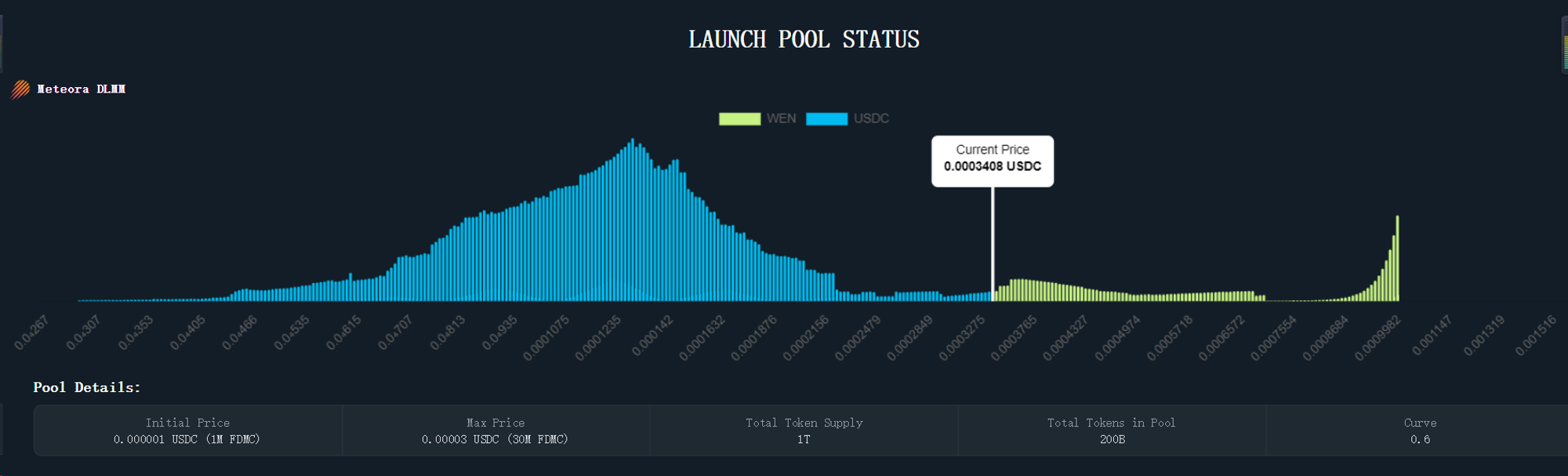

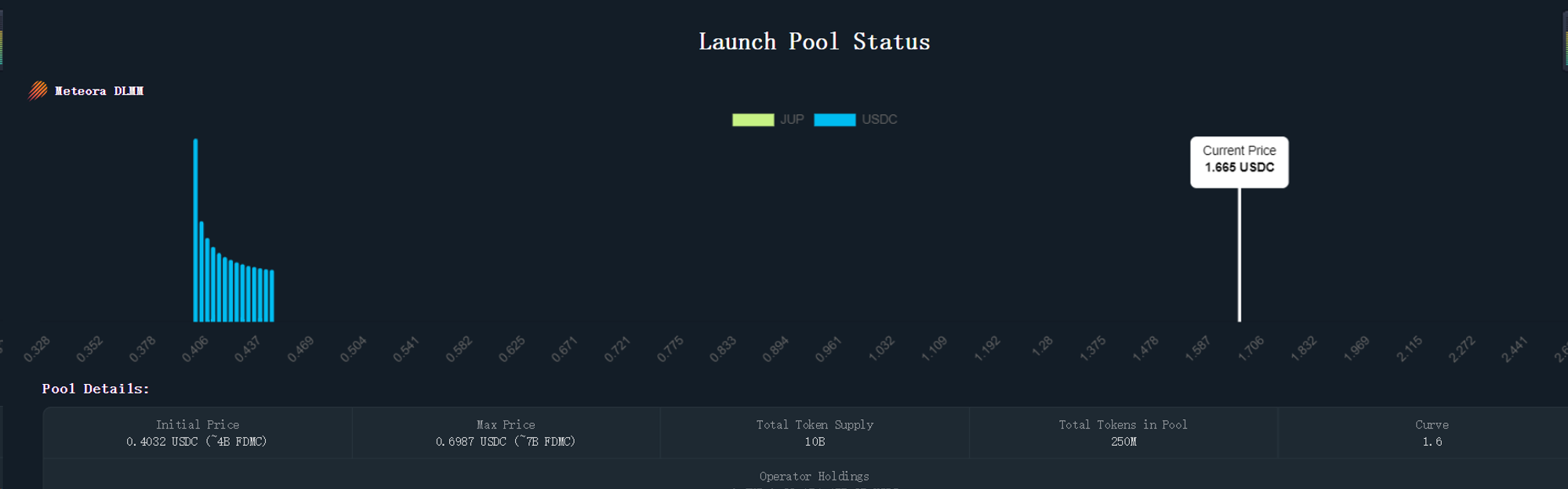

Jupiter launched the beta version of its Launchpad in January 2024 and has already completed token issuances for JUP, WEN, and ZEUS. The main participants in Launchpad include project teams, the JUP community, and token buyers.

For project teams, Jupiter is the largest traffic gateway on Solana. Choosing Jupiter as a launchpad enables maximum exposure to Solana’s user base. Projects participating in Launchpad must allocate a portion of their tokens (typically 1%) to incentivize the JUP community and team.

The JUP community refers to users who hold and stake JUP tokens. They vote to select the next project to launch on Jupiter and receive corresponding rewards. Under the voting rules, users lock a certain amount of JUP to gain proportional voting power. There is no minimum token requirement, but each wallet can only vote for one project. Unlocking takes 30 days, during which voting power gradually diminishes. Currently, Zeus Network and Sharky are scheduled to launch on Jupiter. Benefits for JUP holders who stake and vote include:

-

Launchpad project airdrops: For instance, Zeus Network announced an airdrop to 181,889 addresses that participated in Jupiter LFG Launchpad voting. To attract JUP voters, offering airdrops may become standard practice;

-

Governance rewards: 100 million JUP tokens and 75% of Launchpad fees will be allocated to governance incentives, distributed quarterly. This quarter’s reward includes 50 million JUP and associated fees, with the remaining 50 million to be distributed next quarter. Launchpad fees consist of 0.75% of the total token supply paid by the project to the JUP DAO.

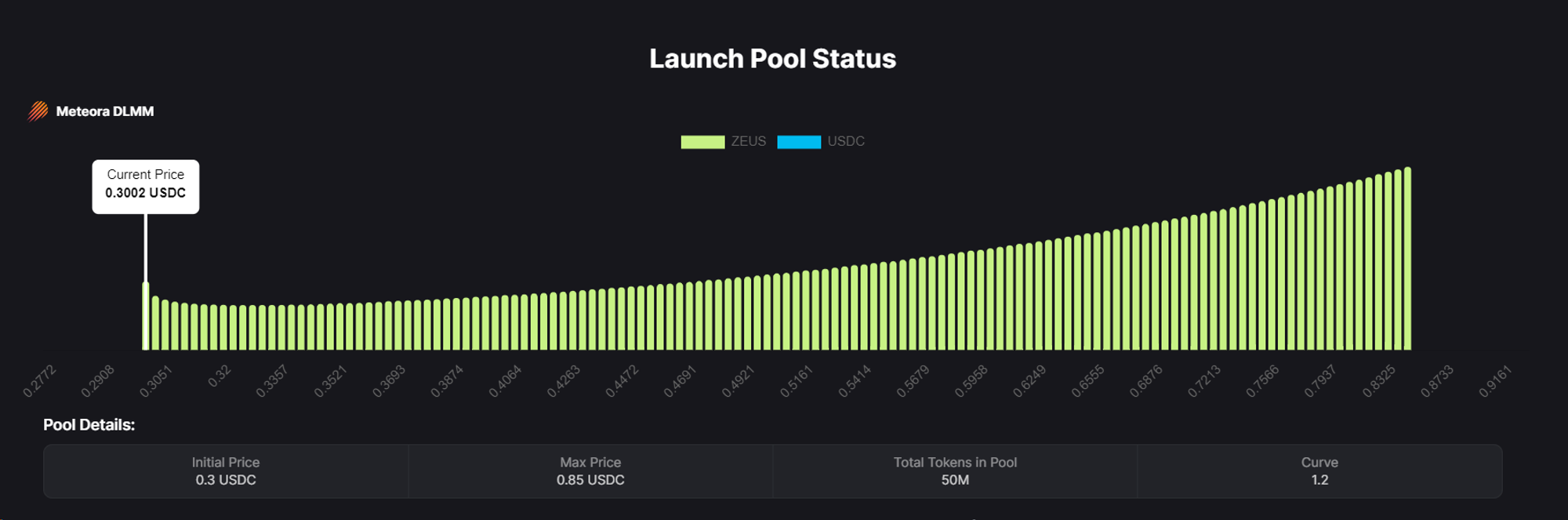

For token buyers, Jupiter Launchpad uses a DLMM (Dynamic Liquidity Market Maker) model for token sales. DLMM divides a price range into multiple discrete intervals. Teams primarily provide token liquidity, while users contribute USDC liquidity, completing the sale process. To reduce complexity for users, Jupiter continues to offer DCA and limit order functionalities, allowing buyers to employ suitable strategies during token distribution.

Currently, Zeus Network—the first unofficial project on Jupiter Launchpad—is undergoing token sale. ZEUS launched with a price range of $0.3–$0.85 and peaked at $1.11, currently trading at $0.83 (as of April 11). At this price, JUP voters collectively received airdrop value of $8.3 million (1% of ZEUS). Additionally, in previously issued tokens JUP and WEN, the majority of participants achieved returns exceeding 3x:

2.6 Summary

Based on the above analysis, we believe Jupiter’s product advantages are as follows:

-

Jupiter offers a full suite of essential trading tools, delivering an exceptional user experience: from basic spot and Perps trading to DCA and limit orders, it covers nearly all necessary functions. Thanks to liquidity aggregation, DCA and limit orders access broader liquidity sources.

-

The strategic evolution from trading infrastructure to Launchpad is sound: trading infrastructure attracts massive user traffic, positioning Jupiter as Solana’s central hub—a natural fit for Launchpad. Multiple trading features also lower barriers for user participation in token launches. The Launchpad strengthens Jupiter’s integration with the Solana ecosystem, reinforces its leadership position, and enhances utility for the JUP token.

3 Tokenomics and Capital Flow Analysis

3.1 Tokenomics Analysis

Jupiter has a total supply of 10 billion JUP tokens. The allocation is as follows: 50% managed by the Jupiter team, and 50% allocated to the community.

Of the 50% allocated to the team, 20% will go to team members but won't begin vesting until two years post-launch; 20% goes to strategic reserves held in a 4/7 Team Cold Multisig wallet, locked for at least one year, with any liquidity event requiring six months’ advance notice to the community. The remaining 10% of JUP tokens will be used for liquidity provision and stored in a Team Hot Multisig wallet.

Of the 50% allocated to the community, 40% will be distributed through four separate airdrops, occurring annually on January 31. The remaining 10% will be granted to community contributors.

During the Genesis release, a total of 1.35 billion (13.5%) tokens entered circulation, including 1 billion from a standalone airdrop, 250 million allocated to Launchpad, 50 million loaned to market makers, and 50 million used for liquidity provisioning.

Therefore, according to the token issuance schedule, there will be no major unlocks of JUP before 2025. The team’s 50% allocation will not unlock in the coming year, and any future unlocks require six months’ prior notice. The next major unlock will occur on January 30, 2025, with a 1 billion token airdrop.

Currently, the primary use cases for the JUP token involve staking and voting to earn governance rewards and Launchpad project airdrops. As of April 4, 2024, 269,290,321 JUP tokens were staked, representing about 20% of the current circulating supply. Notably, Jupiter founder Meow stated in a Reddit AMA that the JUP token was not designed for utility, suggesting that JUP’s price appreciation would stem from perceived value rather than functional usage.

3.2 Capital Flow Analysis

JUP’s market cap is $2,101,677,968, with an FDV of $15,567,984,945 (as of April 11). Given no large-scale unlocks expected within the next year, market cap carries greater relevance than FDV.

JUP trading is concentrated primarily on Binance, followed by OKX, Bybit, and Gate. According to Binance trading data, JUP traded around $0.5 for an extended period and saw heavy turnover between $0.5 and $0.7, forming a dense cost base that now acts as strong support. After consolidating for two months, JUP broke above this range and has entered a new price territory.

4 Competitive Landscape: What Is the Best Leveraged Play on Solana?

Jupiter occupies a unique position as a trading aggregator on Solana. Due to its distinctive functionality and dominant share of trading volume, no other protocol on Solana currently competes directly with Jupiter. Therefore, the real question is: if seeking leveraged exposure to the Solana ecosystem, is JUP a good choice?

There are several ways to gain leveraged exposure to Solana: infrastructure (e.g., JUP), top-tier MEMEs (e.g., WIF), or other ecosystem projects (e.g., AI, DePIN). However, each category offers different risk-return profiles. MEMEs carry higher uncertainty, while other projects depend more on their own narratives (e.g., RNDR benefits from AI trends, not necessarily Solana’s growth). The projects most closely aligned with Solana’s trajectory are infrastructure protocols—such as trading platforms (Raydium/Orca/Jupiter), liquid staking (Jito), and oracles (Pyth). Compared to these, Jupiter’s advantages include:

-

In terms of core operations, Jupiter captures more users and traffic from the Solana ecosystem. Among all activities, trading is the most fundamental need—especially given that recent demand in the Solana ecosystem has centered on Memecoins, further amplifying the importance of trading. Given Jupiter’s de facto monopoly as a trading front-end, anyone entering the Solana ecosystem naturally becomes a Jupiter user. Jupiter serves as the first stop for Solana users, maintaining the strongest and most direct linkage to the ecosystem, and thus represents Solana most comprehensively;

-

Regarding new project airdrops, Jupiter’s Launchpad function enables JUP holders to earn rewards from new launches—something Raydium, Orca, and Jito have not yet matched competitively. Another comparable player is Pyth, as several projects have already airdropped to Pyth stakers (e.g., Wormhole). The speed of Jupiter Launchpad adoption and the wealth-generation effect of its launched tokens warrant close monitoring. If Jupiter leverages its traffic advantage to attract high-quality projects, JUP holders could capture disproportionate value from emerging Solana ecosystem initiatives.

5 Conclusion

With its dual roles as a trading gateway and Launchpad, Jupiter is widely viewed as Solana’s equivalent of Uniswap and the “pickaxe” play, while JUP is likened to BNB. Based on our analysis, Jupiter’s bullish case rests on the following strengths:

-

It has built a comprehensive product suite around trading, significantly enhancing user experience. Jupiter’s trading volume is growing rapidly, making it the second-largest trading infrastructure after Uniswap.

-

Backed by Jupiter’s massive traffic and user base, the Launchpad enables Jupiter to capture more value from new Solana ecosystem projects and deliver substantial airdrop rewards to JUP stakers. Early launches have shown strong price performance.

-

On the capital side, JUP faces no major unlocks or selling pressure over the next three quarters, resulting in a relatively stable token distribution. In terms of price action, JUP has broken out of its consolidation range and entered a new growth phase.

-

Given Jupiter’s tight alignment with the Solana ecosystem, it serves as a leveraged proxy for Solana. This cycle, Solana is poised to stand alongside Ethereum as a top-tier blockchain and ecosystem. With Solana’s market cap reaching new highs, going long on Solana via JUP may offer a more powerful leveraged opportunity.

Potential risks for Jupiter include:

-

Slower-than-expected growth of the Solana ecosystem;

-

Emergence of sophisticated trading bots or competing front-ends that challenge Jupiter’s dominance as the primary entry point;

-

Lack of utility for the JUP token, potentially limiting price appreciation;

-

Underperformance of Jupiter Launchpad in terms of quantity, quality, or wealth-generation effect of launched projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News