Top narratives of the first week of April: Bitcoin halving drives ecosystem growth, AI and gaming trends emerge frequently

TechFlow Selected TechFlow Selected

Top narratives of the first week of April: Bitcoin halving drives ecosystem growth, AI and gaming trends emerge frequently

If the price breaks above the $71,000–$72,000 range again and you have bought on the dip, be prepared for a significant upward move.

Author: VIKTOR

Translation: TechFlow

BTC and the Overall Market

My last article was 10 days ago, when prices were almost identical to today’s—around $69,400—except that they dipped down to $65,000 in between. Nothing significant has happened during these 10 days; most tokens have declined against BTC.

I believe we are in a consolidation zone, and there's no need to overtrade. I wouldn't be surprised if $BTC pulls back to $60,000, but given healthy ETF inflows and funding rates returning to neutral, this isn't necessarily inevitable. If we break above the 71,000–72,000 range again on a retest, be prepared for a strong upward move.

$ETH is more concerning because ETH/BTC has once again reached a low of 0.049, showing no signs of strength. I am a supporter of $ETH—it’s my largest position—and frankly, it’s painful to see $BTC outperform $ETH month after month. At least from a sentiment perspective, we’re at a low point, which typically leads to a nice bounce in ETH/BTC. Also, don’t forget that unlike $BTC, $ETH holders have consistently been able to earn yield on their positions through liquid staking, DeFi, or restaking. $ETH is currently trading slightly below $3,400.

New Token Listings and Some Drama

One of the major events this week was the launch of $ENA, the token of the Ethena protocol. The token launch was hugely successful, with $ENA doubling in one day from $0.60 to a local high of $1.30. It now trades at $1.22, giving it an astonishing market cap of $18 billion. For many major tokens, a $20 billion market cap is often a ceiling.

Ethena has become one of the most hated protocols, as many believe it's too risky and will eventually fail. I think the worst-case scenario is that USDe might slightly depeg—nothing more. There's no death spiral risk like Terra-Luna, and comparing the two protocols makes little sense. Of course, Ethena will eventually hit scaling limits, as it already accounts for 20% of CEXs’ total $ETH holdings.

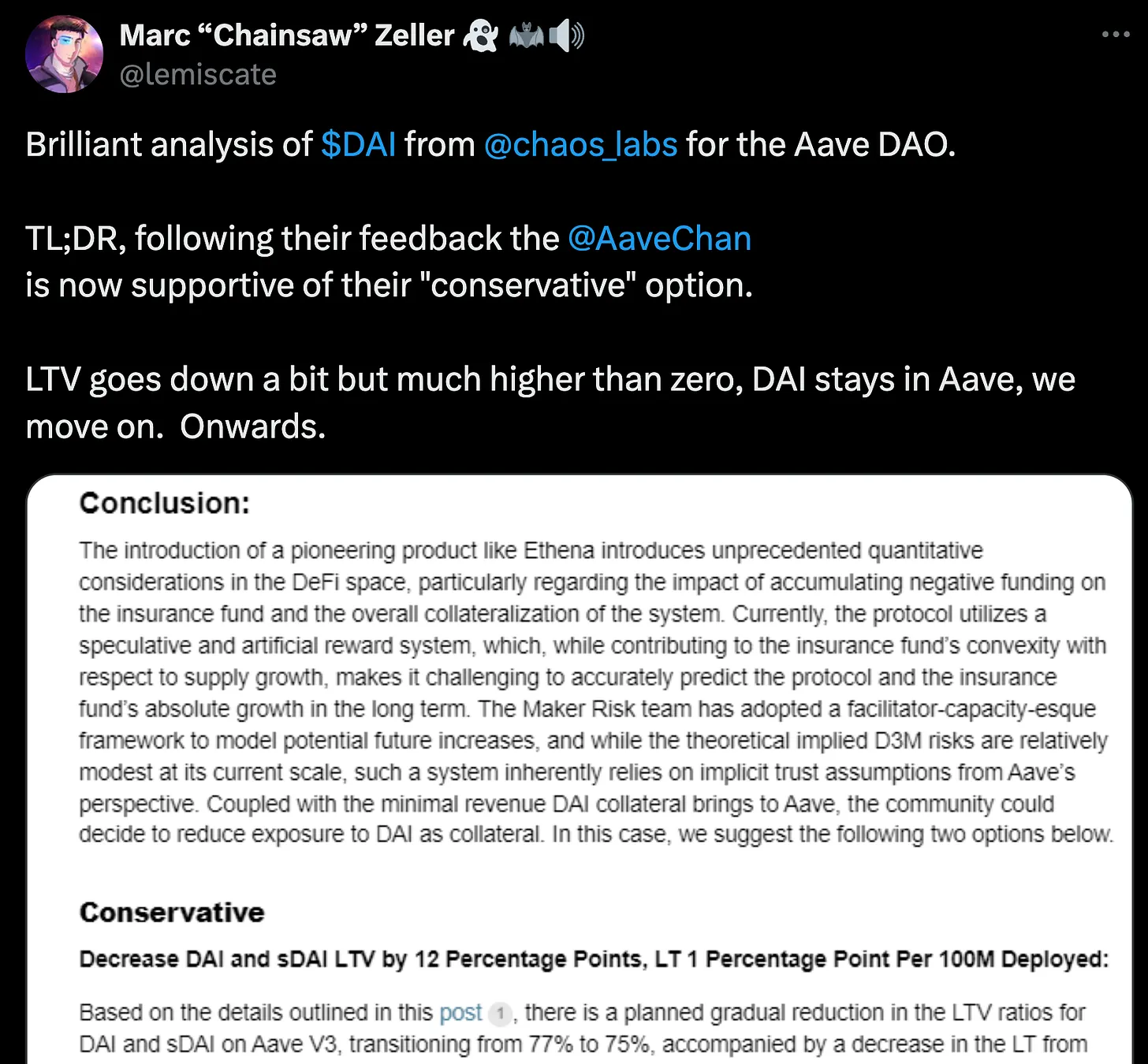

Ethena was also involved in this week’s drama involving Aave and Maker / Ethena / Morpho. Maker plans to use the Morpho lending protocol to issue $DAI loans (worth $600 million to $1 billion) backed by $USDe. This stands in stark contrast to DAI’s historically slow and extremely conservative approach—but seems great for $MKR price action, which hit a local high of $4,000. This completely angered Marc Zeller, a core member of the Aave ecosystem, prompting him to propose on the Aave forum to reduce the loan-to-value (LTV) ratio of DAI as collateral to zero. Chaos Labs issued their risk analysis, concluding that the LTV may indeed be reduced—but only by 12 percentage points.

The second major listing this week was $W, Wormhole’s token (a cross-chain/bridging protocol). It initially rose from $1.20 to $1.60 but has since been declining. It now trades around $1.00, with a market cap of $10 billion. Is it overvalued? Definitely, like most tokens—but at the same time, one could argue that Wormhole’s token should be valued higher, perhaps in the $15–20 billion fully diluted valuation range. For quite some time, W’s pre-market price on Hyperliquid was $1.80. Of course, volume was very low, but that still suggests we might see W return to that valuation—perhaps soon—if it follows the $JUP life cycle (post-launch drop, rounding bottom, then strong rally).

Another launch on Solana this week: $ZEUS. Zeus is a protocol designed to securely and decentralizedly bridge $BTC into the Solana ecosystem. Its current FDV is just $700 million, so it could rise significantly after repricing. Click here to read thiccy’s article on Zeus.

BTCfi and the Halving in Two Weeks

The $BTC halving is about two weeks away (April 20), and people are already shifting capital into “BTC ecosystem tokens.” One of the best performers is $MUBI, a bridge between BTC and the EVM ecosystem, which was a top performer in December 2023 before experiencing a long decline and stabilization. Other strong BTC-related tokens include $SOV, $COVAL, $CKB, and on-chain tokens like $TRAC, $BVM, and $ORDS. I expect this trend to grow as people prepare for the halving.

$PUPS is a BRC-20 meme coin that went viral during Ansem’s livestream two days ago. It surged from $7 to $32 within an hour. Since it was also deployed on Solana, many bought it there at a premium—up to nearly 5x. Some other ordinals projects are also rising, especially Bitcoin Puppets and RSIC Metaprotocol. By the way, I’m hearing more and more about Runes, an improved version of BRC-20. $PUPS will migrate from BRC-20 to Runes in a few weeks.

Altcoin Market

Several Solana-based tokens performed well in the final days of March, especially $JUP, which reached a new high of $1.80 (a $18 billion market cap), while $JTO gained 68% in a week before pulling back by half.

$BCH has been one of the strongest tokens in recent weeks. It underwent its halving a few days ago—a major catalyst that explains its strength—but I'm surprised there hasn’t yet been any news triggering a sell-off. This could be a heavily shorted asset with strong short-seller momentum.

$PRIME rose 23% in two days and is now very close to its recent high of $28. The chart looks excellent—consistently strong with no severe or scary drawdowns—making it a very comfortable hold. Still, I never treated it as a long-term investment, and I somewhat regret that.

$MNT has been one of the top-performing tokens in the top 100 over the past few weeks. Most ETH beta tokens, particularly major L2s like $ARB and $OP, have merely tracked or underperformed $BTC over the past two months, while an overlooked L2, $MNT, has consistently outperformed BTC. One of Mantle’s key tokens, the meme coin $PUFF, surged 120% in a week.

$PENDLE is absolutely unstoppable. It’s the only ETH beta token showing insane strength, up 140% against $BTC in 20 days. In 2024, Pendle’s TVL has exploded—from $200 million to over $4 billion. The reason? People are increasingly using Pendle to gain leveraged exposure to liquid-staked $ETH, making it the premier “EigenLayer beta.”

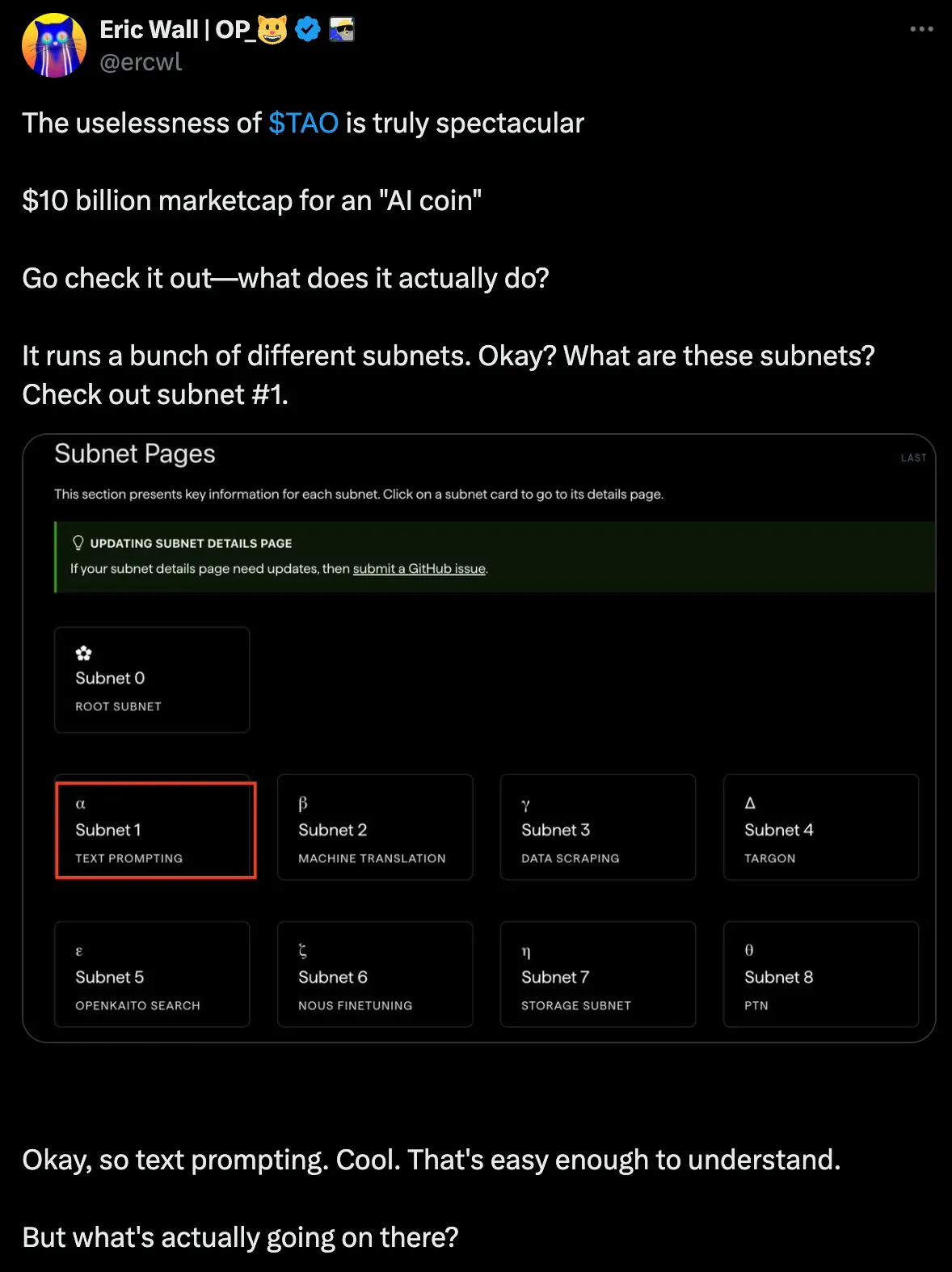

$TAO experienced some FUD after Eric Wall tweeted that it’s a useless cryptocurrency with a $10 billion market cap. $TAO crashed afterward—but then bounced back. I think nearly all AI coins are mostly useless, but $TAO is far from the worst. It reached such a high valuation, yet still has room to go higher. It has conviction—and strong conviction at that. $TAO also tends to move independently, not really following broader market trends.

$BGB, Bitget exchange’s token, was the biggest gainer over 7 days, up 24%. I don’t like buying CEX tokens and have never used Bitget.

$TON was one of the best-performing tokens in March and shows no signs of slowing down—its chart looks primed to break out to new highs. This token remains a mystery to me, as its visibility is relatively low compared to its large market cap.

$ALPH (Alephium) is another obscure token, up 14x since November, with very low visibility on crypto Twitter. Alephium is a PoW L1 very similar to $KAS (Kaspa), and I believe they attract the same type of buyers—unsophisticated, yet capable of generating massive gains.

$DMT tripled in two days as people realized $DEGEN was launching its L3, driving the price up. As one of the few L3 tokens with visibility, $DMT reacted strongly. $DEGEN had a wild March, up 50x, but is now finally seeing a pullback after its run.

$GHST, the main token of the gamefi project Aavegotchi, surged 160% over two weeks.

$BODEN is unstoppable, up 180% in a week, now with a $500 million market cap. At these valuations, meme coins start to offer less attractive risk/reward unless they can enter the “big leagues” above $1 billion market cap.

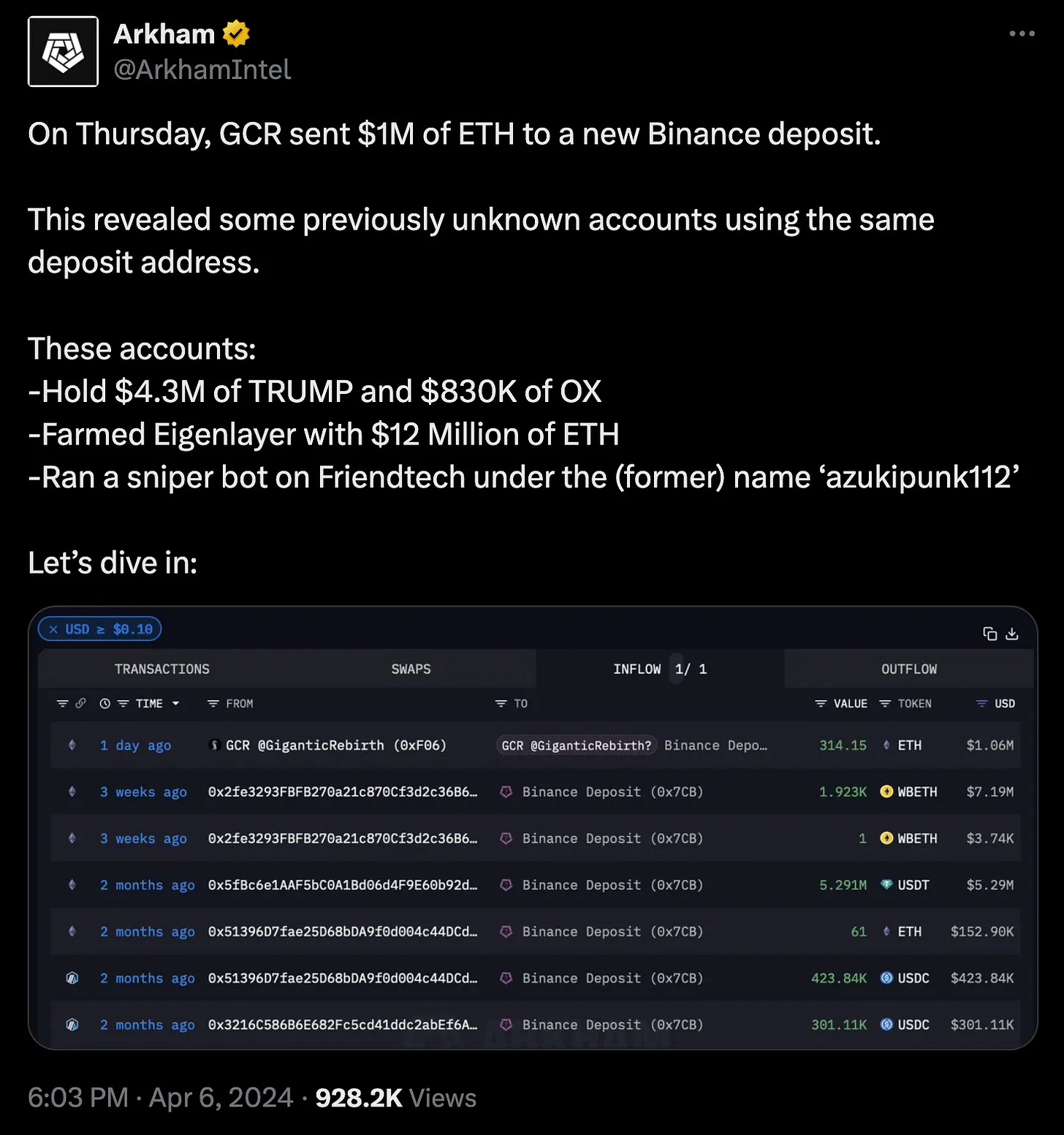

$MAGA jumped 50% in a day after Arkham discovered over $4 million worth of $MAGA tokens in a GCR wallet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News