The bull market has already entered its second phase—how can you seize new airdrop and ecosystem opportunities?

TechFlow Selected TechFlow Selected

The bull market has already entered its second phase—how can you seize new airdrop and ecosystem opportunities?

The bull market is slower and more unpredictable than you imagine.

Author: IGNAS

Translation: Kate, Mars Finance

What happens when you're expecting?

How does the market treat your airdrops?

So far, it's been going well for me. The top three airdrops so far: JITO, STRK, and ETHFI. Fortunately, the fun isn't over yet.

In this post, I’ll walk through where we stand now, revisit my Degen bull market playbook, and highlight both new and previously shared airdrop opportunities still worth farming.

I believe the second phase of the bull market has already begun:

In Phase One, we:

-

Cleaned up the mess from the last bull run (won multiple lawsuits and deleveraged).

-

Saw BTC ETF approval

-

Witnessed Solana ecosystem growth

-

Received several major airdrops

In Phase Two, we will see:

-

Further victories against regulators

-

Rate cut speculation

-

ETH ETF speculation or approval?

-

Increasing inflows into Bitcoin ETFs

-

More innovation on BTC via Runes protocol, L2s, and BTC-native dApps

-

New forms of leverage accumulation using Restaking / LRT / Ethena-style protocols

-

Bigger airdrops: Eigenlayer, LayerZero, L2 airdrops, LRT protocols, etc.

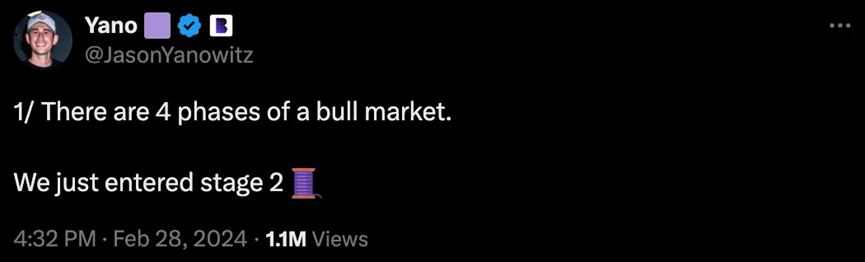

I'm not the only one who thinks Phase Two is here. For Yano, Phase Two is about recognizing we’re in a bull market, while many friends still haven’t realized it.

https://twitter.com/JasonYanowitz/status/1762878513731002570

"It’s the calm before the storm."

Bitcoin is currently in an accumulation zone, and its price will rise once new catalysts emerge.

It just needs a spark—any catalyst—to keep momentum going. The halving narrative might be enough. Perhaps rate cuts, a prominent institutional player entering the space, or something completely unexpected.

The market wants to pump, and we'll find reasons to keep rising.

At least, that’s what I (and most degens) expect.

What Happens When You're Expecting

I remember watching a talk discussing the potential impact of Bitcoin ETFs on crypto. Sorry, I can't find it now. Near the end, there was a comparison showing Bitcoin users before and after the ETF.

The "before" image showed Bitcoin enthusiasts deeply engaged with technical aspects—like Rodarmor here (creator of Ordinals theory).

In contrast, the "after" image depicted retired Bitcoin holders with their kids.

The speaker's main point was that sustained fiat inflows would continue driving Bitcoin's value higher, creating wealth for holders.

The "after" scene reminded me of the movie “What to Expect When You're Expecting” (which I haven’t seen).

There’s another reason the movie title fits: we all expect markets to keep rising, airdrops to keep coming, peaking around early 2025.

Right?

But this journey won’t be smooth.

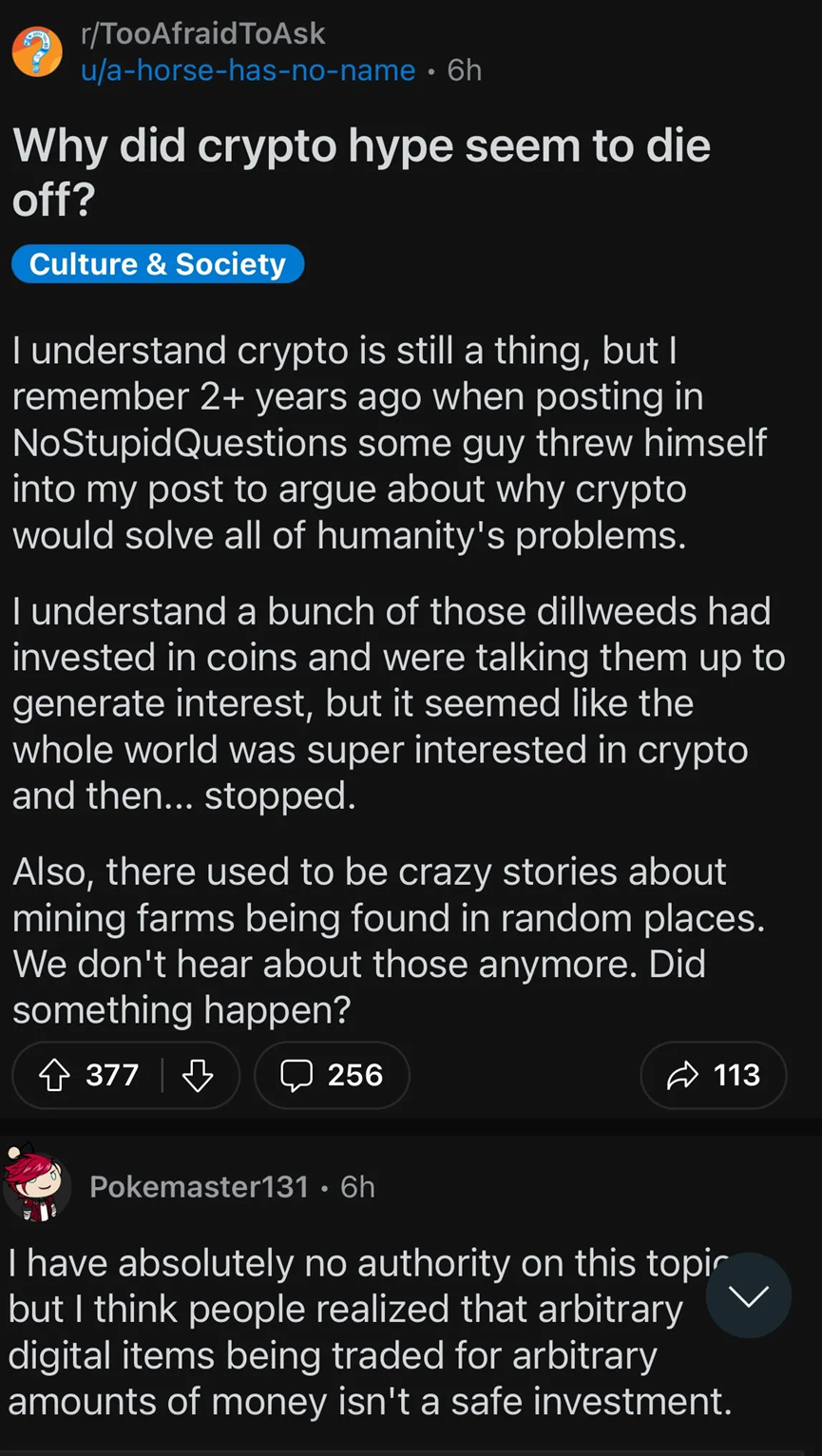

Bull markets are more stubborn and unpredictable than you think. Who could’ve predicted SBF would steal user funds to gamble on coins?

So yes, we all hope markets keep minting millionaires and airdrops keep flowing—but I’m ready for the unexpected.

Still, every bull market repeats similar patterns.

Most importantly, each cycle finds innovative ways to print money by issuing tokens backed by exciting new narratives. These stories are often enabled by technological advances like restaking or RWA.

Opportunities are everywhere in a bull market, but you need to identify Schelling points for crypto market share.

Here are lessons I've learned from the past two bull runs:

Navigating the Crazy Bull Market to Come

Since narratives come and go, my focus is on thriving ecosystems offering: 1) technical innovation, 2) token issuance opportunities, 3) compelling stories.

I detailed how to spot such ecosystems in my previous article:

Three Pillars of Booming Crypto Ecosystems

With each passing bull market, token creation gets easier.

Back then, Dogecoin required PoW hardware to mint tokens. Now even clueless influencers can create tokens in under five minutes.

As this trend continues, I expect we’ll reach a point where excessive token supply overwhelms available attention and liquidity needed to sustain prices. That’s when the party ends.

Fortunately, we’re not there yet!

But signs of increasing leverage risk are emerging—such as Ethena’s sUSDe and LRT ETH derivatives being accepted as collateral in major DeFi protocols.

Still, I believe the market remains healthy. We can afford more leverage.

In fact, I think there’s a shortage of high-quality new tokens in the market.

Few people want to buy last-cycle tokens. They aren’t exciting, and most are overvalued. Plus, teams that succeeded in earlier cycles lack motivation to push their tokens further. Take Compound’s $COMP, for example…

The team has stopped engaging on social media; their proposed Compound Chain plan vanished along with a deleted tweet.

Therefore, I expect new tokens to continue trading at valuations higher than those from the prior cycle.

Newer is better.

JITO and ETHFI have higher FDVs than LIDO. Ethena’s ENA is 2.5x more expensive than MKR.

This is good news for airdrops: higher valuations lead to more generous airdrops.

Given all this, back in December 2023, I shared my DeFi Degen bull market playbook: Part One, covering over 60 protocols across 10 ecosystems.

Four months have passed since that original post. I still expect these 10 ecosystems to outperform the broader market.

So it’s time to update which ecosystems/protocols are still worth farming. Additionally, I’ll include new protocols not mentioned in my previous articles.

Revisiting the Degen Bull Market Playbook

Note: This isn’t a Part Two playbook. The market is entering Phase Two, but it hasn’t changed drastically from four months ago. Some things have shifted:

-

BTC rules, ETH sucks: Luckily, Ethereum has restaking—otherwise I’d consider selling most of my ETH

-

Meme coin mania got weirder

-

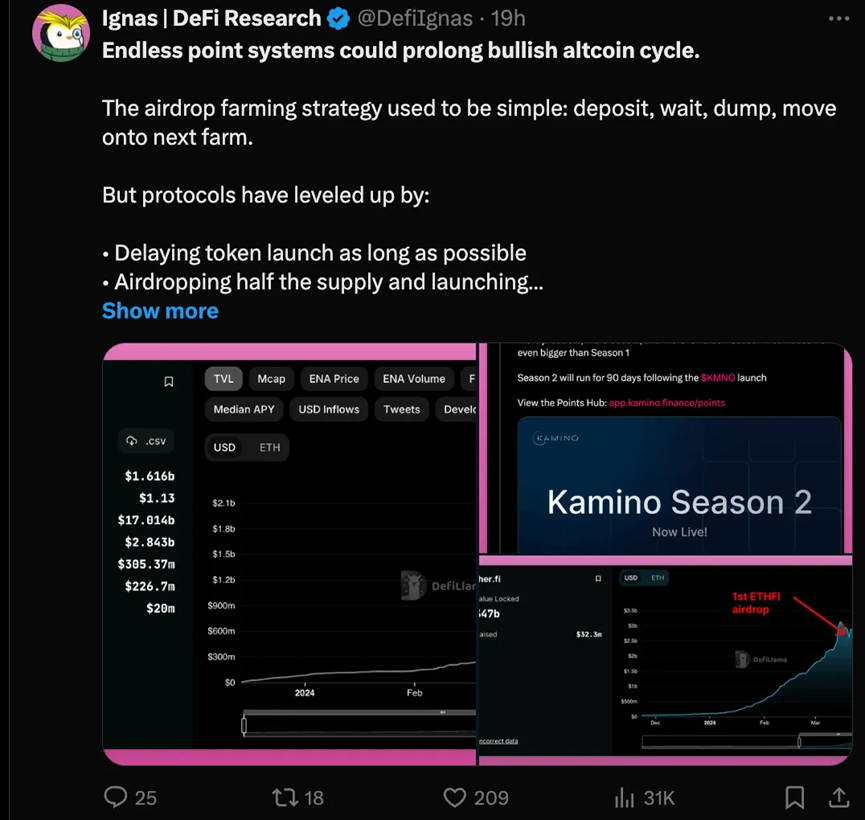

Protocol teams endlessly extend point programs, possibly unintentionally prolonging this bullish cycle by delaying token generation (and dumping)

https://twitter.com/DefiIgnas/status/1775910200962088994

So my degen strategy remains unchanged: deposit assets, click buttons, claim airdrops.

Note: I don’t like meme coin trading. Since I stopped buying crypto with fiat in 2020, I’ve gained 100x. Now targeting a 10x return, focusing on thriving ecosystems via multiple airdrops feels safer.

If you’re hunting for 100x plays, I shared strategies in a previous post:

How to Find 100x Gems: 5 Strategies

First, I’ll share new airdrop strategies, then review ecosystems still worth watching (including new airdrop protocols).

New Airdrops

• Elixir: Order book liquidity network raised $8M at an $800M valuation from Crypto Hayes, Sui, Amber, etc. Elixir enables liquidity provisioning to orderbook exchanges with rewards—including Vertex, Bluefin, and others.

Earn points ("potions") by depositing ETH and minting elxETH. Your ETH will be locked until mainnet launches in August.

• Phaver: Best frontend for Lens. With Farcaster usage and airdrops exploding, momentum is shifting toward Lens. Phaver mining is severely underexploited. Earn Phaver points through actions like posting, connecting NFTs, etc. Phaver raised $7M from Polygon, Nomad Capital, and others.

• Zircuit: Another L2 packed with buzzwords: "AI-powered modular zk rollup," plus an annoying Blast-style invite-only marketing campaign. It's cringe, but...

Backed by Pantera and Dragonfly, and integrates major LRT protocols—so you can farm both LRT and Zircuit airdrops simultaneously. Deposit your LRT ETH for double points. Withdraw anytime.

• Mode Network: Another copycat L2 like Blast/Zircuit/Manta, but built as an Optimistic rollup. Again, I’m in because it supports EtherFi’s weETH and Renzo’s ezETH—double farming opportunity.

Token launch expected this month, but with $175M TVL, it's not overhyped.

• Ethena: Needs no introduction. If you’re sitting on stablecoins, there’s probably no better airdrop opportunity.

Below, I’ll cover both new airdrop protocols and previously shared ones from my DeFi Degen playbook that remain worthwhile in this bull market.

1. Eigenlayer + Liquid Restaking Tokens + Active Validation Services

Eigenlayer mainnet could launch as early as April, likely accompanied by a token. I also expect LRT protocols to release their tokens around the same time.

EigenLayer’s TVL growth has been astonishing. Since my Degen playbook in December, TVL surged from $262M to $12B—an increase of 4,480%! It now ranks second only to Lido, surpassing AAVE.

Liquid restaking has accumulated $8.4B across just 13 protocols, meaning most EIGEN hunters prefer farming via LRT platforms.

Even more importantly, everyone seems to have forgotten about EigenLayer’s AVS airdrops. Over 14 AVS projects are actively preparing. Just this week, a new AVS called “Gasp”—a cross-chain swap platform—announced $5M in seed funding at an $80M valuation. VC backing for AVS projects is a strong signal.

To learn more about AVS protocols, check my earlier post:

Navigating Restaking: Your Guide to Eigenlayer's Actively Validated Services

I expect the number of LRT protocols to keep growing, but the market is consolidating. Only seven have surpassed $100M in TVL.

So if you’re holding native ETH, LRT is the best place to be.

What should you do?

• EtherFi: Even after token launch, ETHFI’s TVL increased. Season 2 ends June 30. Consider these strategies:

(Simple) Deposit eETH into EtherFi’s “Liquidity” strategy for ~20% APY, earning 2x EtherFi and 1x Eigenlayer points

(Advanced) On Fluid, gain up to 10x Eigen and 20x EtherFi points with leveraged positions.

• Renzo: Fastest-growing LRT with $2.3B TVL. Backed by Binance Labs. Thor Hartvigsen’s analysis suggests Renzo is “the best place to park ETH right now.” Token launch date not yet public.

Choose any DeFi strategy across multiple L2s and protocols.

• Swell: Confirmed token launch in mid-to-late April. rswETH withdrawals are coming. Swell will launch its own L2 featuring native staking yield. If you want fast in-and-out access, Swell could be ideal.

Mint rswETH and earn more Pearls

Consider waiting for Swell L2 pre-deposits, opening soon

• Puffer: Third-largest LRT, but TVL is declining. This is because Puffer currently doesn’t support native ETH staking (unlike Renzo and EtherFi). As a result, new stETH depositors can’t earn Eigen points on Puffer. Still, backed by Binance Labs, so some exposure helps.

Join the Crunchy Carrot Quest and deposit into Curve/Convex pools here for double points.

• Kelp: Did something potentially controversial—launched liquid EIGEN points as KEP tokens. Check KEP price here.

Kelp launched a “Road to a Billion” TVL reward: up to 100 extra EIGEN per ETH (~$17 per ETH, ~$0.17 per KEP)

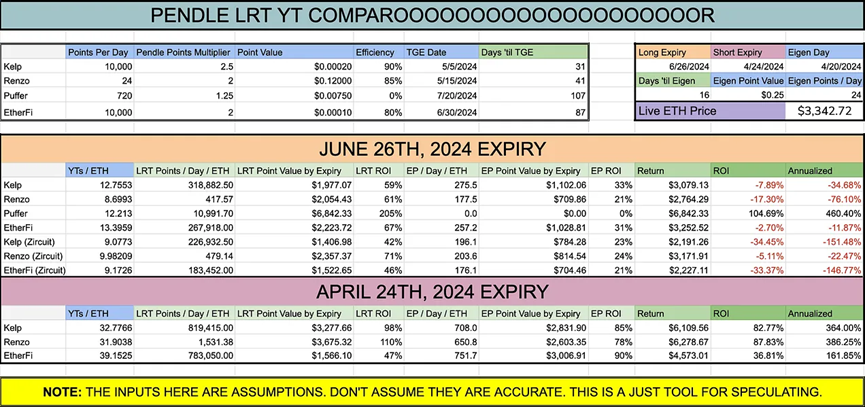

Important: Eigenlayer and LRT tokens are launching soon, so maximize your points using Pendle YT tokens. YT value drops to zero at expiry, but thanks to Pendle, my EtherFi airdrop was the biggest ever.

Check Thor Hartvigsen’s Pendle LRT calculations here, and Stephen DeFi Dojo’s live tracker here.

https://docs.google.com/spreadsheets/d/1ijVL4sNJw1405ifvK3dps_1iuDGcXpndKszRuWQoF9I/edit#gid=0

2. Stacks

Still one of my favorite plays because:

1. Bitcoin L2 narrative

2. Nakamoto upgrade launching in April brings 5-second transaction finality (finally makes transacting on Stacks interesting)

3. Ecosystem is still small with few farmers, making early positioning easy. TVL grew from $35M to $176M in USD terms over 4 months—but largely due to STX price surge. In STX terms, TVL doubled.

Nice. Still early.

If you’re very lazy but still want rewards, Stacks offers two of the best opportunities:

• Stacking DAO: Liquid staking for STX (stSTX). Points live—use my referral if possible 🙇♂️

Reward: Deposit stSTX/STX LP into Bitlow—the Stacks DEX—for 2x airdrop. Stacking DAO will offer additional points on top of Bitlow’s airdrop.

• Lisa: Another liquid stacking platform, just launched. Apply for waitlist here. Alex Lab’s staking and farming initiative.

Other farms to consider:

• Arkadiko: Stake STX to mint USDA stablecoin. Launching Bitcoin-native lending. Swap and hold some USDA.

• Hermetica: Earn yield on BTC using derivatives strategies. Use stacked sBTC. Currently on testnet, but I’ll wait for mainnet.

• Zest: Bitcoin lending. Currently internal testing, but access requests open here.

• Velar: AMM. Recently completed ICO on Gate and Bybit. Airdrop points system is live.

3. Starknet

I know many of you were disappointed not receiving an airdrop and left the ecosystem forever.

But I still like Starknet for its unique Cairo development language (prevents easy forks, fewer protocols → easier to track farming spots), STARK and SNARK scaling tech, and STRK token utility for staking and gas.

Also, a second STRK airdrop is coming. Starknet’s TVL ($314M) remains low compared to STRK’s FDV ($19B)—I can smell another airdrop coming.

However, I was disappointed with zkLend’s airdrop: I earned only a few hundred dollars despite lending/borrowing five-figure amounts. Few even knew it launched—check here.

I hope these three protocols deliver better returns:

• Nostra: Top dApp by TVL ($200M out of Starknet’s total $314M).

• Ekubo: Leading DEX. Besides running a points system, most major asset LPs offer 50% rewards—so you earn points + yield.

Note: Ekubo LP withdrawal fees are outrageously high (up to 1%), so opt for wide-range LP positions.

• Avnu: Jupiter for Starknet. To earn more points, I frequently make small trades.

4. Solana

Most major Solana dApps are launching tokens (especially KMNO, PRCL, TNSR, DRFT?), but farming isn’t over. A new trend is launching tokens and point campaigns immediately in Season Two to prevent TVL outflows. This works because only half the tokens were airdropped initially.

Here’s what I’m currently watching:

• Kamino: Season One ended, Season Two ongoing. Expected listing in April!

My favorite: 5x SOL leverage in degen vault (but lower liquidation risk).

• Sanctum: New LST or LST aggregator. JTO airdrop was solid—Sanctum could be better. Raised $6.1M from Dragonfly, Sequoia, Solana Labs, etc. Early days for $100M TVL. I deposited into INF (basket of LSTs yielding 9.3%).

• Marginfi: Jokingly launching a token, but I’m tired of their endless point program. Also launched native stablecoin YBX. Honestly, Aave and Curve launched stablecoins to attract TVL but failed to gain traction—I don’t expect much from theirs either. Still, farm a little.

• Backpack: Exchange and wallet. Requires KYC for trading to prevent sybil attacks and possibly secure a larger airdrop. Raised $17M led by Placeholder VC & Wormhole.

• Tensor: Still holding and staking Tensorian NFTs, though price has dropped. Surprisingly, despite MagicEden eating into Tensor’s market share, Solana NFT volume keeps growing.

Still, Tensor team is launching new features (price locking), and token launch could reignite FOMO.

• Grass: Passively earn points using an old phone. Great option if capital-constrained.

Fits the Solana x AI narrative. Planning to launch their own L2. Requires installing a Chrome extension to mine points. Just raised $3.5M from Polychain Capital, Bitscale, etc.

• Parcl: Long/short real estate markets. Just sitting in USDC liquidity farming points.

• Flash.trade: Perpetuals for crypto, commodities, forex. They have NFTs that evolve based on your trading history, you receive a portion of protocol fees, and they’re likely to airdrop.

• Drift: Margin trading, lending.

5. SUI

Why SUI?

I joined SUI late with a small position. But the experience exceeded expectations. TVL keeps growing, dwarfing SEI, INJ, or Aptos. Yet major dApps still lack tokens.

I like that it uses Move programming language, preventing simple copy-paste Ethereum forks.

Consider these moves on SUI:

SUI has three LST options available (possibly the easiest play)

• Stake some SUI for haSUI on Headal.

Note: Can swap SUI to haSUI on Cetus for better rates.

• Stake some SUI for a SUI LST here.

Note: Offers up to 100% APY for liquidity provision.

• Lend haSUI and/or afSUI, borrow stablecoins or SUI on Navi (tokenized, up to 30% APY) and Scallop (Season 2 airdrop points live)

• Lend $SUI to borrow Bucket—the Maker-style stablecoin $BUCK on Sui.

6. Bitcoin Ecosystem

Bitcoin ordinals are the second most bullish thing in crypto—right after restaking.

I bought Bitcoin NFTs early—they not only appreciated but rewarded me with multiple airdrops, notably RSIC and Runestone. In fact, I received so many airdrops I don’t even know what some are for.

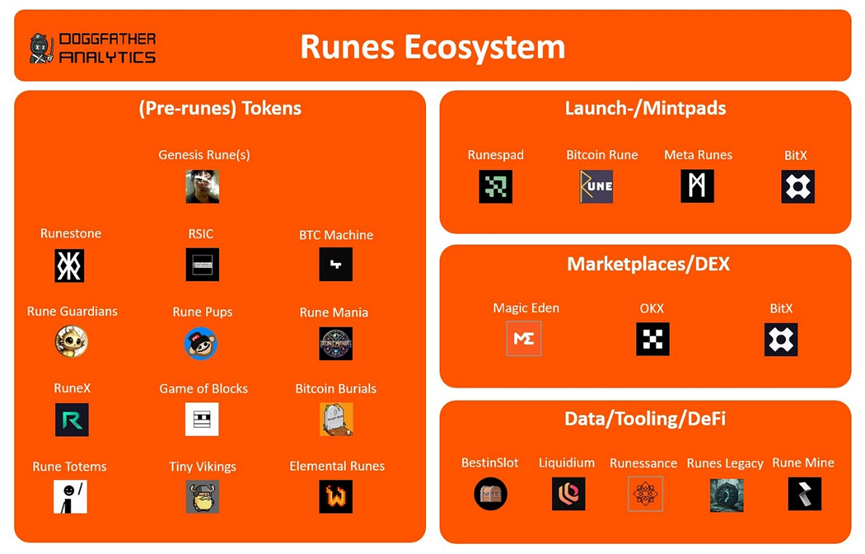

Now, the Runes protocol will launch at the Bitcoin halving block, bringing more trading opportunities to Bitcoin.

Protocols are multiplying rapidly, so I suggest reviewing this thread and learning before the fun begins.

https://twitter.com/DoggfatherCrew/status/1775546878836294102

Also, check peddy’s excellent educational thread:

https://twitter.com/peddy2612/status/1775948393904308314

If you’re new to ordinals, I wrote a beginner’s guide with protocol suggestions:

Ordinals & BTC DeFi: Start Here.

7. SEI

I’ve exited most of the SEI ecosystem. So far, lack of growth and few dApps. SEI will launch SEI V2 with EVM, but I expect it to be flooded with low-effort Ethereum forks.

Still, one area I like is SEI’s Silo liquid staking. Simply stake some SEI and wait for the airdrop.

Stake on Silo.

8. Injective

I’ve recently fully exited the Injective ecosystem.

Filled with low-quality dApps (even their frontends riddled with typos), lacking passionate community, and worst of all—INJ stakers and dApp users received tiny airdrops worth only a few hundred dollars. I farmed for months, depositing nearly six figures.

Seems like Injective lacks internal innovation. My suspicion: investors plan to cash out after final token unlocks. Maybe an exit pump is coming.

Overall, my market expectation is: after accumulation completes, crypto will rise, and airdrops will keep coming.

Then structural changes will occur (as always), and the Degen playbook will shift. So when that happens, stay tuned for Part Two.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News