Solana's Memecoin Explosion: How to Discover Hidden Gems?

TechFlow Selected TechFlow Selected

Solana's Memecoin Explosion: How to Discover Hidden Gems?

Is there any pattern behind successful memecoins?

Authors: HYPHIN, THOR

Translation: Luffy, Foresight News

Thanks to their convenience and low barriers to entry, trading and creating custom tokens have become easier than ever. Combined with social media and a growing base of retail investors, tokens lacking any utility are expanding at an accelerated pace—these coins rely solely on dedicated communities and aggressive marketing to sustain their growth.

Introduction

Internet culture and memes have long held a significant place in the cryptocurrency space. The massive market capitalization of memecoins serves as clear evidence—reaching approximately $66.65 billion at the time of writing. Dogecoin alone accounts for about 43.81% of the entire category, with a valuation higher than some well-established companies such as Vodafone, Pinterest, and Logitech.

For a long time, Ethereum has been the central hub for memecoins, but recently several competitors have emerged. Activity related to these tokens has shifted, with Solana becoming an active battleground for new projects and speculators.

A major contributor to Solana's expansion and surge in trading volume is its vibrant on-chain memecoin ecosystem, which has drawn widespread attention this year. Names like "dog wif hat" and "Bonk" have gone viral, accompanied by sharp price increases.

While we do not endorse trading memecoins, it remains valuable to understand what is happening in this increasingly prominent and established market.

At first glance, you may struggle to discern the reasons behind seemingly absurd price movements. But upon closer inspection, clues may emerge. In this article, we aim to provide a broad overview of the entire memecoin landscape, examining every corner to make sense of what’s really going on.

Overview

Before diving into analysis, it helps to set the scene and familiarize ourselves with the environment and its characteristics, as there is little rationality underpinning the entire phenomenon—it requires an open-minded approach.

Every niche develops its own unique culture, and the Solana chain is no exception. Since the beginning of “Solana season,” stories of missed life-changing wealth and overnight fame have repeatedly circulated on Twitter. Recognizing the potential for massive opportunities ahead, people from diverse backgrounds have rushed into this space chasing fortune.

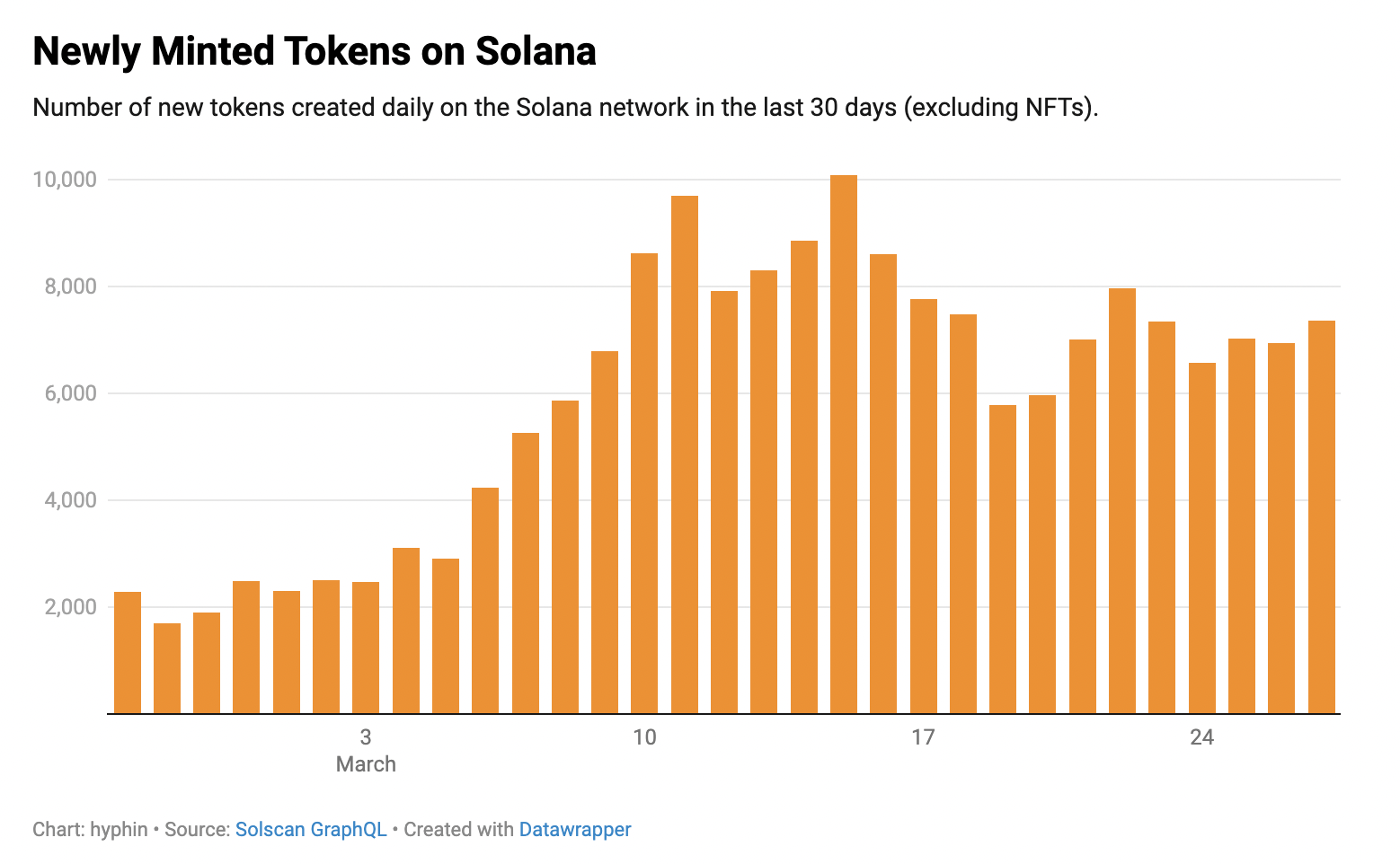

One defining feature of memecoins on Solana is the sheer number created daily.

Given the extremely low cost of launching a memecoin, numerous new trading pairs flood decentralized exchanges each day. This makes it a fast-paced domain. Most new pairs have low liquidity, leading to significant price impact and extreme volatility. The average lifespan of a project often lasts only 24 hours or less, primarily due to bad actors exploiting the frenzy through carefully orchestrated scams and marketing to deceive eager, unsuspecting investors.

If you spend enough time in Telegram groups and sift through hashtags on Twitter, you can map most participants to specific roles critical to the ecosystem.

Developers: Revered as gods, developers are seen as shepherds who can lead the community to financial freedom. Their decisions often influence early price movements and determine a project's longevity, as creators maintain full control over the memecoin fundamentals and typically hold a substantial portion of the token supply.

Influencers: Leveraging their social media reach, influencers share personal investments to raise awareness about various projects with differing motives. Some aim to strengthen the community by increasing social proof, while others simply seek to exit liquidity for profit.

Community Members: Deeply loyal and willing to go to great lengths. These individuals frequently appear in chat groups, interact with others, and tirelessly promote their investment beneath high-profile posts—engagement from key figures can make or break a project.

Snipers: Using automated on-chain interactions, holders of these wallets buy indiscriminately immediately after liquidity pools are created and trading goes live. They aim to capitalize on upward momentum generated when regular traders buy in afterward. In most cases, they don’t hold long-term but sell early for profit, given the abundance of such opportunities.

Keep in mind that all of this unfolds within a ruthless environment of player competition. To stay competitive, a wide range of trading tools with useful analytical features have been developed to accelerate decision-making and execution. Services like Photon and BonkBot are favored by most traders.

Characteristics of Successful Memecoins

Amid the vast ocean of tokens, only a few manage to sustain high valuations over time and cultivate tightly-knit communities. This suggests certain quantifiable factors contribute to their success.

Having a reliable due diligence framework will make screening watchlists easier and more time-efficient. This raises the question: What valuable information can we use to effectively analyze these unpredictable tokens?

Using historical data, we can attempt to identify common patterns and metrics that help gauge a project's potential to some extent. For example, analyzing the top 50 memecoins gives us a rough idea of the attributes shared by top performers.

Trends

Since the entire memecoin sector is primarily driven by trends and narratives, it’s essential to stay aware of currently popular categories or themes to avoid boarding a sinking ship.

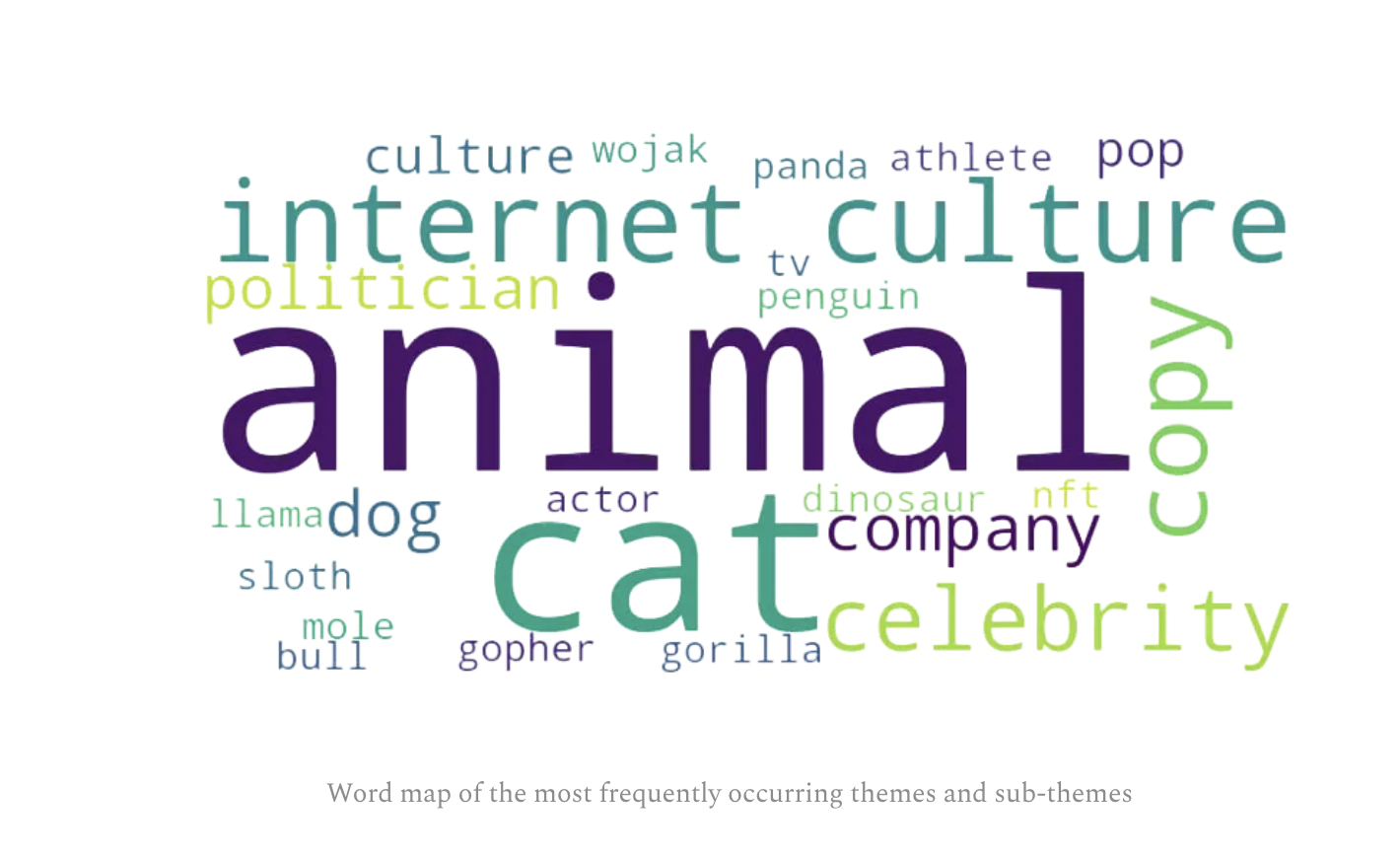

Visualizing hot topics using a word cloud makes current trends easy to spot.

Clearly, animal-themed tokens dominate, with cats being the most popular sub-theme. The second-largest cluster in the chart is “internet culture,” typically encompassing crypto Twitter and mainstream memes.

An interesting detail in the above image is the keyword “copy,” referring to projects derived from original concepts but with their own unique twist. These constantly emerge, offering a second chance to those who missed out on earlier versions.

Metrics

After narrowing down promising categories, some technical details can be evaluated.

Percentage of projects with mint authority disabled: 100%

Each project should disable the ability to mint additional tokens to prevent infinite selling pressure. In our observation group, all projects had this setting disabled.

Liquidity Pool (LP) burn percentage: Average — 78.7%, Median — 98.0%

LP tokens received by deployers when adding initial liquidity are burned, reducing the risk of creators withdrawing liquidity. The median percentage here indicates that typically, most initial LP is destroyed.

Percentage of tokens held by top 10 wallets: Average — 27.51%, Median — 21.79%

In most cases, holdings by top token holders hover around 20%, varying by project. A lower percentage reduces the likelihood of damage caused by large dumps from a small number of holders.

Days since trading began: Average — 23.52, Median — 6.66

Given that most memecoins last only a few days, an age exceeding 100 hours is usually a positive indicator. The fact that the average age of the top 50 memecoins is just under a week highlights the market’s volatility. However, top-tier memecoins tend to remain relatively stable and maintain their rankings over time.

Community

Perhaps the most difficult yet crucial aspect is the foundation of every memecoin—the community. An active, vocal community with its own distinct culture is essential for spreading information and attracting new members to drive growth in an extremely saturated market.

To initiate discussion and self-promotion in early stages, projects need presence across media platforms (e.g., websites, Twitter, Telegram, and Discord) to establish verifiable credibility and maximize impact.

Number of media platforms per project:

-

1 platform — 2%

-

2 platforms — 10%

-

3 platforms — 78%

-

4 platforms — 10%

We observe that over two-thirds of memecoins have at least three marketing channels. Therefore, the absence of Telegram and Twitter chat functionality should immediately raise red flags.

Using these channels, we can investigate the community for positive indicators, which are typically (but not limited to):

No infighting: Constant arguing among members in group chats or on Twitter reflects poorly on the project and may deter investors. Positive sentiment and healthy discussions are far more attractive.

Strong Twitter presence: Having a distinctive brand identity on Twitter—such as inside jokes—is essential to maximize memorability, recognition, and virality, thereby capturing as much attention as possible.

Respected influencers: Endorsement from credible social media figures is a major advantage, whereas association with notorious influencers known for pump-and-dump schemes should be avoided.

Final Evaluation

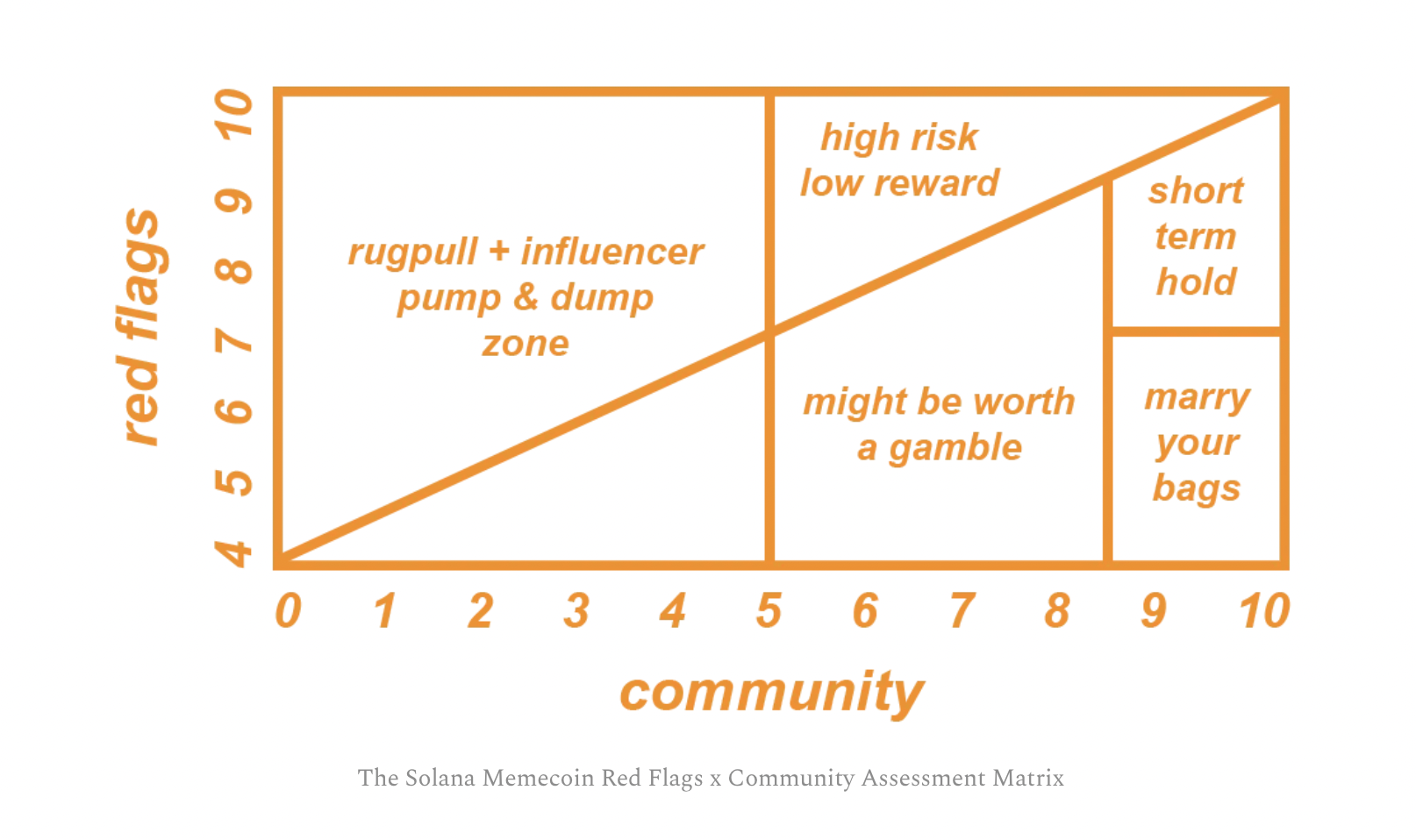

The final stage of analysis will consolidate all our insights and observations using an evaluation matrix to draw conclusions. Everyone should develop their own methodology based on personal parameters and risk tolerance. In this section, we’ll apply an internal solution provided by On Chain Times’ quantitative analysts.

If you're wondering why the “red flags” axis starts at 4, the answer is: There are no memecoins on Solana without red flags. By establishing a ratio between community score and the number of negative factors present, we can loosely assign each token to a category.

The goal should always be to identify and engage with memecoins that have high community ratings and minimal warning signs, as they stand a better chance of success.

However, when attempting to classify projects, several common phenomena should be considered:

Community takeover: In some cases, a developer of a promising and popular concept decides to exit by selling all their tokens. In response, the community creates new communication channels, effectively rebooting the project while avoiding the risks of developer mischief.

Influencer revival: Difficult to predict, but extreme cases exist where a dead project gains a second life and renewed attention due to involvement from a popular creator.

Sniper exit: Early exits by snipers often leave a blemish on a project’s ranking. However, they increase the chances of successful social media marketing, as they’re less likely to undermine community efforts with massive sell pressure—an effect that easily scares people away.

Finding gems is a daunting task, but as history has shown, they do exist—and occasionally appear on our radar.

Conclusion

The significance of memecoins has reached a level that cannot be ignored. Despite their apparent absurdity, they are here to stay. Even without plans to participate, it would be an unforgivable oversight for any well-informed cryptocurrency investor to disregard such an important segment of the market. With the knowledge gained from this article, we hope your journey through the world of tradable memes feels less like stumbling in the dark and grasping at straws.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News