On-Chain Data Product Insights: The Data Analytics Revolution in the Web3 Era

TechFlow Selected TechFlow Selected

On-Chain Data Product Insights: The Data Analytics Revolution in the Web3 Era

This study will delve into the characteristics of the three major platforms—Nansen, Lookonchain, and Dune Analytics—and their significance for the development of blockchain technology.

Author: Kyle Liu, Investment Manager at Bing Ventures

Introduction

In today's rapidly evolving blockchain landscape, on-chain data has become a core asset and its ecosystem significance is growing. From token transactions to NFT minting, every detail of on-chain activity maps the full picture of value flows. In this data-driven era, on-chain data is more than just numbers—it reflects market dynamics, user behavior, and the overall health of the blockchain ecosystem.

Marketing teaches us that consumer behavior analysis profoundly impacts future market trends. Similarly, in the on-chain world, deep insights into user behavior are invaluable for market participants. Nansen, Lookonchain, and Dune Analytics—leading crypto data analytics platforms—not only provide in-depth on-chain data analysis but also play an essential role in blockchain development. This study will explore the characteristics of these three platforms and their significance for the advancement of blockchain technology.

The Importance of On-Chain Data Analysis

On-chain data reflects user behavior. In the blockchain world, on-chain data can represent individuals, institutions, exchanges, market makers, and any entity engaging in on-chain activities. On-chain data analysis offers insights into market trends and user behavior, uncovers potential opportunities and risks, improves operational efficiency and reduces costs, supports decision-making and strategic planning, and enhances security and risk management. Through in-depth analysis of on-chain data, both retail and institutional investors can gain the following benefits:

-

Data-driven decision-making: On-chain data provides investors and projects with an objective perspective, helping them better understand actual market conditions and make informed investment decisions.

-

Optimized market strategies: Deep analysis of on-chain data helps projects and traders understand market demand and shifts, enabling adjustments to market strategies.

-

Improved operational efficiency: By identifying bottlenecks and issues in operations, resources and processes can be optimized.

-

Foster innovation and R&D: Provides valuable feedback to projects, helping them understand user needs and stay aligned with market demands.

-

Increased transparency and trust: On-chain data offers all participants in the decentralized ecosystem a public and transparent platform, enhancing system credibility. Discovering opportunities and risks: Helps identify market opportunities and potential risks, reducing exposure.

-

Enhanced security and risk control: Real-time monitoring and analysis of on-chain data enable timely detection of anomalies and risk events, allowing for prevention and response.

Source: Bing Ventures

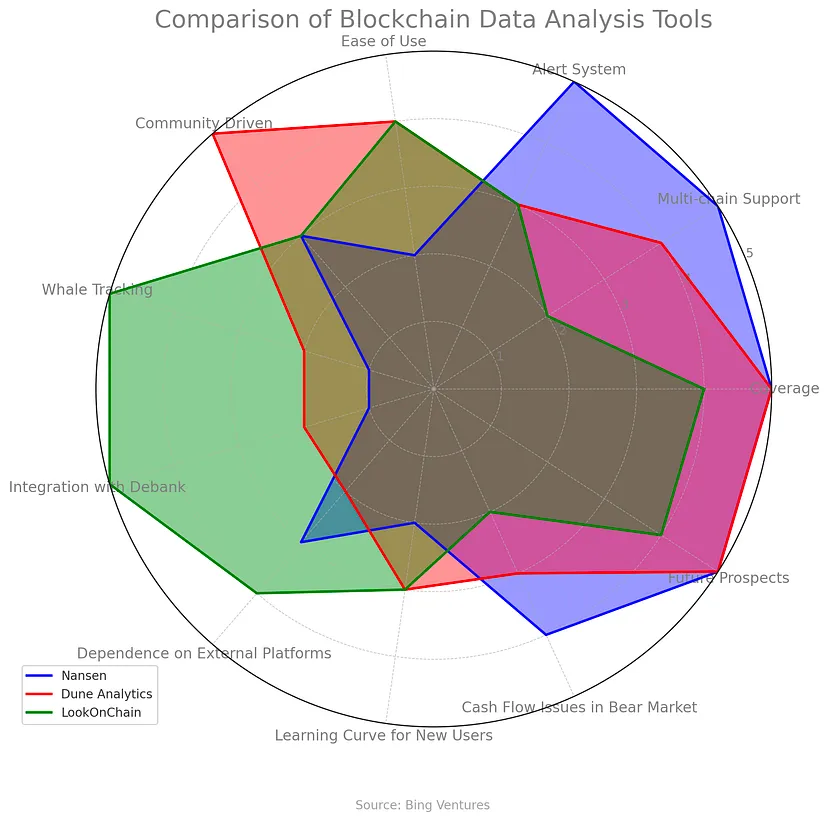

Typical features of Web3 data tools—Nansen, Dune Analytics, and LookOnChain—are leaders in this field, each offering unique and insightful capabilities. A deeper analysis of these tools not only reveals their respective strengths and limitations but also explores future trends in the data market and their impact on investors.

Nansen — Pioneer of On-Chain Behavior Analysis

Source: Nansen

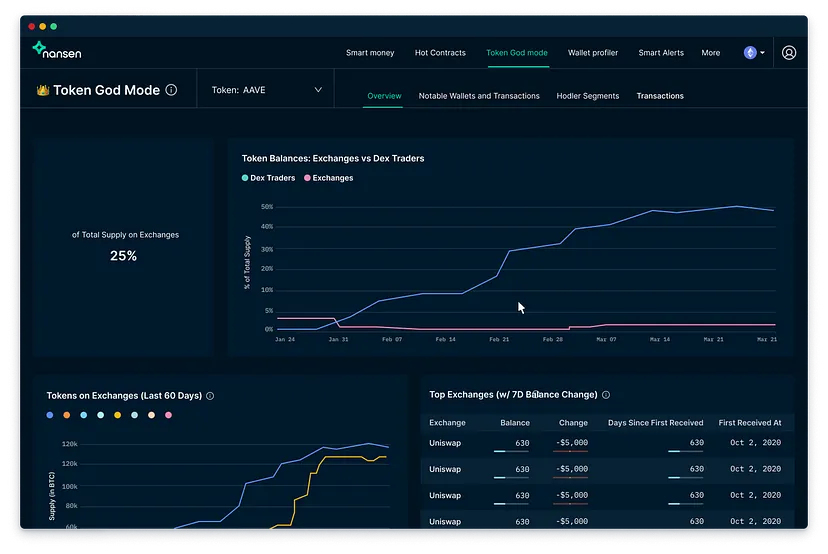

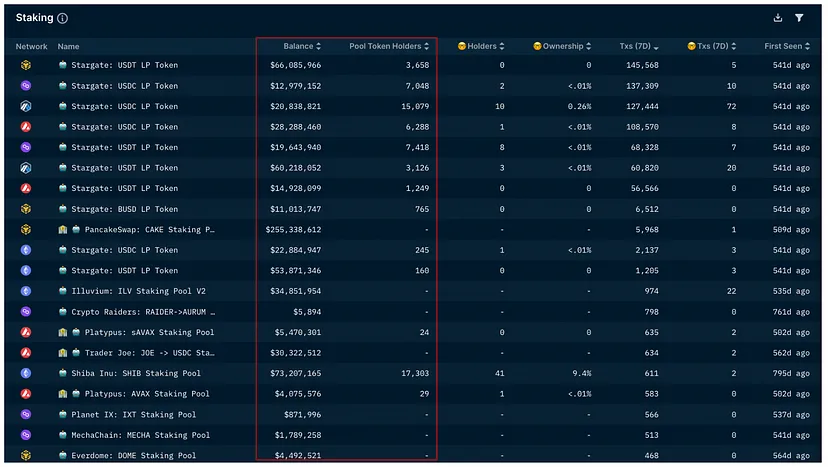

By analyzing behaviors across over 120 million wallet addresses, Nansen provides deep insight into the crypto market. It primarily focuses on token holdings, exchange inflows and outflows, and smart contract dynamics. With its sophisticated labeling system and alert mechanism, users can quickly identify market trends and seize investment opportunities.

Deep Analysis at the Token Level

Nansen’s token-level analysis covers multiple dimensions, including Smart Money position changes, exchange fund flows, and overall token market performance. This comprehensive view enables investors to understand market dynamics from various angles, leading to more accurate investment decisions.

Source: Nansen

Practical Application

Source: Nansen

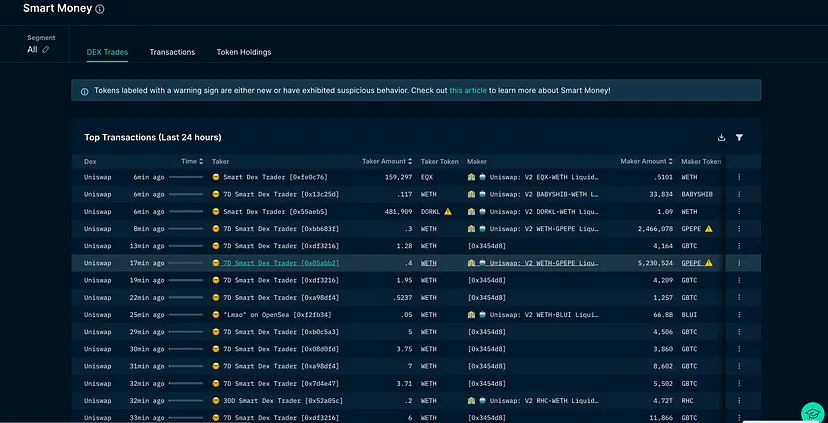

Start at the market level by reviewing Smart Money trading activity for the day and infer their strategy (heavy buying: potential pump opportunity; heavy selling: potential dump signal), thereby identifying promising projects for investment. Unfamiliar projects can be further researched.

Source: Nansen

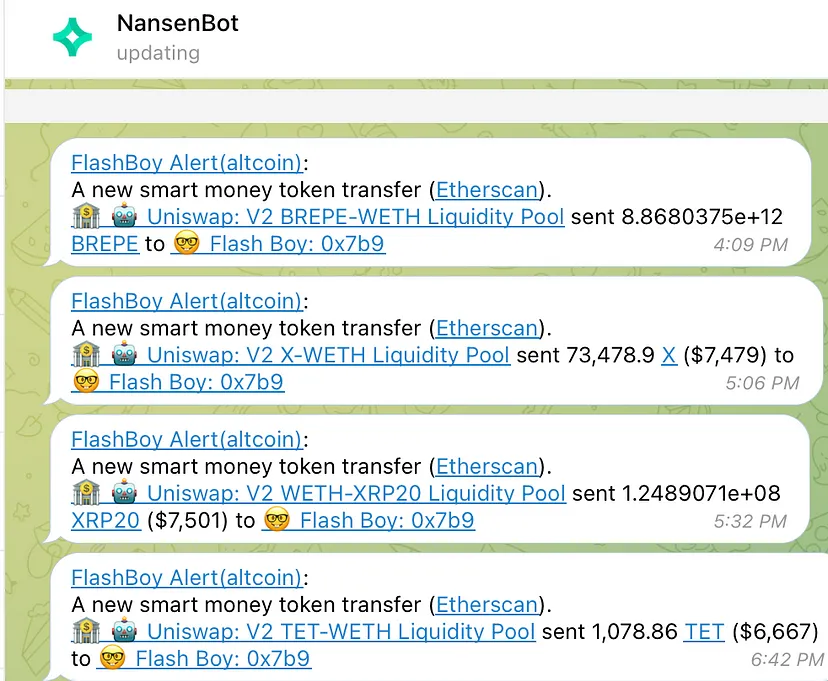

In the cryptocurrency and blockchain space, Smart Money movements are often seen as indicators of market trends. Different Smart Money groups—such as Flash Boys, funds, and other large holders—each have unique trading patterns and strategies. Understanding these can offer investors valuable trading signals and market insights.

Observing Flash Boys’ Trading

Characteristics

Flash Boys typically seek short-term profits, relying on technical analysis and market sentiment rather than long-term fundamental analysis.

Trading Signals

Monitoring Flash Boys’ trades can provide clues about short-term market trends. For example, heavy purchases may indicate near-term upside potential.

Risks

Since Flash Boys rely on short-term trends, following their moves carries higher risk. Investors should ensure alignment with their own risk tolerance.

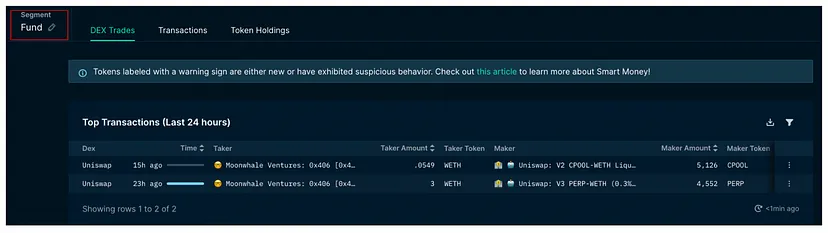

Observing Fund Trades

Characteristics

Funds and large holders typically adopt more conservative, long-term strategies based on in-depth research and fundamental analysis.

Trading Signals

Tracking fund trades can reveal medium-to-long-term trends. For instance, multiple large funds accumulating a token may signal long-term growth potential.

Strategy Reference

Fund strategies are often systematic and stable. By analyzing their trade patterns, investors can learn and refine their own portfolios. However, crypto funds often face periodic token unlocks, so fund holdings and transfers may not fully reflect market sentiment. Investors should remain cautious.

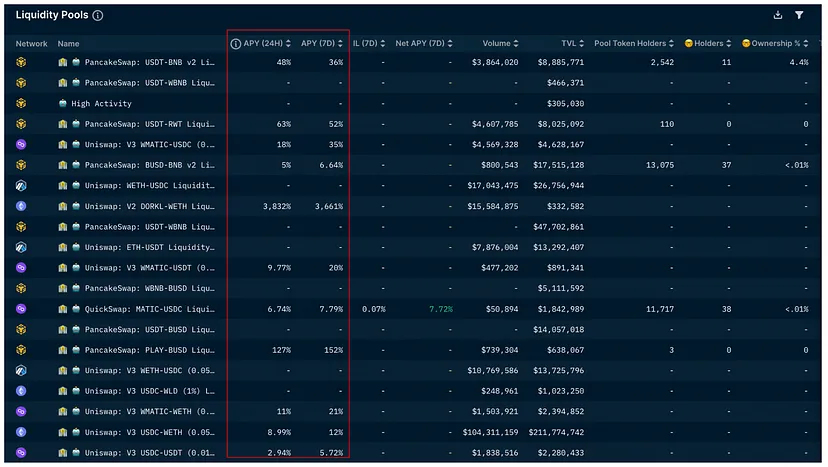

Smart Contract and Liquidity Provider Analysis

Nansen tracks popular contracts and liquidity providers (LPs) to display key metrics such as annual percentage yield (APY). These data points are crucial for assessing the potential value and risk of DeFi projects.

Source: Nansen

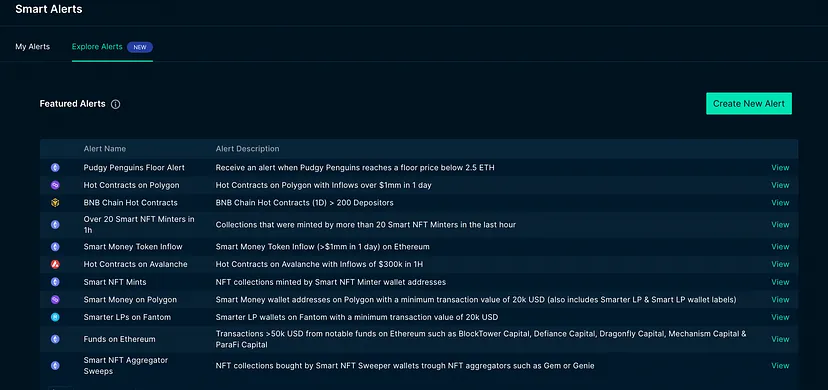

Tagging System and Alert Mechanism The tagging system and alert mechanism provide real-time feedback on market dynamics. By tracking specific tags and wallet addresses, users receive timely information and can quickly adjust investment strategies.

Source: Nansen

Practical Application

Source: Nansen

Nansen AI’s alert system provides a powerful tool for crypto investors and projects, helping them capture market movements, manage risks, and optimize strategies.

Multi-Chain Support

-

Comprehensive Coverage—Support for multiple public chains allows investors to monitor diverse markets, gaining a broader market perspective.

-

Flexibility—Whether TOKEN or NFT, users can select and track according to their needs, offering great flexibility.

Custom Alerts

-

Tracking Smart Money—Users can add Smart Money wallet addresses to monitor their trades in real time, capturing opportunities or avoiding risks.

-

Tag-Based Filtering—Using numerous tag indicators provided by @nansen_ai, users can set precise alert conditions to ensure relevance and accuracy.

-

Amount Filtering—Set alerts based on transaction size to catch large trades and key market movements.

Notification Features

Source: Nansen, Telegram

-

Multi-Platform Integration—Alerts can be delivered via TG (Telegram) and DC (Discord), ensuring users receive notifications across platforms promptly.

-

User-Friendliness—Simple and easy to use; users can customize alert settings without complex operations.

-

Flexibility—The alert system offers strong configurability, allowing users to tailor it to their needs.

Overall, Nansen’s current AI system functions similarly to a bot, tracking pre-defined addresses/tokens and delivering updates through Telegram-like push notifications. The level of AI-powered intelligent analysis remains low—mostly reactive alerts based on on-chain activity—and currently lacks innovation and competitiveness. Nansen may focus more on enhancing this area in the future.

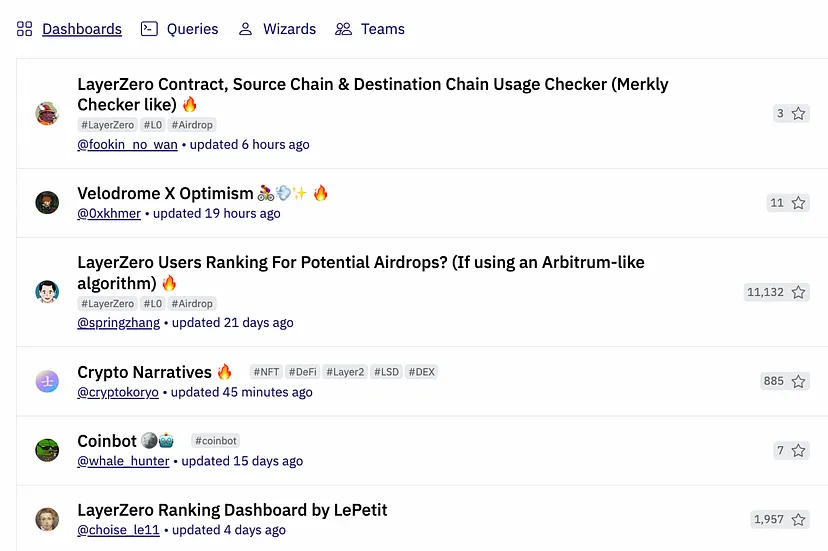

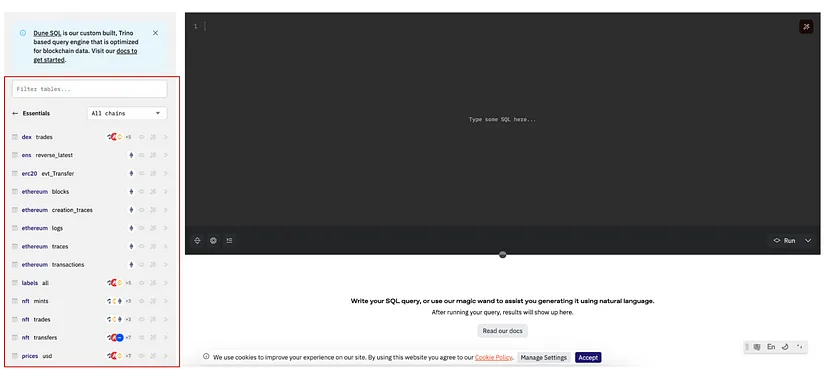

Dune Analytics — A Market Telescope Driven by Data

Dune Analytics offers powerful SQL-based data analysis capabilities covering various aspects of cryptocurrencies and DeFi. Its community-driven model and open data access strategy make it a highly dynamic analytical platform.

Source: Dune

Community Sharing and Collaboration

Dune’s community culture encourages data sharing and collaboration, providing users with a continuously evolving analytical environment. Users can easily access and modify others' dashboards, creating new perspectives adapted to market changes.

Powerful Customization Features

Dune’s customization allows users to tailor data presentation to their needs. This flexibility is one of Dune’s major advantages, making it highly adaptable—especially for advanced users with specific data requirements.

Moreover, Dune Analytics’ comprehensiveness is another reason for its popularity. It supports multi-chain data analysis, offering users a holistic market view. Regardless of the project or domain, users can find detailed data and in-depth analysis on Dune.

Usability

Dune Analytics demonstrates strong functionality and user-friendly design in usability.

-

Chart Flexibility—Dune allows users to zoom, go fullscreen, and select specific chart sections, offering high customizability for tailored data viewing and analysis.

-

Fork Feature—The Fork function lets users copy entire datasets into their workspace. This encourages exploration and experimentation while providing a safe environment for modifications without affecting the original dataset.

-

Query and Code Transparency—The Query feature allows users to view the code behind datasets, increasing transparency and enabling experienced users to understand data sources and processing methods.

-

Search and Sorting—Dune’s search function enables quick discovery of project information, sortable by popularity, favorites, and release date, greatly improving work efficiency.

-

Code Reuse and Modification—Dune encourages users to fork successful datasets and modify their code, lowering entry barriers by allowing users to build upon existing work.

Source: Dune

Compared to Nansen, Dune excels in customizable data design. Users can leverage open APIs to create personalized dashboards—offering greater freedom, flexibility, and composability. Many projects now directly showcase their transaction and operational data on Dune for investor reference. In contrast, Nansen’s “standardized” data suits institutional and novice users. Going forward, Dune could introduce reward mechanisms to incentivize dashboard creators, fostering ecosystem growth.

LookOnChain — Intuitive Tracking of Market Dynamics

LookOnChain is renowned for its intuitive Twitter presence and deep tracking of whale wallets. It offers users a unique lens to observe market dynamics, especially in monitoring large investors.

Source: X

Whale-Centric Strategy

By focusing on key whale wallets, LookOnChain enables users to quickly grasp major market trends. This approach particularly benefits investors aiming to follow market leaders. Through LookOnChain, investors not only access transaction records but also gain insights into underlying strategies and motivations. Such information is invaluable for success in the volatile crypto market. After all, having correct information and strategy is key to success. Thus, LookOnChain offers investors a unique opportunity to better understand the market and make informed decisions.

Integration with DeBank for Deeper Analysis

LookOnChain connects with DeBank to provide more detailed analysis of whale wallets. This deeper insight helps users understand the specific strategies and market movements of these large accounts.

Each of the three platforms showcases a different facet of on-chain data analysis. Nansen offers a comprehensive market view through deep wallet behavior analysis and real-time updates. Dune Analytics provides a collaborative and innovative environment for data analysts and developers through powerful customization and community sharing. LookOnChain delivers quick, intuitive market insights accessible even to non-technical users.

Comparative Analysis Using a Multi-Dimensional Business Evaluation Model

Data infrastructure is essential in the crypto industry. Data analytics platforms not only assist investment decisions but also support AML and crime tracking. On-chain behavior analysis is a key selling point for data platforms—the benefit being early identification of investment opportunities, while the drawback lies in the uncertainty and associated risks. Regardless, on-chain data should serve as supplementary input for decision-making. Investors must combine this with personal judgment and real-world context to execute sound strategies.

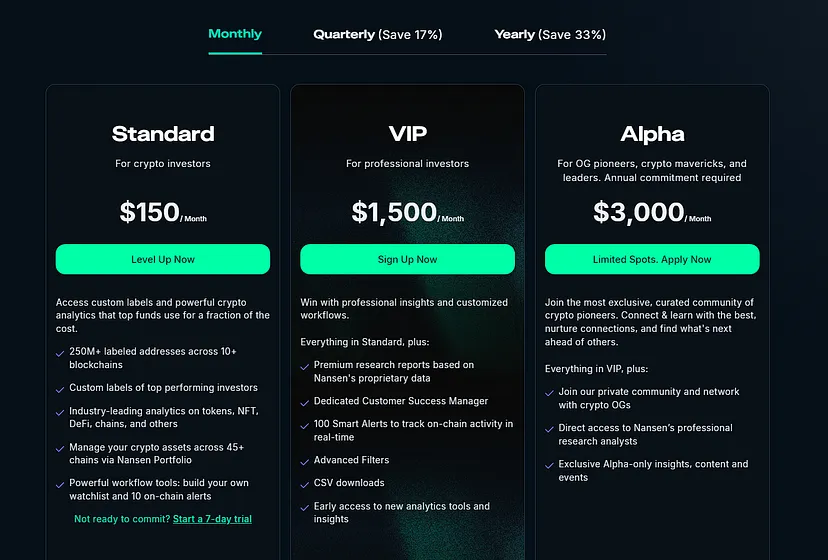

Overview of Monetization Models for Web3 Data Tools

Nansen: Institutional Think Tank Style, More Elite

Revenue model: To serve diverse users, Nansen offers three tiers: $150/month (Standard), $1,500/month (VIP), and $2,500/month (Alpha). Paid subscribers gain access to research reports, project analyses, and direct interaction with Nansen’s professional analysts.

Source: Nansen

Tokenomics: No token has been launched yet.

Dune Analytics: Developer Community-Oriented, More Fun

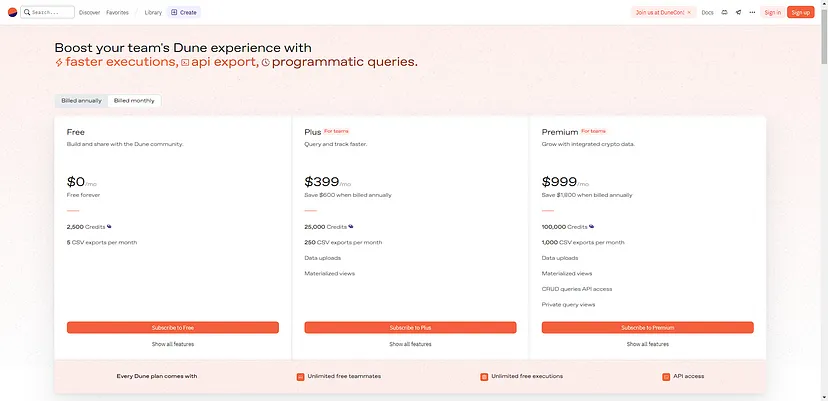

Revenue model: Regular users can freely access blockchain data, create dashboards, share charts, and fork queries. Upgrades to “Dune Plus” ($349/month) or “Dune Premium” ($389/month) unlock features like concurrent queries, queue skipping, result exports, private data, and watermark removal. Enhanced API call limits strengthen enterprise-client relationships, transforming the platform from an external data provider into a core infrastructure component.

Source: Dune

Tokenomics: No token has been launched yet.

LookOnChain: Trend-Following, High Virality

-

Revenue model: LookOnChain currently offers free insights on X, monetizing through paid groups and exchange referral programs.

-

Tokenomics: No token has been launched yet.

From a Traditional Multi-Dimensional Business Evaluation Perspective

When comparing these three blockchain data analytics tools, we find that Nansen, Dune Analytics, and LookOnChain each demonstrate distinct strengths and limitations across different dimensions. Nansen leads in data depth and multi-chain support, Dune Analytics excels in user experience and community-driven content innovation, while LookOnChain stands out in delivering intuitive market insights.

Technological Innovation

Nansen’s technological innovation lies in its ability to deeply analyze over 120 million wallet addresses. Its strength is synthesizing token holdings and smart contract activity to provide a holistic market view. However, this relies heavily on labeled addresses, potentially creating blind spots for emerging or unlabeled ones.

Dune Analytics shines with its superior SQL capabilities in data processing. This not only positions it at the forefront of data analytics but also provides developers with powerful customization tools—a rarity in the market. We strongly believe in this model.

LookOnChain innovates by directly tracking large investors (whale wallets). This is crucial for quickly capturing market trends, especially in the highly volatile crypto market.

Market Adaptability

Nansen shows broad adaptability through multi-chain data analysis. However, this breadth may lead to scattered focus, affecting in-depth analysis of specific chains or market segments. We observed this limitation—Nansen sometimes fails to promptly cover trending sectors or narrative-driven tokens.

Dune Analytics quickly adapts to market changes through its open community culture and user-friendly interface. This flexibility makes it the preferred choice for users seeking fast reactions and deep insights.

LookOnChain leverages Twitter’s popularity to rapidly adapt to social media-driven market dynamics. However, this creates over-reliance on a single platform.

User Experience

Nansen’s tagging and alert systems offer a highly personalized experience, though the complex interface presents a steep learning curve for beginners.

Dune Analytics scores high in UX with its simple SQL interface and rich community content. Its friendliness appeals to both technical and non-technical users, creating a win-win situation.

LookOnChain delivers excellent experiences for non-technical users with intuitive displays and simple interactions. However, the depth and breadth of information may sometimes fall short for advanced users.

Business Model and Profitability

Nansen’s tiered subscription model reflects deep understanding of diverse user segments. This differentiated strategy enhances market coverage and ensures stable revenue.

Dune Analytics demonstrates a flexible business model with free access and premium upgrades. This maintains community engagement while unlocking profit potential.

LookOnChain creatively leverages its massive Twitter following as a revenue supplement, showing business model innovation. However, the sustainability and stability of this model require further validation.

On-Chain Data Tools Evaluation Framework (ODTEF)

To better assess Web3 on-chain data analytics tools, we refined the traditional multi-dimensional business evaluation model to create the “On-chain Data Tools Analysis Evaluation Framework (ODTEF),” tailored specifically to blockchain characteristics and the uniqueness of Web3 data tools. Key evaluation dimensions include:

-

Decentralization Capability: Assess the degree of decentralization in data management and analysis, including distributed storage, processing, and access.

-

Real-Time Data Tracking and Transparency: Evaluate whether the tool offers real-time on-chain monitoring and performs well in data transparency and traceability.

-

Smart Contract Analysis and Interaction Capability: Examine the tool’s ability to analyze smart contracts and integrate with on-chain resources like DeFi and NFTs.

-

Web3 Data Security and Anonymity: Focus on privacy protection during on-chain data handling and overall data security in the Web3 environment.

-

Economic Model and Tokenomics: Evaluate whether the business model integrates tokenomics and how effectively it uses crypto and tokens to drive ecosystem engagement.

Nansen: Benchmark in On-Chain Intelligence and Deep Analysis

-

Decentralization Capability: Nansen excels in data integration and analysis but its reliance on centralized data warehouses weakens its decentralization potential in Web3. Future efforts should explore decentralized storage and analysis solutions to strengthen leadership in decentralized data processing.

-

Real-Time Data Tracking & Transparency: Nansen performs well in real-time on-chain monitoring, especially for token liquidity and large transactions. However, it needs to improve clarity around data sources and analytical logic for users.

-

Smart Contract Analysis Capability: Nansen offers relatively comprehensive smart contract analysis, particularly for DeFi and NFT markets. Future enhancements should deepen integration with smart contracts for richer interactive analysis.

-

Web3 Data Security & Anonymity: Nansen maintains high standards in data security and privacy. As the Web3 environment evolves, it must further strengthen data handling and storage mechanisms to better protect user privacy.

-

Economic Model & Tokenomics: Nansen’s model is subscription-based and hasn’t widely adopted tokenomics. Looking ahead, introducing token incentives could boost user engagement and ecosystem vitality.

Dune Analytics: Frontier of Community-Driven and Customizable Analysis

-

Decentralization Capability: Dune Analytics stands out in decentralized data analysis, especially through its community-driven sharing model. However, there’s room to improve decentralization in data storage and processing.

-

Real-Time Data Tracking & Transparency: Dune offers highly transparent data visualization, especially in community-created dashboards. This transparency and timeliness deliver deep market insights.

-

Smart Contract Analysis Capability: Dune provides flexible and customizable smart contract analysis but needs to improve depth and precision in complex scenarios.

-

Web3 Data Security & Anonymity: As data security and privacy grow in importance, Dune must continue strengthening protections for user data and privacy.

-

Economic Model & Tokenomics: Dune’s business model is flexible but still nascent in integrating tokenomics. Future exploration could embed token economics into its core strategy.

LookOnChain: Leader in Real-Time Monitoring and Market Insight

-

Decentralization Capability: As a social media-based analytics platform, LookOnChain has room to improve data decentralization, particularly in distributed storage and processing.

-

Real-Time Data Tracking & Transparency: LookOnChain uniquely excels in real-time whale and large-transaction tracking, delivering immediate and transparent market insights.

-

Smart Contract Analysis Capability: LookOnChain’s smart contract analysis is relatively limited. It should enhance capabilities for analyzing complex smart contract interactions.

-

Web3 Data Security & Anonymity: In the Web3 environment, LookOnChain must strengthen data security and user privacy, especially when handling sensitive transaction data.

-

Economic Model & Tokenomics: LookOnChain’s model is simple, relying on paid users and partnerships. It could explore integrating tokenomics to boost participation and ecosystem activity.

Creative Ways to Increase the Presence of On-Chain Data Analysis

In summary, Nansen, Dune Analytics, and LookOnChain each demonstrate unique strengths and potential in Web3 on-chain data analysis. They vary in decentralization capability, real-time tracking, smart contract analysis, Web3 data security, and business models. We expect Nansen to solidify or expand its market leadership by supporting more chains and enhancing analytical features. Dune Analytics may maintain its edge by enriching its community and improving tool functionality. LookOnChain can boost competitiveness through broader platform collaborations and enhanced data services.

Nansen: Integrating Decentralized Data Storage and Analytics

-

Develop decentralized data warehouses: Nansen should explore using blockchain technology for data storage and processing to increase decentralization. Collaborations with hardware or DePIN projects could enhance data security and immutability while expanding reach among institutional users.

-

Real-time on-chain data analysis: To offer more timely insights, Nansen could develop smart contracts to monitor and analyze on-chain events like large transactions and liquidity shifts in real time, instantly revealing market dynamics and opportunities.

-

Deepen smart contract and DeFi analysis: Nansen should further enhance its smart contract analysis, particularly within DeFi ecosystems, offering deeper risk and yield assessments to help investors make smarter decisions.

Dune Analytics: Expanding the Community-Driven Model

-

Community incentive mechanisms: Dune could introduce token rewards to encourage community members to create and share high-quality dashboards. This would boost engagement and enrich the platform’s data resources.

-

Enhance decentralized data processing: Dune should explore decentralized computing solutions for complex analyses, improving transparency and security. With abundant data sources, Dune holds strong potential for AI integration.

-

Strengthen smart contract integration: Dune could deepen integration with smart contracts, enabling users to interact directly from dashboards—executing trades or joining DeFi protocols. Dune might even evolve into a preferred Web3 development platform, increasing the likelihood that breakout projects originate directly on Dune, not just as visualizations.

LookOnChain: Enhancing Data Analysis Depth

-

Enhance smart contract analysis: LookOnChain should improve its analysis of complex DeFi protocols and NFT projects, helping users better understand internal mechanics and risks.

-

Expand data sources and partnerships: By collaborating with more blockchain projects and data providers, LookOnChain can broaden its data scope, offering a more comprehensive market view and building trust in data accuracy.

Redefining the Future of Web3 Data Analytics Tools

Beyond Traditional Models Toward True Decentralization:

Traditional analytics rely on centralized data storage and processing—but in Web3, this model must be reimagined. Tools like Nansen, Dune Analytics, and LookOnChain should explore blockchain-based data storage and analysis, using distributed ledgers for transparency and immutability or decentralized compute resources for processing. This is not just a technical shift but a philosophical transformation in data handling.

Real-Time Analytics: From Reaction to Prediction:

The future of Web3 data analytics lies in real-time and predictive capabilities. Tools should evolve from passive monitoring to intelligent systems that predict trends and detect patterns—leveraging machine learning and AI for instant market forecasting.

Deep Smart Contract Integration and Interaction:

Web3 data tools must integrate more deeply with smart contracts—not just analyzing data, but interacting directly to enable automated trading, risk assessment, and strategy execution.

Data Security and Privacy: Building a New Trust Framework:

In the Web3 era, data security and privacy will be core competitive advantages. By adopting advanced technologies like zero-knowledge proofs, analytics tools can perform deep analysis without exposing sensitive user data, building a safer, more trustworthy ecosystem.

Innovation in Token Economics:

Web3 data tools should integrate tokenomics into their business models—not just for incentives, but as mediums of exchange, proof of stake, and governance tools—creating self-sustaining, value-accruing ecosystems.

Agility for the Future:

Finally, Web3 data tools must be agile and adaptive to rapidly changing tech and market conditions. This means continuous iteration, rapid adoption of new technologies, and constant UX optimization. The faster a tool iterates and improves, the more likely it is to win.

The future of Web3 data analytics involves not just technological progress, but a fundamental reinvention of the nature of data analysis and business models. Data providers could become predictors of market dynamics, assistants in user decision-making, and active participants in the blockchain ecosystem—gaining far greater visibility.

The future development of these tools will depend on multiple factors: technological innovation, market adaptability, user experience, business models, and long-term potential. As blockchain technology advances and market needs evolve, these tools must continuously adapt and optimize to maintain competitiveness.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News