GMX v2 and Its Competitors: The New Wave Disrupting the Decentralized Derivatives Market

TechFlow Selected TechFlow Selected

GMX v2 and Its Competitors: The New Wave Disrupting the Decentralized Derivatives Market

This article will use GMX v2 as a starting point to discuss the evolving competitive landscape and future trends of the decentralized derivatives market, focusing on GMX and its main competitors.

Author: Bing Ventures

As the cryptocurrency market matures, decentralized derivatives exchanges such as GMX v2, Vertex Protocol, Hyperliquid, and Apex Protocol are emerging as key players. These platforms are not only challenging GMX's leadership but also signaling a significant transformation in the decentralized finance (DeFi) landscape. This research article by Bing Ventures uses GMX v2 as a starting point to explore the evolving competitive dynamics and future trends within the decentralized derivatives market.

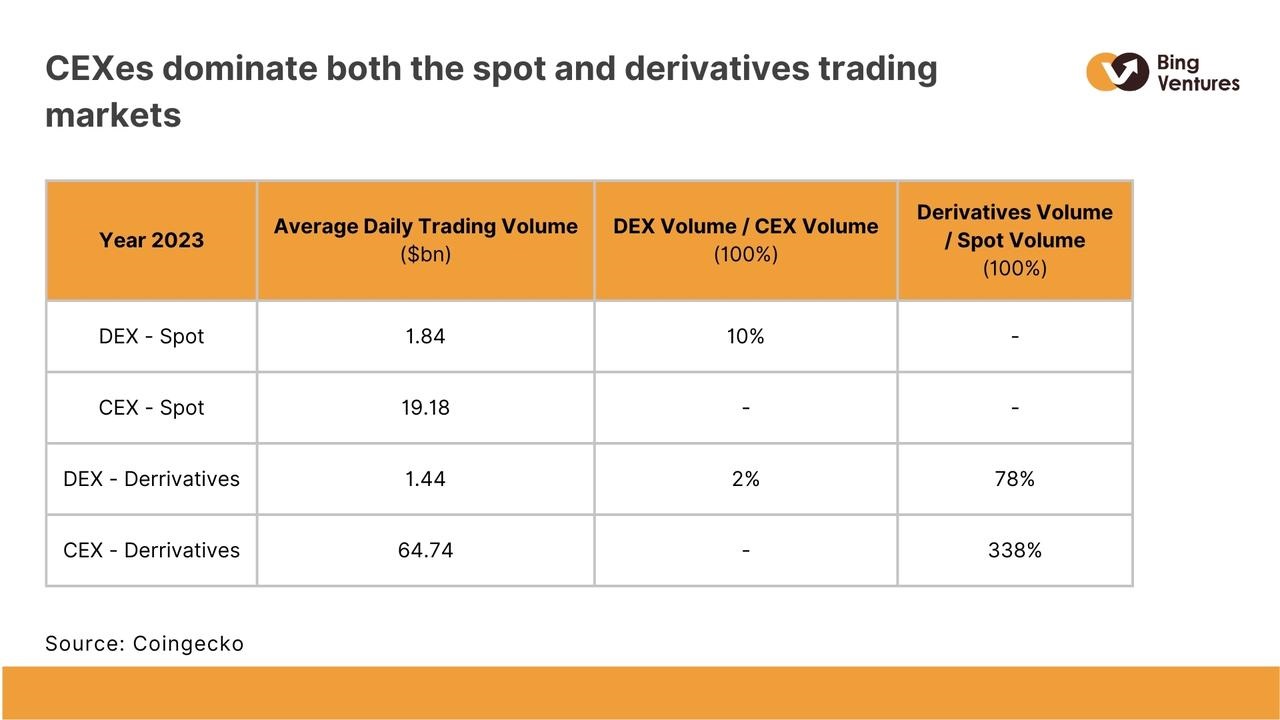

The Scale of the Decentralized Derivatives Market

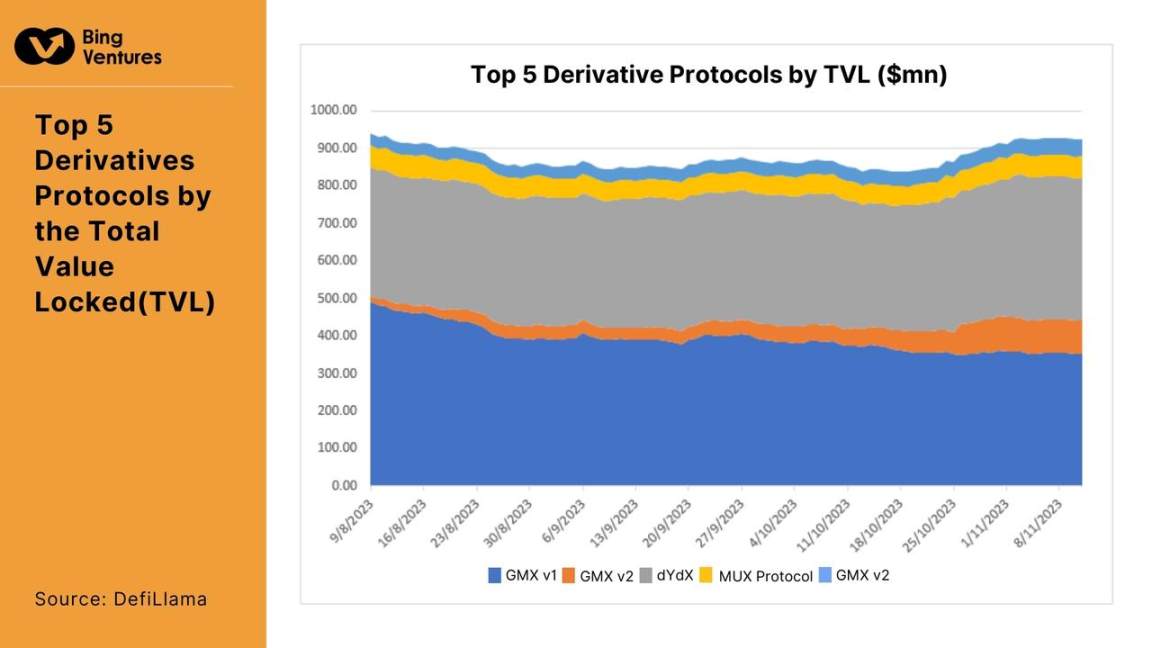

Source: Coingecko

The table above shows average daily trading volumes for spot and derivatives on centralized and decentralized exchanges in 2023. It reveals that decentralized exchanges’ spot trading volume at $1.84B slightly exceeds their derivatives volume of $1.44B. In contrast, centralized exchanges see a much higher derivatives volume of $64.74B compared to $19.18B in spot trading.

From this data, we can observe that both spot and derivatives markets on centralized exchanges significantly outpace those on decentralized platforms, with derivatives being especially dominant. Despite events like the FTX collapse and previous failures of centralized institutions, centralized exchanges remain the preferred choice for most users. Moreover, the ratio of derivatives to spot trading volume is far higher on centralized exchanges, indicating significantly greater activity in their derivatives markets.

Source: DefiLlama

GMX v2 and Its Competitors

GMX v2: A Disruptive Newcomer

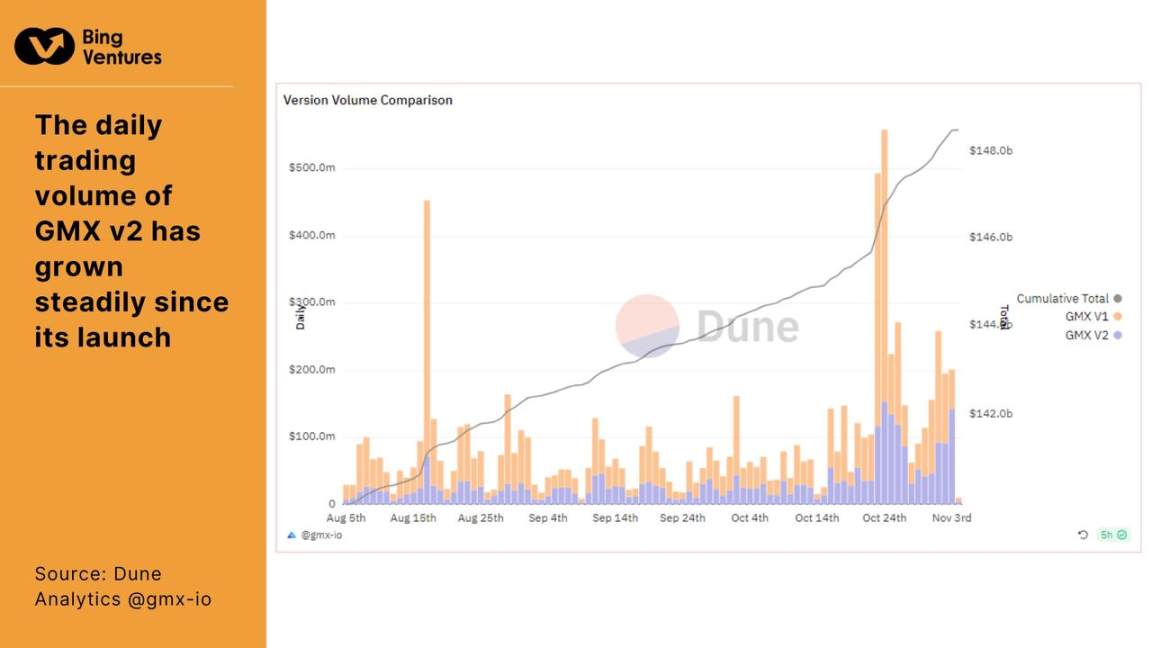

We analyzed market changes since the official launch of GMX v2. Initially, the market was dominated by GMX v1 and dYdX, while Mux Protocol and Apex Protocol trailed far behind in TVL. At its start, GMX v2 had negligible TVL. However, by November 5, 2023—within less than four months—GMX v2 evolved to rival and even surpass Mux Protocol and Apex Protocol in TVL (GMX v2: $89.27M; Mux Protocol: $57.71M; Apex Protocol: $45.51M). Concurrently, GMX v1’s TVL declined, likely due to user migration to v2, which addressed many of v1’s shortcomings, leading to the current market structure.

Source: Dune Analytics @gmx-io

Since its release, GMX v2 has experienced rapid growth in daily trading volume, reflecting strong market response to its new features and improvements. The TVL increase relative to v1 demonstrates the effectiveness of its optimization strategies, particularly in enhancing trading efficiency and reducing user costs. This growth in TVL indicates not just capital inflow but also a deeper shift: migration from older protocols and acquisition of new users. Such growth comes with challenges, especially in sustaining momentum and appeal. GMX v2’s future depends on its ability to maintain this trajectory while ensuring platform stability and security.

Source: Dune Analytics @gmx-io

As shown in the chart above, v2’s daily active users have nearly caught up with v1. However, GMX v2’s user growth stems from a more diverse base, including both migrating users from v1 and entirely new DeFi participants. This growth reflects recognition of GMX v2’s improved trading experience and higher capital efficiency, attracting a broad user segment. On fees, v1 still generates higher fee revenue than v2, highlighting differences in their fee structures. The influx of users underscores GMX v2’s success in marketing and user education. Yet, rapid growth brings challenges—converting these new users into long-term loyalists remains a critical task. We believe GMX v2 should focus on continuous UX improvement and deeper community engagement to solidify its market position.

Meanwhile, to promote balance between long and short positions and improve capital efficiency, GMX v2 adjusted its fee model. Key adjustments include:

-

Reduced opening/closing fees: Lowered from 0.1% to 0.05% or 0.07%, depending on whether the trade helps balance market exposure. Trades that improve balance incur lower fees.

-

Introduction of funding fees: The stronger side in long-short positioning pays a funding rate to the weaker side. This rate is variable and tiered based on position ratios. For example, if total long positions exceed shorts, the funding rate paid by longs increases progressively until the imbalance falls below a threshold or reaches a cap, after which it remains constant. The reverse applies when shorts dominate. This dynamic, tiered mechanism expands arbitrage opportunities, attracting arbitrage capital and promoting market equilibrium.

In summary, one of GMX v2’s biggest challenges lies in maintaining platform security and stability amid rapid growth. In the DeFi space, where security incidents are common, GMX v2 must safeguard against such risks. Another challenge is preserving its competitive edge amid fierce competition, especially against emerging protocols. Continuous innovation will be crucial to keep its products and services appealing. Ultimately, GMX v2’s success hinges on how well it balances growth with stability, and innovation with security.

Source: DefiLlama

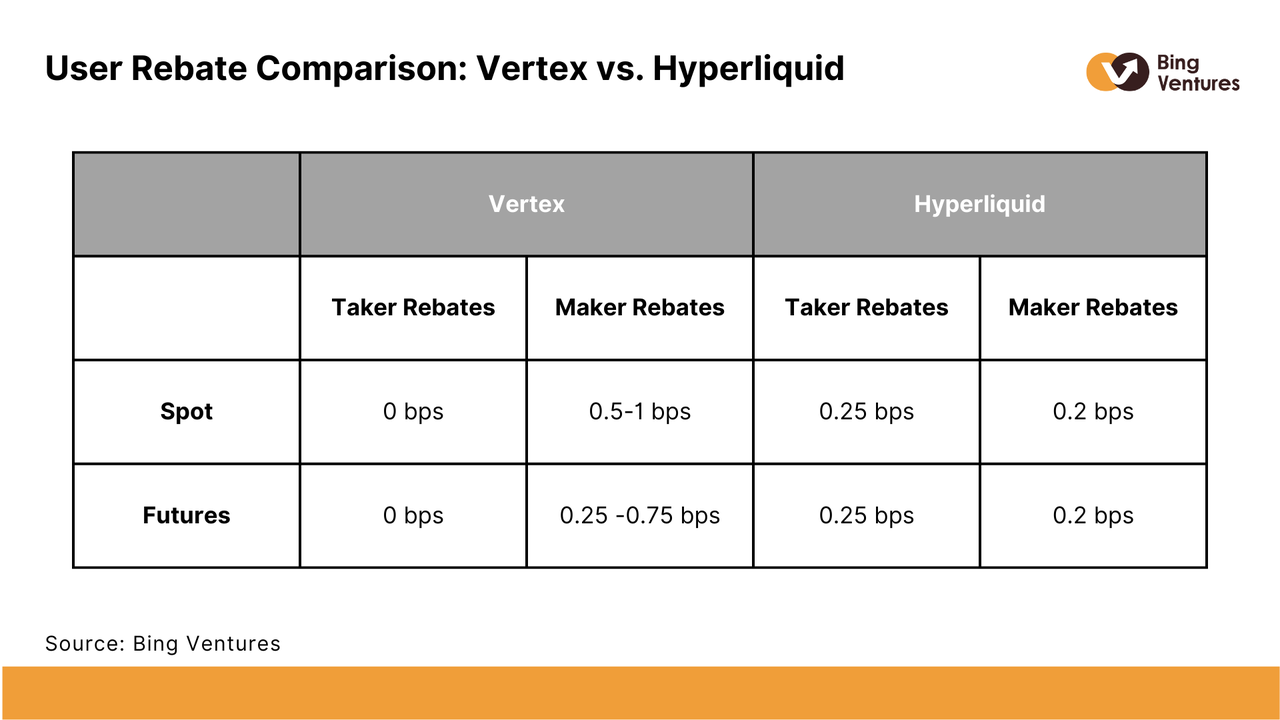

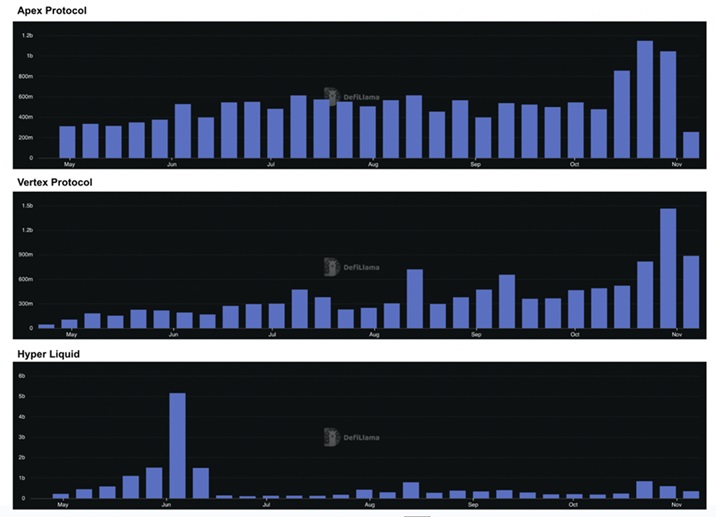

At the same time, we compared the monthly TVL change rates of the top 15 derivative protocols by TVL as of November 6, 2023. While dYdX and GMX showed modest gains, standout performers were Vertex Protocol, Hyperliquid, and Apex Protocol, whose TVL increased by 63.22%, 30.69%, and 25.49% respectively over the past month. Below, we analyze each of these three protocols to uncover the narratives and primary drivers behind their growth.

Vertex Protocol: Cost-Efficiency as Competitive Advantage

Vertex Protocol is a decentralized exchange integrating spot trading, perpetual contracts, and money markets. It uniquely combines a centralized limit order book (CLOB) with an automated market maker (AMM), enhancing liquidity and transforming the user trading experience.

Built on Arbitrum’s Layer 2, Vertex aims to reduce gas fees and mitigate miner extractable value (MEV), promoting efficient and cost-effective trading in the decentralized space. The protocol rests on three pillars: an off-chain sequencer, an on-chain AMM, and a robust on-chain risk engine. The order book and AMM jointly pool liquidity—not only from API-based market makers but also from on-chain contributors. Its risk engine enables fast liquidations, and dual liquidity sources allow traders to achieve better prices. Growing trading volume on Vertex attests to the success of this unique model.

Vertex’s cross-margin system simplifies usage for both novice and experienced traders, significantly lowering margin requirements. For instance, a trader holding a leveraged long ETH spot position and a short ETH perpetual contract may face a combined margin requirement lower than if managing two separate accounts. By introducing portfolio margining, the system allows traders to adjust leverage across positions according to personalized risk preferences. If the value of a long ETH spot position drops, excess collateral from the short ETH perpetual (unrealized gains) can help maintain required margin levels, preventing forced liquidation of the spot position. Clearly, Vertex maximizes capital efficiency.

Project Performance

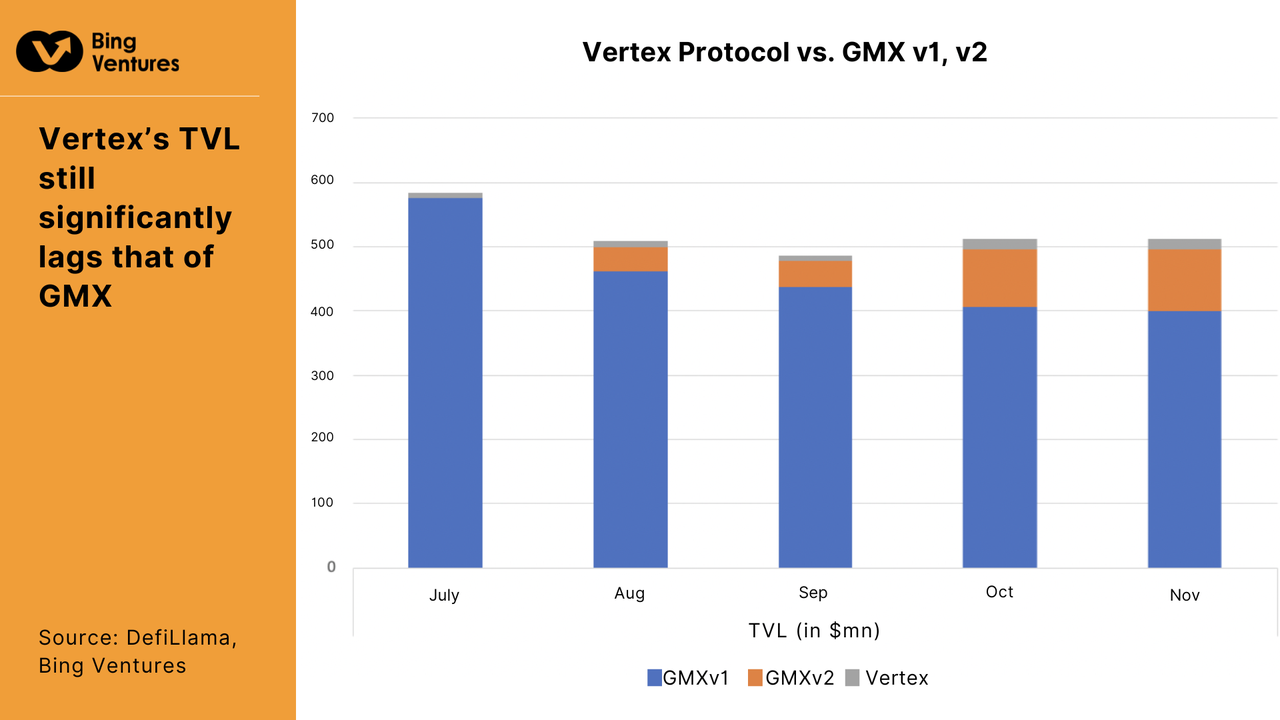

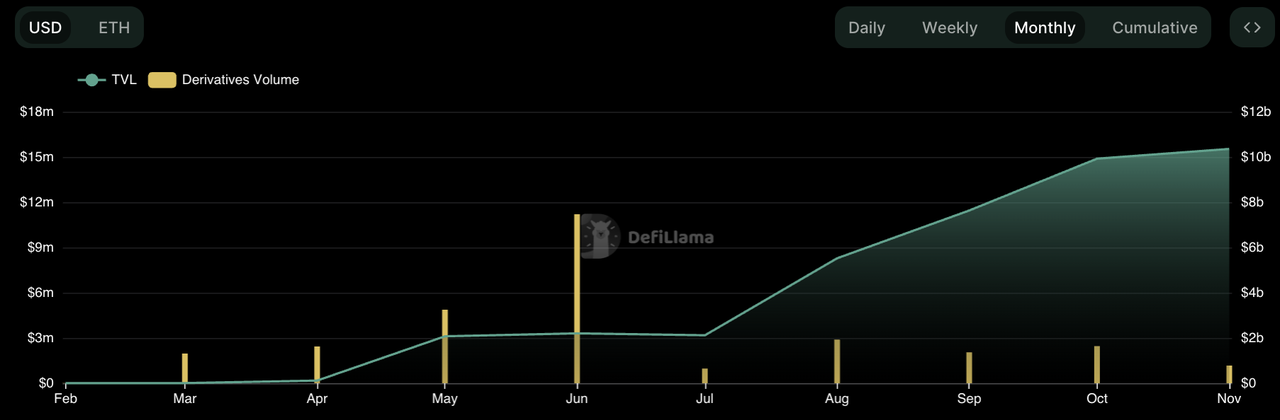

Since its launch, Vertex Protocol has shown steady upward trends in both TVL and derivatives trading volume.

Total Value Locked (TVL)

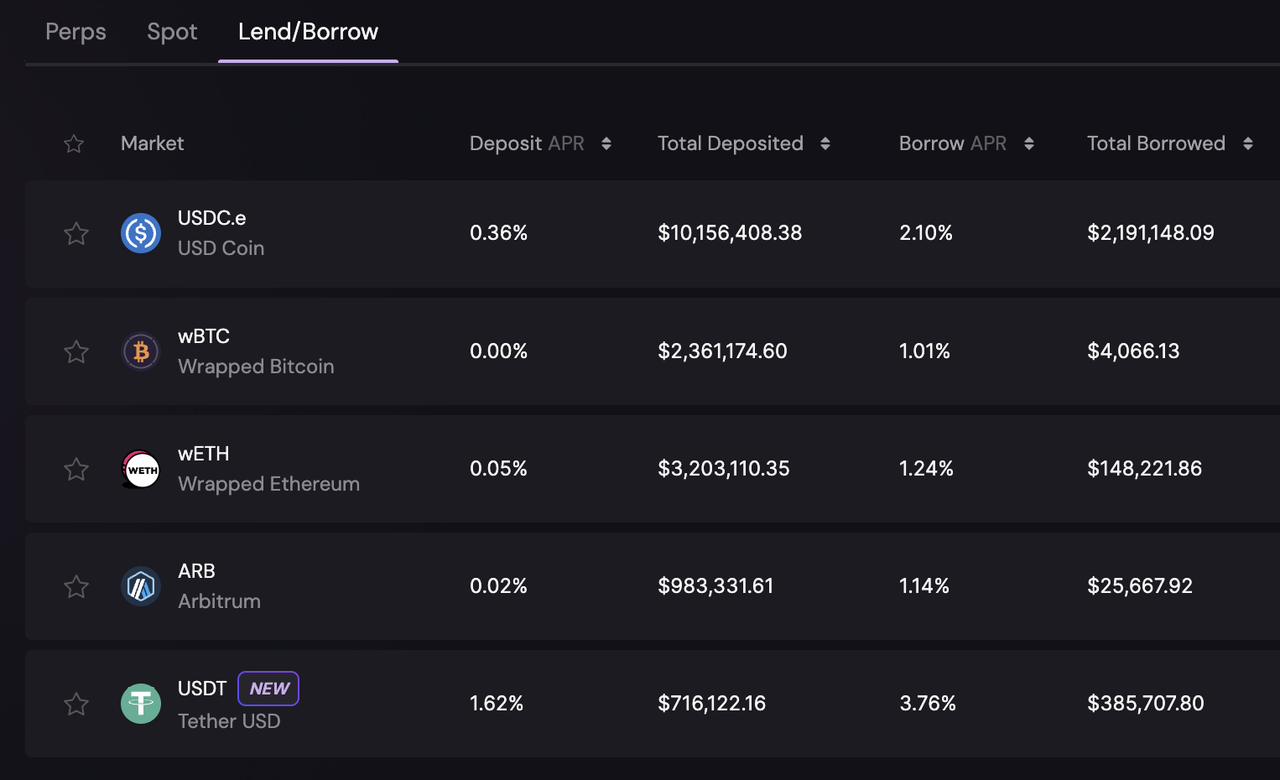

Despite offering innovative trading experiences, Vertex’s TVL remains modest compared to GMX. This is mainly because its lending product is not yet mature, supporting only a limited number of major assets like wBTC, wETH, and USDC—five in total—limiting its ability to attract larger deposits. Additionally, its native token VRTX has not officially launched, so there is no staking reward mechanism yet, contributing further to its relatively low TVL.

Derivatives Trading Volume

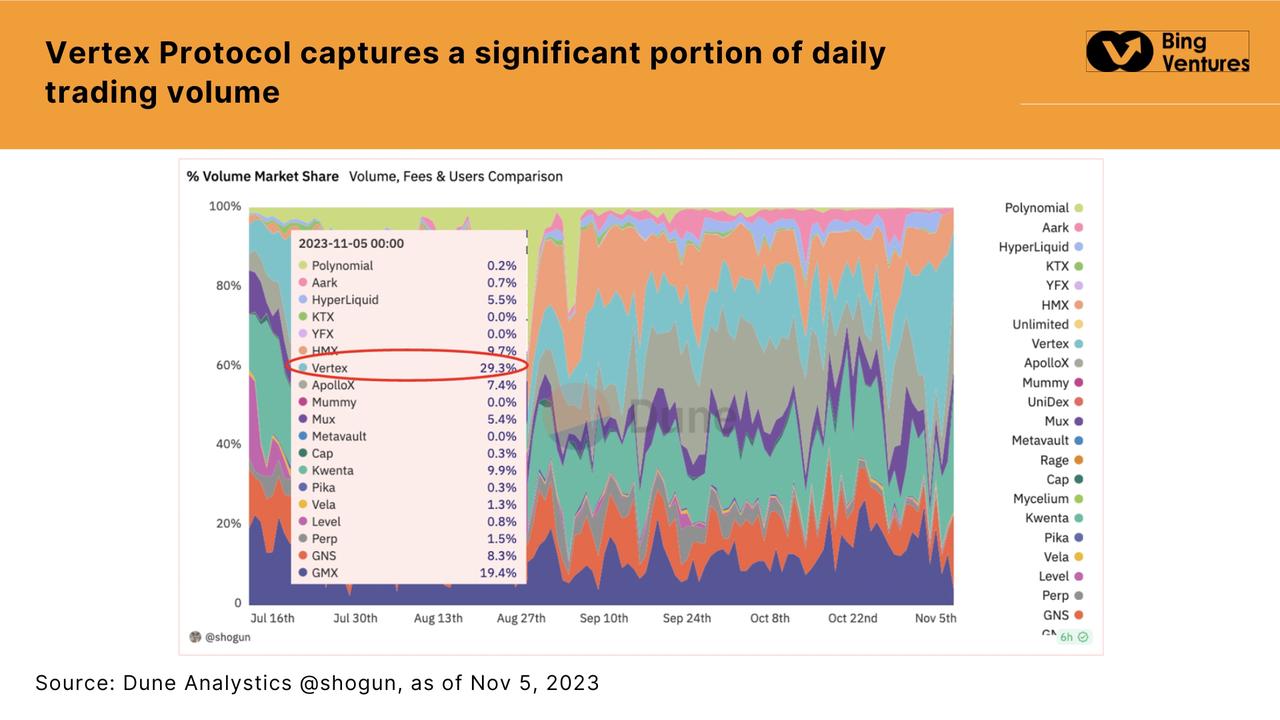

In the fiercely competitive decentralized exchange market, Vertex Protocol has captured 15–30% of daily trading volume, demonstrating exceptional performance even against industry giants like GMX, Gains, and Kwenta. Notably, Vertex surpasses GMX in trading volume. For a new project, exceeding established leaders in volume so quickly proves that its unique design successfully attracts users from across the industry.

Trading Fees and Revenue

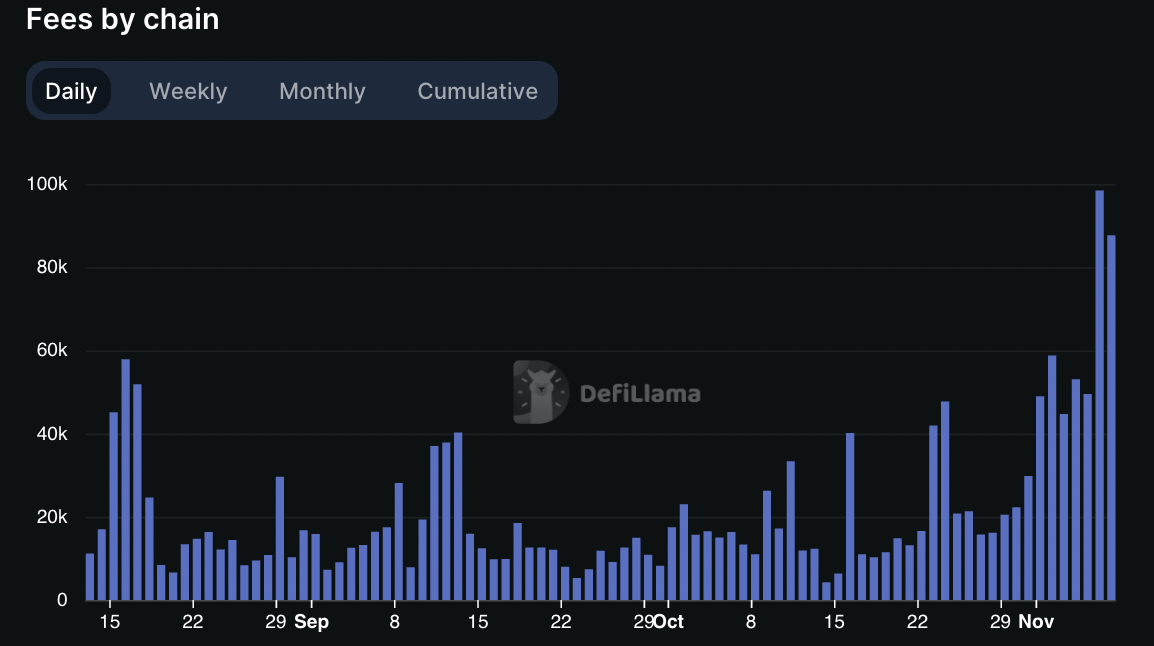

GMX’s Fees; Source: DefiLlama

Vertex Protocol’s Fees; Source: DefiLlama

Compared to Vertex Protocol, GMX charges higher trading fees. Vertex offers zero fees for makers and extremely low taker fees—2 bps for stablecoin pairs, 2–3 bps for core markets, and 4 bps for non-core markets. In contrast, GMX v1 charges 0.1% on entry and exit (v2 reduced to 0.05% or 0.07%), plus additional swap fees ranging from 0.2% to 0.8% when conversions are involved. This favorable fee structure makes Vertex more attractive in the market, although its lower fees may result in slower revenue growth relative to trading volume.

We believe Vertex Protocol has rapidly established itself through highly competitive low-fee pricing. This strategy appeals strongly to cost-conscious traders, especially as users increasingly prioritize transaction costs. However, long-term profitability could become a challenge, particularly in maintaining high-quality services and operational sustainability.

Therefore, Vertex must explore additional value-added services and revenue models while keeping fees low to ensure long-term sustainability. Although GMX previously generated high daily fee income, recent figures have dropped to levels similar to Vertex (around $100K). Given Vertex’s growing trading volume, its future revenue potential could soon surpass GMX’s.

Hyperliquid: An On-Chain Order Book DEX on Its Own L1

Hyperliquid is a decentralized exchange for order-book-based perpetual futures. It operates on the Hyperliquid chain, a Tendermint-based Layer 1 blockchain. A key factor enabling Hyperliquid’s rapid development is its proprietary Layer 1 network, allowing the team to flexibly adjust gas fees, MEV, slippage, and other parameters to deliver ultra-fast, efficient trading. Its performance supports up to 20,000 operations per second.

Owning its own Layer 1 also enables Hyperliquid to develop a fully transparent on-chain order book, a critical feature in a post-FTX environment. The L1 infrastructure allows them to build a platform that is as on-chain, decentralized, trustless, and permissionless as possible.

On Hyperliquid, vaults provide liquidity for on-chain trading strategies. Vaults can be automated or managed by individual traders. Anyone depositing funds into a vault receives a share of profits—whether they are DAOs, protocols, institutions, or individuals. Vault owners earn 10% of total profits. Hyperliquid was also the first exchange to list perpetual contracts on friend.tech indices. Initially based on TVL, it later shifted to the median price of 20 major accounts due to concerns about manipulability in TVL definitions and rising open interest.

Project Performance

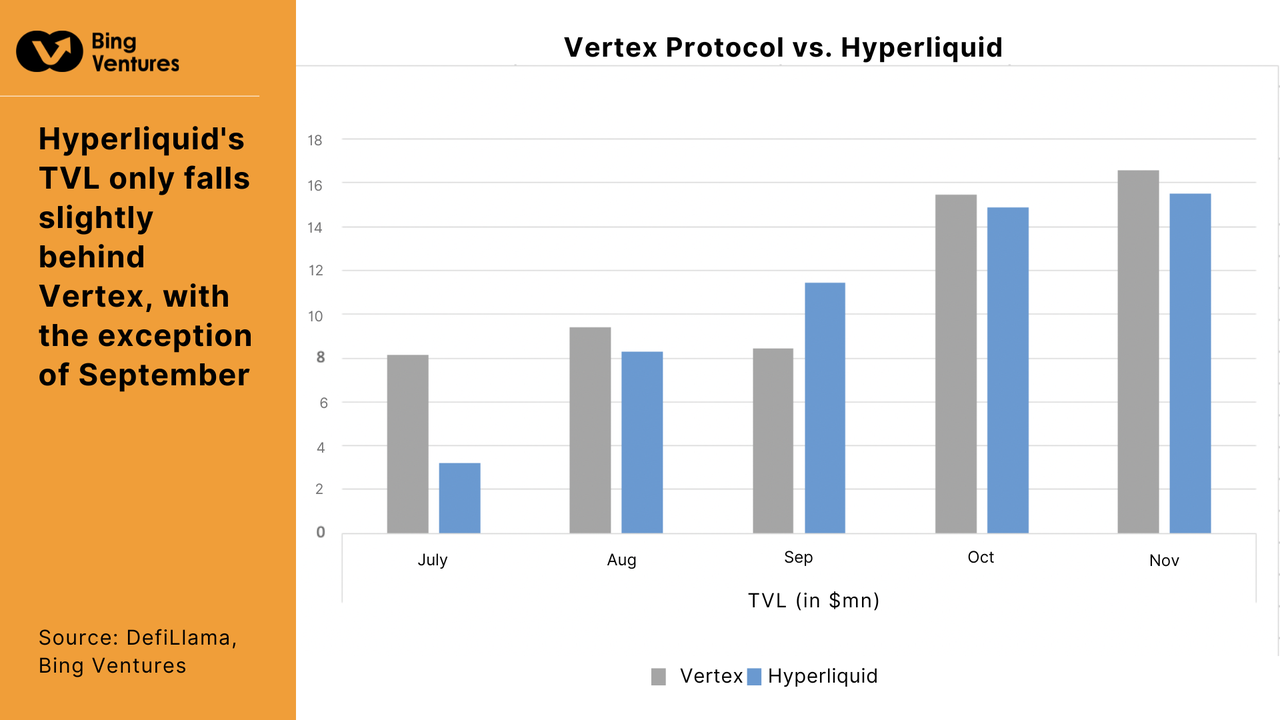

Like Vertex Protocol, Hyperliquid’s TVL has steadily risen. Its monthly derivatives trading volume reached nearly $1.5B upon launch, peaking at $8B, though Vertex generally maintains stronger average volume.

Total Value Locked (TVL)

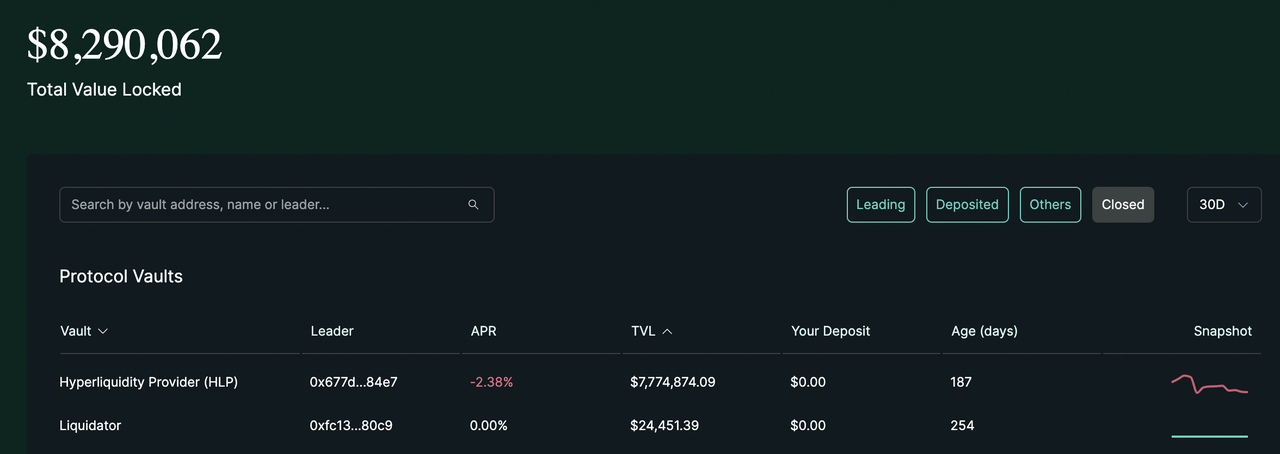

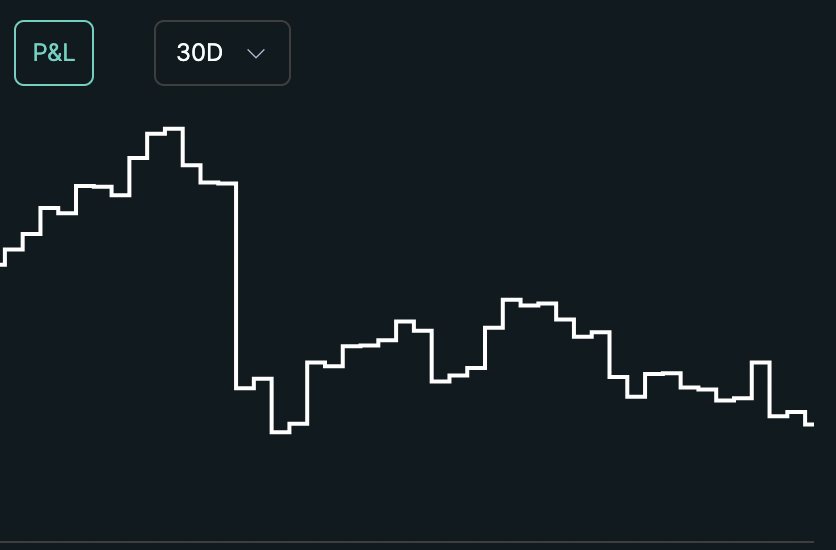

Hyperliquid’s TVL, while not comparable to GMX’s, lags slightly behind Vertex Protocol except in September. The lower TVL primarily results from limitations in its staking mechanism. The project relies heavily on Vaults for capital lockup, where users earn profit shares by depositing funds. However, this copy-trading approach carries inherent risks, as returns depend entirely on the Vault Leader’s trading skill. Consequently, it offers limited investor protection and weaker appeal.

For example, the chart above shows the performance of Hyperliquid Provider (HLP), the protocol’s own vault focused on market making, clearing, and earning a portion of trading fees. Returns are negative (-2.41%) and declining, suggesting that depositing funds into Vaults may not be a wise choice for users.

Derivatives Trading Volume

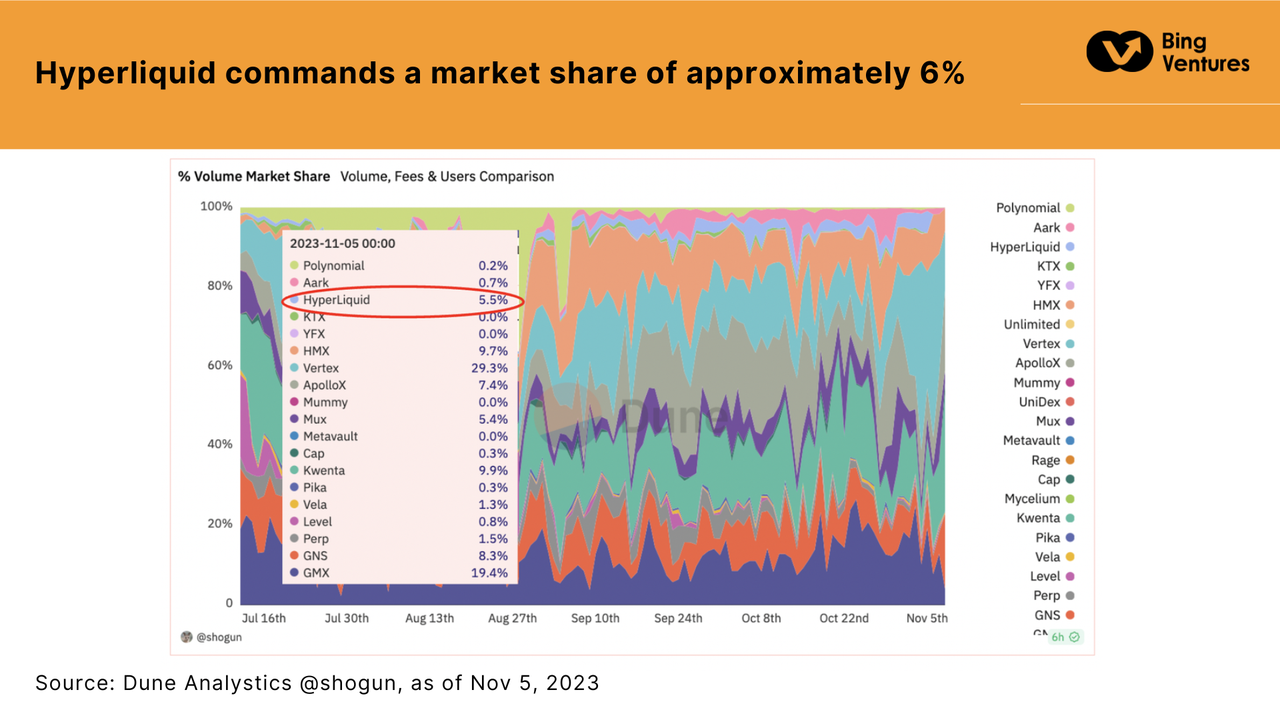

Source: Dune Analytic @shogun, as of Nov 5, 2023

While not capturing as large a market share as Vertex Protocol, achieving around 6% as a new entrant is respectable. However, trading volume has recently declined, failing to sustain earlier momentum.

Trading Fees and Revenue

Hyperliquid’s fee structure is as follows:

Takers pay a fixed 2.5 bps fee, while makers receive a 0.2 bps rebate. Referrers earn 10% of the taker’s fee (0.25 bps). The remaining fees flow to the insurance fund and HLP (~2.05 bps). Compared to Vertex, where internal teams or large token holders benefit most from fees, Hyperliquid distributes fees directly to the community: 40% to the insurance fund and 60% to HLP.

Hyperliquid’s fee model emphasizes greater redistribution to the community. In contrast, Vertex offers zero maker fees and very low taker fees, using part of the fees to support its Vaults and liquidity providers. This difference highlights Hyperliquid’s preference for rewarding community members who directly support network operations and risk management.

ApeX Protocol: A Multi-Chain Exchange Powered by ZK Rollup

ApeX Pro is built on StarkWare’s Layer 2 scaling engine StarkEx, using an order book model to offer cross-margin perpetual contracts with secure, efficient, and user-friendly experiences. It is also non-custodial, meaning traders retain full control of their assets on-chain via private keys. The use of ZK Rollup enhances transaction security and user privacy. Compared to peers like dYdX and GMX, ApeX offers more competitive trading fees. Its staking rewards, token buyback incentives, and referral programs further boost its appeal.

Key attractions of ApeX’s staking mechanism include:

No fixed terms or schedules—users can start or stop staking anytime. Longer staking durations yield higher returns. Rewards consider not only staked assets but also trading activity, with the “T2E” activity score providing additional earnings for stakers.

Project Performance

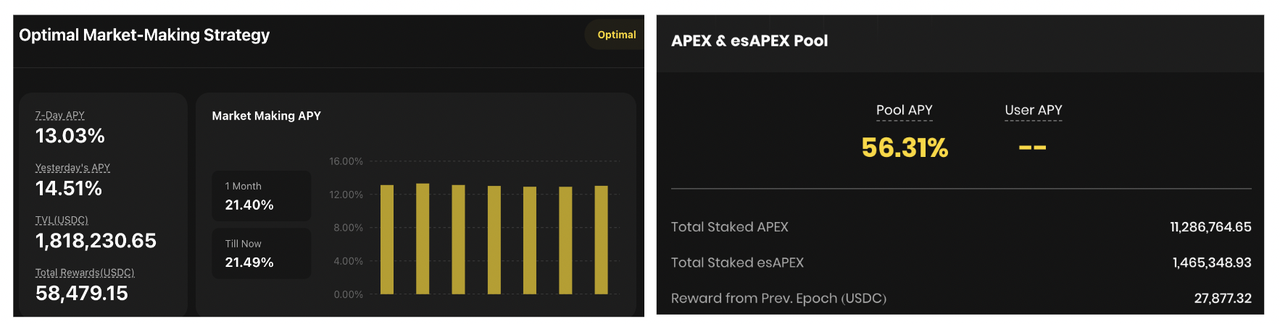

Apex Protocol’s TVL has steadily increased since launch. Its monthly derivatives trading volume consistently stays around $1.7B, comparable to the first two protocols.

Total Value Locked (TVL)

Apex Protocol’s TVL far exceeds the previous two. Its two main incentive mechanisms—Smart Liquidity Pool and Apex Staking Pool—have played a major role in TVL accumulation, with historically strong participation. Platform staking offers up to 56.31% annualized yield, while the Smart Liquidity Pool provides attractive returns—13.03% 7-day annualized yield—for liquidity providers following market-making strategies.

Derivatives Trading Volume

Source: DefiLlama

Compared to the other two protocols, Apex Protocol exhibits a more stable growth trend in trading volume, indicating steady growth in user base and engagement.

Trading Fees and Revenue

Apex mirrors Vertex in fee revenue growth patterns. We believe Hyperliquid and Apex Protocol have carved out market positions by focusing on specific niches and user segments. This targeted strategy enables them to better meet unique market demands. Hyperliquid has built a reputation among specific users through its innovation in on-chain order books. Apex Protocol has gained recognition for its cross-chain capabilities and efficient trade execution.

Comprehensive Comparison

Based on available data, we evaluated four protocols—GMX v2, Vertex Protocol, Hyperliquid, and ApeX Protocol—across five dimensions: Total Value Locked (TVL), trading volume, user growth trend, fee structure, and market distribution—to compare their overall strength and robustness. Some evaluation results are shown in the chart below.

Source: Bing Ventures

As the current market leader, GMX v2 performs well across most metrics, particularly in TVL and trading volume. It also excels in innovation, user experience, and community engagement, though regulatory compliance may be an area for future improvement.

Vertex Protocol stands out in fee structure, reflecting its competitive advantage. While slightly behind GMX v2 in TVL and volume, it shows promise in user growth and community engagement.

As a relatively new platform, Hyperliquid scores lower across all dimensions, reflecting challenges faced by emerging projects. We believe it has potential to catch up in security and user experience.

Apex Protocol performs similarly to Vertex across most metrics but edges ahead slightly in community engagement and user experience.

Future Trends in the Decentralized Derivatives Market

In conclusion, GMX’s position in the decentralized derivatives exchange market is indeed being challenged by emerging protocols, particularly Vertex Protocol. Thanks to its advantageous fee structure, Vertex has begun capturing greater market share. This competitive landscape shows that even in a relatively mature market, innovation and user-friendly pricing remain powerful tools for attracting users and expanding market presence.

From a Total Value Locked (TVL) perspective, the current performance of these three emerging projects does not yet match GMX. This reflects a real issue: users remain cautious about depositing large amounts on new platforms, due to insufficient trust, immature product features, or limited market awareness. Therefore, attracting user capital and increasing TVL will be a major challenge for these new protocols.

Beyond market competition, the future development of these protocols will be influenced by multiple factors including market demand, technological advancement, and regulatory environment. We identify ten key trends that will shape the future of the decentralized derivatives market. Recognizing and adapting to these trends will be crucial for both established and new platforms.

1. Market Restructuring

The decentralized derivatives market is undergoing unprecedented restructuring. Emerging platforms like GMX v2 and Vertex Protocol represent more than technical upgrades—they reflect fundamental shifts in market demand and user expectations. This shift goes beyond adding features, encompassing comprehensive innovations in user trading experience, capital efficiency, and market transparency. We anticipate a major reshaping of the market landscape, where established leaders may be replaced by newer, more agile platforms better aligned with market needs.

2. Accelerated Technological Innovation

Technological innovation is the core driver behind new platforms. We expect more innovative trading mechanisms in the future, such as more efficient liquidity pools and enhanced risk management tools, designed to address the unique challenges of high volatility and liquidity in crypto markets. Smart contracts will also continue to evolve—not just in security, but in enabling more complex and efficient financial strategies. Sustained technological innovation will be key to maintaining competitiveness.

3. Rise of Cross-Chain Operations

As the crypto market matures, users increasingly demand seamless trading across different blockchains. The development of cross-chain functionality not only improves asset liquidity but also opens broader trading opportunities. Platforms supporting multi-chain operations will gain a competitive edge through enhanced interoperability.

4. Increased Demand for Regulatory Adaptability

As global regulations evolve, platforms capable of adapting flexibly while maintaining decentralization will have an advantage. This means platforms must monitor international regulatory developments closely and adjust operations promptly to comply with regional laws. Regulatory adaptability will become a key differentiator among platforms.

5. Comprehensive User Experience Revolution

User experience will become a key differentiator. As the DeFi user base expands, simplifying interfaces and trading processes and lowering technical barriers will be essential to attract broader audiences. This is not just about UI design—it requires rethinking the entire trading workflow. How to deliver a user experience rivaling—or surpassing—centralized exchanges while preserving decentralization will be the top priority for every platform.

6. Smart Contract Security Remains Critical

Smart contracts are the foundation of DeFi, and their security directly impacts platform credibility and asset safety. Strengthening security measures—such as rigorous code audits and bug bounty programs—will be vital for building trust. This is not only about preventing financial losses but also about establishing long-term user confidence.

7. Financial Instrument Innovation Enhances Capital Efficiency

Decentralized platforms face significant challenges in capital utilization. Traditional finance has mature tools and strategies for maximizing capital efficiency, whereas crypto still has room to grow. Innovative financial instruments and sophisticated trading strategies will be central to future DeFi development, testing both market understanding and financial creativity.

8. Deepening Decentralized Governance

Decentralized governance is a core principle of blockchain technology. Effective community participation and transparent decision-making enhance platform credibility and user engagement. We expect future platforms to place greater emphasis on community input, integrating it into core decision processes. This not only boosts loyalty but is also a crucial step toward true decentralization.

9. Greater Diversity in Synthetic Assets and Derivatives

As the market evolves, demand for diverse investment tools grows. Synthetic assets and various derivative types will be key to meeting this demand. We expect future decentralized platforms to offer more derivative varieties, including options, futures, and complex financial products. Greater product diversity will attract a wider investor base and significantly deepen market liquidity.

10. Evolving Liquidity Mining and Incentive Mechanisms

To attract and retain users, new liquidity mining and incentive mechanisms will emerge. These mechanisms must not only drive initial participation but also sustain long-term engagement. Future incentives will likely become more diverse and enduring, moving beyond simple token rewards to include long-term recognition of user loyalty and involvement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News