2024: New Cycle, New Challenges, New Concepts

TechFlow Selected TechFlow Selected

2024: New Cycle, New Challenges, New Concepts

We are about to witness the arrival of a cryptocurrency "super cycle."

Author: Bing Ventures

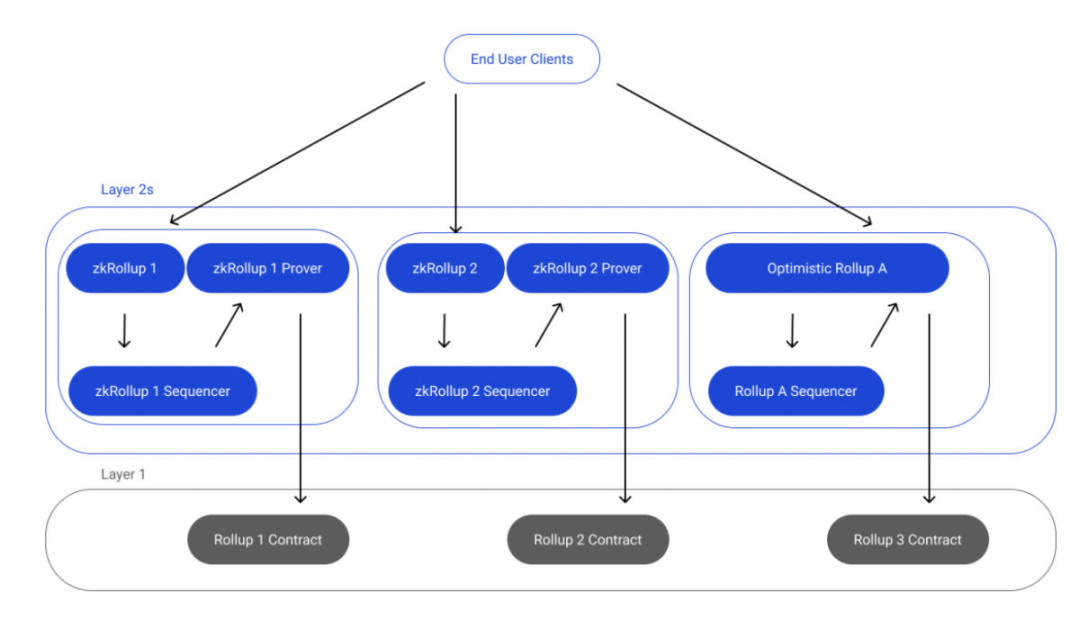

In 2024’s blockchain technology and market outlook, we stand at a crossroads defined by diversified innovation and complex challenges. With breakthroughs in Rollup technology, ZK-EVM advancements, the rise of decentralized sequencers, and the deep maturation of DeFi ecosystems, the entire industry appears to be entering a new phase of development. The tension between security and decentralization, the delicate balance between user experience and cost efficiency, and the boundless possibilities brought by technological convergence—these are key themes we must explore in the coming years.

In 2024, we will witness the arrival of a cryptocurrency "super cycle," driven not only by cyclical economic factors but also by the convergence of traditional finance and decentralized finance (DeFi), which is set to propel the crypto market into an unprecedented growth phase. Within this context, the "Value Network Effect" (VNE) will emerge as a new standard for measuring the impact of crypto assets.

Rollup Innovations, ZK-EVM Breakthroughs, and the Rise of Decentralized Sequencers

Source:https://foresightnews.pro/article/detail/44487?

The Convergence of Rollup Technology

-

Balancing Security and Decentralization: Between optimistic Rollups and zero-knowledge (ZK) Rollups lies a core contradiction—how to maintain data integrity and security while preserving the network's decentralized nature. This is not just a technical challenge but a philosophical one, prompting deeper discussions around the "Security-Decentralization Equilibrium Theorem."

-

Optimizing User Experience and Cost Efficiency: Optimistic Rollups sacrifice transaction speed for cost efficiency, whereas ZK Rollups struggle with high operational costs. This drives exploration into "Dynamic Optimization Algorithms" that could balance both aspects, achieving optimal user experience and cost-effectiveness.

-

Exploring Hybrid Rollups: Combining the strengths of optimistic and ZK Rollups, hybrid Rollups represent an ongoing pursuit of the ideal decentralized network architecture. This effort opens new pathways toward higher security and improved user experience, advancing the practical implementation of the "Hybrid Decentralization Framework" (HDF).

The Double-Edged Sword of MEV

-

MEV Ecosystem Expansion and Network Censorship: As the MEV ecosystem rapidly grows, concerns about network censorship intensify, particularly among large staking service providers and MEV participants. This has spurred interest in developing an "MEV Governance Mechanism" (MEVGM) to balance ecosystem health with economic incentives.

-

Decentralization vs. MEV: The rise of MEV challenges fundamental decentralization principles, prompting renewed thinking around "Decentralization Value Maximization" (DVM)—how to effectively leverage MEV without compromising network decentralization.

Breakthroughs and Integration of Frontier Technologies

-

Advanced Implementation of ZK-EVM: By achieving compatibility with Ethereum’s EVM while enhancing verification efficiency, ZK-EVM unlocks new frontiers in "Zero-Knowledge Computation Optimization" (ZKCO), suggesting the potential to boost network efficiency without sacrificing privacy.

-

Innovation in ePBS Protocol: An evolution of PBS, ePBS introduces a more flexible market structure, offering a new path toward strengthening Ethereum’s decentralization. This advancement represents not only a technical leap but also a practical validation of "Protocol-Level Decentralization Strategy" (PLDS).

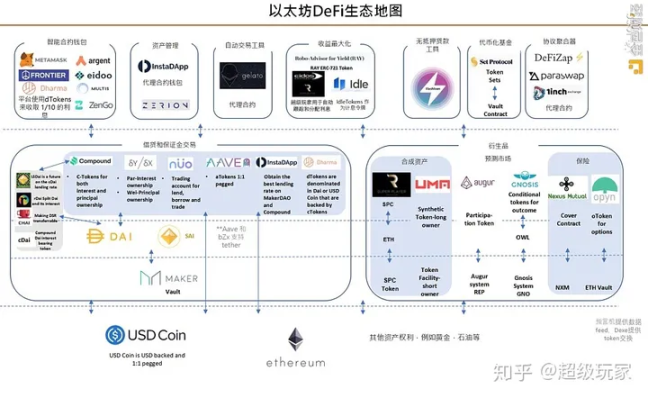

Deep Maturation of DeFi Ecosystems: Capital Efficiency Dancing with Innovation

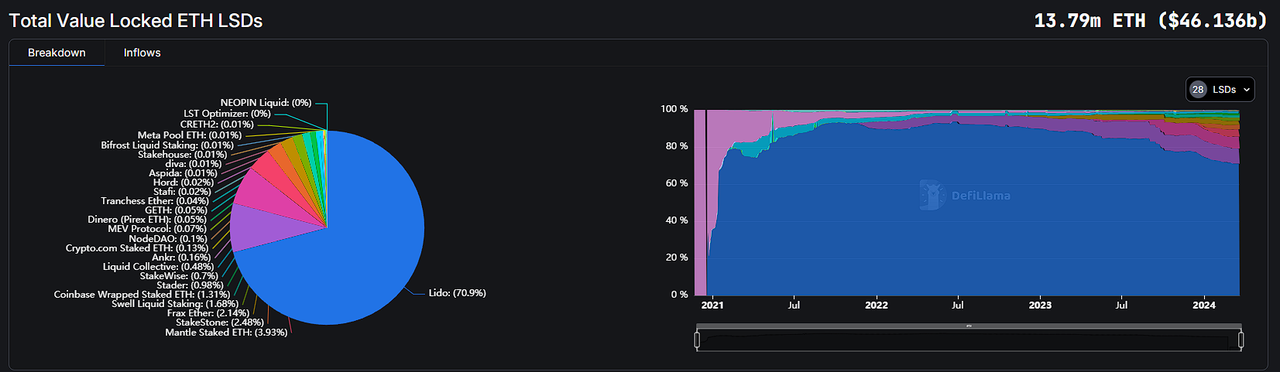

Source:https://defillama.com/lsd

Cosmic Expansion and Intelligent Evolution in the LSDFi Market

As 2024 unfolds, the LSDFi market stands at a pivotal juncture of growth and innovation, poised for a cosmic-scale expansion fueled by technological advances and capital inflows. In this process, staked assets like Lido’s stETH will evolve beyond mere market favorites—they will become defining elements of a new era, signaling the continuous evolution of the LSDFi ecosystem. The entry of centralized exchanges is further disrupting the competitive landscape, rewriting the rules of engagement.

The LSDFi market in 2024 is expected to become a crucible of competition and innovation, where participants vie for user attention and capital through novel yield-generation mechanisms, fostering a vibrant yet fiercely competitive ecosystem. Giants such as Lido, Coinbase, and Rocket Pool will leverage their market dominance to consolidate positions, while emerging players like Puffer Finance seek innovative breakthroughs to drive market diversity.

On the technological front, 2024 will see widespread adoption of cutting-edge technologies like AVS, delivering unprecedented leaps in security and efficiency across the LSDFi ecosystem. Notably, the launch of the EigenLayer protocol—with its innovative restaking mechanism—not only enhances capital efficiency but also injects fresh momentum into the entire LSDFi space.

Source:https://zhuanlan.zhihu.com/p/152197695

Alchemy of Competition: From Conflict to Symbiotic Integration

In 2024, the evolution of the DeFi ecosystem reveals increasing depth and maturity, heralding a synchronized dance between capital efficiency revolution and innovation—one that reshapes not only how wealth grows but fundamentally transforms our relationship with it. At the forefront of this transformation stands DeSyn Protocol, exemplifying leading-edge innovation by merging core DeFi values—openness, transparency, and decentralization—with highly efficient capital utilization, breathing new life into the ecosystem.

First, the "Staking Derivatives Innovation Model" (SDIM) marks the beginning of DeFi’s maturation. SDIM significantly boosts capital efficiency, enabling the development of new DeFi applications and granting users unprecedented financial freedom and flexibility. It transcends simple liquidity-yield trade-offs, establishing a new paradigm that elevates the overall DeFi participant experience. Through protocols like DeSyn, users gain access to high yields, principal safety, investment convenience, and exclusive bonus returns from multiple project partners.

Further, "Cross-Chain Liquidity Solutions" and the "Physical-Digital Asset Fusion Model" (PDAFM) are poised to redefine the future trajectory of DeFi markets. This fusion enhances market liquidity and strengthens stability. Within this framework, protocols such as DeSyn emerge as "Pioneers of DeFi Super-Applications" (PDFSA), leveraging technological innovation and superior user experience to expand DeFi into broader financial services domains.

As the Ethereum ecosystem matures, concepts like "Liquidity Weaving" and the "DeFi Lattice" are expected to gain traction. Liquidity Weaving uses smart contracts and Layer 2 technologies to seamlessly connect liquidity across different assets and platforms, forming a robust network. The DeFi Lattice is a macro-level vision where various financial services and products interconnect freely via on-chain protocols—like atoms in a crystal lattice—creating a diverse, highly customizable financial ecosystem.

As a foundational DeFi infrastructure, DeSyn offers more than just a platform—it embodies a "team battle" concept, demonstrating how organic coordination among different parts of the DeFi ecosystem can achieve shared goals and generate collective rewards. This model promotes healthy ecosystem development and creates a win-win environment for investors, fund managers, projects, and security entities alike. In this ecosystem, every participant enjoys substantial returns from efficient capital use while ensuring capital safety.

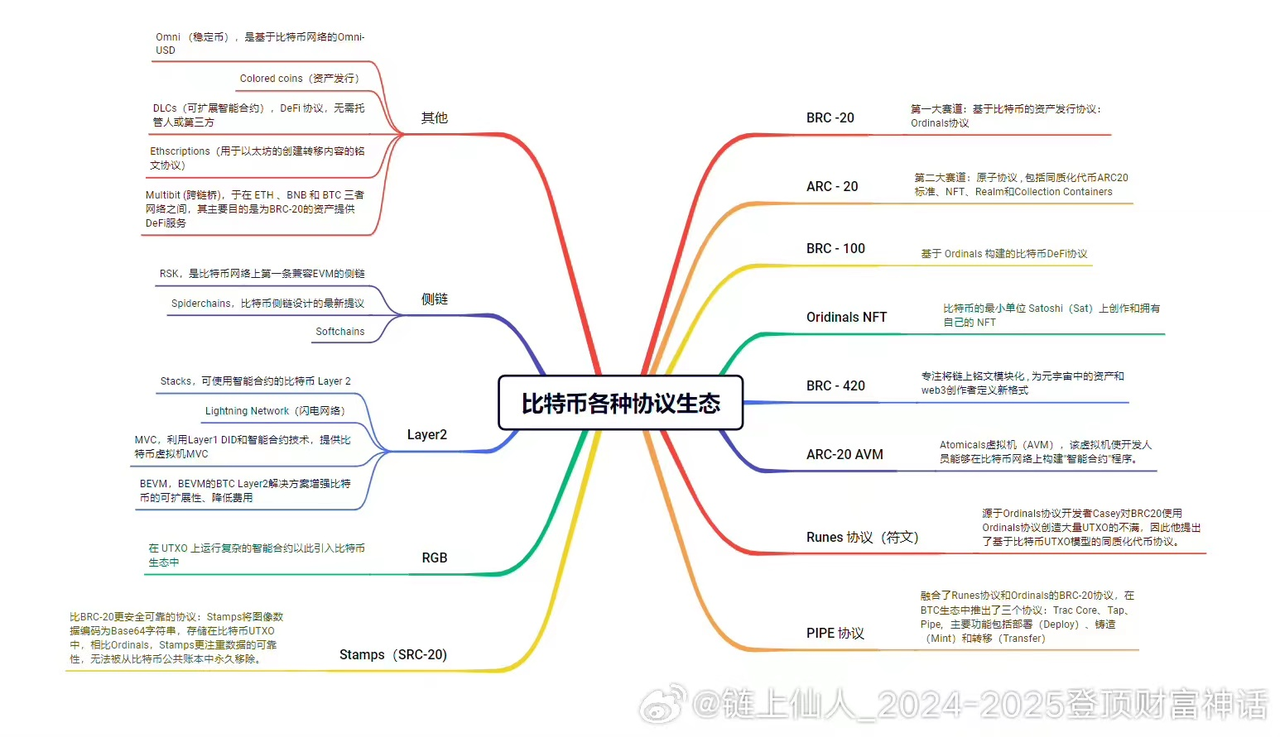

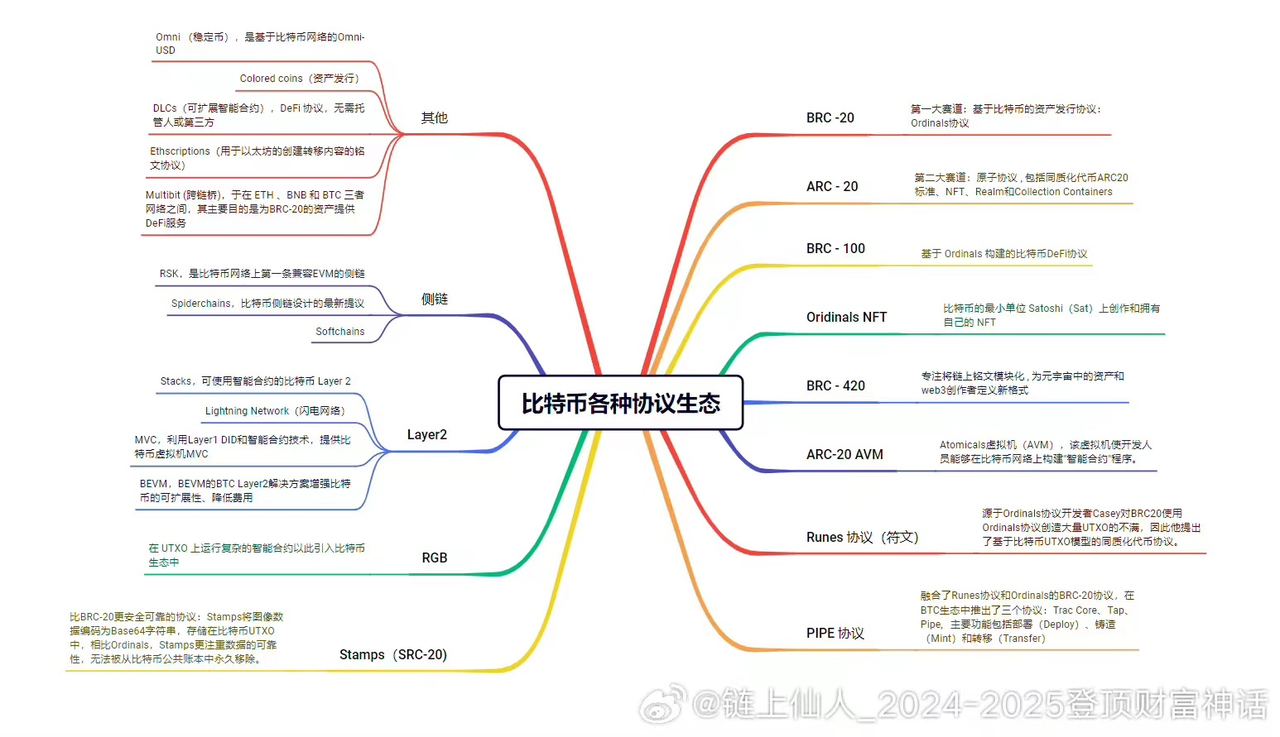

Bitcoin’s Technological Duality: Choosing Between Innovation and Adaptability

Source:https://www.techflowpost.com/article/detail_15939.html

When exploring the future trajectory of Bitcoin’s ecosystem, we face a dual challenge: the push for technological innovation versus the need to maintain system adaptability. In 2024, this tension will manifest clearly in Bitcoin’s technical evolution, as emerging protocols like Ordinals, BRC-20, Atomicals, and Runes signal that Bitcoin is no longer merely a store of value but expanding into multidimensional realms including NFTs and DeFi.

Co-Evolution of Technological Innovation and Ecosystem Adaptation

As Bitcoin becomes more deeply integrated into the global financial system, its value expression extends beyond traditional economic indicators, increasingly influenced by macroeconomic variables—and thus subject to heightened volatility. This shift not only prompts a reevaluation of Bitcoin’s “digital gold” narrative but also reinforces its status as a distinct asset class.

Global Regulatory Landscape: Navigating Bitcoin’s Future Course

The global regulatory environment exerts a clear dual influence on Bitcoin: on one hand, it sets boundaries for innovation and application; on the other, it provides a framework for legalization and broad acceptance. In this context, the "Adaptive Regulatory Framework" (ARF) becomes crucial for understanding how Bitcoin navigates global policies, pointing toward a future path that balances regulation with innovation.

Cosmos’ Unique Positioning: The Future of Decentralized Networks

Image Source:https://www.gemini.com/cryptopedia/cosmos-crypto-network-internet-of-blockchains

Within the blockchain landscape, Cosmos is redefining the future of decentralized networks through its innovative architecture and unique vision. Its distinctive Hub-and-Zone model achieves technical breakthroughs in cross-chain interoperability, while modular design grants developers unprecedented freedom to build and deploy highly customized blockchain applications tailored to specific needs. This philosophy not only energizes DeFi innovation but also charts a clear roadmap for Cosmos’ long-term development.

In the evolving DeFi market, Cosmos demonstrates multifaceted potential, particularly through liquid staking of ATOM assets, attracting both users and capital. There is growing anticipation for Cosmos to strengthen its DeFi ecosystem in lending and DEX sectors, increase cross-chain asset usage, and broaden external asset integration.

Looking ahead, the diversity of dApps and the richness of the ecosystem will be key to attracting developers and users and boosting network activity. Despite competition from platforms like Solana and Aptos, Cosmos maintains a leading edge in the IBC framework, enhancing its network utility. As we look toward 2024, Cosmos is expected to sustain high levels of ecosystem diversity and activity, especially in DeFi, Web3, NFTs, and gaming. Further advancements in cross-chain technology will open new growth avenues. Meanwhile, rising IBC transaction volumes and steady ATOM price appreciation are likely to drive significant increases in Cosmos’ market valuation.

Cryptocurrency Wallet Landscape: Cross-Border Revolution and a New Chapter in Security

Image Source:https://btc-alpha.com/zh/stories/zh-what-are-the-cryptocurrency-wallets

Image Source:https://btc-alpha.com/zh/stories/zh-what-are-the-cryptocurrency-wallets

Image Source:https://learnblockchain.cn/article/5575

As we examine the evolution of cryptocurrency wallets in 2024, we find ourselves amid a revolution driven by dual imperatives: security and user experience—ushering in a new era of cross-domain innovation and advanced security mechanisms. With the deepening expansion of the blockchain ecosystem and growing awareness of privacy and asset protection, wallet innovation is progressing toward "Smart Contract-Driven Security Architecture" (SCDSA) and "Intuitive Interactive User Interface" (IIUI). In this evolution, multi-signature authentication, biometric verification, and hardware wallet technologies are advancing in parallel, enhancing security while streamlining user operations—achieving a harmonious balance between safety and convenience.

To attract and retain new users, wallet design is shifting toward "DeFi-Integrated User Experience" (DeFi-UX), incorporating core DeFi functions such as staking, lending, and liquidity mining, along with deep integration into the rapidly expanding NFT market. This unified experience not only accelerates the adoption of Web3 applications but also signals a shift in the role of crypto wallets—from traditional asset management tools to "Decentralized Identity and Social Interaction Platforms" (DIASP).

In this context, the rise of "Account Abstraction" (AA) technology is particularly significant. AA enables functional leaps for smart contract wallets, including batch transaction processing, gas fee sponsorship, and private key recovery—showcasing the convergence of technological innovation and market demand. Furthermore, as multi-chain ecosystems grow, cross-chain operations and multi-chain compatibility have become critical challenges and turning points for wallet development. Crypto wallets in 2024 must not only overcome these technical hurdles but also deliver revolutionary improvements in user experience, ensuring seamless and efficient transactions.

In summary, the future of cryptocurrency wallets in 2024 will unfold as a multidimensional evolution centered on smart contract security architectures and intuitive interfaces. DeFi-UX and DIASP will define new directions, while breakthroughs in Account Abstraction and cross-chain compatibility mark major functional and experiential innovations. Throughout this journey, the deep application of decentralized technologies and nuanced understanding of user needs will jointly propel wallets into a new era of enhanced security and superior user experience.

From Rollup innovations to the complex dynamics of the LSDFi market, and from Bitcoin to Cosmos, each step forward represents an exploration of the future and a challenge to current limitations. We remain bullish on these directions despite the typical bull-short, bear-long cycles. While the future remains uncertain, understanding today’s technological trends better prepares us for the transformations ahead. After all, in the fast-moving world of blockchain, today’s frontier may well become tomorrow’s norm.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News