Solana MEV Guide: Another Dark Forest Beyond Ethereum

TechFlow Selected TechFlow Selected

Solana MEV Guide: Another Dark Forest Beyond Ethereum

How to mitigate the MEV surge on Solana?

Author: Ryan Chern

Translation: Luffy, Foresight News

This article aims to give you a basic understanding of how MEV works on Solana. In short:

-

MEV on Solana has not disappeared.

-

Not all MEV is bad.

-

Profitable frontrunning opportunities exist not only in AMMs but also within DEX liquidity venue structures.

-

Solana’s continuous block production and lack of an in-protocol mempool change the default behavior and social dynamics of the blockchain.

-

Others may fork or attempt to replicate Jito's off-protocol mempool to extract more MEV, but this is technically and socially challenging.

-

Many validators supported the decision to remove the Jito mempool, giving up sandwiching revenue in favor of Solana’s long-term health and development.

Introduction

In proof-of-stake networks, when you are designated as the leader for a specific block, you have the right to decide its contents. Maximum Extractable Value (MEV) refers to the value obtained by adding, removing, or reordering transactions within a given block.

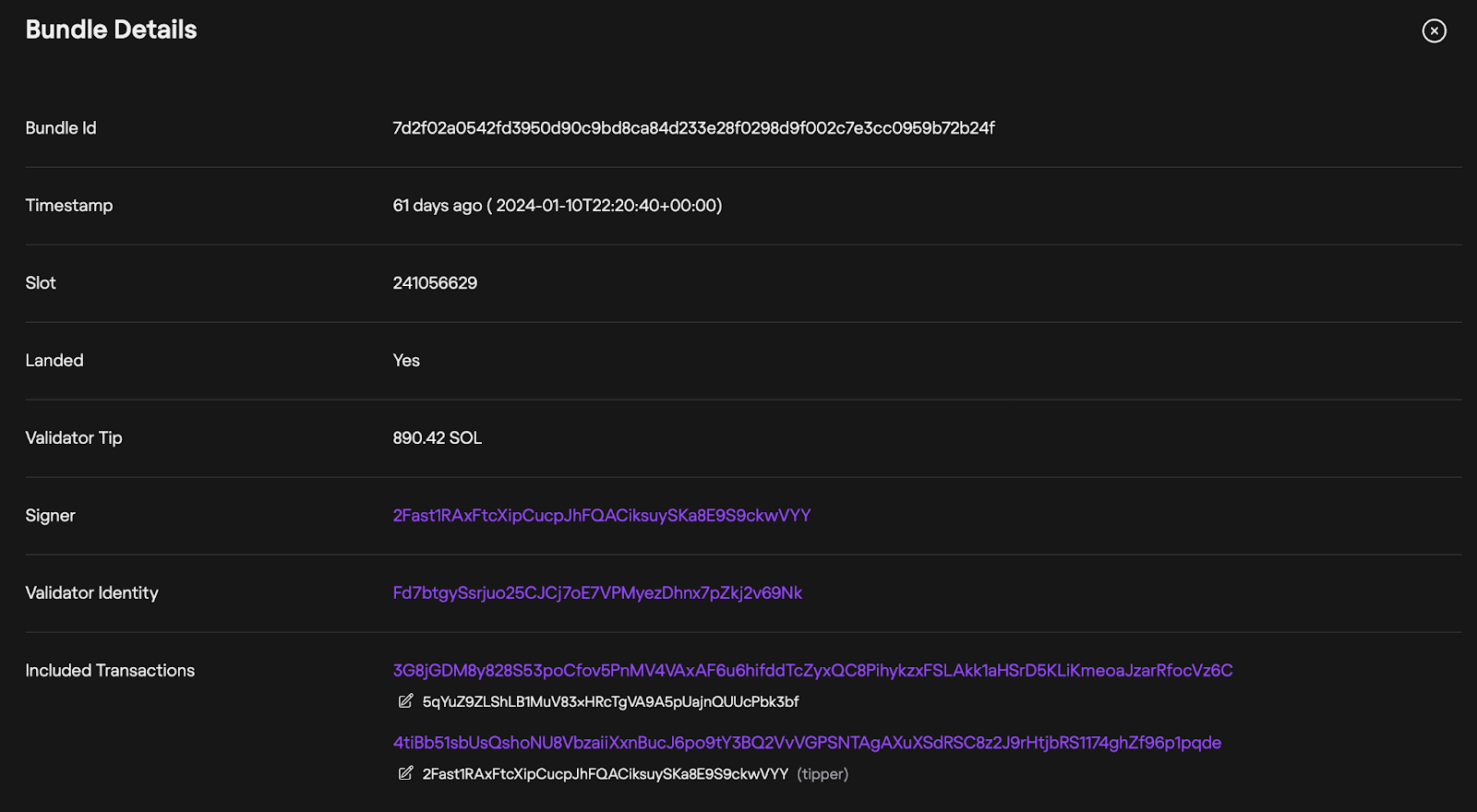

As activity and interest grow on Solana, MEV is becoming an increasingly discussed topic. On January 10, 2024, a searcher tipped validators 890 SOL—one of the largest tips in Jito history:

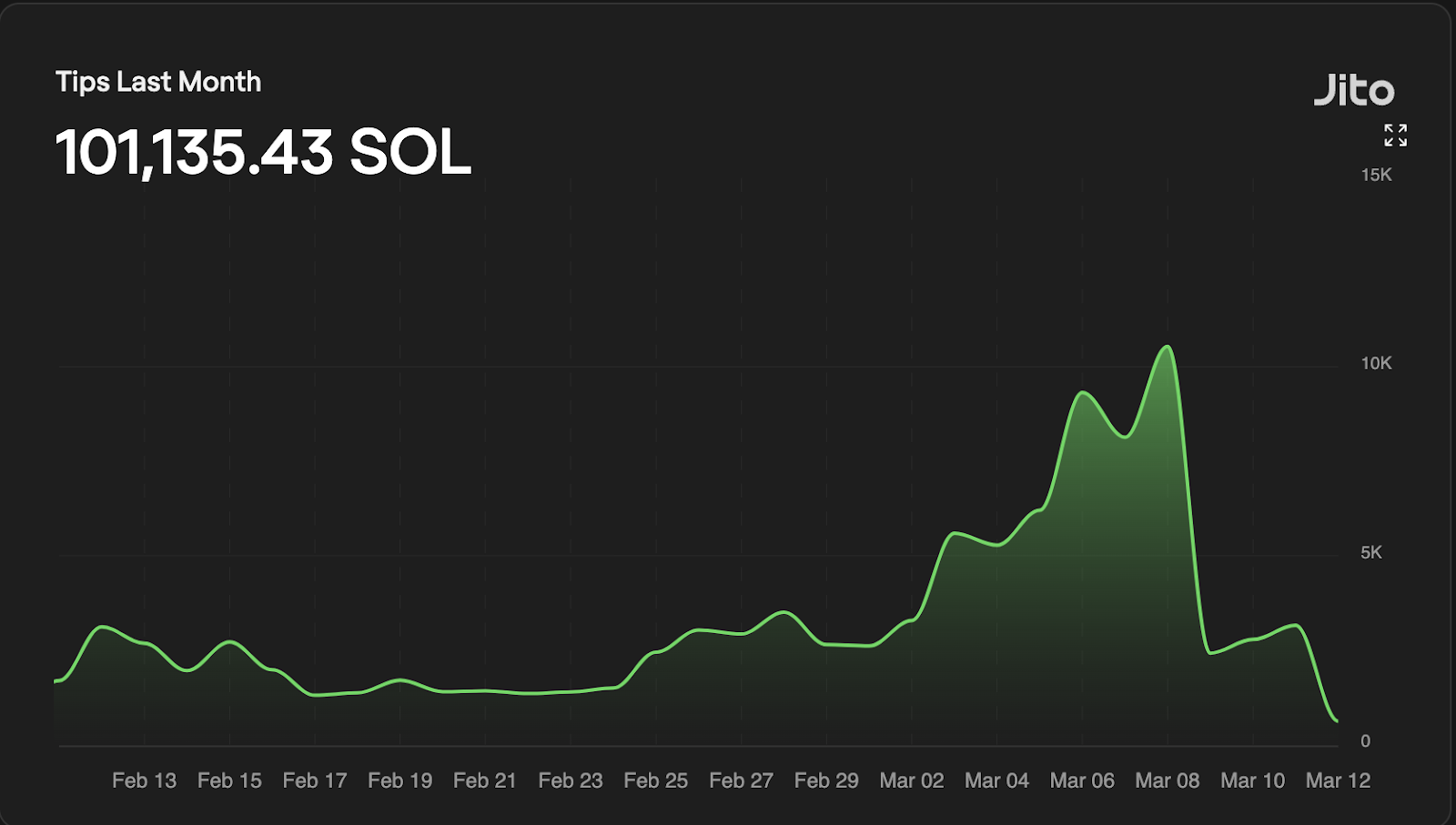

In the week ending March 12, 2024, Solana validators earned over $7 million in Jito tips from block space. Today, more than 50% of Solana transactions are failed arbitrage attempts; due to very low transaction costs, expected returns remain positive. In the long run, traders will profit from such transactions.

Solana’s MEV Structure

Overview

MEV on Solana differs from other chains in that it encourages searchers to run their own nodes and integrate directly with high-stake validators to gain the freshest view of the blockchain (due to Solana’s latency sensitivity). This is driven by Solana’s continuous state updates and stake-weighted mechanisms such as Turbine (for reading updated states) and stake-weighted QoS (for writing new states).

One of the most notable differences is the absence of a traditional mempool like those seen on Ethereum and other chains.

Solana’s continuous block production eliminates the need for any additional or off-protocol auction mechanisms, reducing certain types of MEV—especially frontrunning.

MEV Transactions

MEV opportunities arise in different categories. Below are some common types of MEV transactions currently present on Solana:

-

NFT Minting: MEV occurs during NFT mints when participants compete to acquire rare or valuable NFTs during public mint events—including blue-chip and long-tail NFTs. MEV opportunities spike dramatically during these events—for example, block x-1 may have no NFT MEV opportunity while block x has significant MEV potential (where block x is the block at which the mint goes live). These large-scale congestion events caused by NFT mints were one of the reasons behind Solana’s frequent outages in 2021/2022.

-

Liquidations: When borrowers fail to maintain the required collateral ratio for loans, their positions become eligible for liquidation. Searchers scan the blockchain for undercollateralized positions and execute liquidations to repay part or all of the debt, receiving a portion of the collateral as a reward. Liquidations occur in protocols using both tokens and NFTs as collateral. They are necessary for protocol solvency and beneficial for the broader ecosystem.

-

Arbitrage: Arbitrage involves exploiting price differences of the same asset across different markets or platforms. Such opportunities exist intra-chain, cross-chain, and between CEXs and DEXs. Intra-chain arbitrage is currently the only form guaranteed atomicity since both trades execute on the same chain, whereas cross-chain arbitrage requires additional trust assumptions. As long as they don’t increase harmful order flow, arbitrage helps keep asset prices consistent across markets.

Jito

Jito is an off-protocol blockspace auction mechanism for partial blocks, distinct from full-block builders like MEV-boost (Jito and mev-geth are conceptually similar but vastly different in implementation). Jito provides off-chain inclusion guarantees for a set of specific transactions called bundles. Bundles are executed sequentially and atomically (all included or none). Searchers who win the auction and pay a tip submit bundles guaranteed to be executed on-chain. Jito tips exist off-protocol and are separate from in-protocol priority fees.

This approach aims to reduce spam and improve efficiency of Solana’s computational resources by running the auction off-chain and publishing only the single winning bundle into the block. Searchers can use bundles to achieve one or both of the following properties: fast, guaranteed inclusion and frontrun/backrun bidding. This is especially important considering a large portion of the network’s computing resources are currently consumed by failed transactions.

Mempool

Unlike Ethereum, Solana does not have a native in-protocol mempool. Jito’s now-deprecated mempool service effectively created a canonical off-protocol mempool, as approximately 65% of validators run the Jito-Solana client instead of the native Solana-Labs client.

Upon submission, transactions remained in Jito’s pseudo-mempool for 200 milliseconds. During this window, searchers could bid for the chance to frontrun, backrun, or sandwich pending transactions, with the highest-bidding transaction bundle forwarded to validators for execution. Sandwiching MEV revenue constituted a significant share, measured by tips paid to validators.

Jito’s mempool service shut down on March 8

Jito’s mempool service shut down on March 8

No one likes talking about sandwiching (especially on Ethereum), because it imposes strict negative externalities on end users—they get filled at the worst possible price. For reference, just on Ethereum, sandwiching generated around $24 million in profits over the past 30 days. When users set maximum slippage, they almost always get filled at that price. In other words, if an order executes, the user’s actual slippage is almost always equal to their maximum slippage setting.

Jito searchers can still submit other types of MEV bundles that do not rely on mempool order flow, such as arbitrage and liquidation transactions (which require observing transactions in a block and capturing opportunities in the next Jito auction).

Supply Chain

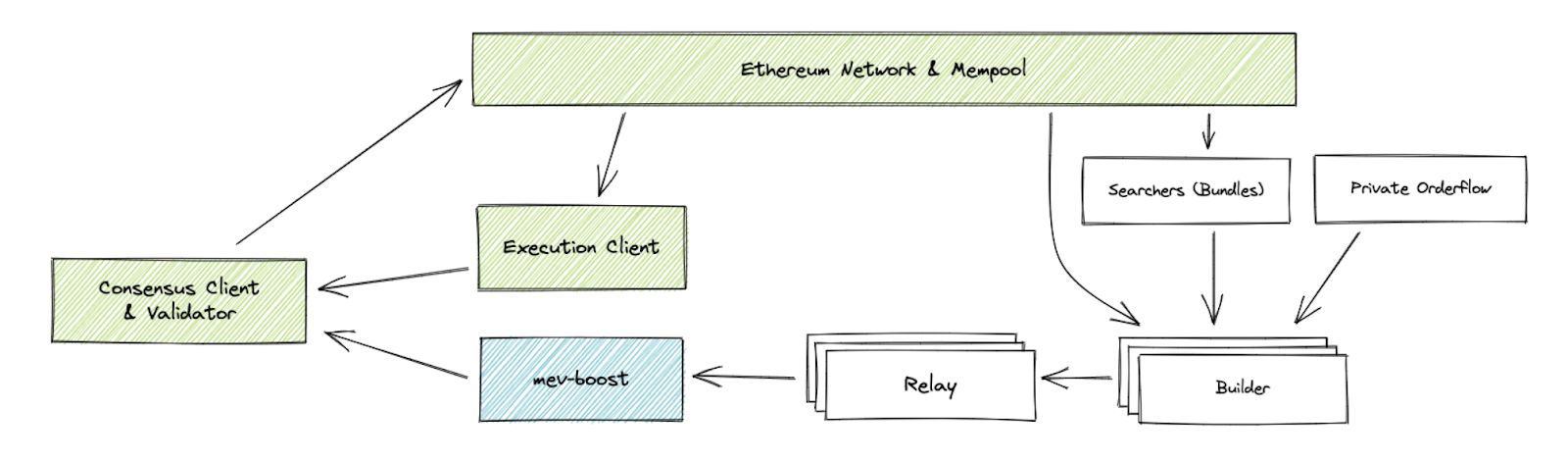

For reference, the current Ethereum block-building supply chain looks like this:

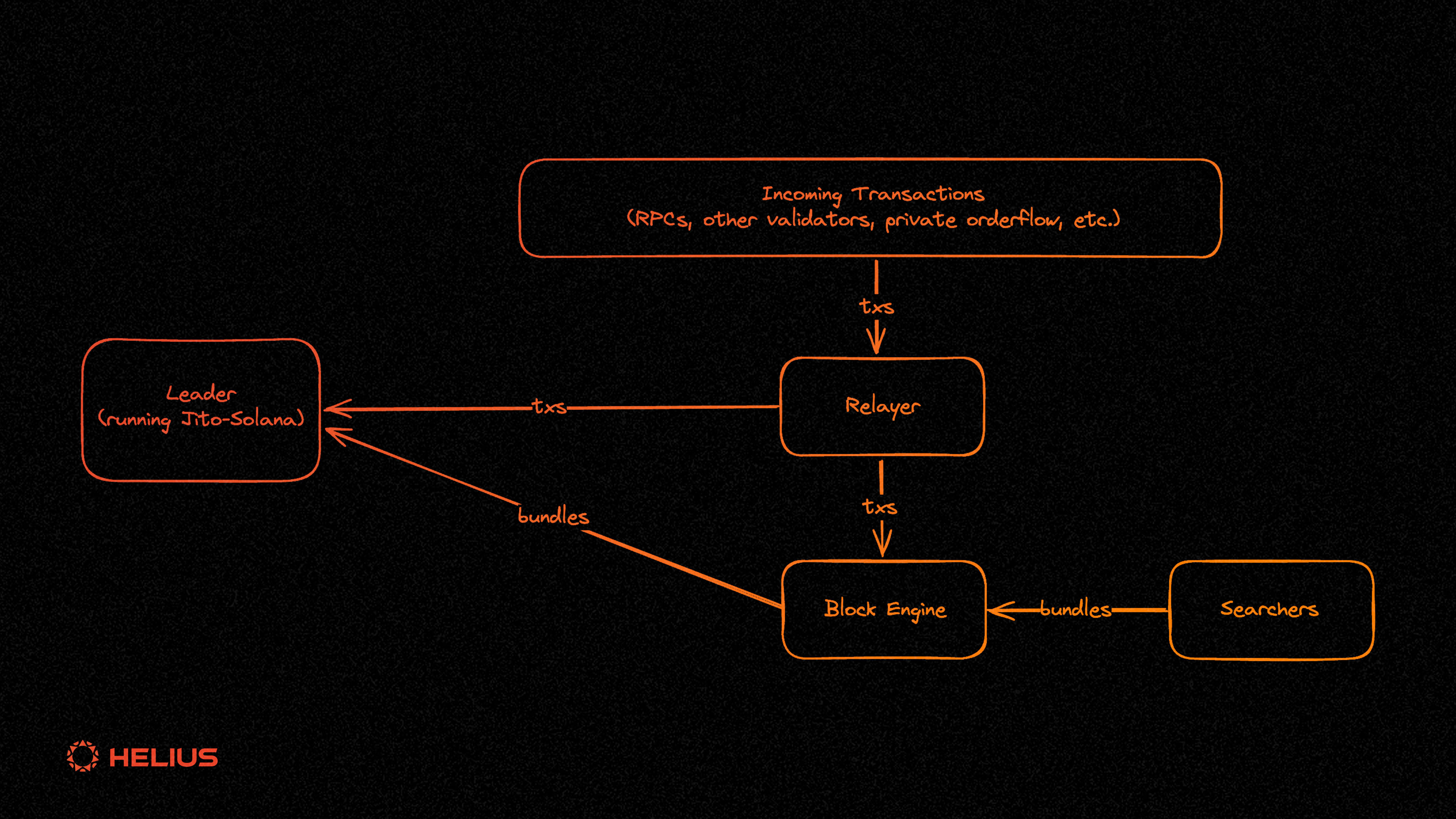

On Solana (for validators running the Jito-Solana client), the block-building supply chain looks like this:

-

Incoming Transactions: The intended state of transactions currently awaiting execution. These can come from RPCs, other validators, private order flow, or other sources.

-

Relayer: Relayers on Solana differ from those on Ethereum. On Ethereum, relayers are trusted intermediaries connecting block builders and proposers (builders trust relayers not to modify their blocks). On Solana, relayers forward incoming transactions and perform limited TPU operations such as packet deduplication and signature verification. Relayers forward packets to the block engine and validators. No equivalent relayer is needed on Ethereum because Ethereum has a mempool, while Solana does not. The relayer logic is open source, and anyone can run their own relayer (Jito operates relayer instances as public resources). Other known Solana network participants also run their own relayers.

-

Block Engine: The block engine simulates transaction combinations and runs off-chain blockspace auctions. It then forwards MEV-maximized transaction bundles to leaders running the Jito-Solana client.

-

Searchers: Searchers seek opportunities to exploit price discrepancies by inserting their own transactions into a given block. They can leverage sources such as Jito’s ShredStream (and previously MempoolStream).

-

Validators: Validators build and produce blocks. Jito-Solana blocks are constructed by a scheduler that reserves 3 million compute units (CU) for transactions routed through Jito, occupying the first 80% of the block.

These participants are not necessarily independent entities, as actors may vertically integrate. As noted earlier, validators have full authority over their blocks. Validators themselves can, when acting as leaders, seek economic opportunities by inserting, reordering, and censoring transactions within a given block.

Regardless of whether a leader runs Jito-Solana, searchers can also submit transactions via RPC methods (standard in-protocol routing). Due to Solana’s relatively low fees and uncertain scheduling, sending transactions remains a common method to capture MEV opportunities. Some MEV opportunities may last longer than expected—approximately one to dozens of blocks.

MEV Distribution Among Participants

While Solana can accelerate transaction execution and reduce certain types of MEV opportunities, it may exacerbate latency-driven centralization, where validators and searchers seek to co-locate infrastructure for competitive advantage. We are far from a competitively stable equilibrium in infrastructure and related mechanisms.

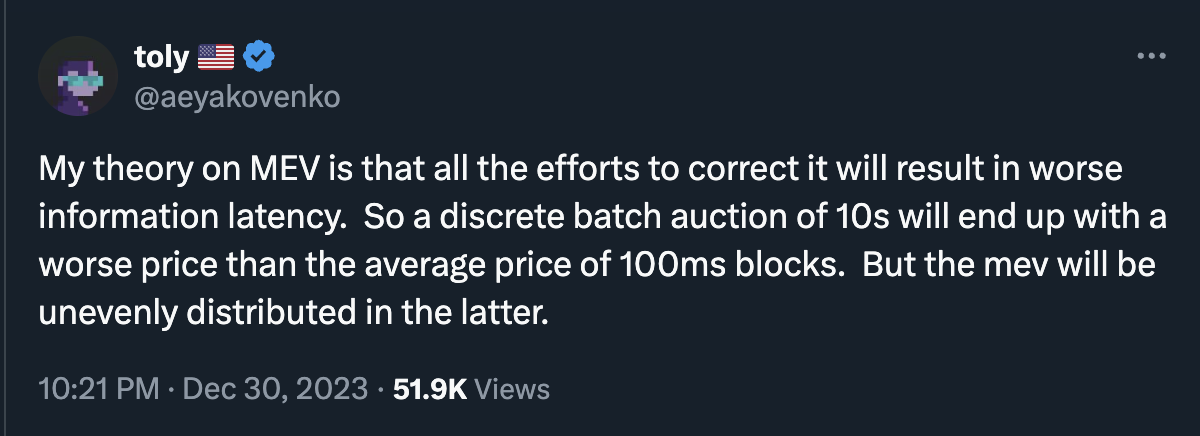

Source: Twitter

In a world where block times are under 200 milliseconds, this gives seasoned participants with the infrastructure and expertise to optimize the system a comparative advantage. So far, Ethereum has diverged from this path by creating off-protocol solutions to democratize searcher participation.

How to Mitigate MEV

Generic off-protocol mechanisms are being integrated into the protocol to reduce MEV opportunities on Solana. These include:

-

RFQ Systems: RFQ (Request-for-Quote) systems such as Hashflow have gained traction on Solana (with cumulative volume exceeding $10 billion across the ecosystem). Orders are fulfilled by professional market makers (Wintermute, Jump Crypto, GSR, LedgerPrime) rather than through on-chain AMMs or order books. Signature-based pricing allows off-chain computation, effectively moving price discovery off-chain, with only completed transfer transactions going on-chain.

-

MEV-Protected RPC Endpoints: These endpoints allow users to receive a portion of the value from their order flow as rebates. Searchers bid for the right to backrun transactions and compete on rebate amounts, which are returned to users. These endpoints typically operate by trusting the counterparty running the endpoint to ensure no frontrunning or sandwiching occurs.

MEV mitigation/redistribution mechanisms combine user extraction of partial value from order flow, moving price discovery auctions and related mechanisms off-chain. These involve trade-offs between cryptocurrency properties such as censorship resistance, auditability, and trustlessness.

Conclusion

This article introduced the key participants in Solana’s MEV supply chain, recent developments, and common forms of MEV on Solana.

Research in the Solana MEV space primarily focuses on evaluating the impact of different MEV mitigation and redistribution mechanisms. Ethereum has invested heavily in infrastructure, with Flashbots aiming to provide democratized MEV access while introducing design constraints to address potential negative externalities.

Solana has the opportunity to explore new models at the frontier of MEV and block production supply chains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News