Solana Ultimate Research Report: Like Apple, But Unlike Apple

TechFlow Selected TechFlow Selected

Solana Ultimate Research Report: Like Apple, But Unlike Apple

A Comprehensive Guide to Understanding Solana

Author: Jay

Translation: TechFlow

With the surge of memes on Solana, the network has attracted increasing attention in the market. Many now regard Solana as a major contender alongside Ethereum. This article offers a comprehensive analysis of the Solana ecosystem, covering its narrative, development journey, key technologies, and ecosystem projects, providing readers with a holistic understanding of Solana.

Executive Summary

-

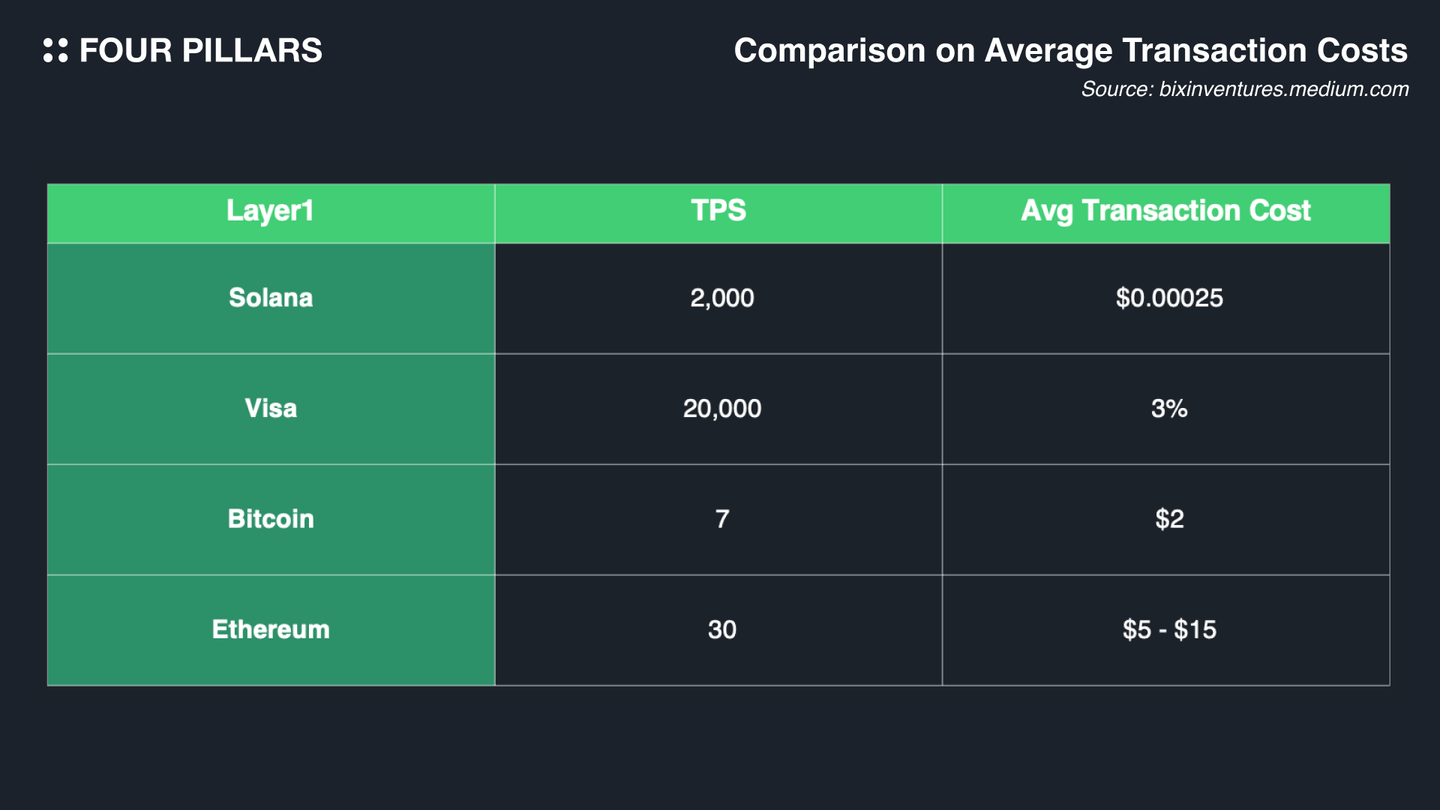

Solana stands out as a leader in integrated blockchain infrastructure by prioritizing simplicity and composability, offering parallel processing, low fees, and fast transaction speeds.

-

Despite challenges, Solana’s ecosystem has rapidly recovered through initiatives aligned with its consistent vision, reclaiming market share.

-

Solana is pioneering innovative applications built on its unique, developer-friendly infrastructure, leading in retail adoption areas such as DePIN, mobile, and payments.

-

While often compared to Apple for its focus on harmony between software and hardware, performance, and user experience, Solana emphasizes new experiences enabled by software rather than hardware convenience—raising even higher expectations.

1. Introduction

Historically, infrastructure markets—often referred to as capital industrial markets—have tended toward winner-takes-all or oligopolistic dominance. Consistent with this trend, since Ethereum emerged nearly nine years ago as a smart contract platform, a central focus in the blockchain space has been the competition for market share among different virtual machines (VMs). Ongoing debates about VM trends and infrastructure needs across periods suggest that various themed VMs will continue to emerge and evolve, further expanding the blockchain market.

Represented by the Solana Virtual Machine (SVM), Solana is undoubtedly a significant player in this landscape. By highlighting the advantages of its monolithic architecture—simplicity, affordability, and speed—Solana has significantly advanced the vertical development of integrated blockchains, an area seemingly destined to be dominated by modular blockchain ecosystems centered around Ethereum. Moreover, Solana is leading the way in enabling off-chain users to adopt blockchain technology, focusing on sectors like DePIN (Decentralized Physical Infrastructure Networks), mobile, and payments.

A popular saying in the market goes: "Solana is no longer alternative; it's only possible on Solana." This article explores how Solana regained market share after a rapid recovery, demonstrated resilience, showcased unique characteristics, and what we can learn from its approach.

2. Solana’s Distinctive Narrative

2.1 Representative of Integrated Blockchains

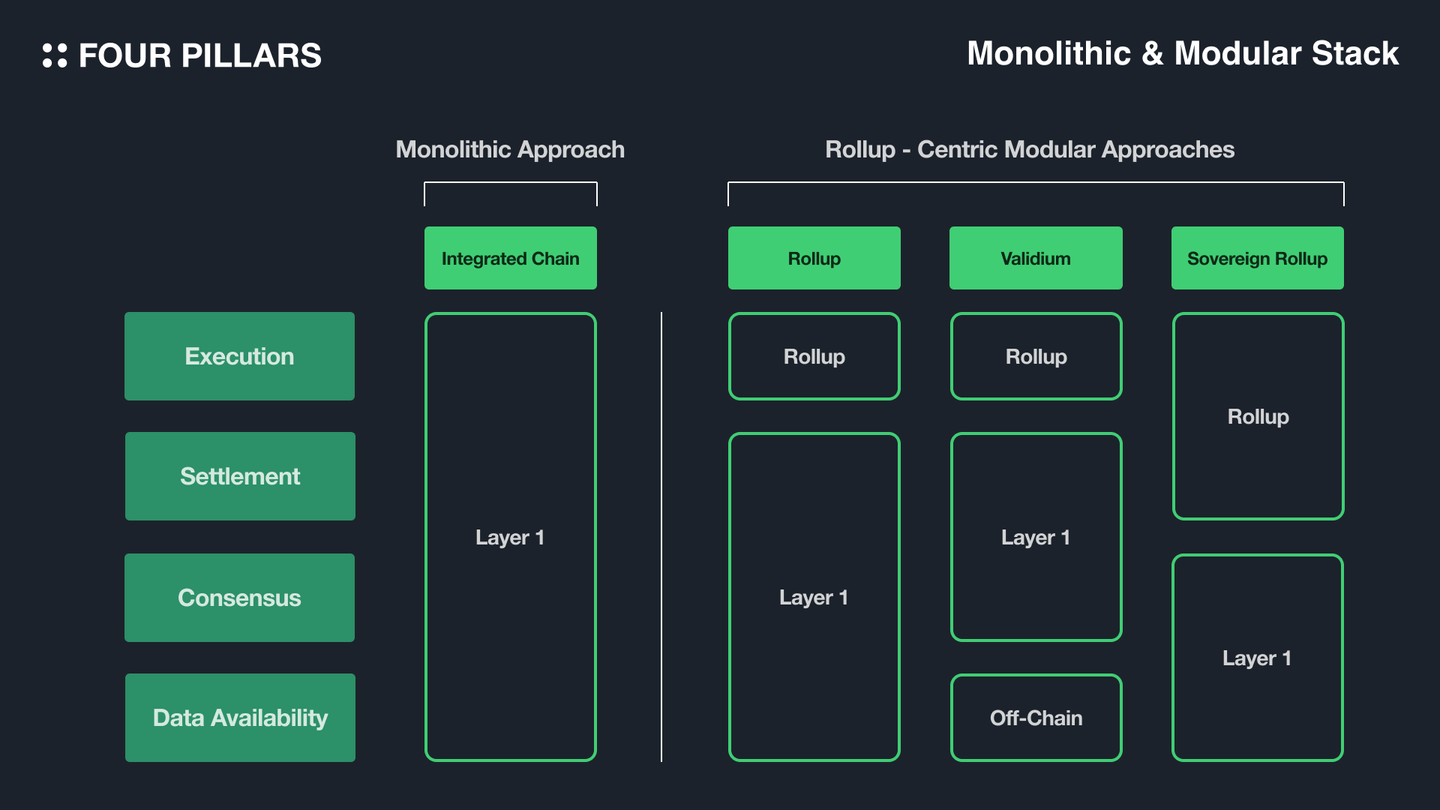

As Ethereum shifted its roadmap toward a rollup-centric model, the concept of modular blockchains gained momentum, with related projects dominating market share. Modular blockchains essentially divide roles—consensus, execution, settlement, and data availability—across different protocols, overcoming limitations of integrated blockchains through improved scalability and flexible governance.

However, complexity remains a critical flaw in modular architectures. Given that a single transaction may traverse multiple protocols, this complexity includes ongoing checks for compatibility and dependencies, increased communication costs, and difficulty quickly identifying and resolving unforeseen issues. How can such a system confidently achieve stability? For infrastructure to be stable and sustainable, it must fundamentally be simple.

By emphasizing simplicity and composability, Solana leads the integrated blockchain faction. Since launch, Solana has developed a unique tech stack centered on these values, attracting distinct applications different from those in the Ethereum ecosystem and nurturing a growing community.

This demonstrates the effectiveness and importance of the integrated blockchain approach within the industry, challenging idealism and academic discourse, particularly in Ethereum-dominated circles. It has also undeniably influenced the emergence of today’s various integrated blockchains (e.g., Sui, Aptos, Sei) and will continue to do so.

2.2 Enabling Product-Driven Founders’ Success

The simplicity and composability championed by Solana aim not just to improve surface-level performance via expensive hardware, but to design a network where functionality matches that of individual nodes through optimized and simplified software and communication technologies.

The importance of creating a developer-friendly environment is self-evident. Developers can eliminate all complexities associated with stack selection for application building and ensure compatibility across smart contracts, optimizing their resources. Benefits like low latency, low fees, and parallel processing lead to localized fee markets, eliminating inefficiencies caused by bottlenecks in individual applications.

Furthermore, Solana provides a suite of built-in features within its simple tech stack, such as configurable token standard libraries, cross-chain interoperability, and RPC for token balance queries without relying on external indexers, fostering organic interactions between applications.

Through comprehensive technical, financial, and operational support programs, Solana offers an ideal environment for product-driven developers, reinforcing an ecosystem aligned with Solana’s values.

2.3 Bridging On-Chain and Off-Chain Boundaries

Blockchain technology is inherently inconvenient, yet its unique real-world value justifies participation and development within this ecosystem. However, without adoption, this value becomes meaningless. Solana understands this better than any other mainnet, possibly aiming to develop utility rather than being overly influenced by the original ideals of blockchain. Solana’s vision for its blockchain ecosystem is “real adoption.”

Currently, Solana focuses on three primary areas: DePIN, mobile, and payments—domains closely tied to everyday infrastructure. DePIN leverages blockchain decentralization to maintain and operate real-world infrastructure networks, forming a rapidly evolving narrative around Solana. Its low fees and fast processing are especially suitable for capital-intensive real-world infrastructure fields such as computing and storage assistance, telecommunications, mapping, and data centers. The development of DePIN and payments will significantly contribute to building real-world infrastructure using Web3 capabilities—and vice versa, serving as a primary method to bring off-chain users into Solana’s on-chain environment. These off-chain users can naturally accumulate on-chain experience through devices like the Saga mobile phone and utilize various on-chain asset classes, including RWA.

In short, Solana’s ecosystem not only blurs the boundaries between off-chain and on-chain spaces but enhances the significance of each domain.

3. Solana’s Dramatic Journey

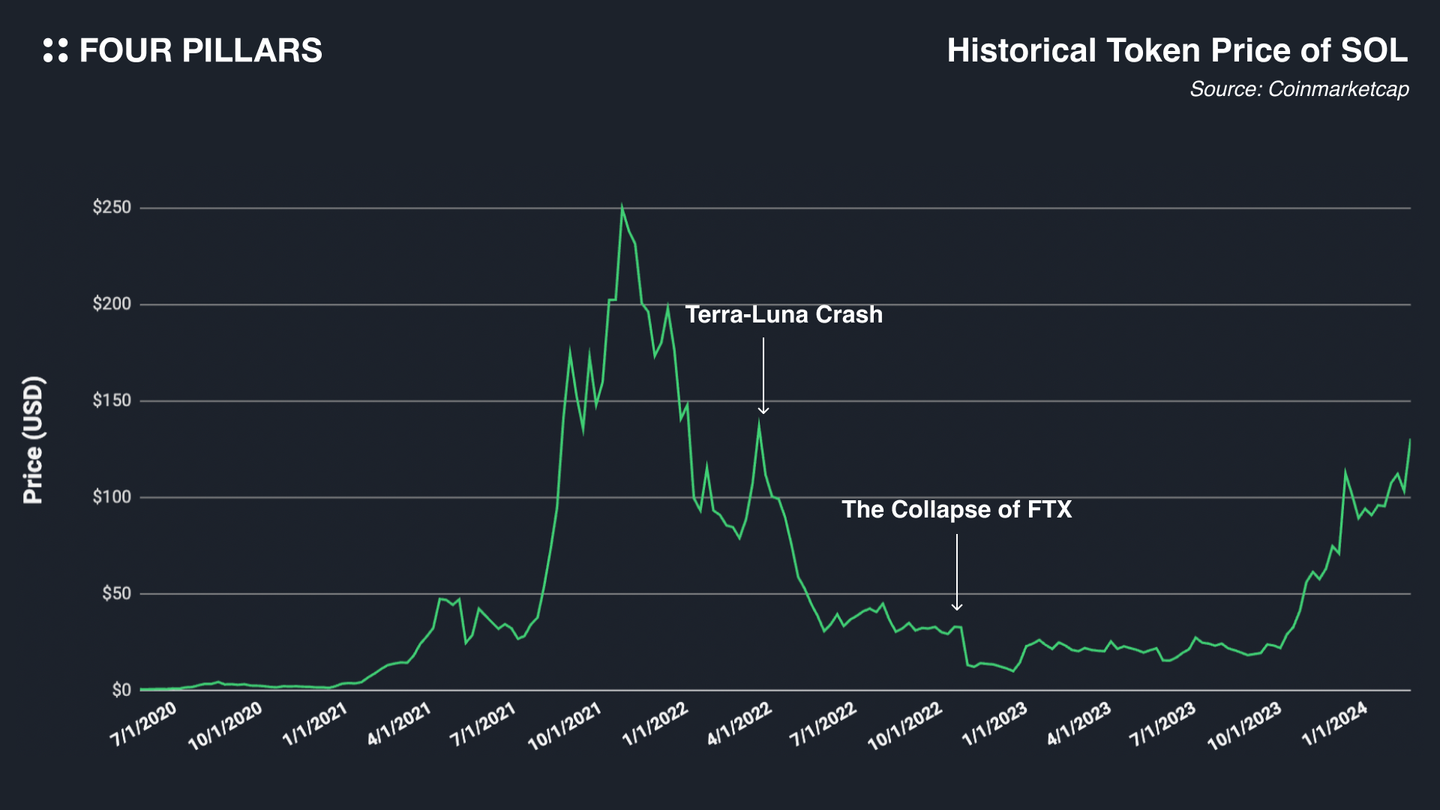

Over a relatively short period, the crypto industry experienced rapid growth, attracting massive attention. Volatility during this expansion has become a familiar phenomenon among industry participants. Yet, Solana faced particularly extreme volatility—during the peak of the 2021–2022 blockchain boom, backed by FTX, the world’s second-largest crypto exchange, and its CEO Sam Bankman-Fried (SBF), Solana rapidly grew into the fourth-largest ecosystem by market cap, excluding stablecoins. However, FTX’s collapse dealt a severe blow to the Solana ecosystem, causing SOL’s price to plummet 97% from its peak.

Despite such a severe crisis, Solana has regained influence. With active participation from developers and enterprises, the ecosystem has become stronger than before. This dramatic turnaround was possible due to Solana’s relentless vision and strong execution.

3.1 Getting Started with Solana

Source: Solana Whitepaper

“A monolithic, globally synchronized state machine with light-speed consensus”

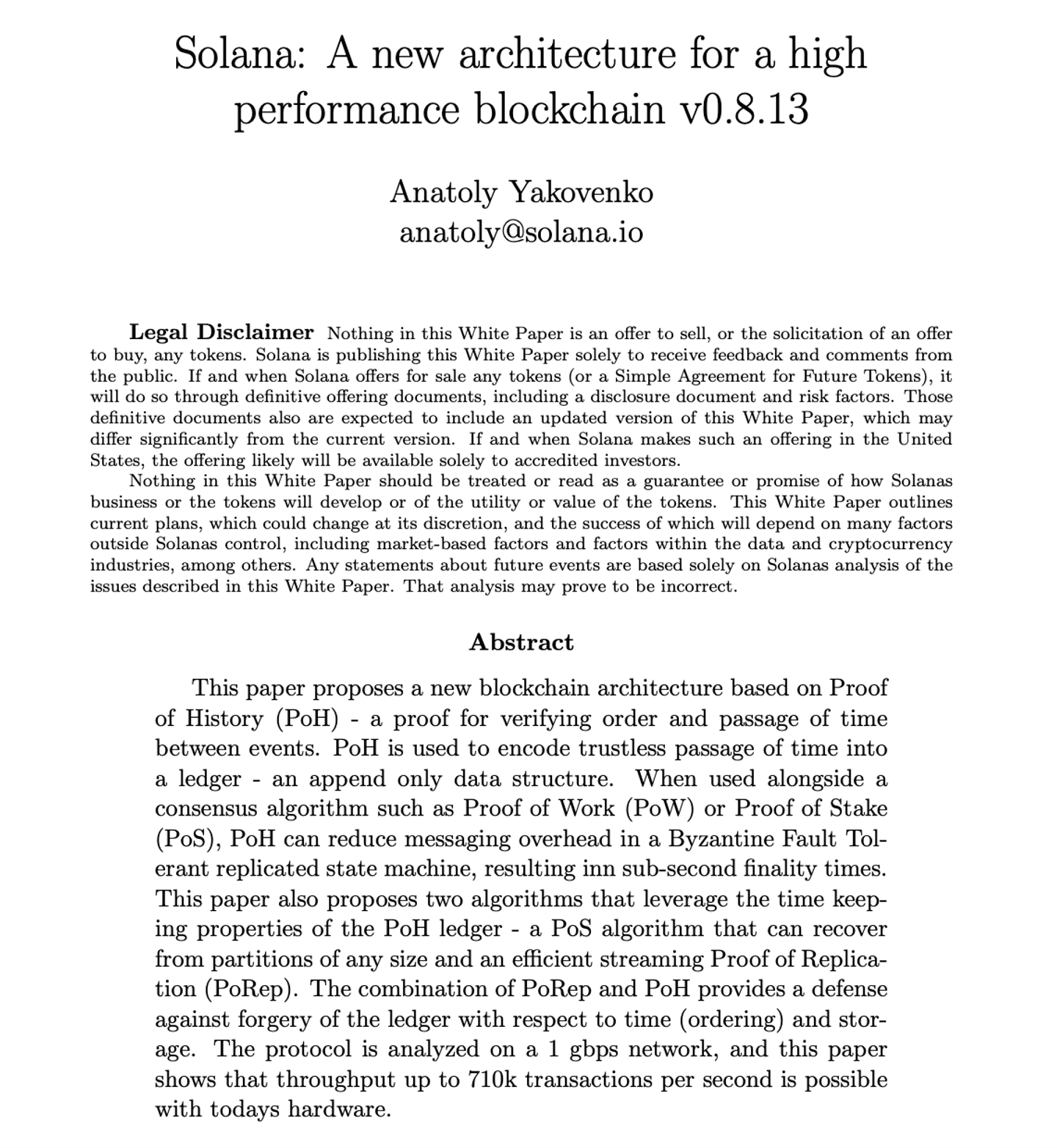

Solana’s journey began in late 2017. Anatoly Yakovenko, drawing from his experience at Qualcomm, studied blockchain technology and identified a major issue with existing solutions: the lack of a trustless, universal clock that all validators could use for transaction timestamps.

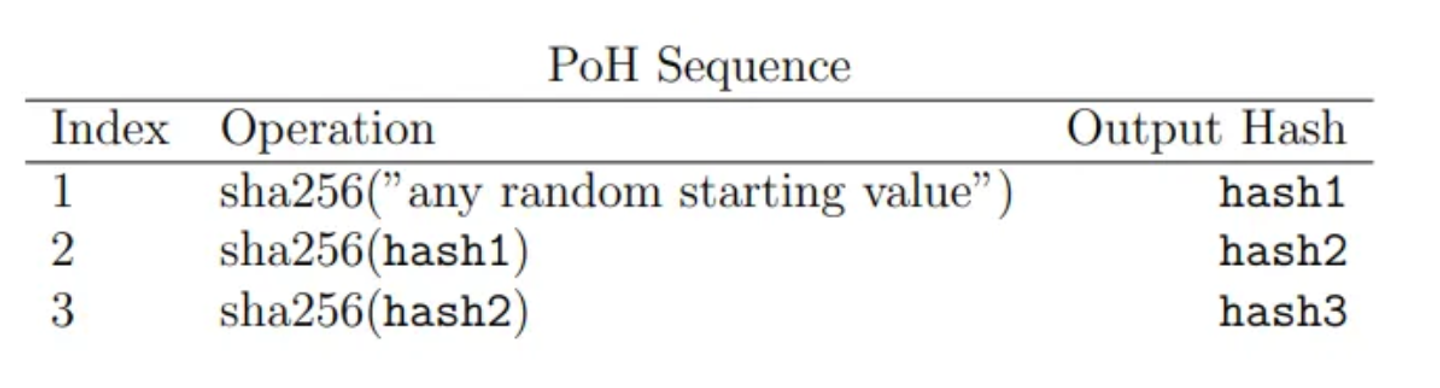

Thus, Anatoly proposed a new method using SHA-256 hash chaining to encode the passage of time and synchronize clocks across multiple nodes via this data structure. Unlike traditional blockchains requiring extensive node-to-node communication to agree on transaction order and timing, a globally verifiable clock allows the network to synchronize more simply and process transactions almost immediately upon arrival.

This idea materialized as Proof of History (PoH), aligning with Solana’s assumption that if software doesn’t hinder hardware, overall network performance can scale linearly with hardware improvements. Today, Solana handles thousands of transactions per second with block times recorded at 400–500 milliseconds—far surpassing the performance of existing blockchains.

Ultimately, Solana’s goal with this technical approach is twofold: a scalable platform capable of high usage and seamless composability between applications. Through the monolithic design of a shared, globally synchronized state, developers can write programs (i.e., smart contracts) more easily, simplifying application development and improving end-user experience.

3.2 Resilience Amid Adversity: Overcoming Challenges

Solana’s philosophy—leveraging multithreading for parallel processing and consistently delivering high network performance—played a crucial role in forming a community centered around pragmatic developers. At the height of blockchain hype, demand for fast transactions and low fees driven by DeFi and NFT booms positioned Solana as a true mainnet competitor to Ethereum.

However, FTX’s collapse temporarily halted this trajectory. At the time, Solana was closely tied to SBF, who publicly supported the Solana ecosystem and attracted projects like DEX Serum and others typically found in Ethereum’s ecosystem. Backed by SBF, FTX grew into the world’s second-largest centralized exchange, amplifying his influence within Solana. But FTX’s misuse of company assets and customer deposits to fund loans and investments into its hedge fund Alameda Research led to its downfall, putting the Solana ecosystem—highly dependent on FTX—at risk of collapse.

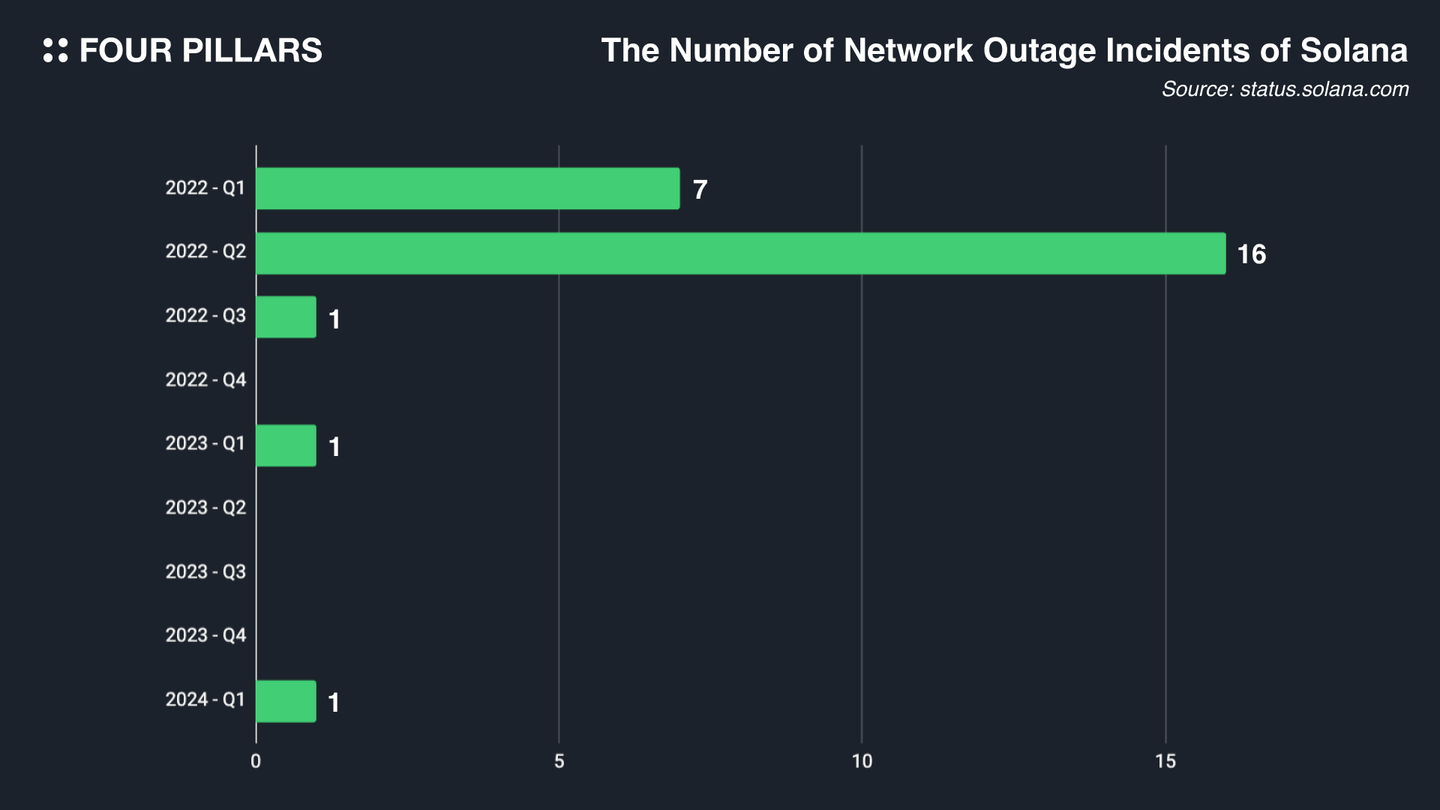

Though the Solana ecosystem seemed precarious, builders resonating with its vision remained. Solana’s first step in this situation was to restore community trust by addressing technical issues to enhance network stability and developer-friendliness.

3.2.1 Technical Improvements

Solana’s network architecture is vulnerable to spam attacks, causing frequent outages. This stems from its design intent: maximizing communication speed through a cheap fixed-fee system and predetermined leader node setup. To address these issues, Solana implemented several upgrades, including QUIC (Quick UDP Internet Connections), Quality of Service (QoS) based on stake weight, and localized fee markets.

QUIC

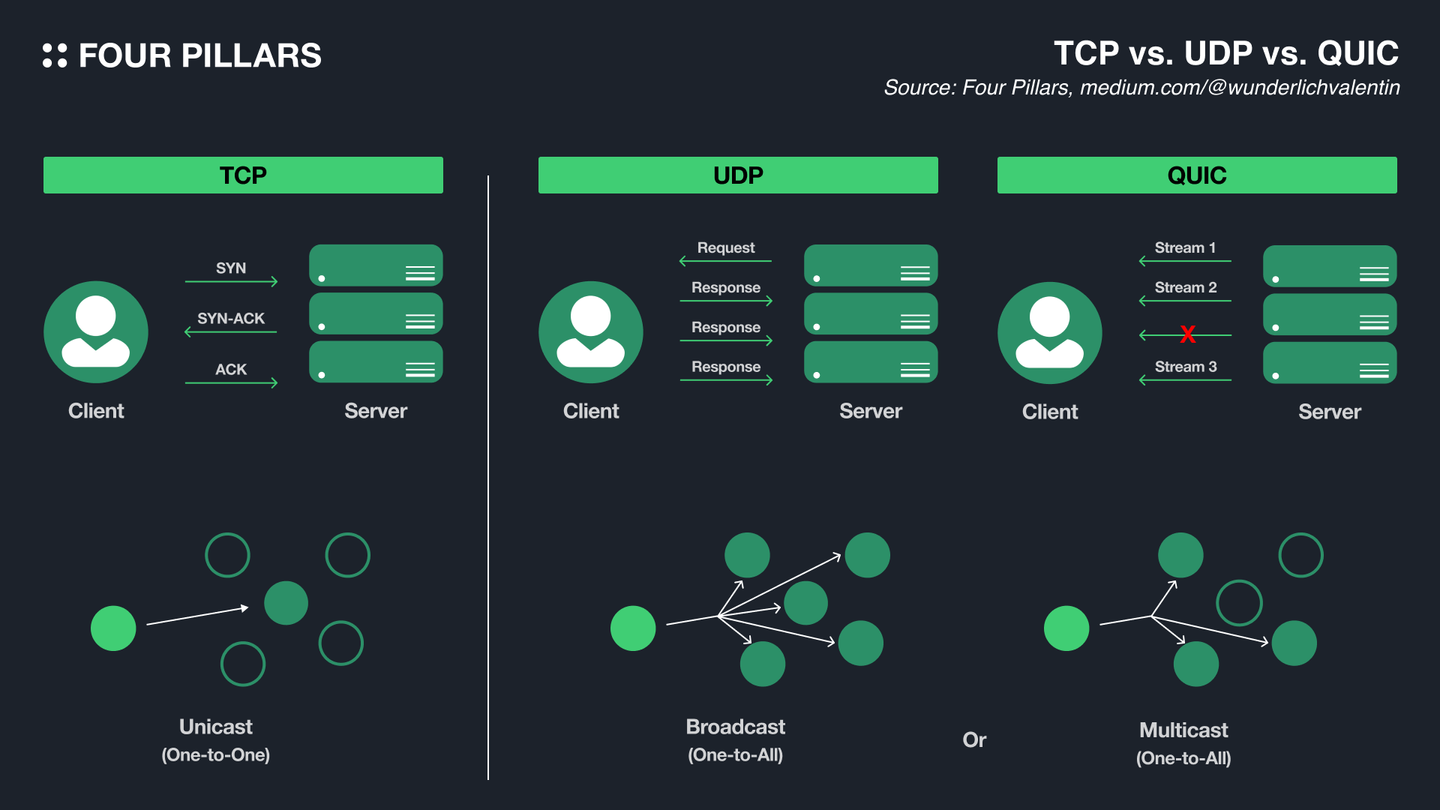

Solana uses a custom UDP protocol for communication between RPC and leader nodes. This simplifies communication and accelerates transmission, but lacks reliability and control mechanisms—such as packet acknowledgment and source IP identification—making it vulnerable to spam. UDP suits services needing continuous real-time streaming but falls short in blockchain environments demanding security and stability.

To overcome this, Solana adopted Google’s QUIC protocol. QUIC is a new UDP-based communication protocol that retains UDP’s benefits while streamlining TCP’s connection flow and handshake process. Thus, QUIC enables reliable communication on Solana—only requesting retransmission for lost packets and continuing transmission of others uninterrupted—significantly improving network efficiency.

Quality of Service (QoS) Based on Stake Weight

When network demand exceeds capacity, Quality of Service (QoS) prioritizes certain traffic types. With QUIC’s introduction, discussions arose about its implementation—previously, Solana’s leader nodes used UDP, processing transactions solely based on arrival time, ignoring source. Now, with QUIC, leader nodes can identify the IP requesting a transaction, allowing them to assign and limit traffic priority for specific connections.

The degree of traffic throttling is proportional to the amount of staked SOL, which defines the essence of the stake-weighted QoS policy. In other words, the maximum number of packets a validator can transmit is proportional to the amount of SOL staked on the Solana network, increasing the likelihood that transactions exceeding a single node’s limit will be dropped by leaders. This method aims both to deter malicious validators from launching spam attacks and to incentivize high-volume validators to stake more SOL, enhancing Solana’s security and SOL demand.

Localized Fee Markets

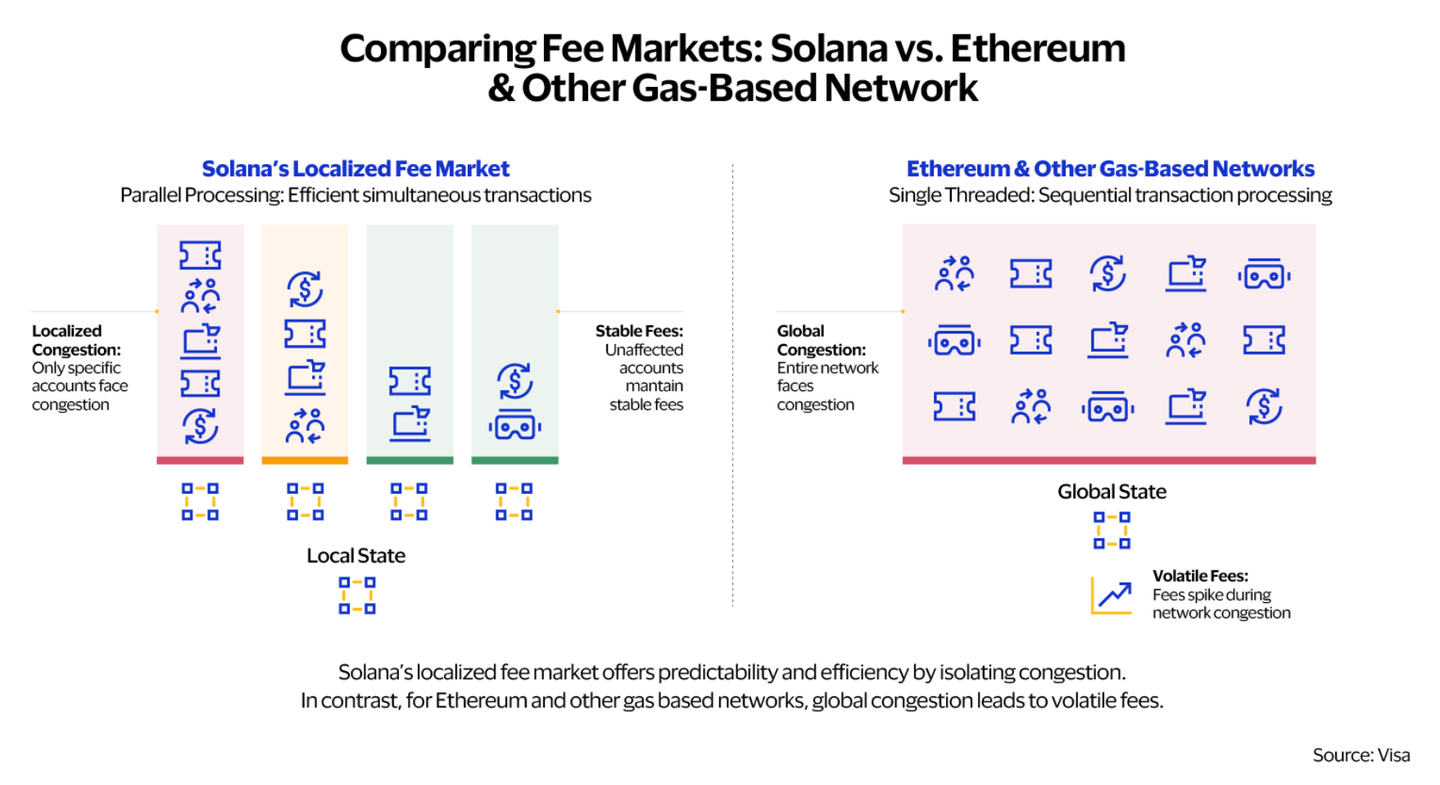

Although Solana maintains a fixed gas fee policy, preserving cost advantages, intense competition for block space can cause transaction failures or trigger spam attacks as users try to ensure inclusion. To address this, the Solana ecosystem began discussing a fee market system, allowing users to add a premium to prioritize faster transaction processing, deterring spam and improving network efficiency.

Further, Solana adopted a localized fee market approach, limiting it to specific apps or markets to reduce the impact of increased operational demands on the broader network. This logic works because each Solana transaction specifies particular account states it modifies and supports parallel processing. For example, even if NFT minting fees spike due to high demand, it won’t affect fee markets for unrelated accounts like token transfers. Currently, localized fee markets apply to specific apps, markets, and AMM pools, capping the maximum compute units (CU) per program per block at 25% in “hotspots” with intense fee competition due to excessive transactions.

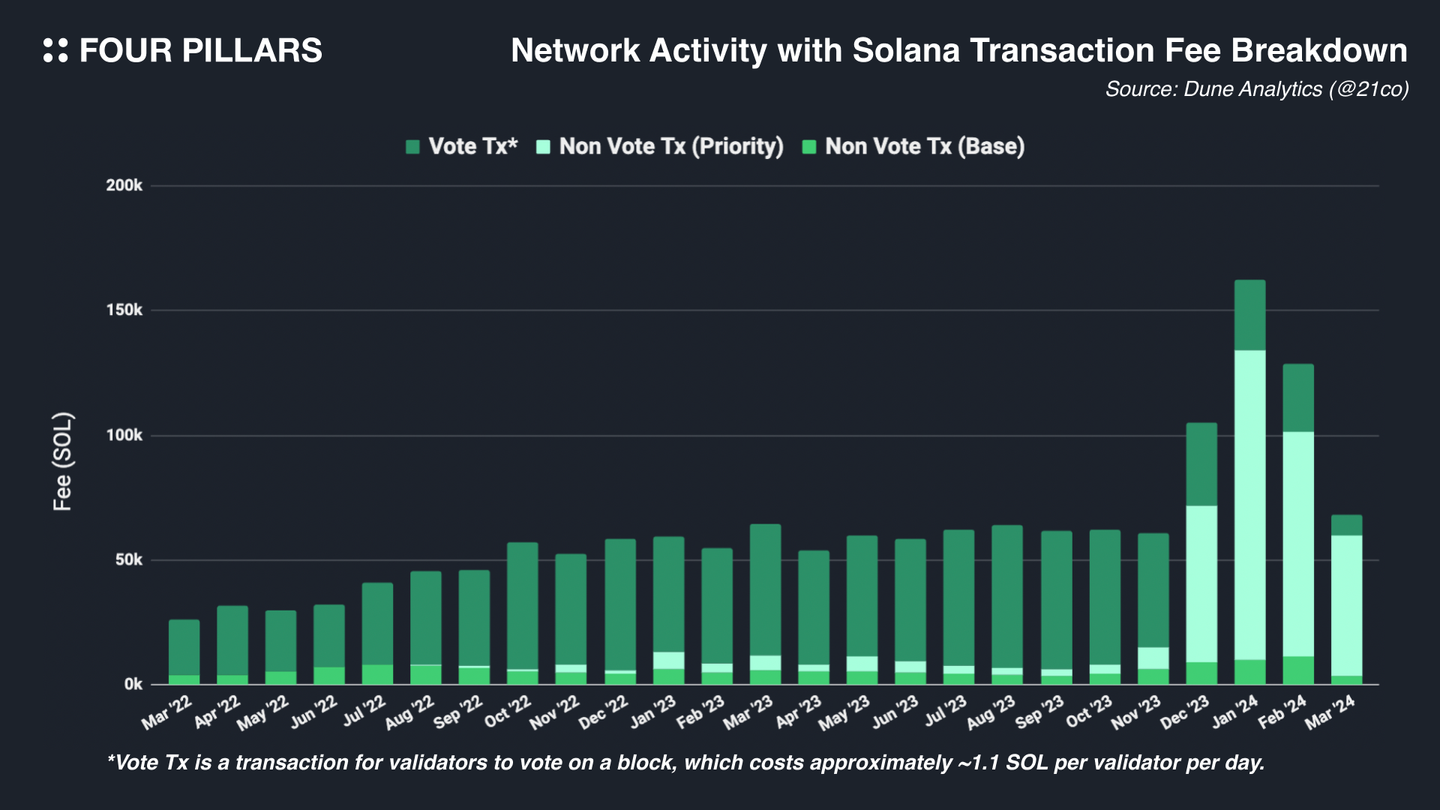

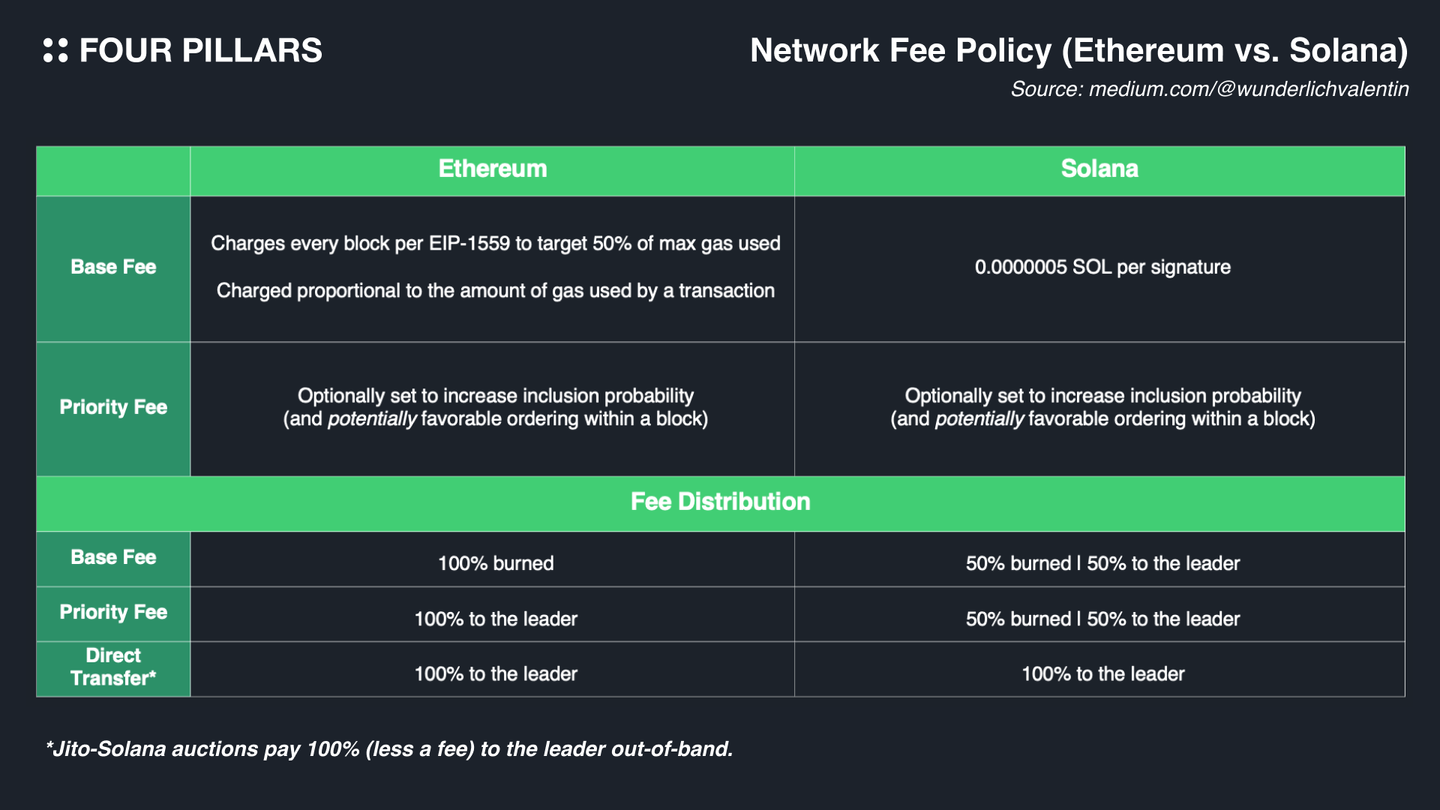

Discussion on localized fee markets continues, including fee structures. As of writing, the current fee policy is as follows:

Additionally, SIMD-003 discusses introducing dynamic base fees to further prevent spam, while SIMD-0096 proposes paying leaders the full priority fee, including the 50% meant to be burned.

3.2.2 Ecosystem and Operational Initiatives

Beyond these technical efforts, Solana’s ability to attract market interest and regain trust stems from actively engaging domains where its tech stack excels and cultivating a developer-centric community.

Strengthening Community Sentiment

The Solana community actively provides essential resources and support to developers eager to contribute, through platforms like the Foundation, hackathons, and Super Team Earn. Its operating principle is: “Benefiting developers is crucial for sustainable ecosystem growth.”

As part of this, a meme token called BONK, created by the LamportDAO community, airdropped 5% of its total supply to developers staying in the Solana ecosystem to help rebuild it. This meme coin helped unify the community—meme tokens gained attention as developers rebuilt the ecosystem, and at one point BONK surged over 15,680% above its lowest price. This surge sparked a virtuous cycle of interest in Solana and its ecosystem, ultimately leading to a proposal to airdrop 30 million BONK tokens to Saga mobile device users, further boosting market interest in BONK and Solana.

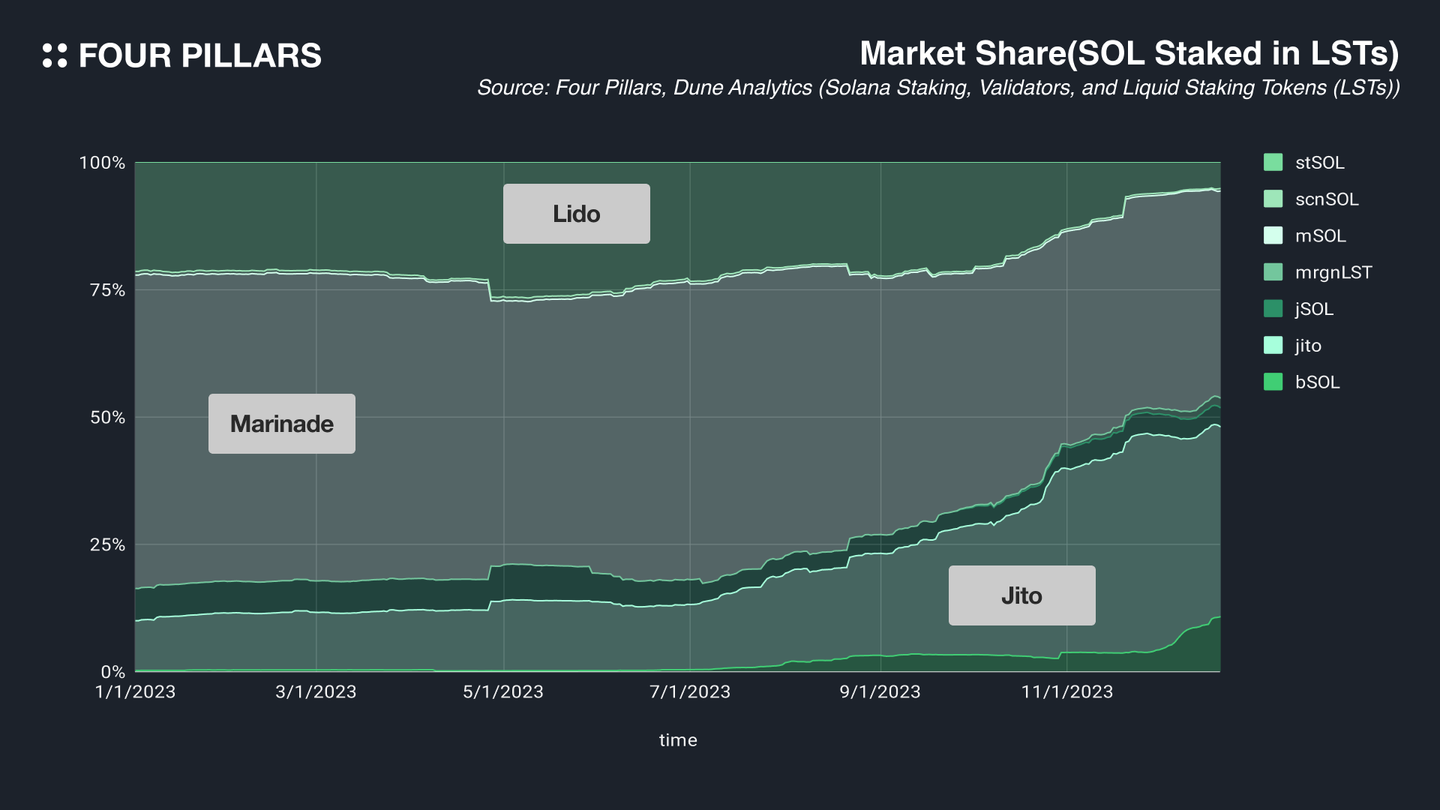

In turn, protocols like Jito (MEV solution client and staking platform), Pyth Network (oracle network), and Jupiter (decentralized exchange) announced their own airdrops, stimulating market interest in Solana. Other ecosystem protocols—including Tensor, marginfi, Zeta, Parcl—announced points programs, building anticipation for future airdrops among Solana participants and contributing to ecosystem vitality.

These cases exemplify how a culture respecting community combined with excellent product design can inject new energy into an ecosystem.

Web2-Inspired Infrastructure Approach

As the 2021–22 blockchain boom faded, a key question remained: “Why use blockchain?” Each mainnet began solidifying its identity and discussing measures for real adoption. In this context, another factor driving market interest in Solana was its swift execution of practical initiatives—actually linking real-world infrastructure with the on-chain world, not just theorizing.

Among these initiatives, DePIN and Mobile stand out. As explained earlier, DePIN leverages blockchain decentralization to maintain and operate real infrastructure. Solana is uniquely pioneering the DePIN space, crafting its narrative—not only proposing use cases where Web3 syntax can replace/supplement real-world infrastructure but also building a funnel to onboard off-chain users into Web3. A physical environment aggregating this experience for users—the Saga series of mobile devices launched by Solana—initially saw poor sales when first released in 2022, but sold out by December amid news of BONK and growing ecosystem momentum. Pre-orders for the second batch exceeded 100,000 units as of February 13, with delivery expected in the first half of 2025.

The second area is payments. Indeed, P2P blockchain-based crypto asset payments are frequently cited as a meaningful solution to traditional finance’s intermediation, high fees, and slow transaction times. Solana positions itself as the optimal blockchain for crypto payments, leveraging multithreaded parallel processing, fast speeds, and low costs. It is actively advancing in this space, making blockchain transactions as intuitive and simple as credit card payments. Circle’s USDC has long partnered officially with Solana; in February 2022, the open-source Solana Pay enabled various apps to build crypto payment functions. Solana Pay plugins have been integrated into platforms like Shopify, Citcon, Checkout.com, and Visa announced incorporating Solana into its stablecoin payment infrastructure.

Client Diversity and Validator Decentralization Initiatives

Additionally, based on the principle that validator client diversity improves network stability and security, Solana is working on enhancing resilience through diverse validator clients. Client diversity minimizes the impact of a single software bug on the entire network, as bugs or vulnerabilities in one client may not exist in another.

Solana initially started with a single client from Solana Labs, but with the August 2022 release of Jito-Solana, a second client developed by Jito Labs, Solana began achieving client diversity. It has also reached a test version of Firedancer, an independent validator client developed by Jump Crypto using C/C++.

Moreover, a lightweight client called Tinydancer, capable of low-cost transaction validation, has drawn significant attention—especially because it reduces hardware requirements, lowering the typical specs needed to run a Solana node. While optimizing hardware specs enhances network performance, according to Vitalik’s Endgame post, reducing node specs to allow more people to produce blocks isn’t favorable for scalability, quality, or stability.

Recommended specs for running a Solana node are:

-

12-core CPU, minimum 2.8GHz clock speed

-

128/256GB RAM (RPC nodes may need more for custom database indexing)

-

2–4 NVMe drives, at least 1TB each

-

10 Gbps network

Ethereum’s PBS (Proposer–Builder Separation) model is also based on similar reasoning.

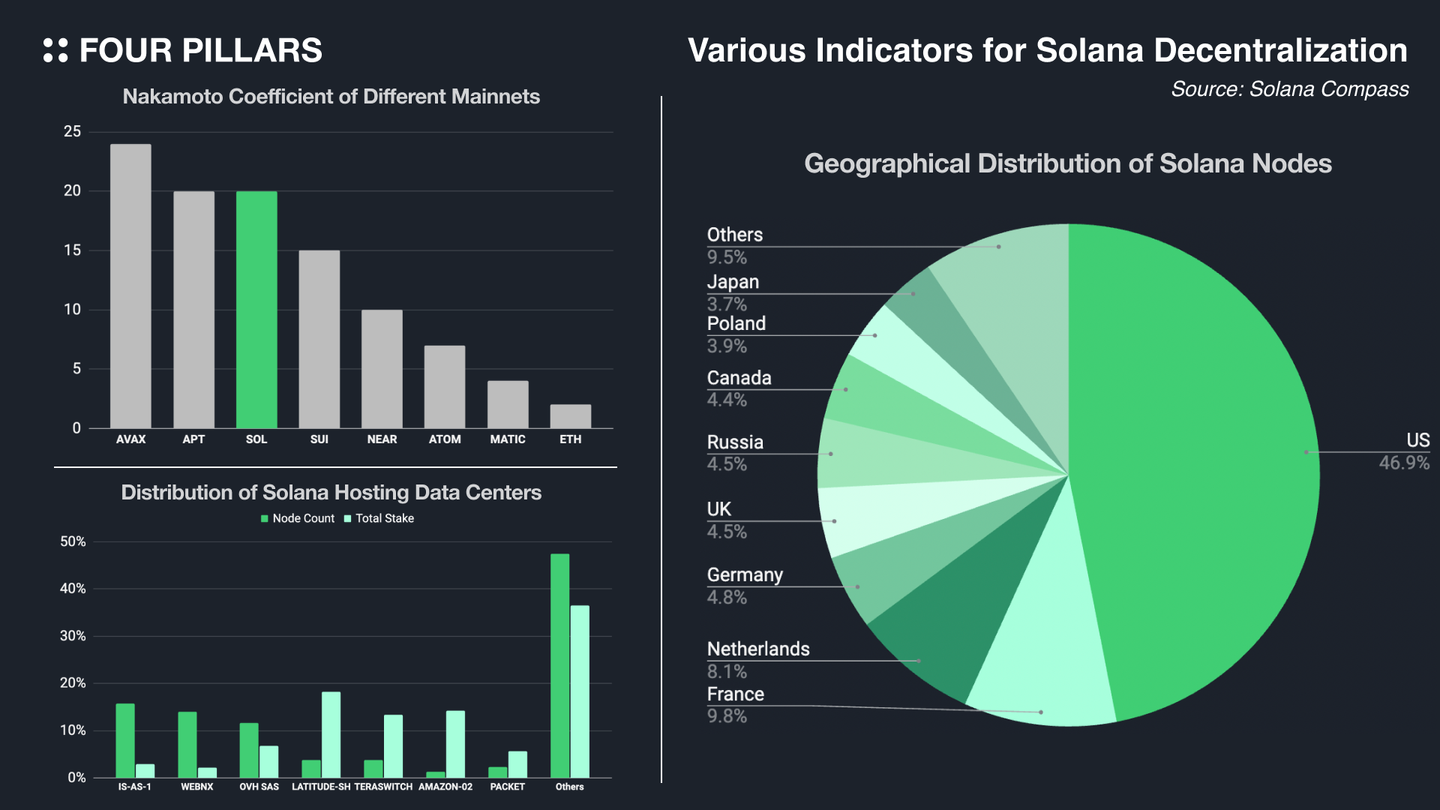

Despite high hardware requirements, the ~2,900 Solana nodes hosted in data centers are widely distributed, with a Nakamoto coefficient (number of validators whose failure could halt the chain) remaining around 20. Though geographically concentrated around the U.S., ongoing software and hardware optimization under Moore’s Law, along with delegation programs based on decentralization standards, indicate Solana is gradually achieving decentralization.

In summary, as one of the few chains beyond Ethereum with multiple independent validator clients, Solana continues advancing toward decentralization and sustained network stability.

Solana has been consolidating its internal foundation while actively expanding operations. This process provides ample elements to attract institutional investors—ARK Invest CEO Cathie Wood publicly expressed positive outlooks on Solana’s vision, while Grayscale’s Solana Trust surged 869%. Fundamentally, Solana has demonstrated its potential to revive an ecosystem once perceived as crisis-stricken through consistent vision and rapid execution.

4. Solana’s Pillars

This section dives into the components of Solana’s tech stack that firmly support its steadfast vision and drive its ecosystem’s recovery.

4.1 Tech Stack for Composability and Efficiency

4.1.1 Programming Language

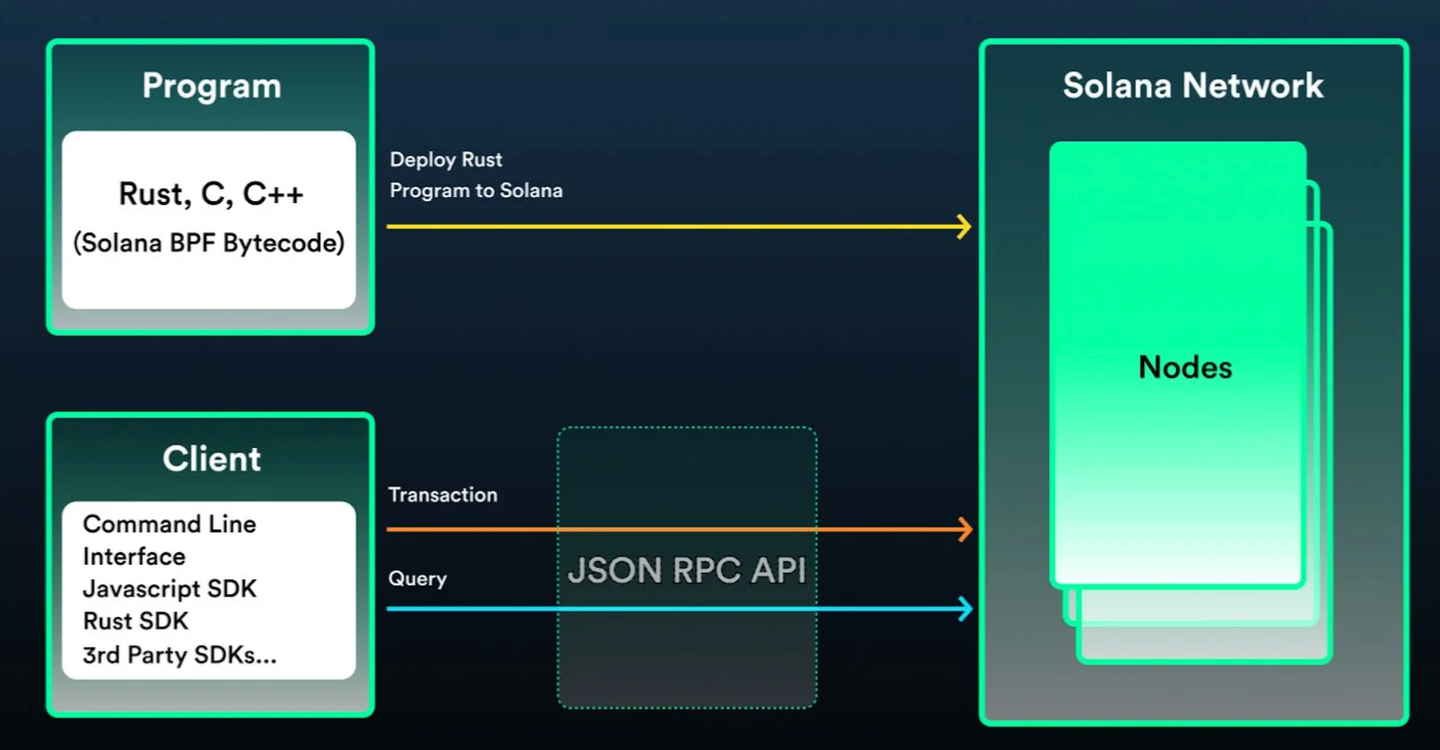

Solana aims to reduce fees and block times on the surface while technically optimizing software to match hardware. This mission requires careful choice of programming language for programs (i.e., smart contracts), leading to Rust—renowned for concurrency, memory safety, low-level control, and a robust type system that prevents type errors and ensures secure, predictable code.

However, Solana’s ultimate goal is to create an environment where all LLVM (Low-Level Virtual Machine)-compatible languages are interchangeable. While Rust remains the default, LLVM allows code written in other languages (like C or C++) to be compiled into machine code executable on Solana.

For client-side communication with the Solana network, developers can use SDKs based on JSON-RPC API in languages like Java, C#, Python, Go, or Kotlin.

LLVM is a set of modular compiler and toolchain technologies enabling high-performance, high-quality code to be efficiently optimized across various hardware platforms, making it a preferred environment for skilled developers.

4.1.2 Core Innovations

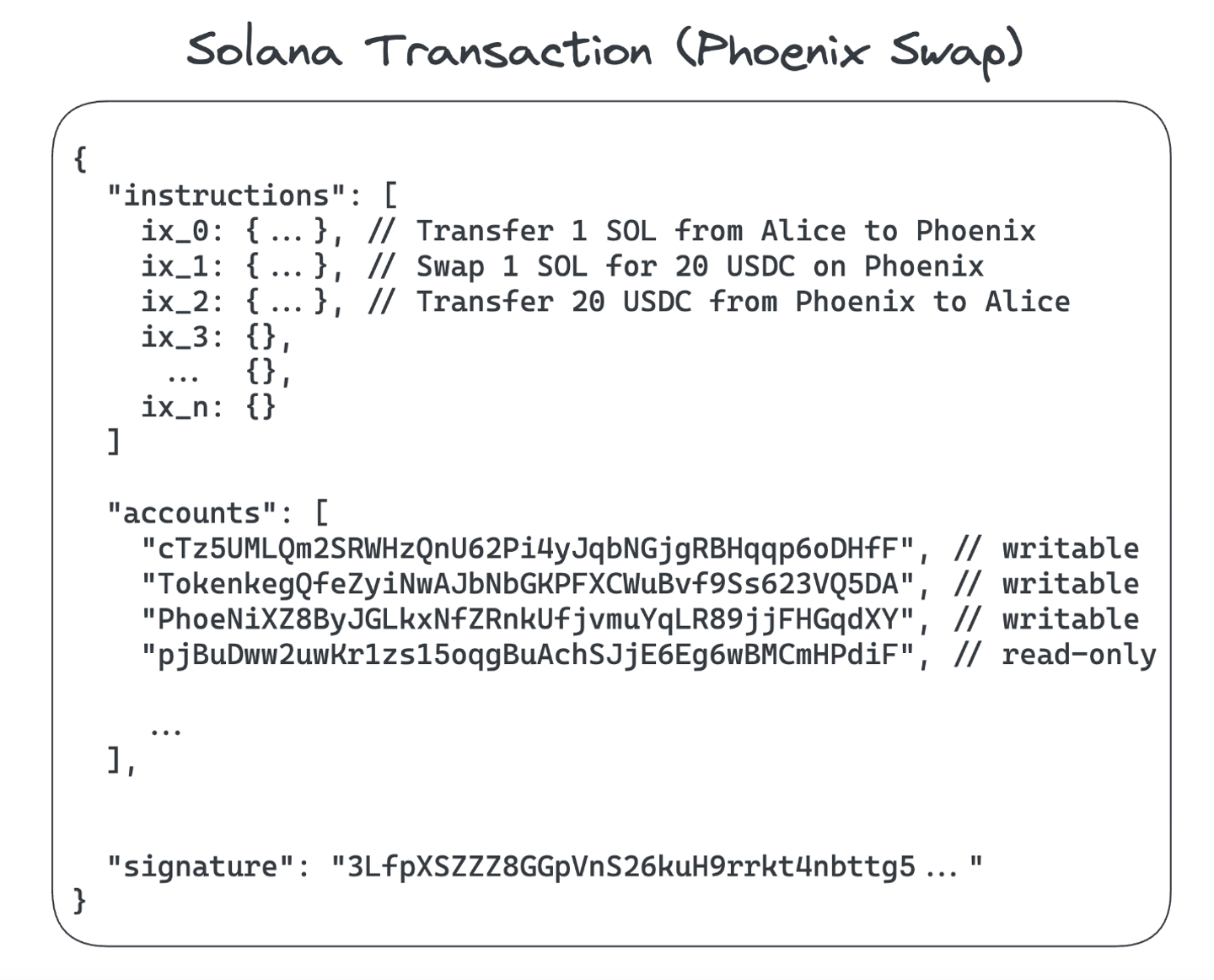

Solana implements eight core technologies to ensure top-tier speed throughout the process from transaction submission to block generation. To aid understanding, here’s a brief overview of how Solana’s consensus mechanism operates:

-

Leader Selection: Leaders are chosen based on stake weight delegated by token holders; validators rotate according to a leader schedule.

-

Timestamping Transactions: The leader receives transactions and timestamps them using PoH.

-

Block Creation: The leader begins creating a block using its PoH sequence.

-

Block Propagation: The newly created block is sent to replica nodes (other validators in the network).

-

Transaction Validation: Replica nodes validate transaction order using their PoH sequences and ensure compliance with network rules. Since transaction order depends on the PoH sequence (i.e., global clock), no P2P communication between nodes is required.

-

Block Finalization: Once transaction ordering and validation are complete, the block is added to the blockchain. The next leader is then selected, and the cycle restarts.

Solana is so fast that it employs a leader rotation schedule ensuring leaders are scheduled ahead of time to prevent delayed or stale blocks.

This will be further clarified in the following Proof of History section.

Proof of History (PoH)

As briefly mentioned earlier, PoH’s essence is a globally verifiable clock reference allowing validators to independently determine transaction order. For instance, by hashing a previous hash (hash1) to generate hash2 (sha256(hash1)), it intuitively shows hash1 came before hash2. Solana calls this process a “sequence.”

This sequential hash data structure acts as proof of elapsed time, enabling validators to rotate leaders without sharing time information. This is why Solana achieves much shorter block times than other blockchains.

Generating this sequence is only possible via single-core processing since it requires referencing prior output hashes, but verification can be done multi-core due to its simple logic—hash computation. Thus, it realizes Solana’s philosophy of “linearly scalable verification per node with hardware.”

Therefore, PoH resembles a global clock data structure or a Verifiable Delay Function (VDF) implemented via sequential hashing, rather than a consensus algorithm. Solana actually uses Tower BFT DPoS as its consensus mechanism.

Tower BFT DPoS

Tower BFT can be described as a PBFT variant optimized with PoH. It leverages Solana’s PoH as a global clock to pre-determine order, focusing solely on consensus, drastically reducing message overhead and latency. With Tower BFT, the consensus process among validators proceeds as follows:

Validators vote for ledger versions they deem accurate and discard incorrect ones, without P2P communication, within fixed time slots (~400ms). After a certain point, each subsequent slot vote doubles the timeout required to revert to a prior block. This means as most validators vote for a PoH sequence, rollback becomes increasingly difficult—for example, if all validators voted 35 times in the past 14 seconds (14,000ms / 400ms ≈ 35 slots), the effective time lockout is about 435 years (2^35 * 0.4 / 3600 / 24 / 365), making rollback virtually impossible.

Thus, only the “heaviest sequence” remains on the blockchain, having received majority validator support, making rollback hardest. In short, PoH allows validators using Tower BFT to asynchronously compute timeouts without P2P communication, ensuring timely voting, maintaining network liveness, and reducing fork likelihood.

Votes are weighted by each validator’s stake share on the network.

Gulf Stream

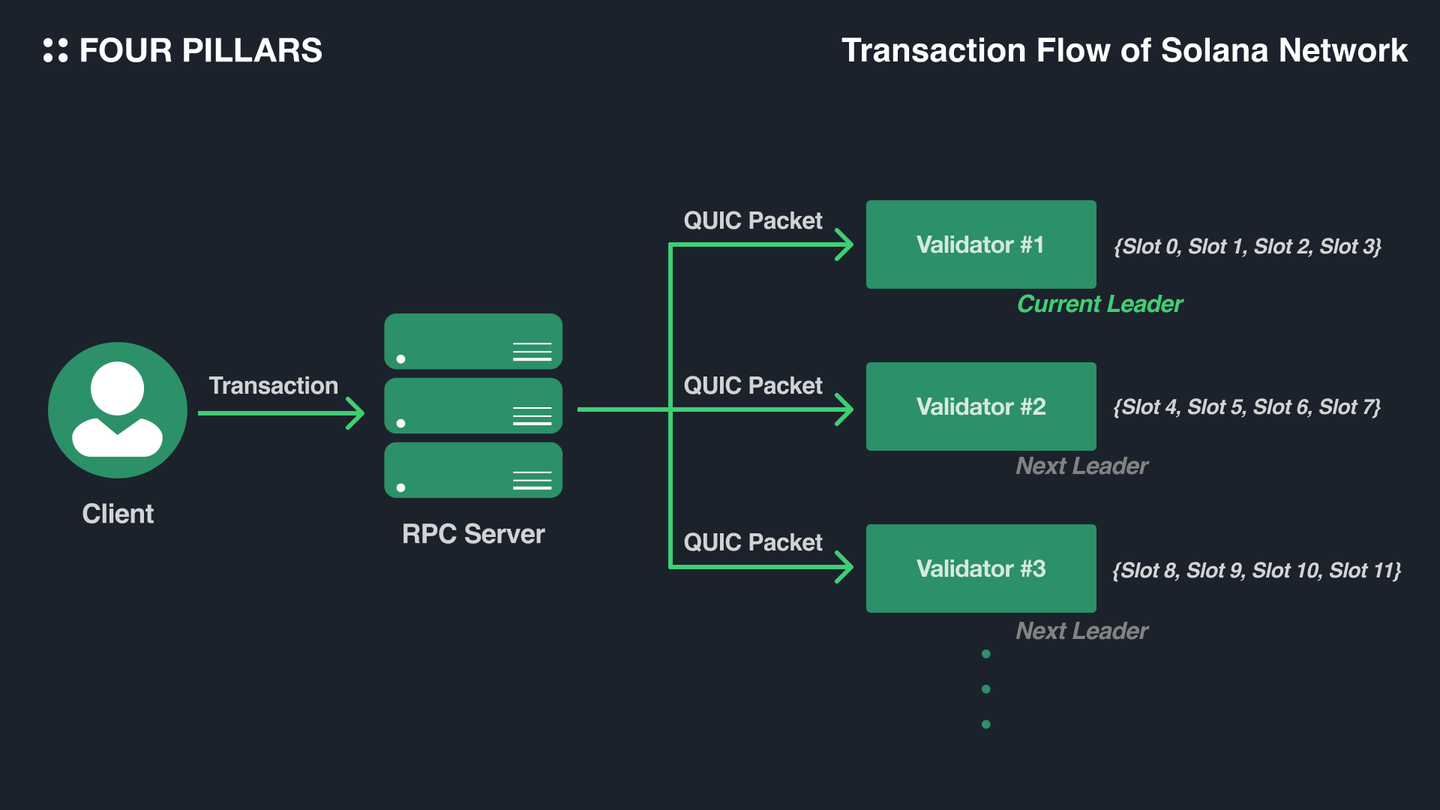

Unlike other blockchains, Solana does not require a public mempool to hold user transactions, as block space is relatively non-scarce due to high throughput. Instead, when users submit transactions, the RPC server converts them into QUIC packets and forwards them immediately to the validator scheduled to be the next leader. This method, called Gulf Stream, enables rapid leader transitions and transaction pre-execution, reducing memory load on other validators.

As noted earlier, this was initially UDP, updated to QUIC in mid-2022.

Sealevel and Cloudbreak

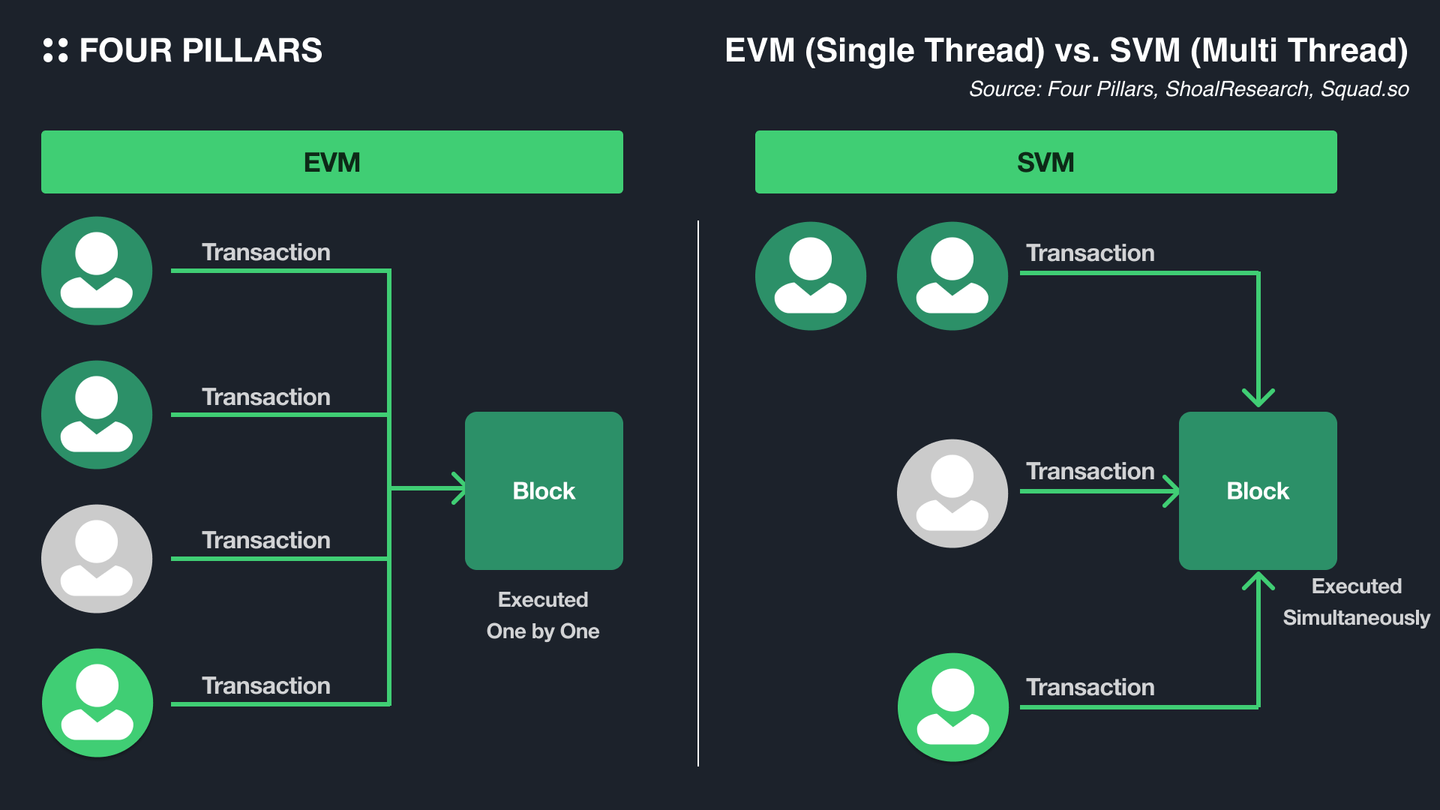

Sealevel is Solana’s core technology enabling multithreaded parallel processing, differing from EVM or WASM-based runtimes. It relies on “instructions” in each transaction containing arrays of account states from Solana’s global state. Transactions are pre-categorized by read/write status of each account for parallel processing.

Incidentally, organizing an account database in a way accessible for simultaneous read/write by multiple threads is extremely difficult even with traditional databases. To solve this, Solana developed Cloudbreak, partitioning account data structures in a specific way to benefit from sequential operation speeds and adopting memory-mapped files to maximize SSD efficiency.

As previously mentioned, this parallel processing logic in Sealevel is also why localized fee markets are feasible.

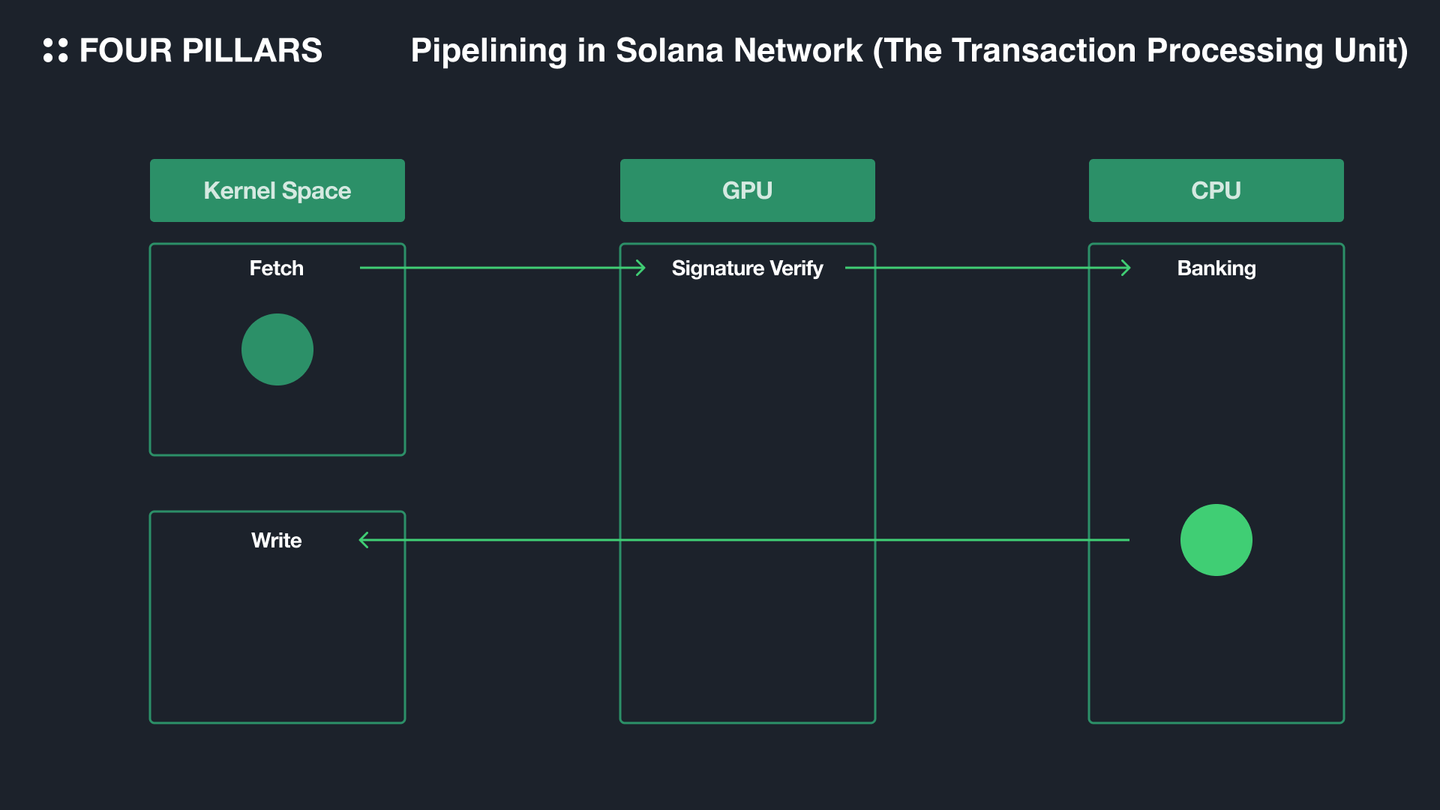

Pipelining

Pipelining in Solana refers to dividing input data streams (i.e., QUIC packets received in advance by the next leader) into multiple processing stages across different hardware components.

The pipelining process works as follows:

-

Data enters kernel space, then moves to GPU for parallel signature verification.

-

Once signatures are verified on GPU, data moves to CPU for banking operations.

-

Meanwhile, kernel space prepares the next data batch, while CPU processes data before recording (writing) it to the blockchain and forwarding it to the next block.

-

Solana maximizes hardware utilization via pipelining, enhancing efficiency and accelerating block validation and transmission.

Turbine

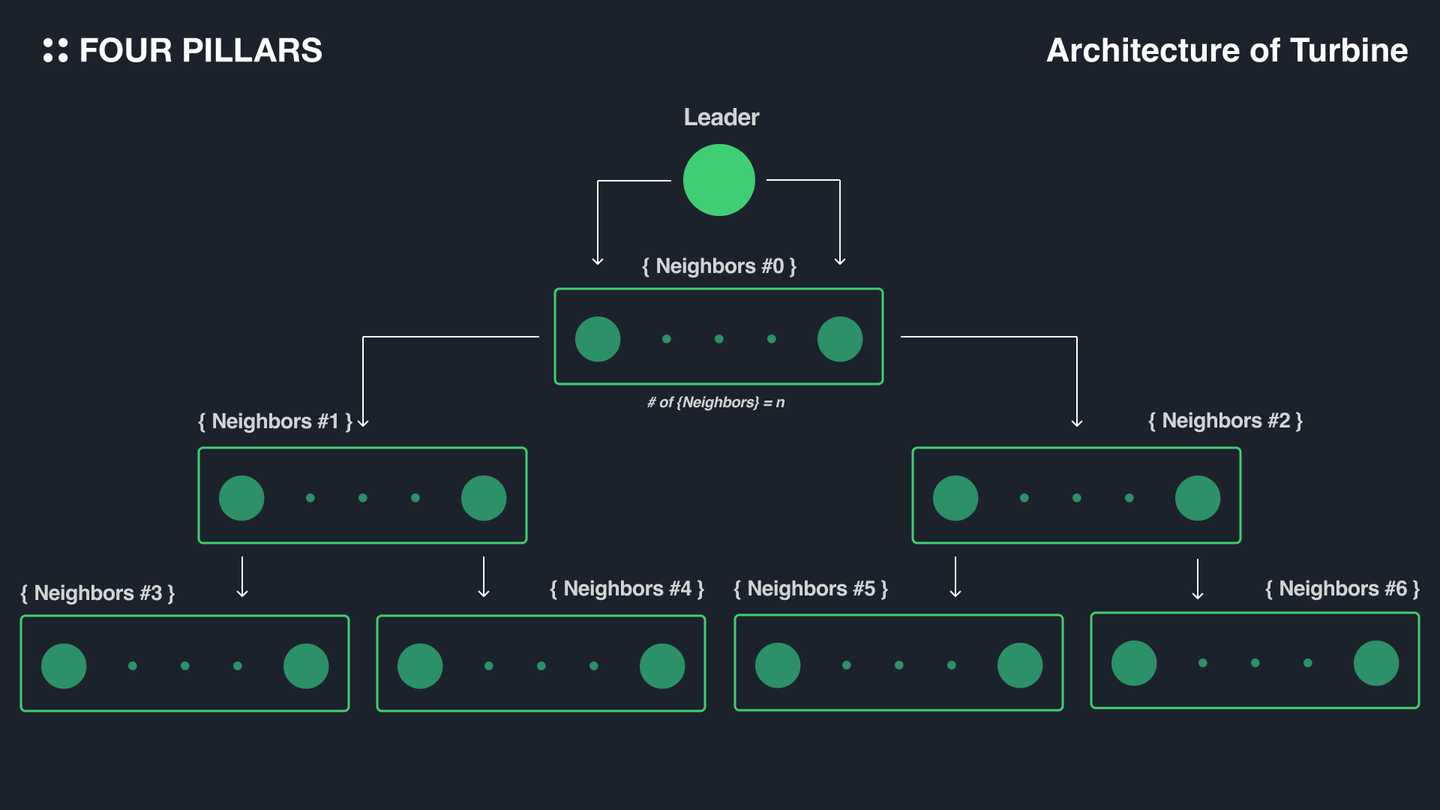

After transactions are processed, the leader must propagate the changed state to every validator. Sending large data directly to many validators would be highly inefficient. To solve this, Solana uses Turbine—a BitTorrent-like technology. Simply put, the leader divides QUIC packets (optionally with error correction codes) into smaller packets and distributes them across a tiered validator structure.

For example, consider a 128MB block. To handle it, the leader splits it into 2,048 64KB packets and sends them to some validators. These validators then relay fragments to neighboring peers, with initial recipients selected from nodes with high SOL stake ratios. Validators recursively pass portions of received data to the next neighbor group. This architecture allows data originally transmitted by the leader to eventually reach exponentially more validators as tiers deepen. As neighbor group size increases, steps needed to connect the network decrease logarithmically, enabling rapid data propagation.

Especially if higher-tier validators engage in malicious activity (e.g., Eclipse attack), their impact on the network could be substantial. Hence, the network uses randomized paths to send packets each time.

Archiver (Ledger Replicator)

Solana’s archivers store about 4PB of data generated annually by the network. They act as light clients, downloading only parts of the Solana ledger instead of the full version, enabling a broad range of validators with varying hardware to participate.

When assigned data to store, archivers verify authenticity via Proof of Replication (PoRep), a Filecoin-derived technique. Archivers announce their storage space to the network and earn up to 3% inflation rewards for storing and validating assigned data.

4.2 Diverse Clients for Reliability and Scalability

The key technologies discussed earlier enable fast transaction processing, parallel execution, and low latency, making Solana an ideal infrastructure for applications built on its network. However, Solana’s high throughput can challenge network stability, such as from MEV bots or spam. In response, Jito became Solana’s second client in August 2022, addressing inefficient MEV extraction and centralization risks in liquid staking, contributing to network stability and decentralization.

Additionally, upcoming performance-enhancing clients like Jump Crypto’s Firedancer and Tinydancer are vital to enriching client diversity within the Solana network.

4.2.1 Jito-Solana

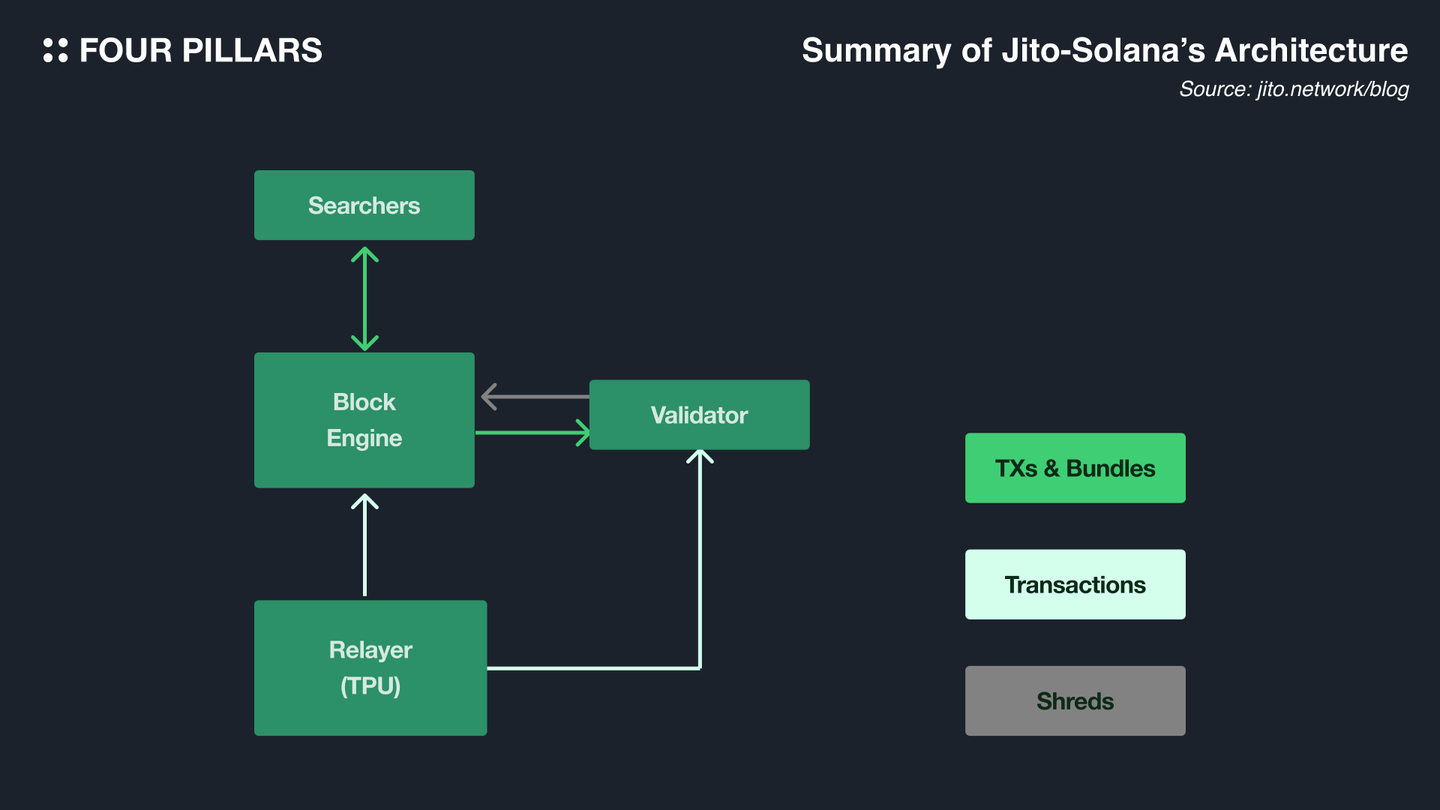

Jito-Solana activates an MEV market, similar to Ethereum’s Flashbots MEV-boost. However, due to Solana’s unique design—lacking a mempool and processing transactions primarily on a first-come-first-served basis with much faster block times—Jito-Solana operates differently.

Jito’s MEV client introduces a virtual mempool, holding auctions every 200ms, streamlining MEV extraction. With Jito-Solana, searchers can check and simulate bundles via Block Engine, then submit them to leaders through a dedicated pipeline. This off-chain handling of transaction bundling and block auctions minimizes network congestion.

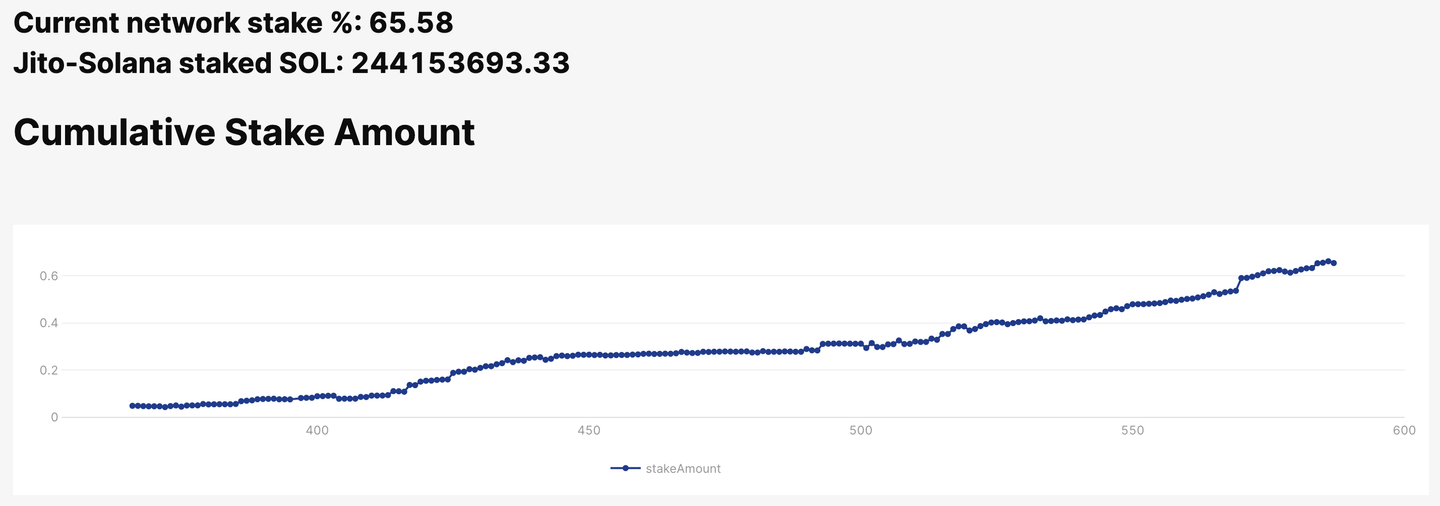

Since its August 2022 launch, Jito-Solana’s adoption has steadily grown, reaching 65% as of this writing.

Additionally, Jito introduced a liquid staking mechanism (JitoSOL) into its MEV solution, extending MEV earnings to users and contributing to DeFi expansion. They aim to operate JitoSOL via StakeNet in a permissionless manner.

4.2.2 Firedancer

Developed by Jump Crypto, Firedancer is a brand-new validator client fully reimplementing Solana Labs’ client in C and C++. It aims to boost performance through software optimization and increase validator client diversity. The demo version shown at Breakpoint 2022 demonstrated handling up to 1.2 million TPS (600k after deduplication).

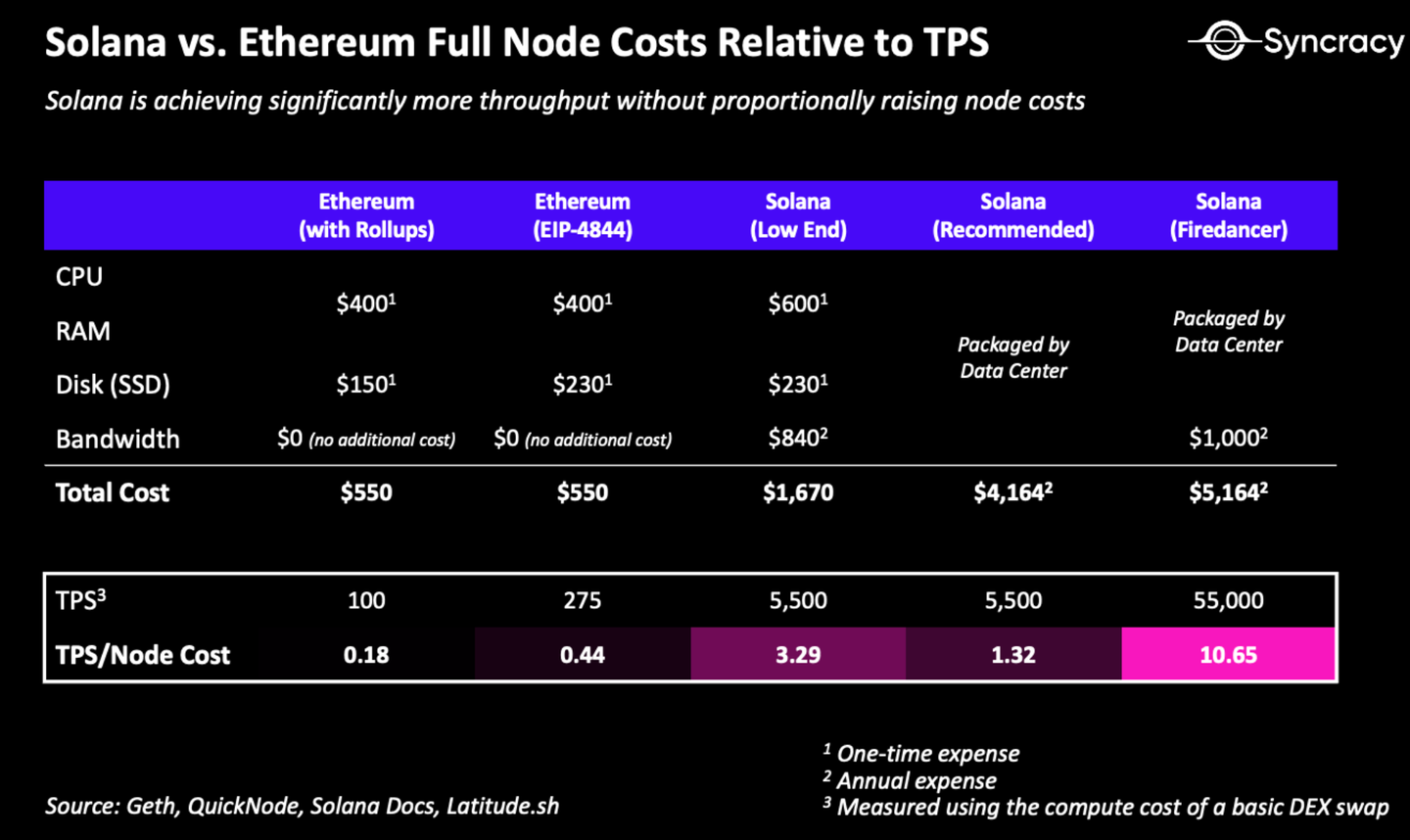

According to Syncracy’s "Solana Thesis: The Fastest Horse Rises from Ashes", using Firedancer might slightly increase node operating costs, but achieves competitiveness with a TPS/node cost ratio of about 55,000.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News