Public Chain Rivalry: Solana Sees Tens of Thousands of Meme Coins Launched Daily, While Other Chains Struggle with "Incompatibility"

TechFlow Selected TechFlow Selected

Public Chain Rivalry: Solana Sees Tens of Thousands of Meme Coins Launched Daily, While Other Chains Struggle with "Incompatibility"

No matter how dismissive value investors may have been toward meme coins before, they can no longer ignore the industry impact brought by meme coins today.

Author: Frank, PANews

Unlike previous market cycles, meme coins have emerged as the hottest theme during the early stages of this bull run. No matter how much value investors may have previously dismissed meme coins, they can no longer ignore the profound impact these assets are having on the industry. For blockchain ecosystem builders, meme coins appear to offer a new growth formula.

Solana Adds Nearly 10,000 New Meme Coins Daily, with ~99.6% Loss Probability Within 24 Hours

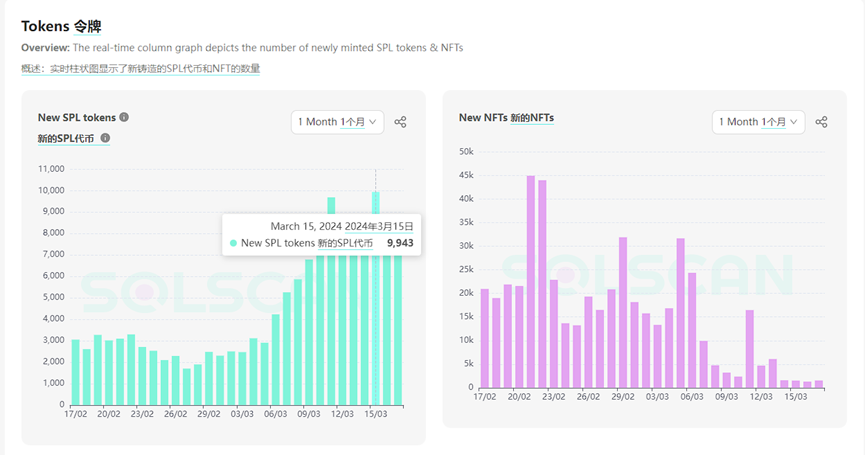

As this wave of speculative investment intensifies, the number of newly launched meme coins on Solana has reached staggering levels. While an average of around 2,500 new tokens per day already made Solana the leader among blockchains, the peak on March 15 saw 9,943 new tokens created in a single day—up 5.8x from 1,699 on February 27.

PANews analyzed newly launched meme coins over the past 24 hours (March 18–19). According to dexscreener data, there were 3,288 meme coins launched and paired on Solana within that period. Only five of them—about 0.15%—had liquidity pools exceeding $100,000 and achieved price gains of over 10x within 24 hours. This threshold typically indicates solid liquidity and the potential for early investors to profit.

When we lower the bar—requiring only that tokens maintain at least $100,000 in liquidity and avoid losses (i.e., gain at least 1%) within 24 hours—the count rises slightly to 15 tokens, or 0.4%.

From this perspective, the probability of losing money after randomly investing in a new Solana meme coin and holding it for 24 hours stands at approximately 99.6%.

It must be said that while stories of overnight riches from memes seem to surface daily, what we’re actually seeing might just be survivor bias.

For example, on March 18, on-chain analyst @ai_9684xtpa reported that the address 2Znc4...pW6Cf lost $1.48 million within 11 hours by chasing and panic-selling various meme tokens. Losses included $236,000 in NOS, $364,000 in SLERF, and $879,000 in NAP. Recent data reveals countless similar cases of massive losses incurred by Solana users speculating on meme coins.

BOME Boosts Solana Active Wallets and Chain Revenue by 160%

Behind the scenes of retail traders getting rich or wiped out, Solana has emerged as the biggest winner from this meme coin frenzy.

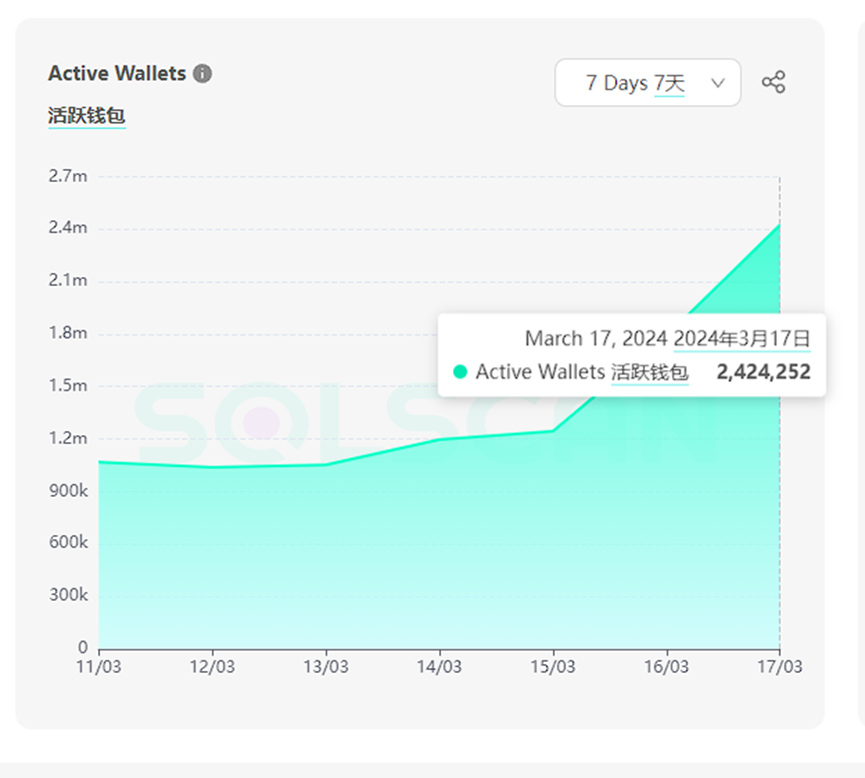

The explosive rise of BOME directly triggered significant changes in Solana’s metrics. Launched on February 14, BOME drove Solana’s active wallet addresses from 1.24 million to 2.42 million between February 15 and 16—an increase of 1.18 million, or 95%. By March 19, Solana ranked first in active address count.

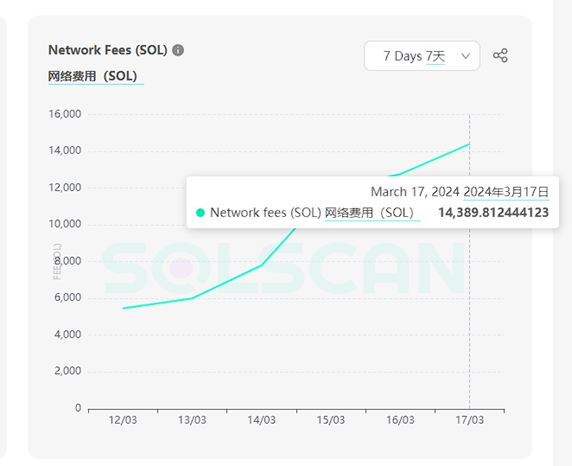

Beyond active wallets, nearly all of Solana’s key on-chain metrics have surged. Network fees climbed from 5,453 SOL on March 12 to 14,389 SOL on March 17—a 163% increase. At a SOL price of $200, Solana earned $2.87 million in fees on March 17 alone.

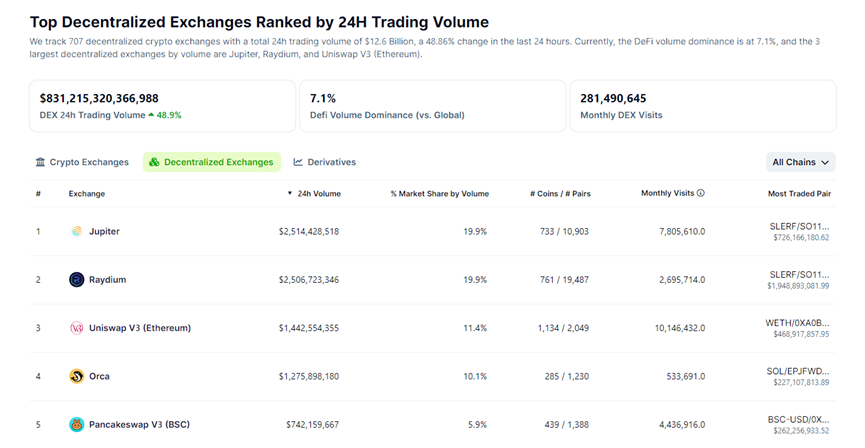

The meme coin surge has also propelled Solana-based DEXs to dominate the decentralized exchange market. On March 19, CoinGecko data showed that three of the top five DEXs by volume were built on Solana: Jupiter (19.9%), Raydium (19.9%), and Orca (10.1%). Together, they captured about 49.9% of the DEX market share—nearly half.

Take Raydium as an example: its hourly trading volume increased from around $150 million before March 15 to $2.5 billion by March 19—a more than 15-fold jump.

However, BOME’s massive impact on Solana is not unprecedented. On December 14, 2023, Solana’s earliest meme coin, BONK, surged 84%, causing active addresses to jump from 550,000 to 1.08 million the next day—almost doubling overnight.

Multiple Blockchains Attempt to Replicate the Meme Effect—with Uncertain Results

Following Solana’s success with meme coins, other blockchains have begun recognizing their potential for driving network growth—some even launching official meme tokens themselves.

On December 29, 2023, the Avalanche Foundation announced it would purchase meme coins to advance its Culture Catalyst initiative.

On March 17, Aptos launched its official meme coin, $LME. The next day, Bitcoin L2 chain Ligo announced the launch of a meme coin called SOLIGO on Solana.

But can meme coins truly serve as a golden ticket for every blockchain to boost key metrics in this bull market?

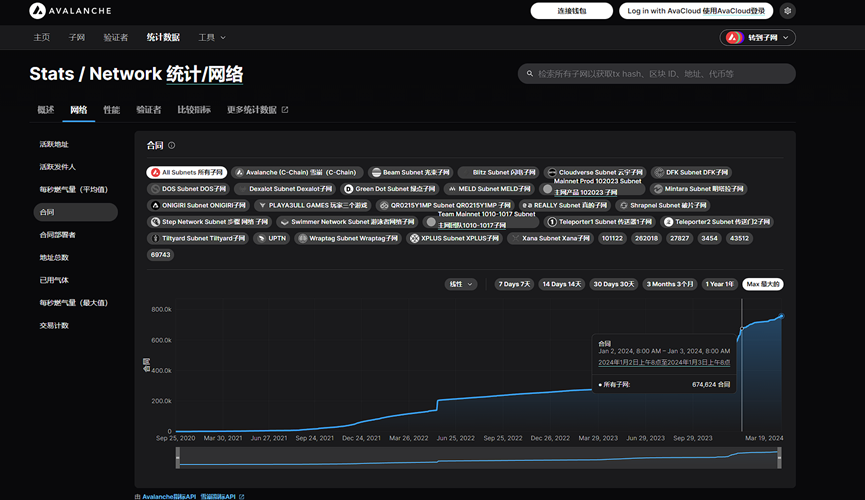

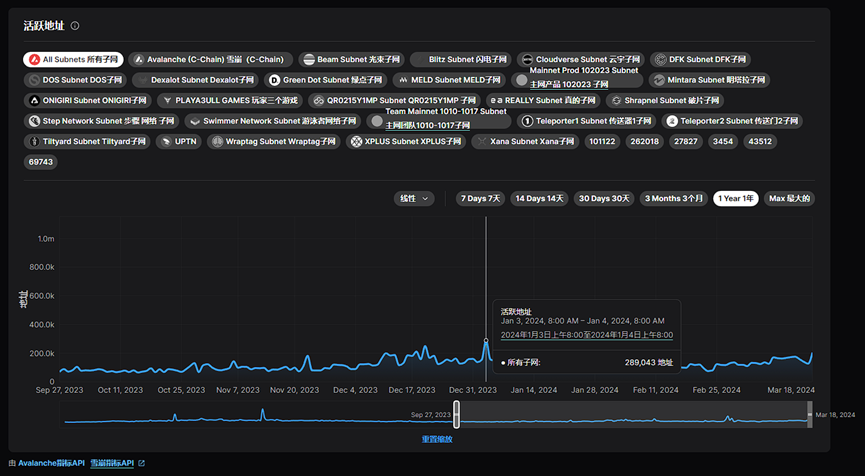

Take Avalanche: after announcing its plan on December 29 to buy meme coins, the number of contracts on Avalanche rose from 630,000 to 660,000. Meanwhile, active addresses jumped 129% from 126,000 on December 29 to 289,000 on January 3.

However, activity on Avalanche did not sustain momentum after the announcement. In fact, shortly after the foundation revealed its holdings in five specific meme coins, active addresses declined for three consecutive days. Moreover, none of those five meme coins experienced significant price increases due to the foundation's backing.

Aptos’ $LME has performed poorly as well. After a brief spike, the token began a steady decline. By March 19, its price had fallen to $0.00001318—down 93.6% from its high of $0.0002075—with no noticeable increase in daily active addresses.

Apparently, the meme coin seed doesn’t sprout on every blockchain’s soil. That may be the real question each ecosystem needs to confront.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News