A step-by-step guide to monitoring VC movements with multiple tools and discovering worthwhile airdrops

TechFlow Selected TechFlow Selected

A step-by-step guide to monitoring VC movements with multiple tools and discovering worthwhile airdrops

Blindly copying VC deals without developing your own investment thesis is not a good idea.

Written by: THE DEFI INVESTOR

Translated by: TechFlow

Many crypto venture capitalists (VCs) made insane amounts of money during the 2021 bull market.

Beyond that, most projects that performed well in the last bull run had strong backers. This is why I believe it's important to pay attention to what VCs are buying.

Of course, blindly copying VC trades without forming your own investment thesis isn't a good idea.

However, tracking their capital movements can help uncover new trends and identify promising tokens with high potential.

Below are several ways to monitor crypto VC activity and how to leverage this information effectively.

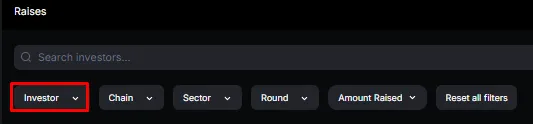

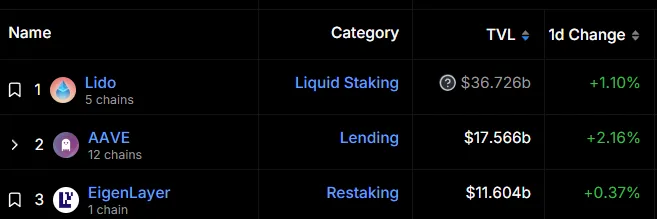

Use DeFillama

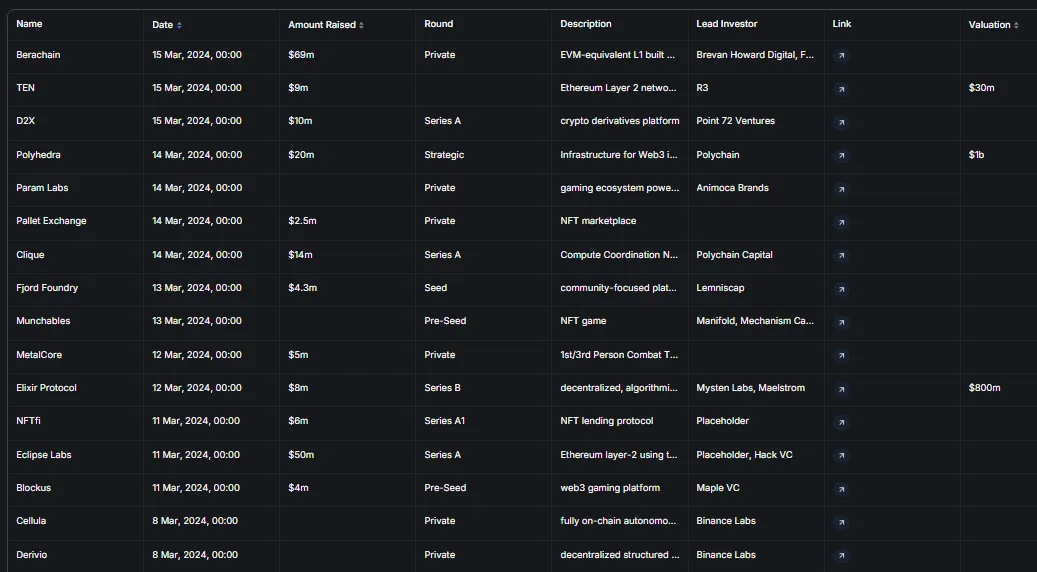

DeFillama has a dashboard displaying the latest crypto funding rounds.

You can easily access it by:

-

Going to DeFillama’s homepage

→ Clicking “Raises” (located on the left side of the page)

→ Clicking “Overview”

DeFillama’s crypto fundraising page

After completing these steps, you’ll be able to sort hundreds of projects by amount raised, investors, chains, industries, and more.

I typically look for projects that:

-

Raised significant funds (e.g., over $20 million)

-

Are building something entirely new (an example is Eclipse, the first Ethereum L2 leveraging Solana’s virtual machine for higher performance)

Many people assume it’s not worth investing in projects that raised large sums from VCs and already have high token valuations at launch.

However, Celestia’s $TIA is an example showing this isn’t always true.

Celestia’s token, $TIA, launched with a $2 billion fully diluted valuation, and its team raised $50 million from VCs. Yet $TIA grew 8x within just a few months last year.

Clearly, this doesn’t mean every project backed by strong VCs will perform well—but it often makes sense to keep an eye on those raising substantial capital.

Use Spot On Chain

Spot On Chain is a blockchain analytics platform that simplifies on-chain data interpretation.

Its database tags hundreds of influential individuals, investment funds, and CEXs.

You can use it to monitor VC on-chain activity through two key features:

1. Tags

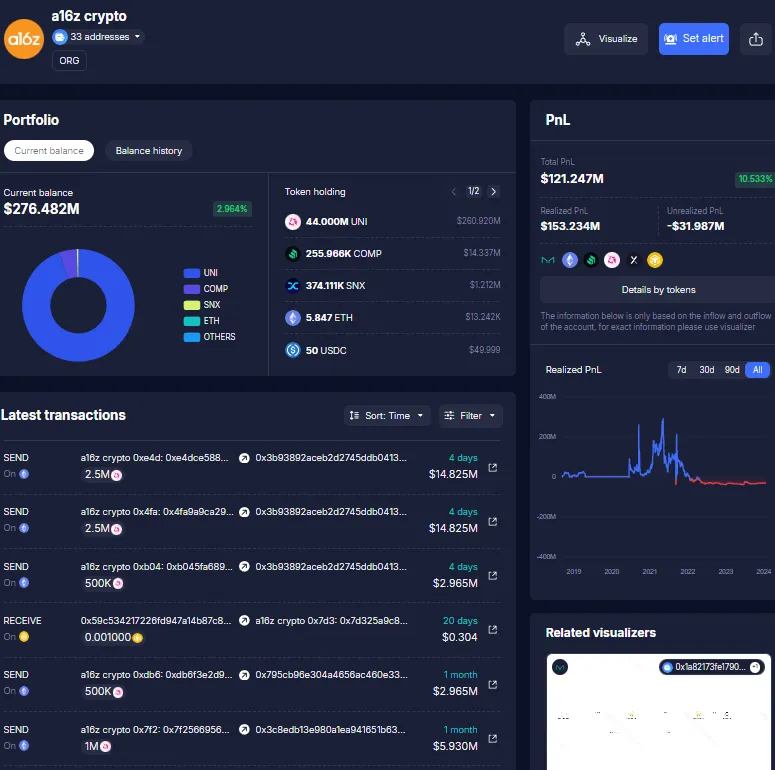

For example, if you want to track the on-chain activity of renowned crypto fund a16z, simply search “a16z” in Spot On Chain’s search bar.

After doing so, SpotOnChain will display the latest on-chain transactions, break-even details for tokens, and the tokens held in a16z’s public wallet addresses.

SpotOnChain tracks the most popular crypto VCs. Therefore, you can monitor the on-chain activities of nearly all major crypto funds this way.

2. Signals

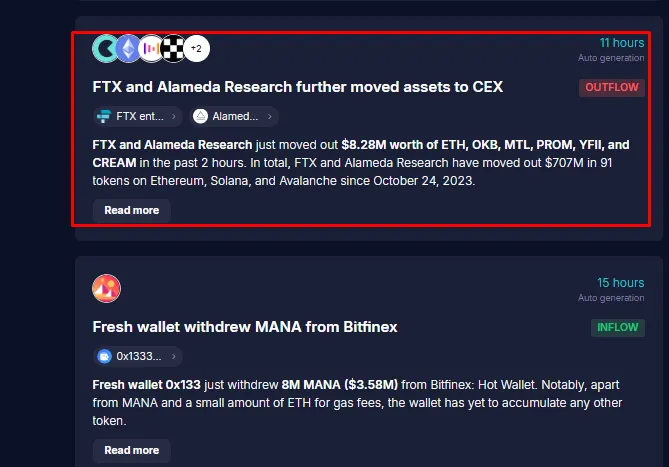

On this platform, you can find a feed of simplified on-chain signals highlighting the most interesting events currently happening on-chain.

Sometimes, you can also find detailed transaction information here about VCs or other prominent crypto entities moving large amounts of funds.

You can leverage this data in multiple ways.

For instance, in most cases, when whales transfer large token supplies to CEXs, it indicates their intention to sell—making it a bearish signal.

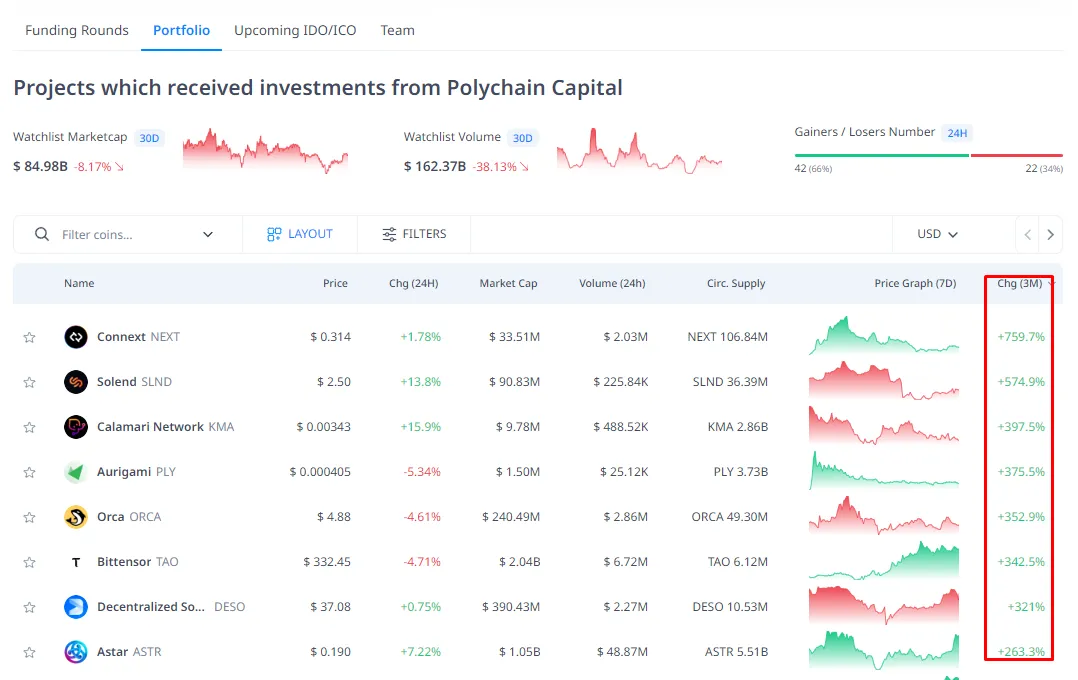

Use CryptoRank

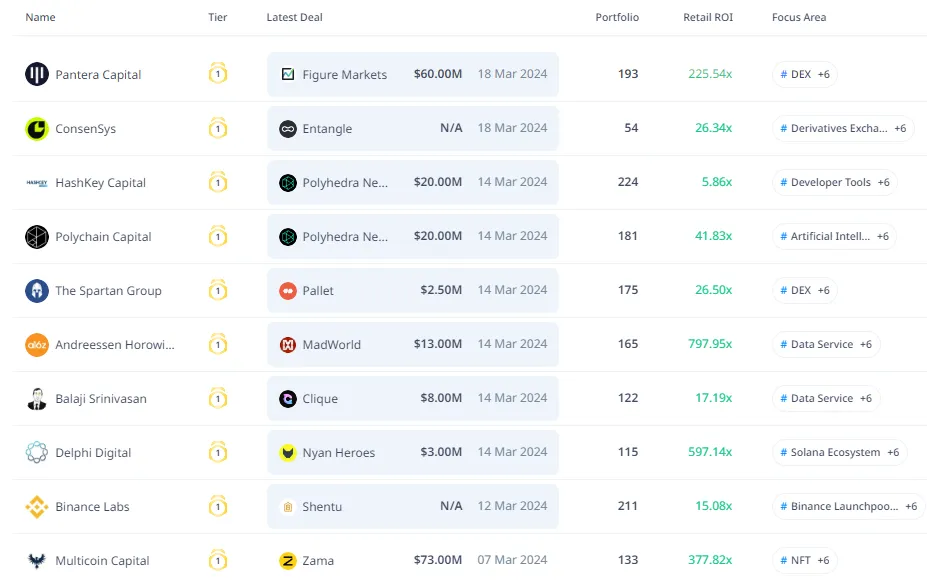

The final tool I’d like to introduce is CryptoRank, which offers valuable insights into VC activity.

To find them, follow these steps:

-

Go to CryptoRank

-

Click “Fundraising” → Funds

-

Select a crypto fund

After completing these steps, you’ll be able to see all projects in the fund’s portfolio, its primary investment categories, and historical performance of the tokens it has invested in.

On the fund’s page, you’ll see a metric labeled “Retail ROI” for each VC. This is extremely useful for identifying highly profitable VCs.

The higher the Retail ROI, the better, as this metric essentially shows how successful most projects in the VC’s portfolio have been.

Based on Retail ROI and other data shown on CryptoRank, you can compile a list of the most profitable VCs.

Once done, you can sort the latest crypto fundraisings on DeFillama Raises by these investors to only view projects backed by top-tier VCs.

How to Profit from All This VC Data

Now that I’ve covered how to monitor VC activity, let’s discuss how to actually use this data to make money.

Most (but not all) projects raising funds from VCs don’t yet have tokens.

While this means you often can’t directly bet on their success by buying tokens, there are still two things you can do:

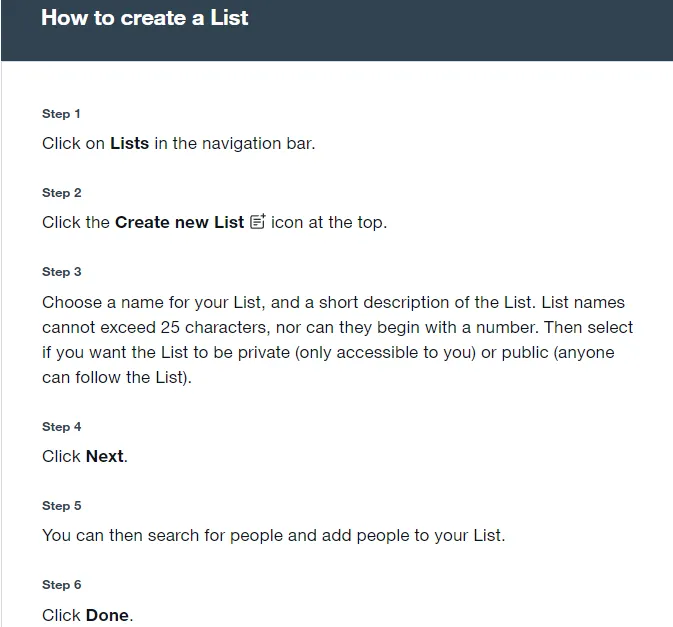

1. Create an X (Twitter) list and add the official X accounts of the most interesting projects that raised from VCs

This can be helpful if you plan to buy their tokens at launch and want to ensure you don’t miss any token release announcements.

Rather than following each project’s X account individually, monitoring a single X list is much easier, keeping you updated on their progress.

Historically, newly launched tokens have performed exceptionally well during bull markets.

That’s why I believe it’s smart to focus on new or upcoming protocols that recently raised from VCs.

2. Farm their airdrops (when possible and the project has an active product)

If a project raised a large sum (e.g., over $20 million) and has an interesting product, its airdrop may be worth farming.

Generally, the more a project raises from VCs, the higher its future token valuation will likely be—meaning it’s more likely to distribute a sizable airdrop.

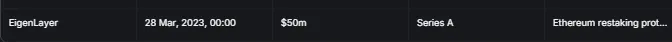

Eigenlayer Case Study

Over the past few months, the Ethereum restaking protocol Eigenlayer has grown at an astonishing pace. It’s now the third-largest DeFi application by TVL.

Last March, its team announced they raised $50 million.

This was even before Eigenlayer launched on mainnet. Considering crypto was still in a bear market then, $50 million was quite substantial.

I had heard of Eigenlayer before the team announced this news, but learning about its funding round prompted me to research it more deeply.

After understanding Eigenlayer’s large funding round and innovative product, I closely monitored it and immediately started farming its airdrop right after its official launch.

This gave me an edge over others who discovered Eigenlayer and its points program just two or three months ago.

Thus, this is a practical example of how you can use crypto fundraising data to gain an advantage in airdrop farming.

In short, my strategy is:

-

Monitor the latest crypto fundraisings (easiest via DeFillama)

-

Research protocols that raised significant funds

-

Add the most interesting ones to your watchlist to track progress and farm airdrops when possible

Using this strategy, you can discover many high-potential airdrop opportunities earlier than most other airdrop farmers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News