Folius Ventures: Web3 China Development Report (Consumer Applications Special Edition)

TechFlow Selected TechFlow Selected

Folius Ventures: Web3 China Development Report (Consumer Applications Special Edition)

Web3 is currently on the eve of entering an application-driven growth phase, with the turning point expected within the next 12–18 months.

Authors: Chris Lu, Kenny Dong, Jason Kam, Folius Ventures

Executive Summary

Over the past 30 years, China's internet industry has nurtured countless tech giants and super apps, amassing a vast pool of engineers, tech entrepreneurs, and talent skilled in consumer-facing (2C) applications. This forms the foundational base and defining character of Chinese internet entrepreneurs. We estimate that approximately 2–3 million Chinese Web2 professionals today already possess the awareness and potential to launch ventures in Web3, and will enter the Web3 entrepreneurial arena within the next three years. This implies at least 200–300 potential top-tier projects with Chinese heritage could emerge in the market over the next three years—at a pace of one to two per week.

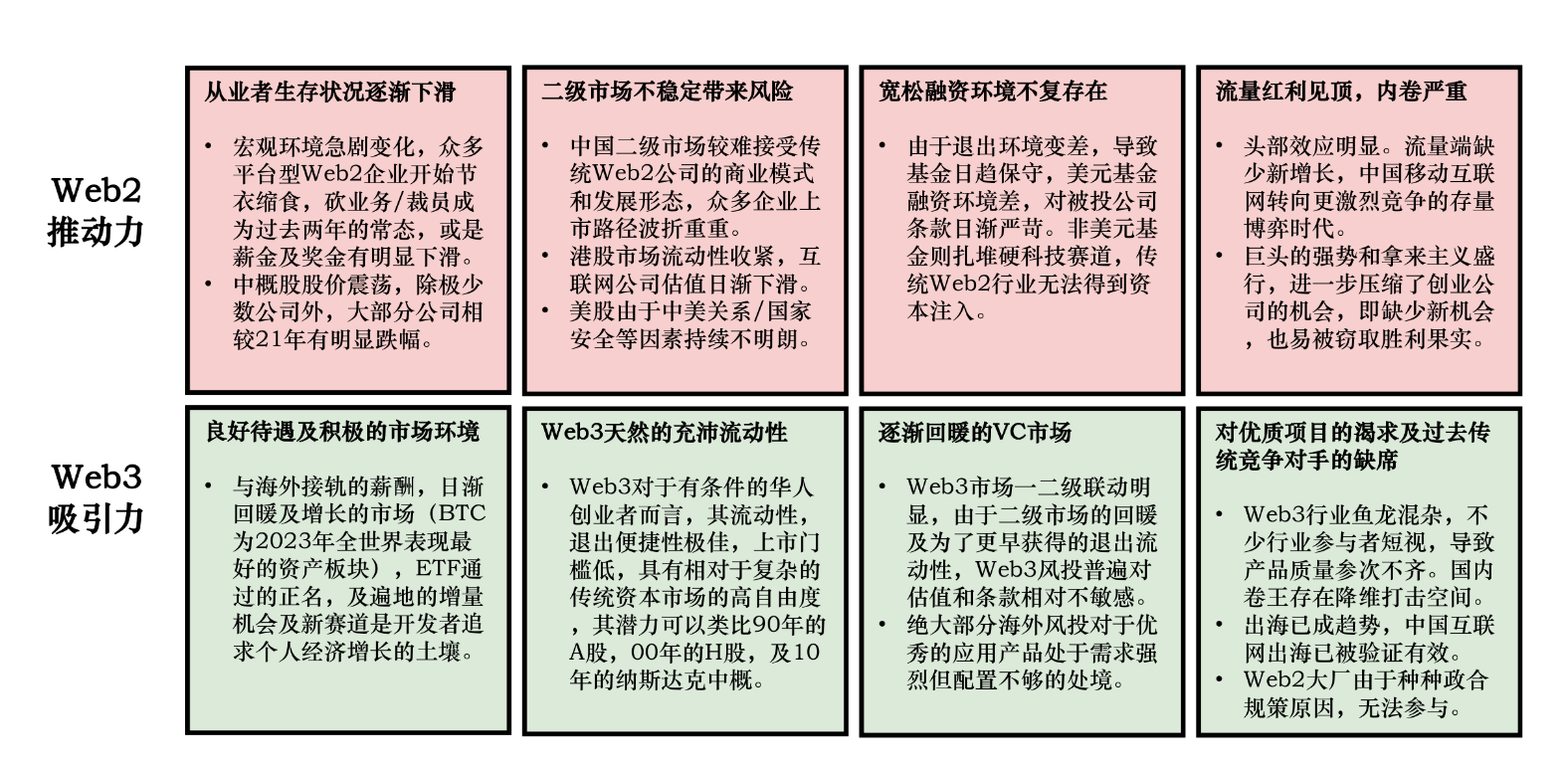

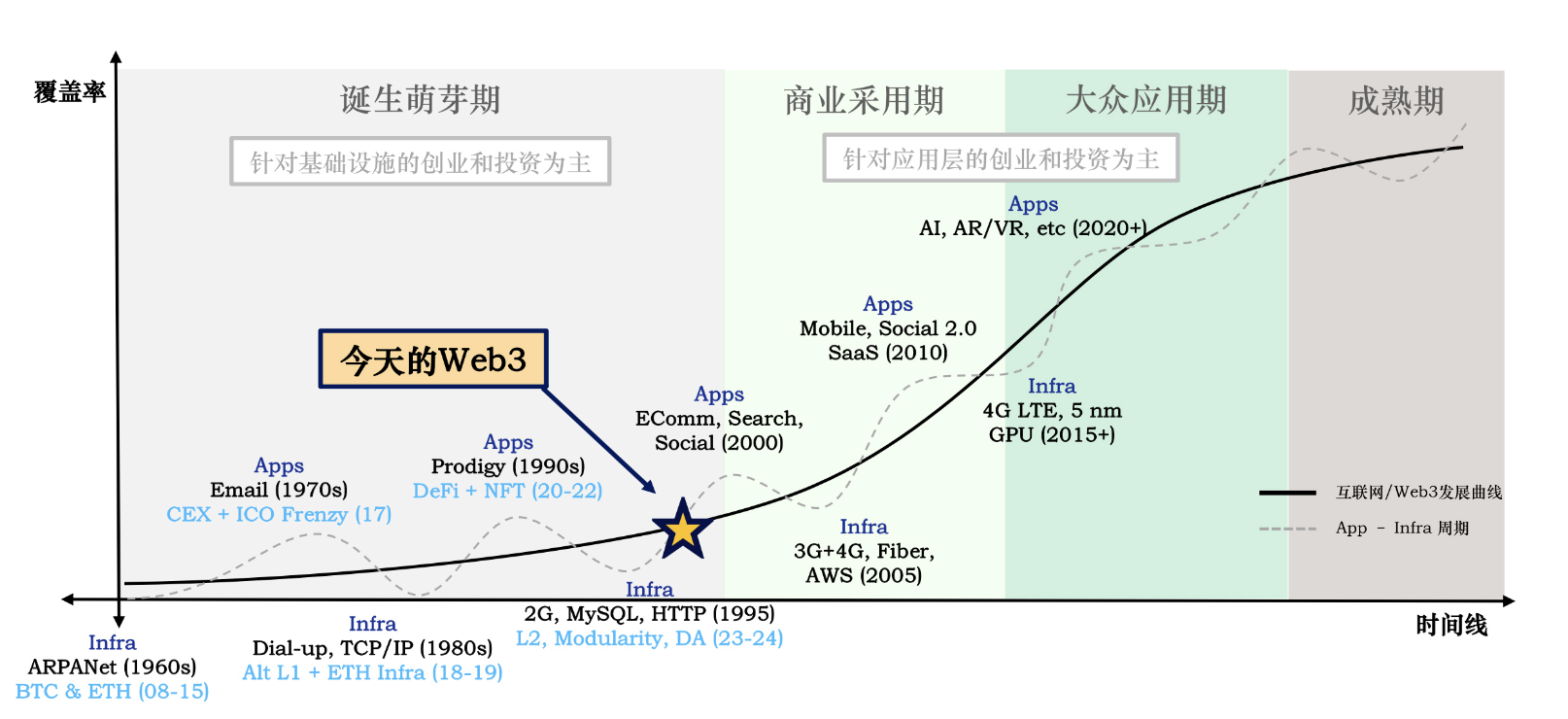

In recent years, China’s internet sector has seen slowing growth, saturation of traffic红利, and shrinking financing and exit opportunities in Web2—creating a confluence of macro-level headwinds. In contrast, the Web3 industry stands out as an emerging blue ocean with positive sentiment, abundant liquidity, and vast upside potential. As such, we anticipate a growing migration of Chinese-speaking Web2 talent into Web3. For those Chinese internet professionals who are competitive, innovative, execution-driven, and well-positioned, Web3 represents their generational next frontier—akin to A-shares in the 1990s, H-shares in the 2000s, or Nasdaq in the 2010s—and will run parallel to AI in catalyzing a new wave of Chinese internet entrepreneurship and innovation. At the same time, we believe that years of accumulated infrastructure development in Web3 have now laid fertile ground capable of supporting super applications, enabling the industry's pendulum to swing from “strong infrastructure, weak applications” toward “strong applications, weak infrastructure.” History shows that technology follows an application-to-infrastructure evolution: applications emerge first and drive infrastructural upgrades, which in turn enable new application paradigms. Signs such as dramatically lower on-chain interaction costs, widespread adoption of customizable solutions, reduced friction in fiat onboarding, improved data and middleware layers, and evolving financial mechanics all indicate that Web3 is on the cusp of an application-driven boom, with the turning point arriving within the next 12–18 months.

Chinese internet entrepreneurs should leverage their Web2 expertise to build differentiated advantages, focusing on use cases that migrate Web2 experiences into Web3 and expanding the overall market size. Chinese Web2 practitioners have achieved remarkable success in C-end domains like social, entertainment, and e-commerce, accumulating deep knowledge in user psychology, product design, and operations. However, Web2 experience is a double-edged sword in Web3: these strengths can also become constraints. The smaller user bases, divergent product strategies, financialization, and cultural differences in Web3 present fresh challenges for Chinese founders. Yet, we believe core Web2 methodologies remain highly transferable. In projects already backed by Folius (StepN, Matr1x, SleeplessAI, Memeland, Metacene, Myshell, etc.), we’ve observed strong evidence of this group’s potential. We encourage Chinese teams to leverage their Web2 strengths—particularly in user growth, community building, business model innovation, product, and operations—to differentiate themselves from global peers, with a focus on bridging Web2 to Web3. They should also prioritize cross-cultural collaboration and broaden their international perspective to better adapt to Web3’s global nature.

I. Three Key Drivers Behind the Surge of Chinese Entrepreneurs This Cycle

Massive engineering talent surplus focused on consumers, powerful internal and external catalysts, and an inflection point in Web3 infrastructure. Their strengths and weaknesses are equally pronounced.

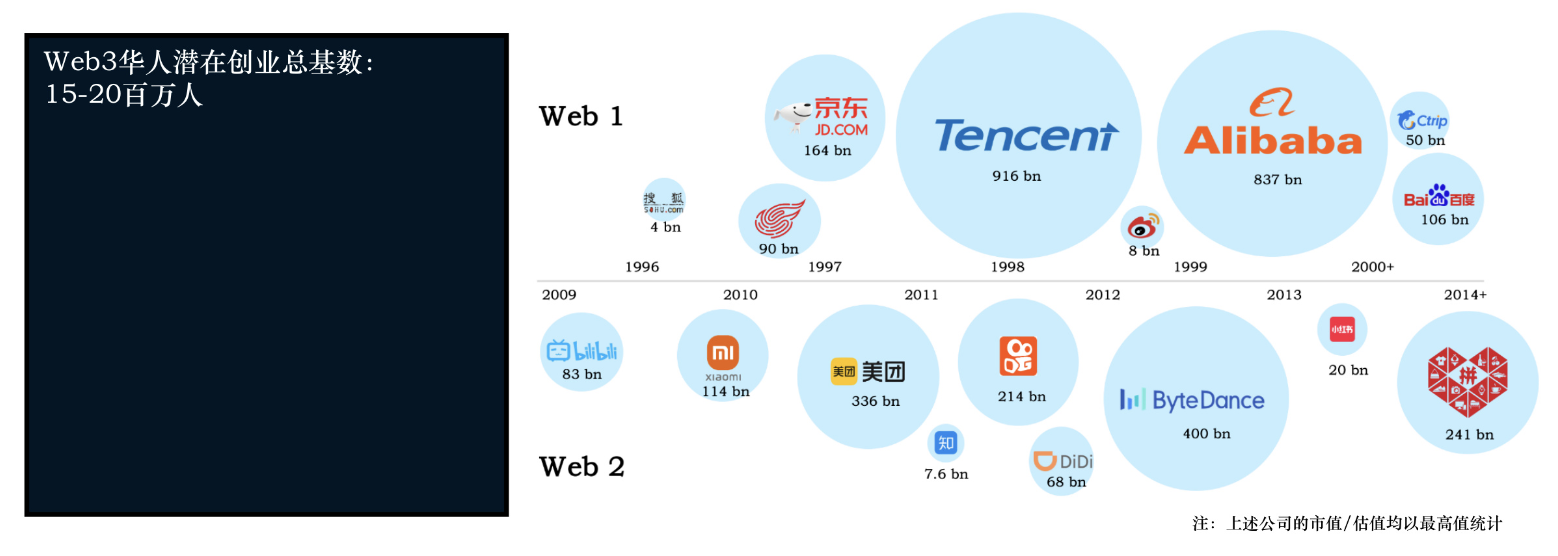

The consumer internet engineer dividend since 2000 has laid a foundation of roughly 15–20 million potential Chinese Web3 entrepreneurs.

Total Potential Chinese Web3 Entrepreneur Base: 15–20 Million

-

China’s internet industry has grown from nothing to amass 15–20 million professionals in just 30 years, with a significant portion of consumer- and application-focused talent cultivated during the mobile internet boom post-2008. This scale defines the baseline for Chinese entrepreneurs in Web3.

-

As the world’s largest single-user market, China’s golden decade of mobile internet gave rise to globally leading innovations across social media (e.g., WeChat), mobile payments (e.g., WeChat Pay, Alipay), entertainment platforms (e.g., Bigo, Huya, Douyu), content-sharing platforms (e.g., Xiaohongshu, Douyin), and e-commerce (e.g., Alibaba, Pinduoduo, Meituan). These sectors developed uniquely distinct models and product forms compared to overseas markets, with distinctive interaction patterns and gameplay. The teams behind leading products emerged victorious through intense competition, gaining proven methodologies in user insight, product design, operational strategy, traffic acquisition, viral growth, and monetization. This cohort of internet talent is among the most competitive ("neijuan") in the world. We’re observing increasing numbers of internet professionals entering the crypto space, and expect this trend to accelerate.

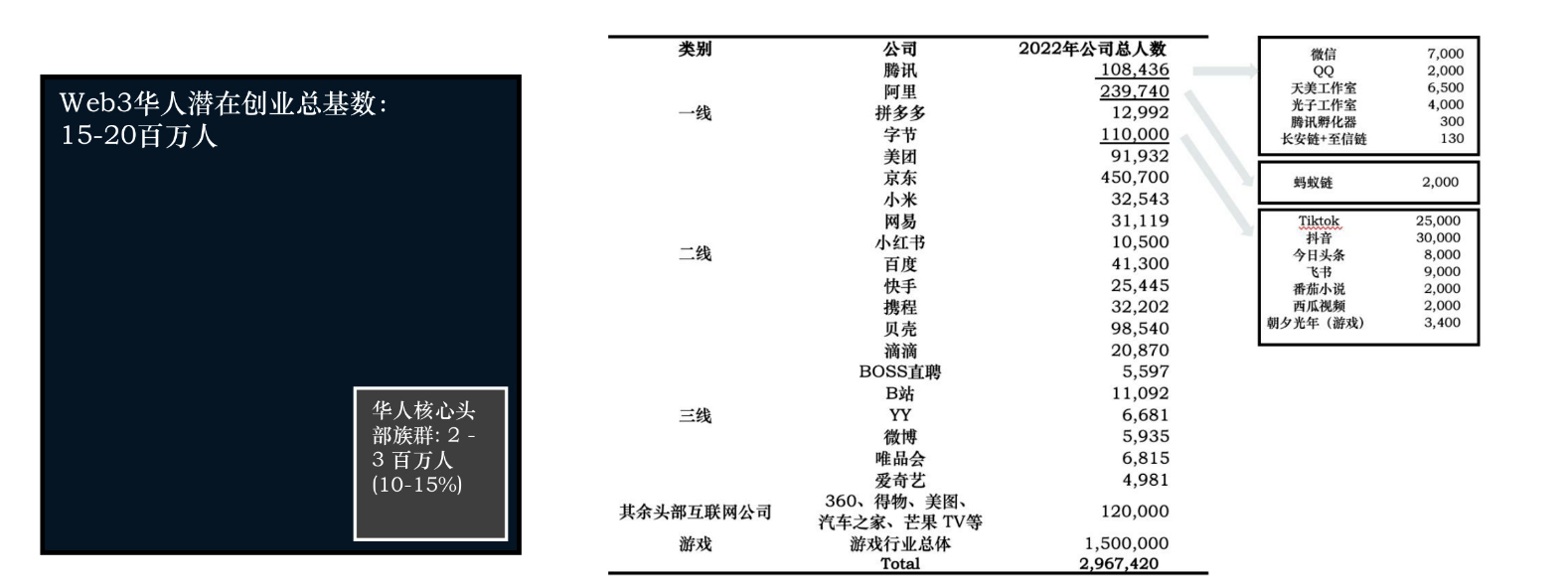

Within this base, we believe 2–3 million represent the core high-potential cohort, possessing initial entrepreneurial capabilities and the ability to secure funding.

Core High-Potential Chinese Cohort: 2–3 Million (10–15%)

-

Numerous well-known Chinese Web2 tech giants are not only cradles of technological innovation but also critical sources of Web3 talent. Our preliminary assessment of top-tier Chinese tech firms suggests—even under conservative estimates—that tens of thousands of highly qualified, experienced, and creatively capable product and engineering elites already exist. These individuals include not only grassroots developers but also senior executives from the industry’s upper echelons, with ranks equivalent to or exceeding ByteDance Level 3–2 or Alibaba P9. When they dive into Web3, the projects they launch demonstrate not only the efficient execution of big-tech teams but also an extreme dedication to product refinement and polish.

-

Beyond top internet giants, China’s game development talent deserves special attention: with 1.5 million professionals in the gaming industry—70% being R&D personnel—China has demonstrated elite development and commercial innovation since the era of Shanda and Giant. Especially during the mobile gaming revolution, they pioneered new production pipelines, enabling rapid product iteration, continuous market testing with real-time adjustments, deep incorporation of user feedback, and multi-product matrix experimentation. This has forged a generation of exceptionally execution-oriented developers who are naturally well-suited for Crypto development.

-

Therefore, among the 15–20 million total professionals in the industry, we estimate about 15%, or 2–3 million, already possess the vision, skills, and background to launch ventures and successfully raise funding and attention. This group represents the most critical cohort Web3 needs to attract.

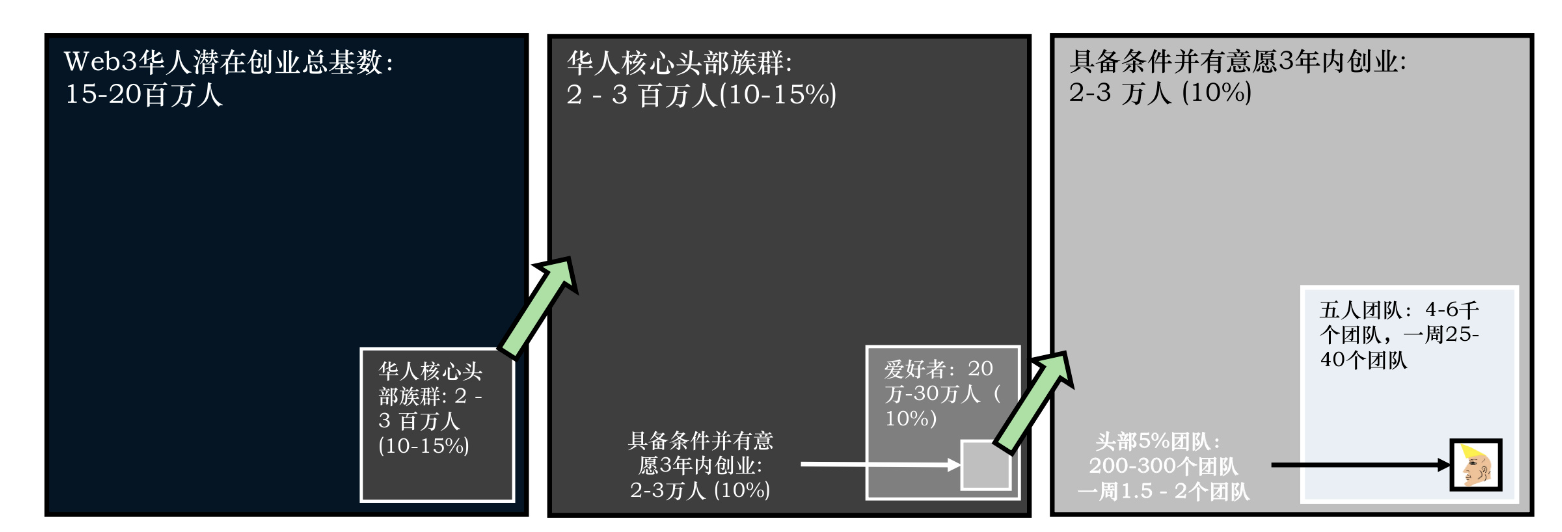

Based on this, we estimate the current Web2 → Web3 conversion rate is around 1% over three years. Over the next three years, Chinese Web2 professionals will contribute 200–300 top-tier teams to Web3—emerging at an average rate of 1.5–2 quality teams per week.

Web3 Enthusiasts: 200,000–300,000 (10%)

-

Among the core cohort, we estimate roughly 1 in 10 individuals holds little bias against Web3, is highly curious, develops a learning interest, and eventually gains deeper industry understanding and engages in on-chain interactions (beyond pure speculation). This ratio may shift with market cycles.

With conditions and intent to launch a venture within 3 years: 20,000–30,000 (10%)

-

Among enthusiasts, we believe fewer than 1 in 10 possess the personal drive, financial readiness, industry experience, and family support required to make a bold leap into Web3 entrepreneurship amid an unfavorable macro environment. In other words, we estimate the conversion rate from core Web2 professionals to Web3 founders is about 1%.

Assuming 5-member founding teams: 4,000–6,000 teams will emerge over three years. Top 5%: 200–300 teams (~65–100 annually, ~1.5–2 weekly)

-

Given the industry’s relative lack of standardization and uneven team quality, we believe only teams combining multidimensional capabilities, long-term vision, sound business models and insights, cross-cultural communication skills, and solid understanding of Web3 finance will have a real shot at becoming leaders. Such teams may appear once in every 20.

Therefore, we project that over the next three years, Chinese Web2 talent will feed 200–300 leading teams into Web3—at an average pace of 1.5–2 teams per week. We look forward to engaging deeply with them at the earliest stages.

Since 2020, a new world order marked by U.S.-China rivalry has taken shape. Against this backdrop, traditional Web2 industries contrast sharply with the rapidly rising Web3 movement, making the latter the ideal incubator for top-tier Web2 talent—especially from China.

The Web2-to-Web3 singularity is emerging. Gradually maturing crypto infrastructure is creating fertile ground for super applications. The pendulum of Web3 development is poised to swing toward "strong applications."

Looking back at tech history, the App–Infra cycle swings like a pendulum: Apps always precede infra and push it to evolve; infra improvements then enable new app paradigms. Email came before TCP/IP, which enabled early portals; portals drove the creation of browsers (Mosaic) and advanced programming languages, fueling Web1.0; high-speed networks (broadband) and cloud providers (AWS), built to meet Web1.0 demands, made complex social apps and streaming possible—ushering in Web2.0. And the need for faster, more scalable systems pushed semiconductor and infinite tech to evolve further, enabling AI, AR, and VR applications.

We believe Web3 follows the same pattern. After multiple cycles of technical iteration, the crypto industry’s pendulum is about to swing decisively toward “strong applications.”

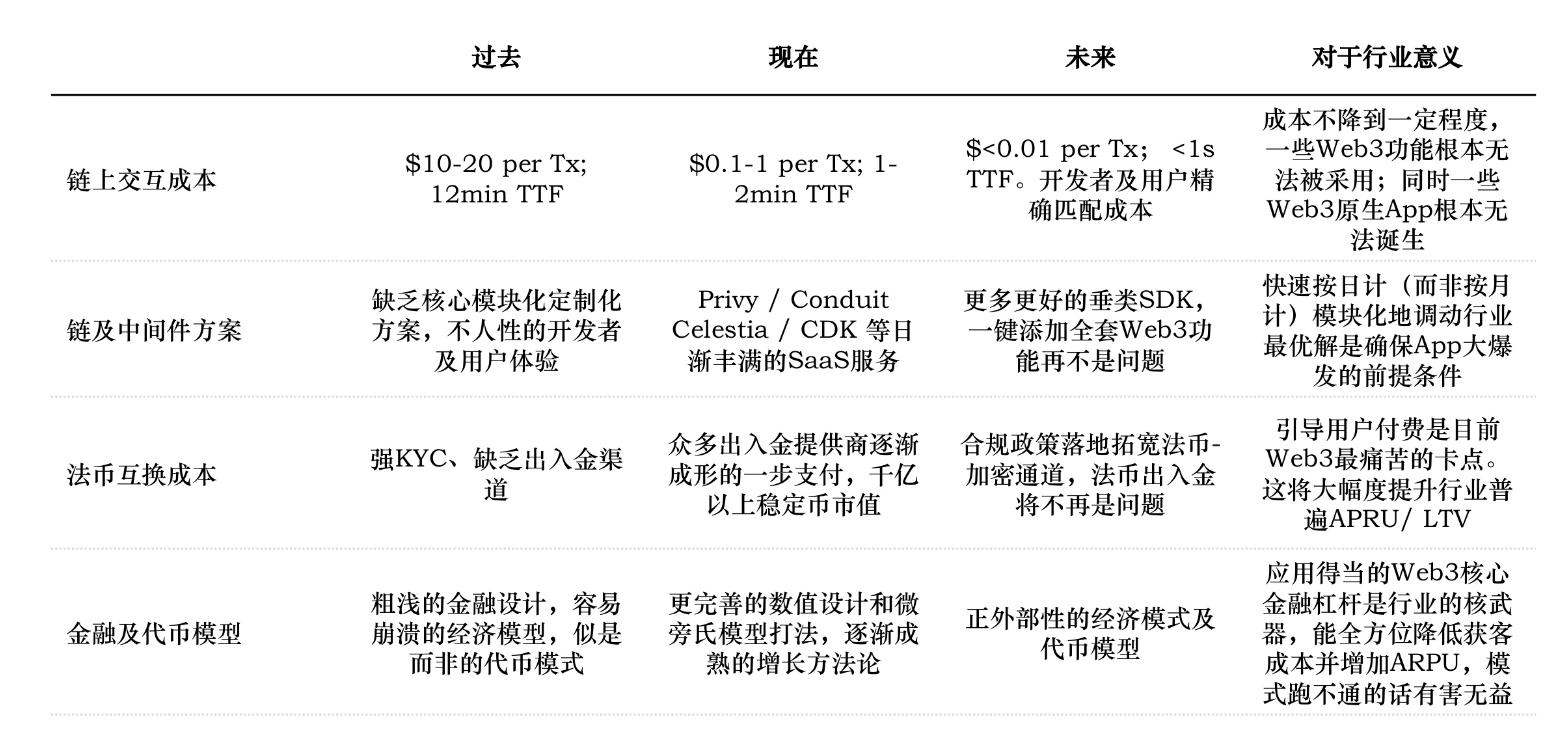

Over previous cycles, Web3 has developed the infra components capable of supporting breakout consumer apps. We are transitioning from accumulation to harvest, and expect the tipping point (LTV >= CAC) for application explosion to arrive within 12–18 months.

The industry has matured infra components capable of supporting hit-level consumer apps—we are shifting from accumulation to harvest. Key drivers include: 1) drastically lower on-chain interaction costs, making user conversion feasible; 2) democratized development and customization tools, allowing rapid prototyping; 3) reduced friction in fiat onboarding, greatly improving payment willingness; 4) refined financial and token models that boost ARPU, improve retention, and lower CAC. These factors strongly enhance dApp unit economics (LTV/CAC), creating a positive flywheel. We expect the application explosion inflection point (LTV >= CAC) to arrive within 12–18 months.

Seven Strengths and Seven Weaknesses of Chinese Entrepreneurs

Yet we remain optimistic, seeing many strengths among Chinese entrepreneurs that can continue to shine in Web3:

-

Mastery of human behavior and aligned mechanism design: Chinese tech giants excel at cultivating exceptional product managers with acute sensitivity to human nature and aesthetics. They've pioneered mobile-era interaction patterns and engagement strategies distinct from Western counterparts, and are masters of viral growth—exemplified by WeChat’s social dynamics and Pinduoduo’s shopping innovations. These battle-tested strategies stand out starkly against Web3’s currently simplistic and primitive growth tactics. There’s broad consensus that Web3 urgently needs high-quality consumer products that appeal to mainstream users. Understanding native Web3 user needs and barriers to Web2 migration remains a key challenge.

-

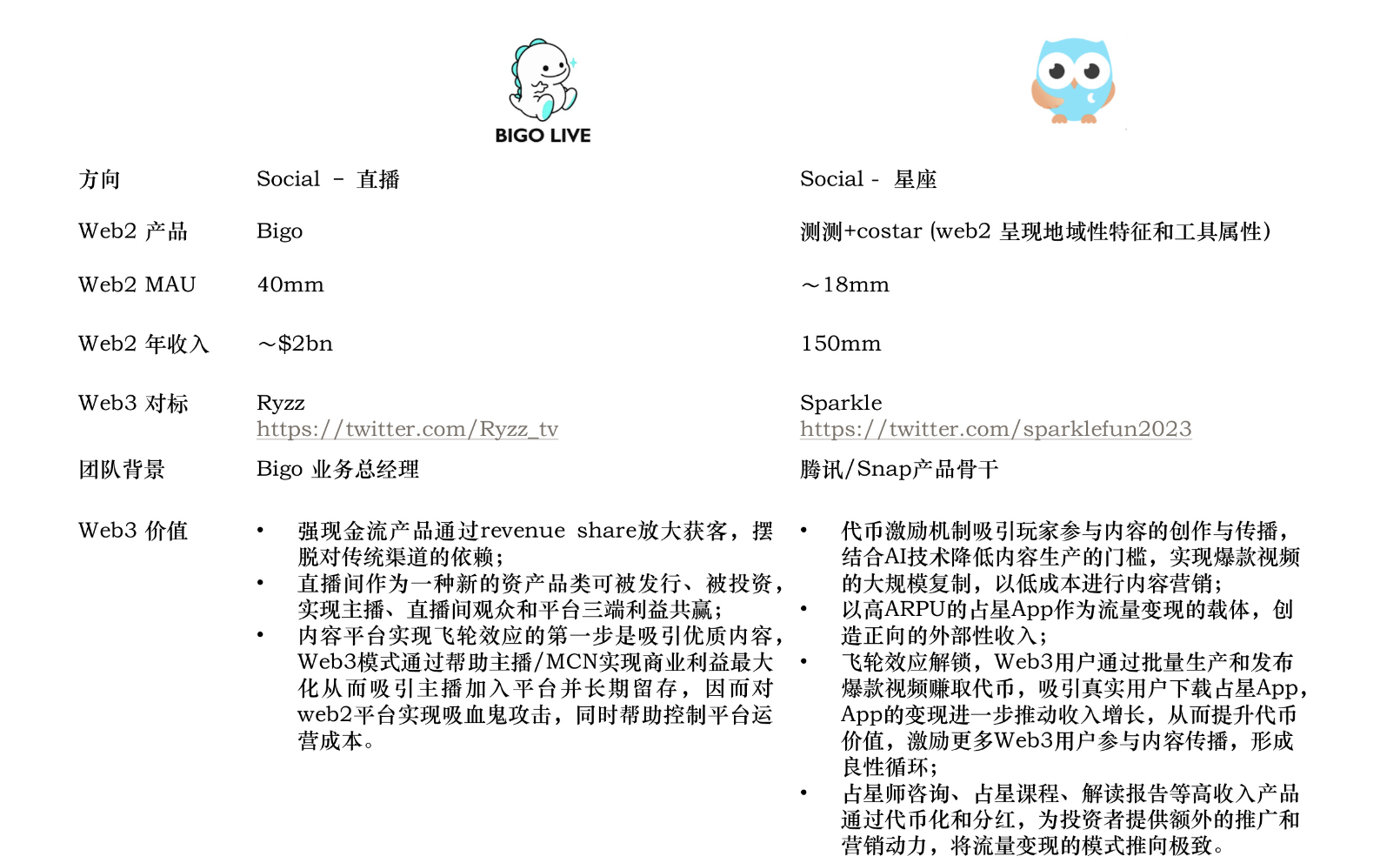

Comprehensive operational capability: Chinese Web2 platforms demonstrate impressive operational prowess and the ability to close commercial loops even in low-ARPU markets. Whether managing complex creator ecosystems, diverse revenue distribution mechanisms, or algorithm-driven content recommendation systems, they showcase deep platform operation expertise. Chinese founders’ achievements in operating crypto exchanges already prove their excellence in building and managing complex platforms. With Web3 content creation still in exploration, Chinese teams should focus on amplifying network effects on both creator and consumer sides by integrating token incentives with existing operational strengths.

-

Core technical strength: Technical prowess is often overlooked, yet Chinese teams have strong R&D foundations in fields like ZK, ML, and AI—technologies poised to revolutionize Web3. Chinese scholars and engineers dominate in many cutting-edge research areas. However, they often serve as backend tech providers rather than front-facing innovators. There’s great opportunity in elevating these “tech gurus” to center stage.

-

Methodology of rapid iteration: Chinese entrepreneurs are known not just for hard work but for smart execution—delivering quickly without relying on brute-force overtime. Combined with China’s dual advantages in supply chain and engineering talent, and by shedding big-corp mentalities, they can leverage their strong execution power to rapidly achieve PMF and iterate fast in the fast-moving Web3 landscape.

-

Vision and ambition of Chinese entrepreneurs: A rare innate advantage. Having grown up in China’s “high-speed system,” where mobile internet grew at miraculous rates, these founders have a natural pursuit of efficiency, exceptional learning agility, and rapid response. They’ve witnessed large-scale, systematic, and highly efficient commercial operations, giving them invaluable high-speed environment experience. This generation is inherently global.

-

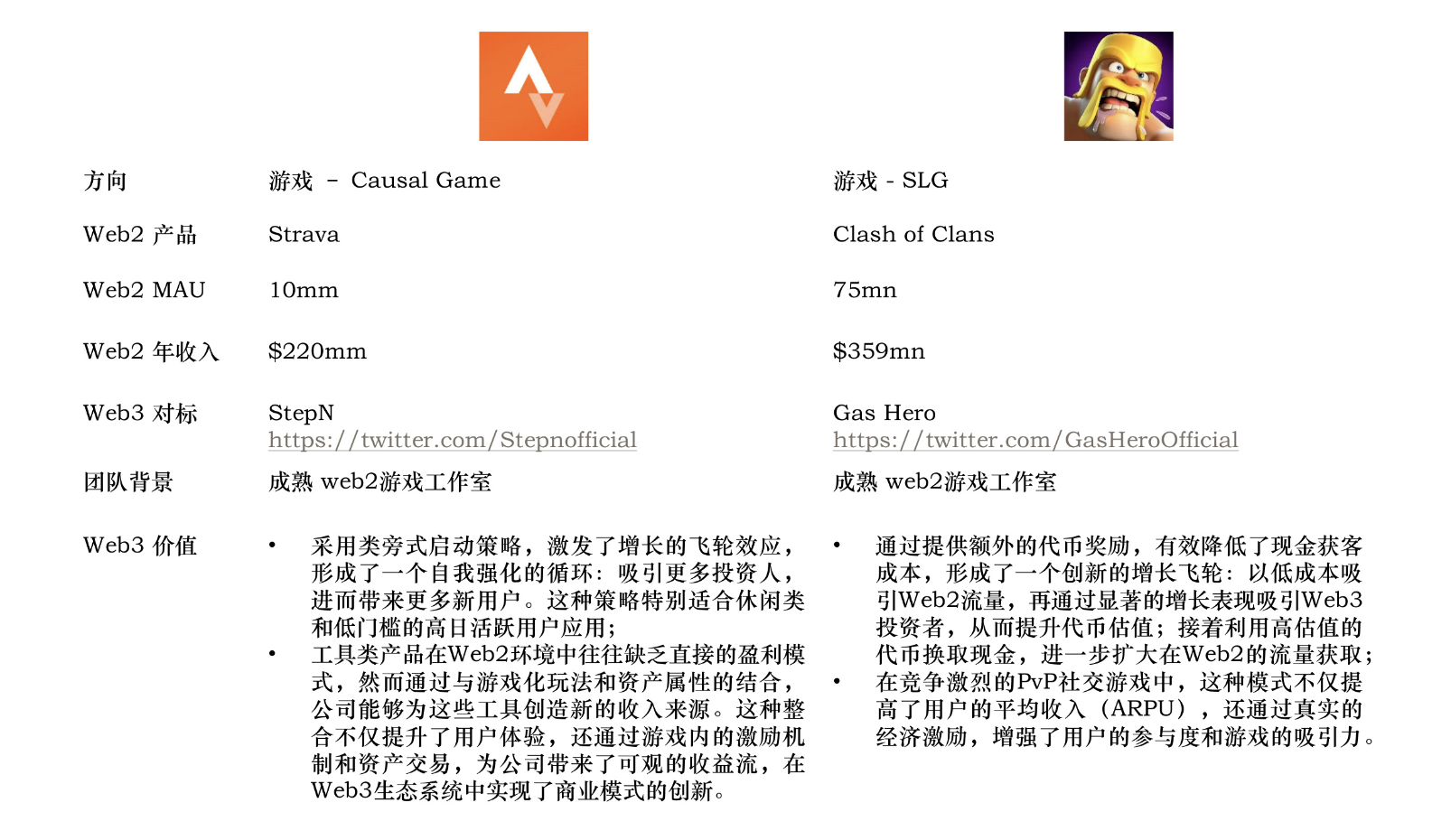

Familiarity with latest consumer application playbooks: “Copy from China” has proven successful over recent years and continues to spawn breakthroughs. The time machine theory has reversed—the playbook now flows outward. By adapting business models, products, and operations validated in China’s market to seek blue oceans overseas, Chinese entrepreneurs are likely to gain a strong edge in copying Web2 successes into Web3, especially in 2C and gaming domains.

-

For Web3 founders who must go global, another advantage lies in the worldwide Chinese diaspora. With a historical spirit of adventure and exploration, and due to sheer population size, Chinese communities are established across the globe—from Singapore to Hong Kong, where many Web3 OGs from the last cycle have gathered. In mining and exchanges, Chinese players often dominate. Leveraging this ethnic network advantage can significantly accelerate global traction.

II. Advantageous Sectors for Chinese Developers

Large DAU base, creator economy, operation-intensive platform economies, and business models already proven in Web2.

We believe the following characteristics define sectors where Chinese entrepreneurs can maximize their potential:

-

Large DAU base with strong social attributes: Can generate powerful network effects by combining token incentives with gamification. Compared to traditional marketing and user acquisition, this model avoids costly partnerships and inefficient spending, and fully unlocks Web3’s potential for decentralized marketing and distribution.

-

Creator Economy: China boasts a massive base of content creators with abundant human resources, and AI breakthroughs have further amplified individual creativity. In this environment, everyone has the potential to become a traffic node or creative node—a “super individual/node.”

-

Operation-intensive platform economic systems: Platform-based economic models that fully leverage Chinese expertise in operations, particularly those that use crypto to introduce new value exchange methods and incentive mechanisms to drive broader participation and collaboration.

-

Business models validated in Web2: Models already proven successful in Web2, especially those with high ARPU, strong cash flow, and high-margin potential. If user behaviors, relationship graphs, and data in these verticals can be assetized, and transaction scenarios enriched with probabilistic elements like blind boxes, commercial potential can be further unleashed.

Moreover, we believe that applying Web3 token playbooks (wealth effect / revenue share) to the above dimensions can greatly amplify this flywheel effect:

-

Lower customer acquisition cost;

-

Higher user ARPU and Retention;

-

Lower operational costs, especially for multi-sided platform systems;

-

More diversified business models unlock additional revenue streams, further strengthened by off-platform liquidity;

However, different directions require different emphases—for example, high-ARPU products can more easily leverage revenue sharing to drive user growth and reduce reliance on traditional channels.

High-DAU Game Genres

Creator Economy and UGC Content Platforms

High-Spending Vertical Social Scenarios

Hardware Supply Chain Advantages and Platform Economies

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News