The Paradigm Shift Brought by Crypto X AI: The Path Toward an Agent-Based Internet

TechFlow Selected TechFlow Selected

The Paradigm Shift Brought by Crypto X AI: The Path Toward an Agent-Based Internet

Integrating blockchain infrastructure with artificial intelligence agents is desirable.

Author: Davide Crapis

Translation: TechFlow

Over the past several months, the theme of "crypto × AI" (the intersection of crypto and artificial intelligence) or "crypto + AI" (cryptocurrency infrastructure enhanced by artificial intelligence) has attracted significant attention. Many in the blockchain community are excited about it, some remain skeptical or unconvinced, while others are actively building it. Real-time projects at the intersection of blockchain and AI have been improving, and many new initiatives are emerging.

Over the past year, I’ve been researching this space, particularly focusing on AI agents running on blockchain infrastructure. Together with colleagues from institutions such as the Ethereum Foundation, Flashbots, and DeepMind, we’ve formed a research group. We continue to push the boundaries of applied research to understand and test which types of AI agent applications are best suited for blockchains, and what new infrastructure is needed to support them.

In this article, I will argue that integrating blockchain infrastructure with AI agents is both desirable and transformative, leading to an "internet of agents"—an upgrade to today’s interconnected paradigm, strengthened by incentives and modern cryptography, enabling us to benefit from economies driven by AI agents with unprecedented security, efficiency, and collaborative potential.

I will then discuss the path toward achieving this vision. I’ll focus on short-term use cases and applications, some of which are already in design and development. I’ll examine their limitations and potential improvements, as well as the research required in both AI and blockchain to unlock new use cases in the medium term.

Blockchain as the Backend for an Internet of Agents

Let me first clarify that the tone of this argument will be speculative yet practical. Blockchain and artificial intelligence are two of the fastest-advancing technologies of the past decade, each profoundly shaping the structure of the internet and human society. Therefore, envisioning how these technologies might evolve and interact meaningfully requires some speculation. However, despite clear trajectories of rapid improvement indicated by scaling laws, I will avoid long-term speculation about AGI. (Despite recent hype, I believe we remain relatively far from autonomous, self-improving AGI, and it's unclear what form such systems would take.)

Instead, I will focus on the near- to mid-term future, where AI takes the form of human assistants and agents—tools serving humans by facilitating or executing new activities on their behalf.

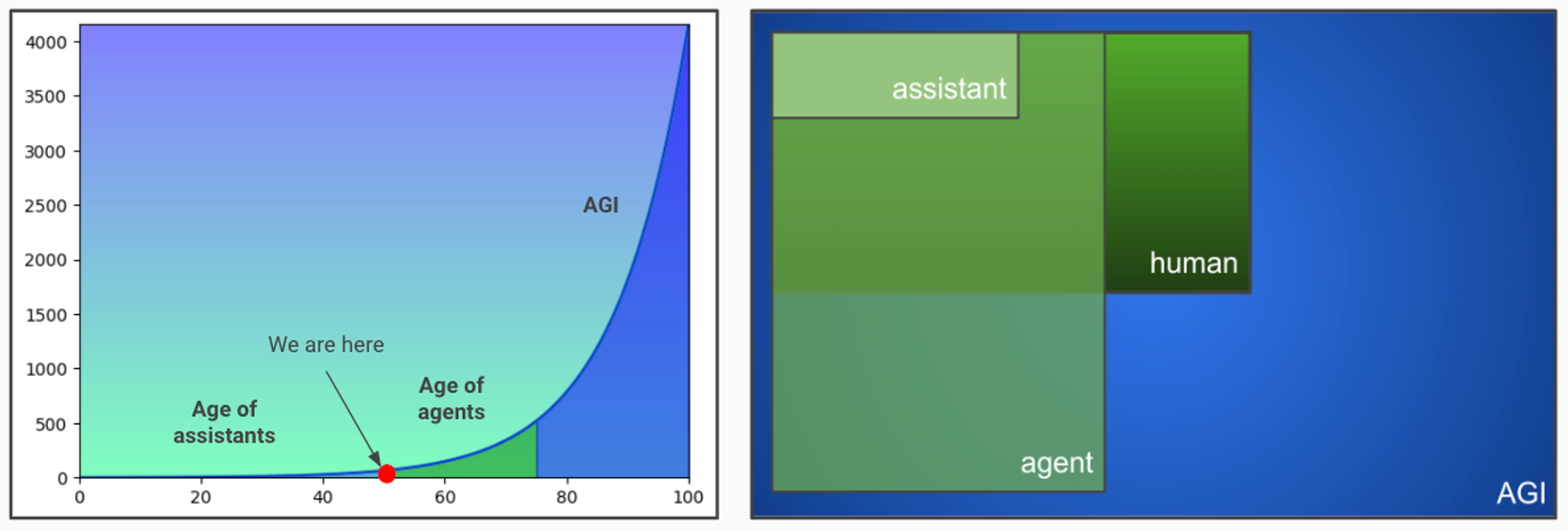

Figure 1. Left: Conceptual timeline of AI evolution with increasing performance. Right: Block diagram of human activities and activities performed by different forms of AI.

Assistants have existed in various forms for years, but recent advances in LLMs suggest that a new generation of AI agents will be significantly more capable and rapidly progressing. Below is my working definition of an AI agent:

A computer program that interacts with the world. It perceives its environment through sensors (input data), autonomously processes data (prediction and planning), and takes actions to achieve goals (actions).

Agents can be constrained or learn from their environment. Today, agents are typically specialized for specific input types and action types. For example, chatbots (like ChatGPT) take text prompts as input, may use tools to generate responses, and output text. In contrast, trading bots take historical market states as input, predict future states and optimal actions, and execute trades. Agents can vary in type (e.g., chatbots based on LLMs vs. small RL agents for trading), and they can also be combined to perform complex tasks. In the future, we may discover a general architecture trainable across most use cases.

Blockchain Has Unique and Desirable Features

Public blockchains possess a unique set of features making them highly suitable for communication and interaction among AI agents. Later, we’ll argue they constitute one of the best backends for supporting AI agents.

Decentralization: Well-designed blockchain protocols are decentralized. Moreover, decentralization is part of the ethos of the communities that initially build and upgrade them. It is built into the protocol and protected through governance.

Incentives: Well-designed blockchains have robust incentive mechanisms that ensure economic security via native assets (e.g., ETH in Ethereum). Additionally, programmable smart contracts allow applications to leverage native assets, issue new digital assets with desired properties, and define their own native assets and incentive structures for participants.

Openness and Composability: Blockchain platforms are open-access for both users and application developers. Furthermore, applications built on smart contracts deployed on blockchains inherit the same properties of openness and frictionless composability.

Cryptographic Guarantees: Blockchains leverage modern cryptography to provide unique levels of security, auditability, and programmable privacy. The result is trust-minimized systems that are more secure than legacy systems. Note that blockchain hacks usually stem from vulnerabilities in smart contracts—an inevitable issue in early-stage technology. As the tech stack matures, it becomes more robust and secure, unlike traditional systems reliant on human trust, which lack this property.

We can contrast this with the traditional internet, which only exhibits decentralization at the base layer. Protocols like TCP/IP or SMTP are open, but nearly all applications built atop them are proprietary. This limits composability on the internet—a key attribute we consider essential for designing protocols for agent interactions. Moreover, the internet lacks incentives and modern cryptography at the protocol level entirely.

Next, we introduce an idealized economic model where humans and agents collaborate, demonstrating that it requires the full suite of properties provided by blockchain protocols.

Benefits of Blockchain for AI Agents

Fast forward a few years. Suppose we reach a stage where AI agents can perform a wide range of human activities with sufficient decision-making and planning capabilities. They could act autonomously, possibly collaborating with other agents. These agents are widely deployed across society, undertaking activities of potentially high value to humans—both socially and financially.

Below are some desired properties/wishes for these AI agent systems and their interactions with humans, along with how blockchain enables them.

Requirements for Agent Systems

-

Consistency: Certain aspects of agent consistency, such as value learning, explainability, and controllability, depend on AI design and training processes, which largely do not directly leverage blockchain. However, the openness and composability of blockchain applications offer unique opportunities to make agent activity transparent, automatically monitored, and attributable—critical for incentive distribution and coordination among agent systems.

-

Security: Blockchains are designed to operate reliably and securely in high-value adversarial environments with minimal trust assumptions. Agents interacting via smart contract applications inherit these strong properties. Moreover, advances in modern cryptography, such as zero-knowledge proofs, empower smart contract applications further. For instance, applications can require proofs for sensitive computations while keeping agent weights and inputs private. Trusted smart contracts are also ideal tools for constraining agent action spaces and setting default or conditional permissions.

-

Discovery: Openness across application environments allows richer request routing based on application state and agent performance history, both fully observable. It’s easy to imagine agents building verifiable reputations based on their action history, which could then be programmatically used to rank and discover optimal agents for tasks.

-

Efficiency: Blockchain infrastructure enhances agent autonomy by enabling agents to execute important decisions—including payments—without direct human intervention and at low cost.

Human Desires

-

Control and Programmable Privacy: Blockchains enable individuals to directly own and maintain control over their agents without intermediaries. Personal data can remain private, with access conditionally controlled via cryptographic tools—from fully private computation (TEE/FHE) to programmable sharing of selected attributes using zk proofs.

-

Ownership and Fairness: People can establish protocols to jointly own and manage agents. Rewards from agent work can be programmatically distributed down to fractions of a cent. Fairness can be measured and improved through protocol upgrades and democratic governance. Combined with emerging modern identity solutions, blockchain infrastructure can also support and automate ambitious distribution schemes such as Universal Basic Income (UBI)—a significant long-term application.

Brief on the AI Supply Chain

Notably, beyond communication and interoperability, blockchain infrastructure can also benefit the entire model production supply chain (data collection, curation, training, fine-tuning). Many applications are under development, including multiple data collection protocols and compute markets. They are vital components of a decentralized AI stack, though we won’t cover them here.

Global Regulation and Governance

Blockchains offer multiple protocols through which broad rules and checks can be executed in a trustworthy manner. In my view, this presents a unique opportunity for global regulation of AI markets and applications, enabling easy auditing and compliance verification. Cross-protocol transparency also makes it easy to identify deviations in real time and deploy corrective fixes—something impossible in traditional systems.

Risks and Costs of Blockchain Infrastructure

When training AI agents to make sensitive and impactful decisions, openness is not always desirable. For example, deploying an open-weight model for insurance underwriting could expose model vulnerabilities and increase susceptibility to attacks/exploitation.

One possible solution is to use modern cryptography to keep agents private while making their behavior public. However, black-box adversarial machine learning attacks are still possible, and generally, cryptographically secure but verifiable machine learning computation remains expensive, adding overhead to an already costly training process. This is one of the most critical areas in the intersection of AI safety and blockchain research. We need to make it technically and economically feasible in practice. A recent innovation is optimistic proofs for ML computation, which I will discuss below.

Another discussed risk is that LLM-based oracles lower the barrier for deploying agents that correctly allocate incentives toward potentially harmful real-world actions. This isn’t possible today, but more research is needed on enabling positive use cases and detecting/preventing harmful behaviors.

Blockchain-Based Systems Can Scale to Meet Demand

A common concern among those unfamiliar with the current state of blockchain systems is whether they are ready to handle increased user activity loads.

For at least the past five years, this has been a central focus of blockchain R&D. Today, we are at an inflection point—many solutions are going live, and scalability has improved by orders of magnitude. For example, Ethereum and its Layer 2 blockchains inherit full economic security and scalable data availability solutions, soon capable of handling tens of thousands of transactions per second (TPS). New chains are launching, leveraging parallelization to process hundreds of thousands of TPS. Shared sequencing solutions and secure bridges will enable applications deployed across different domains to interoperate securely and efficiently. Advances in zero-knowledge proof aggregation will make transactions cheaper and enable new types of off-chain computation and hybrid systems, making security trade-offs more effective.

As all these infrastructure innovations mature over the coming years, there is no doubt that mature blockchain ecosystems will be able to support very high throughput—from today’s tens of thousands of TPS to millions of TPS with minimal per-transaction costs.

The Path to an Internet of Agents

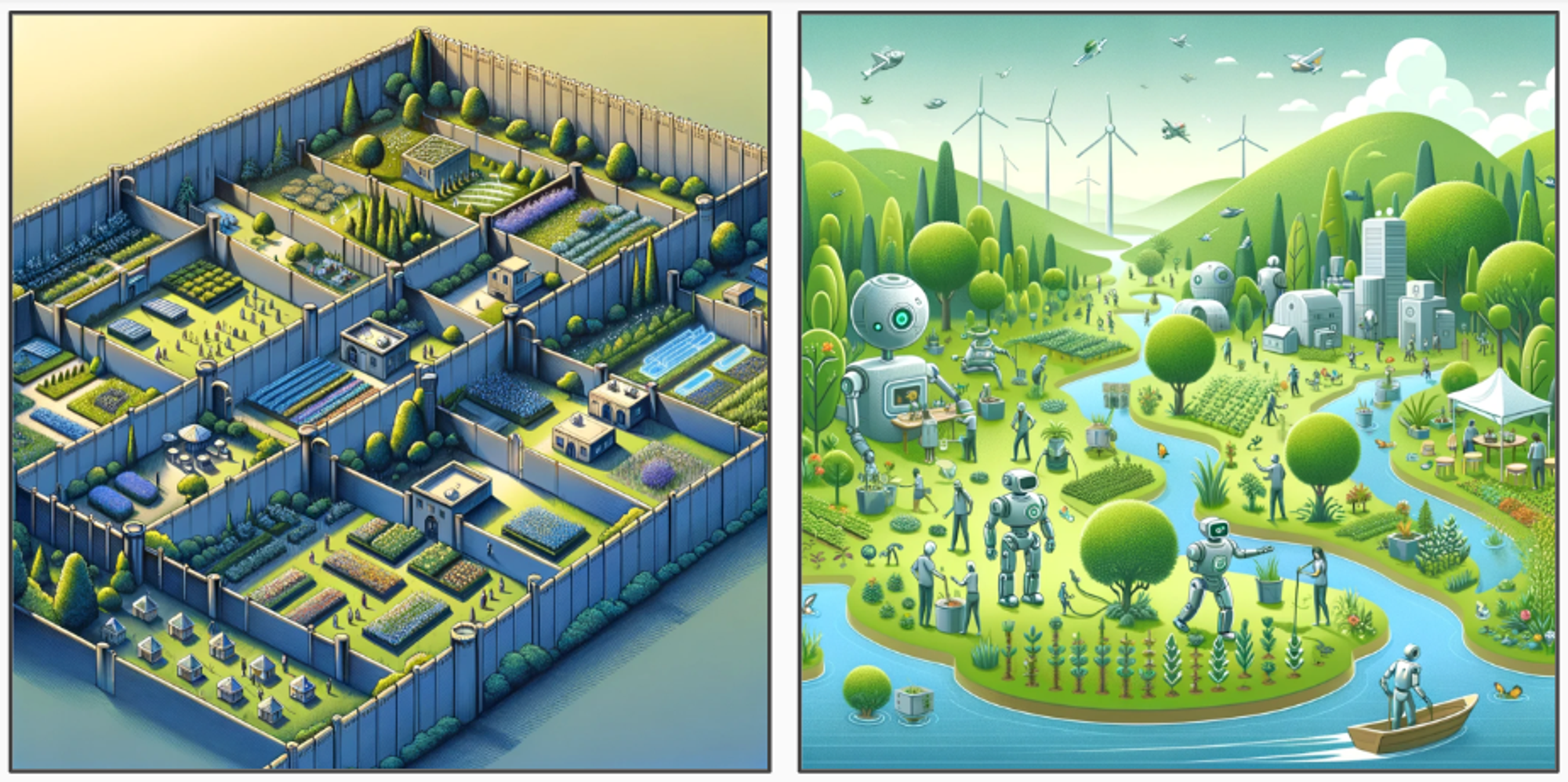

The image above is a treasure map representing three major steps along the path to an internet of agents.

Let’s explore each one.

Enhancing Current Decentralized Applications

The first step is enhancing current blockchain applications with AI. AI is already playing a role in decentralized finance (DeFi), the most popular application category to date. This comes in the form of specialized models continuously monitoring market conditions to take specific actions—for example: trading bots, liquidation bots, routing bots, statistical arbitrage bots, and more broadly, bots executing strategies aimed at extracting profit from user transaction flows (also known as MEV).

As blockchain economies grow beyond current DeFi foundations, it’s natural to begin discussing AI opportunities from here.

DeFi Enhancement

Blockchain protocols are currently automated, but their interfaces are often manual, clunky, and inefficient. AI has the potential to become a new interface connecting humans and on-chain markets, mediated by intelligent agents. At least three areas offer concrete opportunities to enhance current protocols.

-

User Intent Matching: Users interact with AI agents to express—and sometimes construct/refine—their intent, which the AI matches to a sequence of on-chain actions delegated by the user. Intent takes the form of a goal plus multiple safeguards; actions can be single transactions or structured plans executed over longer timeframes. Simple examples of intent include:

-

"I want X units of token Y at no more than $Z", or

-

"I want to invest $Z monthly in Ethereum Layer 2 projects over the next six months", or

-

"I want to restake my $ETH on EigenLayer and delegate it to AVSs with an APR of at least X% and a risk factor no higher than Y%".

-

-

While the first example requires only a few transactions, the others involve creating plans, executing multi-transaction strategies within a plan, multiple price feedback loops, predictive models for risk and return, and contextual information.

-

Action Planning and Routing: The infrastructure for sending transactions on Ethereum has become increasingly mature and complex. There are now different routes optimized for different goals: security, speed, cost-efficiency, privacy. There’s even a protocol aiming to make deploying new routes easier. Similar to how DEX aggregators work across individual exchanges today, more advanced routing algorithms could be designed that also account for broader context across the transaction supply chain and various applications. The action space is quite large—especially when Layer 2 applications plan long-term strategies on behalf of users or when purchasing services on Layer 1—and continues to expand with new mechanisms. For instance, the optimal plan for portfolio optimization might involve partially redeploying funds to a cheaper Layer 2 and executing investments there.

-

Shared Funds and Asset Pools: Creating and managing funds where many people pool resources toward shared goals, delegating execution to AI agents. This requires aspects of intent matching and action planning, along with shared ownership mechanisms uniquely enabled by blockchains. For example, a modern version of a digital art collecting agent would require all these capabilities and could also leverage richer context provided by the latest generation of LLMs—to synthesize community preferences and identify matching assets.

In all these cases, a primary human or community outsources high-value on-chain actions to agents running off-chain. Thus, there’s a strong need for inference guarantees. This can be achieved in two ways:

-

Running a network of agents off-chain with their own security assumptions—for example, by re-staking or operating an L1 with deliberately designed incentives, leveraging the economic security of anchored-chain assets or ETH.

-

Designing on-chain smart contract protocols for agent orchestration that require inference proofs to ensure operational validity. This can be achieved via zkML (zk-proofs) or opML (optimistic proofs). Both fields are advancing rapidly, but opML is a particularly interesting solution for economically securing large LLM executions—something currently impossible or prohibitively expensive using cryptographically secure zk-proofs.

AI Service Protocols

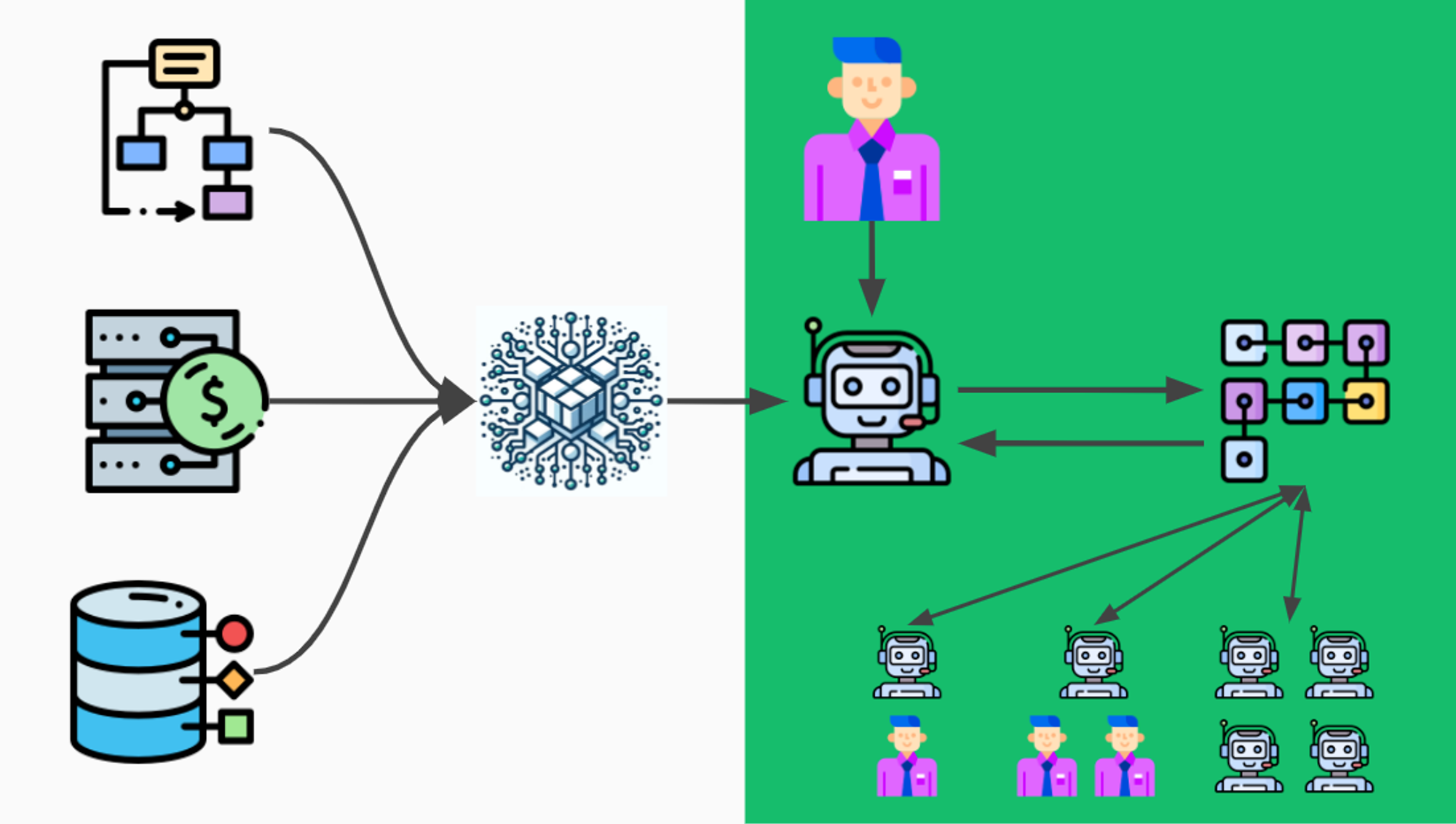

A related category involves enhancing protocol infrastructure with autonomous agents rather than retail applications. Most applications here resemble agent-based products built for traditional business services, but these agents can leverage blockchain’s openness, activity, and data richness.

Examples include agents acting as smart contract security auditors/testers, analytical agents, and automated financial and risk management services. Web3-focused companies already offer various such services, but advances in agent autonomy and inference proofs now present opportunities to decentralize and eliminate trust dependencies from critical services to protocol operations.

A new application area is content moderation. With the rise of decentralized social media platforms like Farcaster and Lens, new opportunities emerge for agent-mediated automation and management. However, these require creating new mechanisms to coordinate the agent collaboration described here.

Building New Mechanisms for Agent Services

We can leverage blockchain’s superpower—trusted commitment devices—to implement new applications and market mechanisms that directly utilize agent users. From here, we begin to see the power of coordinating multiple agents to deliver new services. We discussed this topic in detail in a recent paper; here, I’d like to focus on a few concrete applications.

https://www.coindesk.com/consensus-magazine/2024/03/04/how-ai-crypto-will-lead-to-a-hyper-financialized-future/

AI Prediction Markets

One of the most exciting and concrete short-term applications is AI prediction markets. DeFi unlocked the ability to trade long-tail assets on blockchains—such as utility tokens of small protocols—that are untradeable in traditional markets due to high infrastructure costs. AI prediction markets have the potential to do the same with ultra-long-tail assets. Outcomes of even the smallest events that matter to people can be tokenized and traded. For these markets to function, they need:

-

Effective price discovery: Meaningful liquidity and substantial trading volume to aggregate information.

-

Trustworthy market resolution: Markets must resolve in a credible and efficient manner.

AI can automate these operations by enabling specialized trading agents to query LLMs for probability estimates of events and then place bets, as demonstrated in a recent large-scale competition. It has also been suggested that multi-round dispute protocols could automate market resolution, using LLMs in early rounds and involving humans only in escalated cases.

Once functional, these markets become a new primitive for fully autonomous assessment of minor uncertainties—without relying on central authorities vulnerable to security threats or bias. Numerous applications can be built atop them: micro-insurance, financial products, content moderation on decentralized social media, spam filtering, and more.

Reliable and Efficient Routing for Specialized Models

Today, most human-AI interactions occur in siloed, proprietary environments with general-purpose models—either closed “frontier” models (heavy models) or open-weight models (light models). However, the early success of the GPT Store and similar aggregators like FlowGPT points toward a world where the above interaction patterns serve merely as entry points into a vast supply of GPTs with agent capabilities and specialized skills (i.e., moving quickly from explaining poker rules to playing poker, from trip planning to booking entire journeys).

In such a world, there’s a clear demand for efficiently routing user sessions to specialized models best suited to fulfill their intent optimally. When agents transact on behalf of users, significant value can be extracted from serving them. Both routers/intermediaries (extracting rent) and end-model providers (misreporting results/performance to gain traffic) have incentives to extract value. Hence, there’s a clear need for trusted routing mechanisms and markets where service providers compete to meet user preferences. This is an upcoming application area I’m particularly excited about.

Building Blocks for New Markets

As more agents with specialized skills are deployed and accumulate on-chain histories, stronger infrastructure building blocks can be developed. Examples include agent discovery protocols incorporating reputation based on past outcomes and agent rankings, automated bidding for microservices based on predicted outcomes, and more.

This is an iterative process that will take years to fully realize. With each wave of new agent service protocols, new iterations of communication, reputation, and exchange infrastructure will evolve. The ultimate goal is the most efficient digital coordination mechanism system—extremely lightweight and rent-free—that will become an increasingly significant pillar of the world economy. Eventually, as agent capabilities grow and more real-world activities become automated, we can expect most socioeconomic transactions to be settled on this infrastructure.

Scaling Shared Ownership and Governance

Once scaled, addressing issues of shared ownership, fair value distribution, and governance of AI agent production systems will become critical. Blockchain provides the foundational tools to solve this. Today, we’re in the early stages of experimentation, but some interesting models are emerging. We have two extremes:

-

Direct ownership with minimal governance: A model with minimal protocol governance, similar to Bitcoin. The protocol is minimal and relatively fixed. Agent asset/resource ownership mechanisms are simple—agents are directly owned by their creators and accumulate value proportionally to usage. A native network token serves simply as a utility for paying service fees and as a valuable capital asset rewarding contributors.

-

Shared ownership with DAO governance: The other extreme is richer protocols, more akin to applications we see today on Ethereum. There is a rich protocol specification whose parameters can be changed through explicit governance processes. Native tokens can be used for governance and support richer incentive mechanisms, enabling shared ownership across different system components.

The first resembles what Morpheus is experimenting with; the second aligns with Olas—both early attempts at building autonomous agent economies. We’re still in the early days of these new types of agent-based protocols, and new applications and capabilities will likely reshape how incentives and ownership models are designed. These are just two very different examples illustrating the broad range of solutions available to protocol designers. Finally, note that similar challenges exist at other levels of the AI stack beyond agent economies, and analogous solutions could apply to incentivizing AI training, data, and infrastructure services.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News