Opinion: Bitcoin may rise to $140,000 by mid-year, followed by a rapid pullback

TechFlow Selected TechFlow Selected

Opinion: Bitcoin may rise to $140,000 by mid-year, followed by a rapid pullback

It's unprecedented to reach an all-time high before the halving (i.e., 45 days from now).

Author: A FOX

Translation: TechFlow

Summary:

-

On Tuesday, March 5, Bitcoin briefly touched a record high of $69,000, surpassing its previous all-time high set on November 7, 2021, before pulling back.

-

Reaching an all-time high before the halving—45 days away—is unprecedented and likely driven by surging demand from Bitcoin ETFs.

-

Following the halving, a supply shock combined with strong ETF-driven demand could lead to parabolic growth in a short period.

-

This earlier-than-expected surge may also mean the bull market ends sooner than anticipated—possibly in early 2025 rather than late 2025.

Main Text

Bitcoin has hit a new all-time high of $69,000!

Although this peak was short-lived as the price quickly pulled back, Bitcoin has already reached this milestone even before the upcoming halving event.

This is itself an unprecedented moment in Bitcoin and broader crypto history. Let's analyze what just happened and explore what might come next.

Bitcoin’s All-Time High

On March 5, 2024, Bitcoin surpassed its prior all-time high (ATH) of $69,000 set on November 7, 2021! Though extremely brief, it quickly retreated to $58,000 and later stabilized around $64,000 within hours.

The previous ATH was achieved at the peak of the last bull cycle when Bitcoin became a household name and seemed like it would rise forever—as often happens during bull markets.

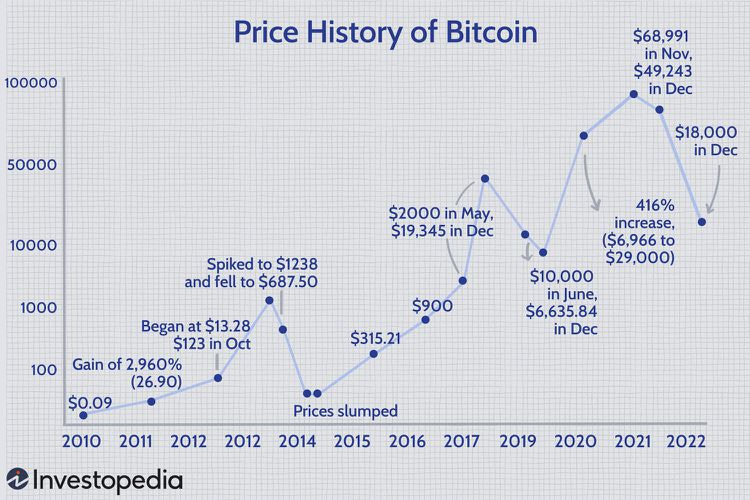

In the chart above, you can see the ATH peaks of approximately $1,200 in 2013, $19,000 in 2017, and $69,000 in 2021. Each of these peaks aligns with Bitcoin’s 4-year cycle.

We are now once again in the bull phase of a new cycle, with Bitcoin rapidly surpassing previous highs and preparing for a price discovery phase, stabilizing above a new ATH.

However, this time is different—it has exceeded the prior ATH before the Bitcoin halving, which is still about 45 days away!

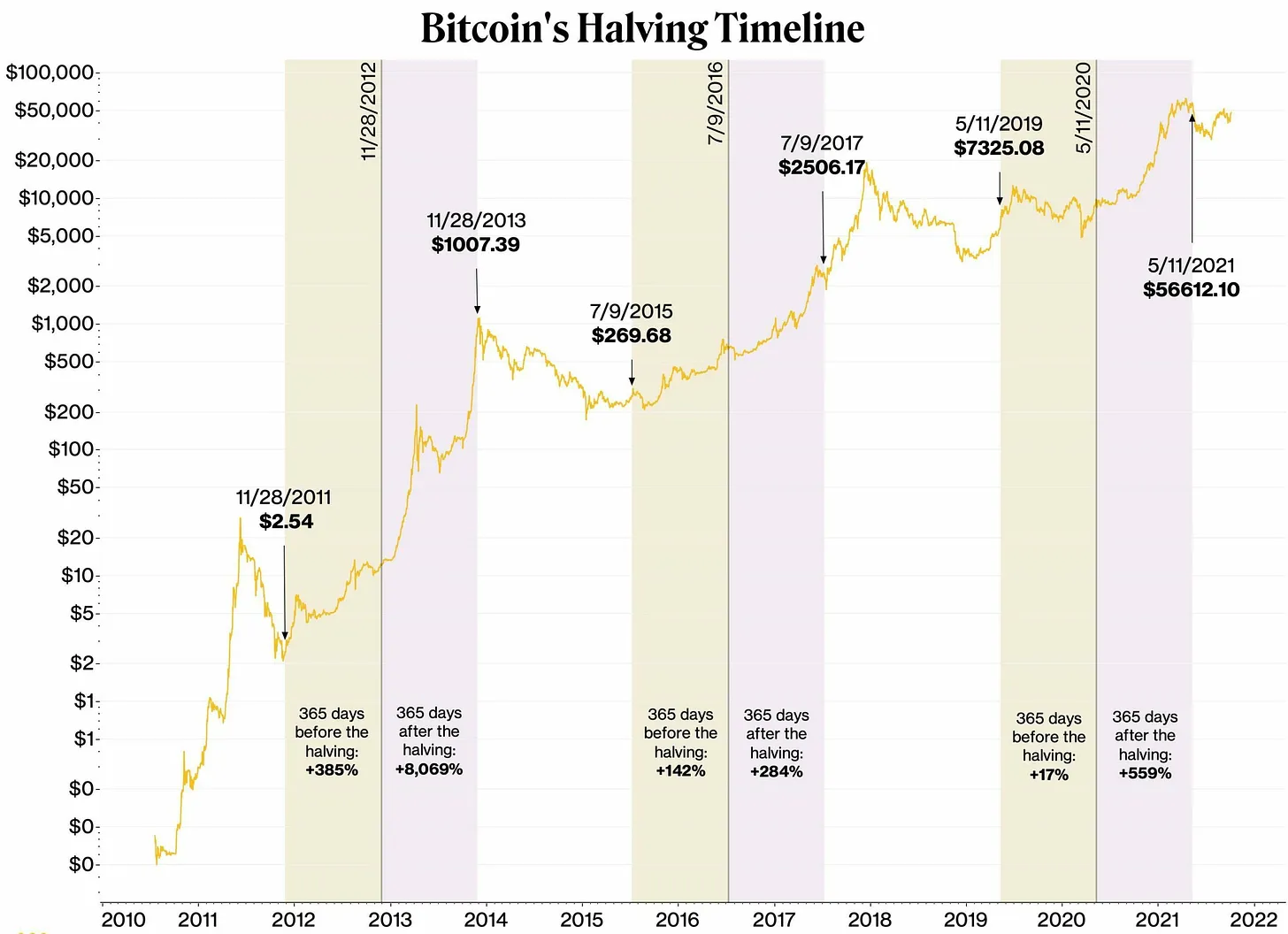

As shown in the chart above, in all previous cycles, Bitcoin experienced such aggressive upward moves months after the halving—not before.

The Halving

Historically, the halving has been the primary catalyst driving Bitcoin beyond old ATHs and into price discovery to establish new ones.

There are many complex market dynamics involved, but the most prominent reason is that the halving cuts the new Bitcoin supply per block by 50%, immediately shifting the balance between supply and demand.

The most likely reason this cycle differs from past ones is Bitcoin ETFs, which since their January launch have created massive demand exceeding available supply. As you can see below, last week ETFs purchased five times more Bitcoin than miners produced!

In approximately 45 days, we will experience another halving, reducing the amount of Bitcoin mined per block from 6.25 to 3.125—equivalent to dropping from roughly 900 BTC per day to 450, or from 6,000 BTC per week to 3,000!

Just as Bitcoin ETFs have caused a dramatic increase in demand, the halving will cause a sharp drop in supply. Bitcoin is about to face another unprecedented moment—simultaneously dealing with massive demand and supply shocks!

What Might Happen Next

Simply put, the surge in ETF-driven demand followed closely by the halving-induced supply reduction could send Bitcoin’s price soaring.

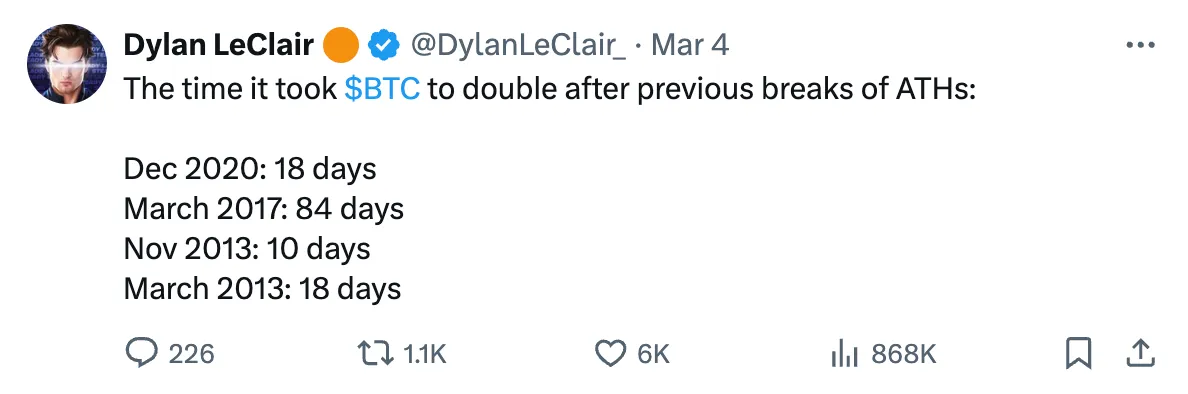

In the past, when Bitcoin broke through prior highs, it took only 10 to 18 days to double in price.

Given current conditions, Bitcoin may well enter another parabolic growth phase, lifting the entire market along with it.

If we see a similar doubling, Bitcoin could reach around $140,000 by mid-year!

Of course, it's hard to say for sure whether Bitcoin will double again so quickly, but significant price increases are highly likely regardless.

Looking ahead, Bitcoin’s 4-year cycle historically consists of 3 years of upward movement followed by 1 year of decline. Since the LUNA collapse in 2022, we’ve had roughly one year of decline and one year of recovery in 2023, suggesting we still have about two more years of upward momentum in this cycle.

Under normal circumstances, we’d expect this 3-year bull cycle to end around Q4 2025.

However, the fact that we’ve already hit an ATH before the halving, combined with the impending supply-demand imbalance and easier access to crypto markets than ever before, suggests things may unfold differently.

I believe we may see the following: The euphoric phase of the bull market arrives earlier, pushing BTC to its ATH peak sooner—meaning the inevitable downturn will also come earlier, possibly in Q1 to Q2 of 2025.

But this is not financial advice—anything can happen. One thing is certain: buckle up and make sure you’re on board, because this is going to be a spectacular year!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News