How to Stake DYDX on pSTAKE to Earn an Extremely High 141% Yield?

TechFlow Selected TechFlow Selected

How to Stake DYDX on pSTAKE to Earn an Extremely High 141% Yield?

Earn staking rewards while maintaining liquidity.

Author: 2Lambroz

Translation: TechFlow

Earn 141% yields on dYdX!

Or earn 125% yield via perpetual contracts hedging + an additional 12% delta-neutral liquidity staking to earn $DYDX

A step-by-step guide to exploring LSD yields on Cosmos

As the DYDX app chain, $TIA and $DYM gain more attention, why not learn more about Cosmos liquid staking?

Summary

pSTAKE Finance is a liquid staking protocol focused on Cosmos assets.

I've been exploring because with the DYDX app chain and growing attention on $TIA and $DYM, I found some excellent yield opportunities!

I'll walk you through step by step how to earn 125% yield on dydx and stkdydx via pSTAKE Finance.

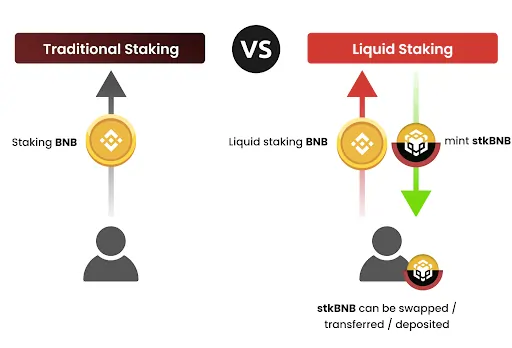

What is Persistence and Liquid Staking

Persistence is a liquid staking protocol on Cosmos.

Liquid staking tokenizes staked positions, allowing users to earn staking rewards while maintaining liquidity.

For example, if you stake $DYDX directly, you must wait 30 days to unstake and redeem your position.

But if you stake via Persistence, your staked DYDX position becomes stkDYDX — a tokenized representation of that staked position.

In simple terms, it allows you to earn staking yields while retaining liquidity.

This enables:

-

Exiting your staked position without waiting 30 days — simply sell your stkDYDX

-

Providing LP to earn trading fees on the DYDX/stkDYDX pair

-

If stkDYDX trades at a discount (not 1:1 with DYDX), you can buy stkDYDX and unstake after 30 days to capture the price difference

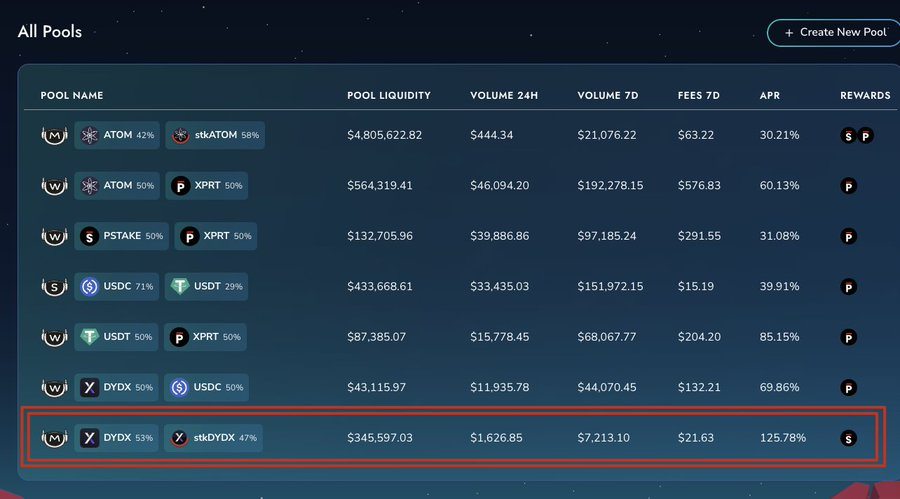

Persistence offers various liquid staking options, but I'm focusing on $DYDX as it currently offers the best yield.

Persistence is the parent company of Pstake Finance and Dexter, which is a DEX for staked assets.

Strategy Overview

-

Stake half of your DYDX into stkDYDX

-

Provide liquidity on Dexter to earn 125% APY

-

Optional: Short DYDX on CEX to earn an extra 12% APY and maintain delta neutrality

Here are the detailed steps:

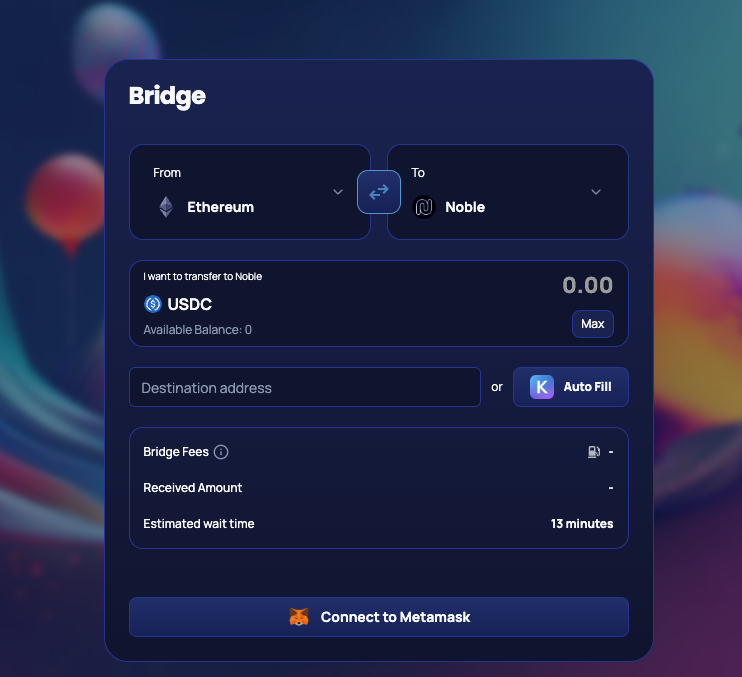

1. If you only hold EVM-based assets, use @CCTPMoney to transfer funds to the Cosmos chain. The route must be EVM → Noble → Persistence

Otherwise, you can send funds from a CEX to XPRT, then swap to DYDX on Dexter

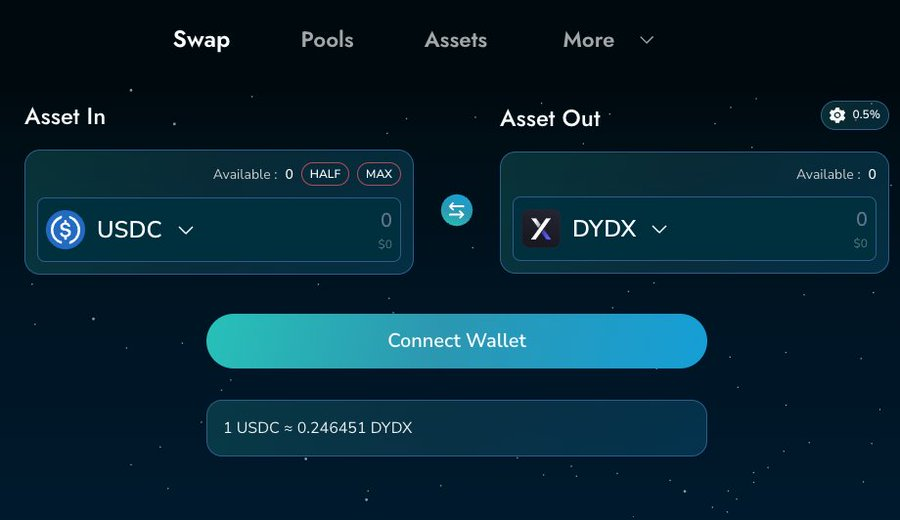

2. If using CCTP, you now hold USDC. Buy DYDX on Dexter. Click here to visit the site.

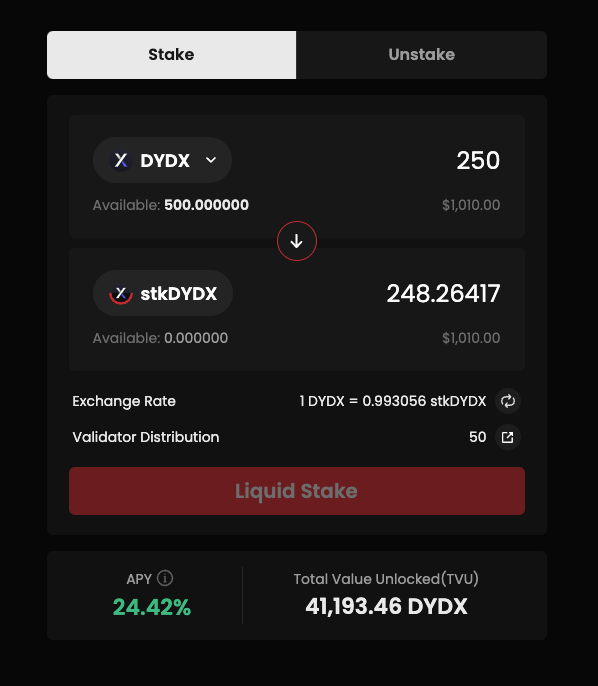

3. Liquid stake half of your DYDX into stkDYDX

4. Add liquidity on Dexter and bond for 7 days to earn 141% APY

Bonding means locking your position for 7 days to receive additional emissions of $xprt (yielding 125.78% APY)

What if you're worried DYDX price might drop?

Hedge it! Also known as a delta-neutral strategy.

Suppose I have 250 DYDX and 250 stkDYDX in my LP position — this means I have 500 DYDX price exposure.

So if I short 500 DYDX on a CEX, my net DYDX price exposure becomes zero — because I’m long 500 and short 500 DYDX!

In practice, since funding rates are usually positive, your short position may even earn funding payments (assuming rates remain unchanged).

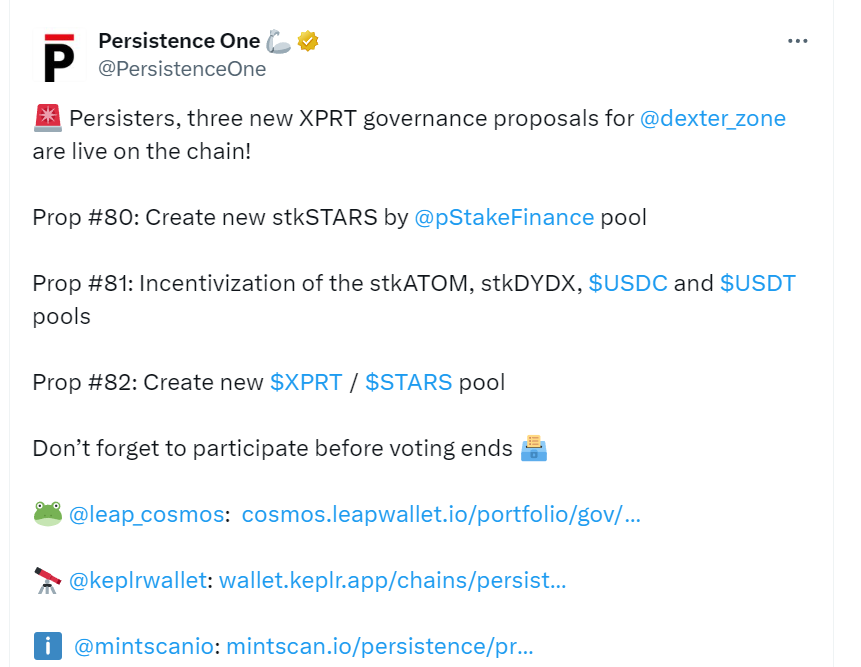

Interestingly, @StargazeZone, the Cosmos NFT chain (where BadKids NFTs reside), has proposed listing $STARS as a liquid staking asset, potentially unlocking new yield opportunities.

Conclusion

-

Liquid staking yields on DYDX are attractive if you already hold it

-

Delta-neutral yield farming is feasible

-

It's worth exploring LSTs further

-

Keeping an eye on the Persistence ecosystem is always beneficial — recently, Cosmos SDK assets like $TIA and $DYM have drawn significant attention

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News