A 20x surge over one weekend — the AI summer in the crypto market is coming

TechFlow Selected TechFlow Selected

A 20x surge over one weekend — the AI summer in the crypto market is coming

Since the beginning of the year, both new and established projects in the AI sector have surged.

Text: Joyce, BlockBeats

Editing: Jack, BlockBeats

After a week of consolidation, the AI sector is taking off again. Over the past half-year, tokens from various projects in the AI space have continued to rise, with WLD, RNDR, AGIX, FET and others seeing multiple-fold gains. And during this past month since early February, many new projects within the AI sector have emerged—each achieving token increases exceeding fivefold or even tens of times their initial value in less than two weeks. Why has the AI sector blossomed so widely, demonstrating sustained and strong growth? Which newly launched projects have shown clear wealth effects? How has the once-perceived complex AI narrative managed to support such a surge of new entrants? BlockBeats explores these questions in this article.

Who Is Fueling the AI Sector?

Crypto VCs Keep Pumping

Mirroring developments in Web2, “AI” had already become a buzzword frequently appearing in year-ahead outlook reports by major investment firms by the end of 2023. As Messari noted in its 2024 investment forecast: "AI has become the new darling of tech. Once again, we’re just spectators."

Tommy, co-founder of Delphi Digital—which has invested in 14 AI x Crypto projects—wrote that he believes “we are heading toward a world with billions of AI models, whether individuals download and personalize open-source models or projects and companies build their own model sets for specific use cases (e.g., Uniswap LP provision, exchange risk analysis, Delphi AI analyst).”

In-depth research on the AI sector is also underway. Vitalik published an essay in January outlining the potential applications and challenges of Crypto + AI, while Galaxy Digital released a detailed analysis of representative AI projects’ business models and limitations. All signs point to strong market optimism about the future of the AI sector in 2024.

Signals from 'AI Giants'

How should AI be integrated with Web3? Clearly, the ignition source for driving AI narratives lies within traditional AI giants. The phrases “AI represents productivity; Web3 represents production relations” and “rebuilding Web2 things using Web3 methods” aptly describe the stories told by most current AI projects in crypto.

Looking at market performance this year, it's evident that enthusiasm for the AI sector remains consistently high, with standout performers emerging one after another across the board.

On February 16, OpenAI unveiled its new large AI model Sora, sparking massive attention across the AI industry. An Ethereum-based meme coin named Sora surged over 1,000x within 12 hours. Following this, Worldcoin—an AI project founded by OpenAI CEO Sam Altman—rose more than 300% in two weeks.

NVIDIA chips meeting computing demands remain highly sought-after among major tech firms. In the early hours of February 22, NVIDIA reported Q4 earnings of $22.1 billion in revenue, far surpassing analysts' expectations of $20.4 billion. It was reported that NVIDIA stock rose 63% in the first two months of the year.

Previously, despite recognition of AI’s growth potential, compared to other sectors like DeFi or GameFi, the AI niche often received praise without corresponding investor interest due to lack of understanding. However, Sora’s debut and NVIDIA’s strong performance have drawn broader attention to the development potential of AI projects. In early February, the entire AI sector experienced a broad rally.

Retail Fear of Missing Out Drives New Projects

Why did everyone find WLD’s continuous rise surprising? One possible reason is that most AI projects entering community awareness had already passed through the “value discovery” phase.

Render Network, a GPU-based decentralized rendering solution, has seen its token RNDR increase over 450% in the past six months, nearing its all-time highs from 2022 and reaching a market cap above $2.7 billion. Fetch.AI, an artificial intelligence ledger launched in 2019, has gained over 240% in the last 20 days alone—already double its previous bull market peak. Other AI tokens like AGIX and ARKM have doubled or tripled within just two weeks.

Left: RNDR daily chart; Middle: FET weekly chart; Right: AGIX daily chart

Demand in the crypto market is strong, but most established AI projects were launched over a year ago. For newer investors wary of unproven concepts and unclear use cases, there’s a preference for buying new rather than old—a mindset keeping some cautious observers on the sidelines.

Thus, whether launching compelling narratives around scarce computing power via Web3 frameworks, or directly applying AI technologies as application-layer DApps to empower ecosystems, any plausible story—even if derivative—can attract significant liquidity driven by fear of missing out amid volatile price surges.

Which AI Projects Are Rising?

It’s important to note that unlike other sectors, valuation models and categorizations within AI remain unclear. Many small-cap AI projects gain traction initially through early promotion by alpha hunters who successfully draw in liquidity. These are better understood as “MEMEs with technical narratives.”

Currently, newly emerging AI projects are achieving ~10x returns relatively quickly—similar to patterns observed during the last bull run. But this cycle differs significantly: influenced by NVIDIA and OpenAI, the AI sector now commands greater attention and higher expectations than before. Therefore, past bull market curves cannot be simply applied to interpret current trends.

Small-Cap Bloom Everywhere

Within the AI space, the easiest-to-understand narrative centers on decentralized computing, particularly the concept of a “peer-to-peer GPU hardware marketplace,” which markets have already warmed up to.

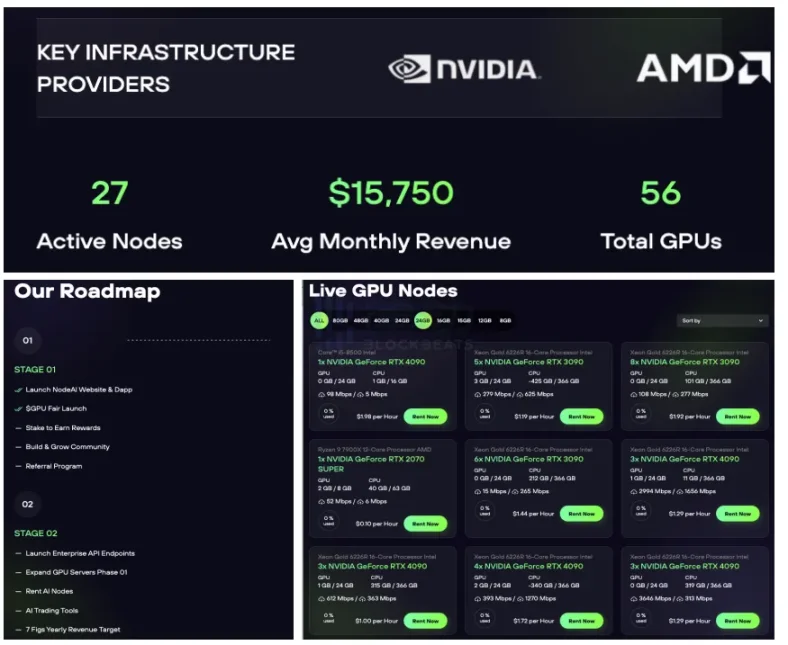

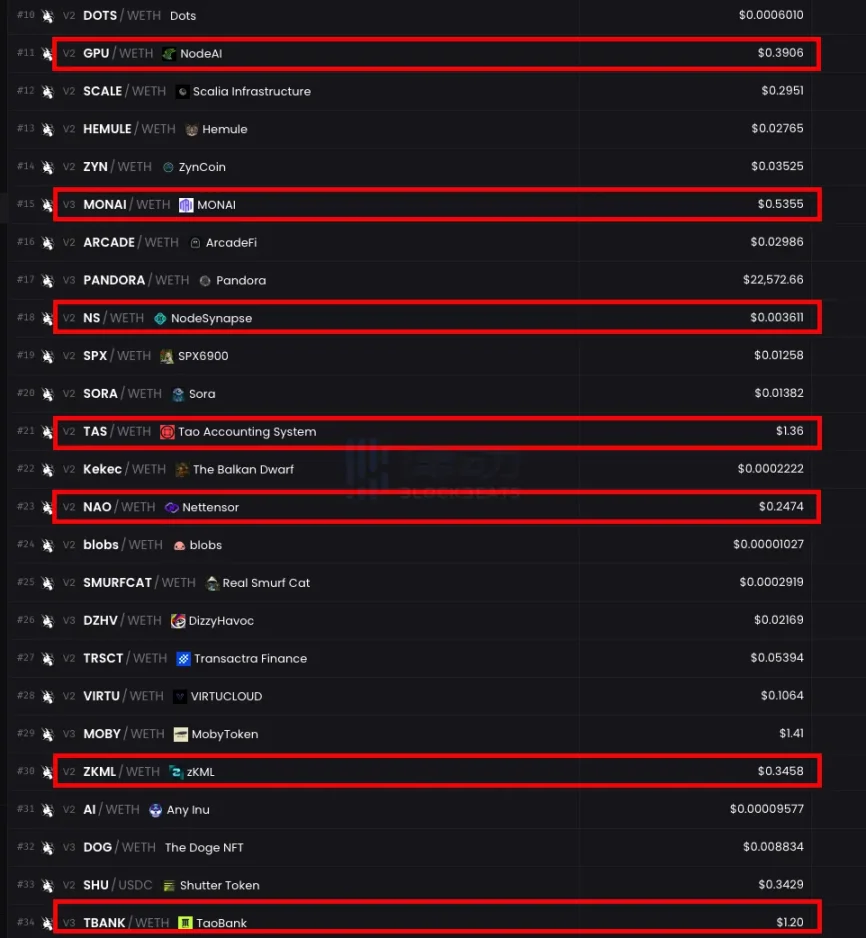

Last month, numerous projects based on the “GPU-sharing model” for decentralized computing/cloud services emerged simultaneously, each showing impressive upward momentum recently. BlockBeats previously highlighted Node AI ($GPU), a GPU leasing project, in our article *“Top 10 AI Alpha Plays You Should Be Onboard”*, when it traded at $0.22. After a week of consolidation, $GPU broke above $0.30 on Monday and climbed further to around $1.20.

Alongside Node AI ($GPU), similarly positioned GPU-sharing ventures NetMind.AI ($NMT) and NodeSynapse ($NS) followed comparable trajectories. Notably, NetMind.AI publicly lists its founding team members—all Chinese nationals.

Left: Node.AI; Middle: NetMind.AI; Right: NodeSynapse

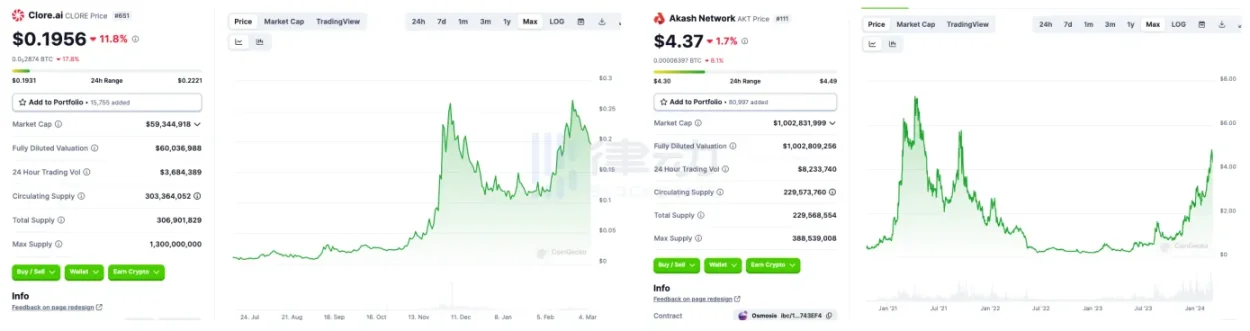

However, GPU rental isn’t a novel idea in this bull cycle. Clore.ai ($CLORE), launched last year, previously achieved over tenfold gains but failed to sustain them before retracing. While the February AI wave briefly boosted $CLORE again, it still hasn’t reclaimed its prior highs.

Akash, founded in 2020 as a decentralized cloud marketplace, launched a GPU-focused testnet last year. Its token AKT has risen nearly fivefold over the past six months—but even this performance pales in comparison to newer entrants.

TAO Ecosystem

As commonly known, AI rests on three pillars: data, algorithms, and computing power. Bittensor targets the algorithm layer by building a network architecture composed of interconnected subnets, allowing anyone to create custom-incentivized subnets with different AI model applications. Currently, TAO boasts a market cap exceeding $4 billion and has traded sideways between $600–$700 for a month. In the short term, TAO may not deliver outsized profits to holders, yet many projects within the Bittensor ecosystem are shining brightly.

OpSec positions itself as a decentralized physical infrastructure provider on Bittensor, offering products including OpSecCloud Bot (a decentralized deployment portal), proxy service OpSecure Mesh, and RDP product OpSec Cloudverse.

Since launching its V2 testnet on February 14, OpSec’s token has been on an uptrend, peaking after gaining over 150% in a week and currently correcting down ~10%. OpSec continues active updates—on March 4, it announced the launch of Cloudverse Epoch 1, simplifying node deployment and launching a Discord community. According to the team, over 500 nodes were sold within 24 hours of release.

Beyond OpSec, Tao Bank ($TBANK)—a lending protocol on the Bittensor network—has appeared in alpha hunters’ tweets, while the experimental token standard Tao Accounting System ($TAS) saw a staggering 7x gain in just three days.

The AI Project Assembly Line: How to Launch Fast?

Historically, the AI sector was overlooked due to technological complexity, long development cycles, and slow results. So what’s behind the sudden flood of AI projects? BlockBeats found that these early-stage projects follow strikingly similar launch strategies.

Pick the Easiest Story to Sell

Among new AI projects launched around February, many position themselves as GPU leasing marketplaces. With precedents already proven in prior years, market appetite is robust. Yet, it remains unclear how these projects plan to orchestrate and utilize the collected computing resources.

Take Node.AI ($GPU), for example—a project hitting new highs, rising nearly 20x in two weeks and still climbing. Although its website displays active node counts and GPU rental pricing tiers, Node.AI has so far only completed steps like “launching the NodeAI website and DApp” and conducting a fair launch of $GPU.

Previously, community members pointed out that Node.AI uses only a Google Sheet to collect requests from customers seeking GPU compute, lacking any concrete implementation roadmap. Before users can actually contribute their own GPU nodes for rent, several stages remain—including opening token staking and launching referral programs.

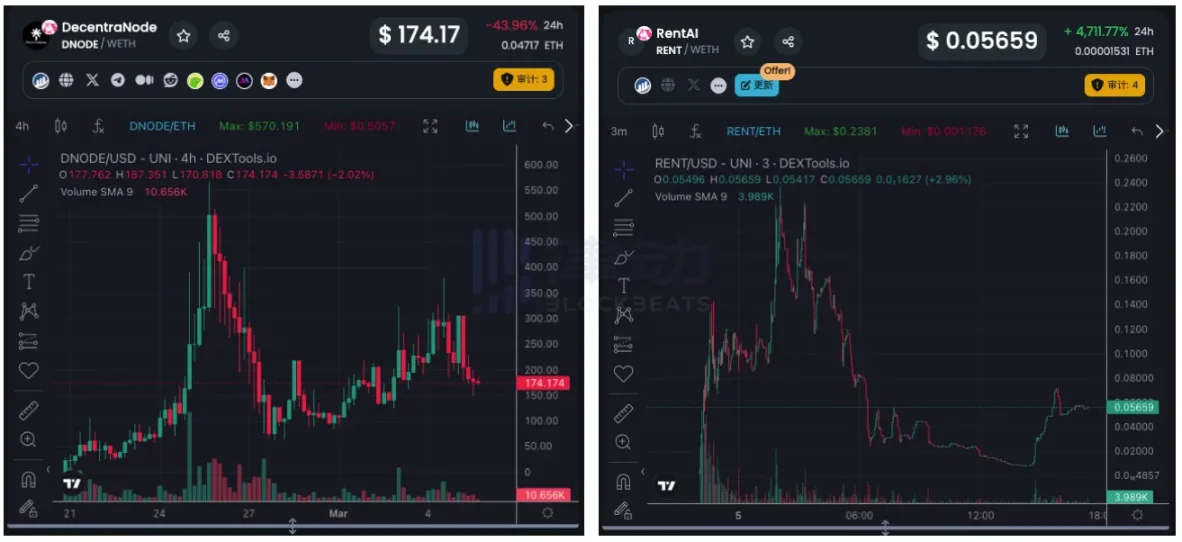

Not every project enjoys lasting success. DecentraNode ($DENODE), another GPU leasing venture described in its whitepaper, rose over 20x in four days upon launch, then lost over 80% of its value in the following two days.

On March 4, a new GPU leasing project Rent AI launched its token ($RENT). Charts show $RENT spiked over 20x within four hours of listing, then began a steady decline, returning near its initial price 16 hours post-launch. Unlike Node.AI, Rent AI opened staking channels immediately at launch.

Additionally, GPUBot, launched on February 29, allows users to sell or rent CPU/GPU capacity directly via Telegram without KYC. It gained over 440% in the past 24 hours, though holding addresses number only around 700.

Besides GPU leasing, AI chatbots have also become a popular theme for new launches. Predictive AI bot SpectreAI ($SPECTRE) rose sixfold in two weeks. Mocai, an AI bot built on Monad’s parallel EVM network, held an LBP priced at $0.125. Despite evidence suggesting its beta version might merely wrap ChatGPT API, its token still surged over 360% in four days.

Everyone Joins the NVIDIA Developer Program

After launching websites and whitepapers, how do projects capture community attention? First and foremost, getting mentioned by KOLs helps immensely. Being labeled “an early-stage AI project” serves as a powerful marketing hook. Early follower lists often include familiar alpha hunters, and project Telegram groups commonly host bots that alert users to token buys.

Moreover, BlockBeats observed that nearly all new AI projects announce participation in the NVIDIA Developer Program—and often phrase it as having “established a partnership with NVIDIA.”

In reality, the Developer Program is an initiative by NVIDIA to provide tools, resources, and training to developers, researchers, and students for building applications based on NVIDIA technology. Joining does not equate to forming an official partnership. Participants only gain access to SDK repositories, the NVIDIA GPU catalog, development tools, and educational materials.

Some projects claiming involvement with the NVIDIA Developer Program

Beyond NVIDIA, developer programs from IBM, Google, and Microsoft are also frequently cited under “partnerships” by many AI projects.

Group Collaboration

Are project teams actually building? Given that AI projects typically require long development timelines, communities often assess credibility based on partnerships. Hence, frequent partnership announcements have become common practice.

For instance, Vault—a Layer 1 blockchain launched in 2023—announced collaborations with eight AI projects within just 11 days: MineAI (GPU sharing), NodeSynapse (server hosting), SyntaxErc (AI design tool), SpectreAI (AI prediction bot), DecentraNode (GPU leasing), MultiDexAI (AI-powered DEX), SmartAudit AI (AI auditing tool), and SmartMoney (AI-driven on-chain trading tool).

For AigentX—a platform designed to help Web3 projects implement AI-driven operational solutions—such collaborations offer mutual benefits. Over the past half-month, AigentX has announced partnerships with 14 AI-themed projects: NodeSynapse, SmartAudit AI, DecentraNode, SmartMoney, Blendr Network (GPU sharing), BetAI (AI betting platform), ShellifyAI (AI gambling), VirtuMate (smart chatbot), Artemisai (AI trading tool), BuildAI (Telegram tool), aph5nt (Bittensor subnet), Volumint (AI trading tool), DeCloud (decentralized cloud), and Node.AI (GPU leasing).

Conclusion

A flood of AI projects has emerged en masse. Whether promoted by alpha hunters or topping on-chain trading charts, AI has become a constant presence. Some enjoy lasting rallies; others crash overnight.

Who leads the AI sector? This is hard to answer. Many mention Bittensor (TAO), likely because it holds the top market cap among AI projects. Yet Bittensor lacks real-world use cases, and no peer projects pursue similar goals. How much room does TAO have to grow? What’s its development pace? With no comparable benchmarks, Bittensor stands uniquely apart in the AI landscape.

In decentralized computing, Render Network—backed by strong legacy rendering businesses from traditional giants—now faces rising competition from formidable players like io.net. Still, these projects appear to be cooperating by sharing GPU supply resources, indicating the sector is still in a collaborative, energy-building phase.

The absence of clear leaders may be the best opportunity to capture wealth effects. Unlike other sectors, DeFi projects can be analyzed through metrics like TVL and ecosystem strength, and their mechanisms can be understood by referencing traditional finance. GameFi can be evaluated via studio reputation, economic design, development progress, and community health. But how should one analyze an AI project?

From a short-term profit perspective, signals such as Twitter activity, frontend development, whitepaper quality, Telegram engagement, and Discord ecosystem vitality can indicate whether a team is actively building and gauge market sentiment. To some extent, investing in early-stage projects resembles meme speculation: assess market cap, holder count, KOL mentions, exercise caution, and secure profits promptly. Based on existing project trajectories, those who enter early and exit wisely stand to earn solid returns.

Long-term, unlike other sectors, AI encompasses vastly different subdomains—all still in exploration. Is decentralized computing AI or DePIN? Beyond GPT wrappers, what narratives exist at the application layer? Beyond the current wave of largely meme-like AI projects, the market still includes established names from the last cycle—Bittensor, Render, Arkham—and promising unbuilt projects like io.net, Scopechat, and Ritual that continue developing with high expectations despite not yet launching tokens.

Just last night, Fetch.ai announced a $100 million infrastructure investment initiative called “Fetch Compute,” while io.net revealed a $30 million Series A round backed by marquee investors including Hack VC and Multicoin Capital. Whether 2024 will bring an “AI summer” remains uncertain—but one thing is clear: the AI x Crypto narrative is becoming increasingly defined.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News