Crypto Market Data Insights for February: Top 50 Projects Underperform Bitcoin, While AI and MEME Sectors Remain Strong

TechFlow Selected TechFlow Selected

Crypto Market Data Insights for February: Top 50 Projects Underperform Bitcoin, While AI and MEME Sectors Remain Strong

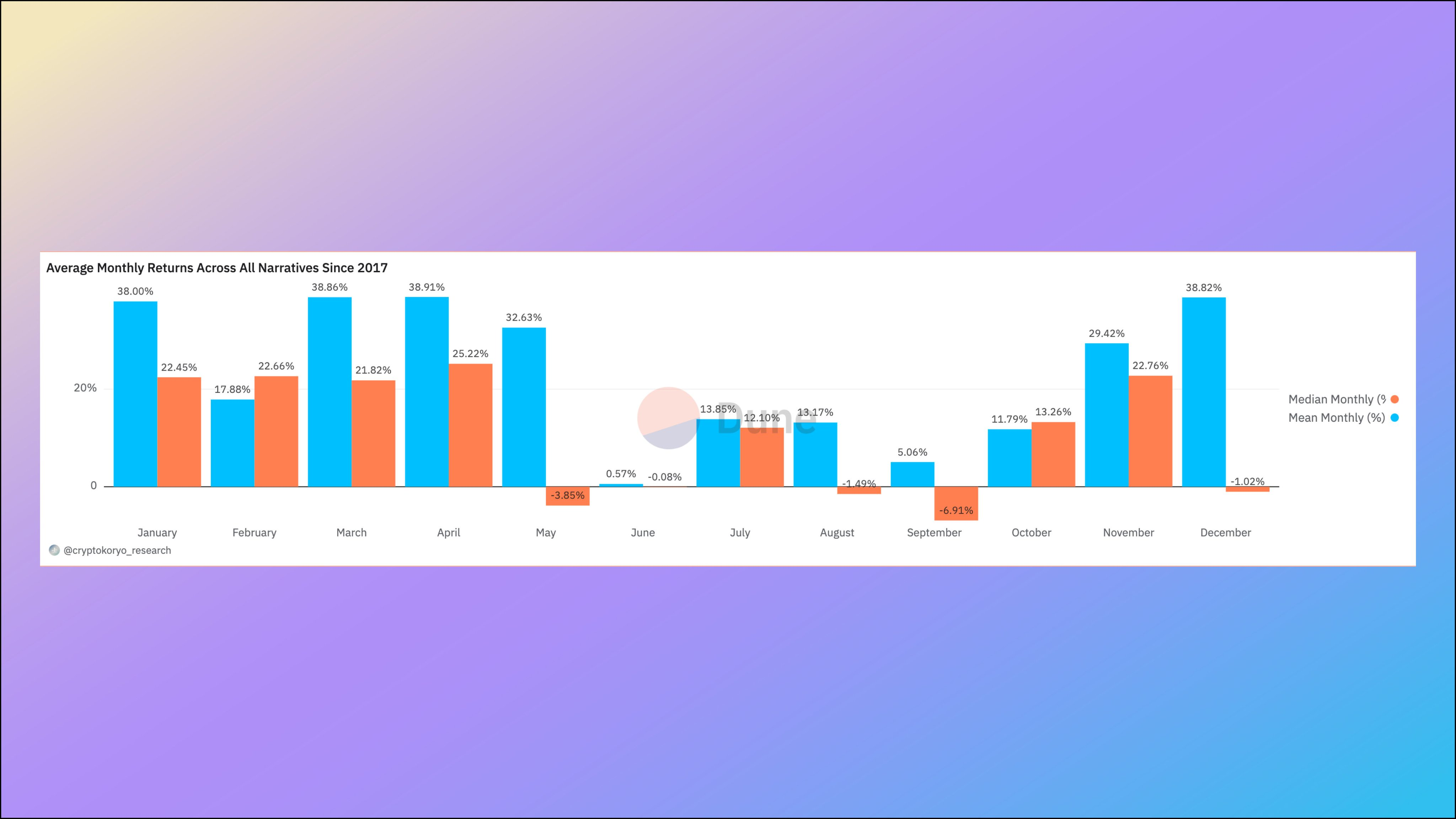

January to April are bullish months in cryptocurrency history.

Author: Crypto Koryo

Translation: TechFlow

What does the data on market trends and narratives in February tell us? This article will explain in detail.

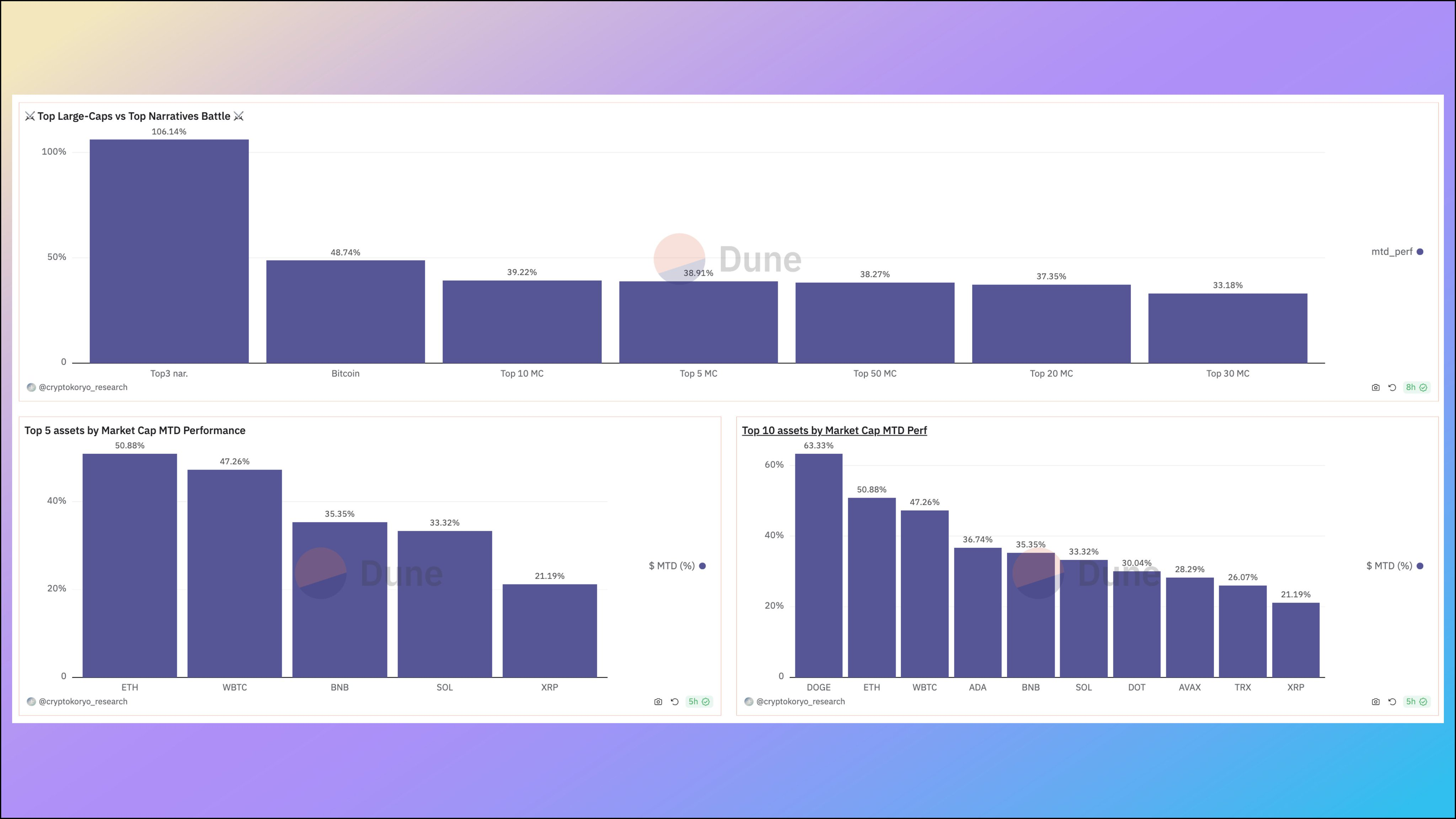

February was a significant month for Bitcoin. BTC rose 47%, clearly outperforming other assets.

As in January, the average performance of the top 5/10/20/30/50 market cap assets lagged behind BTC, although most of the top 50 assets delivered returns exceeding 20%.

ETH slightly outperformed BTC.

$DOGE was the best-performing asset among the Top 10. More on the meme narrative later.

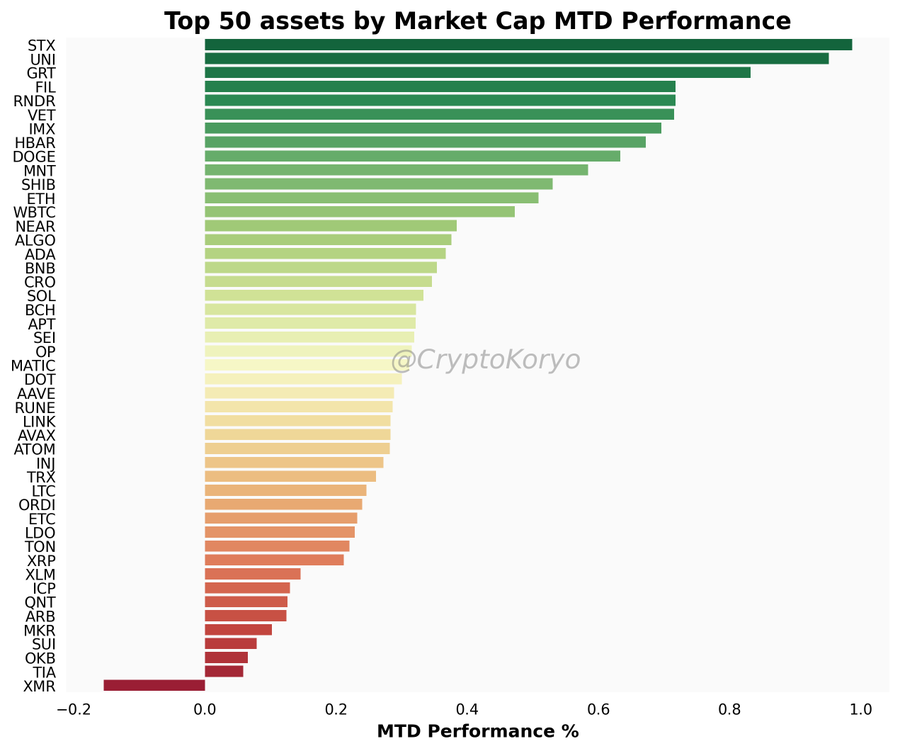

Among the top 50 market cap assets, the best performers were: STX, UNI, GRT, FIL, RNDR, VET, and IMX.

Note that this month’s worst performers were last month’s best: SUI, TIA, ARB, MKR, ETC, and LDO.

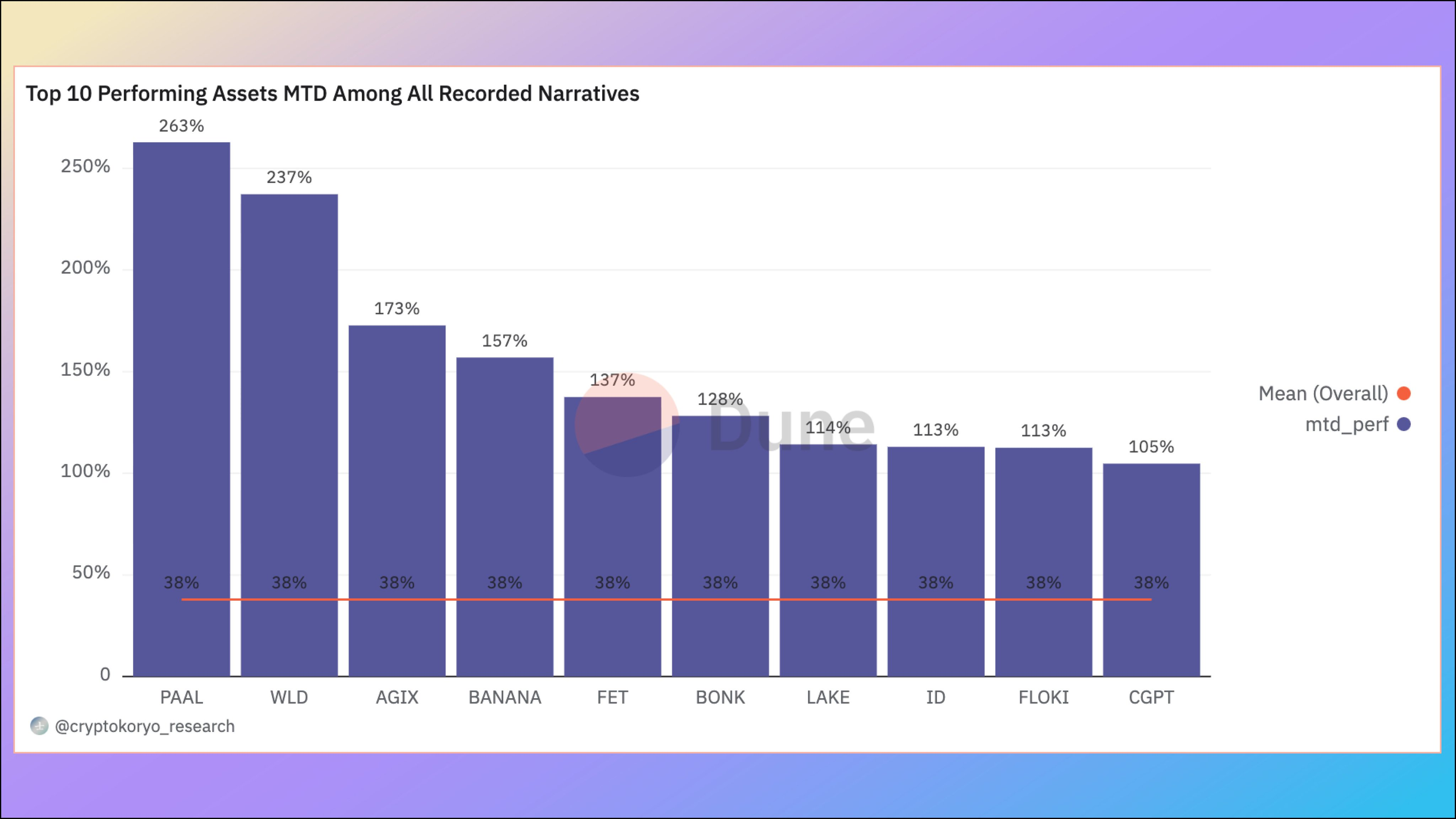

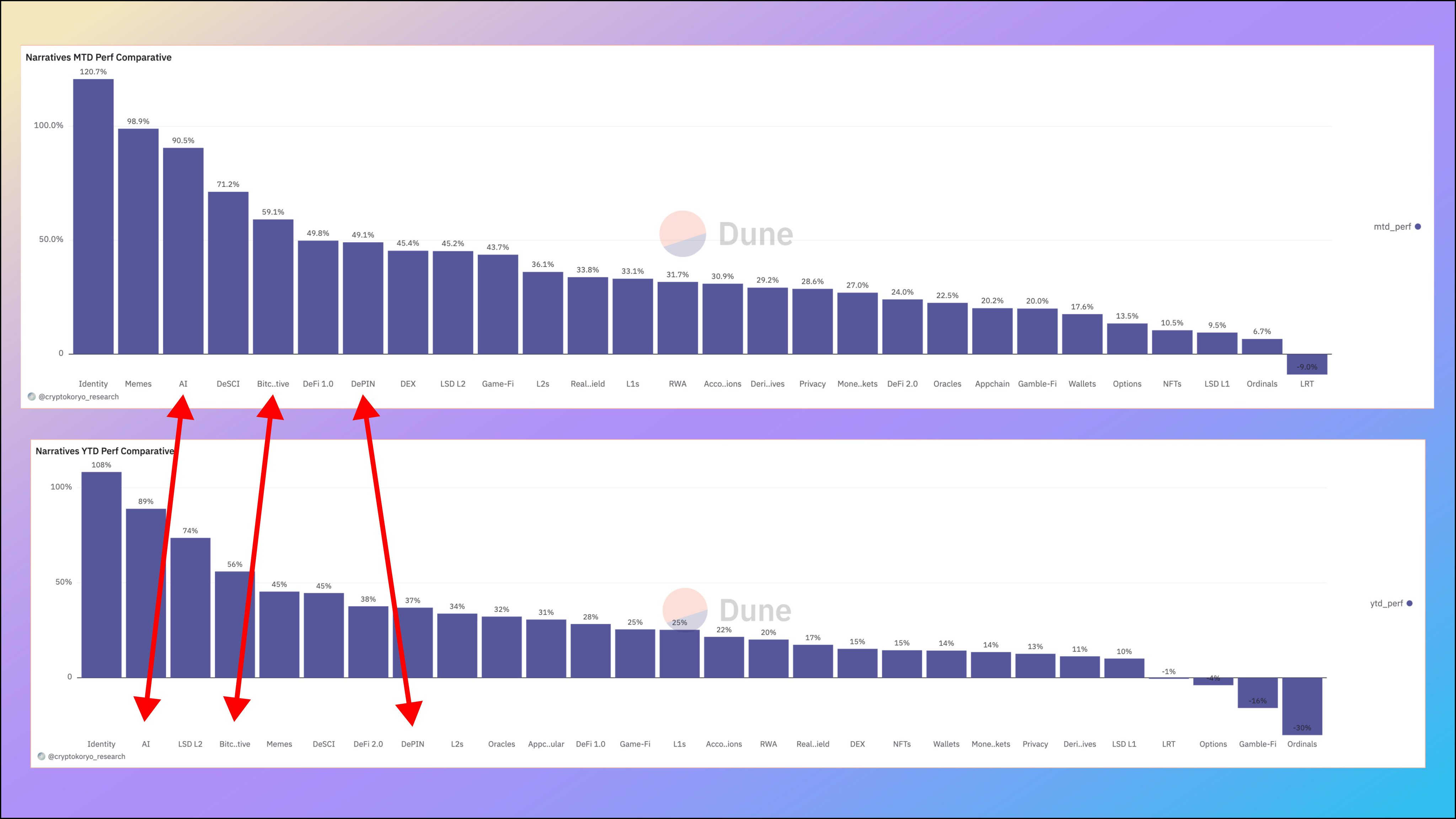

On average, narrative-linked tokens rose 38% in February (compared to -7% in January). February was the month of artificial intelligence and memes.

Among the 10 best-performing tracked assets:

-

AI: PAAL, AGIX, FET, CGPT, "WLD"

-

Meme: BONK, FLOKI

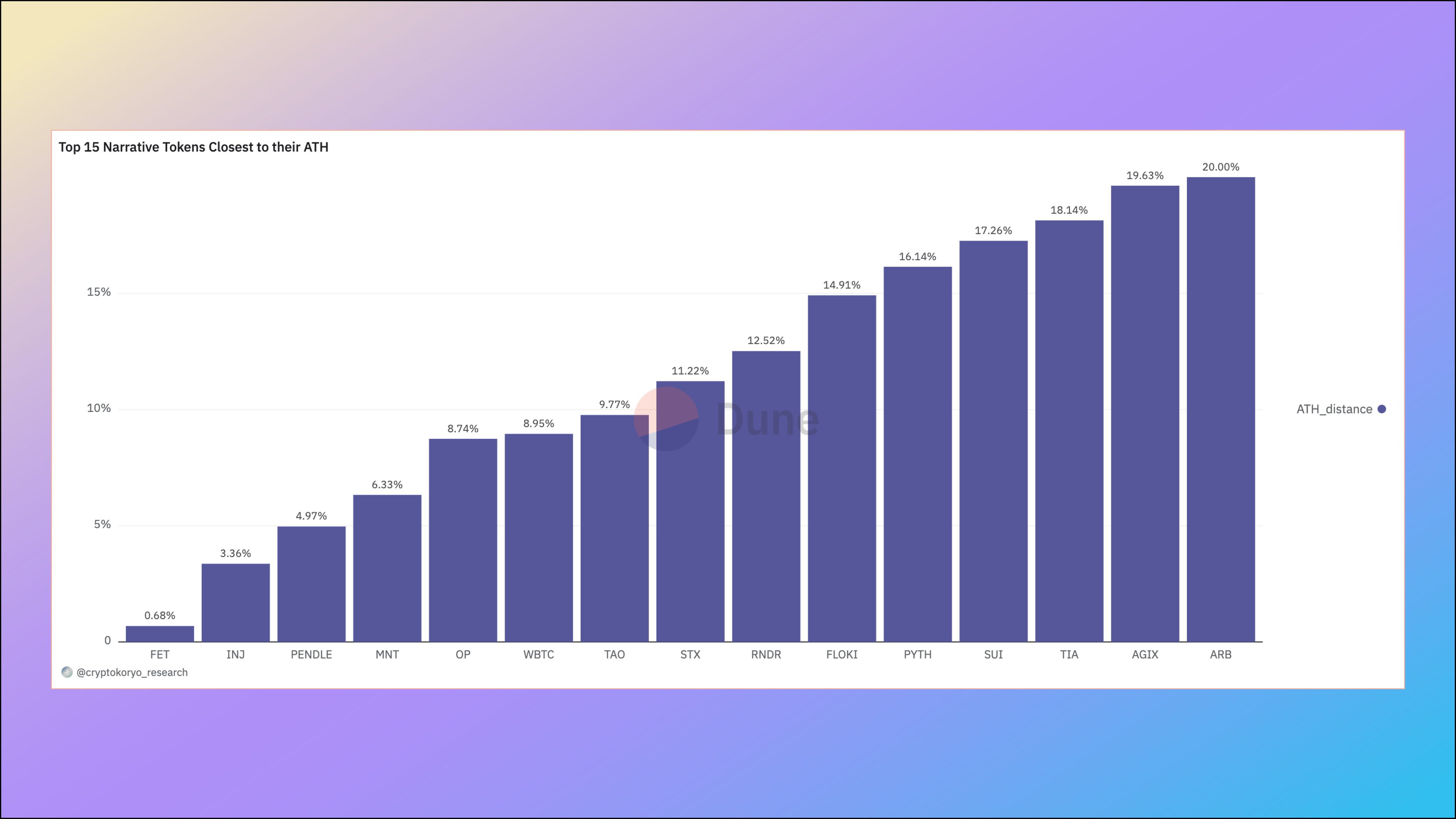

15 Narrative Assets Closest to Their All-Time Highs (ATH)

Compared to last month, new additions to this list include: FET, BTC, STX, RNDR, FLOKI, and AGIX.

Highlights:

-

AI narrative

-

Bitcoin narrative (BTC, STX, BCH)

-

Meme narrative

Now Let's Compare the Narratives

The three narratives you need to pay attention to are:

-

AI

-

Bitcoin DeFi

-

DePIN

In the first/second quarter of 2024, I believe other narratives are either noise affecting your investments or will perform poorly.

Some less popular narratives have short-term catalysts:

-

Uniswap fee mechanism switch benefits DEXs

-

OpenAI Sora benefits WLD (identity narrative)

I believe these are short-term and not sustainable long-term narrative shifts. Therefore, I would ignore them.

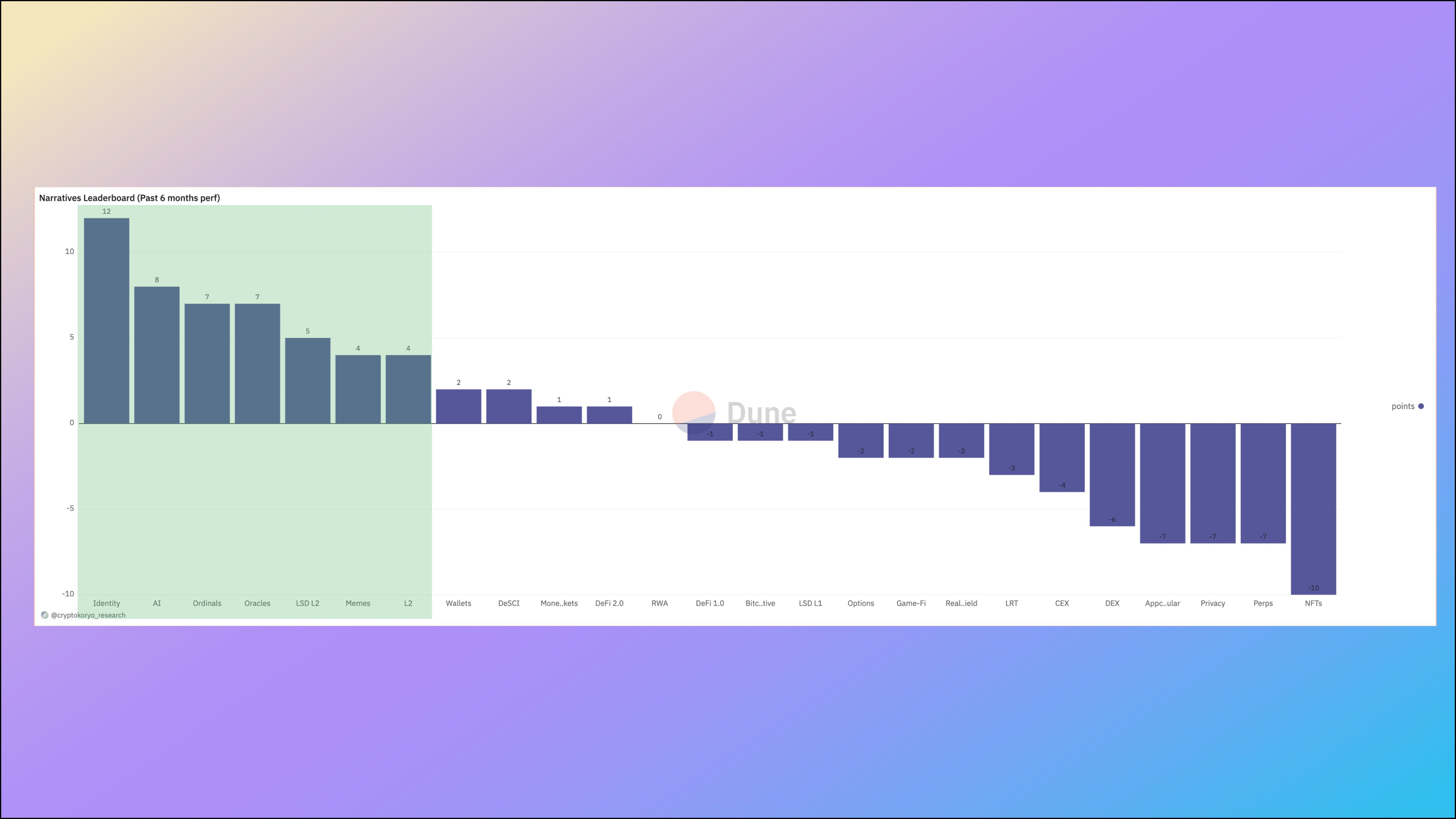

Narrative Rankings

Now let me introduce the new feature in my narrative dashboard.

We track the historical performance of each narrative every month and rank them accordingly.

Over the past six months, we proportionally reward the best performers and penalize the worst ones.

This chart shows that narratives on the right have consistently ranked among the bottom five performers over recent months (NFT, Perps, Privacy, DEX, etc.). You don’t want to be holding these tokens.

Narratives on the left have consistently ranked in the top five.

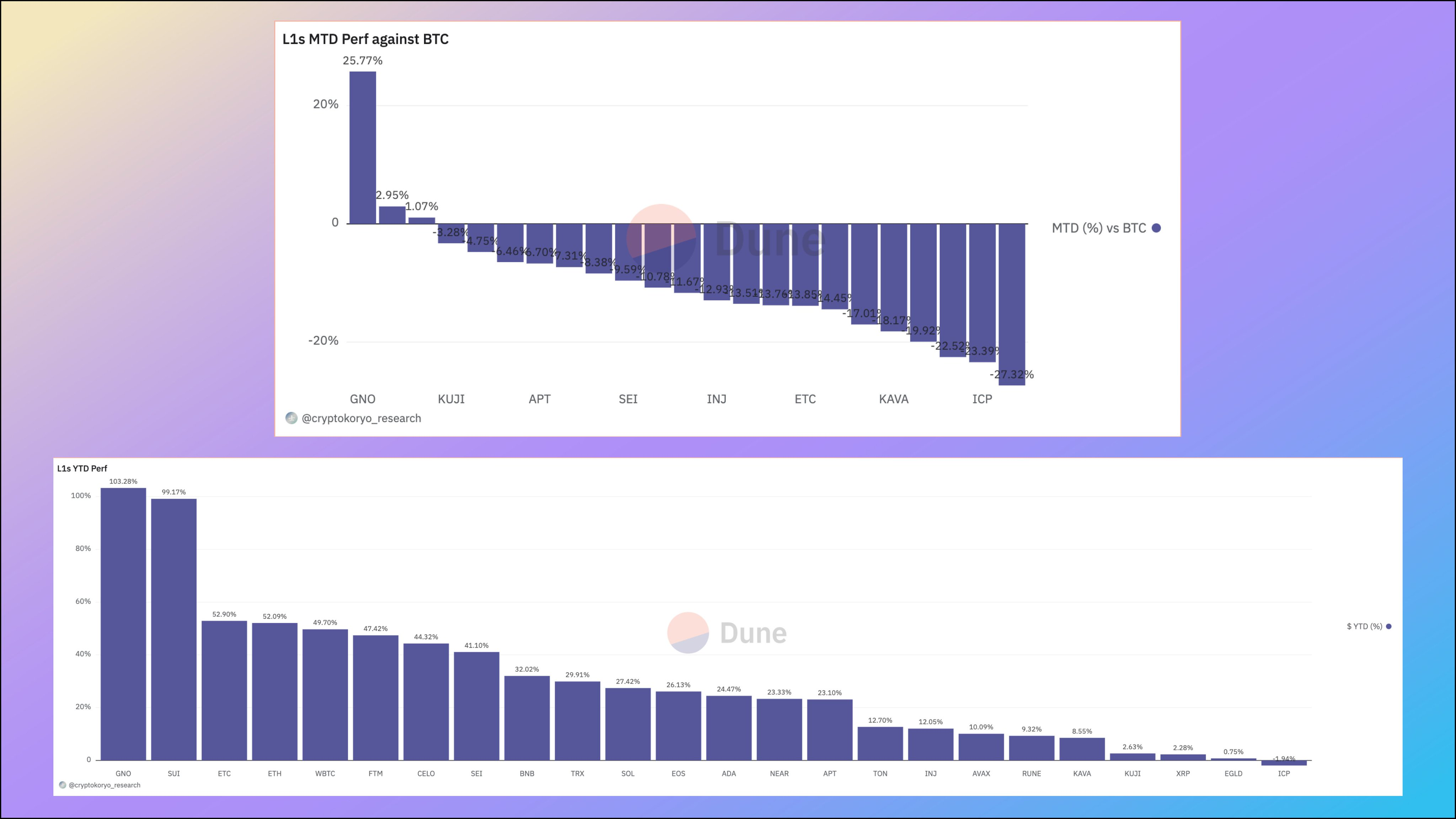

L1

GNO was the only L1 that truly outperformed BTC in February.

GNO is also the best-performing L1 token year-to-date, outperforming SUI and BTC.

I've outlined its pattern several times before.

After strong performance in Q4, L1s such as SOL, AVAX, KUJI, and Sui have recently underperformed.

L2

In the L2 space, STX dominates everything.

Why?

Simple: two narratives beat one. STX has two narratives: L2 + Bitcoin.

Narrative traders make easy money.

AI + Meme

AI continues to heat up. FET, RNDR, Ocean, TAO, etc.

Memes have also risen sharply recently. The old saying goes that a massive meme surge represents the final leg of a bull market rally, followed by a sharp correction. Not sure if this holds true in this bull run. Let's see.

What's Next

January through April are historically bullish months for cryptocurrency.

I expect the next two months to remain bullish.

The trend is your friend—and it hasn’t been this strong in a long time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News