Bitcoin charges forward, will the mindless profit-making altcoin season arrive as scheduled?

TechFlow Selected TechFlow Selected

Bitcoin charges forward, will the mindless profit-making altcoin season arrive as scheduled?

Market rotation patterns, ETH/BTC exchange rate, stablecoin inflows, and more—data will tell you the answer.

Author: Jake Pahor

Translation: Frank, Foresight News

Bitcoin has surged past $60,000, but why are our altcoins lagging behind?

No need to panic. In the long run, your altcoins remain among the most favorable long-term investments right now.

This article presents the latest report from crypto researcher Jake Pahor, offering a detailed analysis of the current altcoin market. It explores multiple dimensions including market cycle stage, Bitcoin dominance, ETH/BTC exchange rate, stablecoin capital inflows, DeFi TVL, and whether new retail investors are entering the market. The full text has been translated by Foresight News.

Market Cycle Stage

In the early stages of a bull market, Bitcoin typically absorbs most of the liquidity and rises first (Phase One), leading to an increase in Bitcoin's market dominance.

During this period, most altcoins (though not all) usually underperform compared to Bitcoin. In fact, this is a sign of a healthy market.

Bitcoin Dominance

The higher Bitcoin’s market dominance climbs, the more likely we are to see a prolonged altcoin summer afterward.

Bitcoin's dominance briefly dipped below its 20-week moving average in January 2024, but has since rebounded and stabilized at 55%—a key resistance level. If this resistance breaks, the next target could be 58–60%.

Eventually, BTC dominance will peak in this cycle and begin to decline.

As risk appetite grows, capital will progressively rotate into ETH → large-cap blue-chip alts → broader altcoins. “History doesn’t repeat itself, but it often rhymes.”

ETH/BTC Exchange Rate

Now let’s look at the ETH/BTC exchange rate chart—same story, opposite direction. Since December 2021, the ETH/BTC ratio has been in a prolonged downtrend.

In January 2024, there was a false breakout above the 20-week moving average, sparking premature hopes that the trend had reversed.

However, we’ve now pulled back again and are retesting the 20-week MA as resistance.

If the ETH/BTC ratio falls below 0.05—a previous key resistance level—we might see a sharp drop to even lower levels.

On the other hand, if the 0.05 level holds as new support, it may signal growing strength in Ethereum and potentially mark the beginning of Phase Two of the market cycle, which could coincide with the approval of spot Ethereum ETFs.

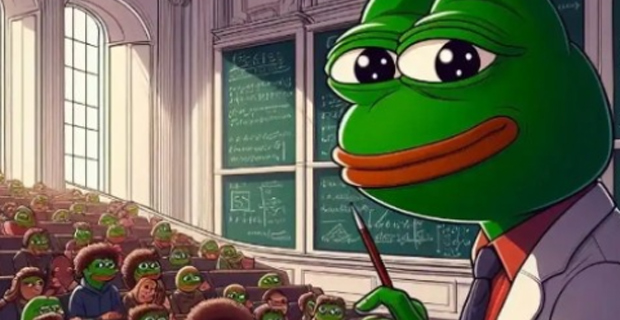

Stablecoin Capital Inflows

Since 2022, stablecoin market cap has been in a strong downtrend, consistent with capital outflows from the crypto space during bear markets.

However, data suggests a bottom may have formed in Q4 2023:

-

October 2023: Stablecoin market cap = $124 billion;

-

February 2024: Stablecoin market cap = $141 billion;

That’s a 14% increase over the period, confirming that bull markets go hand-in-hand with stablecoin inflows.

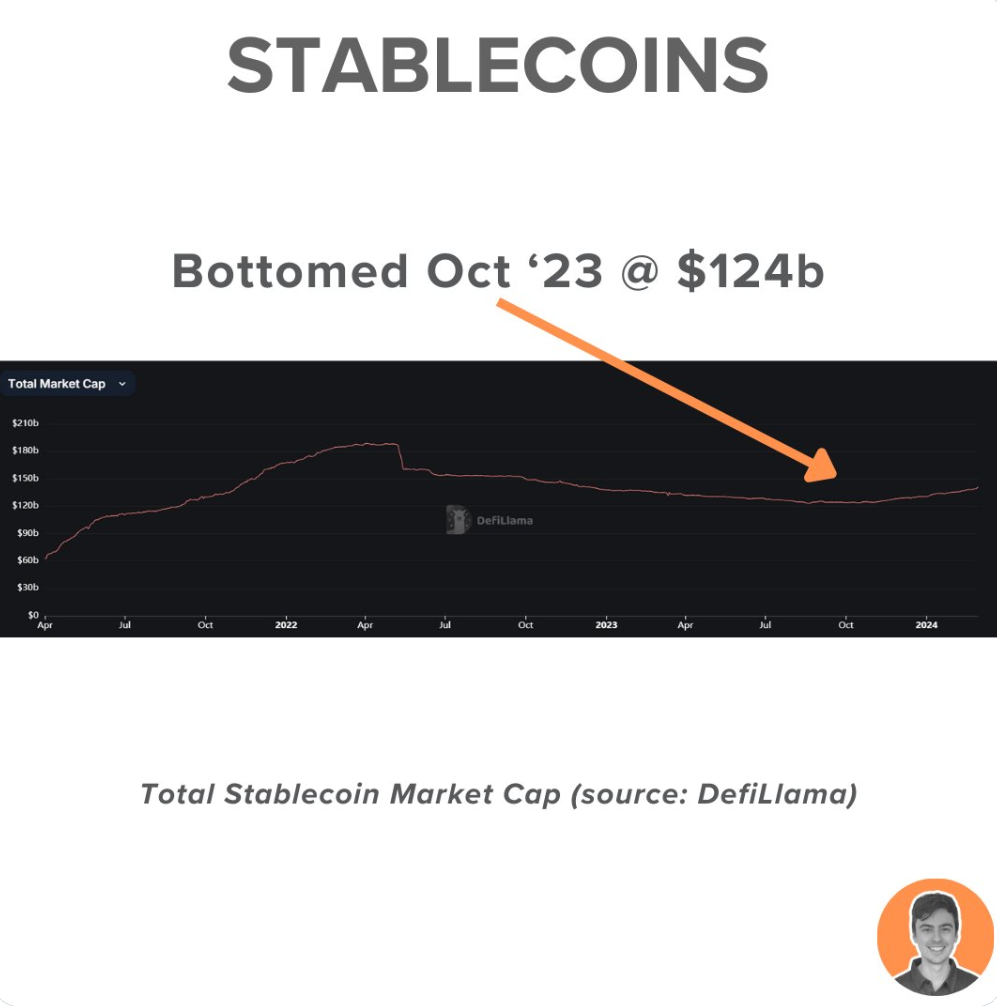

DeFi TVL

TVL is often seen as a lagging indicator, but still useful for gauging overall trends.

Since June 2022, DeFi TVL has fluctuated within a range of $35–65 billion. But in 2024, we appear to be breaking out:

-

October 2023: DeFi TVL = $36 billion;

-

February 2024: DeFi TVL = $86 billion;

In just four months, DeFi TVL surged by 239%!

Are New Retail Investors Entering?

New retail investors from outside the ecosystem are definitely not yet participating (at least not yet)—my family and friends outside the crypto world haven’t messaged me about crypto, and mainstream media coverage remains sparse.

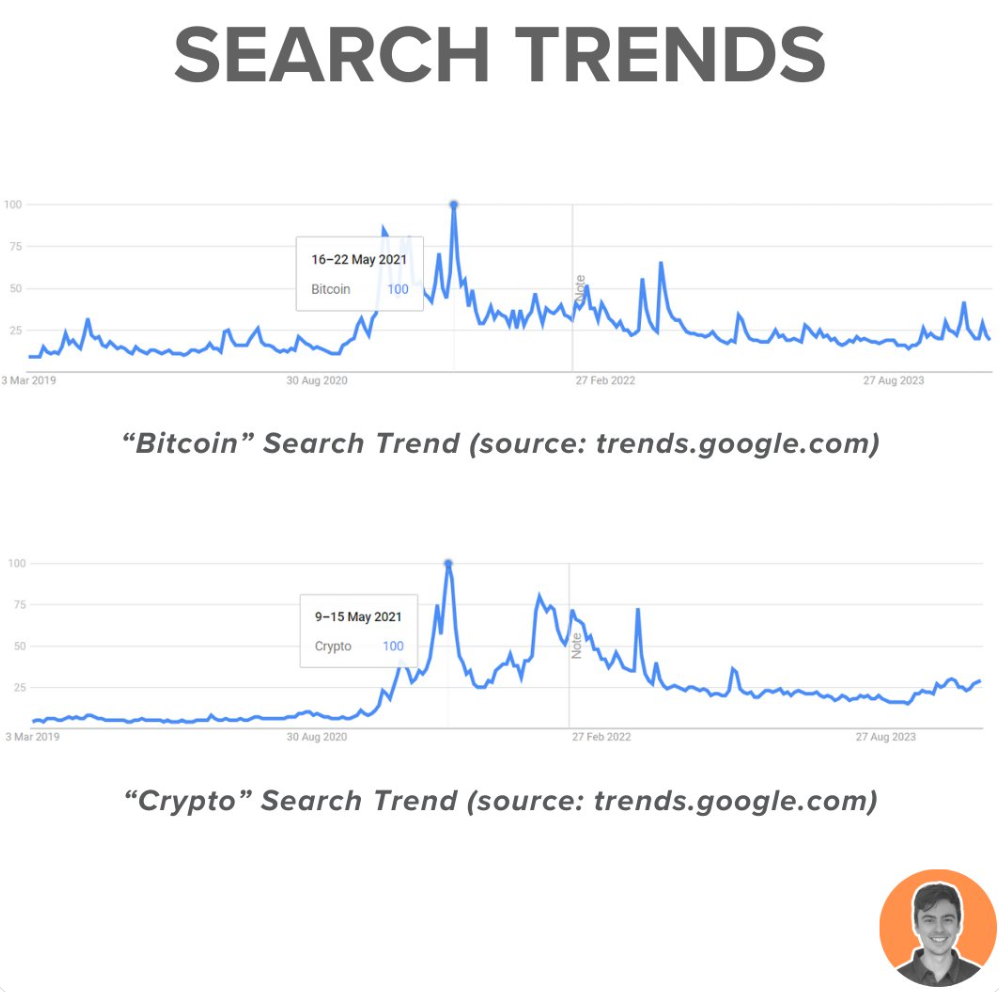

Google search interest for “Bitcoin” and “Crypto” peaked in May 2021, shortly after Bitcoin reached $64,000.

Currently, retail investor interest remains very low—scores stand at 19% and 29% respectively.

That said, retail interest is clearly recovering. The clearest evidence? Coinbase’s app crashed temporarily due to overwhelming demand, and its app store ranking is climbing rapidly.

-

Current rank = 165;

-

Historical low rank = 500;

-

Historical high rank = 1;

When Coinbase hits #1 again, we’ll undoubtedly be at the peak of the bull market.

Overall, I still find it hard to believe that BTC has truly broken past $60K and that we’re on the verge of new all-time highs.

Yet, with so many catalysts in 2024, it’s difficult not to turn bullish: ongoing inflows into BTC ETFs, potential approval of spot ETH ETFs, the Bitcoin halving, Fed rate cuts, and the U.S. election year.

There’s no doubt we’re in the early phase of a bull cycle, with capital still flowing predominantly into Bitcoin. Next, we’ll see momentum shift to Ethereum, then to altcoins.

Therefore, now is absolutely the time to double down and prepare for the inevitable alt season.

Whatever you do, don’t sell your altcoin portfolio now. Most people should simply hold steady and stay calm until the bull market peaks—just cash out incrementally during the expected period of wild volatility and surging prices.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News