What impact does AI have on secondary market investing?

TechFlow Selected TechFlow Selected

What impact does AI have on secondary market investing?

AI is useful, but the role of large language models is very limited.

Author: Lucida

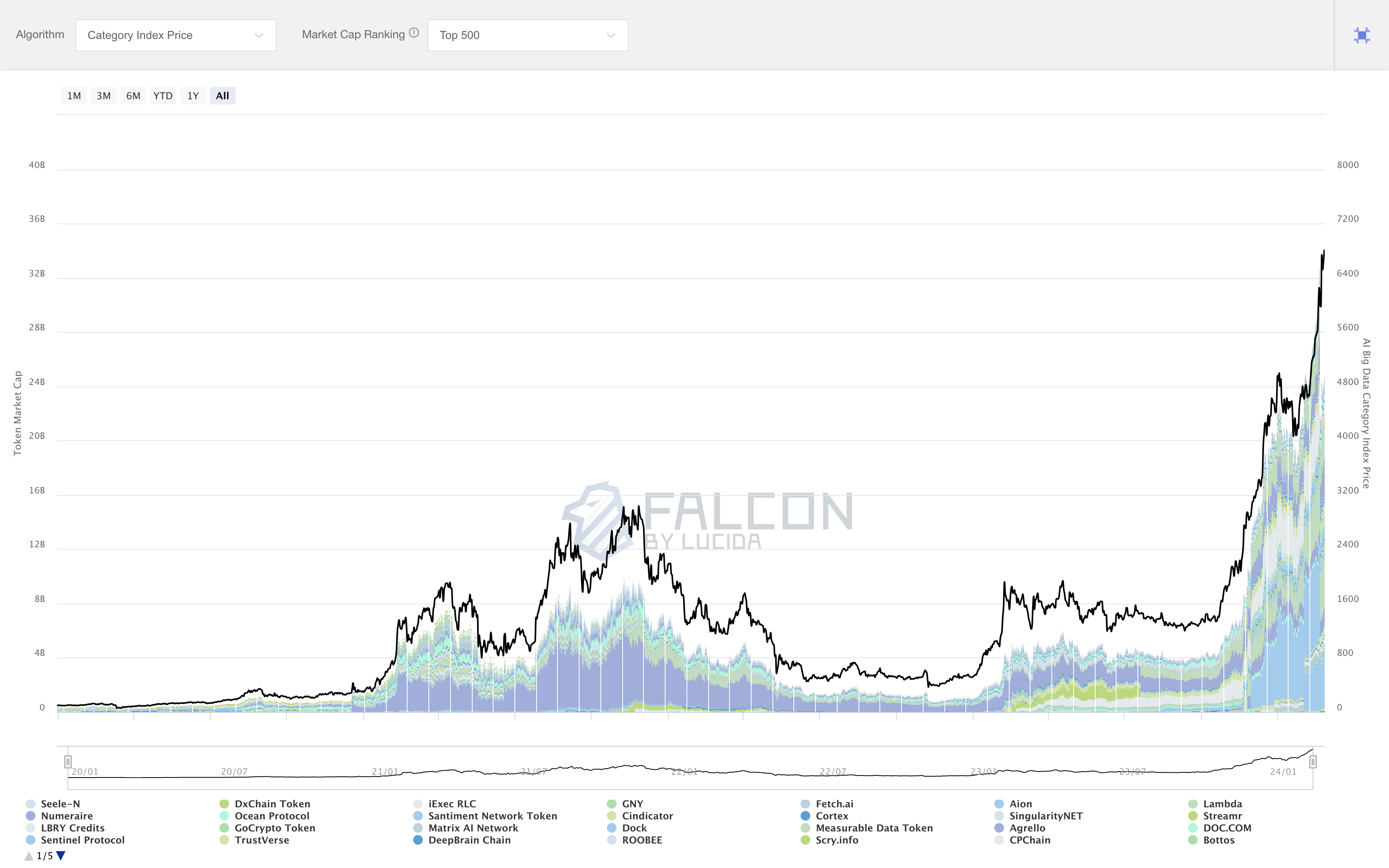

With the release of Sora, AI has recently gained another surge in popularity, sending the AI sector into a frenzy.

In recent years, traditional financial institutions such as Bloomberg, Wind, and Tiger Brokers have successively launched their own vertical large model applications. In the crypto industry, many products including Dune have integrated AI or even released specialized GPTs; I’ve tried most of them.

Core Competitiveness in Secondary Markets

Regarding "AI's impact on secondary market investing," my personal view is: AI is useful, but large language models play a very limited role.

The reason is: The core competitiveness in secondary markets lies in methodological and cognitive superiority over other market participants, not in productivity dominance.

Skilled (quantitative) traders develop stable, quantifiable trading strategies through long-term experience and deep understanding of market characteristics. Less competent traders suffer consistent losses and are eventually eliminated from the market, enabling a “survival of the fittest” evolutionary process that makes profitability increasingly difficult.

Therefore, to consistently outperform the market and generate profits, you must evolve faster than the market and understand other participants more deeply—this represents victory at the level of methodology and cognition, which is the true core competitiveness in secondary markets. In most cases, market consensus itself acts as a risk factor, so the ability to “seek non-consensus views” becomes the most crucial skill for a (quant) trader—an indicator of superior cognitive levels.

To elaborate further, this capability isn’t directly tied to whether one has studied CFA or financial engineering. If mastering CFA or financial engineering guaranteed profits, making money in secondary markets would be far too easy. A basic life principle applies: in any industry, to earn money you need something that the vast majority lack—that’s what creates competitive advantage. It could be resources, capital, cognition, methodology, experience, etc.

Hence, any person, thing, or project promising you easy or extremely low-cost high returns can safely be categorized as either malicious or foolish.

Back to AI. Based on my access to the most advanced publicly available large language model, GPT-4, its understanding and cognition of the world clearly lag behind humans. Its strength lies in enhanced productivity, with performance roughly equivalent to an undergraduate student. Thus, it does not meet the core competitiveness criteria we outlined above for secondary market investing. Only when GPT-level models approach—or surpass—human-level comprehension of the world will they bring revolutionary change to secondary market investment.

Moreover, current large language models within the crypto industry still exhibit generational gaps compared to even GPT-3.5, let alone GPT-4. Therefore, using vertical GPTs for crypto trading or providing investment decision support remains a long and challenging journey.

What Exactly Is AI Useful For?

Does this mean AI is ultimately useless for secondary market investing? No—it does have some applications. Here are several potential directions:

-

Factor mining: In traditional finance, a small number of top-tier hedge funds use ML/DL models to mine factors. Compared to manual approaches, this method excels mainly in generating a larger quantity of factors, albeit often at the cost of quality. However, this isn't mainstream practice and demands exceptionally high team capabilities.

-

Data cleaning/processing: For example, using ML to optimize missing values or outliers in datasets, or identifying MEV bot trading volumes.

-

Algorithmic trading: Primarily applied to micro-market structures like order books and bid-ask spreads.

-

Processing alternative factors: Analyzing content from news or social media to determine sentiment (Positive/Negative), or even assigning scores.

-

Using GPT to organize natural language data: For instance, converting unstructured text-based corporate filings from the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system into structured data—where GPT should perform quite effectively.

These are the main points I can think of—feel free to add if anything is missing. From these scenarios, we can observe several patterns:

-

Scenarios 1, 2, and 3 were already relatively mature before the rise of GPT.

-

Scenarios 4 and 5 fall primarily under GPT applications. I haven't tested #4 extensively, but its usefulness is likely limited—for two reasons: first, alternative factors usually make up a small portion of multi-factor strategies; second, factors extracted via simple, low-cost methods are unlikely to be effective, and if they are, they’ll quickly become obsolete. Scenario #5 mainly boosts productivity.

-

All the above use cases involve applying AI to very specific, narrow tasks—not using AI directly to execute trades or make investment decisions—because AI’s level of market understanding remains too low. Additionally, the signal-to-noise ratio in finance is extremely poor compared to fields like autonomous driving.

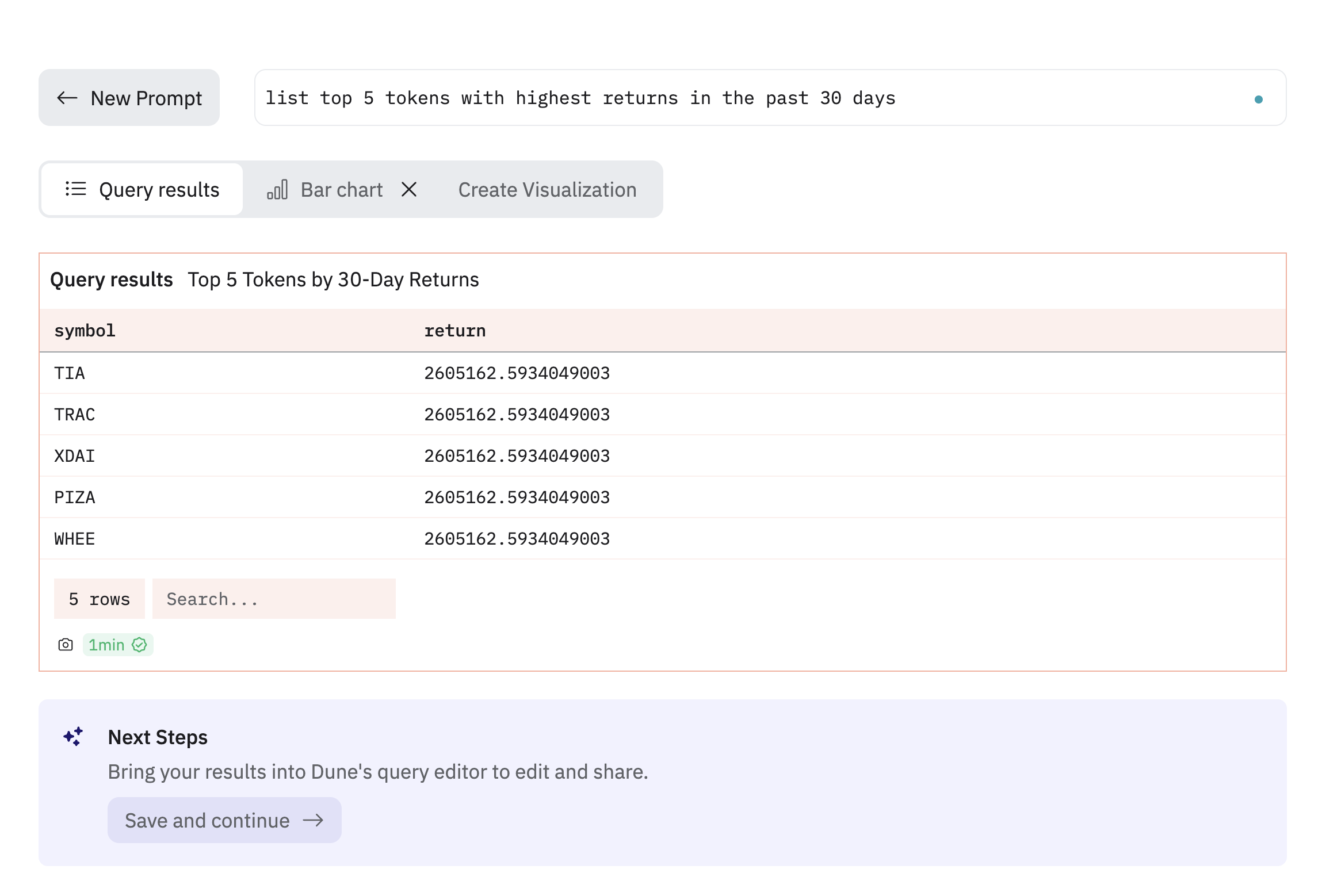

Viewed from this angle, Dune’s approach in the crypto space seems relatively reasonable. It doesn’t attempt to act as a smart advisor giving direct trading signals—nor is that its intended role. Instead, it uses AI to enhance user productivity, since writing SQL poses a significant barrier for average users. Although admittedly, the product isn’t particularly intelligent yet…

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News