It's not easy to buy crypto in a bull market: seven indicators to consider for decision-making

TechFlow Selected TechFlow Selected

It's not easy to buy crypto in a bull market: seven indicators to consider for decision-making

The best thing to do during a bubble is to invest in promises and projects that cannot yet be quantified.

Author: ROUTE 2 FI

Translation: TechFlow

What to Consider When Buying Cryptocurrencies in a Bull Market

The bull market is driving wave after wave of upward momentum, with every coin rising to varying degrees.

Today I want to talk about some fundamental principles you should consider when investing in tokens.

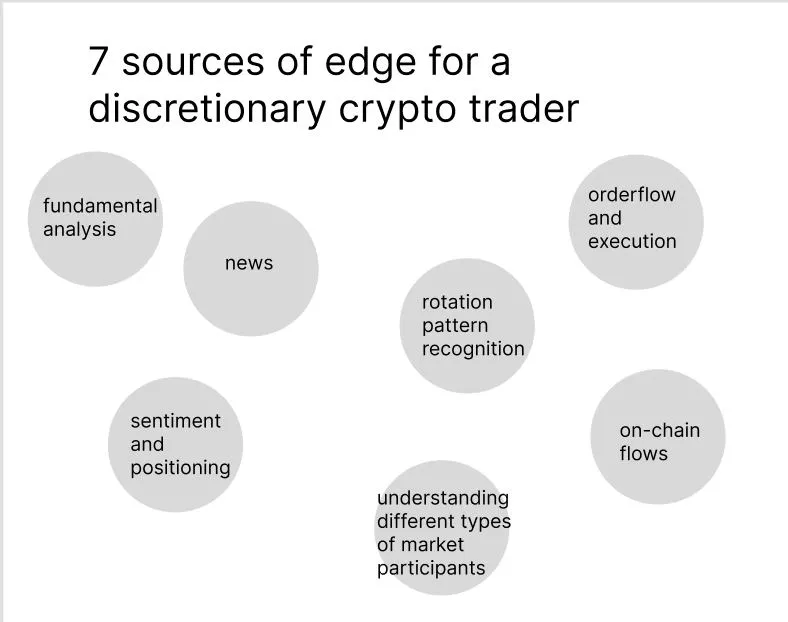

I think the image below perfectly summarizes what you need to keep in mind.

From the chart above, you can see seven different categories:

-

Fundamental analysis

-

News

-

Sentiment and positioning (including technical analysis)

-

Market sector rotation pattern recognition

-

Understanding different types of market participants (difficult unless deeply involved in the industry)

-

Order flow and execution

-

On-chain flows

Let’s dive straight into discussing a few specific tokens.

$MATIC

Polygon has lagged behind the market over the past year due to oversupply, lack of focus in its roadmap, and failed product launches around mid-2023.

-

AggLayer Mainnet launched last Friday the 23rd

-

Polygon is becoming a dominant player in the ZK ecosystem

-

Conversion from MATIC to POL will occur in Q2 2024

-

POL stakers will receive airdrops from new L2s on Polygon, similar to Celestia

-

Similar to Eigenlayer, POL can be re-staked to earn yield from new L2s built on Polygon

-

Everyone has already sold; downside risk is low

-

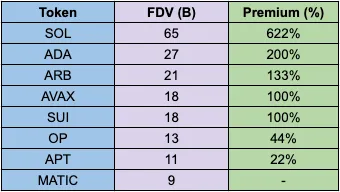

With a FDV of $9 billion, MATIC appears significantly undervalued compared to many other L1s

We are in an uptrend, and L2s will benefit from EIP-4844 (Matic should also ride this narrative). Downside risk for Matic seems minimal, but it remains a cursed token—personally, I don’t see massive upside potential in Matic.

$SEI

It's a Layer 1 blockchain designed specifically for asset exchange and trading, featuring ultra-fast TPS and finality (settlement), making it ideal for DEX perpetual contracts. Don't we already have plenty of DEXs? Well, they still fall short compared to CEX user experience—and that’s exactly what $SEI aims to solve. Here are its key features:

-

Fastest L1

-

Team members from Google, Goldman Sachs, Robinhood, Nvidia

-

Raised over $130 million (Jump, Coinbase Ventures, Circle, Delphi, etc.)

-

Developers from Terra (smooth UX/UI)

-

$2 billion market cap, $9 billion FDV

-

Frequently mentioned by influencers like Hsaka

-

Just launched v2

-

Appears poised to replace last cycle’s $LUNA and is highly favored within the space

As a drawback, Sei’s DeFi ecosystem only has $20 million in TVL—essentially no real ecosystem yet. However, their main goal is to launch a DEX capable of competing with Binance/Bybit, so evaluating them based on early-stage TVL may not be meaningful.

Dangers of the Bull Market

A few months ago, I read this sentence on Twitter and wrote it down in my notebook—I don’t remember who originally said it, but it’s excellent advice:

-

Don’t be the person who isn’t bullish enough, doesn’t hold long-term, lacks diamond hands, hesitates, fails to understand the power of a bull market, and takes profits after small gains. This kind of person won’t make big money because he lacks courage, vision, and the ability to endure pressure. Day-trader type, technical-analysis-focused...

-

But also don’t become the one with diamond hands who believes every narrative, holds positions and invests out of excessive optimism, accumulating generation-after-generation of paper gains. That’s all fine. But he never fully understands the market, so he keeps betting bigger and bigger, never cashing out. His wealth eventually gets returned entirely to the market. His reason for success becomes his reason for failure.

What Kind of Investor Should You Be?

Be the ultimate degen. The one who believes in everything, believes in a bright future, makes bigger bets, and doubles down on long-term positions. But then at some point, this person suddenly exits the market completely, laughing while talking about the massive fortune he just made on something that was about to collapse—a Ponzi scheme that will never happen again.

Investors who performed well during the 2022 bear market might struggle in a bull market, at least initially. The reason is they can’t approach two very different market environments in the same way—only those who adapt will excel again.

In a bull market, money becomes greedy, leading to rampant speculation. The best thing you can do during a bubble is invest in promises and projects whose value cannot yet be quantified. A perfect example is Worldcoin—they aim to scan everyone’s eyes worldwide, and Sam Altman is behind it. When you don’t understand something but hear everyone saying it will revolutionize an industry, it becomes easier for such a project to reach valuations in the hundreds of millions or even billions. You start seeing projects adopt new technologies, new platforms, new partnerships—everything looks amazing.

If you look closely, you’ll find that some coins with zero revenue and no activity still appear promising and perform far better than coins with stable income streams. Next time you see a project, don’t dismiss it just because it lacks a mature product, has few users, or doesn’t generate sufficient revenue. Those shouldn’t be reasons to reject investing in a token. If you want to make crazy money, embrace speculation.

Many believe that once a token gets hyped, it’s too late or too risky to buy. But flip the script: the primary purpose of a token is to generate hype. Therefore, once a token *is* being hyped, it has already proven its ability to attract attention—making it actually less risky.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News