How to identify 20x to 100x coins in the next bull market?

TechFlow Selected TechFlow Selected

How to identify 20x to 100x coins in the next bull market?

Don't let bear market PTSD rob you of the chance to capture insane gains during bull markets and alt seasons.

Author: VIKTOR

Translation: TechFlow

I've spent considerable time studying the previous bull market, the popular narratives at the time, profit-maximizing rotations, the top-performing tokens of 2021, and the logic behind their massive gains.

This new cycle won't be exactly the same as the last one, but we should remember many lessons because history rhymes—especially in financial markets, where much of the boom stems from how the human brain works, something that never changes.

Let’s dive right in.

General Lessons from Bull Markets

New coins outperform; old coins underperform

A notable trend during the 2021 bull run was the poor performance of older coins—almost none of the 2018-cycle tokens performed well in 2021.

Ripple (XRP), Stellar Lumens (XLM), Bitcoin Cash (BCH), NEO, XEM, IOTA, EOS, Dash, Monero (XMR), Zcash (ZEC), and Tron (TRX) have never again reached their prior all-time highs (in USD) and have essentially only declined against BTC since 2018.

Of course, apart from BTC and ETH, the only strong performers among major legacy coins were BNB, Cardano (ADA), Ethereum Classic (ETC), and of course DOGE.

Below is a screenshot of CoinMarketCap's rankings from December 2017. I strongly recommend reviewing historical snapshots from several dates to help you understand how the crypto market "rotates."

Most altcoins underperform BTC before the real bull market begins

When we're mid-bear market and believe we're near the bottom, it's clearly the best time to buy BTC and ETH and hold into the next bull run.

But under the same logic, you might also be tempted to buy altcoins because they have high beta to BTC and thus should outperform. While this may indeed be true for certain altcoins, it didn’t fully play out in the last bull market.

Most altcoins underperformed Bitcoin during its late-2020 rally and only suddenly began to take off in early 2021.

The good news is that by holding BTC and ETH until the bull market started, you didn’t really miss out on outsized gains.

If history repeats, here’s what we should expect: BTC (and perhaps ETH) should experience a period of independent strength while altcoins lag, leading to rising BTC dominance—then suddenly rotation kicks in, and altcoins begin to surge wildly.

But I don’t think this is exactly what has already happened or will happen: over the past few months, we’ve seen $BTC rise alongside BTC dominance, just like in 2020, but this time—from June 2023 onward—we’ve already seen many tokens outperform BTC.

BTC Dominance

My interpretation:

-

For long-term investors, the bottom came in November 2022 for $BTC (and $ETH—even though in hindsight, avoiding ETH dips in 2023 was the best move), and the right time to buy select altcoins was around June 2023

-

There’s significant divergence in altcoin performance: $ETH underperformed $BTC in 2023, some older altcoins have also trailed $BTC over recent months, while certain altcoins have vastly outperformed the market

Still, we haven’t yet seen the mania phase for altcoins. I expect full-blown mania to kick in when BTC breaks through its previous all-time high ($69,000).

Most gains are concentrated in just a few months

A large portion of these crypto gains occur within a relatively short timeframe. Almost all the action happens within a few months—especially with altcoins.

For example, in the last bull market, the key periods were January to May 2021, then August to November. These were “only up” phases where your new competitors were retail investors who had given up on crypto three years earlier.

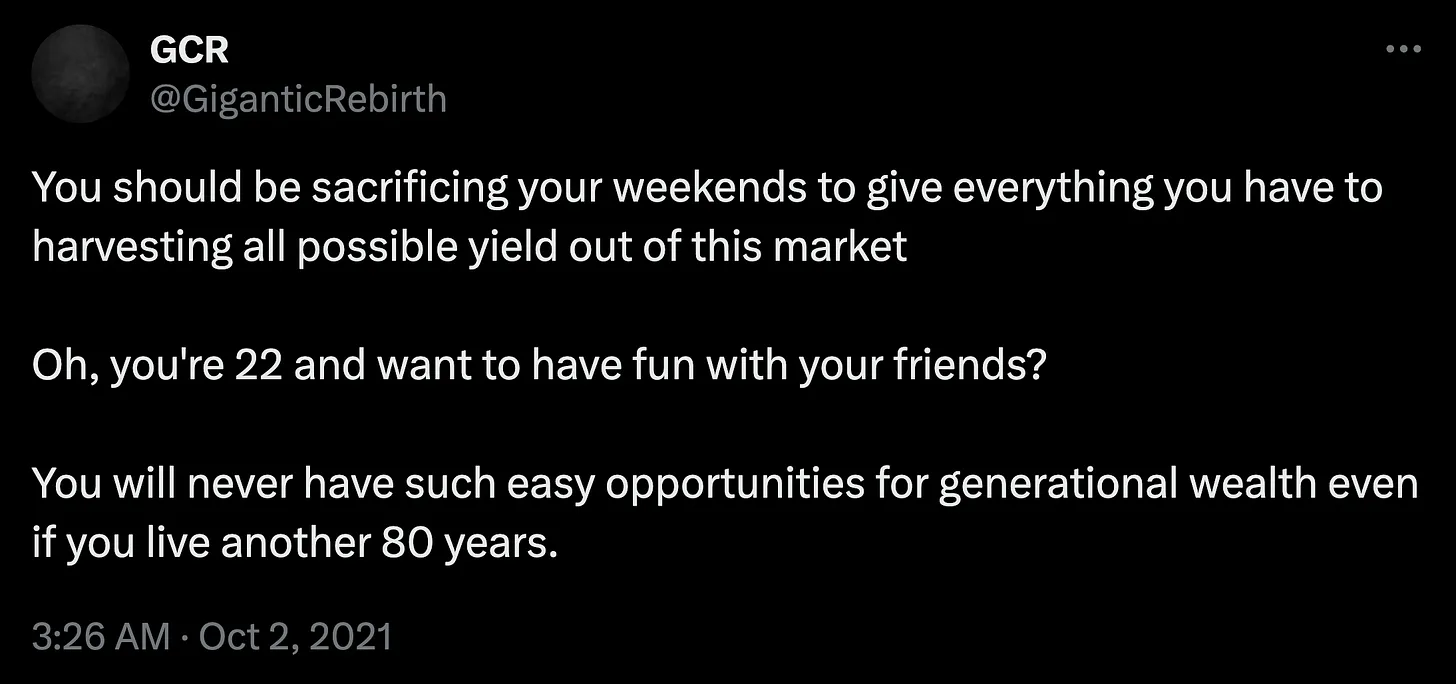

These are the moments when you need to dedicate 100% of your attention to the market. A famous GCR tweet summarizes what you need to do during such times:

Here are a few examples to illustrate just how fast and concentrated these rallies can be:

-

$CHZ: up 30x in one month (February–March 2021)

-

$BNB: up 8x in 20 days (February 2021)

-

$DOT: up 8x in two months (January–February 2021)

-

$SUSHI: up 6x in one month (January 2021)

-

$AAVE: up 6x in one month (January 2021)

-

$HOT: up 35x in two months (February–March 2021)

-

$JOE: up 60x in two weeks (August 2021)

Don’t let bear market PTSD rob you of the chance to capture insane gains during the bull market and alt season

If this is your first market cycle, you’ll likely enter too late, let your investments skyrocket at irrational valuations without taking profits, and end up giving back many of your gains. But if you’re reading this, you’ve probably lived through the last cycle and survived the particularly brutal 2022 bear market. During a bear market, you must remain skeptical of every rally and be ready to short any altcoin that spikes due to some catalyst. This behavior gets rewarded. But in a bull market, everything flips: coins go far higher than you imagine. You must be prepared to benefit from it.

Below are several examples of tokens that went absolutely parabolic in short periods during 2021, reaching extremely high valuations:

-

In January 2021, $DOGE surged nearly 10x in a single day—even though it was already a billion-dollar token

-

$THETA’s market cap rose from $1B to $12B in 3 months

-

$RUNE’s market cap grew from $200M to nearly $5B in 5 months

-

$FIL briefly reached a FDV close to $400B

-

$ICP launched with a $250B FDV

-

$AXS’s market cap jumped from $200M to $10B in 5 months, peaking with a $43B FDV

-

$GALA peaked at a $5.4B market cap in 2021, up from just $5M at the start of the year

-

$TEL’s market cap soared from $10M to $30B (300x) in 5 months

Evolution of total crypto market cap during the last bull market

Key Narratives of the 2021 Cycle—and Where the Best Gains Were Made:

DeFi 1.0:

DeFi emerged as something new in crypto in 2020, offering novel use cases and appearing seemingly out of nowhere. DeFi was the focus of the market during the summer of 2020, which is why it became known as “DeFi Summer”—we can consider this the beginning (or pre-beginning) of the bull market.

Add a layer of ponzi economics to the whole thing, and you have the recipe for massive returns. The two biggest winners in fundamentally strong DeFi projects were $AAVE and $SNX. From bottom to peak, these delivered gains between 500x and 1000x. We can also mention $SUSHI, which rose 30x between November 2020 and March 2021.

Alt L1

Alt L1 plays are among the most enduring trades in crypto and were one of the most valuable during the last cycle. The main winners here were $SOL, $LUNA, $AVAX, but also $FTM, $ADA, $BNB, $EGLD.

The market assigned a very high premium to Alt L1s, meaning on average they were valued (by market cap or FDV) higher than other categories like applications. Once you know this, you know you must engage with this narrative. It quickly became clear that this was one of the defining themes of the 2021 bull market, as some of these were among the top performers from the outset—until Terra-Luna’s collapse in May 2022.

The lesson here is: once you identify the main theme of the cycle, simply ride it. The second lesson: Alt L1 plays never disappear. It was a dominant theme in 2021, but in fact, it was already prominent in 2017 and is emerging again in 2023–2024.

The Alt L1 Ecosystem Playbook

In crypto, whenever a coin starts rising, traders look for tokens associated with it—or logically expected to follow. That’s why, when an L1 coin surges, people start hunting for all tokens within that network’s “ecosystem,” expecting smaller-cap tokens to pump even harder as “beta” to the L1.

Usually, the primary ecosystem token is the dominant decentralized exchange (DEX) on that network, and in the last cycle, some insane gains were made there:

-

For example, BSC had its moment in the first two months of 2021, so $BNB began a massive run from $40 to a high of $700, while $CAKE, the main DEX on BSC, went up nearly 50x in about a month. For some traders, $CAKE was their single best trade of the entire 2021 bull market.

-

Another example was in the Avalanche ecosystem: like most coins, $AVAX had a strong start in early 2021 but dropped sharply (-70%) in May, then rebounded strongly in August 2021. Naturally, traders looked for beta plays—$JOE, Avalanche’s DEX token, surged 50x in two weeks. $PNG, another major DEX on Avalanche, only managed a 4x gain over the same period.

Beyond DEXs, you could also consider meme coins, money markets, perpetual DEXs, CDPs (over-collateralized stablecoins), and launchpads. In 2024, I believe people are more inclined toward “main meme coin on X chain” rather than “main DEX on X chain.”

Metaverse

On October 28, 2021, Facebook announced it was rebranding to Meta, with the new company’s focus being “building the metaverse.” This immediately triggered an extreme speculative wave in the crypto market: metaverse mania had begun.

Three tokens led this narrative: $SAND, $MANA, and $GALA. All nearly 10x’d within a month, and all you needed to do was buy them after Meta’s announcement—even if they had already risen 20% post-news.

At the time, the market was nearing peak euphoria, and with Meta’s announcement bringing traditional finance and real-world media attention, it created a powerful narrative that lasted about a month.

Moreover, the metaverse was closely tied to gaming, and a major crypto game, $AXS, went completely parabolic during summer 2021. Gaming + metaverse became another strong catalyst, prompting people to search for “the next Axie Infinity.”

The lesson here: stay aware of tech and real-world trends beyond crypto, because in a risk-on environment, if a tech trend has any link to crypto, it will almost certainly become a narrative—as we saw with the metaverse and gaming frenzy.

The closest equivalent in 2024 to the 2021 metaverse narrative is AI: ChatGPT’s release didn’t coincide perfectly with a bull market or a concentrated AI narrative, so we didn’t get a full-on one-month AI mania (unlike metaverse), but AI tokens performed exceptionally well during the January–February 2023 bubble—the most risk-on environment of that year—and again in October/November 2023, and now once more in February 2024.

I believe many AI tokens are mostly vaporware, but I don’t want to dismiss a narrative so powerful in the tech world. Some of the wildest gains of this cycle will come from the AI sector.

Meme Coins

Meme coins were among the top performers in the last cycle. $DOGE started 2021 with a $600M market cap. Over the next five months, fueled by Elon Musk’s strong promotion, it surged 150x to a massive $90B market cap at its peak.

A few months later, a great rotation occurred, and another dog-themed meme coin, $SHIB, reached a $40B market cap—up from less than $5M at the start of 2021.

Many other meme coins reached insane valuations: $SAFEMOON (peaked at $17B), $ELON (over $1B), $AKITA ($1.5B), $FLOKI ($3B).

Memes will definitely persist, and likely some meme coins will be the top performers in the new cycle. In crypto, price is driven not by fundamentals, but by narrative and speculation—and meme coins take this to the extreme.

NFTs

NFTs represented a completely new crypto category and narrative during the 2021 bull market (technically not new, but new to the market)—and also produced some of the wildest gains.

When we say “NFT,” we mainly mean profile picture (PFP) collections. The first (and OG) craze was CryptoPunks, whose floor price jumped from 5 ETH in January 2021 to 20 ETH in March, then soared again to 100 ETH by summer! Just a year earlier, in summer 2020, the floor was only 1 ETH.

Numerous NFT PFP collections launched, with Bored Apes clearly the most successful after CryptoPunks—but we can also mention Pudgy Penguins, Art Blocks (not a PFP series), Doodles, Cool Cats, etc.

Thoughts on the Cycle: How to Play Narrative Rotation for Maximum Profit?

Crypto trading is a game of rotating from one narrative to another. While it’s nearly impossible to catch every short-term rotation perfectly, we can remember some key lessons. Some narratives stay strong throughout the bull market—for example, L1 plays never really stopped—but most trends last about a month, which is the first thing to know. The bulk of the move usually happens over a few weeks to a month, then fatigue sets in, and market attention shifts elsewhere. Of course, this is a very rough pattern—some coins manage to perform well for consecutive months—but generally, if people have been talking about something nonstop for a month (think metaverse in November 2021), beware: the trend may already be exhausted.

As we progress through a bull market, risk appetite increases. This means early-stage narratives may have solid fundamentals, but over time, traders seek increasingly risky, high-return, and increasingly illogical opportunities.

For example, in 2020–2021, $LINK (strong fundamentals) was the top performer in the bear market, followed by DeFi Summer, which introduced a new paradigm—DeFi (strong fundamentals). Then came the BTC rally, and in the first part of the bull market, some DeFi tokens were the best performers ($AAVE, $SNX, $RUNE, $UNI).

In the following months, the market grew increasingly speculative: virtual items were valued at multi-billion dollar FDVs (metaverse, gaming), and ultra-high-yield pure ponzi economics were hailed as the future of finance (Olympus DAO $OHM). When such top signals flood the market, you may want to consider exiting or at least significantly reducing risk. Seeing numerous crypto games (e.g., via launchpads) launching at absurd valuations (> $1B) with nothing to offer beyond promises is a strong sign we’re nearing the top. Of course, take all this with a grain of salt—crypto constantly becomes more degen (DeFi Summer was already ponzi-like, new meme coins keep launching and trading, etc.), and if you look hard enough, you can always find “top signals” in crypto.

If a coin was the top performer in the bear market, it’s unlikely to outperform again across the entire bull cycle. At least, that was the case in 2021—a unique bull market clearly divided into two parts (pre-May 2021 and post-July 2021). Many coins that performed strongly in the bear market topped out around May 2021 or earlier: $AAVE, $SNX, $RUNE, $THETA, $KSM, $SUSHI.

In the latter half of the bull market, look for new narratives (metaverse, NFTs in 2021) and be ready to embrace things that grow increasingly irrational, introduce new forms of ponzi economics, and foster religious devotion (more on this in the next section).

Signs of Massive Rallies… Followed by Massive Dumps

Crypto tends to amplify many human psychological biases and emotions, often acting as a catalyst for more extreme rallies—and more extreme dumps. Identifying two such catalysts seems especially important:

“Main characters” and cult-like worship of certain crypto figures

Crypto markets love “main characters,” who are often idolized and become catalysts for certain crypto rallies. You can easily trace several 2021 pumps back to a central figure:

-

SBF (Sam Bankman-Fried) was seen as a genius—partly explaining $SOL’s incredible performance (Sam was a vocal $SOL bull and supporter) and the rise of $FTT

-

CZ, leader of Binance, contributed to $BNB’s success

-

Su Zhu was seen as a godlike investor/trader managing billions—his bullish stance on Avalanche helped fuel $AVAX

-

Elon Musk was a major reason $DOGE surged to nearly a $100B market cap

-

Do Kwon, founder of Terra Luna, likely played a role in $LUNA’s (initial) success through his “confidence” (to say the least)

-

Richard Heart, the colorful figure behind $HEX, worshipped by Hexicans

-

Charles Hoskinson, father of Cardano, possibly a key reason $ADA reached such a large market cap

-

Andre Cronje, central figure behind Fantom ($FTM) and co-founder of several other projects, viewed by some as a genius

-

Daniele Sestagalli led three parabolic projects: $TIME, $SPELL, and $ICE

Two types of main characters stand out: either “geniuses” or “community leaders/idolized by community.” Remember this as you prepare for the next bull market.

Religion x Ponzi = Imminent Rally and Crash

The second and third catalysts are religion and “ponzi-like” tokenomics. Interestingly, these often appear together. Ponzi economics usually means extremely high yields, ultimately unsustainable in some form. Religion is harder to define, but a few examples illustrate it well:

-

Luna is one of the best examples: Do Kwon was a charismatic leader, the system had a clear ponzi component (20% yield on UST via Anchor), and it felt somewhat like a religion—community members called themselves “Lunatics,” and anyone questioning UST’s sustainability faced backlash and attacks

-

Olympus DAO ($OHM): the main catalyst was ponzi economics—basically insane staking yields. Olympus even had a leader, a Twitter-anonymous figure named “Zeus”

-

Daniele Sestagalli’s projects clearly had a “degen flavor”: Wonderland was an Olympus fork with even higher yields, and Abracadabra had a “DegenBox” product allowing users to loop their UST and earn leveraged Anchor yields, if I recall correctly. The community around Daniele Sestagalli was even called the “Frog Nation”…

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News