DeFi Staking New Wave: Liquid Restaking Tokens and Layer2 Public Chains

TechFlow Selected TechFlow Selected

DeFi Staking New Wave: Liquid Restaking Tokens and Layer2 Public Chains

DeFi's next narrative: LRT.

The innovative application of Liquid Re-Staking Tokens (LRT) and the recent emergence of Blast—a public blockchain supporting automatic staking on Layer 2—are spearheading a new wave in the DeFi staking landscape. This article by Bing Ventures explores the backdrop behind these developments, their significance for the DeFi staking space, and the current major trends and future outlook.

Liquid Re-Staking Protocols: The Latest Innovation in the LSD Space

Source: Bing Ventures

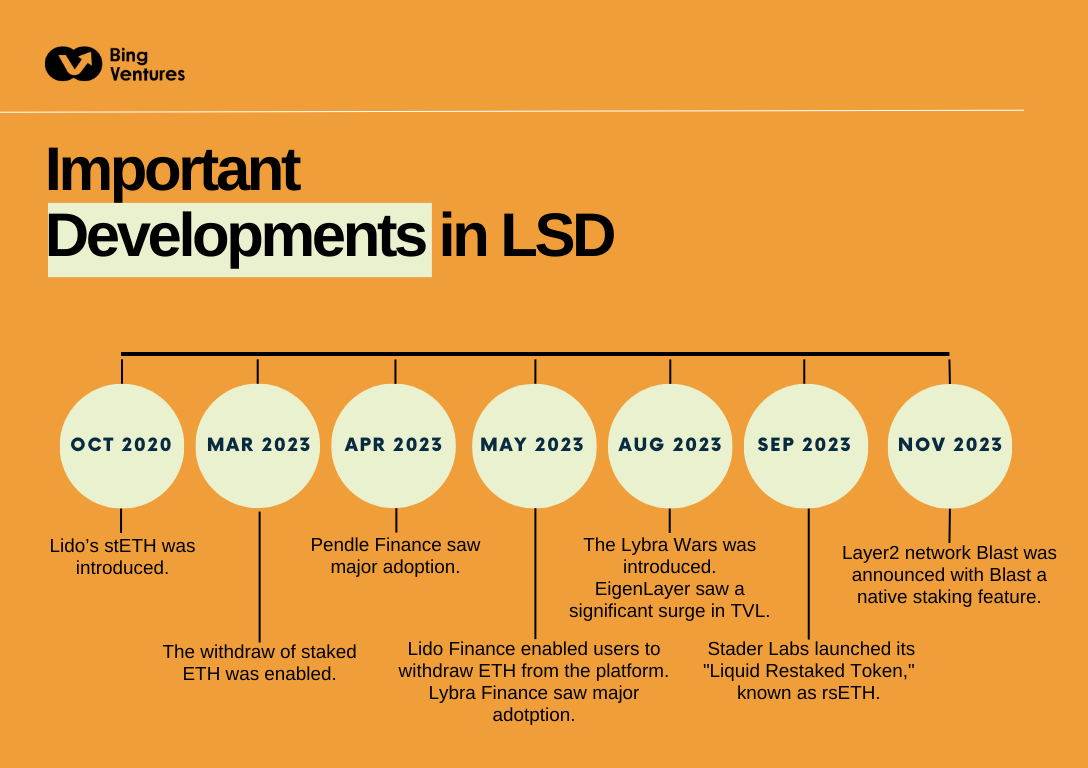

Within the Ethereum ecosystem, particularly following the Shanghai upgrade, the Liquid Staking Derivatives (LSD) sector has demonstrated remarkable innovation and adaptability. It began with Lido, a key player in Ethereum’s staking mechanism. By offering staking solutions for Ethereum, Lido addressed the critical issue of liquidity lock-up. Their approach allows users to stake ETH while retaining some liquidity—an important leap beyond traditional, rigid staking models.

Pendle Finance then introduced a transformative shift by tokenizing yield, enabling users to trade yield through interest-rate-based protocols. This added a new dimension to the LSD space, opening pathways for yield optimization and risk management.

However, market demand for higher returns and more efficient use of staked assets remained unmet. This led to the development of more sophisticated mechanisms such as Eigenlayer’s re-staking protocol. Eigenlayer enables stakers to re-stake their ETH, thereby enhancing the security and reliability of other protocols. This not only increases potential returns for stakers but also contributes to the overall resilience and security of the Ethereum network.

Soon after, a challenge emerged: tokens locked on Eigenlayer became illiquid and inactive, limiting their utility across DeFi. This gave rise to Liquid Re-Staking Tokens (LRTs)—an innovation that unlocks liquidity for these re-staked assets while allowing stakers to further boost returns through participation in DeFi. Users can deposit LRTs into liquid re-staking protocols to earn additional yield.

As a result, the LSD space has evolved from its origins in single-layer staking into a more complex and multifaceted ecosystem. Recent developments like the launch of Blast exemplify this trend. Blast is an EVM-compatible Ethereum Layer 2 network that offers native staking rewards for ETH and stablecoins directly on its chain. This further democratizes access to staking rewards, making the process more user-friendly and diversified. The evolution of the LSD narrative highlights a dynamic and adaptive Ethereum ecosystem—one that continuously innovates to meet user demands for greater liquidity and yield, all while navigating the inherent complexity and risks of decentralized finance.

The Next Narrative in DeFi: LRT

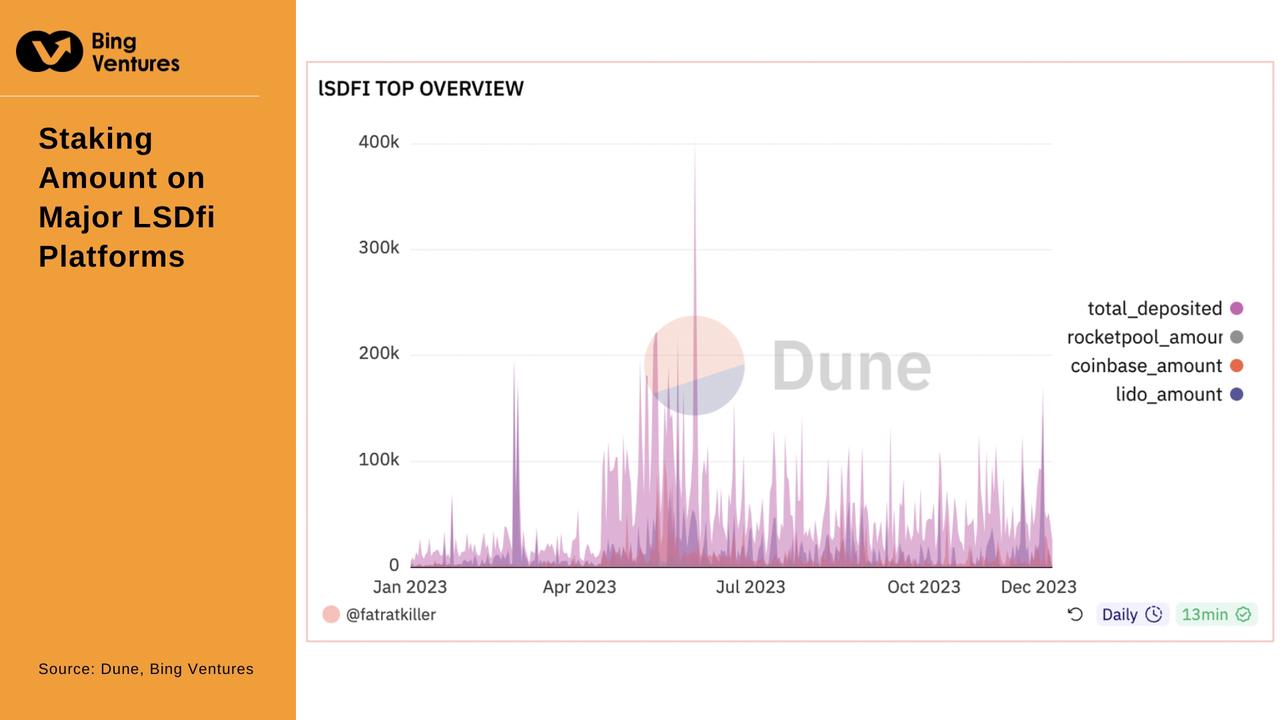

Source: Dune, Bing Ventures

In the DeFi space, the emergence of Liquid Re-Staking Tokens (LRTs) represents a profound transformation of traditional staking models. LRTs break not only conceptually from the limitations of single-protocol staking but also practically promote the widespread adoption of multi-protocol staking enhancement. Through platforms like EigenLayer, users can transcend the boundaries of individual protocols, distributing their ETH across multiple Active Validation Services (AVS). This significantly strengthens network security and introduces a more intricate layer of security into the DeFi ecosystem.

The advantages of LRTs are manifold: improved capital efficiency, enhanced network security, and substantial resource savings for developers. Nevertheless, we must remain vigilant about associated risks—such as potential slashing penalties, protocol centralization, and yield dilution caused by intense market competition.

Looking at market prospects, the high-yield potential of LRTs presents strong appeal. They offer ETH stakers additional revenue streams—not only base staking yields but also rewards from EigenLayer and potential token emissions. Furthermore, through incentives like airdrops, LRTs could attract broader user participation, driving overall leverage growth in DeFi. This trend may replicate—or even surpass—the boom seen during DeFi Summer 2020.

Future trends are striking. Driven by LRTs, we expect competitive dynamics akin to the “Curve War” to emerge within DeFi. Tokenomics may evolve toward more complex veTokenomics models. Meanwhile, emerging AVSs—by offering token rewards or influencing LRT protocol governance decisions—could become key drivers in attracting ETH re-staking.

In summary, LRTs have already demonstrated unique value in unlocking liquidity, increasing yield, and optimizing governance and risk management. As such, LRTs are not merely staking tools—they are pivotal catalysts for innovation and growth in DeFi. Their development and application will bring deep transformations to the DeFi ecosystem, opening new possibilities for users, developers, and the entire blockchain world.

Accompanying Risks and Challenges

Stader Labs, an industry dark horse, recently launched rsETH, a liquid re-staking token that has drawn significant attention on the Ethereum mainnet. With rsETH, users can take existing liquid staking tokens (e.g., Coinbase's cbETH, Lido's stETH, Rocket Pool's rETH) and re-stake them across multiple networks, minting new liquid tokens representing their share in the re-staking protocol. This greatly enhances the flexibility and liquidity of staked assets. Supported by EigenLayer and simplifying user entry into the re-staking ecosystem, rsETH has enabled large-scale ETH re-staking, further strengthening Ethereum’s decentralization.

Yet, this innovative financial instrument brings notable risks. Ethereum co-founder Vitalik Buterin and EigenLayer’s co-founders have both warned that re-staking could create complex scenarios that threaten the security of the main network. Additionally, as more AVSs and LRTs emerge, excessive fragmentation of capital and attention could lead to market instability and weakened governance structures.

Blast, an emerging Layer 2 blockchain in the Web3 ecosystem, injects fresh vitality into Layer 2 solutions through its novel auto-compounding feature. Blast innovatively provides base yield on deposits made within its Layer 2 network—partnering with protocols like Lido to deliver stable staking returns, while deploying stablecoin assets into protocols such as MakerDAO for additional yield. While Blast’s model offers convenience and returns for users, its TVL composition and strategy also reveal potential issues around centralization risks and market sensitivity.

Blast’s future challenge lies in how its strategy impacts actual asset utilization and dynamic capital flows within the ecosystem. Its TVL strategy must shift from static capital preservation to dynamic capital appreciation, ensuring network vitality and sufficient liquidity for dApps. Only then can it truly fulfill its goal of advancing blockchain network growth, rather than serving merely as a capital storage medium.

Overall, the emergence of Stader Labs’ rsETH and the Blast Layer 2 blockchain marks significant innovation and progress in DeFi staking models. Yet, while pursuing maximum yield, we must remain alert to the potential risks embedded in these new paradigms, ensuring the long-term security and healthy development of the Ethereum network. The future DeFi ecosystem will need to strike a more robust and sustainable balance between innovation and risk management.

Imagining New Ethereum Staking Paradigms

We believe that dynamic staking strategies like LRT are having a profound impact on the Ethereum staking market. First, automation and efficiency lower investment barriers, attracting more retail investors. Second, increased capital inflows significantly enhance market liquidity, contributing to the stability of the entire DeFi ecosystem. Moreover, dynamic staking strategies drive innovation and development by offering diversified and customizable investment options. However, implementing these strategies faces technical challenges—particularly in building efficient and accurate algorithmic models and ensuring system security against cyberattacks.

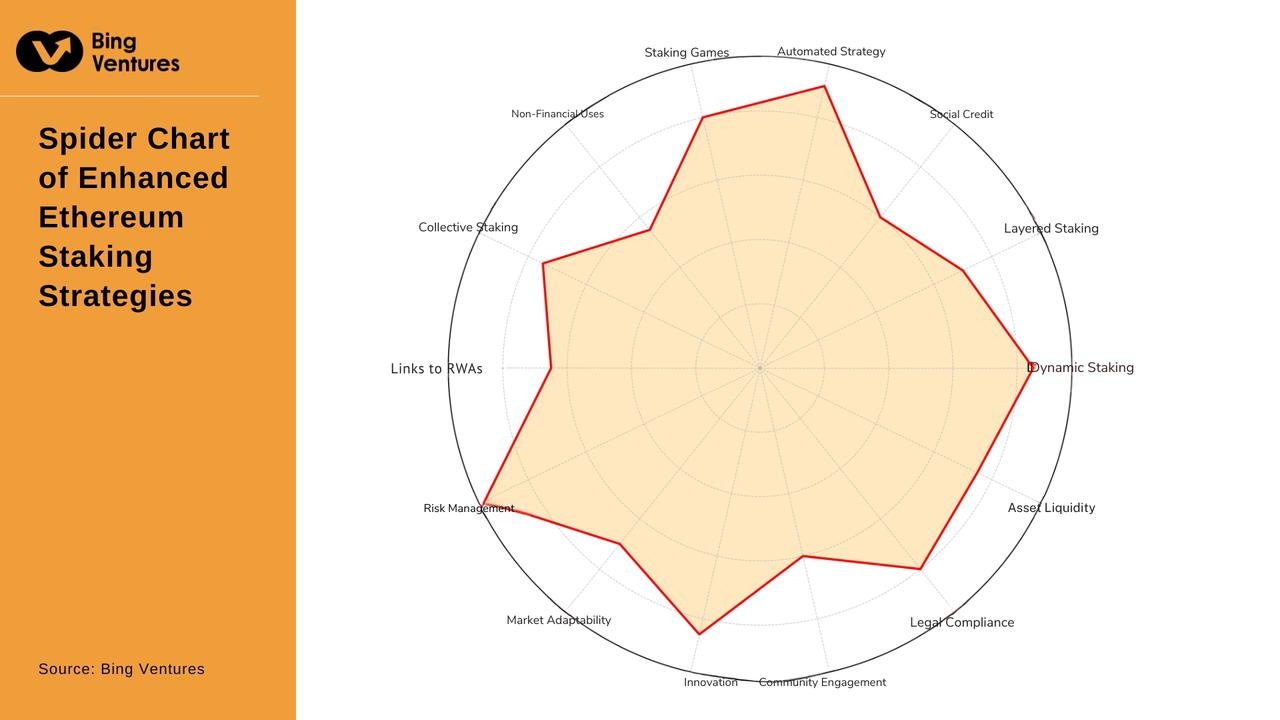

Source: Bing Ventures

Meanwhile, new Ethereum staking paradigms beyond LRT are also being explored and warrant attention.

The Layered Staking System is emerging as a new model amid market maturation and increasingly diverse investor needs. This system distributes staked assets across different risk tiers, each with distinct return potentials and risk profiles. Lower-risk tiers offer relatively stable returns suitable for risk-averse investors, while higher-risk tiers cater to those with greater risk tolerance. The model’s flexibility allows investors to allocate assets based on personal risk preferences and market outlook. Implementing such a system requires sophisticated smart contracts and refined risk management strategies to ensure liquidity and security across tiers. The advent of layered staking offers investors more choices and flexibility, pushing the Ethereum staking market toward greater maturity and diversification.

Additionally, smart contract-based automated staking strategies automatically execute staking, unstaking, or reallocation via code, improving asset management efficiency and effectiveness. Risk management in automated staking is enhanced through predefined parameters in smart contracts; when market conditions trigger these thresholds, the contracts autonomously adjust staking positions. Despite challenges—such as ensuring smart contract security and reliability—advancements in technology are expected to strengthen contract integrity, promoting wider adoption of automated staking strategies.

Collective staking and shared yield models allow multiple investors to pool their assets for joint staking, sharing generated returns proportionally. These models rely on smart contracts to automate yield distribution, offering small investors cooperative wealth-building opportunities. Smart contracts play a central role here, executing fair payouts and ensuring every participant receives their due. Collective staking reduces risk and cost for smaller investors, enhancing inclusivity within the DeFi ecosystem.

Finally, linking staked assets to real-world assets (RWA) represents an innovative frontier in DeFi. In this model, physical assets such as real estate or artwork serve as underlying collateral for staked assets, tokenized on-chain and used for staking. This brings liquidity to otherwise illiquid assets and opens new funding avenues for asset owners. Despite challenges—including accurate valuation and tokenization of real-world assets, as well as regulatory and compliance hurdles—the integration of RWA-backed staking is expected to gain broader traction. It could provide traditional asset holders with new financing channels and offer crypto investors novel opportunities, deepening the convergence between crypto markets and traditional finance.

In conclusion, the DeFi staking space is poised for further innovation and growth—making it a compelling area for investors and DeFi participants to watch closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News